UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

20-F

(Mark

One)

☐ REGISTRATION

STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2023

OR

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL

COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from to

Commission

file number: 001-42014

TOP

WEALTH GROUP HOLDING LIMITED

(Exact

name of Registrant as specified in its charter)

Cayman

Islands

(Jurisdiction

of incorporation or organization)

Units 714 &

715, Hong Kong Plaza

Connaught

Road West

Hong Kong

(Address

of principal executive offices)

Kim

Kwan Kings, WONG

+852

36158567

kings@topwealth.cc

Units 714 &

715, Hong Kong Plaza

Connaught

Road West

Hong Kong

(Name,

Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities

registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Ordinary shares, par value $0.0001 per share | | TWG | | The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Securities

registered or to be registered pursuant to Section 12(g) of the Act: None

Securities

for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate

the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered

by the annual report: 27,000,000 shares of ordinary shares issued and outstanding as of December 31, 2023.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth

company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | | Accelerated filer ☐ | | Non-accelerated filer ☒ |

| | | | | Emerging growth company ☒ |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

Indicate

by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | | International Financial Reporting Standards as issued | | Other ☐ |

| | | by the International Accounting Standards Board ☐ | | |

If

“Other” has been checked in response to the previous question, indicate by check mark which financial statement item the

registrant has elected to follow.

☐ Item 17 ☐ Item 18

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Securities Exchange Act of 1934).

☐ Yes ☒ No

(APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of

the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

Table

of Contents

INTRODUCTION

Except

where the context otherwise requires and for purposes of this annual report only the term:

| |

● |

“China”

or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Taiwan

region, Hong Kong, and Macau; |

| ● | “Frost &

Sullivan” refers to Frost & Sullivan Limited, an independent market research

agency, which is an independent third party; |

| ● | “HK$”

or “Hong Kong dollars” refers to the legal currency of Hong Kong; |

| ● | “Hong Kong”

refers to Hong Kong Special Administrative Region of the People’s Republic of

China; |

| ● | “Industry

Report” refers to the market research report commissioned by us and prepared by Frost &

Sullivan on the overview of the industry in which we operate; |

| ● | “Ordinary

Shares” refers to the Company’s ordinary shares, par value US$0.0001 per share; |

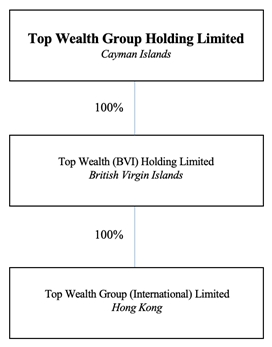

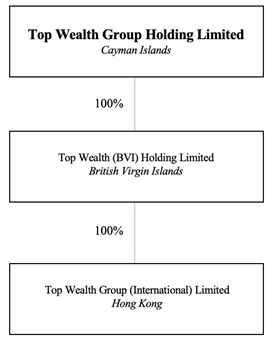

| ● | “our

Group”, “the Group”, “the Company” “we,” “us,”

“or “our” refers to Top Wealth Group Holding Limited and its subsidiaries; |

| ● | “SEC”

refers to the United States Securities and Exchange Commission; |

| ● | “TW

BVI” refers to Top Wealth (BVI) Holding Limited; |

| ● | “TW

Cayman” refers to Top Wealth Group Holding Limited, a Cayman Islands exempted company; |

| ● | “TW

HK” or “Operating Subsidiary” refers to Top Wealth Group (International)

Limited; |

| ● | “US$”

or “U.S. dollars” refers to the legal currency of the United States;

and |

| ● | “Winwin

Development (BVI)” refers to Winwin Development Group Limited. |

Top Wealth Group Holding

Limited is a holding company with operations conducted in Hong Kong through its Operating Subsidiary in Hong Kong, using Hong Kong dollars.

The reporting currency is U.S. dollars. Assets and liabilities denominated in foreign currencies are translated at year-end exchange

rates, income statement accounts are translated at average rates of exchange for the year and equity is translated at historical exchange

rates. Any translation gains or losses are recorded in other comprehensive income (loss). Gains or losses resulting from foreign currency

transactions are included in net income. The conversion of Hong Kong dollars into U.S. dollars are based on the exchange rates set forth

in the H.10 statistical release of the Board of Governors of the Federal Reserve System. Unless otherwise noted, all translations from

Hong Kong dollars to U.S. dollars and from U.S. dollars to Hong Kong dollars in this annual report were made at a year-end spot rate

of HK$ 7.8 to US$1.00 or an average rate of HK$ 7.8 to US$1.00 for the fiscal year ended December 31, 2023. On December 31, 2022, the

year-end spot rate and average rate for Hong Kong dollars were, respectively, HK$7.8 to US$1.00 and HK$7.8 to US$1.00.

We

obtained the industry and market data used in this annual report or any document incorporated by reference from industry publications,

research, surveys and studies conducted by third parties and our own internal estimates based on our management’s knowledge and

experience in the markets in which we operate. We did not, directly or indirectly, sponsor or participate in the publication of such

materials, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual

report. We have sought to provide current information in this annual report and believe that the statistics provided in this annual report

remain up-to-date and reliable, and these materials are not incorporated in this annual report other than to the extent specifically

cited in this annual report.

DISCLOSURE

REGARDING FORWARD-LOOKING STATEMENTS

This

annual report contains forward-looking statements that reflect our current expectations and views of future events, all of which are

subject to risks and uncertainties. Forward-looking statements give our current expectations or forecasts of future events. You can identify

these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these

statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,”

“anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,”

“would,” “should,” “could,” “may” or other similar expressions in this annual report.

These statements are likely to address our growth strategy, financial results and product and development programs. You must carefully

consider any such statements and should understand that many factors could cause actual results to differ from our forward-looking statements.

These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known

and some that are not. No forward-looking statement can be guaranteed and actual future results may vary materially. Factors that could

cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| ● | our

goals and strategies; |

| ● | our

future business development, financial condition and results of operations; |

| ● | prices

and availability of raw materials for our products,; |

| ● | expected

changes in our revenues, costs or expenditures; |

| ● | our

expectations regarding the demand for and market acceptance of our products; |

| ● | changes

in our relationships with significant customers, suppliers, and other business relationships; |

| |

● |

competition

in our industry; |

| ● | uncertainties

associated with our ability to implement our business strategy and to innovate successfully; |

| ● | any

event that could have a material adverse effect on our brands or reputation, such as product

contamination or quality control difficulties; |

| ● | government

policies and regulations relating to our industry; |

| ● | our

ability to obtain, maintain or procure all necessary certifications, approvals, and/or licenses

to conduct our business, and in the relevant jurisdictions in which we operate; |

| ● | any

recurrence of the COVID-19 pandemic and scope of related government orders and

restrictions and the extent of the impact of the COVID-19 pandemic on the global economy; |

| ● | other

factors that may affect our financial condition, liquidity and results of operations; and |

| ● | other

risk factors discussed under “Item 3. Key Information — 3.D. Risk Factors.” |

We

base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management

at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materially from what

is expressed, implied or forecast by our forward-looking statements. Accordingly, you should be careful about relying on any forward-looking

statements. Except as required under the federal securities laws, we do not have any intention or obligation to update publicly any forward-looking

statements after the distribution of this annual report, whether as a result of new information, future events, changes in assumptions,

or otherwise.

