Current Report Filing (8-k)

February 01 2021 - 5:20PM

Edgar (US Regulatory)

VERINT SYSTEMS INC NASDAQ false 0001166388 0001166388 2021-02-01 2021-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 1, 2021

Verint Systems Inc.

(Exact name of registrant as specified in its charter)

001-34807

(Commission File Number)

|

|

|

|

|

Delaware

|

|

11-3200514

|

|

(State or other jurisdiction

of incorporation)

|

|

(I.R.S. Employer

Identification No.)

|

175 Broadhollow Road

Melville, New York 11747

(Address of principal executive offices, with zip code)

(631) 962-9600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol

|

|

Name of exchange

on which registered

|

|

Common Stock, $0.001 par value per share

|

|

VRNT

|

|

The NASDAQ Stock Market, LLC

(NASDAQ Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On February 1, 2021, Verint Systems Inc. (“Verint” or “we,” “us,” “our,” and the “Company”) completed the previously announced spin-off (the “Spin-Off”) of Cognyte Software Ltd. (“Cognyte”), a company limited by shares incorporated under the laws of the State of Israel whose business and operations consist of Verint’s former Cyber Intelligence Solutions™ business (the “Cognyte Business”). The Spin-Off was completed by way of a pro rata distribution (the “Distribution”) on February 1, 2021 of all of the then-issued and outstanding ordinary shares, no par value, of Cognyte (the “Cognyte shares”) to holders of record of Verint’s common stock as of the close of business on January 25, 2021.

As a result of the Distribution, which was effective as of 5:01 p.m. Eastern Time on February 1, 2021 (the “Effective Time”), Cognyte is now an independent, publicly traded company and the Cognyte shares are listed on the Nasdaq Global Select Market (“NASDAQ”) under the symbol “CGNT.” Trading in Cognyte shares is expected to commence on NASDAQ on February 2, 2021.

In connection with the Spin-Off, we entered into certain agreements with Cognyte, including each of the following:

|

|

•

|

|

a Separation and Distribution Agreement;

|

|

|

•

|

|

a Tax Matters Agreement;

|

|

|

•

|

|

an Employee Matters Agreement;

|

|

|

•

|

|

a limited duration Transition Services Agreement;

|

|

|

•

|

|

an Intellectual Property Cross License Agreement; and

|

|

|

•

|

|

a Trademark Cross License Agreement.

|

Summaries of certain terms of these agreements can be found in the section entitled “Item 7.B. Related Party Transactions–Agreements Between Verint and Us” in Registration Statement on Form 20-F (File No. 001-39829) (as amended, the “Form 20-F”) filed by Cognyte with the Securities and Exchange Commission (“SEC”), and are incorporated herein by reference. Such summaries are qualified in their entirety by reference to the full text of the Separation and Distribution Agreement, Tax Matters Agreement, Employee Matters Agreement, Transition Services Agreement, Intellectual Property Cross License Agreement and Trademark Cross License Agreement, copies of which are attached as Exhibits 2.1, 10.2, 10.3, 10.4, 10.5 and 10.6, respectively, to this current report on Form 8-K and are incorporated herein by reference.

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

The information contained in Item 1.01 is incorporated herein by reference.

The Form 20-F relating to the Spin-Off was filed by Cognyte with the SEC and was declared effective on January 15, 2021.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

In connection with the consummation of Spin-Off, the previously announced resignation of Earl Shanks as a director of the Company became effective. Mr. Shanks’s resignation from the Verint board of directors was not due to a disagreement with the Company on any matter relating to the Company’s operations, policies, or practices.

|

Item 7.01

|

Regulation FD Disclosure

|

On February 1, 2021, Verint issued a press release announcing the closing of the Spin-Off. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(b) Pro forma financial information.

