Streamline Health Solutions Inc. - Current report filing (8-K)

May 13 2008 - 10:45AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 12, 2008

Streamline Health Solutions, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

0-28132

|

|

31-1455414

|

|

|

|

|

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

10200 Alliance Road, Suite 200, Cincinnati, OH

|

|

45242-4716

|

|

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

(513) 794-7100

(Former name, former address, and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing

obligation of the registrant under any of the following provisions:

|

|

|

|

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

1

|

|

|

|

|

Item 2.03

|

|

CREATION OF A DIRECT FINANCIAL OBLIGATION

|

On May 12, 2008, Streamline Health, Inc., a wholly owned subsidiary of Streamline Health Solutions,

Inc., entered into a ninety day extension of the existing revolving loan agreement with the Fifth

Third Bank, Cincinnati, OH, in the principal amount of $500,000. The interest rate on amounts

borrowed will accrue at a variable rate from the Prime Rate to the Prime Rate plus 3%, based on the

ratio of the funded indebtedness to the trailing twelve months earnings before interest, taxes,

depreciation and amortization (EBITDA). The agreement contains other covenants including; Minimum

Tangible Net Worth, Fixed Charge Coverage Ratio and Funded Indebtedness to EBITDA. The loan is

guaranteed by the Registrant and is secured by a first lien on all of the assets of the Registrant

and its subsidiary. The complete terms of this loan are set forth in the Revolving Note and

Continuing Guarantee Agreement attached as Exhibits 10.1 & 10.2 of Form 8-K dated January 7, 2008,

previously filed with the Commission

This extended facility expires on July 30, 2008. Currently the Registrant is negotiating with

several lenders for a larger multi year facility and expects to enter into a new agreement prior to

June 30, 2008.

Streamline Health believes that its present cash position, combined with cash generation currently

anticipated from operations will be sufficient to meet anticipated cash requirements for the short

term and the Registrant believes that, based on current cash projections, it will not be required

to use this temporary facility in the short term.

Signatures

Pursuant to the requirements of the Securities Act of 1934, registrant has duly caused this report

to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Streamline Health Solutions, Inc.

|

|

|

Date: May 12, 2008

|

By:

|

/s/ Paul W. Bridge, Jr.

|

|

|

|

|

Paul W. Bridge, Jr.

|

|

|

|

|

Chief Financial Officer

|

|

|

|

2

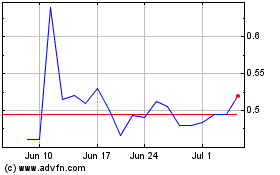

Streamline Health Soluti... (NASDAQ:STRM)

Historical Stock Chart

From Oct 2024 to Nov 2024

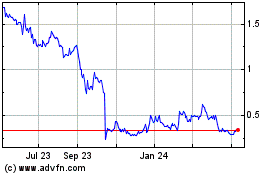

Streamline Health Soluti... (NASDAQ:STRM)

Historical Stock Chart

From Nov 2023 to Nov 2024