PART

I

Item

1. Identity of Directors, Senior Management and Advisers

Not

applicable for annual reports on Form 20-F.

Item

2. Offer Statistics and Expected Timetable

Not

applicable for annual reports on Form 20-F.

Item

3. Key Information

3.A.

[Reserved]

3.B.

Capitalization and Indebtedness

Not

applicable for annual reports on Form 20-F.

3.C.

Reasons for the Offer and Use of Proceeds

Not

applicable for annual reports on Form 20-F.

3.D.

Risk Factors

You

should carefully consider the following risk factors, together with all of the other information included in this Annual Report. Investment

in our securities involves a high degree of risk. You should carefully consider the risks described below together with all of the other

information included in this Annual Report before making an investment decision. The risks and uncertainties described below represent

our known material risks to our business. If any of the following risks actually occurs, our business, financial condition or results

of operations could suffer. In that case, you may lose all or part of your investment.

Risks

Related to Doing Business in the Jurisdictions in which We Operate

All

of our operations are in Hong Kong. However, due to the long arm application of the current PRC laws and regulations, the PRC government

may exercise significant direct oversight and discretion over the conduct of our business and may intervene or influence our operations,

which could result in a material change in our operations and/or the value of our Ordinary Shares. Our Operating Subsidiaries in Hong Kong

may be subject to laws and regulations of the Mainland China, which may impair our ability to operate profitably and result in a material

negative impact on our operations and/or the value of our Ordinary Shares. Furthermore, the changes in the policies, regulations, rules,

and the enforcement of laws of the PRC may also occur quickly with little advance notice and our assertions and beliefs of the risk imposed

by the PRC legal and regulatory system cannot be certain.

Our

operating subsidiary is located and operates its business in Hong Kong, a special administrative region of the PRC. The operating

subsidiary, or TW HK does not have operation in Mainland China and is not regulated by any regulator in Mainland China. As a result,

the laws and regulations of the Mainland China do not currently have any material impact on our business, financial condition and results

of operation. Furthermore, except for the Basic Law of the Hong Kong Special Administrative Region of the People’s Republic

of China (“Basic Law”), national laws of the Mainland China do not apply in Hong Kong unless they are listed in Annex III

of the Basic Law and applied locally by promulgation or local legislation. National laws that may be listed in Annex III are currently

limited under the Basic Law to those which fall within the scope of defense and foreign affairs as well as other matters outside the

limits of the autonomy of Hong Kong. National laws and regulations relating to data protection, cybersecurity and the anti-monopoly

have not been listed in Annex III and so do not apply directly to Hong Kong.

However,

due to long arm provisions under the current Mainland China laws and regulations, there remain regulatory and legal uncertainty with

respect to the implementation of laws and regulations of Mainland China to Hong Kong. As a result, there is no guarantee that the

PRC government may not choose to implement the laws of the Mainland China to Hong Kong and exercise significant direct influence

and discretion over the operation of our operating subsidiary in the future and, it will not have a material adverse impact on our business,

financial condition and results of operations, due to changes in laws, political environment or other unforeseeable reasons.

In

the event that we or our Hong Kong operating subsidiary were to become subject to laws and regulations of Mainland China, the legal

and operational risks associated in Mainland China may also apply to our operations in Hong Kong, and we face the risks and uncertainties

associated with the legal system in the Mainland China, complex and evolving Mainland China laws and regulations, and as to whether and

how the recent PRC government statements and regulatory developments, such as those relating to data and cyberspace security and anti-monopoly

concerns, would be applicable to companies like our operating subsidiary and us, given the substantial operations of our operating subsidiary

in Hong Kong and the PRC government may exercise significant oversight over the conduct of business in Hong Kong.

The

laws and regulations in the Mainland China are evolving, and their enactment timetable, interpretation, enforcement, and implementation

involve significant uncertainties, and may change quickly with little advance notice, along with the risk that the PRC government may

intervene or influence our operating subsidiary’s operations at any time could result in a material change in our operations and/or

the value of our securities. Moreover, there are substantial uncertainties regarding the interpretation and application of Mainland China

laws and regulations including, but not limited to, the laws and regulations related to our business and the enforcement and performance

of our arrangements with customers in certain circumstances. The laws and regulations are sometimes vague and may be subject to future

changes, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness and interpretation

of newly enacted laws or regulations, including amendments to existing laws and regulations, may be delayed, and our business may be

affected if we rely on laws and regulations which are subsequently adopted or interpreted in a

manner

different from our understanding of these laws and regulations. New laws and regulations that affect existing and proposed future businesses

may also be applied retroactively. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have

on our business.

The

laws, regulations, and other government directives in the Mainland China may also be costly to comply with, and such compliance or any

associated inquiries or investigations or any other government actions may:

| ● | delay

or impede our development; |

| ● | result

in negative publicity or increase our operating costs; |

| ● | require

significant management time and attention; |

| ● | cause

devaluation of our securities or delisting; and, |

| ● | subject

us to remedies, administrative penalties and even criminal liabilities that may harm our

business, including fines assessed for our current or historical operations, or demands or

orders that we modify or even cease our business operations. |

The

PRC government may intervene or influence the Hong Kong operations of an offshore holding company, such as ours, at any time. The PRC

government may exert more control over offerings conducted overseas and/or foreign investment in Hong Kong-based issuers. If the PRC

government exerts more oversight and control over offerings that are conducted overseas and/or foreign investment in Hong Kong-based

issuers and we were to be subject to such oversight and control, it may result in a material adverse change to our subsidiaries’

business operations, including our subsidiaries’ operations in Hong Kong.

As

a company mainly conducting business in Hong Kong, a special administrative region of China and our subsidiaries’ clients include

mainland China residents, our subsidiaries’ business and our prospects, financial condition, and results of operations may be influenced

to a significant degree by political, economic, and social conditions in China generally. The PRC government may intervene or influence

the operations in mainland China of an offshore holding company at any time, which, if extended to our subsidiaries’ operations

in Hong Kong, could result in a material adverse change to our subsidiaries’ operations. The PRC government has recently indicated

an intent to exert more oversight and control over listings conducted overseas and/or foreign investment in issuers based in mainland

China. For instance, on July 6, 2021, the relevant PRC governmental authorities promulgated the Opinions on Strictly Cracking Down on

Illegal Securities Activities, which emphasized the need to strengthen the supervision over overseas listings by companies in mainland

China. We cannot assure you that the oversight will not be extended to companies operating in Hong Kong like us and any such action may

significantly limit or completely hinder our ability to offer or continue to offer our securities to investors, result in a material

adverse change to our subsidiaries’ business operations, including our subsidiaries’ Hong Kong operations, and damage our

reputation.

