Verint® Systems Inc. (NASDAQ: VRNT) a

global leader in Actionable Intelligence® solutions and value-added

services, today announced its third quarter results.

“We are pleased with our strong performance in the third

quarter, which we believe reflects our leadership position and

growth in the actionable intelligence market as well as an

improving economic environment. Our non-GAAP operating margin came

in strong at 28.5%, ahead of our annual target, reflecting

sustained focus on execution in the workforce optimization and

security intelligence markets. We look forward to discussing our

results and outlook during today’s conference call,” said Dan

Bodner, CEO and President of Verint Systems Inc.

Below is selected financial information for the three and nine

months ended October 31, 2010 and 2009 prepared in accordance with

generally accepted accounting principles (“GAAP”) and not prepared

in accordance with GAAP (“Non-GAAP”).

(In thousands, except per share data) Selected GAAP

Information Three Months Ended October 31, Nine Months Ended

October 31, 2010 2009

2010 2009 Revenue $ 186,641 $

186,480 $ 539,930 $ 530,897 Gross Profit 127,700 122,970

362,836 351,251 Gross Margin 68.4 % 65.9 % 67.2 % 66.2 %

Operating Income 30,393 23,735 50,210 73,453 Operating Margin 16.3

% 12.7 % 9.3 % 13.8 % Diluted Net Income per Share

Attributable to Verint Systems Inc. $ 0.36 $ 0.29 $ 0.05 $ 0.74

Selected Non-GAAP Information Three Months Ended October 31,

Nine Months Ended October 31, 2010 2009

2010 2009 Revenue $ 186,641 $

186,480 $ 539,930 $ 530,897 Gross Profit 131,613 126,590

374,845 361,418 Gross Margin 70.5 % 67.9 % 69.4 % 68.1 %

Operating Income 53,105 55,240 141,707 157,048 Operating Margin

28.5 % 29.6 % 26.2 % 29.6 % Diluted Net Income per Share

Attributable to Verint Systems Inc. $ 0.92 $ 0.98 $ 2.14 $ 2.64

Outlook for the Year Ending January 31,

2011

- We are updating our revenue outlook

from a range of $710 to $720 million to a range of $715 to $720

million.

- We are updating our target non-GAAP

operating margin from a range of 22% to 24% to approximately

25%.

Conference Call Information

We will be conducting a conference call today at 4:30 p.m. to

discuss our third quarter results, outlook for the year ending

January 31, 2011 and preliminary outlook for the year ending

January 31, 2012. An on-line, real-time webcast of the conference

call will be available on our website at www.verint.com. The

conference call can also be accessed live via telephone at

1-800-295-4740 (United States) and 1-617-614-3925 (international),

and the passcode is 80492863. Please dial in 5-10 minutes prior to

the scheduled start time.

About Non-GAAP Financial Measures

This press release and the accompanying tables include non-GAAP

financial measures. For a description of these non-GAAP financial

measures, including the reasons management uses each measure, and

reconciliations of these non-GAAP financial measures to the most

directly comparable financial measures prepared in accordance with

GAAP, please see Table 2 as well as "Supplemental Information About

Non-GAAP Financial Measures" at the end of this press release.

Because we do not predict special items that might occur in the

future, and our outlook is developed at a level of detail different

than that used to prepare GAAP financial measures, we are not

providing a reconciliation to GAAP of our forward-looking financial

measures for the year ending January 31, 2011.

About Verint Systems Inc.

Verint® Systems Inc. is a global leader in Actionable

Intelligence® solutions and value-added services. Our solutions

enable organizations of all sizes to make timely and effective

decisions to improve enterprise performance and make the world a

safer place. More than 10,000 organizations in over 150

countries—including over 80 percent of the Fortune 100—use Verint

Actionable Intelligence solutions to capture, distill, and analyze

complex and underused information sources, such as voice, video,

and unstructured text. Headquartered in Melville, New York, we

support our customers around the globe directly and with an

extensive network of selling and support partners. Visit us at our

website www.verint.com.

