Strong Q1 Results Across Key Metrics including Revenue, EPS and

Cash Flow.

Raising Guidance for FY2020

Introducing New Three Year Targets

Verint® Systems Inc. (NASDAQ:VRNT), a

global Actionable Intelligence® leader, today announced results for

the three months ended April 30, 2019 (FY2020).

“We are pleased to have started the year strong with continued

business momentum. Our first quarter results were ahead of our

guidance, for both revenue and EPS, and we are well positioned for

a year of double-digit revenue and EPS growth, on a non-GAAP basis.

We are also pleased with our 55% increase in cash from operations,

to $93 million in Q1, demonstrating the underlying strength in our

business. We believe our strong results reflect the execution of

our strategy to accelerate innovation that we started two years

ago, and that this strategy will enable us to sustain growth over

the long-run. We are also pleased to be in a position to raise our

guidance for the current fiscal year, and to introduce new

three-year targets,” said Dan Bodner, CEO.

FY2020 Financial Highlights (Three Months Ending April 30,

2019, Compared to Prior Year)

GAAP Non-GAAP Revenue of

$315 million, up 9.0% Revenue of $324 million, up 11.0%

Gross margin of 63.8%, up 320bps Gross margin of 67.4%, up

350bps Operating income of $14 million, up 86% Operating

income of $62 million, up 35% Operating margin of 4.6%, up 190bps

Operating margin of 19.2%, up 340bps Diluted EPS of $0.02,

vs. ($0.03) in FY19 Diluted EPS of $0.73, up 38.0% Cash flow

from operations of $93 million, up 55%

Financial Outlook for FY2020 (Year Ending January 31,

2020)

Today, we are raising our non-GAAP outlook for revenue and EPS

for the year ending January 31, 2020 as follows:

- Revenue: Increasing by $5 million to

$1.375 billion with a range of +/- 2%

- Reflects 10.5% year-over-year

growth

- EPS: Increasing by 5 cents to $3.65 at

the midpoint of our revenue guidance

- Reflects 14% year-over-year growth

Three Year Targets (Year Ending January 31,

2022)

Today, we are introducing non-GAAP targets for revenue and EPS

for the year ending January 31, 2022 as follows:

- Revenue: $1.65 billion

- EPS: $4.70

Our non-GAAP outlook for the year ending January 31, 2020

excludes the following GAAP measures which we are able to quantify

with reasonable certainty:

- Amortization of intangible assets of

approximately $55 million.

- Amortization of discount on convertible

notes of approximately $12 million.

Our non-GAAP outlook for the year ending January 31, 2020

excludes the following GAAP measures for which we are able to

provide a range of probable significance:

- Revenue adjustments are expected to be

between approximately $24 million and $26 million.

- Stock-based compensation is expected to

be between approximately $73 million and $77 million, assuming

market prices for our common stock approximately consistent with

current levels.

Our non-GAAP outlook does not include the potential impact of

any in-process business acquisitions that may close after the date

hereof, and, unless otherwise specified, reflects foreign currency

exchange rates approximately consistent with current rates.

We are unable, without unreasonable efforts, to provide a

reconciliation for other GAAP measures which are excluded from our

non-GAAP outlook, including the impact of future business

acquisitions or acquisition expenses, future restructuring

expenses, and non-GAAP income tax adjustments due to the level of

unpredictability and uncertainty associated with these items. For

these same reasons, we are unable to assess the probable

significance of these excluded items. While historical results may

not be indicative of future results, actual amounts for the three

months ended April 30, 2019 and 2018 for the GAAP measures excluded

from our non-GAAP outlook appear in Table 3 to this press

release.

Our non-GAAP Consolidated, Customer Engagement, and Cyber

Intelligence three-year targets exclude various GAAP measures,

including:

- Amortization of intangible assets.

- Stock-based compensation expenses.

- Revenue adjustments.

- Acquisition expenses.

- Restructuring expenses.

Our non-GAAP Consolidated three-year targets also reflect income

tax provisions on a non-GAAP basis.

We are unable, without unreasonable efforts, to provide a

reconciliation for these GAAP measures which are excluded from our

non-GAAP Consolidated, Customer Engagement, and Cyber Intelligence

three-year targets, due to the level of unpredictability and

uncertainty associated with these items. For these same reasons, we

are unable to assess the probable significance of these excluded

items.

Our non-GAAP Consolidated, Customer Engagement, and Cyber

Intelligence three-year targets reflect foreign currency exchange

rates approximately consistent with current rates.

Conference Call

Information

We will conduct a conference call today at 4:30 p.m. ET to

discuss our results for the three months ended April 30, 2019 and

outlook. An online, real-time webcast of the conference call will

be available on our website at www.verint.com. The conference call can also be

accessed live via telephone at 1-844-309-0615 (United States and

Canada) and 1-661-378-9462 (international) and the passcode is

8290147. Please dial in 5-10 minutes prior to the scheduled start

time.

About Non-GAAP Financial Measures

This press release and the accompanying tables include non-GAAP

financial measures. For a description of these non-GAAP financial

measures, including the reasons management uses each measure, and

reconciliations of non-GAAP financial measures presented for

completed periods to the most directly comparable financial

measures prepared in accordance with GAAP, please see the tables

below as well as "Supplemental Information About Non-GAAP Financial

Measures" at the end of this press release.

About Verint Systems Inc.

Verint® (Nasdaq: VRNT) is a global leader in Actionable

Intelligence® solutions with a focus on customer engagement

optimization and cyber intelligence. Today, over 10,000

organizations in more than 180 countries—including over 85 percent

of the Fortune 100—count on intelligence from Verint solutions to

make more informed, effective and timely decisions. Learn more

about how we’re creating A Smarter World with Actionable

Intelligence® at www.verint.com.