Our subsidiaries’ business, our financial condition and results of operations, and/or the value of our Ordinary Shares or our ability

to offer or continue to offer securities to investors may be materially and adversely affected by existing or future PRC laws and regulations

which may become applicable to our subsidiaries.

We

have no operations in Mainland China. However, our operating subsidiary, or TW HK is located and operate in Hong Kong, a special

administrative region of the PRC, there is no guarantee that if certain existing or future PRC laws become applicable to our subsidiaries,

it will not have a material adverse impact on our subsidiaries’ business, financial condition and results of operations and/or

our ability to offer or continue to offer securities to investors.

Except

for the Basic Law of the Hong Kong Special Region of the People’s Republic of China (“Basic Law”), national laws of

mainland China (“National Laws”) do not apply in Hong Kong unless they are listed in Annex III of the Basic Law and applied

locally by promulgation or local legislation. National Laws that may be listed in Annex III are currently limited under the Basic Law

to those which fall within the scope of defense and foreign affairs as well as other matters outside the limits of the autonomy of Hong

Kong. PRC laws and regulations relating to data protection, cyber security and the anti-monopoly have not been listed in Annex III and

thus they may not apply directly to Hong Kong.

The

PRC laws and regulations are evolving, and their enactment timetable, interpretation and implementation involve significant uncertainties.

To the extent any PRC laws and regulations become applicable to our subsidiaries, we may be subject to the risks and uncertainties associated

with the legal system in mainland China, including with respect to the enforcement of laws and the possibility of changes of rules and

regulations with little or no advance notice.

We

may also become subject to the PRC laws and regulations to the extent our subsidiaries commence business and customer facing operations

in mainland China as a result of any future acquisition, expansion or organic growth. There is no guarantee that this will continue to

be the case in the future in relation to the continued listing of our securities on a securities exchange outside of the PRC, or even

when such permission is obtained, it will not be subsequently denied or rescinded. It remains uncertain as to the enactment, interpretation

and implementation of regulatory requirements related to overseas securities offering and other capital markets activities and due to

the possibility that laws, regulations, or policies in the PRC could change rapidly in the future, it remains uncertain whether the PRC

government will adopt additional requirements or extend the existing requirements to apply to our operating subsidiary located in Hong Kong.

It is also uncertain whether the Hong Kong government will be mandated by the PRC government, despite the constitutional constraints

of the Basic Law, to control over offerings conducted overseas and/or foreign investment of entities in Hong Kong, including our

operating subsidiary. Any actions by the PRC government to exert more oversight and control over offerings (including businesses whose

primary operations are in Hong Kong) that are conducted overseas and/or foreign investments in Hong Kong-based issuers could

significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our

securities to significantly decline or be worthless.

The

PRC government may exert substantial influence and discretion over mainland China residents and the manner in which companies incorporated

under the PRC laws must conduct their business activities. Through our subsidiaries, we are a Hong Kong-based company with no operations

in mainland China, and mainland China residents may purchase our subsidiaries’ product in Hong Kong. If we were to become subject

to such direct influence or discretion, it may result in a material change in our subsidiaries’ operations.

We

currently have no operations in mainland China. Our principal executive offices are located, and our subsidiaries operate, in Hong Kong,

a special administrative region of China. In addition, we do not solicit any client or collect, store or process in mainland China any

personal data of any client. As of the date of this Annual Report, the PRC government has not exerted direct influence and discretion

over the manner in which our subsidiaries conduct their business activities outside of mainland China. However, there is no guarantee

that we will not be subject to such direct influence or discretion in the future due to changes in laws or other unforeseeable reasons

or as a result of our expansion or acquisition of operations in mainland China, considering our subsidiaries’ clients include residents

of mainland China.

The

legal system of mainland China is evolving rapidly and the PRC laws, regulations, and rules may change quickly with little advance notice.

In particular, because these laws, rules and regulations are relatively new, and because of the limited number of published decisions

and the non-precedential nature of these decisions, the interpretation of these laws, rules and regulations may contain inconsistences,

the enforcement of which involves uncertainties. The PRC government may exercise substantial control over many sectors of the economy

in mainland China through regulation and/or state ownership. Government actions have had, and may continue to have, a significant effect

on economic conditions in mainland China and businesses which are subject to such government actions.

If

we or our subsidiaries to become subject to the direct intervention or influence of the PRC government at any time due to changes in

laws or other unforeseeable reasons or as a result of our development, expansion or acquisition of operations in mainland China, it may

require a material change in our subsidiaries’ operations and/or result in increased costs necessary to comply with existing and

newly adopted laws and regulations or penalties for any failure to comply.

Uncertainties

with respect to the PRC legal system, including uncertainties regarding the enforcement of laws, and sudden or unexpected changes in

laws and regulations in China could adversely affect us and limit the legal protections available to you and us.

The

HK subsidiary was formed under and are governed by the laws of the HK, however, we may be subject to the uncertainties of PRC legal system.

The PRC legal system is based on written statutes. Prior court decisions may be cited for reference, but have limited precedential value.

In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general,

such as foreign investment, corporate organization and governance, commerce, taxation and trade. As a significant part of our business

is conducted in HK, our operations may be governed by PRC laws and regulations. However, since the PRC legal system continues to evolve

rapidly, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and

rules involves uncertainties, which may limit legal protections available to us. In addition, some regulatory requirements issued by

certain PRC government authorities may not be consistently applied by other PRC government authorities (including local government authorities),

thus making strict compliance with all regulatory requirements impractical, or in some circumstances impossible. For example, we may

have to resort to administrative and court proceedings to enforce the legal protection that we enjoy either by law or contract. However,

since PRC administrative and court authorities have discretion in interpreting and implementing statutory and contractual terms, it may

be more difficult to predict the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more

developed legal systems. Furthermore, the PRC legal system is based in part on government policies and internal rules, some of which

are not published on a timely basis or at all and may have retroactive effect. As a result, we may not be aware of our violation of these

policies and rules until sometime after the violation. Such uncertainties, including uncertainty over the scope and effect of our contractual,

property (including intellectual property) and procedural rights, could materially and adversely affect our business and impede our ability

to continue our operations.

Furthermore,

if China adopts more stringent standards with respect to environmental protection or corporate social responsibilities, we may incur

increased compliance costs or become subject to additional restrictions in our operations. Intellectual property rights and confidentiality

protections in China may also not be as effective as in the United States or other countries. In addition, we cannot predict the

effects of future developments in the PRC legal system on our business operations, including the promulgation of new laws, or changes

to existing laws or the interpretation or enforcement thereof. These uncertainties could limit the legal protections available to us

and our investors, including you. Moreover, any litigation in China may be protracted and result in substantial costs and diversion of

our resources and management attention.

