UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2024

TechTarget, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

1-33472 |

04-3483216 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

275 Grove Street, Newton, MA |

|

02466 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (617) 431-9200

(Former Name or Former Address, if Changed Since Last Report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below): |

☑ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act.

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.001 per value per share |

TTGT |

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 7, 2024, TechTarget, Inc. (the “Company”) disclosed its results for the three months ended December 31, 2023 in its Shareholder Letter. The Shareholder Letter is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information contained in Item 2.02 of this Form 8-K (including Exhibit 99.1) is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

The following Exhibit 99.1 relating to Item 2.02 shall be deemed to be furnished, and not filed:

|

|

|

|

Exhibit Number |

|

Description |

|

|

|

99.1 |

|

Shareholder Letter dated February 7, 2024. |

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

TechTarget, Inc. |

|

|

|

|

Date: February 7, 2024 |

|

By: |

/s/ Daniel Noreck |

|

|

|

Daniel Noreck |

|

|

|

Chief Financial Officer and Treasurer |

Exhibit 99.1

February 7, 2024

Dear Fellow Shareholders:

TechTarget’s revenue during the fourth quarter was stable and came in slightly above the high end of our guidance. This reflects a macro technology environment in which customers remain cautious regarding their sales and marketing investment levels. We expect this dynamic to continue throughout 2024 because of uncertainty surrounding inflation, interest rates, the presidential election and geopolitical issues internationally.

While sales and marketing levels among our customers were down year over year, investments in R&D remain robust, which provides an opportunity for significant new technology products to be brought to market and we expect our customers will necessarily invest in sales and marketing to ensure the proper return on their R&D investments.

Customers and prospects continue to value our leading content as a key source for their investment decisions despite a dynamic environment, which is reflected in our increasingly strong domain presence. While we saw contraction in demand since the end of 2022, we believe we are well-positioned to benefit from the rebound, as we have similarly seen from past recessions as clients turned to quality and higher ROI solutions. Our organic traffic grew 14% YoY – which was on top of a Q4 2022 quarter that had already exhibited significant growth of 51% compared to Q4 2021, a high water mark for that year. We were pleased to see TechTarget.com was ranked 28th in Sistrix’s “Biggest Domain Winners of SEO Visibility,” up from 54th in 2022. This widely read report measures nearly 2,500 domains to analyze sites with the strongest organic visibility growth. Additionally, in the quarter we gained 9,000 new position #1 rankings and 30,000 new keywords ranking in positions #1-3. We maintained over 1,000 #1 rankings for AI-related content, including the #1 position for “generative AI”.

Historically, technology companies have been rewarded for revenue growth, and we believe that, as interest rates may decrease in the future, our customers’ and their investors’ focus will reprioritize growth. This reprioritization is likely on the horizon as we believe macro conditions in the technology market will recover in 2025 and 2026. Therefore, we have taken opportunistic actions to position TechTarget to capitalize on the impending recovery. As you know, we recently announced a strategic combination with Informa Tech’s digital businesses. In addition to the exciting benefits of immediate scale opportunities, diversification and resiliency that we anticipate the combination will give us, we are confident in our belief that the full effect of our product suite integration and anticipated revenue synergies will be optimally timed with a rebound of the technology market.

For the Full Year 2023:

•GAAP revenue declined 23% to approximately $230.0 million.

•Net income was approximately $4.5 million, a decrease of 89%; Adjusted EBITDA1 decreased 42% to $70.6 million. Net income margin was 2%; Adjusted EBITDA Margin1 was 31%.

•GAAP Gross margin was 67%; Adjusted Gross Margin1 was 72%.

•Longer-Term Revenue decreased 31% to $85.7 million, representing 37% of total revenue.

•Cash flow from operations was $72.5 million; Free Cash Flow1 was $57.9 million.

For Q4 2023:

•GAAP revenue was approximately $57.3 million, a decrease of 22%.

•Net loss was approximately $1.6 million, a decrease of 122%; Adjusted EBITDA1 decreased 42% to $17.1 million. Net income margin was (3%); Adjusted EBITDA Margin1 was 30%.

•GAAP Gross margin was 66%; Adjusted Gross Margin1 was 71%.

•Longer-Term Revenue decreased 37% to $18.4 million, representing 32% of total revenue.

•Cash flow from operations was $18.7 million; Free Cash Flow1 was $15.0 million.

1 of 15

Key Customer Metrics

|

|

|

|

|

2023 |

2022 |

2021 |

Number of Customers |

2,566 |

3,411 |

2,872 |

Customers spending $100k+ |

318 |

447 |

414 |

Customers spending $1mm+ |

38 |

49 |

43 |

Same Customer Sales(a) |

71% |

100% |

150% |

(a) Same Customer Sales is defined as (x) the sum of the GAAP revenue attributable to all Retained Customers for the year presented divided by (y) the sum of the GAAP revenue attributable to such Retained Customers for the prior year. We define a “Retained Customer” as a customer that made at least one purchase in both the year presented and the year preceding the year presented.

Product Update and Roadmap

We’ve continued to maintain the pace of innovation with regard to our Priority Engine offering to ensure that it can serve as a growth catalyst for us as the macro environment improves. In Q4, we released IntentMail AI, which utilizes generative AI to combine our prospect-level purchase intent insights with solution-relevant company information and other publicly available information to craft personalized email outreach that our customers can use to break into new sales opportunities. Customers have been impressed with their ability to choose amongst multiple “entry point” interest angles that allow their sales executives to iterate through multiple alternatives quickly.

We also recently released a new version of our CRM Connector feature which allows for single click set-up, integration of CRM-based prospect insights directly within Priority Engine, the ability to add multiple prospect records or an entire buying team into CRM simultaneously, and new support for HubSpot CRM. Customers’ ability to integrate their own workflows and data with the insights that we provide in Priority Engine are a key area of product development focus going forward.

To that end, we are actively working on a release in the first half of 2024 of a new offering under the Priority Engine family that will provide a direct feed of account-level insights, separate from the prospect-level insights that have been the core basis of the offering historically. Customers have been requesting this type of data in order to fuel various platforms and use cases within their martech stack. We plan for this data to be available in a number of formats, including some direct integrations with key platform providers. We’ll have more updates as we formally roll out this offering following early adopter testing.

