Value Line, Inc., (NASDAQ: VALU) reported results for the third

fiscal quarter ended January 31, 2012.

During the nine months ended January 31, 2012, the Company’s net

income of $5,835,000, or $0.59 per share, compared to net income of

$34,841,000, or $3.49 per share, for the nine months ended January

31, 2011. Net income of $1,844,000 for the third quarter of fiscal

2012 compared to net income of $31,437,000 for the third quarter of

fiscal 2011. The net income of the Company during the three and

nine months ended January 31, 2011 included $50,510,000 of pre-tax

accounting (non-cash) gain from deconsolidation of the former Value

Line subsidiaries, EULAV Asset Management LLC (“EAM LLC”) and EULAV

Securities, Inc. (“ESI”), that performed the operations of the

investment management business prior to deconsolidation of these

subsidiaries. The Company received substantial non-voting revenues

and non-voting profits interests upon the formation of EULAV Asset

Management Trust (“EAM”) on December 23, 2010, to provide the

investment management services to the Value Line Family of Mutual

Funds (“Restructuring Transaction”).

Following the Restructuring Transaction, the Company no longer

engages, through subsidiaries, in the investment management or

mutual fund distribution businesses. During the three and nine

months ended January 31, 2012, the Company recorded income from its

non-voting revenues and non-voting profits interests in EAM of

$1,456,000 and $4,371,000, respectively, and $724,000 from December

23, 2010 through January 31, 2011, without incurring any directly

related expenses.

Income from operations of $4,979,000 for the nine months ended

January 31, 2012 was $586,000 or 11% below income from operations

of $5,565,000 for the nine months ended January 31, 2011. Income

from operations of $1,823,000 for the third quarter of fiscal 2012

compared to income from operations of $229,000 for the third

quarter of fiscal 2011. The net income and income from operations

included restructuring expenses of $1,302,000 and $3,764,000 for

the three and nine months ended January 31, 2011, respectively, and

non-cash postemployment compensation expense of $1,770,000.

Income from operations for the nine months ended January 31,

2012, does not include income from the Company’s non-voting

revenues and profits interests in EAM of $4,371,000, while income

from operations for the nine months ended January 31, 2011 includes

$10,693,000 of advisory management fees and service distribution

fees from the former Value Line subsidiaries, EAM LLC and ESI, that

performed the operations of the investment management business

prior to deconsolidation of these subsidiaries on December 23,

2010. Income before income taxes, which is inclusive of the income

from the Company’s non-voting revenues and profits interests in EAM

through January 31, 2012, was $9,384,000 as compared to $56,847,000

for the nine months ended January 31, 2011, which included the

aforementioned gain on Restructuring Transaction of $50,510,000,

non-cash postemployment compensation expense of $1,770,000, and

$3,764,000 of expenses related to the Restructuring

Transaction.

Shareholders’ equity of $32,699,000 at January 31, 2012,

compared to shareholders’ equity of $32,286,000 at January 31,

2011. Retained earnings were $32,022,000 and cash and short term

liquid assets were $15,614,000 at January 31, 2012.

The Company launched a new institutional sales website

ValueLinePro.com. during March 2012.

ValueLinePro.com provides a dedicated internet destination for

investment advisers, portfolio managers, corporate professionals

and professional librarians who seek to learn how Value Line’s

proprietary research tools can help them research stocks, mutual

funds, options, convertible securities and ETFs.