If

we and/or our subsidiaries were to be required to comply with cybersecurity, data privacy, data protection, or any other PRC laws and

regulations related to data and we and/or our subsidiaries cannot comply with such PRC laws and regulations, our subsidiaries’

business, financial condition, and results of operations may be materially and adversely affected.

We

may be subject to a variety of cybersecurity, data privacy, data protection, and other PRC laws and regulations related to data, including

those relating to the collection, use, sharing, retention, security, disclosure, and transfer of confidential and private information,

such as personal information and other data. These laws and regulations apply not only to third-party transactions, but also to transfers

of information within our organization. These laws and regulations may restrict our subsidiaries’ business activities and require

us and/or our subsidiaries to incur increased costs and efforts to comply, and any breach or noncompliance may subject us and/or our

subsidiaries to proceedings against such entity(ies), damage our reputation, or result in penalties and other significant legal liabilities,

and thus may materially and adversely affect our subsidiaries’ business and our financial condition and results of operations.

As

the laws and regulations related to cybersecurity, data privacy, and data protection in mainland China where our subsidiaries do not

have operations are relatively new and evolving, and their interpretation and application may be uncertain, it is still unclear if we

and/or our subsidiaries may become subject to such new laws and regulations.

The

PRC Data Security Law, or the Data Security Law, which was promulgated by the Standing Committee of the National People’s Congress

on June 10, 2021 and took effect on September 1, 2021, requires data collection to be conducted in a legitimate and proper manner, and

stipulates that, for the purpose of data protection, data processing activities must be conducted based on data classification and hierarchical

protection system for data security. According to Article 2 of the Data Security Law, it applies to data processing activities within

the territory of mainland China as well as data processing activities conducted outside the territory of mainland China which jeopardize

the national interest or the public interest of China or the rights and interest of any PRC organization and citizens. Any entity failing

to perform the obligations provided in the Data Security Law may be subject to orders to correct, warnings and penalties including ban

or suspension of business, revocation of business licenses or other penalties. As of the date of this Annual Report, we do not have any

operation or maintain any office or personnel in mainland China, and we have not conducted any data processing activities which may endanger

the national interest or the public interest of China or the rights and interest of any Chinese organization and citizens. Therefore,

we do not believe that the Data Security Law is applicable to us.

On

August 20, 2021, the Standing Committee of the National People’s Congress of China promulgated the Personal Information Protection

Law, which integrates the scattered rules with respect to personal information rights and privacy protection and took effect on November

1, 2021. According to Article 3 of the Personal Information Protection Law, it is applied not only to personal information processing

activities carried out in the territory of mainland China but also to personal information processing activities outside the mainland

China for the purpose of offering products or services to domestic natural persons in the territory of mainland China. The offending

entities could be ordered to correct, or to suspend or terminate the provision of services, and face confiscation of illegal income,

fines or other penalties. As our subsidiaries’ services are provided in Hong Kong, Cayman Islands, British Virgin Islands and the

U.S. rather than in the mainland China to clients worldwide, including but not limited to clients of mainland China who visit our offices

in these locations, we take the view that we and our subsidiaries are not subject to the Personal Information Protection Law.

On

July 7, 2022, the Cyberspace Administration of China (the “CAC”) issued the Measures for Security Assessment of Outbound

Data Transfer, or the Measures, which took effect on September 1, 2022. According to the Measures, in addition to the self-risk assessment

requirement for provision of any data outside mainland China, a data processor shall apply to the competent cyberspace department for

data security assessment and clearance of outbound data transfer in any of the following events: (i) outbound transfer of important data

by a data processor; (ii) outbound transfer of personal information by an operator of critical information infrastructure or a data processor

which has processed more than one million users’ personal data; (iii) outbound transfer of personal information by a data processor

which has made outbound transfers of more than one hundred thousand users’ personal information or more than ten thousand users’

sensitive personal information cumulatively since January 1 of the previous year; (iv) such other circumstances where ex-ante security

assessment and evaluation of cross-border data transfer is required by the CAC. As of the date of this Annual Report, we and our subsidiaries

have not collected, stored, or managed any personal information in mainland China. therefore, we believe that the Measures is not applicable

to us.

However,

given the recency of the issuance of the above PRC laws and regulations related to cybersecurity and data privacy, we and our subsidiaries

still face uncertainties regarding the interpretation and implementation of these laws and regulations and we could not rule out the

possibility that any PRC governmental authorities may subject us and/or our subsidiaries to such laws and regulations in the future.

If they are deemed to be applicable to us and/or our subsidiaries, we cannot assure you that we and our subsidiaries will be compliant

with such new regulations in all respects, and we and/or our subsidiaries may be ordered to rectify and terminate any actions that are

deemed illegal by the PRC governmental authorities and become subject to fines and other government sanctions, which may materially and

adversely affect our subsidiaries’ business and our financial condition and results of operations.

If

we and/or our subsidiaries were to be required to obtain any permission or approval from or complete any filing procedure with the China

Securities Regulatory Commission (the “CSRC”), the CAC, or other PRC governmental authorities in connection with the initial

public offering (“IPO”) or future follow-on offerings under PRC laws, we and/or our subsidiaries may be fined or subject

to other sanctions, and our subsidiaries’ business and our reputation, financial condition, and results of operations may be materially

and adversely affected.

The

Cybersecurity Review Measures jointly promulgated by the CAC and other relevant PRC governmental authorities on December 28, 2021 required

that, among others, “critical information infrastructure” or network platform operators holding over one million users’

personal information to apply for a cybersecurity review before any public offering on a foreign stock exchange. However, this regulation

is recently issued and there remain substantial uncertainties about its interpretation and implementation.

