Xometry, Inc. (NASDAQ:XMTR), the global online marketplace

connecting enterprise buyers with suppliers of manufacturing

services, today reported financial results for the fourth quarter

and full year ended December 31, 2022.

“In Q4 2022, Xometry delivered strong 32% marketplace growth in

a period of increasingly challenging macroeconomic conditions,"

said Randy Altschuler, Xometry CEO. "As we continue to grow rapidly

year-over-year, we are also implementing a 5-point strategic plan

to ensure that we continue to deliver strong growth. These steps

include realigning our sales efforts to improve our focus on our

top 200 accounts who represent significant revenue opportunities

and who depend on Xometry to strengthen their crucial supply

chains; continued expansion of processes and materials with a

deeper integration with Thomas; rapid international expansion and

growth; and further enhancements and adoption of new products,

including Workcenter. Additionally, we are taking an aggressive

approach to reducing operating expenses, which included a 6%

headcount reduction in January.”

Fourth Quarter 2022 Financial Highlights

- Total revenue for the fourth quarter

2022 was $98.2 million, an increase of 46% year-over-year.

- Marketplace revenue for the fourth

quarter of 2022 was $79.1 million, an increase of 32%

year-over-year.

- Supplier services revenue for the

fourth quarter of 2022 was $19.1 million.

- Total gross profit for the fourth

quarter 2022 was $36.0 million, an increase of 72%

year-over-year.

- Marketplace Active Buyers increased 45%

from 28,130 as of December 31, 2021 to 40,664 as of December 31,

2022.

- Marketplace Accounts with Last

Twelve-Months Spend of at least $50,000 increased 47% from 701 as

of December 31, 2021, to 1,027 as of December 31, 2022.

- Marketplace Percentage of Revenue from

Existing Accounts was 96%.

- Net loss attributable to common

stockholders was $24.4 million for the quarter, an increase of $0.5

million year-over-year, and Adjusted EBITDA was negative $14.2

million for the quarter, reflecting an increase of $2.4 million

year-over-year. Net loss for Q4 2022 included $5.1 million of

stock-based compensation and a $1.5 million restructuring

charge.

- Cash and cash equivalents were $319.4

million as of December 31, 2022.

Fourth Quarter 2022 Business Highlights

- Grew the number of Active Suppliers 22%

year-over-year from 2,010 to 2,447.

- Introduced a new instant quoting page

for the Xometry Marketplace, offering easier navigation and greater

usability of the quoting engine.

- Appointed Brendan Sterne, a veteran

product executive skilled in scaling technology for growth and

revenue, as our Chief Product Officer, and elevated Matt Leibel to

Chief Technology Officer.

- Expanded the offerings of our Xometry

Europe marketplace to include compression molding and vacuum

casting, which are critical for the automotive, electronics,

medical device and other industries.

- Integrated the Gravity Climate API into

the Xometry Marketplace to help our customers instantly calculate

carbon emissions in real-time.

Full Year Financial Highlights

- Total revenue for the full year 2022

was $381.1 million, an increase of 75% year-over-year.

- Marketplace revenue for the full year

2022 was $303.1 million.

- Supplier services revenue for the full

year 2022 was $77.9 million.

- Total gross profit for the full year

2022 was $147.6 million, an increase of 158% year-over-year. Gross

profit margin improved to 38.7% for year ended December 31, 2022

from 26.2% for the year ended December 31, 2021.

- Marketplace gross profit margin

improved to 28.6% for the year ended December 31, 2022 from 25.1%

for the year ended December 31, 2021.

- Net loss attributable to common

stockholders was $76.0 million for the full year 2022, an increase

of $14.6 million year-over-year, and Adjusted EBITDA was negative

$41.8 million for the full year 2022, reflecting an increase of

$2.0 million year-over-year. Net loss for the full year 2022

includes $19.2 million of stock-based compensation expense, $2.3

million of expense for charitable contributions and a $1.5 million

restructuring charge.

Full Year Business Highlights

- Introduced “Xometry Everywhere”

software which extends the reach of Xometry’s AI-driven

instant-quoting pricing engine to popular third-party sites where

engineers and other buyers spend significant amounts of time.

- Obtained certification for Medical

Device Manufacturing (ISO 13485) enabling the Xometry marketplace

to expand the breadth of medical device manufacturing.

- Expanded European operations including

an enhanced site for European customers, www.xometry.eu, which

makes it even easier for buyers to compare and price technologies,

materials and finishes in real time. Added new languages including

Spanish, Polish, Norwegian and Dutch.

- Introduced new self-serve advertising

subscription options for suppliers on Thomasnet.

- Launched a local manufacturing network

in China (Xometry.Asia) and began taking orders from Chinese

customers in April 2022.

- Expanded CAD integrations with the

addition of PTC’s Onshape product development platform which has

over 2 million users. The integration provides seamless instant

quoting with our proprietary, AI-driven Xometry Instant Quoting

Engine®.

- On February 11, 2022 completed an

offering of Convertible Senior Notes, raising net proceeds of

$278.2 million.

- Introduced Workcenter which gives

suppliers a one-stop view into all their Xometry and non-Xometry

work. A cloud-based manufacturing execution system, Workcenter

brings the job board and financial services into one, easy-to-use

platform.

- Launched the Industrial Buying Engine

which helps customers source and purchase from the more than

500,000 suppliers on Thomasnet.com. Through the Industrial Buying

Engine, buyers can request quotes for products and services from

suppliers.

- Extended Xometry quoting capabilities

into new categories based on the data and suppliers from the Thomas

network. The new processes include laser tube cutting and tube

bending.

