Current Report Filing (8-k)

May 06 2020 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2020

Sypris Solutions, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

0-24020

|

|

61-1321992

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

101 Bullitt Lane, Suite 450

|

|

|

|

|

|

Louisville, Kentucky

|

|

|

|

40222

|

|

(Address of Principal

Executive Offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (502) 329-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

SYPR

|

NASDAQ Global Select Market

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

Item 1.01 Entry Into Material Definitive Agreement

On May 1, 2020, Sypris Solutions, Inc. (the “Company”) executed a promissory note (the “Note”) to BMO Harris Bank N.A. (“BMO Harris”), as lender, in the aggregate principal amount of $3,558,000 (the “PPP Loan”) under the Paycheck Protection Program (the “PPP”). The PPP was established under the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) and is administered by the U.S. Small Business Administration (the “SBA”).

The Note has a two-year term and bears interest at a rate of 1.0% per annum. Monthly principal and interest payments are deferred for six months after the date of the Note. The Company did not provide any collateral or personal guarantees for the PPP Loan, nor did the Company pay any facility charge to the government or to BMO Harris. The PPP Loan amount may be prepaid by the Company at any time prior to maturity with no prepayment penalties, subject to certain notice requirements. The PPP Loan provides for customary events of default. The PPP Loan may be accelerated upon the occurrence of an event of default.

Under the terms of the CARES Act, PPP loan recipients can apply for and be granted forgiveness for all or a portion of loans granted under the PPP. Such forgiveness will be determined, subject to limitations, based on the use of loan proceeds for payroll costs, and rent or utility costs over the eight-week period following receipt of the loan proceeds. Forgiveness will be reduced if full-time headcount declines, or if salaries and wages decrease. Any forgiveness of the PPP Loan shall be subject to approval of the SBA and will require the Company and BMO Harris to apply to the SBA for such treatment in the future. The Company intends to comply with the necessary requirements to seek forgiveness of all or a portion of the PPP Loan, but no assurance can be provided that the Company will obtain forgiveness of the PPP Loan in whole or in part.

The SBA has recently issued guidance regarding the required borrower certifications of a borrower’s need for a PPP loan. Although the CARES Act suspends the ordinary SBA requirement that borrowers must be unable to obtain credit elsewhere (as defined in section 3(h) of the Small Business Act), borrowers still must certify in good faith that their PPP loan request is necessary. As a result, the Company carefully reviewed the required certification that current economic uncertainty makes the PPP Loan necessary to support the ongoing operations of the Company. The Company made this certification in good faith, taking into account its current business activity and its inability to access other sources of liquidity sufficient to support its ongoing operations in a manner that is not significantly detrimental to its business. In making this certification, among other things, the Company considered its lack of access to debt and equity capital markets, its current non-compliance with the NASDAQ’s requirement to maintain a minimum bid price of $1 per share, as well as the unavailability of traditional bank financing and its recent operating performance.

The foregoing description of the Note does not purport to be complete and is qualified in its entirety by reference to the full text of the Note attached to this Form 8-K as Exhibit 10.1 and incorporated herein by reference.

Forward Looking Statements

This Current Report on Form 8-K contains “forward-looking” statements within the meaning of the federal securities laws. Such forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. The Company can give no assurances that such plans will be attained or achieved. Potential risks and uncertainties include, but are not limited to, our ability to comply with the covenants and conditions of the PPP Loan and the CARES Act, including the conditions for forgiveness of the PPP Loan; actions by BMO Harris; our ability to demonstrate that we satisfied the eligibility and other requirements of the PPP and the CARES Act, including the required certifications about our need for the PPP Loan; changes by the SBA or other governmental authorities regarding the CARES Act, the PPP or related administrative matters; and the impact of the COVID-19 pandemic and changes in worldwide and U.S. economic conditions. We undertake no obligation to update our forward-looking statements, except as may be required by law.

Item 2.03 Creation of Direct Financial Obligation under an Off-Balance Sheet Arrangement of a Registrant

The disclosure in Item 1.01 of this Current Report on Form 8-K is incorporated in this Item 2.03 by reference.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: May 6, 2020

|

Sypris Solutions, Inc.

|

|

|

|

|

|

|

|

|

|

/S/ Anthony C. Allen

|

|

|

By:

|

Anthony C. Allen

|

|

|

|

Vice President and Chief Financial Officer

|

|

|

|

|

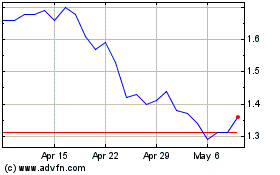

Sypris Solutions (NASDAQ:SYPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

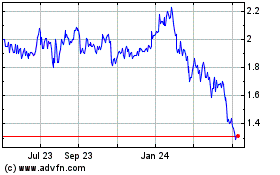

Sypris Solutions (NASDAQ:SYPR)

Historical Stock Chart

From Apr 2023 to Apr 2024