As

of the date of this Annual Report, we and our subsidiaries do not have any business operation or maintain any office or personnel in

mainland China. We and our subsidiaries have not collected, stored, or managed any personal information in mainland China. Based on our

inquiry with the China Cybersecurity Review Technology and Certification Center (the “CCRC”) and the assessment conducted

by the management, we believe that we and our subsidiaries are not currently required to proactively apply to a cybersecurity review

for our IPO or follow-on offerings overseas, on the basis that (i) our subsidiaries are incorporated in Hong Kong, the British Virgin

Islands, and other jurisdictions outside of mainland China and operate in Hong Kong without any subsidiary or variable interest entities

(“VIE”) structure in mainland China, and we do not maintain any office or personnel in mainland China; (ii) except for the

Basic Law, the National Laws do not apply in Hong Kong unless they are listed in Annex III of the Basic Law and applied locally by promulgation

or local legislation, and National Laws that may be listed in Annex III are currently limited under the Basic Law to those which fall

within the scope of defense and foreign affairs as well as other matters outside the limits of the autonomy of Hong Kong, and PRC laws

and regulations relating to data protection and cyber security have not been listed in Annex III as the date of this Annual Report; (iii)

our data processing activities are solely carried out by our overseas entities outside of mainland China for the purpose of offering

products or services in Hong Kong and other jurisdictions outside of mainland China; (iv) we and our subsidiaries do not control more

than one millions users’ personal information as of the date of this Annual Report; (v) as of the date of this Annual Report, we

and our subsidiaries have not received any notice of identifying us as critical information infrastructure from any relevant PRC governmental

authorities; (vi) as of the date of this Annual Report, none of us or our subsidiaries have been informed by any PRC governmental authority

of any requirement for a cybersecurity review; and (vii) based on our inquiry with the CCRC, the officer who provides cybersecurity review

consultation service under CCRC believes that we are currently not required to apply to a cybersecurity review for our public offerings

on a foreign stock exchange with the CAC because we neither currently have any operation in mainland China nor control more than one

millions users’ personal information as of the date of this Annual Report. Additionally, we believe that we and our subsidiaries

are compliant with the regulations and policies that have been issued by the CAC to date and there was no material change to these regulations

and policies since our IPO. However, regulatory requirements on cybersecurity and data security in the mainland China are constantly

evolving and can be subject to varying interpretations or significant changes, which may result in uncertainties about the scope of our

responsibilities in that regard, and there can be no assurance that the relevant PRC governmental authorities, including the CAC, would

reach the same conclusion as our PRC counsel. We will closely monitor and assess the implementation and enforcement of the Cybersecurity

Review Measures. If the Cybersecurity Review Measures mandates clearance of cybersecurity and/or data security regulators and other specific

actions to be completed by companies like us, we may face uncertainties as to whether we can meet such requirements timely, or at all.

On

February 17, 2023, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies

(the “Trial Measures”) and five supporting guidelines, which took effect on March 31, 2023. The Trial Measures requires companies

in mainland China that seek to offer and list securities overseas, both directly and indirectly, to fulfill the filing procedures with

the CSRC. According to the Trial Measures, the determination of the “indirect overseas offering and listing by companies in mainland

China” shall comply with the principle of “substance over form” and particularly, an issuer will be required to go

through the filing procedures under the Trial Measures if the following criteria are met at the same time: (i) 50% or more of the issuer’s

operating revenue, total profits, total assets or net assets as documented in its audited consolidated financial statements for the most

recent accounting year are accounted for by companies in mainland China; and (ii) the main parts of the issuer’s business activities

are conducted in mainland China, or its main places of business are located in mainland China, or the senior managers in charge of its

business operation and management are mostly Chinese citizens or domiciled in mainland China. On the same day, the CSRC held a press

conference for the release of the Trial Measures and issued the Notice on Administration for the Filing of Overseas Offering and Listing

by Domestic Companies, which clarifies that (i) on or prior to the effective date of the Trial Measures, companies in mainland China

that have already submitted valid applications for overseas offering and listing but have not obtained approval from overseas regulatory

authorities or stock exchanges shall complete the filing before the completion of their overseas offering and listing; and (ii) companies

in mainland China which, prior to the effective date of the Trial Measures, have already obtained the approval from overseas regulatory

authorities or stock exchanges and are not required to re-perform the regulatory procedures with the relevant overseas regulatory authority

or stock exchange, but have not completed the indirect overseas listing, shall complete the overseas offering and listing before September

30,2023, and failure to complete the overseas listing within such six-month period will subject such companies to the filing requirements

with the CSRC.

Based

on the assessment conducted by the management, we are not subject to the Trial Measures, because we are incorporated in the Cayman Islands

and our subsidiaries are incorporated in Hong Kong, the British Virgin Islands and other regions outside of mainland China and operate

in Hong Kong without any subsidiary or VIE structure in mainland China, and we do not have any business operations or maintain any office

or personnel in mainland China. However, as the Trial Measures and the supporting guidelines are newly published, there exists uncertainty

with respect to the implementation and interpretation of the principle of “substance over form”. As of the date of this Annual

Report, there was no material change to these regulations and policies since our IPO If our offering, including the IPO and future follow-on

offerings, and listing were later deemed as “indirect overseas offering and listing by companies in mainland China” under

the Trial Measures, we may need to complete the filing procedures for our offering, including the IPO and future follow-on offerings,

and listing. If we are subject to the filing requirements, we cannot assure you that we will be able to complete such filings in a timely

manner or even at all.

Since

these statements and regulatory actions are new, it is also highly uncertain in the interpretation and the enforcement of the above cybersecurity

and overseas listing laws and regulation. There is no assurance that the relevant PRC governmental authorities would reach the same conclusion

as us. If we and/or our subsidiaries are required to obtain approval or fillings from any governmental authorities, including the CAC

and/or the CSRC, in connection with the listing or continued listing of our securities on a stock exchange outside of Hong Kong or mainland

China, it is uncertain how long it will take for us and/or our subsidiaries to obtain such approval or complete such filing, and, even

if we and our subsidiaries obtain such approval or complete such filing, the approval or filing could be rescinded. Any failure to obtain

or a delay in obtaining the necessary permissions from or complete the necessary filing procedure with the PRC governmental authorities

to conduct offerings or list outside of Hong Kong or mainland China may subject us and/or our subsidiaries to sanctions imposed by the

PRC governmental authorities, which could include fines and penalties, suspension of business, proceedings against us and/or our subsidiaries,

and even fines on the controlling shareholder and other responsible persons, and our subsidiaries’ ability to conduct our business,

our ability to invest into mainland China as foreign investments or accept foreign investments, or our ability to list on a U.S. or other

overseas exchange may be restricted, and our subsidiaries’ business, and our reputation, financial condition, and results of operations

may be materially and adversely affected.

Our

Hong Kong subsidiaries may be subject to restrictions on paying dividends or making other payments to us, which may restrict their ability

to satisfy liquidity requirements, conduct business and pay dividends to holders of our ordinary shares.

We

are a holding company incorporated in the Cayman Islands with the majority of our operations in Hong Kong. Accordingly, most of our cash

is maintained in Hong Kong dollars. We rely in part on dividends from our Hong Kong subsidiaries for our cash and financing requirements,

such as the funds necessary to service any debt we may incur.