The unaudited pro forma condensed consolidated balance sheet of the Company as of October 31, 2020 and the unaudited pro forma condensed consolidated statement of operations of the Company for the nine months ended October 31, 2020 and for the years ended January 31, 2020, January 31, 2019 and January 31, 2018 giving pro forma effect to the Spin-Off are included as Exhibit 99.2 to this Current Report on Form 8-K and are incorporated into this Item 9.01 by reference.

(d) Exhibits.

|

|

|

|

|

Exhibit

|

|

Title

|

|

|

|

|

2.1

|

|

Separation and Distribution Agreement, dated February 1, 2021, by and between Cognyte Software Ltd. and Verint Systems Inc. (incorporated by reference to Exhibit 99.1 to the Report on Form 6-K filed by Cognyte on February 1, 2021 (the “Cognyte Form 6-K”))

|

|

|

|

|

10.2

|

|

Tax Matters Agreement, dated February 1, 2021, by and between Cognyte Software Ltd. and Verint Systems Inc. (incorporated by reference to Exhibit 99.2 to the Cognyte Form 6-K)

|

|

|

|

|

10.3

|

|

Employee Matters Agreement, dated February 1, 2021, by and between Cognyte Software Ltd. and Verint Systems Inc. (incorporated by reference to Exhibit 99.3 to the Cognyte Form 6-K)

|

|

|

|

|

10.4

|

|

Transition Services Agreement, dated February 1, 2021, by and between Cognyte Software Ltd. and Verint Systems Inc. (incorporated by reference to Exhibit 99.4 to the Cognyte Form 6-K)

|

|

|

|

|

10.5

|

|

Intellectual Property Cross License Agreement, dated February 1, 2021, by and between Cognyte Software Ltd. and Verint Systems Inc. (incorporated by reference to Exhibit 99.5 to the Cognyte Form 6-K)

|

|

|

|

|

10.6

|

|

Trademark Cross License Agreement, dated February 1, 2021, by and between Cognyte Software Ltd. and Verint Systems Inc. (incorporated by reference to Exhibit 99.6 to the Cognyte Form 6-K)

|

|

|

|

|

99.1

|

|

Press Release

|

|

|

|

|

99.2

|

|

Unaudited Pro Forma Financial Information

|

|

|

|

|

104

|

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

|

Forward-Looking Statements

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the Spin-Off of Cognyte, Verint’s and Cognyte’s future plans, areas of focus, positioning for future success following the Spin-Off, and technology development plans. These forward-looking statements are based on the Company’s current assumptions, expectations and beliefs and involve substantial risks and uncertainties that may cause results, performance or achievement to materially differ from those expressed or implied by these forward-looking statements. Some of the factors that could cause actual results or conditions to differ materially from current expectations include, among others: the Company’s expectations regarding the anticipated benefits to be achieved following the Spin-Off, including the possibility that the spin-off may negatively impact the Company’s operations or stock price; rapid technological changes and evolving industry standards; and challenges in establishing and maintaining relationships with third-party suppliers, manufacturers, and partners. The Company assumes no obligation to revise or update any forward-looking statement, except as otherwise required by law. For a detailed discussion of these risk factors, see the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2020, its Quarterly Report on Form 10-Q for the quarter ended April 30, 2020, its Quarterly Report on Form 10-Q for the quarter ended July 31, 2020, its Quarterly Report on Form 10-Q for the quarter ended October 31, 2020 and other filings the Company makes with the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

VERINT SYSTEMS INC.

|

|

|

|

|

By:

|

|

/s/ Peter Fante

|

|

Name:

|

|

Peter Fante

|

|

Title:

|

|

Chief Administrative Officer

|

Date: February 1, 2021

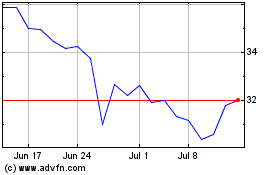

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jun 2024 to Jul 2024

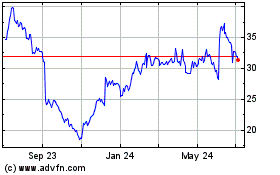

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jul 2023 to Jul 2024