Cautions About Forward-Looking Statements

This press release contains forward-looking statements,

including statements regarding expectations, predictions, views,

opportunities, plans, strategies, beliefs, and statements of

similar effect relating to Verint Systems Inc. These

forward-looking statements are not guarantees of future performance

and they are based on management's expectations that involve a

number of known and unknown risks, uncertainties, assumptions, and

other important factors, any of which could cause our actual

results or conditions to differ materially from those expressed in

or implied by the forward-looking statements. Some of the factors

that could cause our actual results or conditions to differ

materially from current expectations include, among others:

uncertainties regarding the impact of general economic conditions

in the United States and abroad, particularly in information

technology spending and government budgets, on our business; risks

associated with our ability to keep pace with technological

changes, evolving industry standards and challenges, to adapt to

changing market potential from area to area within our markets, and

to successfully develop, launch, and drive demand for new,

innovative, high-quality products that meet or exceed customer

needs, while simultaneously preserving our legacy businesses and

migrating away from areas of commoditization; risks due to

aggressive competition in all of our markets, including with

respect to maintaining revenues, margins, and sufficient levels of

investment in our business and operations; risks created by the

continued consolidation of our competitors or the introduction of

large competitors in our markets with greater resources than we

have; risks associated with our ability to successfully compete

for, consummate, and implement mergers and acquisitions, including

risks associated with valuations, reputational considerations,

capital constraints, costs and expenses, maintaining profitability

levels, expansion into new areas, management distraction,

post-acquisition integration activities, and potential asset

impairments; risks relating to our ability to properly manage

investments in our business and operations, execute on growth

initiatives, and enhance our existing operations and

infrastructure, including the proper prioritization and allocation

of limited financial and other resources; risks associated with our

ability to retain, recruit, and train qualified personnel in

regions in which we operate, including in new markets and growth

areas we may enter; risks that we may be unable to establish and

maintain relationships with key resellers, partners, and systems

integrators and risks associated with our reliance on third-party

suppliers, partners, or original equipment manufacturers (“OEMs”)

for certain components, products, or services, including companies

that may compete with us or work with our competitors; risks

associated with the mishandling or perceived mishandling of

sensitive or confidential information, including information that

may belong to our customers or other third parties, and with

security vulnerabilities or lapses, including cyber-attacks,

information technology system breaches, failures, or disruptions;

risks that our products or services, or those of third-party

suppliers, partners, or OEMs which we use in or with our offerings

or otherwise rely on, including third-party hosting platforms, may

contain defects, develop operational problems, or be vulnerable to

cyber-attacks; risks associated with our significant international

operations, including, among others, in Israel, Europe, and Asia,

exposure to regions subject to political or economic instability,

fluctuations in foreign exchange rates, and challenges associated

with a significant portion of our cash being held overseas; risks

associated with political factors related to our business or

operations, including reputational risks associated with our

security solutions and our ability to maintain security clearances

where required as well as risks associated with a significant

amount of our business coming from domestic and foreign government

customers; risks associated with complex and changing local and

foreign regulatory environments in the jurisdictions in which we

operate, including, among others, with respect to trade compliance,

anti-corruption, information security, data privacy and protection,

tax, labor, government contracts, relating to both our own

operations as well as the use of our solutions by our customers;

challenges associated with selling sophisticated solutions,

including with respect to assisting customers in understanding and

realizing the benefits of our solutions, and developing, offering,

implementing, and maintaining a broad and sophisticated solution

portfolio; challenges associated with pursuing larger sales

opportunities, including with respect to longer sales cycles,

transaction reductions, deferrals, or cancellations during the

sales cycle, risk of customer concentration, our ability to

accurately forecast when a sales opportunity will convert to an

order, or to forecast revenue and expenses, and increased

volatility of our operating results from period to period; risks

that our intellectual property rights may not be adequate to

protect our business or assets or that others may make claims on

our intellectual property, claim infringement on their intellectual

property rights, or claim a violation of their license rights,

including relative to free or open source components we may use;

risks that our customers or partners delay or cancel orders or are

unable to honor contractual commitments due to liquidity issues,

challenges in their business, or otherwise; risks that we may

experience liquidity or working capital issues and related risks

that financing sources may be unavailable to us on reasonable terms

or at all; risks associated with significant leverage resulting

from our current debt position or our ability to incur additional

debt, including with respect to liquidity considerations, covenant

limitations and compliance, fluctuations in interest rates,

dilution considerations (with respect to our convertible notes),

and our ability to maintain our credit ratings; risks arising as a

result of contingent or other obligations or liabilities assumed in

our acquisition of our former parent company, Comverse Technology,

Inc. (“CTI”), or associated with formerly being consolidated with,

and part of a consolidated tax group with, CTI, or as a result of

the successor to CTI's business operations, Mavenir, Inc., being

unwilling or unable to provide us with certain indemnities to which

we are entitled; risks relating to the adequacy of our existing

infrastructure, systems, processes, policies, procedures, and

personnel and our ability to successfully implement and maintain

enhancements to the foregoing and adequate systems and internal

controls for our current and future operations and reporting needs,

including related risks of financial statement omissions,

misstatements, restatements, or filing delays; risks associated

with changing accounting principles or standards, tax laws and

regulations, tax rates, and the continuing availability of expected

tax benefits; and risks associated with market volatility in the

prices of our common stock and convertible notes based on our

performance, third-party publications or speculation, or other

factors and risks associated with actions of activist stockholders.

We assume no obligation to revise or update any forward-looking

statement, except as otherwise required by law. For a detailed

discussion of these risk factors, see our Annual Report on Form

10-K for the fiscal year ended January 31, 2019, our Quarterly

Report on Form 10-Q for the quarter ended April 30, 2019, when

filed, and other filings we make with the SEC.