There

is currently no restriction or limitation under the laws of Hong Kong on the conversion of Hong Kong dollars into foreign currencies

and the transfer of currencies out of Hong Kong and the foreign currency regulations of mainland China do not currently have any material

impact on the transfer of cash between us and our Hong Kong subsidiaries. However, there is a possibility that certain PRC laws and regulations,

including existing laws and regulations and those enacted or promulgated in the future were to become applicable to our Hong Kong subsidiaries

in the future and the PRC government may prevent our cash maintained in Hong Kong from leaving or restrict the deployment of the cash

into our business or for the payment of dividends in the future. Any such controls or restrictions, if imposed in the future and to the

extent cash is generated in our Hong Kong subsidiaries and to the extent assets (other than cash) in our business are located in Hong

Kong or held by a Hong Kong entity and may need to be used to fund operations outside of Hong Kong, may adversely affect our ability

to finance our cash requirements, service debt or make dividend or other distributions to our shareholders. Furthermore, there can be

no assurance that the PRC government will not intervene or impose restrictions on our ability to transfer or distribute cash within our

organization, which could result in an inability or prohibition on making transfers or distributions to entities outside of Hong Kong

and adversely affect our business.

The

Chinese government may intervene or influence our Chinese supplier and its exclusive overseas agent’s operations at any time, or

may exert more control over how our PRC-based supplier operate their business or cooperate with us. This could result in a material change

in our PRC-based supplier’s operations and indirectly the value of our Ordinary Shares.

We

rely on one PRC-based sturgeon farm for our supply of caviar, with which we entered into supplier agreement through its exclusive overseas

agent. The PRC government may choose to exercise significant oversight and discretion, and the policies, regulations, rules, and the

enforcement of laws of the Chinese government to which our PRC-based supplier and its exclusive overseas agent is subject to may change

rapidly and with little advance notice. As a result, the application, interpretation, and enforcement of new and existing laws and regulations

in the PRC are often uncertain. In addition, these laws and regulations may be interpreted and applied inconsistently by different agencies

or authorities, and may be inconsistent with our supplier or its exclusive overseas agent’s current policies and practices. New

laws, regulations, and other government directives in the PRC may also be costly to comply with, and such compliance or any associated

inquiries or investigations or any other government actions may:

| ● | Delay

or impede our supplier’s development; |

| ● | result

in negative publicity or increase our supplier’s operating costs; |

| ● | require

significant management time and attention; and/or |

| ● | subject

us to remedies, administrative penalties and even criminal liabilities that may harm our

supplier’s business, including fines assessed for our supplier’s current or historical

operations, or demands or orders that our supplier modifies or even ceases their business

practices. |

The

PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in China with

little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based

companies listed overseas using a variable interest entity (“VIE”) structure, adopting new measures to extend the scope of

cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. These regulatory actions and statements emphasize the

need to strengthen the administration over illegal securities activities and the supervision of China-based companies seeking overseas

listings. Additionally, companies are required to undergo a cybersecurity review if they hold large amounts of data related to issues

of national security, economic development or public interest before carrying our mergers, restructuring or splits that affect or may

affect national security. These statements were recently issued and their official guidance and interpretation remain unclear at this

time.

The

Chinese government may intervene or influence our PRC-based supplier’s operations at any time and may exert more control over offerings

conducted overseas and foreign investment in China-based companies, which may result in a material change in our PRC-based operations.

Any legal or regulatory changes that restrict or otherwise unfavorably impact our PRC-based supplier’s ability to conduct their

business could decrease demand for their services, reduce revenues, increase costs, require them to obtain more licenses, permits, approvals

or certificates, or subject them to additional liabilities. To the extent any new or more stringent measures are implemented, our supplier’s

and our business, financial condition and results of operations could be adversely affected, and the value of our Ordinary Shares could

decrease or become worthless.

The

Hong Kong legal system embodies uncertainties which could limit the legal protections available to the Operating Subsidiaries.

Hong Kong

is a Special Administrative Region of the PRC. Following British colonial rule from 1842 to 1997, China assumed sovereignty under

the “one country, two systems” principle. The Hong Kong Special Administrative Region’s constitutional document,

the Basic Law, ensures that the current principles and policies regarding Hong Kong will remain unchanged for 50 years. Hong Kong

has enjoyed the freedom to function with a high degree of autonomy for its affairs, including currencies, immigration and customs operations,

and its independent judiciary system.

On

July 14, 2020, the former President of the U.S., Mr. Donald Trump, signed the Hong Kong Autonomy Act and an executive

order to remove the preferential trade status of Hong Kong, pursuant to § 202 of the United States-Hong Kong Policy

Act of 1992. The U.S. government has determined that Hong Kong is no longer sufficiently autonomous to justify preferential

treatment in relation to the PRC, especially with the issuance of the Law of the People’s Republic of China on Safeguarding National

Security in the Hong Kong Special Administrative Region (the “Hong Kong National Security Law”) on July 1,

2020. Hong Kong will now be treated as Mainland China, in terms of visa application, academic exchange, tariffs and trading, etc.

According to § 3(c) of the executive order issued on July 14, 2020, the license exception for exports and re-exports to

Hong Kong and transfer within the PRC is revoked, while exports of defense items are banned. On the other hand, the existing punitive

tariffs the U.S. imposed on the Mainland China will also be applied to Hong Kong exports. Losing its special status, Hong Kong’s

competitiveness as a food trading hub may deteriorate in the future as its tax benefits as a result of preferential situation no longer

exists and companies might prefer exporting through other cities. The level of activities of domestic exports and re-exports and other

trading activities in Hong Kong may decline owing to the tariff being imposed on Hong Kong exports and the export restriction.

In the event that Hong Kong loses its position as a food trading hub in Asia, the demand for food export or re-export from Hong Kong

and thus our business, financial conditions and results of operations, may be adversely affected. According to the Hong Kong Policy Act Report issued by the Department

of State in 2021, 2022 and 2023, since July 2020, the suspension of an agreement concerning surrender of fugitive offenders and the terminations

of an agreement concerning transfer of sentenced persons and an agreement concerning certain reciprocal tax exemptions, there were no

terminations pursuant to § 202(d) of the United States-Hong Kong Policy Act of 1992 or determinations under § 201(b) up to the

date of this annual report. The executive order to remove the preferential trade status of Hong Kong remains in effect. Since July 2020

and as of the date of this annual report, the removal of the preferential trade status of Hong Kong did not have a material impact on

our business and operations.

The

enactment of Law of the PRC on Safeguarding National Security in the Hong Kong Special Administrative Region (the “Hong Kong National

Security Law”) could impact our Hong Kong subsidiaries.

On

June 30, 2020, the Standing Committee of the PRC National People’s Congress adopted the Hong Kong National Security Law. This law

defines the duties and government bodies of the Hong Kong National Security Law for safeguarding national security and four categories

of offences - secession, subversion, terrorist activities, and collusion with a foreign country or external elements to endanger national

security - and their corresponding penalties. On July 14, 2020, the former U.S. President Donald Trump signed the Hong Kong Autonomy

Act, or HKAA, into law, authorizing the U.S. administration to impose blocking sanctions against individuals and entities who are determined

to have materially contributed to the erosion of Hong Kong’s autonomy. On August 7, 2020 the U.S. government imposed HKAA-authorized

sanctions on eleven individuals, including former HKSAR chief executive Carrie Lam. On October14, 2020, the U.S. State Department submitted

to relevant committees of Congress the report required under HKAA, identifying persons materially contributing to “the failure

of the Government of China to meet its obligations under the Joint Declaration or the Basic Law.” The HKAA further authorizes secondary

sanctions, including the imposition of blocking sanctions, against foreign financial institutions that knowingly conduct a significant

transaction with foreign persons sanctioned under this authority. The imposition of sanctions may directly affect the foreign financial

institutions as well as any third parties or customers dealing with any foreign financial institution that is targeted.

