Prospectus Supplement No. 1

(to Prospectus dated December 19, 2023)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-275521

PROSPECTUS

MultiSensor AI Holdings, Inc.

Resale of up to 17,841,456 Shares of Common

Stock

Resale of 506,250 Private Placement Warrants

Issuance of up to 10,263,655 Shares of Common

Stock underlying Warrants and Options

This prospectus supplement

updates, amends and supplements the prospectus dated December 19, 2023 (the “Prospectus”), which forms a part of our Registration

Statement on Form S-1, as amended (Registration No. 333-275521). Capitalized terms used in this prospectus supplement and not otherwise

defined herein have the meanings specified in the Prospectus. This prospectus supplement is being filed to supplement, modify or supersede

certain information contained in the Prospectus. Any statement in the Prospectus that is modified or superseded is not deemed to constitute

a part of the Prospectus, except as modified or superseded by this prospectus supplement. Except to the extent that the information in

this prospectus supplement modifies or supersedes the information contained in the Prospectus, this prospectus supplement should be read,

and will be delivered, with the Prospectus. This prospectus supplement is not complete without, and may not be utilized except in connection

with, the Prospectus.

Our Common Stock and Public

Warrants are listed on The Nasdaq Global Market (“Nasdaq”) and trade under the symbols “MSAI” and “MSAIW,”

respectively. On March 6, 2024, the closing price of our Common Stock was $3.37 and the closing price for our Public Warrants was $0.04.

We are an “emerging growth

company” and “smaller reporting company” for purposes of federal securities laws and are subject to reduced public company

reporting requirements. Additionally, Gary Strahan, our chief executive officer and a member of its board of directors, owns approximately

51% of the outstanding Common Stock, and as a result we are considered a “controlled company” for purposes of Nasdaq listing

rules.

INVESTING IN OUR SECURITIES

INVOLVES RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 8 OF THE PROSPECTUS.

Neither the Securities and

Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus

or this related prospectus supplement or determined if the Prospectus or this related prospectus supplement is truthful or complete. Any

representation to the contrary is a criminal offense.

The date of this prospectus supplement is March

7, 2024.

ABOUT THIS PROSPECTUS SUPPLEMENT

We are filing this prospectus

supplement to amend and update the “Beneficial Ownership” and “Registered Holders” tables and the applicable footnotes

of the Prospectus to reflect a distribution of shares of Common Stock and Private Warrants from SportsMap, LLC (the “Sponsor”),

one of the Registered Holders previously identified in the Prospectus, to certain of the other Registered Holders previously identified

in the Prospectus (the “Transferees”). This prospectus supplement is not increasing the number of shares or Private Warrants

being offered under the Prospectus, but only reflecting the transfer of shares of Common Stock and Private Warrants previously registered

and providing updated information about the securities the Transferees may offer pursuant to the Prospectus. The information set forth

below has been provided by or on behalf of the Registered Holders listed below as of February 27, 2024.

Additionally, in February 2024,

we changed the name of our company from “Infrared Cameras Holdings, Inc.” to “MultiSensor AI Holdings, Inc.”.

BENEFICIAL OWNERSHIP

The information in the table

that appears under the caption “Beneficial Ownership” on pages 108 and 109 of the Prospectus is modified by (i) decreasing

the number of shares of Common Stock beneficially owned by David Gow, (ii) removing the Sponsor and David Gow from the subsection of Five

Percent Holders, and (iii) increasing the number of shares of Common Stock beneficially owned by Reid Ryan, who received securities in

the distribution by the Sponsor. Beneficial ownership is determined according to the rules of the SEC, which generally provides that a

person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security,

including options and warrants that are currently exercisable or exercisable within 60 days. The beneficial ownership percentages set

forth below are based on 11,956,823 shares of Common Stock issued and outstanding as of February 27, 2024.