VERINT, ACTIONABLE INTELLIGENCE, THE CUSTOMER ENGAGEMENT

COMPANY, NEXT IT, FORESEE, OPINIONLAB, KIRAN ANALYTICS, TERROGENCE,

SENSECY, CUSTOMER ENGAGEMENT SOLUTIONS, CYBER INTELLIGENCE

SOLUTIONS, EDGEVR, RELIANT, VANTAGE, STAR-GATE, SUNTECH, and VIGIA

are trademarks or registered trademarks of Verint Systems Inc. or

its subsidiaries. Other trademarks mentioned are the property of

their respective owners.

Table 1 VERINT SYSTEMS INC. AND

SUBSIDIARIES Consolidated Statements of Operations

(Unaudited) Three Months EndedApril 30,

(in thousands, except per share data)

2019

2018 Revenue: Product $ 104,224 $ 105,864 Service and

support 211,035 183,343

Total revenue

315,259 289,207 Cost of revenue:

Product 28,120 34,809 Service and support 79,361 71,857

Amortization of acquired technology 6,707 7,426

Total cost of revenue 114,188 114,092

Gross profit 201,071 175,115

Operating expenses: Research and development, net

57,169 52,152 Selling, general and administrative 121,721 107,497

Amortization of other acquired intangible assets 7,713 7,684

Total operating expenses 186,603

167,333 Operating income 14,468

7,782 Other income (expense), net: Interest

income 1,426 793 Interest expense (9,934 ) (9,062 ) Other expense,

net (790 ) (464 )

Total other expense, net (9,298

) (8,733 ) Income (loss) before provision

for income taxes 5,170 (951 ) Provision

for income taxes 1,409 274

Net income (loss)

3,761 (1,225 ) Net income attributable to

noncontrolling interests 2,185 990

Net income

(loss) attributable to Verint Systems Inc. $

1,576 $ (2,215 ) Net

income (loss) per common share attributable to Verint Systems

Inc.: Basic $ 0.02 $

(0.03 ) Diluted $ 0.02

$ (0.03 ) Weighted-average common

shares outstanding: Basic 65,438

63,298 Diluted 67,088

63,298 Table 2

VERINT SYSTEMS INC. AND SUBSIDIARIES Segment Revenue

(Unaudited)

Three Months Ended April

30,

(in thousands)

2019 2018 GAAP Revenue By

Segment: Customer Engagement $ 207,095 $ 186,456 Cyber

Intelligence 108,164 102,751

GAAP Total Revenue

$ 315,259 $ 289,207

Revenue Adjustments: Customer Engagement $ 8,772 $ 2,719

Cyber Intelligence 127 44

Total Revenue Adjustments

$ 8,899 $ 2,763

Non-GAAP Revenue By Segment: Customer Engagement $ 215,867 $

189,175 Cyber Intelligence 108,291 102,795

Non-GAAP Total

Revenue $ 324,158 $ 291,970

Table 3 VERINT SYSTEMS INC.

AND SUBSIDIARIES Reconciliation of GAAP to Non-GAAP

Results (Unaudited)

Three Months Ended April

30,

(in thousands, except per share data)

2019

2018

Table of

Reconciliation from GAAP Gross Profit to Non-GAAP Gross

Profit

GAAP gross profit $ 201,071

$ 175,115 GAAP gross margin 63.8

% 60.6 % Revenue adjustments 8,899 2,763

Amortization of acquired technology 6,707 7,426 Stock-based

compensation expenses 1,404 846 Acquisition expenses, net 15 17

Restructuring expenses 449 363

Non-GAAP gross

profit $ 218,545 $ 186,530

Non-GAAP gross margin 67.4 %

63.9 %

Table of

Reconciliation from GAAP Operating Income to Non-GAAP Operating

Income

GAAP operating income $ 14,468

$ 7,782 As a percentage of GAAP revenue

4.6 % 2.7 % Revenue adjustments 8,899

2,763 Amortization of acquired technology 6,707 7,426 Amortization

of other acquired intangible assets 7,713 7,684 Stock-based

compensation expenses 17,103 16,459 Acquisition expenses, net 3,868

2,315 Restructuring expenses 1,437 1,091 Other adjustments 2,059

595

Non-GAAP operating income $

62,254 $ 46,115 As a

percentage of non-GAAP revenue 19.2 % 15.8

%

Table of

Reconciliation from GAAP Other Expense, Net to Non-GAAP Other

Expense, Net

GAAP other expense, net $ (9,298

) $ (8,733 ) Unrealized losses (gains)

on derivatives, net 679 (543 ) Amortization of convertible note

discount 3,061 2,905 Acquisition expenses, net (34 ) 28

Non-GAAP other expense, net(1) $ (5,592

) $ (6,343 )

Table of

Reconciliation from GAAP Provision for Income Taxes to Non-GAAP

Provision for Income Taxes

GAAP provision for income taxes $ 1,409

$ 274 GAAP effective income tax

rate 27.3 % (28.8 )% Non-GAAP tax

adjustments 4,001 3,982

Non-GAAP provision for

income taxes $ 5,410 $ 4,256

Non-GAAP effective income tax rate 9.5

% 10.7 %

Table of

Reconciliation from GAAP Net Income (Loss) Attributable to Verint

Systems Inc. to Non-GAAP Net Income Attributable to Verint Systems

Inc.

GAAP net income (loss) attributable to Verint Systems

Inc. $ 1,576 $ (2,215

) Revenue adjustments 8,899 2,763 Amortization of acquired

technology 6,707 7,426 Amortization of other acquired intangible

assets 7,713 7,684 Stock-based compensation expenses 17,103 16,459

Unrealized losses (gains) on derivatives, net 679 (543 )

Amortization of convertible note discount 3,061 2,905 Acquisition

expenses, net 3,834 2,343 Restructuring expenses 1,437 1,091 Other

adjustments 2,059 595 Non-GAAP tax adjustments (4,001 ) (3,982 )

Total GAAP net income (loss) adjustments 47,491 36,741

Non-GAAP net income attributable to Verint Systems

Inc. $ 49,067 $ 34,526

Table Comparing

GAAP Diluted Net Income (Loss) Per Common Share Attributable to

Verint Systems Inc. to Non-GAAP Diluted Net Income Per Common Share

Attributable to Verint Systems Inc.