- Launched the universal login experience

which improves and centralizes the login experience and user

credentials. Universal login allows Xometry and Thomas buyers and

suppliers to seamlessly move and transact across platforms.

Financial Summary(In

thousands, except per share amounts)

|

|

For the Three MonthsEnded

December 31, |

|

|

|

|

|

For the YearEnded

December 31, |

|

|

|

|

|

|

2022 |

|

|

2021 |

|

|

% Change |

|

|

2022 |

|

|

2021 |

|

|

% Change |

|

|

|

(unaudited) |

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

98,196 |

|

|

$ |

67,098 |

|

|

|

46 |

% |

|

$ |

381,053 |

|

|

$ |

218,336 |

|

|

|

75 |

% |

| Gross profit |

|

36,030 |

|

|

|

20,937 |

|

|

|

72 |

% |

|

|

147,566 |

|

|

|

57,141 |

|

|

|

158 |

% |

| Net loss attributable to

common stockholders |

|

(24,423 |

) |

|

|

(23,905 |

) |

|

|

(2 |

)% |

|

|

(76,025 |

) |

|

|

(61,379 |

) |

|

|

(24 |

)% |

| EPS, basic and diluted |

|

(0.51 |

) |

|

|

(0.53 |

) |

|

|

4 |

% |

|

|

(1.61 |

) |

|

|

(2.33 |

) |

|

|

31 |

% |

| Adjusted EBITDA(1) |

|

(14,249 |

) |

|

|

(11,854 |

) |

|

|

(20 |

)% |

|

|

(41,765 |

) |

|

|

(39,757 |

) |

|

|

(5 |

)% |

| Non-GAAP net loss(1) |

|

(13,729 |

) |

|

|

(11,414 |

) |

|

|

(20 |

)% |

|

|

(40,097 |

) |

|

|

(40,432 |

) |

|

|

1 |

% |

| Non-GAAP EPS, basic and

diluted(1) |

|

(0.29 |

) |

|

|

(0.25 |

) |

|

|

(16 |

)% |

|

|

(0.85 |

) |

|

|

(1.54 |

) |

|

|

45 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketplace |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

$ |

79,062 |

|

|

|

|

|

|

|

|

$ |

303,134 |

|

|

|

|

|

|

|

| Cost of revenue |

|

57,630 |

|

|

|

|

|

|

|

|

|

216,336 |

|

|

|

|

|

|

|

| Gross Profit |

$ |

21,432 |

|

|

|

|

|

|

|

|

$ |

86,798 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplier

services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

$ |

19,134 |

|

|

|

|

|

|

|

|

$ |

77,919 |

|

|

|

|

|

|

|

| Cost of revenue |

|

4,536 |

|

|

|

|

|

|

|

|

|

17,151 |

|

|

|

|

|

|

|

| Gross Profit |

$ |

14,598 |

|

|

|

|

|

|

|

|

$ |

60,768 |

|

|

|

|

|

|

|

|

(1) |

These non-GAAP financial measures, and reasons why we believe these

non-GAAP financial measures are useful, are described below and

reconciled to their most directly comparable GAAP measures in the

accompanying tables. |

Key Operating

Metrics(2):

|

|

As of December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

Active Buyers(3) |

|

40,664 |

|

|

|

28,130 |

|

|

|

45 |

% |

| Percentage of Revenue from

Existing Accounts(3) |

|

96 |

% |

|

|

95 |

% |

|

|

1 |

% |

| Accounts with Last

Twelve-Months Spend of at Least $50,000(3) |

|

1,027 |

|

|

|

701 |

|

|

|

47 |

% |

|

(2) |

These key operating metrics are for Marketplace. See “Key Terms for

our Key Metrics and Non-GAAP Financial Measures” below for

definitions of these metrics. |

| (3) |

Amounts shown for Active Buyers

and Accounts with Last Twelve-Months Spend of at Least $50,000 are

as of December 31, 2022 and 2021, and Percentage of Revenue from

Existing Accounts is presented for the quarters ended December 31,

2022 and 2021. |

Subsequent to Fourth Quarter 2022

On January 2, 2023, the Company acquired 100% of the equity of

Tridi Teknoloj A.S. ("Tridi") located in Istanbul, Turkey. The

acquisition of Tridi extended our marketplace capabilities in

Europe by opening a vast array of affordable suppliers. Tridi

operates an online marketplace for manufacturing with the ability

to serve all of Europe within a 24-hour turn around period. The

aggregate non-contingent portion of the purchase price was

approximately $3.8 million. In addition, the purchase price

includes a contingent consideration arrangement to the former

owners of Tridi up to a maximum amount of $1.25 million

(undiscounted) in Class A common shares in two installments on the

first and second anniversary of the acquisition and is based on the

achievement of certain revenue targets.

In December 2022, we initiated a restructuring action to help

manage our operating expenses by reducing our workforce by

approximately 6%. The workforce reduction focused on realigning our

staffing levels to help us meet the current and future objectives

of our business. For the year ended December 31, 2022, we incurred

$1.5 million for employee termination costs related to this

restructuring. The majority of these costs will be paid by the

Company in the first quarter of 2023. We expect the reduction in

workforce will reduce operating expenses by approximately $8.0

million on a full year basis.

Financial Guidance and Outlook:

| |

Q1 2023 |

|

|

FY 2023 |

|

| |

(in millions) |

|

| |

Low |

|

|

High |

|

|

Low |

|

|

High |

|

|

Revenue |

$ |

100.0 |

|

|

$ |

102.0 |

|

|

$ |

470.0 |

|

|

$ |

480.0 |

|

| Adjusted EBITDA |

$ |

(11.0 |

) |

|

$ |

(9.0 |

) |

|

$ |

(22.0 |

) |

|

$ |

(20.0 |

) |

Xometry’s first quarter and full year 2023 financial outlook is

based on a number of assumptions that are subject to change and

many of which are outside of its control. If actual results vary

from these assumptions, Xometry’s expectations may change. There

can be no assurance that Xometry will achieve these results.