| Name and Address of Beneficial Owner(1) | |

Number of Shares Beneficially Owned | | |

% of Ownership | |

| Directors and Executive Officers | |

| | | |

| | |

| Gary Strahan(2) | |

| 6,115,939 | | |

| 51.2 | % |

| Steven Winch(3) | |

| 1,156,081 | | |

| 9.2 | % |

| Peter Baird(4) | |

| 834,625 | | |

| 6.6 | % |

| David Gow(5) | |

| 571,512 | | |

| 4.8 | % |

| Jeff Guida(6) | |

| 785,828 | | |

| 6.2 | % |

| Reid Ryan(7) | |

| 129,932 | | |

| * | |

| Stuart V. Flavin III | |

| - | | |

| - | |

| Petros Kitsos | |

| - | | |

| - | |

| Margaret Chu | |

| - | | |

| - | |

| All Directors and Executive Officers as a Group (9 Individuals) | |

| 9,593,917 | | |

| 69.1 | % |

| Five Percent Holders | |

| | | |

| | |

| Gary Strahan | |

| 6,115,939 | | |

| 51.2 | % |

| | |

| | | |

| | |

* Less than 1%.

(1) Unless otherwise noted, the business address of each of the following

entities or individuals is 2105 West Cardinal Drive, Beaumont, Texas 77705.

(2) Includes 100,000 shares of common stock held by the Jill A. Blashak

Revocable Trust U/A May 8, 2004, as amended and restated, of which Jill A. Blashak Strahan, the wife of Gary Strahan, is trustee.

(3) Consists of (i) 5,595 shares of common stock held by Mr. Winch,

(ii) 547,210 shares of common stock held of record by Villard Capital, LLC, an estate-planning vehicle for Mr. Winch controlled by Mr.

Winch and (iii) 603,276 shares of common stock issuable upon the settlement of Participating Company RSU Awards vesting within 60 days

of the date of this prospectus supplement. Does not include 635,649 New ICI Transaction RSU Awards expected to be granted to Mr. Winch

following the Closing.

(4) Consists of (i) 5,608 shares of common stock held by Mr. Baird,

(ii) 204,493 shares of common stock issuable upon the exercise of Participating Company Options exercisable within 60 days of the date

of this prospectus supplement and (iii) 624,524 shares of common stock issuable upon the settlement of Participating Company RSU Awards

vesting within 60 days of the date of this prospectus supplement. Does not include 373,630 New ICI Transaction RSU Awards expected to

be granted to Mr. Baird following the Closing.

(5) Consists of (i) 535,812 shares of common stock held by Mr. Gow

and (ii) 35,700 shares of common stock underlying private placement warrants that will be exercisable within 60 days of this prospectus

supplement. The business address for Mr. Gow is 5353 West Alabama, Suite 415 Houston, Texas 77056.

(6) Consists of (i) 127,463 shares of common stock issuable upon the

exercise of Participating Company Options exercisable within 60 days of the date of this prospectus supplement and (ii) 658,365 shares

of common stock issuable upon the settlement of Participating Company RSU Awards vesting within 60 days of the date of this prospectus

supplement. Does not include 373,630 New ICI Transaction RSU Awards expected to be granted to Mr. Guida following the Closing. Mr. Guida

is the Chief Innovation Officer of the Company.

(7) Consists of (i) 535,812 shares of common stock held by Mr. Ryan and (ii) 3,750 shares of common stock underlying private placement warrants that will be exercisable within 60 days of this prospectus

supplement.

REGISTERED HOLDERS

The information in the table

that appears under the caption “Registered Holders” on pages 110 through 120 of the Prospectus is modified by (i) removing

the Sponsor and (ii) increasing the number of shares of Common Stock and Private Warrants beneficially owned by each of the Transferees

that received the shares of Common Stock and Private Warrants distributed by the Sponsor. The beneficial ownership percentages set forth

in the table below are based on 11,956,823 shares of Common Stock issued and outstanding as of February 27, 2024.