GAAP diluted net income (loss) per common share attributable

to Verint Systems Inc. $ 0.02 $ (0.03 ) Non-GAAP diluted net

income per common share attributable to Verint Systems Inc. $ 0.73

$ 0.53

GAAP weighted-average shares used in

computing diluted net income (loss) per common share attributable

to Verint Systems Inc. 67,088 63,928 Additional

weighted-average shares applicable to non-GAAP diluted net income

per common share attributable to Verint Systems Inc. — 1,203

Non-GAAP diluted weighted-average shares used in

computing net income per common share attributable to Verint

Systems Inc. 67,088 65,131

Table of

Reconciliation from GAAP Net Income (Loss) Attributable to Verint

Systems Inc. to Adjusted EBITDA

GAAP net income (loss) attributable to Verint Systems

Inc. $ 1,576 $ (2,215

) As a percentage of GAAP revenue 0.5 %

(0.8 )% Net income attributable to noncontrolling

interest 2,185 990 Provision for income taxes 1,409 274 Other

expense, net 9,298 8,733 Depreciation and amortization(2) 22,293

23,310 Revenue adjustments 8,899 2,763 Stock-based compensation

expenses 17,103 16,459 Acquisition expenses, net 3,868 2,315

Restructuring expenses 1,437 1,090 Other adjustments 2,059

595

Adjusted EBITDA $ 70,127

$ 54,314 As a percentage of non-GAAP

revenue 21.6 % 18.6 %

Table of

Reconciliation from Gross Debt to Net Debt

April 30,

2019

January 31,

2019

Current maturities of long-term debt $ 4,303 $ 4,343

Long-term debt 780,260 777,785 Unamortized debt discounts and

issuance costs 33,052 36,589

Gross debt

817,615 818,717 Less: Cash and cash

equivalents 412,024 369,975 Restricted cash and cash equivalents,

and restricted time deposits 39,749 42,262 Short-term investments

39,334 32,329

Net debt, excluding long-term

restricted cash, cash equivalents, time deposits, and

investments 326,508 374,151

Long-term restricted cash, cash equivalents, time deposits and

investments 25,082 23,193

Net debt, including

long-term restricted cash, cash equivalents, time deposits, and

investments $ 301,426 $

350,958 (1) For the three months ended

April 30, 2019, non-GAAP other expense, net of $5.6 million was

comprised of $5.6 million of interest and other expense. (2)

Adjusted for financing fee amortization.

Table 4 VERINT SYSTEMS INC. AND

SUBSIDIARIES Consolidated Balance Sheets

(Unaudited) April 30, January 31, (in

thousands, except share and per share data)

2019 2019

Assets Current Assets: Cash and cash equivalents $

412,024 $ 369,975 Restricted cash and cash equivalents, and

restricted bank time deposits 39,749 42,262 Short-term investments

39,334 32,329 Accounts receivable, net of allowance for doubtful

accounts of $4.5 million and $3.8 million, respectively 316,101

375,663 Contract assets 63,228 63,389 Inventories 27,845 24,952

Prepaid expenses and other current assets 90,016 97,776

Total current assets 988,297

1,006,346 Property and equipment, net 102,340 100,134

Operating lease right-of-use assets 96,811 — Goodwill 1,431,517

1,417,481 Intangible assets, net 219,552 225,183 Other assets

119,024 117,883

Total assets $

2,957,541 $ 2,867,027

Liabilities and Stockholders' Equity Current

Liabilities: Accounts payable $ 65,275 $ 71,621 Accrued

expenses and other current liabilities 244,983 212,824 Contract

liabilities 350,488 377,376

Total current

liabilities 660,746 661,821

Long-term debt 780,260 777,785 Long-term contract liabilities

32,726 30,094 Operating lease liabilities 85,649 — Other

liabilities 123,583 136,523

Total liabilities

1,682,964 1,606,223 Commitments and

Contingencies Stockholders' Equity: Preferred stock -

$0.001 par value; authorized 2,207,000 shares at April 30, 2019 and

January 31, 2019, respectively; none issued. — — Common stock -

$0.001 par value; authorized 120,000,000 shares. Issued 67,446,000

and 66,998,000 shares; outstanding 65,773,000 and 65,333,000 shares

at April 30, 2019 and January 31, 2019, respectively. 67 67

Additional paid-in capital 1,601,156 1,586,266 Treasury stock, at

cost - 1,673,000 and 1,665,000 shares at April 30, 2019 and January

31, 2019, respectively. (58,072 ) (57,598 ) Accumulated deficit

(132,698 ) (134,274 ) Accumulated other comprehensive loss (149,523

) (145,225 )

Total Verint Systems Inc. stockholders' equity

1,260,930 1,249,236 Noncontrolling interests 13,647

11,568

Total stockholders' equity

1,274,577 1,260,804 Total

liabilities and stockholders' equity $ 2,957,541

$ 2,867,027

Table 5 VERINT SYSTEMS INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows (Unaudited)

Three Months EndedApril 30, (in thousands)

2019 2018 Cash flows from operating

activities: Net income (loss) $ 3,761 $ (1,225 )

Adjustments

to reconcile net income (loss) to net cash provided by operating

activities: Depreciation and amortization 22,954 23,963

Stock-based compensation, excluding cash-settled awards 17,065

16,443 Amortization of discount on convertible notes 3,061 2,905

Non-cash gains on derivative financial instruments, net (549 )

(1,488 ) Other non-cash items, net 2,646 (448 )

