0001636222FALSEAddisonTexas00016362222023-08-232023-08-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 23, 2023

WINGSTOP INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-37425 | 47-3494862 |

| (State or other jurisdiction of incorporation or organization) | Commission File Number | (IRS Employer Identification No.) |

| | |

| 15505 Wright Brothers Drive | | |

Addison, Texas | | 75001 |

| (Address of principal executive offices) | | (Zip Code) |

(972) 686-6500

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | WING | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On August 23, 2023, Wingstop Inc. (the “Company”) entered into an accelerated share repurchase agreement (the “ASR Agreement”) with Morgan Stanley & Co. LLC (“Morgan Stanley”) to repurchase $125.0 million of the Company’s common stock, par value $0.01 per share (“Common Stock”). The Company is funding the repurchases under the ASR Agreement with cash on hand. The ASR Agreement is being executed under the Company’s previously announced $250.0 million share repurchase program.

Under the terms of the ASR Agreement, on August 25, 2023, the Company will make a $125.0 million payment to Morgan Stanley and will receive an initial delivery of approximately 567,000 shares of Common Stock. The final number of shares of Common Stock to be repurchased from Morgan Stanley will be based on the volume-weighted average share price of the Company’s Common Stock during the term of the transaction, less a discount and subject to adjustments pursuant to the terms of the ASR Agreement. At settlement, Morgan Stanley may be required to deliver additional shares of Common Stock to the Company, or the Company may be required either to make a cash payment or deliver shares of Common Stock to Morgan Stanley, at the Company’s election. The ASR Agreement contains customary terms for this type of transaction, including but not limited to the mechanisms to determine the number of shares of Common Stock or the amount of cash that will be delivered at settlement, the required timing of delivery of the Common Stock, provisions for adjustments to the transaction terms, the circumstances under which the ASR Agreement may be accelerated, extended or terminated, and various acknowledgments, representations and warranties made by the Company and Morgan Stanley to each other. The final settlement of the transactions under the ASR Agreement is expected to occur no later than the end of fiscal year 2023.

On August 24, 2023, the Company issued a press release announcing its entry into the ASR Agreement. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Forward-looking Statements

This Current Report on Form 8-K includes statements of our expectations, intentions, plans and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to come within the safe harbor protection provided by those sections. These statements, which involve risks and uncertainties, relate to the discussion of our expectations concerning transactions under the ASR Agreement. These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “may,” “will,” “should,” “expect,” “intend,” “plan,” “outlook,” “guidance,” “anticipate,” “believe,” “think,” “estimate,” “seek,” “predict,” “can,” “could,” “project,” “potential” or, in each case, their negative or other variations or comparable terminology, although not all forward-looking statements are accompanied by such terms. These forward-looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties, risks, and factors relating to our operations and business environments, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed or implied by these forward-looking statements. Please refer to the risk factors discussed in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which can be found at the SEC’s website www.sec.gov. The discussion of these risks is specifically incorporated by reference into this Current Report on Form 8-K.

When considering forward-looking statements in this Current Report on Form 8-K or that we make in other reports or statements, you should keep in mind the cautionary statements in this Current Report on Form 8-K and future reports we file with the SEC. New risks and uncertainties arise from time to time, and we cannot predict when they may arise or how they may affect us. Any forward-looking statement in this Current Report on Form 8-K speaks only as of the date on which it was made. Except as required by law, we assume no obligation to update or revise any forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

| | | | | |

| (d) | Exhibits |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. | | | | | | | | | | | | | | |

| | | | Wingstop Inc. |

| | | | |

| | | | |

| Date: | August 24, 2023 | | By: | /s/ Alex R. Kaleida |

| | | | Chief Financial Officer (Principal Financial and Accounting Officer) |

Wingstop Announces $125 Million Accelerated Share Repurchase Agreement

DALLAS, August 24, 2023 – Wingstop (NASDAQ: WING) today announced that it has entered into an accelerated share repurchase agreement (“ASR”) with Morgan Stanley & Co. LLC to repurchase $125.0 million of Wingstop common stock. The ASR was entered into under Wingstop’s previously announced $250.0 million share repurchase program. After completion of the ASR, $125.0 million will remain available under Wingstop’s share repurchase program.