Reconciliation of Adjusted EBITDA on a forward-looking basis to

net loss, the most directly comparable GAAP measure, is not

available without unreasonable efforts due to the high variability

and complexity and low visibility with respect to the charges

excluded from this non-GAAP measure; in particular, the effects of

stock-based compensation expense specific to equity compensation

awards that are directly impacted by unpredictable fluctuations in

Xometry’s stock price. Xometry expects the variability of the above

charges to have a significant, and potentially unpredictable,

impact on its future GAAP financial results.

Use of Non-GAAP Financial Measures To

supplement its consolidated financial statements, which are

prepared and presented in accordance with generally accepted

accounting principles in the United States of America (“GAAP”),

Xometry, Inc. (“Xometry”, the “Company”, “we” or “our”) uses

Adjusted EBITDA, non-GAAP net loss and non-GAAP Earnings Per Share,

which are considered non-GAAP financial measures, as described

below. These non-GAAP financial measures are presented to enhance

the user’s overall understanding of Xometry’s financial performance

and should not be considered a substitute for, nor superior to, the

financial information prepared and presented in accordance with

GAAP. The non-GAAP financial measures presented in this release,

together with the GAAP financial results, are the primary measures

used by the Company’s management and board of directors to

understand and evaluate the Company’s financial performance and

operating trends, including period-to-period comparisons, because

they exclude certain expenses and gains that management believes

are not indicative of the Company’s core operating results.

Management also uses these measures to prepare and update the

Company’s short and long term financial and operational plans, to

evaluate investment decisions, and in its discussions with

investors, commercial bankers, equity research analysts and other

users of the Company’s financial statements. Accordingly, the

Company believes that these non-GAAP financial measures provide

useful information to investors and others in understanding and

evaluating the Company’s operating results in the same manner as

the Company’s management and in comparing operating results across

periods and to those of Xometry’s peer companies. In addition, from

time to time we may present adjusted information (for example,

revenue growth) to exclude the impact of certain gains, losses or

other changes that affect period-to-period comparability of our

operating performance.

The use of non-GAAP financial measures has certain limitations

because they do not reflect all items of income and expense, or

cash flows, that affect the Company’s financial performance and

operations. Additionally, non-GAAP financial measures do not have

standardized meanings, and therefore other companies, including

peer companies, may use the same or similarly named measures but

exclude or include different items or use different computations.

Management compensates for these limitations by reconciling these

non-GAAP financial measures to their most comparable GAAP financial

measures in the tables captioned “Reconciliations of Non-GAAP

Financial Measures” included at the end of this release. Investors

and others are encouraged to review the Company’s financial

information in its entirety and not rely on a single financial

measure.

Key Terms for our Key Metrics and Non-GAAP Financial

Measures

Marketplace revenue: includes the sale of parts

and assemblies.

Supplier service revenue: includes the sales of

advertising on Thomasnet, marketing services, supplies, financial

service products and other fintech products.

Active Buyers: The Company defines “buyers” as

individuals who have placed an order to purchase on-demand parts or

assemblies on our marketplace. The Company defines Active

Buyers as the number of buyers who have made at least one purchase

on our marketplace during the last twelve months.

Active Suppliers: The Company defines

“suppliers” as individuals or businesses that have been approved by

us to either manufacture a product on our platform for a buyer or

have utilized our supplier services, including our digital

marketing services, data services, financial services or supplies.

The Company defines Active Suppliers as suppliers that have used

our platform at least once during the last twelve months to

manufacture a product or buy tools or supplies.

Percentage of Revenue from Existing Accounts:

The Company defines an “account” as an individual entity, such as a

sole proprietor with a single buyer or corporate entities with

multiple buyers, having purchased at least one part on our

marketplace. The Company defines an existing account as an

account where at least one buyer has made a purchase on our

marketplace.

Accounts with Last Twelve-Month Spend of At Least

$50,000: The Company defines Accounts with Last

Twelve-Month Spend of At Least $50,000 as an account that has spent

at least $50,000 on our marketplace in the most recent twelve-month

period.

Adjusted earnings before interest, taxes, depreciation

and amortization (Adjusted EBITDA): The Company defines

Adjusted EBITDA as net loss, adjusted for interest expense,

interest and dividend income and other expenses, income tax

benefit, and certain other non-cash or non-recurring items

impacting net loss from time to time, principally comprised of

depreciation and amortization, stock-based compensation, charitable

contributions of common stock, income from unconsolidated joint

venture, impairment charges, restructuring charges and acquisition

and other adjustments not reflective of the Company’s ongoing

business, such as adjustments related to purchase accounting, the

revaluation of contingent consideration and transaction costs.

Non-GAAP net loss: The Company defines non-GAAP

net loss as net loss adjusted for depreciation and amortization,

stock-based compensation expense, amortization of lease intangible,

amortization of deferred costs on convertible notes, unrealized

loss on marketable securities, loss on sale of property and

equipment, charitable contributions of common stock, impairment

charges, restructuring charges and acquisition and other

adjustments not reflective of the Company’s ongoing business, such

as adjustments related to purchase accounting, the revaluation of

contingent consideration and transaction costs.

Non-GAAP Earnings Per Share, basic and diluted (Non-GAAP

EPS, basic and diluted): The Company calculates non-GAAP

earnings per share, (basic and diluted) as non-GAAP net loss

divided by weighted average number of common stock outstanding.