Cautions About Forward-Looking Statements

This press release contains forward-looking statements,

including statements regarding expectations, predictions, views,

opportunities, plans, strategies, beliefs, and statements of

similar effect relating to Verint Systems Inc. These

forward-looking statements are not guarantees of future performance

and they are based on management's expectations that involve a

number of risks and uncertainties, any of which could cause actual

results to differ materially from those expressed in or implied by

the forward-looking statements. Some of the factors that could

cause actual future results or conditions to differ materially from

current expectations include: risks relating to the filing of our

SEC reports, including the occurrence of known contingencies or

unforeseen events that could delay our future filings, management

distractions, and significant expense; risks that our credit rating

could be downgraded or placed on a credit watch based on, among

other things, our financial results or delays in the filing of our

periodic reports; risks associated with being a consolidated,

controlled subsidiary of Comverse Technology, Inc. (“Comverse”) and

formerly part of Comverse’s consolidated tax group, including risk

of any future impact on us resulting from Comverse’s special

committee investigation and restatement or related effects, and

risks related to our dependence on Comverse to provide us with

accurate financial information, including with respect to

stock-based compensation expense and net operating loss

carryforwards (“NOLs”), for our financial statements; uncertainties

regarding the impact of general economic conditions, particularly

in information technology spending, on our business; risks that our

financial results will cause us not to be compliant with the

leverage ratio covenant under our credit facility or that any

delays in the filing of future SEC reports could cause us not to be

compliant with the financial statement delivery covenant under our

credit facility; risks that customers or partners delay or cancel

orders or are unable to honor contractual commitments due to

liquidity issues, challenges in their business, or otherwise; risks

that we will experience liquidity or working capital issues and

related risks that financing sources will be unavailable to us on

reasonable terms or at all; uncertainties regarding the future

impact on our business of our now concluded internal investigation,

restatement, and extended filing delay, including customer,

partner, employee, and investor concerns, and potential customer

and partner transaction deferrals or losses; risks relating to the

remediation or inability to adequately remediate material

weaknesses in our internal controls over financial reporting and

relating to the proper application of highly complex accounting

rules and pronouncements in order to produce accurate SEC reports

on a timely basis; risks relating to our implementation and

maintenance of adequate systems and internal controls for our

current and future operations and reporting needs; risks of

possible future restatements if the processes used to produce the

financial statements contained in our SEC reports are inadequate;

risks associated with future regulatory actions or private

litigations relating to our internal investigation, restatement, or

previous delays in filing required SEC reports; risks that we will

be unable to maintain our listing on the NASDAQ Global Market;

risks associated with Comverse controlling our board of directors

and a majority of our common stock (and therefore the results of

any significant stockholder vote); risks associated with

significant leverage resulting from our current debt position;

risks due to aggressive competition in all of our markets,

including with respect to maintaining margins and sufficient levels

of investment in the business and with respect to introducing

quality products which achieve market acceptance; risks created by

continued consolidation of competitors or introduction of large

competitors in our markets with greater resources than we have;

risks associated with significant foreign and international

operations, including exposure to fluctuations in exchange rates;

risks associated with complex and changing local and foreign

regulatory environments; risks associated with our ability to

recruit and retain qualified personnel in geographies in which we

operate; challenges in accurately forecasting revenue and expenses;

risks associated with acquisitions and related system integrations;

risks relating to our ability to improve our infrastructure to

support growth; risks that our intellectual property rights may not

be adequate to protect our business or that others may make claims

on our intellectual property or claim infringement on their

intellectual property rights; risks associated with a significant

amount of our business coming from domestic and foreign government

customers; risks that we improperly handle sensitive or

confidential information or perception of such mishandling; risks

associated with our dependence on a limited number of suppliers for

certain components of our products; risks that we are unable to

maintain and enhance relationships with key resellers, partners,

and systems integrators; and risks that use of our tax benefits may

be restricted or eliminated in the future. We assume no obligation

to revise or update any forward-looking statement, except as

otherwise required by law. For a detailed discussion of these risk

factors, see our Annual Report on Form 10-K for the fiscal year

ended January 31, 2010 and our Quarterly Reports on Form 10-Q

for the quarterly periods ended thereafter.

