Current Report Filing (8-k)

October 02 2019 - 9:11AM

Edgar (US Regulatory)

false

STERICYCLE INC

0000861878

0000861878

2019-09-26

2019-09-26

0000861878

dei:FormerAddressMember

2019-09-26

2019-09-26

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 26, 2019

Stericycle, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

1-37556

|

36-3640402

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification Number)

|

2355 Waukegan Road

Bannockburn, Illinois 60015

(Address of principal executive offices including zip code)

(847) 367-5910

(Registrant’s telephone number, including area code)

28161 North Keith Drive

Lake Forest, Illinois 60045

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

SRCL

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05. Costs Associated with Exit or Disposal Activities.

As described below under Item 8.01 of this Current Report on Form 8-K, which description is incorporated by reference in this Item 2.05, the Company completed the disposition of its TAS Business on October 1, 2019. The Company expects to incur pre-tax charges in the range of $33.0 million to $40.0 million during the third quarter of fiscal 2019 as a result of classifying the TAS business assets as held for sale as of September 30, 2019.

Item 8.01. Other Events.

On October 2, 2019, Stericycle, Inc. (the “Company”) announced that it had completed the sale of the Company’s North American telephone answering services business (the “TAS Business”), currently operated within the Company’s Communication and Related Services business, for $34.0 million in cash. The Company expects to incur pre-tax charges in the range of $33.0 million to $40.0 million during the third quarter of fiscal 2019 as a result of classifying the TAS business assets as held for sale as of September 30, 2019.

Safe Harbor Statement

This document may contain forward-looking statements that involve risks and uncertainties, some of which are beyond our control (for example, general economic and market conditions). When we use words such as “believes,” “expects,” “anticipates,” “estimates” or similar expressions, we are making forward-looking statements. Actual results could differ significantly from the results described here. Factors that could cause such differences include changes in governmental regulation of the collection, transportation, treatment and disposal of regulated waste or the proper handling and protection of personal and confidential information, the level of government enforcement of regulations governing regulated waste collection and treatment or the proper handling and protection of personal and confidential information, decreases in the volume of regulated wastes or personal and confidential information collected from customers, the ability to implement our enterprise resource planning system or execute on Business Transformation initiatives and achieve the anticipated benefits and cost savings, charges related to the portfolio rationalization strategy or the failure of this strategy to achieve the desired results, failure to consummate strategic alternative transactions with respect to CRS or other non-core businesses, potential charges related to a strategic alternative transactions with respect to CRS, or the failure of any such transactions to achieve desired results, the obligations to service substantial indebtedness and comply with the covenants and restrictions contained in private placement notes and credit agreements, a downgrade in our credit rating resulting in an increase in interest expense, political, economic, inflationary, currency and other risks related to our foreign operations, the outcome of pending or future litigation or investigations including with respect to the Foreign Corrupt Practices Act, changing market conditions in the healthcare industry, competition and demand for services in the regulated waste and secure information destruction industries, changes in the demand and price for recycled paper, failure to maintain an effective system of internal control over financial reporting, delays in implementing remediation efforts with respect to existing material weaknesses, identification of additional material weaknesses, failure of current remediation efforts to address existing material weaknesses, disruptions in or attacks on information technology systems, as well as other factors described in filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and subsequent Quarterly Reports on Forms 10-Q. As a result, past financial performance should not be considered a reliable indicator of future performance, and investors should not use historical trends to anticipate future results or trends. To the extent permitted under applicable law, we make no commitment to disclose any subsequent revisions to forward-looking statements

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Dated: October 2, 2019

|

|

Stericycle, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Janet H. Zelenka

|

|

|

|

|

|

|

|

Janet H. Zelenka

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

|

|

|

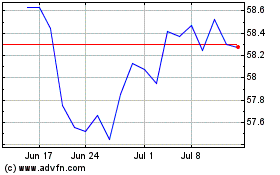

Stericycle (NASDAQ:SRCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

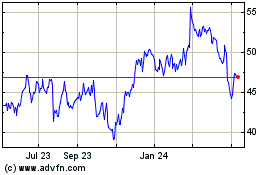

Stericycle (NASDAQ:SRCL)

Historical Stock Chart

From Apr 2023 to Apr 2024