Creating a Leading Global Platform in B2B Data and Market Access

On January 10, 2024, TechTarget and Informa entered into a definitive agreement to combine TechTarget with Informa Tech’s digital businesses. The combined company, which will retain the TechTarget name and branding following the close of the transaction, will offer end-to-end solutions to support all phases of the go-to-market from strategy, messaging and content to awareness, influence and demand generation to activation and sales enablement.

Expected accelerated growth drivers include:

•Enhanced scale across geographies, with approximately 8,000 customers in 20+ countries, up from approximately 2,600 customers today

•Proven strategy and execution capabilities of our world-class management team applied across 20+ new verticals, up from two verticals currently, including Healthcare, Retail, Banking, Automotive, Food, Legal, Manufacturing and Utilities, among others, which expand our current addressable market more than 10x

•Cross-selling TechTarget’s suite of products and services to Informa Tech customers, and leveraging additional first-party purchase intent data from Informa Tech’s assets

•Larger, more diversified data set and specialized content platform positioning the combined company to further capitalize on the current development and launch of new AI products

We believe the larger portfolio of digital assets, market expertise, targeted original content and expanded research scope will significantly strengthen our leadership position in B2B data and market access.

On a pro-forma basis, we believe the combined company would be expected to have 2024 combined revenues of approximately $500 million, ~4% annual growth in revenue versus ~2% on a standalone basis, and Adjusted EBITDA1 of approximately $123 million with a strong path to accelerate growth, increase profitability and enhance operating margins.

2 of 15

Continued Focus on Margins, Cash Flow Generation and Disciplined Capital Allocation

Over more than 15 years, TechTarget has demonstrated its commitment to balancing growth with strong profitability and returning of cash to shareholders. The combined company is expected to continue on this proven path of growth, high margins, cash flow generation and disciplined capital allocation.

Post closing, the company aims to leverage the benefits of the combined organization to accelerate growth at very attractive operating leverage with at least 50% anticipated Adjusted EBITDA margins on incremental revenue and target 35%+ Adjusted EBITDA margins in aggregate within three years of closing.

Projected annual cost savings of at least $25 million are expected to further enhance the margins of the combined company, driven by increased scale, improved productivity, product margin rationalization, efficiencies in real estate, software, systems and corporate functions. In addition, run-rate revenue synergies are expected to represent an additional $20 million Adjusted EBITDA contribution within three years of closing.

Anchored by expectations of strong liquidity and anticipated low leverage, the combined business has the potential to have the financial flexibility to pursue a growth strategy that benefits from impending technology and economic tailwinds. With an anticipated industry rebound in 2025 and 2026, we believe we will be primed to achieve our ambition to generate $1 billion in annual revenue within five years of closing, through a combination of organic and inorganic growth.

Significant Value Creation Opportunity

The announced transaction is expected to generate significant value creation to existing TechTarget shareholders, driven by:

1.$350 million cash consideration2 (~$11.79/share estimated) equivalent to ~39% of TTGT market capitalization prior to announcement3

2.43% equity stake in the combined company allowing participation in the upside of the combined company supported by enhanced scale, expanded total addressable market, increased product diversification and a stronger financial profile with significant synergy opportunities

3.Potential for multiple expansion supported by increased scale, diversified revenue streams with higher resiliency through-the-cycle, accelerating growth, and larger market capitalization

Exhibit 1 – Illustrative value creation for existing TechTarget’s shareholders

|

|

|

|

|

|

|

|

|

|

|

$mm, except for share price |

|

|

|

|

|

|

|

|

|

Excl. revenue synergy |

|

|

|

Incl. revenue synergy |

|

'24E Adjusted EBITDA TechTarget4 |

|

|

|

$73 |

|

|

|

'24E Adjusted EBITDA Informa Tech |

|

|

|

50 |

|

|

|

New TechTarget '24E pro-forma Adjusted EBITDA, pre-synergies |

|

|

|

$123 |

|

|

|

Adjusted EBITDA, run-rate cost synergy |

|

|

|

25 |

|

|

|

Adjusted EBITDA, run-rate revenue synergy |

|

- |

|

|

|

20 |

|

Total announced Adjusted EBITDA run-rate synergies |

|

$ |

25 |

|

|

|

$ |

45 |

|

New TechTarget '24E pro-forma Adjusted EBITDA |

|

$ |

148 |

|

|

|

$ |

168 |

|

'24E Adjusted EBITDA multiple5 |

|

|

|

16.0x |

|

|

|

New TechTarget pro-forma enterprise value |

|

$ |

2,367 |

|

|

|

$ |

2,687 |

|

(-) Pro-forma net debt as of 12/31/23 |

|

|

|

(91) |

|

|

|

New TechTarget pro-forma equity value |

|

$ |

2,276 |

|

|

|

$ |

2,596 |

|

New TechTarget pro-forma fully diluted shares outstanding (mm) |

|

|

|

~70.7 |

|

|

|

New TechTarget share price |

|

$ |

32.20 |

|

|

|

$ |

36.73 |

|

|

|

|

|

|

|

|

|

Value creation for existing TechTarget's shareholders |

|

|

|

|

|

|

|

Cash merger consideration per share |

|

|

|

$ |

11.79 |

|

|

|

New TechTarget share price |

|

$ |

32.20 |

|

|

|

$ |

36.73 |

|

Total shareholder value |

|

$ |

43.99 |

|

|

|

$ |

48.52 |

|

% premium to 3-month VWAP leading to announcement3 |

|

47% |

|

|

|

62% |

|

% premium to current share price as of 02/05/24 |

|

32% |

|

|

|

45% |

|

3 of 15

Balance Sheet and Liquidity

As of December 31, 2023, we had approximately $326.3 million in cash, cash equivalents and short-term investments.