VERINT, the VERINT logo, ACTIONABLE INTELLIGENCE, POWERING

ACTIONABLE INTELLIGENCE, INTELLIGENCE IN ACTION, ACTIONABLE

INTELLIGENCE FOR A SMARTER WORKFORCE, VERINT VERIFIED, WITNESS

ACTIONABLE SOLUTIONS, STAR-GATE, RELIANT, VANTAGE, X-TRACT,

NEXTIVA, EDGEVR, ULTRA, AUDIOLOG, WITNESS, the WITNESS logo, IMPACT

360, the IMPACT 360 logo, IMPROVE EVERYTHING, EQUALITY,

CONTACTSTORE, EYRETEL, BLUE PUMPKIN SOFTWARE, BLUE PUMPKIN, the

BLUE PUMPKIN logo, EXAMETRIC and the EXAMETRIC logo, CLICK2STAFF,

STAFFSMART, AMAE SOFTWARE and the AMAE logo are trademarks and

registered trademarks of Verint Systems Inc. Other trademarks

mentioned are the property of their respective owners.

Table 1 Verint Systems Inc. and Subsidiaries Condensed

Consolidated Statements of Operations (Unaudited) (In thousands,

except per share data) Three

Months Ended October 31, Nine Months Ended October 31, 2010

2009 2010 2009

Revenue: Product $ 97,769 $ 98,467 $ 282,942 $

283,645 Service and support 88,872 88,013

256,988 247,252

Total

revenue 186,641 186,480

539,930 530,897

Cost of revenue: Product 28,156 35,718 88,411 98,675 Service

and support 28,529 25,819 81,974 74,922 Amortization of acquired

technology 2,256 1,973 6,709

6,049

Total cost of revenue

58,941 63,510

177,094 179,646 Gross

profit 127,700 122,970

362,836 351,251

Operating expenses: Research and development, net 24,063

21,461 72,544 61,000 Selling, general and administrative 67,868

72,398 224,029 199,882 Amortization of other acquired intangible

assets 5,376 5,376 16,053 16,892 Restructuring -

- - 24

Total operating

expenses 97,307 99,235

312,626 277,798

Operating income 30,393

23,735 50,210

73,453 Other income (expense), net Interest

income 109 336 309 581 Interest expense (8,941 ) (6,178 ) (20,825 )

(18,900 ) Other income (expense), net 2,159

(2,775 ) (3,987 ) (10,844 )

Total other expense,

net (6,673 ) (8,617 )

(24,503 ) (29,163 )

Income before provision for income taxes 23,720

15,118 25,707 44,290 Provision for income

taxes 5,332 1,803 10,544

8,921

Net income 18,388 13,315

15,163 35,369 Net income attributable to

noncontrolling interest 1,214 139

2,722 961

Net income attributable to

Verint Systems Inc. 17,174 13,176 12,441

34,408 Dividends on preferred stock (3,592 )

(3,443 ) (10,549 ) (10,111 )

Net income

attributable to Verint Systems Inc. common shares $

13,582 $ 9,733 $

1,892 $ 24,297 Net

income per share attributable to Verint Systems Inc.

Basic $ 0.38 $ 0.30

$ 0.06 $ 0.75

Diluted $ 0.36 $ 0.29

$ 0.05 $ 0.74

Weighted-average common shares outstanding

Basic 35,368 32,471

33,785 32,465

Diluted 47,679 33,330

36,525 32,879

Table 2 Verint Systems Inc. and Subsidiaries Reconciliation

of GAAP to Non-GAAP Results (Unaudited) (In thousands, except per

share data) Three Months Ended October 31, Nine

Months Ended October 31, 2010 2009

2010 2009

Table of

Reconciliation from GAAP Gross Profit to Non-GAAP Gross

Profit

GAAP gross profit $ 127,700 $ 122,970 $ 362,836 $ 351,251

Amortization of acquired technology 2,256 1,973 6,709 6,049

Stock-based compensation expenses 1,657 1,647

5,300 4,118 Non-GAAP gross

profit $ 131,613 $ 126,590 $ 374,845 $ 361,418

Table of

Reconciliation from GAAP Operating Income to Non-GAAP Operating

Income

GAAP operating income $ 30,393 $ 23,735 $ 50,210 $ 73,453

Amortization of acquired technology 2,256 1,973 6,709 6,049

Amortization of other acquired intangible assets 5,376 5,376 16,053

16,892 Restructuring - - - 24 Stock-based compensation expenses

13,090 11,682 39,095 31,376 Other adjustments 1,175 - 2,546 -

Expenses related to our filing delay 815

12,474 27,094 29,254 Non-GAAP

operating income $ 53,105 $ 55,240 $ 141,707 $

157,048

Table of

Reconciliation from GAAP Other Expense, Net to Non-GAAP Other

Expense, Net

GAAP other expense, net $ (6,673 ) $ (8,617 ) $ (24,503 ) $

(29,163 ) Unrealized (gains) losses on derivatives, net 922

(634 ) (6,840 ) (4,477 ) Non-GAAP other

expense, net $ (5,751 ) $ (9,251 ) $ (31,343 ) $ (33,640 )