Changes in

operating assets and liabilities, net of effects of business

combinations: Accounts receivable 58,900 45,386 Contract assets

(39 ) (18,811 ) Inventories (3,118 ) 2,434 Prepaid expenses and

other assets 5,268 (1,028 ) Accounts payable and accrued expenses

8,487 (3,027 ) Contract liabilities (24,648 ) (4,543 ) Other, net

(725 ) (409 )

Net cash provided by operating activities

93,063 60,152 Cash flows from

investing activities: Cash paid for business combinations,

including adjustments, net of cash acquired (20,210 ) — Purchases

of property and equipment (8,331 ) (7,747 ) Purchases of

investments (9,995 ) (2,792 ) Maturities and sales of investments

2,965 — Cash paid for capitalized software development costs (2,819

) (1,121 ) Change in restricted bank time deposits, and other

investing activities, net 2,941 398

Net cash used

in investing activities (35,449 ) (11,262

) Cash flows from financing activities:

Proceeds from borrowings, net of original issuance discount —

(1,275 ) Repayments of borrowings and other financing obligations

(1,584 ) — Purchases of treasury stock (474 ) (173 ) Dividends paid

to noncontrolling interest — (760 ) Payments of deferred purchase

price and contingent consideration for business combinations

(financing portion) (11,674 ) (2,584 ) Other financing activities,

net — (15 )

Net cash used in financing activities

(13,732 ) (4,807 ) Foreign currency

effects on cash, cash equivalents, restricted cash, and restricted

cash equivalents (853 ) (1,495 )

Net increase in cash, cash

equivalents, restricted cash, and restricted cash equivalents

43,029 42,588 Cash, cash equivalents, restricted

cash, and restricted cash equivalents, beginning of period

412,699 398,210 Cash, cash

equivalents, restricted cash, and restricted cash equivalents, end

of period $ 455,728 $

440,798 Reconciliation of cash, cash

equivalents, restricted cash, and restricted cash equivalents at

end of period to the condensed consolidated balance sheets:

Cash and cash equivalents $ 412,024 $ 382,237 Restricted cash and

cash equivalents included in restricted cash and cash equivalents,

and restricted bank time deposits 39,373 32,541 Restricted cash and

cash equivalents included in other assets 4,331 26,020

Total cash, cash equivalents, restricted cash, and

restricted cash equivalents $ 455,728

$ 440,798

Table 6 VERINT SYSTEMS INC. AND SUBSIDIARIES

Calculation of Change in Revenue on a Constant Currency

Basis (Unaudited)

GAAP Revenue

Non-GAAP Revenue

(in thousands, except percentages)

Three Months Ended

Three Months Ended

Total Revenue Revenue for the three months ended April 30,

2018 $ 289,207 $ 291,970 Revenue for the three months ended April

30, 2019 $ 315,259 $ 324,158 Revenue for the three months ended

April 30, 2019 at constant currency(1) $ 321,000 $ 329,000 Reported

period-over-period revenue growth 9.0 % 11.0 % % impact from change

in foreign currency exchange rates 2.0 % 1.7 % Constant currency

period-over-period revenue growth 11.0 % 12.7 %

Customer

Engagement Revenue for the three months ended April 30, 2018 $

186,456 $ 189,175 Revenue for the three months ended April 30, 2019

$ 207,095 $ 215,867 Revenue for the three months ended April 30,

2019 at constant currency(1) $ 211,000 $ 219,000 Reported

period-over-period revenue growth 11.1 % 14.1 % % impact from

change in foreign currency exchange rates 2.1 % 1.7 % Constant

currency period-over-period revenue growth 13.2 % 15.8 %

Cyber Intelligence Revenue for the three months ended April

30, 2018 $ 102,751 $ 102,795 Revenue for the three months ended

April 30, 2019 $ 108,164 $ 108,291 Revenue for the three months

ended April 30, 2019 at constant currency(1) $ 110,000 $ 110,000

Reported period-over-period revenue growth 5.3 % 5.3 % % impact

from change in foreign currency exchange rates 1.8 % 1.7 % Constant

currency period-over-period revenue growth 7.1 % 7.0 %

(1) Revenue for the three months ended April 30, 2019 at

constant currency is calculated by translating current-period

foreign currency revenue into U.S. dollars using average foreign

currency exchange rates for the three months ended April 30, 2018

rather than actual current-period foreign currency exchange rates.

For further information see "Supplemental Information About

Constant Currency" at the end of this press release.

Table 7 VERINT SYSTEMS INC. AND

SUBSIDIARIES GAAP to Non-GAAP Customer Engagement Cloud

Revenue, Recurring Revenue, and Nonrecurring Revenue

(Unaudited)

Three Months Ended April

30,

(in thousands)

2019 2018

Table of

Reconciliation from GAAP Cloud Revenue to Non-GAAP Cloud

Revenue

Customer

Engagement

Cloud revenue - GAAP $ 47,085 $

30,641 Estimated revenue adjustments 8,644 1,719

Cloud revenue - non-GAAP $ 55,729

$ 32,360

Table of

Reconciliation from GAAP Recurring Revenue to Non-GAAP Recurring

Revenue

Customer

Engagement

Recurring revenue - GAAP $ 123,358

$ 105,666 As a percentage of GAAP

revenue 59.6 % 56.7 % Estimated

revenue adjustments 8,772 1,921

Recurring revenue

- non-GAAP $ 132,130 $

107,587 As a percentage of non-GAAP revenue

61.2 % 56.9 %

Table of

Reconciliation from GAAP Nonrecurring Revenue to Non-GAAP

Nonrecurring Revenue

Customer

Engagement

Nonrecurring revenue - GAAP $ 83,737

$ 80,790 As a percentage of GAAP

revenue 40.4 % 43.3 % Estimated

revenue adjustments — 798

Nonrecurring revenue -

non-GAAP $ 83,737 $ 81,588

As a percentage of non-GAAP revenue 38.8

% 43.1 % Table

8 VERINT SYSTEMS INC. AND SUBSIDIARIES Estimated GAAP

and Non-GAAP Fully Allocated Gross Margins (Unaudited)

