TD Banknorth Selects Verint ULTRA Solution

December 04 2006 - 8:30AM

Business Wire

Verint Systems Inc. (NASDAQ: VRNT), a leading provider of analytic

software-based solutions for security and business intelligence,

today announced that TD Banknorth selected its ULTRA� Analytics

suite to enhance customer service and increase operational

efficiency. ULTRA�s actionable intelligence will enable TD

Banknorth to drive superior performance by understanding the root

cause of customer calls. TD Banknorth Inc. (NYSE: BNK) is a leading

banking and financial services company headquartered in Portland,

Maine with banking divisions in eight Northeastern states. TD

Banknorth has assets of $40 billion and provides financial services

to nearly 1.6 million households in Connecticut, Maine,

Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania

and Vermont. Through its three New England-based contact centers,

TD Banknorth provides accounts inquiries, loans, credit cards and

tax assistance services to its customer base. Verint�s ULTRA

Analytics suite is being deployed in these centers to help TD

Banknorth understand why customers are calling and the actionable

intelligence that it delivers will help them to reduce call handle

time, lower operational costs and enhance the loyalty and

satisfaction of their customers. �As TD Banknorth grows, it is our

mission to continue to deliver the high quality service for which

our brand has come to be known,� said Jon Cogswell, Senior Vice

President of Direct Banking at TD Banknorth. �With Verint�s ULTRA

Analytics suite, we will leverage the voice of our customers to

help us continually meet their needs and give them the best service

possible.� ULTRA and its Analytics suite drive total quality by

enabling organizations of all sizes to cost effectively capture all

customer interactions and extract actionable intelligence from

telephone, Voice-over-IP, email, chat or agent assisted co-browsing

contacts. In addition, ULTRA�s Web-based desktop portal offers easy

access to all customer data and enables enterprises to use what

they learn from customer contacts to optimize their processes,

increase productivity, comply with risk management requirements and

improve service to their customers. �TD Banknorth joins our global

base of financial services customers that recognizes the tremendous

value of understanding not only what is happening in their contact

centers, but why it is happening,� said Dan Bodner, CEO and

President of Verint. �Our ULTRA suite and its powerful analytics

enables these leading enterprises to enhance virtually every aspect

of their customer-focused operations.� About Verint Systems Inc.

Verint� Systems Inc., headquartered in Melville, New York, is a

leading provider of analytic software-based solutions for security

and business intelligence. Verint software, which is used by over

1,000 organizations in over 50 countries worldwide, generates

actionable intelligence through the collection, retention and

analysis of voice, fax, video, email, Internet and data

transmissions from multiple communications networks. Visit us at

our website www.verint.com. Note: Certain statements concerning

Verint�s future revenues, earnings per share, results or prospects

are �forward-looking statements� under the Private Securities

Litigation Reform Act of 1995. There can be no assurances that

forward-looking statements will be achieved, and actual results

could differ materially from forecasts and estimates. Important

risks, uncertainties and other important factors that could cause

actual results to differ materially include, among others:

potential impact on Verint�s financial results as a result of

Comverse�s creation of a special committee of the Board of

Directors of Comverse to review matters relating to grants of

Comverse stock options, including but not limited to, the accuracy

of the stated dates of Comverse option grants and whether Comverse

followed all of its proper corporate procedures, as well as certain

other accounting matters, and the results of the Comverse special

committee�s review; the effect of Verint's failure to timely file

all required reports under the Securities Exchange Act of 1934, and

the resultant likely delisting of Verint's common stock on NASDAQ;

the impact of governmental inquiries arising out of or related to

option grants or other matters; introducing quality products on a

timely basis that satisfy customer requirements and achieve market

acceptance; lengthy and variable sales cycles create difficulty in

forecasting the timing of revenue; integrating the business and

personnel of Mercom and CM Insight; risks associated with

significant foreign operations, including fluctuations in foreign

currency exchange rates; aggressive competition in all of Verint�s

markets, which creates pricing pressure; integrating the business

and personnel of MultiVision, including implementation of adequate

internal controls; managing our expansion in the Asia Pacific

region; risks that Verint�s intellectual property rights may not be

adequate to protect its business or that others may claim that

Verint infringes upon their intellectual property rights; risks

associated with integrating the business and employees of Opus and

RP Sicherheissysteme GMBH; risks associated with Verint�s ability

to retain existing personnel and recruit and retain qualified

personnel in all geographies in which Verint operates; decline in

information technology spending; changes in the demand for Verint�s

products; challenges in increasing gross margins; risks associated

with changes in the competitive or regulatory environment in which

Verint operates; dependence on government contracts; expected

increase in Verint�s effective tax rate; perception that Verint

improperly handles sensitive or confidential information; inability

to maintain relationships with value added resellers and systems

integrators; difficulty of improving Verint�s infrastructure in

order to be able to continue to grow; risks associated with

Comverse Technology, Inc. controlling Verint�s business and

affairs; and other risks described in filings with the Securities

and Exchange Commission. All documents are available through the

SEC�s Electronic Data Gathering Analysis and Retrieval system

(EDGAR) at www.sec.gov or from Verint�s website at www.verint.com.