Table of

Reconciliation from GAAP Provision for Income Taxes to Non-GAAP

Provision for Income Taxes

GAAP provision for income taxes $ 5,332 $ 1,803 $ 10,544 $

8,921 Non-cash tax adjustments (2,962 ) 1,867

(2,819 ) 927 Non-GAAP provision for income

taxes $ 2,370 $ 3,670 $ 7,725 $ 9,848

Table of

Reconciliation from GAAP Net Income Attributable to Verint Systems

Inc. Common Shares to Non-GAAP Net Income Attributable to Verint

Systems Inc. Common Shares

GAAP net income attributable to Verint Systems Inc. common

shares $ 13,582 $ 9,733 $ 1,892 $ 24,297 Amortization of acquired

technology 2,256 1,973 6,709 6,049 Amortization of other acquired

intangible assets 5,376 5,376 16,053 16,892 Restructuring - - - 24

Stock-based compensation expenses 13,090 11,682 39,095 31,376 Other

adjustments 1,175 - 2,546 - Expenses related to our filing delay

815 12,474 27,094 29,254 Unrealized (gains) losses on derivatives,

net 922 (634 ) (6,840 ) (4,477 ) Non-cash tax adjustments

2,962 (1,867 ) 2,819 (927 )

Non-GAAP net income attributable to Verint Systems Inc. common

shares $ 40,178 $ 38,737 $ 89,368 $ 102,488

Table Comparing GAAP

Diluted Net Income Per Share Attributable to Verint Systems Inc. to

Non-GAAP Diluted Net Income Per Share Attributable to Verint

Systems Inc.

GAAP diluted net income per share $ 0.36 $ 0.29

$ 0.05 $ 0.74 Non-GAAP diluted net

income per share $ 0.92 $ 0.98 $ 2.14 $ 2.64

Shares used in computing GAAP diluted net income per

share (in thousands) 47,679 33,330

36,525 32,879 Shares used in

computing non-GAAP diluted net income per share (in thousands)

47,679 43,213 46,722

42,667 Table 3 Verint Systems Inc. and

Subsidiaries Segment Revenue (Unaudited) (In thousands)

Three Months Ended October 31, Nine

Months Ended October 31, 2010 2009 2010 2009 Revenue By

Segment Workforce Optimization Segment $ 106,473 $ 105,398 $

298,148 $ 279,001 Video Intelligence Segment 30,611 33,985

99,216 116,548 Communications Intelligence Segment 49,557

47,097 142,566 135,348 Total Video and

Communications Intelligence 80,168 81,082 241,782 251,896

Total Revenue $ 186,641 $ 186,480 $ 539,930 $

530,897 Table 4 Verint Systems Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (Unaudited) (In thousands,

except share and per share data) October 31,

2010

January 31,

2010

Assets Current Assets: Cash and cash

equivalents $ 134,006 $ 184,335 Restricted cash and bank time

deposits 18,367 5,206 Accounts receivable, net 137,330 127,826

Inventories 17,495 14,373 Deferred cost of revenue 7,555 11,232

Prepaid expenses and other current assets 60,480

64,554

Total current assets

375,233 407,526 Property and

equipment, net 23,204 24,453 Goodwill 738,161 724,670 Intangible

assets, net 158,228 173,833 Capitalized software development costs,

net 6,756 8,530 Long-term deferred cost of revenue

23,385

33,019 Other assets

28,085

24,306

Total assets $

1,353,052 $ 1,396,337

Liabilities, Preferred Stock, and Stockholders' Equity

(Deficit) Current Liabilities: Accounts payable $ 39,177

$ 46,570 Accrued expenses and other current liabilities 142,304

155,422 Current maturities of long-term debt - 22,678 Deferred

revenue 135,433 183,719 Liabilities to affiliates 1,806

1,709

Total current liabilities

318,720 410,098 Long-term debt

598,234 598,234 Long-term deferred revenue 44,278 51,412 Other

liabilities 54,405 65,618

Total

liabilities 1,015,637

1,125,362

Preferred Stock - $0.001 par value;

authorized 2,500,000 shares. Series

A convertible preferred stock; 293,000

shares issued and outstanding;

aggregate liquidation preference and

redemption value of $335,441 at

October 31, 2010.

