Combined Backlog Hits All-Time High of $1.2

billion at a Record 9.1% Gross Margin

Q2’19 Results and FY’19 Guidance Impacted by

Weather and Delayed Project Starts

Sterling Construction Company, Inc. (NasdaqGS: STRL) (“Sterling”

or “the Company”) today announced financial results for the second

quarter of 2019.

Consolidated Second Quarter 2019 Financial Results Compared

to Second Quarter 2018:

• Revenues were $264.1 million compared to $268.7 million;

• Gross margin was 9.7% of revenues compared to 11.6%;

• Net income attributable to Sterling common stockholders was

$7.8 million compared to $8.2 million; and,

• Net income per diluted share attributable to Sterling common

stockholders was $0.29 compared to $0.30.

Consolidated Financial Position, Liquidity and Cash Flows at

June 30, 2019:

• Cash and Cash Equivalents were $71.7 million;

• Debt totaled $78.6 million in the second quarter 2019;

and,

• To date under the stock repurchase plan, Sterling has

repurchased 717 thousand shares of common stock for $7.9

million.

Business Overview

During the second quarter, severe weather conditions, especially

in the Texas market, significantly hampered the execution of

existing projects, delayed the starts of new projects, and impeded

our residential business. As a result, second quarter 2019 revenues

decreased $4.6 million compared to the prior year quarter,

primarily driven by a $9.5 million decrease in residential

construction. Additionally, notice to proceed on several

significant new heavy civil projects has been delayed and the

projects are now expected to ramp-up in late 2019 or early

2020.

Gross profit was $25.5 million in the second quarter of 2019, a

decrease of $5.6 million from the prior year second quarter. Gross

margin declined 190 basis points to 9.7%, which was driven by lower

revenues from our higher margin residential construction segment

and a lower margin mix of heavy civil construction projects.

General and administrative expenses were $10.8 million in the

second quarter of 2019, or 4.1% of revenues compared to $13.2

million or 4.9% of revenues in the second quarter of 2018,

reflecting better leverage across the enterprise.

Heavy Civil Construction Backlog Highlights

• Combined backlog at June 30, 2019 was $1.2 billion, an

increase of 7.0% from $1.1 billion at December 31, 2018. Combined

backlog consists of $909.0 million of backlog and $314.9 million of

unsigned contracts as of June 30, 2019 compared to $850.7 million

and $292.7 million at December 31, 2018, respectively. No

residential construction contracts are included in backlog;

• Gross margin on projects in combined backlog as of June 30,

2019 averaged 9.1%, an increase from 8.6% at March 31, 2019 and

8.9% at December 31, 2018; and,

• Non-heavy highway revenues accounted for 43.0% of second

quarter of 2019 heavy civil construction revenues, consistent with

the second quarter of 2018.

CEO Remarks and Outlook

“Severe weather conditions caused our second quarter results to

come in below our expectations,” stated Joe Cutillo, Sterling’s

Chief Executive Officer. “While our Heavy Civil revenues increased

compared to the same period last year and our combined backlog is

at a record high, we have yet to realize the growth in both revenue

and margin that we expect to see out of this backlog. The growth in

the segment’s top and bottom line was impacted by the delayed start

of several large projects, on top of an already challenging

year-over-year comparison given that the second quarter of 2018

included substantial work on two sizable JV projects which were

completed in late 2018. Additionally, we expect these delayed

projects to commence before the end of the year or early 2020,

benefiting our outlook for 2020. Notably, our Combined Backlog and

the gross margin in backlog are both at an all-time high level,

providing us with several quarters of strong visibility for our

Heavy Highway business.”

Mr. Cutillo continued, “Our Residential segment lost 30 days due

to rain in the quarter. Although these delays in our Residential

segment caused us a large revenue decline versus our expectation,

our team was still able to maintain operating margins and claw back

enough production to get close to our prior year's operating income

with $9.5 million less revenue. On top of that, they hit an

all-time new record in July for slabs completed once the weather

returned to normal.”

Mr. Cutillo concluded, “Despite our record high backlog, our

record high margins in backlog, and our Residential segment's very

strong performance in July, the set back in the second quarter

coupled with the delayed starts of several Heavy Civil projects has

caused us to temper our full year expectations for 2019. We now

expect revenues of between $1.010 billion and $1.025 billion and

net income attributable to Sterling common stockholders of $27

million to $29 million. Even with this adjustment in our outlook,

the mid-point of our guidance still represents a double-digit

percentage increase in our net income as compared to 2018. With our

robust backlog, increasing margin profile and favorable end market

outlook, we anticipate a strong second half of 2019 and our outlook

for 2020 has become increasingly positive for both top and

bottom-line growth, which we expect to lead to greater value for

our shareholders.”