Three Months Ended April

30,

2019 2018 (in thousands)

Customer Engagement

Cyber Intelligence

Consolidated

Customer Engagement

Cyber Intelligence

Consolidated GAAP product revenue $ 54,002 $ 50,222 $

104,224 $ 48,364 $ 57,500 $ 105,864 GAAP service

revenue 153,093 57,942 211,035 138,092

45,251 183,343

Total GAAP revenue

207,095 108,164 315,259

186,456 102,751 289,207

Products costs 8,462 17,850 26,312 8,799 25,012 33,811

Service expenses 57,523 18,514 76,037 51,521 16,687 68,208

Amortization of acquired technology 5,388 1,319 6,707 4,265 3,161

7,426 Stock-based compensation expenses (1) 1,084 320 1,404 684 162

846 Shared support service allocation (2) 2,431 1,297

3,728 2,494 1,307 3,801

Total GAAP

cost of revenue 74,888 39,300

114,188 67,763 46,329

114,092 GAAP gross profit $

132,207 $ 68,864 $

201,071 $ 118,693 $

56,422 $ 175,115 GAAP gross

margin 63.8 % 63.7 % 63.8

% 63.7 % 54.9 % 60.6

% Revenue adjustments 8,772 127 8,899 2,719 44 2,763

Amortization of acquired technology 5,388 1,319 6,707 4,265 3,161

7,426 Stock-based compensation expenses (1) 1,084 320 1,404 684 162

846 Acquisition expenses, net (3) 10 5 15 11 6 17 Restructuring

expenses (3) 293 156 449 238 125

363

Non-GAAP gross profit $ 147,754

$ 70,791 $ 218,545

$ 126,610 $ 59,920

$ 186,530 Non-GAAP gross margin

68.4 % 65.4 % 67.4 %

66.9 % 58.3 % 63.9 %

(1) Represents the stock-based compensation expenses

applicable to cost of revenue, allocated proportionally to our year

ended January 31, 2019 and 2018, respectively, annual operations

and service expense wages for each segment, which we believe

provides a reasonable approximation for purposes of understanding

the relative GAAP and non-GAAP gross margins of our two businesses.

(2) Represents the portion of our shared support expenses

(as disclosed in footnote 16 to our April 30, 2019 Form 10-Q, when

filed) applicable to cost of revenue, allocated proportionally to

our year ended January 31, 2019 and 2018, respectively, annual

non-GAAP segment revenue, which we believe provides a reasonable

approximation for purposes of understanding the relative GAAP and

non-GAAP gross margins of our two businesses. (3) Represents

the portion of our acquisition expenses, net and restructuring

expenses applicable to cost of revenue, allocated proportionally to

our year ended January 31, 2019 and 2018, respectively, annual

non-GAAP segment revenue, and our acquisition expenses, net and

restructuring expenses applicable to cost of revenue, which we

believe provides a reasonable approximation for purposes of

understanding the relative GAAP and non-GAAP gross margins of our

two businesses.

Table 9

VERINT SYSTEMS INC. AND SUBSIDIARIES Estimated Non-GAAP

Fully Allocated Operating Margins and Estimated Fully Allocated

Adjusted EBITDA (Unaudited)

Three Months Ended April

30,

2019 2018 (in thousands)

Customer Engagement

Cyber Intelligence

Consolidated

Customer Engagement

Cyber Intelligence

Consolidated Non-GAAP segment revenue

$ 215,867 $ 108,291

$ 324,158 $ 189,175

$ 102,795 $ 291,970

Segment contribution (1) 78,818 27,290 106,108 66,802 21,222

88,024 Estimated allocation of shared support expenses (2) 28,593

15,261 43,854 27,492 14,417

41,909

Estimated non-GAAP operating income

50,225 12,029 62,254

39,310 6,805 46,115

Depreciation and amortization (3) 5,133 2,740 7,873

5,379 2,821 8,200

Estimated adjusted

EBITDA $ 55,358 $ 14,769

$ 70,127 $ 44,689

$ 9,626 $ 54,315

Estimated non-GAAP fully allocated operating margin

23.3 % 11.1 % 19.2 %

20.8 % 6.6 % 15.8 %

Estimated fully allocated adjusted EBITDA margin 25.6

% 13.6 % 21.6 % 23.6

% 9.4 % 18.6 % (1)

See footnote 16 to our April 30, 2019 Form 10-Q, when filed.

(2) Represents our shared support expenses (as disclosed in

footnote 16 to our April 30, 2019 Form 10-Q, when filed), allocated

proportionally to our non-GAAP segment revenue for the year ended

January 31, 2019 and 2018, respectively, which we believe provides

a reasonable approximation for purposes of understanding the

relative non-GAAP operating margins of our two businesses.

(3) Represents certain depreciation and amortization expenses,

which are otherwise included in our non-GAAP operating income,

allocated proportionally to our non-GAAP segment revenue for the

year ended January 31, 2019 and 2018, respectively, which we

believe provides a reasonable approximation for purposes of

understanding the relative adjusted EBITDA of our two businesses.

Verint Systems Inc. and Subsidiaries

Supplemental Information About Non-GAAP Financial

Measures

This press release contains non-GAAP financial measures,

consisting of non-GAAP revenue, non-GAAP recurring revenue,

non-GAAP nonrecurring revenue, non-GAAP cloud revenue, non-GAAP

gross profit and gross margin, non-GAAP operating income and

operating margin, non-GAAP other income (expense), net, non-GAAP

provision (benefit) for income taxes and non-GAAP effective income

tax rate, non-GAAP net income attributable to Verint Systems Inc.,

non-GAAP net income per common share attributable to Verint Systems

Inc., adjusted EBITDA, net debt, constant currency measures,

estimated GAAP and non-GAAP fully allocated gross margins, and

estimated non-GAAP fully allocated operating margins. The tables

above include a reconciliation of each non-GAAP financial measure

for completed periods presented in this press release to the most

directly comparable GAAP financial measure.