Management believes that the exclusion of certain expenses and

gains in calculating Adjusted EBITDA, non-GAAP net loss and

non-GAAP EPS, basic and diluted provides a useful measure for

period-to-period comparisons of the Company’s underlying core

revenue and operating costs that is focused more closely on the

current costs necessary to operate the Company’s businesses, and

reflects its ongoing business in a manner that allows for

meaningful analysis of trends. Management also believes that

excluding certain non-cash charges can be useful because the

amounts of such expenses is the result of long-term investment

decisions made in previous periods rather than day-to-day operating

decisions.

About Xometry

Xometry (XMTR) powers the industries of today and tomorrow by

connecting the people with big ideas to the manufacturers who can

bring them to life. Xometry’s digital marketplace gives

manufacturers the critical resources they need to grow their

business while also making it easy for buyers at Fortune 1000

companies to tap into global manufacturing capacity and create

locally resilient supply chains. Learn more at www.xometry.com or

follow @xometry.

Conference Call and Webcast Information

The Company will host a conference call and webcast to discuss

the results at 8:30 a.m. ET (5:30 a.m. PT) on March 1, 2023. In

addition to issuing a press release, the Company will post an

earnings presentation to its investor website at

investors.xometry.com.

Xometry, Inc. Fourth Quarter 2022 Earnings Presentation and

Conference Call

- 8:30 a.m. Eastern / 5:30 a.m. Pacific on Wednesday, March 1,

2023

- To register please use the following link: Xometry, Inc. Q4

2022 Earnings Call

- You may also visit the Xometry Investor Relations Homepage at

investors.xometry.com to listen to a live webcast of the call

Cautionary Information Regarding Forward-Looking

StatementsThis press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, which statements involve substantial risks and

uncertainties. Forward-looking statements generally relate to

future events or our future financial or operating performance. In

some cases, you can identify forward-looking statements because

they contain words such as “may,” “will,” “should,” “expect,”

“plan,” “anticipate,” “could,” “would,” “intend,” “target,”

“project,” “contemplate,” “believe,” “estimate,” “predict,”

“potential” or “continue” or the negative of these words or other

similar terms or expressions that concern our expectations,

strategy, plans or intentions. Forward-looking statements in this

press release include, but are not limited to, our beliefs

regarding our financial position and operating performance,

including our outlook and guidance for the first quarter and full

year 2023, our expectation regarding our operating leverage and

2023 operating expenses, our potential for growth, and demand for

our marketplaces in general. Our expectations and beliefs regarding

these matters may not materialize, and actual results in future

periods are subject to risks and uncertainties that could cause

actual results to differ materially from those projected, including

risks and uncertainties related to: competition, managing our

growth, financial performance, the impact of the health crises such

as COVID-19 on our business and operations, our ability to forecast

our performance due to our limited operating history, investments

in new products or offerings, our ability to attract buyers and

sellers to our marketplace, legal proceedings and regulatory

matters and developments, any future changes to our business or our

financial or operating model, our brand and reputation, and the

impact of fluctuations in general macroeconomic conditions, such as

the current inflationary environment and rising interest rates. The

forward-looking statements contained in this press release are also

subject to other risks and uncertainties that could cause actual

results to differ from the results predicted, including those more

fully described in our filings with the SEC, including our Annual

Report on Form 10-K for the period ended December 31, 2022. All

forward-looking statements in this press release are based on

information available to Xometry and assumptions and beliefs as of

the date hereof, and we disclaim any obligation to update any

forward-looking statements, except as required by law.

|

Investor Contact: |

Media Contact: |

| Shawn MilneVP Investor

Relations240-335-8132shawn.milne@xometry.com |

Matthew Hutchison Corporate

Communications for

Xometry415-583-2119matthew.hutchison@xometry.com |

Xometry, Inc. and Subsidiaries

Consolidated Balance Sheets (In thousands, except share and per

share data)