285,542 285,542

Commitments and Contingencies Stockholders' Equity

(Deficit):

Common stock - $0.001 par value;

authorized 120,000,000 shares. Issued

36,875,000 and 32,687,000 shares,

respectively; outstanding 36,615,000

and 32,584,000 shares, as of October 31,

2010 respectively; outstanding 36,615,000 and January 31, 2010,

respectively.

36 33 Additional paid-in capital 504,449 451,166

Treasury stock, at cost - 260,000 and

103,000 shares as of October 31,

2010 and January 31, 2010,

respectively.

(6,639 ) (2,493 ) Accumulated deficit (407,897 ) (420,338 )

Accumulated other comprehensive loss (41,267 )

(43,134 )

Total Verint Systems Inc. stockholders' equity

(deficit) 48,682 (14,766 ) Noncontrolling

interest 3,191 199

Total liabilities

stockholders' equity (deficit) 51,873

(14,567 ) Total liabilities, preferred

stock, and stockholders' equity (deficit) $

1,353,052 $ 1,396,337

Table 5 Verint Systems Inc. and Subsidiaries Condensed Consolidated

Statements of Cash Flows (Unaudited) (In thousands)

Nine Months Ended October 31, 2010

2009

Cash flows from operating

activities: Net income $ 15,163 $ 35,369

Adjustments to

reconcile net income to net cash provided by operating

activities: Depreciation and amortization 36,100 37,424

Equity-based compensation 22,856 23,170 Non-cash losses on

derivative financial instruments, net 4,271 11,745 Other non-cash

items, net 1,626 (957 )

Changes in operating assets and

liabilities, net of effects of business combination:

Accounts receivable (9,719 ) (15,692 ) Inventories (3,369 ) 4,511

Deferred cost of revenue 12,957 10,448 Accounts payable and accrued

expenses (1,585 ) (1,408 ) Deferred revenue (56,177 ) (22,821 )

Prepaid expenses and other assets

(405 ) (13,675 ) Other, net (3,252 ) (2,623 )

Net

cash provided by operating activities 18,466

65,491 Cash flows from

investing activities:

Cash paid for business combination, net of

cash acquired, and payments of contingent

consideration associated with business

combinations in prior periods

(15,292 ) (96

)

Purchases of property and equipment (5,845 ) (3,346 ) Settlements

of derivative financial instruments not designated as hedges

(32,640 ) (13,140 ) Cash paid for capitalized software development

costs (1,604 ) (1,897 ) Change in restricted cash and bank time

deposits (12,878 ) 2,094

Net cash used in

investing activities (68,259 )

(16,385 ) Cash flows from financing

activities: Repayments of borrowings and other financing

obligations (22,960 ) (6,088 ) Proceeds from exercises of stock

30,572 - Dividends paid to noncontrolling interest - (2,142 )

Purchases of treasury stock (4,146 ) - Other financing activities

(4,039 ) (202 )