As of December 31, 2023, we had approximately $417 million outstanding aggregate principal of convertible senior notes, which are convertible into shares of our common stock contingent upon the satisfaction of certain conditions contained within the applicable note indenture. Our 2025 convertible senior notes ($3 million aggregate principal amount outstanding as of December 31, 2023) bear interest at 0.125% per annum, have regular semi-annually interest payments (June and December) and mature in December 2025. Our 2026 convertible senior notes ($414 million aggregate principal amount outstanding as of December 31, 2023) do not bear interest and mature in December 2026.

Repurchase Plan

In November 2022, we announced the adoption of a repurchase program (the “November 2022 Program”) that authorized the repurchase of up to $200 million of our outstanding common stock and convertible debt from time to time on the open market or in privately negotiated transactions with an expiration in November of 2024.

During the quarter ended December 31, 2023, we did not repurchase any of our common stock.

During 2023 we repurchased 1,318,664 shares of our common stock at an average price of $37.90 and we repurchased approximately $48 million of aggregate principal of our 2025 Convertible Notes for approximately $43 million. As of December 31, 2023, we may still repurchase up to $92.9 million of our outstanding common stock and convertible debt under the November 2022 Repurchase Program, subject to Informa's consent.

Q1 2024 and Full Year 2024 Guidance6

For Q1 2024, we expect GAAP revenue to be between $50.0 million and $52.0 million. We expect Q1 2024 net loss to be between $(1.1) million and $(0.4) million and Adjusted EBITDA1 to be between $12.0 million and $13.0 million.

For 2024, we expect GAAP revenue to be between $230.0 million and $235.0 million. We expect net income to be between $10.9 million and $14.9 million and Adjusted EBITDA1 to be between $70.0 million and $75.0 million.

Strongly Positioned to Capitalize on Industry Recovery

We believe that now is the time to make the proper, opportunistic investments while staying close to our customers. We believe our combination with Informa Tech’s digital business creates a compelling vehicle to accelerate TechTarget’s strategy and take full advantage of the anticipated market upturn.

Sincerely,

|

|

|

|

Michael Cotoia |

Greg Strakosch |

Chief Executive Officer |

Executive Chairman |

© 2024 TechTarget, Inc. All rights reserved. TechTarget and the TechTarget logo are registered trademarks of TechTarget. All other trademarks are the property of their respective owners.

___________________

1 Non-GAAP measures. See “Non-GAAP Financial Measures” for definitions and reconciliations.

2 Subject to certain adjustments as set forth in the definitive merger agreement.

3 Calculated using the 3-month VWAP prior to announcement of $29.91/share

4 Represents midpoint of 2024E Adjusted EBITDA guidance.

5 TTGT FV / 2024E Wall Street consensus Adjusted EBITDA multiple before announcement as of 01/09/24.

6 2024 guidance does not include costs associated with the proposed merger transaction, which are expected to affect 2024 performance including net income (loss).

4 of 15

Conference Call and Webcast

TechTarget will discuss these financial results in a conference call at 5:00 p.m. (Eastern Time) today (February 7, 2024). Our Letter to Shareholders with supplemental financial information will be posted to the Investor Relations section of our website.

NOTE: Our Letter to Shareholders will not be read on the conference call. The conference call will include only brief remarks followed by questions and answers.

The public is invited to listen to a live webcast of TechTarget’s conference call, which can be accessed on the investor relations website at https://investor.techtarget.com. The conference call can also be heard via telephone by dialing:

•United States (Local): 1 404 975 4839

•United States (Toll Free): 1 833 470 1428

•Canada (Toll Free): 1 833 950 0062

•Canada (Local): 1 226 828 7575

•Please access the call at least 10 minutes prior to the time the conference is set to begin.

•Please ask to be joined into the TechTarget call.

For those investors unable to participate in the live conference call, a replay of the conference call will be available via telephone beginning February 7, 2024 one (1) hour after the conference call through March 8, 2024 at 11:59 p.m. EDT. To listen to the replay:

•United States (Toll Free): 1 866 813 9403

•United States (Local): 1 929 458 6194

The webcast replay will also be available on https://investor.techtarget.com during the same period.

5 of 15

Non-GAAP Financial Measures

This letter and the accompanying tables include a discussion of Adjusted Revenue, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Net Income, Adjusted Net Income Per Share and Free Cash Flow, all of which are non-GAAP financial measures which are provided as a complement to results provided in accordance with GAAP.

“Adjusted EBITDA” means earnings before net interest, other income and expense such as asset impairment (including expenses related to the induced conversion of our 2025 convertible notes), income taxes, depreciation and amortization, as further adjusted to include the impact of the fair value adjustments to contingent consideration and acquired unearned revenue and to exclude stock-based compensation and other one-time charges, such as costs related to mergers, acquisitions or reduction in forces expenses, if any.

“Adjusted EBITDA Margin” means Adjusted EBITDA divided by Adjusted Revenue.

“Adjusted Gross Margin” means Adjusted Gross Profit divided by Adjusted Revenue.

“Adjusted Gross Profit” means gross profit adding back the effects of stock compensation, depreciation and amortization, and the impact of fair value adjustments to acquired unearned revenue.

“Adjusted Net Income” means net income adjusted for amortization, stock-based compensation, foreign exchange, interest on our debt instruments (including expenses related to the induced conversion of our 2025 convertible notes), impact of the fair value adjustment to contingent consideration and acquired unearned revenue and one-time charges, if any, as further adjusted for the related income tax impact of the adjustments.

“Adjusted Net Income Per Share” means Adjusted Net Income divided by adjusted weighted average diluted shares outstanding. We adjust the average diluted shares outstanding to include shares on the if converted basis for our convertible note.

“Adjusted Revenue” means revenue recorded in accordance with GAAP plus the impact of fair value adjustments to acquired unearned revenue in accordance with ASC 805, Business Combinations.

“Free Cash Flow” means the change in net cash provided by operations less purchases of equipment and other capitalized assets.

“Longer-Term Contracts” means contracts in excess of 270 days.

“Longer-Term Revenue” means the amount of revenue subject to Longer-Term Contracts.

“Revenue from Our Legacy Global Customers” means GAAP revenue from this cohort of customers.