| |

December 31, |

|

|

December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

|

(unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

319,432 |

|

|

$ |

86,262 |

|

|

Marketable securities |

|

— |

|

|

|

30,465 |

|

|

Accounts receivable, less allowance for credit losses of $2.0

million and $0.8 million as of December 31, 2022 and 2021,

respectively. |

|

49,188 |

|

|

|

32,427 |

|

|

Inventory |

|

1,571 |

|

|

|

2,033 |

|

|

Prepaid expenses |

|

7,591 |

|

|

|

6,664 |

|

|

Other current assets |

|

12,273 |

|

|

|

5,580 |

|

|

Total current assets |

|

390,055 |

|

|

|

163,431 |

|

|

Property and equipment, net |

|

19,079 |

|

|

|

10,287 |

|

|

Operating lease right-of-use assets |

|

25,923 |

|

|

|

27,489 |

|

|

Investment in unconsolidated joint venture |

|

4,068 |

|

|

|

4,198 |

|

|

Intangible assets, net |

|

39,351 |

|

|

|

41,736 |

|

|

Goodwill |

|

258,036 |

|

|

|

254,672 |

|

|

Other assets |

|

413 |

|

|

|

773 |

|

|

Total assets |

$ |

736,925 |

|

|

$ |

502,586 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

12,437 |

|

|

$ |

12,718 |

|

|

Accrued expenses |

|

33,430 |

|

|

|

30,905 |

|

|

Contract liabilities |

|

8,509 |

|

|

|

7,863 |

|

|

Income taxes payable |

|

3,956 |

|

|

|

— |

|

|

Operating lease liabilities, current portion |

|

5,471 |

|

|

|

5,549 |

|

|

Finance lease liabilities, current portion |

|

— |

|

|

|

2 |

|

|

Total current liabilities |

|

63,803 |

|

|

|

57,037 |

|

|

Convertible notes |

|

279,909 |

|

|

|

— |

|

|

Operating lease liabilities, net of current portion |

|

16,940 |

|

|

|

16,920 |

|

|

Long term income taxes payable |

|

— |

|

|

|

1,450 |

|

|

Deferred income taxes |

|

429 |

|

|

|

18 |

|

|

Other liabilities |

|

1,011 |

|

|

|

1,678 |

|

|

Total liabilities |

|

362,092 |

|

|

|

77,103 |

|

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

Preferred stock, $0.000001 par value. Authorized; 50,000,000

shares; zero shares issued and outstanding as of December 31, 2022

and 2021, respectively |

|

— |

|

|

|

— |

|

|

Class A Common stock, $0.000001 par value. Authorized; 750,000,000

shares; 44,822,264 shares and 43,998,404 shares issued and

outstanding as of December 31, 2022 and 2021, respectively |

|

— |

|

|

|

— |

|

|

Class B Common stock, $0.000001 par value. Authorized; 5,000,000

shares; 2,676,154 shares issued and outstanding as of December 31,

2022 and 2021, respectively |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

623,081 |

|

|

|

597,641 |

|

|

Accumulated other comprehensive income (loss) |

|

28 |

|

|

|

149 |

|

|

Accumulated deficit |

|

(249,366 |

) |

|

|

(173,341 |

) |

| Total stockholders’

equity |

|

373,743 |

|

|

|

424,449 |

|

|

Noncontrolling interest |

|

1,090 |

|

|

|

1,034 |

|

|

Total equity |

|

374,833 |

|

|

|

425,483 |

|

| Total liabilities and

stockholders’ equity |

$ |

736,925 |

|

|

$ |

502,586 |

|

Xometry, Inc. and Subsidiaries

Consolidated Statements of Operations and Comprehensive Loss(In

thousands, except share and per share amounts)

|

|

Three Months

EndedDecember 31, |

|

|

Year EndedDecember 31, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

Revenue |

$ |

98,196 |

|

|

$ |

67,098 |

|

|

$ |

381,053 |

|

|

$ |

218,336 |

|

| Cost of revenue |

|

62,166 |

|

|

|

46,161 |

|

|

|

233,487 |

|

|

|

161,195 |

|

|

Gross profit |

|

36,030 |

|

|

|

20,937 |

|

|

|

147,566 |

|

|

|

57,141 |

|

| Sales and marketing |

|

24,376 |

|

|

|

13,173 |

|

|

|

83,222 |

|

|

|

39,422 |

|

| Operations and support |

|

12,414 |

|

|

|

8,089 |

|

|

|

48,572 |

|

|

|

23,683 |

|

| Product development |

|

8,315 |

|

|

|

5,648 |

|

|

|

31,013 |

|

|

|

17,780 |

|

| General and

administrative |

|

14,849 |

|

|

|

16,601 |

|

|

|

57,992 |

|

|

|

34,942 |

|

| Impairment of assets |

|

380 |

|

|

|

- |

|

|

|

824 |

|

|

|

- |

|

| Total operating expenses |

|

60,334 |

|

|

|

43,511 |

|

|

|

221,623 |

|

|

|

115,827 |

|

|

Loss from operations |

|

(24,304 |

) |

|

|

(22,574 |

) |

|

|

(74,057 |

) |

|

|

(58,686 |

) |

| Other (expenses)