On

March 19, 2024, the Legislative Council of Hong Kong passed the Safeguarding National Security bill. The Safeguarding National Security

Ordinance (effective on March 23, 2024) was enacted according to the Article 23 of the Basic Law of the Hong Kong Special Administrative

Region which stipulates that Hong Kong shall enact laws on its own to prohibit any act of treason, secession, sedition, subversion against

the central people’s government, or theft of state secrets. The Safeguarding National Security Ordinance mainly covers five types

of offences: treason, insurrection, offences in connection with state secrets and espionage, sabotage endangering national security and

related activities, and external interference and organizations engaging in activities endangering national security. It is difficult

to predict the full impact of the Hong Kong National Security Law and HKAA and the Safeguarding National Security Ordinance on Hong Kong

and companies located in Hong Kong. If our Hong Kong subsidiaries are determined to be in violation of the Hong Kong National Security

Law or the HKAA or the Safeguarding National Security Ordinance, by competent authorities, our business operations, financial position

and results of operations could be materially and adversely affected.

Changes

and the downturn in the economic, political, or social conditions of Hong Kong, Mainland China and other countries or changes to

the government policies of Hong Kong and Mainland China could have a material adverse effect on our business and operations.

Our

operations are located in Hong Kong. Accordingly, our business, prospects, financial condition and results of operations may be

influenced to a significant degree by political, economic and social conditions in Hong Kong and Mainland China generally. Economic

conditions in Hong Kong are sensitive to Mainland China and the global economic conditions. Any major changes to Hong Kong’s

social and political landscape will have a material impact on our business.

Economic conditions in Hong Kong and China are sensitive to global economic conditions. Any prolonged slowdown in the global or Chinese

economy may affect potential clients’ spending power on luxury products as a whole and have a negative impact on our business,

results of operations and financial condition. Additionally, continued turbulence in the international markets may adversely affect our

ability to access the capital markets to meet liquidity needs.

The

Mainland China economy differs from the economies of most developed countries in many respects, including the amount of government involvement,

level of development, growth rate, control of foreign exchange and allocation of resources. While the economy in the Mainland China has

experienced significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy.

The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these

measures may benefit the overall Chinese economy but may have a negative effect on Hong Kong and us.

Additionally,

the outbreak of war in Ukraine in 2022 has already affected global economic markets, and the uncertain resolution of this conflict could

result in protracted and/or severe damage to the global economy. Russia’s recent military interventions in Ukraine have led to,

and may lead to, additional sanctions being levied by the United States, European Union and other countries against Russia. The

extent and duration of the military action, sanctions, and resulting market disruptions are impossible to predict, but could be substantial.

Any such disruptions caused by Russian military action or resulting sanctions may magnify the impact of other risks described in this

section. We cannot predict the progress or outcome of the situation in Ukraine, as the conflict and governmental reactions are rapidly

developing and beyond their control. Prolonged unrest, intensified military activities, or more extensive sanctions impacting the region

could have a material adverse effect on the global economy, and such effect could in turn have a material adverse effect on the operations,

results of operations, financial conditions, liquidity and business outlook of our business.

Risks

Related to our Business and Industry

We

have a short operating history and are subject to risks and uncertainties associated with operating in a rapidly developing and evolving

industry. Our limited operating history makes it difficult to evaluate our business and prospects.

We

established our caviar business in Hong Kong in August 2021 and have subsequently experienced rapid growth. We expect we will

continue to expand as global market presence, broaden our product portfolio, enlarge our customer bases and explore new market opportunities.

However, due to our limited operating history, our historical growth rate may not be indicative of our future performance. Our future

performance may be more susceptible to certain risks than a company with a longer operating history in a different industry. Many of

the factors discussed below could adversely affect our business and prospects and future performance, including:

| ● | our

ability to maintain, expand and further develop our relationships with customers; |

| ● | our

ability to introduce and manage new caviar products in response to changes in customer demographics

and consumer tastes and preferences; |

| ● | the

continued growth and development of the caviar industry; |

| ● | our

ability to maintain the quality of our caviar products; |

| ● | our

ability to effectively manage our growth; |

| ● | our

ability to compete effectively with our competitors in the caviar industry; and |

| ● | our

ability to attract and retain qualified and skilled employees. |

You

should consider our business and prospects in light of the risks and uncertainties we face as a fast growing company operating in a rapidly

developing and evolving market. We may not be successful in addressing the risks and uncertainties listed above, among others, which

may materially and adversely affect our business and prospects and future performance.

We

solely and materially rely on Fujian Aoxuanlaisi Biotechnology Co., Ltd (“Fujian Aoxuanlaisi”), the exclusive distributor

of a PRC sturgeon farm, as our sole supplier for the supply of caviar raw product. Such arrangement materially and adversely exposes

us to unique risk. Any disruption in the supplier’s relationships, either between Fujian Aoxuanlaisi and the PRC sturgeon farm,

or between Fujian Aoxuanlaisi and us, could have a material adverse effect on our business. Any disruption in the provision of caviar

from Fujian Aoxuanlaisi or PRC sturgeon farm and our inability to identify alternative caviar supplier may materially and adversely affect

our business operations and financial results.

We solely and materially rely on Fujian Aoxuanlaisi,

the agent and sole distributor of a PRC sturgeon farm, as our supplier for caviar raw product. For years ended December 31, 2023,

2022 and 2021, our procurement from the PRC sturgeon farm, through Fujian Aoxuanlaisi, amounted to approximately US$6.2 million, US$5.3

million, and US$0.3million respectively, representing approximately 64.3%, 90% and 100% of our total purchases for the corresponding

year. Before April 2022, we obtain all of the caviar raw product supply from Fujian Aoxuanlaisi on an as-demand per order basis,

without any long-term agreement. In April 2022, our Operating Subsidiary, Top Wealth Group (International) Limited, has entered

into the Caviar Sales Agreement with Fujian Aoxuanlaisi, the agent and the sole distributor of Fujian Longhuang Biotech Co., Limited

(“Fujian Longhuang”), a PRC sturgeon farm. Pursuant to the Caviar Sales Agreement between Fujian Aoxuanlaisi and Top Wealth

Group (International) Limited, by way of Power of Attorney, Fujian Aoxuanlaisi appointed Top Wealth Group (International) Limited, our

Operating Subsidiary, as its exclusive distributor in Hong Kong and Macau for conducting overseas distribution and granted us the

rights to procure caviar directly from it for a term of 10 years, from 30 April 2022 to 30 April 2032.