These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for, or superior to, GAAP results. In addition, our definitions of Adjusted EBITDA, Free Cash Flow, Adjusted EBITDA margin, Adjusted Gross Margin, Adjusted Net Income, Adjusted Revenue and Adjusted Net Income Per Share, may not be comparable to the definitions as reported by other companies. We believe that these measures provide relevant and useful information to enable us and investors to compare our operating performance using an additional measurement. We use these measures in our internal management reporting and planning process as primary measures to evaluate the operating performance of our business, as well as potential acquisitions.

The components of Adjusted EBITDA include the key revenue and expense items for which our operating managers are responsible and upon which we evaluate their performance. In the case of senior management, Adjusted EBITDA, Adjusted Revenue growth and the percentage of revenue under Longer-Term Contracts are used as the principal financial metrics in their annual incentive compensation program. Adjusted EBITDA is also used for planning purposes and in presentations to our Board of Directors. Adjusted Net Income is useful to us and investors because it presents an additional measurement of our financial performance, taking into account depreciation, which we believe is an ongoing cost of doing business, but excluding the impact of certain non-cash expenses and items not directly tied to the core operations of our business, such as costs related to acquisitions and interest on our debt instruments. Free Cash Flow represents net cash provided by operating activities excluding purchases of property and equipment and other capitalized assets. Free Cash Flow provides useful information to management and investors about the amount of cash generated by the business after the purchases of property and equipment and other capitalized assets, which can then be used to, among other things, invest in the business and make strategic acquisitions. A limitation of the utility of Free Cash Flow as a measure of financial performance is that it does not represent the total increase or decrease in our cash balance for the period. We use revenue from our legacy global customers to monitor customer concentration trends within the Company, which we deem an important metric for evaluating revenue diversification. Furthermore, we intend to provide these non-GAAP financial measures as part of our future earnings discussions and, therefore, the inclusion of these non-GAAP financial measures will provide consistency in our financial reporting. A reconciliation of these non-GAAP measures to GAAP is provided in the accompanying tables, except that full reconciliations of certain forward-looking non-GAAP measures are not provided because the Company is unable to provide such reconciliations without unreasonable effort due to the uncertainty and inherent difficulty of predicting the occurrence and financial impact of certain items, including but not limited to, stock-based compensation and other one-time charges such as acquisitions.

6 of 15

Additional Information and Where to Find It

In connection with the proposed transaction (the “proposed transaction”), among TechTarget, Inc. (“TechTarget”) Toro CombineCo, Inc. (“CombineCo”), Toro Acquisition Sub, LLC, Informa plc (“Informa”), Informa US Holdings Limited and Informa Intrepid Holdings Inc. (“Informa Tech”), TechTarget will prepare and file relevant materials with the Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4 that will contain a proxy statement of TechTarget that also constitutes a prospectus of CombineCo (the “Proxy Statement/Prospectus”). A definitive Proxy Statement/Prospectus will be mailed to stockholders of TechTarget. TechTarget and CombineCo may also file other documents with the SEC regarding the proposed transaction. This communication is not a substitute for any proxy statement, registration statement or prospectus, or any other document that TechTarget or CombineCo (as applicable) may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF TECHTARGET ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED BY TECHTARGET OR COMBINECO WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, IN CONNECTION WITH THE PROPOSED TRANSACTION, WHEN THEY BECOME AVAILABLE BECAUSE THESE DOCUMENTS CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. TechTarget investors and security holders will be able to obtain free copies of the Proxy Statement/Prospectus (when they become available), as well as other filings containing important information about TechTarget, CombineCo, and other parties to the proposed transaction (including Informa), without charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by TechTarget will be available free of charge under the tab “Financials” on the “Investor Relations” page of TechTarget’s internet website at https://investor.techtarget.com or by contacting TechTarget’s Investor Relations Department at gmann@techtarget.com.

Participants in the Solicitation

Informa, TechTarget, CombineCo, and their respective directors and certain of their respective executive officers and employees may be deemed to be participants in the solicitation of proxies from TechTarget’s stockholders in connection with the proposed transaction. Information regarding the directors of Informa is contained in Informa’s annual reports and accounts available on Informa’s website at www.informa.com/investors/ and in the National Storage Mechanism at data.fca.org.uk/#/nsm/nationalstoragemechanism. Information regarding the directors and executive officers of TechTarget is contained in TechTarget’s proxy statement for its 2023 annual meeting of stockholders, filed with the SEC on April 19, 2023, and in other documents subsequently filed with the SEC. Additional information regarding the participants in the proxy solicitations and a description of their direct or indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement/Prospectus and other relevant materials filed with the SEC (when they become available). These documents can be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