income |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

(1,246 |

) |

|

|

(53 |

) |

|

|

(4,418 |

) |

|

|

(852 |

) |

| Interest and dividend

income |

|

2,201 |

|

|

|

525 |

|

|

|

4,115 |

|

|

|

982 |

|

| Other expenses |

|

(450 |

) |

|

|

(1,846 |

) |

|

|

(2,183 |

) |

|

|

(2,866 |

) |

| (Loss) income from

unconsolidated joint venture |

|

(30 |

) |

|

|

41 |

|

|

|

570 |

|

|

|

41 |

|

| Total other income

(expenses) |

|

475 |

|

|

|

(1,333 |

) |

|

|

(1,916 |

) |

|

|

(2,695 |

) |

|

Loss before income taxes |

|

(23,829 |

) |

|

|

(23,907 |

) |

|

|

(75,973 |

) |

|

|

(61,381 |

) |

| Provision (benefit) for income

taxes |

|

(595 |

) |

|

|

- |

|

|

|

(36 |

) |

|

|

- |

|

|

Net loss |

|

(24,424 |

) |

|

|

(23,907 |

) |

|

|

(76,009 |

) |

|

|

(61,381 |

) |

| Net (loss) income attributable

to noncontrolling interest |

|

(1 |

) |

|

|

(2 |

) |

|

|

16 |

|

|

|

(2 |

) |

|

Net loss attributable to common stockholders |

$ |

(24,423 |

) |

|

$ |

(23,905 |

) |

|

$ |

(76,025 |

) |

|

$ |

(61,379 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.51 |

) |

|

$ |

(0.53 |

) |

|

$ |

(1.61 |

) |

|

$ |

(2.33 |

) |

| Weighted-average number of

shares outstanding used to compute net loss per share,

basic and diluted |

|

47,457,139 |

|

|

|

44,995,598 |

|

|

|

47,158,247 |

|

|

|

26,318,349 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

$ |

492 |

|

|

$ |

(38 |

) |

|

$ |

(81 |

) |

|

$ |

(61 |

) |

|

Total other comprehensive income (loss) |

|

492 |

|

|

|

(38 |

) |

|

|

(81 |

) |

|

|

(61 |

) |

| Net loss |

|

(24,424 |

) |

|

|

(23,907 |

) |

|

|

(76,009 |

) |

|

|

(61,381 |

) |

| Comprehensive

loss |

|

(23,932 |

) |

|

|

(23,945 |

) |

|

|

(76,090 |

) |

|

|

(61,442 |

) |

| Comprehensive (loss) income

attributable to noncontrolling interest |

|

(29 |

) |

|

|

- |

|

|

|

56 |

|

|

|

- |

|

| Total comprehensive

loss attributable to common stockholders |

$ |

(23,903 |

) |

|

$ |

(23,945 |

) |

|

$ |

(76,146 |

) |

|

$ |

(61,442 |

) |

Xometry, Inc. and Subsidiaries

Consolidated Statements of Cash Flows(In thousands)

|

|

Year Ended December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

| Cash flows from

operating activities: |

(unaudited) |

|

|

|

|

|

|

|

|

Net loss |

$ |

(76,009 |

) |

|

$ |

(61,381 |

) |

|

$ |

(31,085 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

7,819 |

|

|

|

3,596 |

|

|

|

3,120 |

|

|

Impairment of assets |

|

824 |

|

|

|

— |

|

|

|

1,592 |

|

|

Reduction in carrying amount of right-of-use asset |

|

7,236 |

|

|

|

1,056 |

|

|

|

1,045 |

|

|

Stock based compensation |

|

19,172 |

|

|

|

7,395 |

|

|

|

1,006 |

|

|

Non-cash interest expense |

|

— |

|

|

|

111 |

|

|

|

320 |

|

|

Loss on debt extinguishment |

|

— |

|

|

|

272 |

|

|

|

— |

|

|

Revaluation of contingent consideration |

|

817 |

|

|

|

— |

|

|

|

— |

|

|

Loss (income) from unconsolidated joint venture |

|

130 |

|

|

|

(41 |

) |

|

|

— |

|

|

Donation of common stock |

|

2,272 |

|

|

|

2,226 |

|

|

|

— |

|

|

Unrealized loss on marketable securities |

|

1,855 |

|

|

|

2,002 |

|

|

|

— |

|

|

Loss on sale of property and equipment |

|

47 |

|

|

|

20 |

|

|

|

— |

|

|

Inventory write-off |

|

133 |

|

|

|

— |

|

|

|

(15 |

) |

|

Amortization of deferred costs on convertible notes |

|

1,718 |

|

|

|

— |

|

|

|

— |

|

|

Deferred taxes benefit |

|

(653 |

) |

|

|

(179 |

) |

|

|

— |

|

|

Restructuring charge |

|

1,549 |

|

|

|

— |

|

|

|

— |

|

|

Changes in other assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

(16,923 |

) |

|

|

(11,117 |

) |

|

|

(2,130 |

) |

|

Inventory |

|

351 |

|

|

|

293 |

|

|

|

(956 |

) |

|

Prepaid expenses |

|

(1,616 |

) |

|

|

(4,025 |

) |

|

|

(210 |

) |

|

Other assets |

|

(7,016 |

) |

|

|

464 |

|

|

|

(469 |

) |

|

Accounts payable |

|

(215 |

) |

|

|

5,215 |

|

|

|

(2,350 |

) |

|

Accrued expenses |

|

403 |

|

|

|

(12,008 |

) |

|

|

8,569 |

|

|

Contract liabilities |

|

515 |

|

|

|

(1,625 |

) |

|

|

518 |

|

|

Lease liabilities |

|

(5,727 |

) |

|

|

(845 |

) |

|

|

(1,004 |

) |

|

Income taxes payable |

|

743 |

|

|

|

— |

|

|

|

— |

|

|

Net cash used in operating activities |

|

(62,575 |

) |

|

|

(68,571 |

) |

|

|

(22,049 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

Purchase of marketable securities |

|

(326 |

) |

|

|

(267,467 |

) |

|

|

— |

|

|

Proceeds from sale of marketable securities |

|

28,927 |

|

|

|

235,000 |

|

|

|

— |

|

|

Purchase of short-term investments |

|

— |

|

|

|

— |

|

|

|

(17,711 |

) |

|

Proceeds from short-term investments |

|

— |

|

|

|

— |

|

|

|

28,571 |

|

|

Purchases of property and equipment |

|

(13,650 |

) |

|

|

(6,262 |

) |

|

|

(4,190 |

) |

|

Proceeds from life insurance |

|

— |

|

|

|

627 |

|

|

|

— |

|

|

Proceeds from sale of property and equipment |

|

189 |

|

|

|

— |

|

|

|

— |

|

|

Cash paid for business combinations, net of cash acquired |

|

— |

|

|

|

(174,646 |

) |

|

|

— |

|

|

Net cash provided by (used in) investing

activities |

|

15,140 |

|

|

|

(212,748 |

) |

|

|

6,670 |

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of Series A-2, Series B, Series C, Series D

and Series E convertible preferred stock, net of issuance

costs |

|

— |

|

|

|

— |

|

|

|

52,409 |

|

|

Repurchase of Series A-2, Series B, Series C and Series D

convertible preferred stock |

|

— |

|

|

|

— |

|

|

|

(12,852 |

) |

|

Deemed dividend to preferred stockholders |

|

— |

|

|

|

— |

|

|

|

(8,801 |

) |

|

Proceeds from initial public offering, net of underwriters'