| | |

Securities Benificially Owned

prior to this Offering | | |

Securities To be Sold

in this Offering | | |

Securities Beneficially Owned

Following this Offering | |

| Name of Registered Holder | |

Shares of Common Stock | | |

% of Ownership | | |

Warrants | | |

Shares of Common Stock | | |

Warrants | | |

Shares of Common Stock | | |

% of Ownership | | |

Warrants | |

| GARY STRAHAN (2) | |

| 6,115,939 | | |

| 51.2 | % | |

| - | | |

| 6,115,939 | | |

| - | | |

| - | | |

| - | | |

| - | |

| STEVEN WINCH (3) | |

| 1,156,081 | | |

| 9.2 | % | |

| - | | |

| 1,156,081 | | |

| - | | |

| - | | |

| - | | |

| - | |

| DAVID GOW (4) | |

| 535,812 | | |

| 4.5 | % | |

| 35,700 | | |

| 667,512 | | |

| 35,700 | | |

| - | | |

| - | | |

| - | |

| REID RYAN (5) | |

| 126,182 | | |

| 1.1 | % | |

| 3,750 | | |

| 129,932 | | |

| 3,750 | | |

| - | | |

| - | | |

| - | |

| JACOB SWAIN (6) | |

| 36,266 | | |

| * | | |

| 1,875 | | |

| 38,141 | | |

| 1,875 | | |

| - | | |

| - | | |

| - | |

| LAWSON GOW (7) | |

| 102,000 | | |

| * | | |

| 1,500 | | |

| 103,500 | | |

| 1,500 | | |

| - | | |

| - | | |

| - | |

| DAVID GRAFF (8) | |

| 75,278 | | |

| * | | |

| 75 | | |

| 75,353 | | |

| 75 | | |

| - | | |

| - | | |

| - | |

| OLIVER LUCK (9) | |

| 85,313 | | |

| * | | |

| 75 | | |

| 133,388 | | |

| 75 | | |

| - | | |

| - | | |

| - | |

| STEVEN WEBSTER (10) | |

| 433,356 | | |

| 3.6 | % | |

| 37,500 | | |

| 710,856 | | |

| 37,500 | | |

| - | | |

| - | | |

| - | |

| DEEPAK MENON | |

| 11,137 | | |

| * | | |

| - | | |

| 11,137 | | |

| - | | |

| - | | |

| - | | |

| - | |

| ANIL ANNADATA | |

| 22,281 | | |

| * | | |

| - | | |

| 22,281 | | |

| - | | |

| - | | |

| - | | |

| - | |

| JOSHUA BONDELE (11) | |

| 11,211 | | |

| * | | |

| - | | |

| 40,584 | | |

| - | | |

| - | | |

| - | | |

| - | |

| STEVEN JAMES BUSH (12) | |

| 11,211 | | |

| * | | |

| - | | |

| 17,378 | | |

| - | | |

| - | | |

| - | | |

| - | |

| RICHARD E. SHORMA TRUST U/A dated June 22, 2021 | |

| 22,429 | | |

| * | | |

| - | | |

| 22,429 | | |

| - | | |

| - | | |

| - | | |

| - | |

| NOLAN RYAN | |

| 21,320 | | |

| * | | |

| - | | |

| 21,320 | | |

| - | | |

| - | | |

| - | | |

| - | |

| IKE CLAYPOOL | |

| 10,487 | | |

| * | | |

| - | | |

| 10,487 | | |

| - | | |

| - | | |

| - | | |

| - | |

| CORBY J ROBERTSON JR | |

| 52,089 | | |

| * | | |

| - | | |

| 52,089 | | |

| - | | |

| - | | |

| - | | |

| - | |

| KEEN ENDEAVORS, LLC | |

| 31,254 | | |

| * | | |

| - | | |

| 31,254 | | |

| - | | |

| - | | |

| - | | |

| - | |

| ROBERT JEFFREY WILLIAMS | |

| 20,908 | | |

| * | | |

| - | | |

| 20,908 | | |

| - | | |

| - | | |

| - | | |

| - | |

| JERRY DEARING | |

| 20,974 | | |

| * | | |

| - | | |

| 20,974 | | |

| - | | |

| - | | |

| - | | |

| - | |

| CASEY CRENSHAW | |

| 20,582 | | |

| * | | |

| - | | |

| 20,582 | | |

| - | | |

| - | | |

| - | | |

| - | |

| DON A SANDERS (13) | |

| 183,750 | | |

| 1.5 | % | |

| 22,500 | | |

| 350,250 | | |

| 22,500 | | |

| - | | |

| - | | |

| - | |

| BRAD SANDERS (14) | |

| 17,500 | | |

| * | | |

| - | | |

| 53,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| LAURA SANDERS (15) | |