7 of 15

Cautionary Note Regarding Forward-Looking Statements

This shareholder letter contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included or referenced in this shareholder letter that address activities, events or developments which we expect will or may occur in the future are forward-looking statements, including statements regarding our intent, beliefs or current expectations and those of our management team. In some cases, you can identify forward-looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates,” “going to,” "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential," or "continue," or the negative of these words or other similar terms or expressions that concern our expectations, strategy, priorities, plans, or intentions. Such statements may include those regarding our future financial results and other projections or measures of our future operating performance, including the drivers of such growth, profitability, and performance (including, in each case, any potential impact of product and service development efforts, third-party privacy initiatives, GDPR and other similar laws, potential changes to customer relationships, and other operational decisions); the expected timing and structure of the proposed transaction to combine our business with Informa Tech’s digital businesses; our and Informa’s ability to complete the proposed transaction considering the various closing conditions; the expected benefits of the proposed transaction with Informa, such as improved operations, enhanced revenues and cash flow, synergies, growth potential, market profile, business plans, expanded portfolio and financial strength; the competitive ability and position of the combined company following completion of the proposed transaction; legal, economic, and regulatory conditions; expectations concerning market opportunities and our ability to capitalize on them; the amount and timing of the benefits expected from acquisitions, new strategies, products or services and other potential sources of additional revenue; the behavior of our members, partners, and customers; and any assumptions underlying any of the foregoing. These statements speak only as of the date of this shareholder letter and are based on our current plans and expectations. Such forward-looking statements are not guarantees of future performance and involve important risks and uncertainties that could cause actual future events or results to be different than those described in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, that one or more closing conditions to the proposed transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay, or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations, or restrictions in connection with such approvals or that the required approval by our shareholders may not be obtained; the risk that the proposed transaction may not be completed in the time frame expected by us or the other parties to the proposed transaction, or at all; unexpected costs, charges, or expenses resulting from the proposed transaction; uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the relevant portion of the Informa Tech business with our business; the ability of Informa to implement its business strategy; difficulties and delays in achieving revenue and cost synergies of Informa; the occurrence of any event that could give rise to termination of the proposed transaction; potential litigation in connection with the proposed transaction or other settlements or investigations that may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification, and liability; evolving legal, regulatory, and tax regimes; changes in economic, financial, political, and regulatory conditions, in the United States and elsewhere, and other factors that contribute to uncertainty and volatility, natural and man-made disasters, civil unrest, pandemics, geopolitical uncertainty, and conditions that may result from legislative, regulatory, trade, and policy changes associated with the current or subsequent U.S. administration; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact our ability to pursue certain business opportunities or strategic transactions; the ability of us or the other parties to the proposed transaction to meet expectations regarding the accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of our common stock; the risk that the proposed transaction and its announcement could have an adverse effect on our ability to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, stockholders, strategic partners and other business relationships and on our operating results and business generally; market acceptance of our and the relevant portion of the Informa Tech business’s products and services; the impact of pandemics and future health epidemics and any related economic downturns on our business and the markets in which we and our customers operate; changes in economic or regulatory conditions or other trends affecting the internet, internet advertising and information technology industries; data privacy and artificial intelligence laws, rules, and regulations; the impact of foreign currency exchange rates; certain macroeconomic factors facing the global economy, including instability in the regional banking sector, disruptions in the capital markets, economic sanctions and economic slowdowns or recessions, rising inflation and interest rate fluctuations on our and the relevant portion of the Informa Tech business’s results and other matters included in our SEC filings, including in our Annual Report on Form 10-K for the year ended December 31, 2022 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. Actual results may differ materially from those contemplated by the forward-looking statements. We undertake no obligation to update our forward-looking statements to reflect future events or circumstances.

8 of 15

TechTarget, Inc.

Consolidated Balance Sheet

(in 000’s, except per share data)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

(Unaudited) |

|

|

(Unaudited) |

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

226,668 |

|

|

$ |

344,523 |

|

Short-term investments |

|

|

99,601 |

|

|

|

20,210 |

|

Accounts receivable, net of allowance for doubtful accounts of $5,028 and $4,494 respectively |

|

|

39,239 |

|

|

|

60,359 |

|

Prepaid taxes |

|

|

1,634 |

|

|

|

— |

|

Prepaid expenses and other current assets |

|

|

4,331 |

|

|

|

5,745 |

|

Total current assets |

|

|

371,473 |

|

|

|

430,837 |

|

Property and equipment, net |

|

|

24,917 |

|

|

|

22,507 |

|

Goodwill |

|

|

194,074 |

|

|

|

192,227 |

|

Intangible assets, net |

|

|

89,163 |

|

|

|

95,517 |

|

Operating lease assets with right-of-use |

|

|

17,166 |

|

|

|

20,039 |

|

Deferred tax assets |

|

|

2,445 |

|

|

|

2,945 |

|

Other assets |

|

|

650 |

|

|

|

645 |

|

Total assets |

|

$ |

699,888 |

|

|

$ |

764,717 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

5,312 |

|

|

$ |

3,298 |

|

Current operating lease liabilities |

|

|

4,049 |

|

|

|

4,099 |

|

Accrued expenses and other current liabilities |

|

|

9,041 |

|

|

|

10,935 |

|

Accrued compensation expenses |

|

|

1,345 |

|

|

|

4,643 |

|

Income taxes payable |

|

|

2,522 |

|

|

|

7,827 |

|

Contract liabilities |

|

|

14,721 |

|

|

|

27,086 |

|

Total current liabilities |

|

|

36,990 |

|

|

|

57,888 |

|

Non-current operating lease liabilities |

|

|

16,615 |

|

|

|

20,371 |

|

Convertible senior notes |

|

|

410,500 |

|

|

|

455,694 |

|

Deferred tax liabilities |

|

|

12,856 |

|

|

|

13,290 |

|

Total liabilities |

|

|

476,961 |

|

|

|

547,243 |

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 5,000,000 shares authorized; no shares issued or outstanding |

|

|

— |

|

|

|

— |

|

Common stock, $0.001 par value; 100,000,000 shares authorized; 58,659,065 and 57,919,501 shares issued, respectively; 28,415,144 and 29,023,093 shares outstanding, respectively |

|

|

59 |

|

|

|

58 |

|

Treasury stock, at cost; 30,243,921 and 28,896,408 shares, respectively |

|

|

(329,118 |

) |

|

|

(278,876 |

) |

Additional paid-in capital |

|

|

471,696 |

|

|

|

425,458 |

|

Accumulated other comprehensive loss |

|

|

(4,542 |

) |

|

|

(9,537 |

) |

Retained earnings |

|

|

84,832 |

|

|

|

80,371 |

|

Total stockholders’ equity |

|

|

222,927 |

|

|

|

217,474 |

|

Total liabilities and stockholders’ equity |

|

$ |

699,888 |

|

|

$ |

764,717 |

|

9 of 15

TechTarget, Inc.