Wingstop is funding the ASR with cash on hand. Under the terms of the agreement, Wingstop will receive an initial share delivery of approximately 567,000 shares, with the final settlement scheduled to occur no later than the end of fiscal year 2023. The final number of shares to be repurchased by Wingstop under the ASR will be based on the volume-weighted average stock price of Wingstop’s common stock during the term of the agreement, less a discount and subject to adjustments.

About Wingstop

Founded in 1994 and headquartered in Dallas, TX, Wingstop Inc. (NASDAQ: WING) operates and franchises more than 2,000 locations worldwide. The Wing Experts are dedicated to Serving the World Flavor through an unparalleled guest experience and use of a best-in-class technology platform, all while offering classic and boneless wings, tenders, and chicken sandwiches, always cooked to order and hand sauced-and-tossed in fans’ choice of 11 bold, distinctive flavors. Wingstop’s menu also features signature sides including fresh-cut, seasoned fries and freshly-made ranch and bleu cheese dips.

In fiscal year 2022, Wingstop’s system-wide sales increased 16.8% to approximately $2.7 billion, marking the 19th consecutive year of same store sales growth. With a vision of becoming a Top 10 Global Restaurant Brand, Wingstop’s system is comprised of independent franchisees, or brand partners, who account for approximately 98% of Wingstop’s total restaurant count of 2,046 as of July 1, 2023.

A key to this business success and consumer fandom stems from The Wingstop Way, which includes a core value system of being Authentic, Entrepreneurial, Service-minded, and Fun. The Wingstop Way extends to the brand’s environmental, social and governance platform as Wingstop seeks to provide value to all guests.

Rounding out a strong year in 2022, the Company made Technomic 500’s “Fastest Growing Franchise” list, was ranked #16 on Entrepreneur Magazine’s “Franchise 500,” won Fast Casual’s Excellence in Food Safety award, and was named to Fast Company’s “The World’s Most Innovative Companies” list ranking #4 in the dining category.

For more information visit www.wingstop.com or www.wingstop.com/own-a-wingstop and follow @Wingstop on Twitter, Instagram, Facebook, and TikTok. Learn more about Wingstop’s involvement in its local communities at www.wingstopcharities.org.

Forward-looking Statements

This news release includes statements of our expectations, intentions, plans and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to come within the safe harbor protection provided by those sections. These statements, which involve risks and uncertainties, relate to the discussion of our expectations concerning the implementation and execution of our share repurchase program. These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “may,” “will,” “should,” “expect,” “intend,” “plan,” “outlook,” “guidance,” “anticipate,” “believe,” “think,” “estimate,” “seek,” “predict,” “can,” “could,” “project,” “potential” or, in each case, their negative or other variations or comparable terminology, although not all forward-looking statements are accompanied by such terms. These forward-looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties, risks, and factors relating to our operations and business environments, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed or implied by these forward-looking statements. Please refer to the risk factors discussed in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which can be found at the SEC’s website www.sec.gov. The discussion of these risks is specifically incorporated by reference into this news release.

When considering forward-looking statements in this news release or that we make in other reports or statements, you should keep in mind the cautionary statements in this news release and future reports we file with the SEC. New risks and uncertainties arise from time to time, and we cannot predict when they may arise or how they may affect us. Any forward-looking statement in this news release speaks only as of the date on which it was made. Except as required by law, we assume no obligation to update or revise any forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Media Contact

Maddie Lupori

Media@wingstop.com

Investor Contact

Kristen Thomas

IR@wingstop.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

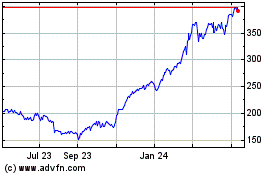

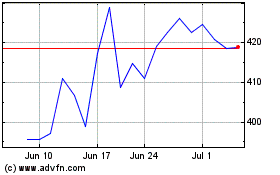

Wingstop (NASDAQ:WING)

Historical Stock Chart

From Apr 2024 to May 2024

Wingstop (NASDAQ:WING)

Historical Stock Chart

From May 2023 to May 2024