| 25,000 | | |

| * | | |

| - | | |

| 97,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| SUSAN SANDERS (16) | |

| 17,500 | | |

| * | | |

| - | | |

| 82,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| WEIR HOLDINGS LP (17) | |

| 30,625 | | |

| * | | |

| 3,750 | | |

| 58,375 | | |

| 3,750 | | |

| - | | |

| - | | |

| - | |

| HORN MANAGEMENT, LLC (18) | |

| 78,672 | | |

| * | | |

| 7,500 | | |

| 182,172 | | |

| 7,500 | | |

| - | | |

| - | | |

| - | |

| CREEKSIDE 1 HOLDINGS LLC (19) | |

| 30,000 | | |

| * | | |

| 9,375 | | |

| 231,375 | | |

| 9,375 | | |

| - | | |

| - | | |

| - | |

| JERRELL GLEN CLAY SR. (20) | |

| 5,000 | | |

| * | | |

| - | | |

| 29,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| LIFT HIGH, LLC (21) | |

| 50,000 | | |

| * | | |

| - | | |

| 290,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| RWI PARTNERSHIP, LTD (22) | |

| 51,250 | | |

| * | | |

| 7,500 | | |

| 154,750 | | |

| 7,500 | | |

| - | | |

| - | | |

| - | |

| BOCO NVST, LLC (23) | |

| 5,000 | | |

| * | | |

| - | | |

| 29,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| BRENT J. SMOLIK (24) | |

| 25,000 | | |

| * | | |

| - | | |

| 145,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| CULLEN AND CARSON CONE 2010 TRUST (25) | |

| 20,000 | | |

| * | | |

| - | | |

| 116,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| BRAD KANGIESER (26) | |

| 15,000 | | |

| * | | |

| - | | |

| 87,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| HERRIN DESCENDANTS 2010 TRUST (27) | |

| 15,000 | | |

| * | | |

| - | | |

| 87,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| MACHAN INVESTMENTS, LLC (28) | |

| 25,000 | | |

| * | | |

| - | | |

| 145,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| CULLEN SPITZER (29) | |

| 15,000 | | |

| * | | |

| - | | |

| 87,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| CAMACA AS (30) | |

| 25,000 | | |

| * | | |

| - | | |

| 145,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| JAMES CHRISTMAS (31) | |

| 50,000 | | |

| * | | |

| - | | |

| 290,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| KOSBERG HOLDINGS (32) | |

| 20,000 | | |

| * | | |

| - | | |

| 116,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| JOHNNY CARRABBA (33) | |

| 20,000 | | |

| * | | |

| - | | |

| 116,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| TANYA JO DRURY TRUST (34) | |

| 20,000 | | |

| * | | |

| - | | |

| 116,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| CHRISTINE PATTERSON (35) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| CHARLES HENRY FERNANDEZ 2021 Trust UAD 5/6/21 (36) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| BENJAMIN AVERY BATISTICK 2021 Trust UAD 5/6/21 (37) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| MELANIE E. SHAW 2015 KIDS TRUST (38) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| JOHN HARRIS WHITMIRE 2015 Grandchildrens Trust (39) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| ALBERT SANDERS KELLER U/T/D 02/11/97 (40) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| MIA SCARLET BATISTICK 2016 Trust UAD 12/23/16 (41) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| EILEEN COLGIN 2015 Grandchildrens Trust UAD 12/3/2015 (42) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| RUSSELL HARDIN, JR GRANDCHILDREN'S TRUST UAD 12/3/15 (43) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| BRET SANDERS (44) | |