Consolidated Statements of Operations and Comprehensive Income

(in 000’s, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

For the Years Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Revenue |

|

$ |

57,292 |

|

|

$ |

73,035 |

|

|

$ |

229,963 |

|

|

$ |

297,488 |

|

Cost of revenue(1) |

|

|

18,770 |

|

|

|

19,025 |

|

|

|

72,776 |

|

|

|

75,740 |

|

Amortization of acquired technology |

|

|

694 |

|

|

|

651 |

|

|

|

2,761 |

|

|

|

2,748 |

|

Gross profit |

|

|

37,828 |

|

|

|

53,359 |

|

|

|

154,426 |

|

|

|

219,000 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Selling and marketing(1) |

|

|

23,546 |

|

|

|

25,765 |

|

|

|

97,161 |

|

|

|

100,800 |

|

Product development(1) |

|

|

3,145 |

|

|

|

3,358 |

|

|

|

10,911 |

|

|

|

12,348 |

|

General and administrative(1) |

|

|

11,090 |

|

|

|

7,831 |

|

|

|

34,097 |

|

|

|

31,882 |

|

Restructuring cost for a reduction in force(1) |

|

|

— |

|

|

|

4,435 |

|

|

|

— |

|

|

|

4,435 |

|

Depreciation, excluding depreciation of $1,086, $778, $3,846, $2,758 included in cost of revenues |

|

|

2,252 |

|

|

|

1,939 |

|

|

|

8,527 |

|

|

|

7,218 |

|

Amortization |

|

|

1,498 |

|

|

|

1,515 |

|

|

|

5,999 |

|

|

|

5,624 |

|

Total operating expenses |

|

|

41,531 |

|

|

|

44,843 |

|

|

|

156,695 |

|

|

|

162,307 |

|

Operating income (loss) |

|

|

(3,703 |

) |

|

|

8,516 |

|

|

|

(2,269 |

) |

|

|

56,693 |

|

Interest and other income (expense), net |

|

|

3,192 |

|

|

|

2,514 |

|

|

|

11,655 |

|

|

|

861 |

|

Gain from early extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

5,033 |

|

|

|

- |

|

Income (loss) before provision for income taxes |

|

|

(511 |

) |

|

|

11,030 |

|

|

|

14,419 |

|

|

|

57,554 |

|

Provision for income taxes |

|

|

1,090 |

|

|

|

3,841 |

|

|

|

9,958 |

|

|

|

15,945 |

|

Net income (loss) |

|

$ |

(1,601 |

) |

|

$ |

7,189 |

|

|

$ |

4,461 |

|

|

$ |

41,609 |

|

Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized income (loss) on investments (net of tax effect of $(245), $(2), $(228), and $64) |

|

$ |

866 |

|

|

$ |

6 |

|

|

$ |

808 |

|

|

$ |

(225 |

) |

Foreign currency translation gain (loss) |

|

|

2,959 |

|

|

|

6,578 |

|

|

|

4,187 |

|

|

|

(9,610 |

) |

Other comprehensive income (loss) |

|

|

3,825 |

|

|

|

6,584 |

|

|

|

4,995 |

|

|

|

(9,835 |

) |

Comprehensive income |

|

$ |

2,224 |

|

|

$ |

13,773 |

|

|

$ |

9,456 |

|

|

$ |

31,774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.06 |

) |

|

$ |

0.24 |

|

|

$ |

0.16 |

|

|

$ |

1.41 |

|

Diluted |

|

$ |

(0.06 |

) |

|

$ |

0.23 |

|

|

$ |

0.16 |

|

|

$ |

1.30 |

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

28,424 |

|

|

|

29,437 |

|

|

|

28,328 |

|

|

|

29,589 |

|

Diluted |

|

|

28,424 |

|

|

|

33,383 |

|

|

|

28,495 |

|

|

|

34,072 |

|

(1) Amounts include stock-based compensation expense as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

$ |

890 |

|

|

$ |

825 |

|

|

$ |

3,419 |

|

|

$ |

2,978 |

|

Selling and marketing |

|

|

6,800 |

|

|

|

6,917 |

|

|

|

29,245 |

|

|

|

23,803 |

|

Product development |

|

|

440 |

|

|

|

395 |

|

|

|

1,748 |

|

|

|

1,617 |

|

General and administrative |

|

|

3,032 |

|

|

|

3,571 |

|

|

|

13,236 |

|

|

|

12,814 |

|

Restructuring cost for a reduction in force |

|

|

— |

|

|

|

2,295 |

|

|

|

— |

|

|

|

2,295 |

|

10 of 15

TechTarget, Inc.

Consolidated Statements of Cash Flows

(in 000’s, except per share data)

|

|

|

|

|

|

|

|

|

|

|

For the Years Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Operating Activities: |