Net cash used in financing

activities (573 ) (8,432

) Effect of exchange rate changes on cash and cash

equivalents 37 4,582

Net increase (decrease) in cash and cash equivalents

(50,329 ) 45,256 Cash and cash equivalents,

beginning of period 184,335

115,928 Cash and cash equivalents, end of

period $ 134,006 $ 161,184

Supplemental disclosures of cash flow

information: Cash paid for interest $ 13,014 $ 18,839

Cash paid for income taxes $ 5,533 $ 9,688

Non-cash investing and financing transactions: Accrued but

unpaid purchases of property and equipment $ 929 $ 520

Inventory transfers to property and equipment $ 372 $

480 Stock options exercised, proceeds received subsequent to

period end $ 340 $ - Purchases under supplier

financing arrangements $ 1,858 $ -

Verint Systems Inc. and

Subsidiaries

Supplemental Information About Non-GAAP

Financial Measures

This press release contains non-GAAP financial measures. Table 2

includes a reconciliation of each non-GAAP financial measure

presented in this press release to the most directly comparable

GAAP financial measure. Non-GAAP financial measures should not be

considered in isolation or as a substitute for comparable GAAP

financial measures. The non-GAAP financial measures we present have

limitations in that they do not reflect all of the amounts

associated with our results of operations as determined in

accordance with GAAP and these non-GAAP financial measures should

only be used to evaluate our results of operations in conjunction

with the corresponding GAAP financial measures. These non-GAAP

financial measures do not represent discretionary cash available to

us to invest in the growth of our business, and we may in the

future incur expenses similar to the adjustments made in these

non-GAAP financial measures.

We believe that the non-GAAP financial measures we present

provide meaningful supplemental information regarding our operating

results primarily because they exclude certain non-cash charges or

items that we do not believe are reflective of our ongoing

operating results when budgeting, planning and forecasting,

determining compensation, and when assessing the performance of our

business with our individual operating segments or our senior

management. We believe that these non-GAAP financial measures also

facilitate the comparison by management and investors of results

between periods and among our peer companies. However, those

companies may calculate similar non-GAAP financial measures

differently than we do, limiting their usefulness as comparative

measures.

Adjustments to Non-GAAP Financial

Measures

Amortization of acquired intangible assets, including acquired

technology. When we acquire an entity, we are required under GAAP

to record the fair value of the intangible assets of the acquired

entity and amortize them over their useful lives. We exclude the

amortization of acquired intangible assets, including acquired

technology, from our non-GAAP financial measures. These expenses

are excluded from our non-GAAP financial measures because they are

non-cash charges. In addition, these amounts are inconsistent in

amount and frequency and are significantly impacted by the timing

and size of acquisitions. Thus, we also exclude these amounts to

provide better comparability of pre- and post-acquisition operating

results.

Restructuring costs. We exclude from our non-GAAP financial

measures expenses associated with the restructuring of our

operations due to internal or external factors. These expenses are

excluded from our non-GAAP financial measures because we believe

that they are not reflective of our ongoing operations.

Stock-based compensation expenses. We exclude stock-based

compensation expenses related to stock options, restricted stock

awards and units and phantom stock from our non-GAAP financial

measures. These expenses are excluded from our non-GAAP financial

measures because they are primarily non-cash charges. In recent

periods we also incurred significant cash-settled stock

compensation due to our extended filing delay and restrictions on

our ability to issue new shares of common stock to our

employees.

Other adjustments. We exclude from our non-GAAP financial

measures legal and other professional fees associated with

acquisitions and certain extraordinary transactions, in both cases,

whether or not consummated. These expenses are excluded from our

non-GAAP financial measures because we believe that they are not

reflective of our ongoing operations.

Expenses related to our filing delay. We exclude from our

non-GAAP financial measures expenses associated with our

restatement of previously filed financial statements and our

extended filing delay. These expenses included professional fees

and related expenses as well as expenses associated with a special

cash retention program. These expenses are excluded from our

non-GAAP financial measures because we believe that they are not

reflective of our ongoing operations.

Unrealized (gains)losses on derivatives, net. We exclude from

our non-GAAP financial measures unrealized gains and losses on

interest rate swaps and foreign currency derivatives. These gains

and losses are excluded from our non-GAAP financial measures

because they are non-cash transactions.

Non-cash tax adjustments. Non-cash tax adjustments represent the

difference between the amount of taxes we actually paid and our

GAAP tax provision on an annual basis. On a quarterly basis, this

adjustment reflects our expected annual effective tax rate on a

cash basis.

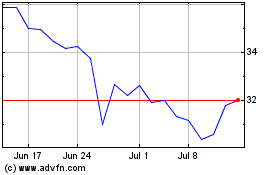

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Aug 2024 to Sep 2024

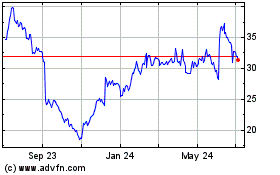

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Sep 2023 to Sep 2024