We believe these non-GAAP financial measures, used in

conjunction with the corresponding GAAP measures, provide investors

with useful supplemental information about the financial

performance of our business by:

- facilitating the comparison of our

financial results and business trends between periods, by excluding

certain items that either can vary significantly in amount and

frequency, are based upon subjective assumptions, or in certain

cases are unplanned for or difficult to forecast,

- facilitating the comparison of our

financial results and business trends with other technology

companies who publish similar non-GAAP measures, and

- allowing investors to see and

understand key supplementary metrics used by our management to run

our business, including for budgeting and forecasting, resource

allocation, and compensation matters.

We also make these non-GAAP financial measures available because

a number of our investors have informed us that they find this

supplemental information useful.

Non-GAAP financial measures should not be considered in

isolation as substitutes for, or superior to, comparable GAAP

financial measures. The non-GAAP financial measures we present have

limitations in that they do not reflect all of the amounts

associated with our results of operations as determined in

accordance with GAAP, and these non-GAAP financial measures should

only be used to evaluate our results of operations in conjunction

with the corresponding GAAP financial measures. These non-GAAP

financial measures do not represent discretionary cash available to

us to invest in the growth of our business, and we may in the

future incur expenses similar to or in addition to the adjustments

made in these non-GAAP financial measures. Other companies may

calculate similar non-GAAP financial measures differently than we

do, limiting their usefulness as comparative measures.

Our non-GAAP financial measures are calculated by making the

following adjustments to our GAAP financial measures:

Revenue adjustments. We exclude from our non-GAAP revenue the

impact of fair value adjustments required under GAAP relating to

cloud services and customer support contracts acquired in a

business acquisition, which would have otherwise been recognized on

a stand-alone basis. We believe that it is useful for investors to

understand the total amount of revenue that we and the acquired

company would have recognized on a stand-alone basis under GAAP,

absent the accounting adjustment associated with the business

acquisition. Our non-GAAP revenue also reflects certain adjustments

from aligning an acquired company’s revenue recognition policies to

our policies. We believe that our non-GAAP revenue measure helps

management and investors understand our revenue trends and serves

as a useful measure of ongoing business performance.

Amortization of acquired technology and other acquired

intangible assets. When we acquire an entity, we are required under

GAAP to record the fair values of the intangible assets of the

acquired entity and amortize those assets over their useful lives.

We exclude the amortization of acquired intangible assets,

including acquired technology, from our non-GAAP financial measures

because they are inconsistent in amount and frequency and are

significantly impacted by the timing and size of acquisitions. We

also exclude these amounts to provide easier comparability of pre-

and post-acquisition operating results.

Stock-based compensation expenses. We exclude stock-based

compensation expenses related to restricted stock awards, stock

bonus programs, bonus share programs, and other stock-based awards

from our non-GAAP financial measures. We evaluate our performance

both with and without these measures because stock-based

compensation is typically a non-cash expense and can vary

significantly over time based on the timing, size and nature of

awards granted, and is influenced in part by certain factors which

are generally beyond our control, such as the volatility of the

price of our common stock. In addition, measurement of stock-based

compensation is subject to varying valuation methodologies and

subjective assumptions, and therefore we believe that excluding

stock-based compensation from our non-GAAP financial measures

allows for meaningful comparisons of our current operating results

to our historical operating results and to other companies in our

industry.

Unrealized gains and losses on certain derivatives, net. We

exclude from our non-GAAP financial measures unrealized gains and

losses on certain foreign currency derivatives which are not

designated as hedges under accounting guidance. We exclude

unrealized gains and losses on foreign currency derivatives that

serve as economic hedges against variability in the cash flows of

recognized assets or liabilities, or of forecasted transactions.

These contracts, if designated as hedges under accounting guidance,

would be considered “cash flow” hedges. These unrealized gains and

losses are excluded from our non-GAAP financial measures because

they are non-cash transactions which are highly variable from

period to period. Upon settlement of these foreign currency

derivatives, any realized gain or loss is included in our non-GAAP

financial measures.

Amortization of convertible note discount. Our non-GAAP

financial measures exclude the amortization of the imputed discount

on our convertible notes. Under GAAP, certain convertible debt

instruments that may be settled in cash upon conversion are

required to be bifurcated into separate liability (debt) and equity

(conversion option) components in a manner that reflects the

issuer’s assumed non-convertible debt borrowing rate. For GAAP

purposes, we are required to recognize imputed interest expense on

the difference between our assumed non-convertible debt borrowing

rate and the coupon rate on our $400.0 million of 1.50% convertible

notes. This difference is excluded from our non-GAAP financial

measures because we believe that this expense is based upon

subjective assumptions and does not reflect the cash cost of our

convertible debt.

Acquisition expenses, net. In connection with acquisition

activity (including with respect to acquisitions that are not

consummated), we incur expenses, including legal, accounting, and

other professional fees, integration costs, changes in the fair

value of contingent consideration obligations, and other costs.

Integration costs may consist of information technology expenses as

systems are integrated across the combined entity, consulting

expenses, marketing expenses, and professional fees, as well as

non-cash charges to write-off or impair the value of redundant

assets. We exclude these expenses from our non-GAAP financial

measures because they are unpredictable, can vary based on the size

and complexity of each transaction, and are unrelated to our

continuing operations or to the continuing operations of the

acquired businesses.

Restructuring expenses. We exclude restructuring expenses from

our non-GAAP financial measures, which include employee termination

costs, facility exit costs, certain professional fees, asset

impairment charges, and other costs directly associated with

resource realignments incurred in reaction to changing strategies

or business conditions. All of these costs can vary significantly

in amount and frequency based on the nature of the actions as well

as the changing needs of our business and we believe that excluding

them provides easier comparability of pre- and post-restructuring

operating results.