Such

arrangement materially and adversely exposes us to unique risk. Our business relies solely and heavily on a stable and adequate supply

of caviar from the Fujian Aoxuanlaisi, which ultimately depends on the stable and adequate supply of caviar from Fujian Longhuang, the

PRC sturgeon farm, to Fujian Aoxuanlaisi, the PRC sturgeon farm’s distributor. If our business relationships with Fujian Aoxuanlaisi

is interrupted or terminated, or if for any reason Fujian Aoxuanlaisi became unable or unwilling to continue to provide raw product caviar

to us, these would likely lead to a material interruption of our operation or suspension in our ability to obtain caviar supply or fulfilling

customer order, until we found another supplier that could supply our product. Furthermore, if the business relationships between Fujian

Aoxuanlaisi and Fujian Longhuang are interrupted or terminated, it would also likely lead to a material interruption of our operation

or suspension of our ability to obtain caviar supply or fulfilling customer order. Although Fujian Aoxuanlaisi and Fujian Longhuang maintain

a long-term exclusive sales agreement for 15 years, from December 2020 to December 2035, whether their relationship

may be interrupted or terminated is beyond our control. There are no also assurances that our Caviar Sales Agreement with Fujian Aoxuanlaisi

renewed on commercially favorable terms upon its expiration.

Any

disruption in our supplier relationships, either between Fujian Aoxuanlaisi and Fujian Longhuang, or between Fujian Aoxuanlaisi and us,

could have a material adverse effect on our business. Events that adversely affect our suppliers could impair our ability to obtain caviar

inventory in the quantities that we desire. Such events include problems with our suppliers’ businesses, finances, labor relations,

ability to obtain caviar, costs, production, quality control, insurance and reputation, as well as natural disasters, pandemics, or other

catastrophic occurrences. A failure by any current or future supplier to comply with food safety, environmental or other laws and regulations,

meet required timelines, and hire and retain qualified employees may disrupt our supply of products.

In

the event of any early termination or non-renewal of the Caviar Sales Agreement with Fujian Aoxuanlaisi or any early termination

or non-renewal of long-term exclusive sales agreement between Fujian Aoxuanlaisi and Fujian Longhuang, or in the event of any

disruption, delay or inability on the part of with Fujian Aoxuanlaisi in making sufficient and quality supply to us, we cannot assure

you that we would be able to identify alternative suppliers on commercially acceptable terms which may thereby result in material and

adverse effects on our business, financial conditions and operating results. Failure to find a suitable replacement, even on a temporary

basis, would have an adverse effect on our brand image, financial conditions, and the result of operations. Further, should there be

any changes in the commercial terms of the Caviar Sales Agreement, especially to the effect that we could no longer act as the exclusive

distributor of Fujian Aoxuanlaisi in Hong Kong and Macau, we may face an increase in competition, and we may not be able to continue

to procure caviar from the PRC sturgeon farm on commercially acceptable terms.

If

Fujian Aoxuanlaisi fails to deliver the caviar raw product we need on the terms we have agreed, we may be challenged to secure alternative

sources at commercially acceptable prices or on other satisfactory terms, in a timely manner. Any extended delays in securing an alternative

source could result in production delays and late shipments of our products to distributors and end-customers, which could materially

and adversely affect our customer relationships, profitability, results of operations, and financial condition. If we experience significant

increased demand for our products, there can be no assurance that additional supplies of caviar raw product will be available for us

when required on acceptable terms, or at all, or that Fujian Aoxuanlaisi or any supplier would allocate sufficient capacity to us in

order to meet our requirements, fill our orders in a timely manner or meet our strict quality standards. Even if our existing supplier

is able to meet our needs or we are able to find new sources of caviar supply, we may encounter delays in production, inconsistencies

in quality, and added costs. We are not likely to be able to pass increased costs to the customer immediately, if at all, which may decrease

or eliminate our profitability in any period. Any delays or interruption in or increased costs of our supply of caviar could have a material

and adverse effect on our ability to meet consumer demand for our products and result in lower net sales and profitability both in the

short and long term.

Adverse

weather conditions, natural disasters, disease, pests and other natural conditions, or shutdown, interruption, and damage to the PRC

sturgeon farm, or lack of availability of power, fuel, oxygen, eggs, water, or other key components needed for the operations of the

PRC sturgeon farm, could result a loss of a material percentage of our caviar raw product supply and a material adverse effect on our

operations, business results, reputation, and the value of our brands.

Our

ability to ensure a continuing supply of caviar raw product from our suppliers depends on many factors beyond our control. An interruption

in the power, fuel, oxygen supply, water quality systems, or other critical infrastructure of an aquaculture facility for more than a

short period of time could lead to the loss of a large number of sturgeon, hence the caviar supply. A shutdown of or damage to PRC sturgeon

farm due to natural disaster, reduction in water supply, deterioration of water quality, contamination of aquifers, interruption in services,

or human interference could result in a loss of supply of caviar for production. Sturgeon farming of the PRC sturgeon farm is vulnerable

to adverse weather conditions, including severe rains, drought and temperature extremes, typhoon, floods and windstorms, which are quite

common but difficult to predict. Sturgeon farms are vulnerable to disease and pests, which may vary in severity and effect, depending

on the stage of production at the time of infection or infestation, the type of treatment applied and climatic conditions. Unfavorable

growing conditions caused by these factors can reduce both sturgeon populations of our supplier and the quality of the sturgeon, and,

in extreme cases, entire harvests may be lost. Additionally, adverse weather or natural disasters, including earthquakes, winter storms,

droughts, or fires, could impact the manufacturing and business facilities of our supplier, which could result in significant costs and

meaningfully reduce our capacity to fulfill orders and maintain normal business operations. These factors may result in lower sales volume

and increased costs due increased costs of products. Incremental costs, including transportation, may also be incurred if we need to

find alternate short-term supplies of products from alternative areas. These factors can increase costs, decrease revenues and lead

to additional charges to earnings, which may have a material adverse effect on our business, results of operations and financial condition.

Climate

change may have a long-term adverse impact on our business and operations.

Climate

change may have an adverse impact on global temperatures, weather patterns, and the frequency and severity of extreme weather and natural

disasters. In the event that climate change may a negative effect on sturgeon or caviar productivity of our supplier, we may be subject

to decreased availability or less favorable pricing for caviar raw product or other commodities that are necessary for our products.

Extreme weather conditions may adversely impact the sturgeon farm or facilities of our supplier, lead to the disruption of distribution

networks or the availability and cost of key raw materials used by us in production, or the demand for our products. As a result of climate