Verint makes no commitment to revise or update any forward-looking

statements. Verint, the Verint word mark, Actionable Intelligence,

Powering Actionable Intelligence, STAR-GATE, RELIANT, NEXTIVA,

LORONIX, SmartSight, Lanex and ULTRA are trademarks of Verint

Systems Inc. Other names may be trademarks of their respective

owner. Verint Systems Inc. (NASDAQ: VRNT), a leading provider of

analytic software-based solutions for security and business

intelligence, today announced that TD Banknorth selected its

ULTRA(TM) Analytics suite to enhance customer service and increase

operational efficiency. ULTRA's actionable intelligence will enable

TD Banknorth to drive superior performance by understanding the

root cause of customer calls. TD Banknorth Inc. (NYSE: BNK) is a

leading banking and financial services company headquartered in

Portland, Maine with banking divisions in eight Northeastern

states. TD Banknorth has assets of $40 billion and provides

financial services to nearly 1.6 million households in Connecticut,

Maine, Massachusetts, New Hampshire, New Jersey, New York,

Pennsylvania and Vermont. Through its three New England-based

contact centers, TD Banknorth provides accounts inquiries, loans,

credit cards and tax assistance services to its customer base.

Verint's ULTRA Analytics suite is being deployed in these centers

to help TD Banknorth understand why customers are calling and the

actionable intelligence that it delivers will help them to reduce

call handle time, lower operational costs and enhance the loyalty

and satisfaction of their customers. "As TD Banknorth grows, it is

our mission to continue to deliver the high quality service for

which our brand has come to be known," said Jon Cogswell, Senior

Vice President of Direct Banking at TD Banknorth. "With Verint's

ULTRA Analytics suite, we will leverage the voice of our customers

to help us continually meet their needs and give them the best

service possible." ULTRA and its Analytics suite drive total

quality by enabling organizations of all sizes to cost effectively

capture all customer interactions and extract actionable

intelligence from telephone, Voice-over-IP, email, chat or agent

assisted co-browsing contacts. In addition, ULTRA's Web-based

desktop portal offers easy access to all customer data and enables

enterprises to use what they learn from customer contacts to

optimize their processes, increase productivity, comply with risk

management requirements and improve service to their customers. "TD

Banknorth joins our global base of financial services customers

that recognizes the tremendous value of understanding not only what

is happening in their contact centers, but why it is happening,"

said Dan Bodner, CEO and President of Verint. "Our ULTRA suite and

its powerful analytics enables these leading enterprises to enhance

virtually every aspect of their customer-focused operations." About

Verint Systems Inc. Verint(R) Systems Inc., headquartered in

Melville, New York, is a leading provider of analytic

software-based solutions for security and business intelligence.

Verint software, which is used by over 1,000 organizations in over

50 countries worldwide, generates actionable intelligence through

the collection, retention and analysis of voice, fax, video, email,

Internet and data transmissions from multiple communications

networks. Visit us at our website www.verint.com. Note: Certain

statements concerning Verint's future revenues, earnings per share,

results or prospects are "forward-looking statements" under the

Private Securities Litigation Reform Act of 1995. There can be no

assurances that forward-looking statements will be achieved, and

actual results could differ materially from forecasts and

estimates. Important risks, uncertainties and other important

factors that could cause actual results to differ materially

include, among others: potential impact on Verint's financial

results as a result of Comverse's creation of a special committee

of the Board of Directors of Comverse to review matters relating to

grants of Comverse stock options, including but not limited to, the

accuracy of the stated dates of Comverse option grants and whether

Comverse followed all of its proper corporate procedures, as well

as certain other accounting matters, and the results of the

Comverse special committee's review; the effect of Verint's failure

to timely file all required reports under the Securities Exchange

Act of 1934, and the resultant likely delisting of Verint's common

stock on NASDAQ; the impact of governmental inquiries arising out

of or related to option grants or other matters; introducing

quality products on a timely basis that satisfy customer

requirements and achieve market acceptance; lengthy and variable

sales cycles create difficulty in forecasting the timing of

revenue; integrating the business and personnel of Mercom and CM

Insight; risks associated with significant foreign operations,

including fluctuations in foreign currency exchange rates;

aggressive competition in all of Verint's markets, which creates

pricing pressure; integrating the business and personnel of

MultiVision, including implementation of adequate internal

controls; managing our expansion in the Asia Pacific region; risks

that Verint's intellectual property rights may not be adequate to

protect its business or that others may claim that Verint infringes

upon their intellectual property rights; risks associated with

integrating the business and employees of Opus and RP

Sicherheissysteme GMBH; risks associated with Verint's ability to

retain existing personnel and recruit and retain qualified

personnel in all geographies in which Verint operates; decline in

information technology spending; changes in the demand for Verint's

products; challenges in increasing gross margins; risks associated

with changes in the competitive or regulatory environment in which

Verint operates; dependence on government contracts; expected

increase in Verint's effective tax rate; perception that Verint

improperly handles sensitive or confidential information; inability

to maintain relationships with value added resellers and systems

integrators; difficulty of improving Verint's infrastructure in

order to be able to continue to grow; risks associated with

Comverse Technology, Inc. controlling Verint's business and

affairs; and other risks described in filings with the Securities

and Exchange Commission. All documents are available through the

SEC's Electronic Data Gathering Analysis and Retrieval system

(EDGAR) at www.sec.gov or from Verint's website at www.verint.com.

Verint makes no commitment to revise or update any forward-looking

statements. Verint, the Verint word mark, Actionable Intelligence,

Powering Actionable Intelligence, STAR-GATE, RELIANT, NEXTIVA,

LORONIX, SmartSight, Lanex and ULTRA are trademarks of Verint

Systems Inc. Other names may be trademarks of their respective

owner.

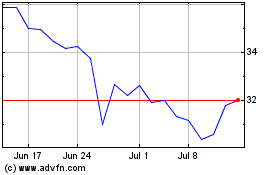

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From May 2024 to Jun 2024

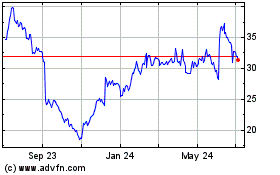

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jun 2023 to Jun 2024