discount |

|

— |

|

|

|

325,263 |

|

|

|

— |

|

|

Payments in connection with initial public offering |

|

— |

|

|

|

(3,678 |

) |

|

|

— |

|

|

Proceeds from stock options exercised |

|

3,715 |

|

|

|

2,291 |

|

|

|

518 |

|

|

Proceeds from term loan |

|

— |

|

|

|

— |

|

|

|

4,000 |

|

|

Repayment of term loan |

|

— |

|

|

|

(16,136 |

) |

|

|

— |

|

|

Proceeds from the exercise of warrants |

|

— |

|

|

|

40 |

|

|

|

— |

|

|

Proceeds from issuance of convertible notes |

|

287,500 |

|

|

|

— |

|

|

|

— |

|

|

Costs incurred in connection with issuance of convertible

notes |

|

(9,309 |

) |

|

|

— |

|

|

|

— |

|

|

Payment of contingent consideration |

|

(932 |

) |

|

|

— |

|

|

|

— |

|

|

Proceeds from other borrowings |

|

— |

|

|

|

— |

|

|

|

4,783 |

|

|

Repayment of other borrowings |

|

— |

|

|

|

— |

|

|

|

(4,783 |

) |

|

Payments on finance lease obligations |

|

(2 |

) |

|

|

(12 |

) |

|

|

(13 |

) |

|

Net cash provided by financing activities |

|

280,972 |

|

|

|

307,768 |

|

|

|

35,261 |

|

|

Effect of foreign currency translation on cash and cash

equivalents |

|

(367 |

) |

|

|

(61 |

) |

|

|

(130 |

) |

|

Net (decrease) increase in cash and cash

equivalents |

|

233,170 |

|

|

|

26,388 |

|

|

|

19,752 |

|

| Cash and cash

equivalents at beginning of the year |

|

86,262 |

|

|

|

59,874 |

|

|

|

40,122 |

|

| Cash and cash

equivalents at end of the year |

$ |

319,432 |

|

|

$ |

86,262 |

|

|

$ |

59,874 |

|

| Supplemental cash flow

information: |

|

|

|

|

|

|

|

|

| Cash paid for interest |

$ |

1,414 |

|

|

$ |

907 |

|

|

$ |

1,269 |

|

| Non-cash investing and

financing activities: |

|

|

|

|

|

|

|

|

| Non-cash purchase of property

and equipment |

|

279 |

|

|

|

— |

|

|

|

— |

|

| Non-cash consideration in

connection with business combinations |

|

(518 |

) |

|

|

2,339 |

|

|

|

— |

|

| Shares issued in business

combinations |

|

— |

|

|

|

102,888 |

|

|

|

— |

|

Xometry, Inc. and Subsidiaries

Unaudited Reconciliations of Non-GAAP Financial Measures (In

thousands)