Value Line, Inc. is a leading New York based provider of

investment research. The Value Line Investment Survey is one

of the most widely used sources of independent equities investment

research. Value Line also publishes a range of proprietary

investment research in both print and digital formats including our

original research in the areas of Mutual Funds, Options,

Convertible securities and ETFs. Value Line’s acclaimed research

also enables the Company to provide specialized products such as

Value Line Select, Value Line Special Situations, Value

Line Dividend Select, and copyright data, distributed

under copyright agreements for fees, including certain proprietary

ranking system information and other proprietary information used

in third party products. Investment Management services are

provided through its substantial non-controlling and non-voting

interests in EULAV Asset Management, the investment adviser to The

Value Line Family of Mutual Funds. Value Line’s products are

available to individual investors at www.valueline.com or through

1-800-VALUELINE, while our institutional-level services for

professional investors, advisers, corporate, academic, municipal

and legal libraries are offered at www.ValueLinePro.com.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995

This report contains statements that are predictive in nature,

depend upon or refer to future events or conditions (including

certain projections and business trends) accompanied by such

phrases as “believe”, “estimate”, “expect”, “anticipate”, “will”,

“intend” and other similar or negative expressions, that are

“forward-looking statements” as defined in the Private Securities

Litigation Reform Act of 1995. Actual results for Value Line, Inc.

(“Value Line” or “the Company”) may differ materially from those

projected as a result of certain risks and uncertainties, including

but not limited to the following:

- dependence on key personnel;

- maintaining revenue from subscriptions

for the Company’s digital and print published products;

- protection of intellectual property

rights;

- changes in market and economic

conditions, including global financial issues;

- dependence on non-voting revenues and

non-voting profits interests in EULAV Asset Management Trust, a

Delaware business trust (“EAM”), which provides investment

management and distribution, marketing and administrative services

to the Value Line branded mutual funds;

- fluctuations in EAM’s assets under

management due to broadly based changes in the values of equity and

debt securities, redemptions by investors and other factors, and

the effect these changes may have on the valuation of EAM’s

intangible assets;

- competition in the fields of

publishing, copyright data and investment management;

- the impact of government regulation on

the Company’s and EAM’s business and the uncertainties of

litigation and regulatory proceedings;

- availability of free or low cost

investment data through discount brokers or generally over the

internet;

- the risk that, while the Company

believes that the restructuring transaction that closed on December

23, 2010, achieved compliance with the requirements of the order

issued by the Securities and Exchange Commission (“SEC”) on

November 4, 2009, the Company might be required to take additional

steps which could adversely affect the Company’s results of

operations or the Company’s financial condition;

- terrorist attacks, cyber security

attacks and natural disasters;

- other risks and uncertainties,

including but not limited to the risks described in Item 1A, “Risk

Factors” of the Company’s Annual Report on Form 10-K for the year

ended April 30, 2011 and in Part II, Item 1A of this Quarterly

Report on Form 10-Q for the period ended January 31, 2012; and

- other risks and uncertainties arising

from time to time.

Any forward-looking statements are made only as of the date

hereof, and the Company undertakes no obligation to update or

revise the forward-looking statements, whether as a result of new

information, future events or otherwise.

Value Line, Inc.

Consolidated Condensed Summary of

Financial Results

(in thousands, except per share

amounts)

(unaudited)

For the three months

ended January 31,

For the nine months

ended January 31,

2012 2011

(1)

2012

2011

(1)

Revenues $8,996 $12,035 $27,506

$39,142 Income from operations $1,823 $229 $4,979

$5,565

Revenues and profits interests in

EAM Trust

$1,456

$724

$4,371

$724

Income from securities

transactions, net

$3

$(40)

$34

$48

Income before income taxes $3,282 $51,423 $9,384 $56,847 Net income

$1,844 $31,437 $5,835 $34,841

Earnings per share, basic and

fully diluted

$0.19

$3.15

$0.59

$3.49

(1)

Restated to include the final valuation of

$1.77 million of non-cash postemployment compensation

expense compared to the previous estimate

of $1.475 million, and the tax effect of $115 thousand.

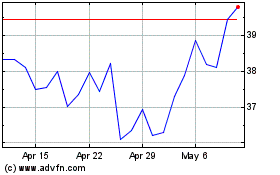

Value Line (NASDAQ:VALU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Value Line (NASDAQ:VALU)

Historical Stock Chart

From Jul 2023 to Jul 2024