Impairment charges and other adjustments. We exclude from our

non-GAAP financial measures asset impairment charges (other than

those already included within restructuring or acquisition

activity), rent expense for redundant facilities, gains or losses

on sales of property, gains or losses on settlements of certain

legal matters, and certain professional fees unrelated to our

ongoing operations, including $1.9 million of fees and expenses for

the three months ended April 30, 2019 related to a shareholder

proxy contest, all of which are unusual in nature and can vary

significantly in amount and frequency.

Non-GAAP income tax adjustments. We exclude our GAAP provision

(benefit) for income taxes from our non-GAAP measures of net income

attributable to Verint Systems Inc., and instead include a non-GAAP

provision for income taxes, determined by applying a non-GAAP

effective income tax rate to our income before provision for income

taxes, as adjusted for the non-GAAP items described above. The

non-GAAP effective income tax rate is generally based upon the

income taxes we expect to pay in the reporting year. Our GAAP

effective income tax rate can vary significantly from year to year

as a result of tax law changes, settlements with tax authorities,

changes in the geographic mix of earnings including acquisition

activity, changes in the projected realizability of deferred tax

assets, and other unusual or period-specific events, all of which

can vary in size and frequency. We believe that our non-GAAP

effective income tax rate removes much of this variability and

facilitates meaningful comparisons of operating results across

periods. Our non-GAAP effective income tax rate for the year ending

January 31, 2020 is currently approximately 10%, and was 11.0% for

the year ended January 31, 2019. We evaluate our non-GAAP effective

income tax rate on an ongoing basis and it can change from time to

time. Our non-GAAP income tax rate can differ materially from our

GAAP effective income tax rate.

Customer Engagement Cloud, Recurring and

Nonrecurring Revenue Metrics

Recurring revenue, on both a GAAP and non-GAAP basis, is the

portion of our revenue that we believe is likely to be renewed in

the future, and primarily consists of initial and renewal post

contract support and cloud revenue.

Nonrecurring revenue, on both a GAAP and non-GAAP basis,

primarily consists of our perpetual licenses, consulting,

implementation and installation services, and training.

Cloud revenue, on both a GAAP and non-GAAP basis, primarily

consists of SaaS and optional managed services.

SaaS revenue includes bundled SaaS, software with standard

managed services and unbundled SaaS that we account for as term

licenses where managed services are purchased separately.

We believe that recurring revenue, nonrecurring revenue, and

cloud revenue, provide investors with useful insight into the

nature and sustainability of our revenue streams. The recurrence of

these revenue streams in future periods depends on a number of

factors including contractual periods and customers' renewal

decisions. Please see “Revenue adjustments” above for an

explanation for why we present these revenue numbers on both a GAAP

and non-GAAP basis.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP measure defined as net income

(loss) before interest expense, interest income, income taxes,

depreciation expense, amortization expense, revenue adjustments,

restructuring expenses, acquisition expenses, and other expenses

excluded from our non-GAAP financial measures as described above.

We believe that adjusted EBITDA is also commonly used by investors

to evaluate operating performance between companies because it

helps reduce variability caused by differences in capital

structures, income taxes, stock-based compensation, accounting

policies, and depreciation and amortization policies. Adjusted

EBITDA is also used by credit rating agencies, lenders, and other

parties to evaluate our creditworthiness.

Net Debt

Net Debt is a non-GAAP measure defined as the sum of long-term

and short-term debt on our consolidated balance sheet, excluding

unamortized discounts and issuance costs, less the sum of cash and

cash equivalents, restricted cash, restricted cash equivalents,

restricted bank time deposits, and restricted investments

(including long-term portions), and short-term investments. We use

this non-GAAP financial measure to help evaluate our capital

structure, financial leverage, and our ability to reduce debt and

to fund investing and financing activities, and believe that it

provides useful information to investors.

Supplemental Information About Constant

Currency

Because we operate on a global basis and transact business in

many currencies, fluctuations in foreign currency exchange rates

can affect our consolidated U.S. dollar operating results. To

facilitate the assessment of our performance excluding the effect

of foreign currency exchange rate fluctuations, we calculate our

GAAP and non-GAAP revenue, cost of revenue, and operating expenses

on both an as-reported basis and a constant currency basis,

allowing for comparison of results between periods as if foreign

currency exchange rates had remained constant. We perform our

constant currency calculations by translating current-period

foreign currency results into U.S. dollars using prior-period

average foreign currency exchange rates or hedge rates, as

applicable, rather than current period exchange rates. We believe

that constant currency measures, which exclude the impact of

changes in foreign currency exchange rates, facilitate the

assessment of underlying business trends.

Unless otherwise indicated, our financial outlook for revenue,

operating margin, and diluted earnings per share, which is provided

on a non-GAAP basis, reflects foreign currency exchange rates

approximately consistent with rates in effect when the outlook is

provided.

We also incur foreign exchange gains and losses resulting from

the revaluation and settlement of monetary assets and liabilities

that are denominated in currencies other than the entity’s

functional currency. We periodically report our historical non-GAAP

diluted net income per share both inclusive and exclusive of these

net foreign exchange gains or losses. Our financial outlook for

diluted earnings per share includes net foreign exchange gains or

losses incurred to date, if any, but does not include potential

future gains or losses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190529005934/en/

Investor RelationsAlan

RodenVerint Systems Inc.(631) 962-9304alan.roden@verint.com

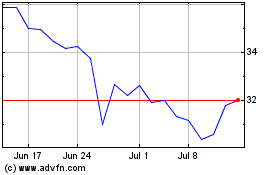

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jun 2024 to Jul 2024

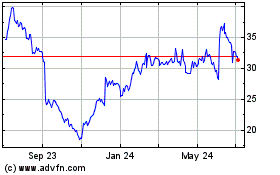

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jul 2023 to Jul 2024