Conference Call

Sterling’s management will hold a conference call to discuss

these results and recent corporate developments on Tuesday, August

6, 2019 at 9:00 a.m. ET/8:00 a.m. CT. Interested parties may

participate in the call by dialing (201) 493-6744 or (877)

445-9755. Please call in ten minutes before the conference call is

scheduled to begin and ask for the Sterling Construction call.

Following management’s opening remarks, there will be a question

and answer session. Questions may be asked during the live call, or

alternatively, you may e-mail questions in advance to

Brigette.Wilcox@strlco.com.

To listen to a simultaneous webcast of the call, please go to

the Company’s website at www.strlco.com at least fifteen minutes

early to download and install any necessary audio software. If you

are unable to listen live, the conference call webcast will be

archived on the Company’s website for thirty days.

About Sterling

Sterling is a construction company that specializes in heavy

civil infrastructure construction and infrastructure rehabilitation

as well as residential construction projects. The Company operates

primarily in Arizona, California, Colorado, Hawaii, Nevada, Texas

and Utah, as well as other states in which there are feasible

construction opportunities. Heavy civil construction projects

include highways, roads, bridges, airfields, ports, light rail,

water, wastewater and storm drainage systems, foundations for

multi-family homes, commercial concrete projects and parking

structures. Residential construction projects include concrete

foundations for single-family homes.

Important Information for Investors and Stockholders

Cautionary Statement Regarding Forward-Looking Statements

This press release contains statements that are considered

forward-looking statements within the meaning of the federal

securities laws. These forward-looking statements are subject to a

number of risks and uncertainties, many of which are beyond our

control, which may include statements about our: business strategy;

financial strategy; and plans, objectives, expectations, forecasts,

outlook and intentions. All of these types of statements, other

than statements of historical fact included in this press release,

are forward-looking statements. In some cases, forward-looking

statements can be identified by terminology such as “may,” “will,”

“could,” “should,” “expect,” “plan,” “project,” “intend,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,”

“pursue,” “target,” “continue,” the negative of such terms or other

comparable terminology. The forward-looking statements contained in

this press release are largely based on our expectations, which

reflect estimates and assumptions made by our management. These

estimates and assumptions reflect our best judgment based on

currently known market conditions and other factors. Although we

believe such estimates and assumptions to be reasonable, they are

inherently uncertain and involve a number of risks and

uncertainties that are beyond our control. In addition,

management’s assumptions about future events may prove to be

inaccurate. Management cautions all readers that the

forward-looking statements contained in this press release are not

guarantees of future performance, and we cannot assure any reader

that such statements will be realized or the forward-looking events

and circumstances will occur. Actual results may differ materially

from those anticipated or implied in the forward-looking statements

due to factors listed in the “Risk Factors” section in our filings

with the U.S. Securities and Exchange Commission (“SEC”) and

elsewhere in those filings. The forward-looking statements speak

only as of the date made, and other than as required by law, we do

not intend to publicly update or revise any forward-looking

statements as a result of new information, future events or

otherwise. These cautionary statements qualify all forward-looking

statements attributable to us or persons acting on our behalf.

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

Revenues

$

264,086

$

268,734

$

488,035

$

491,226

Cost of revenues

(238,590

)

(237,688

)

(443,036

)

(440,346

)

Gross profit

25,496

31,046

44,999

50,880

General and administrative expense

(10,774

)

(13,203

)

(23,263

)

(25,543

)

Other operating expense, net

(3,538

)

(5,694

)

(5,832

)

(6,509

)

Operating income

11,184

12,149

15,904

18,828

Interest income

291

201

655

330

Interest expense

(2,904

)

(3,112

)

(5,964

)

(6,199

)

Income before income taxes

8,571

9,238

10,595

12,959

Income tax expense

(706

)

(97

)

(869

)

(138

)

Net income

7,865

9,141

9,726

12,821

Less: Net income attributable to

noncontrolling interests

(37

)

(967

)

(83

)

(2,158

)

Net income attributable to Sterling common

stockholders

$

7,828

$

8,174

$

9,643

$

10,663

Net income per share attributable to

Sterling common stockholders:

Basic

$

0.30

$

0.30

$

0.37

$

0.40

Diluted

$

0.29

$

0.30

$

0.36

$

0.39

Weighted average common shares

outstanding:

Basic

26,338

26,887

26,357

26,881

Diluted

26,623

27,125

26,657

27,162

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

SEGMENT INFORMATION

(In thousands)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2019

% of

Total

2018

% of

Total

2019

% of

Total

2018

% of

Total

Revenues

Heavy Civil Construction

$

228,130

86%

$

223,283

83%

$

409,314

84%

$

410,524

84%

Residential Construction

35,956

14%

45,451

17%

78,721

16%

80,702

16%

Total Revenues

$

264,086

$

268,734

$

488,035

$

491,226

Operating Income

Heavy Civil Construction

$

6,146

55%

$

6,395

53%

$

5,299

33%

$

8,340

44%

Residential Construction

5,038

45%

5,754

47%

10,605

67%

10,488

56%

Total Operating Income

$

11,184

$

12,149

$

15,904

$

18,828

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except per

share data)

(Unaudited)

June 30, 2019

December 31, 2018

Assets

Current assets:

Cash and cash equivalents

$

71,730

$

94,095

Accounts receivable, including

retainage

157,813

145,026

Costs and estimated earnings in excess of

billings

53,896

41,542

Inventory

3,252

3,159

Receivables from and equity in

construction joint ventures

14,381

10,720

Other current assets

7,951

8,074

Total current assets

309,023

302,616

Property and equipment, net

49,217

51,999

Operating lease right-of-use assets

14,995

—

Goodwill

85,231

85,231

Other intangibles, net

41,218

42,418

Other non-current assets, net

211

309

Total assets

$

499,895

$

482,573

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

101,342

$

99,426

Billings in excess of costs and estimated

earnings

60,571

62,407

Current maturities of long-term debt

12,128

2,899

Current portion of long-term lease

obligations

7,059

—

Income taxes payable

101

318

Accrued compensation

12,148

9,448

Other current liabilities

5,183

4,676

Total current liabilities

198,532

179,174

Long-term debt

66,497

79,117

Long-term lease obligations

8,030

—

Members’ interest subject to mandatory

redemption and undistributed earnings

48,831

49,343

Deferred taxes

2,211

1,450

Other long-term liabilities

1,101

1,229

Total liabilities

325,202

310,313

Stockholders’ equity:

Preferred stock, par value $0.01 per

share; 1,000 shares authorized, none issued

—

—

Common stock, par value $0.01 per share;

38,000 shares authorized, 27,049 and 27,064 shares issued, 26,466

and 26,597 shares outstanding

271

271

Additional paid in capital

233,559

233,795

Treasury Stock, at cost: 583 and 467

shares

(6,688

)

(4,731

)

Retained deficit

(55,291

)

(64,934

)

Total Sterling stockholders’ equity

171,851

164,401

Noncontrolling interests

2,842

7,859

Total stockholders’ equity

174,693

172,260

Total liabilities and stockholders’

equity

$

499,895

$

482,573

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Six Months Ended June

30,

2019

2018

Cash flows from operating

activities:

Net income

$

9,726

$

12,821

Adjustments to reconcile net income to net

cash used in operating activities:

Depreciation and amortization

8,473

8,307

Amortization of deferred debt costs

1,602

1,610

Gain on disposal of property and

equipment

(441

)

(470

)

Deferred tax expense

761

—

Stock-based compensation expense

1,670

1,383

Changes in operating assets and

liabilities

(26,116

)

(31,565

)

Net cash used in operating activities

(4,325

)

(7,914

)

Cash flows from investing

activities:

Capital expenditures

(4,854

)

(5,263

)

Proceeds from sale of property and

equipment

802

1,307

Net cash used in investing activities

(4,052

)

(3,956

)

Cash flows from financing

activities:

Repayments of long-term debt

(5,763

)

(5,344

)

Distributions to noncontrolling interest

owners

(5,100

)

—

Purchase of treasury stock

(3,201

)

—

Other

76

(154

)

Net cash used in financing activities

(13,988

)

(5,498

)

Net decrease in cash and cash

equivalents

(22,365

)

(17,368

)

Cash and cash equivalents at beginning of

period

94,095

83,953

Cash and cash equivalents at end of

period

$

71,730

$

66,585

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190805005618/en/

Sterling Construction Company, Inc. Ron Ballschmiede, Chief

Financial Officer 281-214-0800

Investor Relations Counsel: The Equity Group Inc. Fred

Buonocore, CFA 212-836-9607

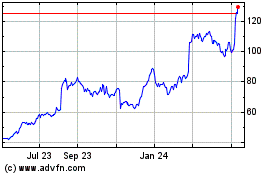

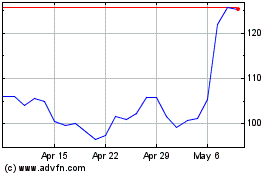

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Apr 2023 to Apr 2024