|

(Unaudited) |

|

|

(Unaudited) |

|

Net income |

|

$ |

4,461 |

|

|

$ |

41,609 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation |

|

|

12,373 |

|

|

|

9,976 |

|

Amortization |

|

|

8,760 |

|

|

|

8,372 |

|

Provision for bad debt |

|

|

2,021 |

|

|

|

2,239 |

|

Stock-based compensation |

|

|

47,648 |

|

|

|

43,507 |

|

Amortization of debt issuance costs |

|

|

2,400 |

|

|

|

2,500 |

|

Deferred tax provision |

|

|

(711 |

) |

|

|

(4,205 |

) |

Gain on Early Extinguishment of Debt |

|

|

(5,033 |

) |

|

|

— |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

19,213 |

|

|

|

(12,463 |

) |

Operating lease assets with right of use |

|

|

2,293 |

|

|

|

2,895 |

|

Prepaid expenses and other current assets |

|

|

(202 |

) |

|

|

(427 |

) |

Other assets |

|

|

(4 |

) |

|

|

225 |

|

Accounts payable |

|

|

2,003 |

|

|

|

(401 |

) |

Income taxes payable |

|

|

(5,341 |

) |

|

|

5,818 |

|

Accrued expenses and other current liabilities |

|

|

(76 |

) |

|

|

1,755 |

|

Accrued compensation expenses |

|

|

(1,433 |

) |

|

|

(2,599 |

) |

Operating lease liabilities with right of use |

|

|

(3,336 |

) |

|

|

(2,975 |

) |

Contract liabilities |

|

|

(12,547 |

) |

|

|

(2,345 |

) |

Other liabilities |

|

|

— |

|

|

|

(2,779 |

) |

Net cash provided by operating activities |

|

|

72,489 |

|

|

|

90,702 |

|

Investing activities: |

|

|

|

|

|

|

Purchases of property and equipment, and other capitalized assets |

|

|

(14,635 |

) |

|

|

(14,028 |

) |

Purchases of investments |

|

|

(78,386 |

) |

|

|

(422 |

) |

Net cash used in investing activities |

|

|

(93,021 |

) |

|

|

(14,450 |

) |

Financing activities: |

|

|

|

|

|

|

Tax withholdings related to net share settlements |

|

|

(4,564 |

) |

|

|

(9,418 |

) |

Purchase of treasury shares and related costs |

|

|

(50,000 |

) |

|

|

(79,080 |

) |

Proceeds from exercise of stock options |

|

|

17 |

|

|

|

391 |

|

Issuance of common stock from ESPP |

|

|

1,236 |

|

|

|

355 |

|

Payment of earnout liabilities |

|

|

(2,267 |

) |

|

|

(5,206 |

) |

Payments for repurchase and conversion of convertible senior notes |

|

|

(42,560 |

) |

|

|

— |

|

Net cash used in financing activities |

|

|

(98,138 |

) |

|

|

(92,958 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

815 |

|

|

|

(394 |

) |

Net increase (decrease) in cash and cash equivalents |

|

|

(117,855 |

) |

|

|

(17,100 |

) |

Cash and cash equivalents at beginning of year |

|

|

344,523 |

|

|

|

361,623 |

|

Cash and cash equivalents at end of year |

|

$ |

226,668 |

|

|

$ |

344,523 |

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

Cash paid for taxes, net |

|

$ |

17,686 |

|

|

$ |

12,577 |

|

Schedule of non-cash investing and financing activities: |

|

|

|

|

|

|

Right of use assets and operating lease liabilities |

|

$ |

495 |

|

|

$ |

740 |

|

11 of 15

TechTarget, Inc.

Reconciliation of Revenue to Adjusted Revenue

(in 000’s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Three Months Ended

December 31, |

|

|

For Years Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Revenue |

|

$ |

57,292 |

|

|

$ |

73,035 |

|

|

$ |

229,963 |

|

|

$ |

297,488 |

|

Impact of fair value adjustment on acquired unearned revenue |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,676 |

|

Adjusted Revenue |

|

$ |

57,292 |

|

|

$ |

73,035 |

|

|

$ |

229,963 |

|

|

$ |

299,164 |

|

TechTarget, Inc.

Reconciliation of Gross Profit to Adjusted Gross Profit and Gross Margin to Adjusted Gross Margin

(in 000’s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Three Months Ended

December 31, |

|

|

For Years Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Gross Profit |

|

$ |

37,828 |

|

|

$ |

53,359 |

|

|

$ |

154,426 |

|

|

$ |

219,000 |

|

Stock compensation |

|

|

890 |

|

|

|

825 |

|

|

|

3,419 |

|

|

|

2,978 |

|

Depreciation and amortization |

|

|

1,780 |

|

|

|

1,429 |

|

|

|

6,607 |

|

|

|

5,506 |

|

Impact of fair value adjustment of acquired unearned revenue |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,676 |

|

Adjusted Gross Profit |

|

$ |

40,498 |

|

|

$ |

55,613 |

|

|

$ |

164,452 |

|

|

$ |

229,160 |

|

Gross Margin |

|

|

66 |

% |

|

|

73 |

% |

|

|

67 |

% |

|

|

74 |

% |

Adjusted Gross Margin |

|

|

71 |

% |

|

|

76 |

% |

|

|

72 |

% |

|

|

77 |

% |

TechTarget, Inc.

Reconciliation of Cash Provided by Operations to Free Cash Flow

(in 000’s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Three Months Ended

December 31, |

|

|

For Years Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Net cash provided by operating activities |

|

$ |

18,689 |

|

|

$ |

19,782 |

|

|

$ |

72,489 |

|

|

$ |

90,702 |

|

Purchases of property and equipment, and other capitalized assets, net |

|

|

(3,729 |

) |

|

|

(3,169 |

) |

|

|

(14,635 |

) |

|

|

(14,028 |

) |

Free Cash Flow |

|

$ |

14,960 |

|

|

$ |

16,613 |

|

|

$ |

57,854 |

|

|

$ |

76,674 |

|

12 of 15

TechTarget, Inc.

Reconciliation of Net Income (Loss) to Adjusted EBITDA and Net Income Margin to Adjusted EBITDA Margin

(in 000’s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Three Months Ended

December 31, |

|

|

For Years Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Net income (loss) |

|

$ |

(1,601 |

) |

|

$ |

7,189 |

|

|

$ |

4,461 |

|

|

$ |

41,609 |

|

Interest (income) expense, net |

|

|

(2,940 |

) |

|

|

(2,027 |

) |

|

$ |

(11,475 |

) |

|

|

(1,820 |

) |

Provision for income taxes |

|

|

1,090 |

|

|

|

3,841 |

|

|

|

9,958 |

|

|

|

15,945 |

|

Depreciation and amortization |

|

|

5,530 |

|

|

|

4,883 |

|

|

|

21,133 |

|

|

|

18,348 |

|

EBITDA |

|

|

2,079 |

|

|

|

13,886 |

|

|

|

24,077 |

|

|

|

74,082 |

|

Stock-based compensation expense(1) |

|

|

11,162 |

|

|

|

11,708 |

|

|

|

47,648 |

|

|

|

41,212 |

|

Gain from early extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

(5,033 |

) |

|

|

— |

|

Restructuring cost for a reduction in force |

|

|

— |

|

|

|

4,435 |

|

|

|

— |

|

|

|

4,435 |

|

Other (income) expense, net |

|

|

(252 |

) |

|

|

(487 |

) |

|

|

(180 |

) |

|

|

958 |

|

Merger related costs |

|

|

4,130 |

|

|

|

— |

|

|

|

4,130 |

|

|

|

— |

|

Impact of fair value adjustment on acquired unearned revenue |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,676 |

|

Adjusted EBITDA |

|

$ |

17,119 |

|

|

$ |

29,542 |

|

|

$ |

70,642 |

|

|

$ |

122,363 |

|

Net income (loss) margin |

|

|

-3 |

% |

|

|

10 |

% |

|

|

2 |

% |

|

|

14 |

% |

Adjusted EBITDA margin |

|

|

30 |

% |

|

|

40 |

% |

|

|

31 |

% |

|

|

41 |

% |

(1)Stock based compensation expense excludes $2.3 million of stock based compensation included in restructuring cost for a reduction in force for the three and twelve months ended December 31, 2022.