|

|

For the Three MonthsEnded

December 31, |

|

|

For the YearEnded

December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(24,424 |

) |

|

$ |

(23,907 |

) |

|

$ |

(76,009 |

) |

|

$ |

(61,381 |

) |

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, interest and

dividend income and other expenses |

|

(505 |

) |

|

|

1,374 |

|

|

|

2,486 |

|

|

|

2,736 |

|

| Depreciation and amortization

expense(1) |

|

2,103 |

|

|

|

1,292 |

|

|

|

7,819 |

|

|

|

3,596 |

|

| Income tax provision |

|

595 |

|

|

|

— |

|

|

|

36 |

|

|

|

— |

|

| Amortization of lease

intangible |

|

333 |

|

|

|

— |

|

|

|

1,332 |

|

|

|

— |

|

| Stock-based

compensation(2) |

|

5,124 |

|

|

|

2,648 |

|

|

|

19,172 |

|

|

|

7,395 |

|

| Charitable contribution of

common stock |

|

— |

|

|

|

1,084 |

|

|

|

2,272 |

|

|

|

2,242 |

|

| (Loss) income from

unconsolidated joint venture |

|

30 |

|

|

|

(41 |

) |

|

|

(570 |

) |

|

|

(41 |

) |

| Acquisition and other(3) |

|

566 |

|

|

|

5,696 |

|

|

|

(676 |

) |

|

|

5,696 |

|

| Impairment of assets |

|

380 |

|

|

|

— |

|

|

|

824 |

|

|

|

— |

|

| Restructuring charge |

|

1,549 |

|

|

|

— |

|

|

|

1,549 |

|

|

|

— |

|

| Adjusted

EBITDA |

$ |

(14,249 |

) |

|

$ |

(11,854 |

) |

|

$ |

(41,765 |

) |

|

$ |

(39,757 |

) |

| |

For the Three MonthsEnded

December 31, |

|

|

For the YearEnded

December 31, |

|

| |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| Non-GAAP Net

Loss: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(24,424 |

) |

|

$ |

(23,907 |

) |

|

$ |

(76,009 |

) |

|

$ |

(61,381 |

) |

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization

expense(1) |

|

2,103 |

|

|

|

1,292 |

|

|

|

7,819 |

|

|

|

3,596 |

|

| Stock-based

compensation(2) |

|

5,124 |

|

|

|

2,648 |

|

|

|

19,172 |

|

|

|

7,395 |

|

| Amortization of lease

intangible |

|

333 |

|

|

|

— |

|

|

|

1,332 |

|

|

|

— |

|

| Amortization of deferred costs

on convertible notes |

|

468 |

|

|

|

— |

|

|

|

1,718 |

|

|

|

— |

|

| Unrealized loss on marketable

securities |

|

196 |

|

|

|

1,763 |

|

|

|

1,855 |

|

|

|

2,002 |

|

| Acquisition and other(3) |

|

566 |

|

|

|

5,696 |

|

|

|

(676 |

) |

|

|

5,696 |

|

| (Gain) loss on sale of

property and equipment |

|

(24 |

) |

|

|

10 |

|

|

|

47 |

|

|

|

18 |

|

| Charitable contribution of

common stock |

|

— |

|

|

|

1,084 |

|

|

|

2,272 |

|

|

|

2,242 |

|

| Impairment of assets |

|

380 |

|

|

|

— |

|

|

|

824 |

|

|

|

— |

|

| Restructuring charge |

|

1,549 |

|

|

|

— |

|

|

|

1,549 |

|

|

|

— |

|

| Non-GAAP Net

Loss |

$ |

(13,729 |

) |

|

$ |

(11,414 |

) |

|

$ |

(40,097 |

) |

|

$ |

(40,432 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of

shares outstanding used to compute Non-GAAP Net Loss per share,

basic and diluted |

|

47,457,139 |

|

|

|

44,995,598 |

|

|

|

47,158,247 |

|

|

|

26,318,349 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP EPS, basic and

diluted |

$ |

(0.29 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.85 |

) |

|

$ |

(1.54 |

) |

|

(1) |

Represents depreciation expense of the Company’s long-lived

tangible assets and amortization expense of its finite-lived

intangible assets, as included in the Company’s GAAP results of

operations. |

| (2) |

Represents the non-cash expense

related to stock-based awards granted to employees, as included in

the Company’s GAAP results of operations. |

| (3) |

Includes adjustments related to

purchase accounting, the revaluation of contingent consideration

and transaction costs. |

Xometry, Inc. and Subsidiaries

Segment Results(In thousands)

| |

For the Three Months Ended December 31, |

|

|

For the Year Ended December 31, |

|

| |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| Segment

Revenue: |

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

U.S. |

$ |

88,130 |

|

|

$ |

61,769 |

|

|

$ |

347,842 |

|

|

$ |

202,034 |

|

| International |

|

10,066 |

|

|

|

5,329 |

|

|

|

33,211 |

|

|

|

16,302 |

|

|

Total revenue |

$ |

98,196 |

|

|

$ |

67,098 |

|

|

$ |

381,053 |

|

|

$ |

218,336 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Segment Net

Loss: |

|

|

|

|

|

|

|

|

|

|

|

| U.S. |

$ |

(20,509 |

) |

|

$ |

(21,080 |

) |

|

$ |

(58,758 |

) |

|

$ |

(51,230 |

) |

| International |

|

(3,914 |

) |

|

|

(2,825 |

) |

|

|

(17,267 |

) |

|

|

(10,149 |

) |

|

Total net loss attributable to common stockholders |

$ |

(24,423 |

) |

|

$ |

(23,905 |

) |

|

$ |

(76,025 |

) |

|

$ |

(61,379 |

) |

Xometry, Inc. and Subsidiaries

Supplemental Information(In thousands)

| |

For the Three MonthsEnded

December 31, |

|

|

For the YearEnded

December 31, |

|

| |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| Summary of Stock-based

Compensation Expense |

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

Sales and marketing |

$ |

804 |

|

|

$ |

533 |

|

|

$ |

3,875 |

|

|

$ |

1,223 |

|

| Operations and support |

|

2,007 |

|

|

|

1,295 |

|

|

|

6,886 |

|

|

|

2,659 |

|

| Product development |

|

1,181 |

|

|

|

765 |

|

|

|

4,300 |

|

|

|

1,744 |

|

| General and

administrative |

|

1,132 |

|

|

|

55 |

|

|

|

4,111 |

|

|

|

1,769 |

|

| Total stock-based compensation

expense |

$ |

5,124 |

|

|

$ |

2,648 |

|

|

$ |

19,172 |

|

|

$ |

7,395 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Summary of

Depreciation and Amortization Expense |

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

$ |

(17 |

) |

|

$ |

34 |

|

|

$ |

82 |

|

|

$ |

104 |

|

| Sales and marketing |

|

776 |

|

|

|

211 |

|

|

|

3,102 |

|

|

|

300 |

|

| Operations and support |

|

15 |

|

|

|

36 |

|

|

|

57 |

|

|

|

155 |

|

| Product development |

|

1,046 |

|

|

|

909 |

|

|

|

3,483 |

|

|

|

2,821 |

|

| General and

administrative |

|

283 |

|

|

|

102 |

|

|

|

1,095 |

|

|

|

216 |

|

| Total depreciation and

amortization expense |

$ |

2,103 |

|

|

$ |

1,292 |

|

|

$ |

7,819 |

|

|

$ |

3,596 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Restructuring

charge |

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing |

$ |

506 |

|

|

$ |

- |

|

|

$ |

506 |

|

|

$ |

- |

|

| Operations and support |

|

432 |

|

|

|

- |

|

|

|

432 |

|

|

|

- |

|

| Product development |

|

458 |

|

|

|

- |

|

|

|

458 |

|

|

|

- |

|

| General and

administrative |

|

153 |

|

|

|

- |

|

|

|

153 |

|

|

|

- |

|

| Total restructuring

charge |

$ |

1,549 |

|

|

$ |

- |

|

|

$ |

1,549 |

|

|

$ |

- |

|

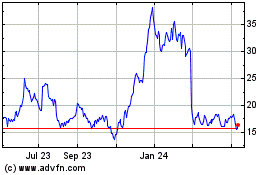

Xometry (NASDAQ:XMTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

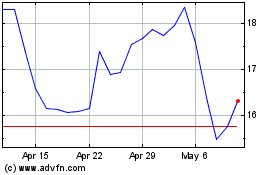

Xometry (NASDAQ:XMTR)

Historical Stock Chart

From Apr 2023 to Apr 2024