13 of 15

TechTarget, Inc.

Reconciliation of Net Income (Loss) to Adjusted Net Income and

Net Income per Diluted Share to Adjusted Net Income per Diluted Share

(in 000’s, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Years Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Net income (loss) |

|

$ |

(1,601 |

) |

|

$ |

7,189 |

|

|

$ |

4,461 |

|

|

$ |

41,609 |

|

Provision for income taxes |

|

|

1,090 |

|

|

|

3,841 |

|

|

|

9,958 |

|

|

|

15,945 |

|

Net income (loss) before taxes |

|

|

(511 |

) |

|

|

11,030 |

|

|

|

14,419 |

|

|

|

57,554 |

|

Amortization of intangible assets |

|

|

2,192 |

|

|

|

2,167 |

|

|

|

8,760 |

|

|

|

8,373 |

|

Gain from early extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

(5,033 |

) |

|

|

— |

|

Stock-based compensation expense(1) |

|

|

11,162 |

|

|

|

11,708 |

|

|

|

47,648 |

|

|

|

41,212 |

|

Restructuring cost for a reduction in force |

|

|

— |

|

|

|

4,435 |

|

|

|

— |

|

|

|

4,435 |

|

Acquisition and Other NR Costs |

|

|

4,130 |

|

|

|

— |

|

|

|

4,130 |

|

|

|

— |

|

Foreign exchange loss, impairment expense and interest expense |

|

|

308 |

|

|

|

278 |

|

|

|

2,401 |

|

|

|

3,725 |

|

Impact of fair value adjustment on acquired unearned revenue |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,676 |

|

Adjusted income tax provision(2) |

|

|

(4,127 |

) |

|

|

(6,820 |

) |

|

|

(17,820 |

) |

|

|

(29,757 |

) |

Adjusted net income |

|

$ |

13,154 |

|

|

$ |

22,798 |

|

|

$ |

54,505 |

|

|

$ |

87,218 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per diluted share(3) |

|

$ |

(0.06 |

) |

|

$ |

0.23 |

|

|

$ |

0.16 |

|

|

$ |

1.30 |

|

Weighted average diluted shares outstanding |

|

|

28,424 |

|

|

|

33,383 |

|

|

|

28,495 |

|

|

|

34,072 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income per diluted share |

|

$ |

0.42 |

|

|

$ |

0.68 |

|

|

$ |

1.72 |

|

|

$ |

2.56 |

|

Adjusted weighted average diluted shares outstanding(4) |

|

|

31,656 |

|

|

|

33,383 |

|

|

|

31,686 |

|

|

|

34,072 |

|

(1)Stock-based compensation expense excludes $2.3 million of stock based compensation included in restructuring cost for a reduction in force for the three and twelve months ended December 31, 2022.

(2)Adjusted income tax provision was calculated using an adjusted effective tax rate, excluding discrete items, for each respective period.

(3)Includes add back of $0.6 million and $2.6 million in interest expense for the 2025 and 2026 notes for the three and twelve months ended December 31, 2022, respectively. There is no add back for three and twelve months ended December 31, 2023 due to the anti-dilutive nature

(4)Adjusted weighted average diluted shares outstanding for the three and twelve months ended, December 31, 2023 includes 3.3 million shares and 3.4 million shares respectively, related to unvested stock awards calculated using the treasury method and the dilutive impact on the if converted basis of our convertible bond. Adjusted weighted average diluted shares outstanding for the three and twelve months ended, December 31, 2022 includes 4.1 million and 4.6 million shares respectively, related to unvested stock awards calculated using the treasury method and the dilutive impact on the if converted basis of our convertible bond.

14 of 15

TechTarget, Inc.

Standalone Financial Guidance for the Three Months Ended March 31, 20246

(in 000’s)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, 2024 |

|

|

|

Range |

|

Revenue |

|

$ |

50,000 |

|

|

$ |

52,000 |

|

|

|

|

|

|

|

|

Net (loss) |

|

$ |

(1,100 |

) |

|

$ |

(400 |

) |

Depreciation, amortization and stock-based compensation |

|

|

17,200 |

|

|

|

17,200 |

|

Interest and other expense, net |

|

|

(2,900 |

) |

|

|

(2,900 |

) |

Provision for income taxes |

|

|

(1,200 |

) |

|

|

(900 |

) |

Adjusted EBITDA |

|

$ |

12,000 |

|

|

$ |

13,000 |

|

TechTarget, Inc.

Standalone Financial Guidance for the Year Ended December 31, 20246

(in 000’s)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended

December 31, 2024 |

|

|

|

Range |

|

Revenue |

|

$ |

230,000 |

|

|

$ |

235,000 |

|

|

|

|

|

|

|

|

Net income |

|

$ |

7,600 |

|

|

$ |

11,600 |

|

Depreciation, amortization and stock-based compensation |

|

|

65,000 |

|

|

|

65,000 |

|

Interest and other expense, net |

|

|

(11,600 |

) |

|

|

(11,600 |

) |

Provision for income taxes |

|

|

9,000 |

|

|

|

10,000 |

|

Adjusted EBITDA |

|

$ |

70,000 |

|

|

$ |

75,000 |

|

15 of 15

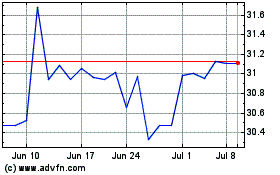

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

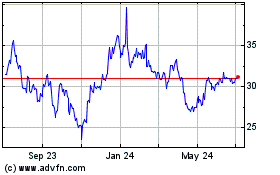

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Apr 2023 to Apr 2024