| 30,625 | | |

| * | | |

| 3,750 | | |

| 80,875 | | |

| 3,750 | | |

| - | | |

| - | | |

| - | |

| DAVID GOW, JR. (52) | |

| 2,747 | | |

| * | | |

| 750 | | |

| 3,497 | | |

| 750 | | |

| - | | |

| - | | |

| - | |

| CHRISTOPHER GOW (52) | |

| 5,495 | | |

| * | | |

| 1,500 | | |

| 6,995 | | |

| 1,500 | | |

| - | | |

| - | | |

| - | |

| SARAH V GOW FOY (52) | |

| 5,495 | | |

| * | | |

| 1,500 | | |

| 6,995 | | |

| 1,500 | | |

| - | | |

| - | | |

| - | |

| | |

Securities Benificially Owned

prior to this Offering | | |

Securities To be Sold

in this Offering | | |

Securities Beneficially Owned

Following this Offering | |

| Name of Registered Holder | |

Shares of Common Stock | | |

% of Ownership | | |

Warrants | | |

Shares of Common Stock | | |

Warrants | | |

Shares of Common Stock | | |

% of Ownership | | |

Warrants | |

| WESLEY GOW (52) | |

| 2,747 | | |

| * | | |

| 750 | | |

| 3,497 | | |

| 750 | | |

| - | | |

| - | | |

| - | |

| DON A SANDERS CHILDRENS TRUST DTD 2003 (53) | |

| 46,875 | | |

| * | | |

| 11,250 | | |

| 58,125 | | |

| 11,250 | | |

| - | | |

| - | | |

| - | |

| GLYNDA FAYE PATTERSON (45) | |

| 2,500 | | |

| | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| QUINCY CATALINA SANDERS 2009 Trust UAD 6/16/2003 (46)(54) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| NOLAN BRADLEY SANDERS 2005 Trust UAD 6/16/2003 (47) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| SELA RIVAS SANDERS 2003 Trust UAD 6/16/2003 (48)(54) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| 2009 SANDERS CHILDRENS TRUST UAD 10/21/2009 FBO Chelsea Collmer (49)(55) | |

| 2,500 | | |

| * | | |

| - | | |

| 14,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| JILL A BLASHACK STRAHAN TRUST U/A May 8, 2004, as amended and restated (50) | |

| 100,000 | | |

| * | | |

| - | | |

| 580,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| BYRON ROTH LLC (51) | |

| 54,273 | | |

| | | |

| 7,652 | | |

| 61,925 | | |

| 7,652 | | |

| - | | |

| - | | |

| - | |

| CR FINANCIAL HOLDINGS, INC (51) | |

| 162,750 | | |

| 1.4 | % | |

| 25,312 | | |

| 188,062 | | |

| 25,312 | | |

| - | | |

| - | | |

| - | |

| DIANE S KENDALL | |

| 20,604 | | |

| * | | |

| 5,625 | | |

| 26,229 | | |

| 5,625 | | |

| - | | |

| - | | |

| - | |

| GRANT GUTHRIE | |

| 8,314 | | |

| * | | |

| - | | |

| 8,314 | | |

| - | | |

| - | | |

| - | | |

| - | |

| MIGHTY EQUITIES MANAGEMENT, LLC | |

| 41,209 | | |

| * | | |

| 11,250 | | |

| 52,459 | | |

| 11,250 | | |

| - | | |

| - | | |

| - | |

| JOHN LIPMAN | |

| 85,814 | | |

| * | | |

| 14,220 | | |

| 100,034 | | |

| 14,220 | | |

| - | | |

| - | | |

| - | |

| WILLIAM F. HARTFIEL III | |

| 51,203 | | |

| * | | |

| 7,963 | | |

| 59,166 | | |

| 7,963 | | |

| - | | |

| - | | |

| - | |

| TODD FARQUHARSON | |

| 4,240 | | |

| * | | |

| - | | |

| 4,240 | | |

| - | | |

| - | | |

| - | | |

| - | |

| BRADLEY W. BAKER | |

| 51,203 | | |

| * | | |

| 7,963 | | |

| 59,166 | | |

| 7,963 | | |

| - | | |

| - | | |

| - | |

| JAMES GRAHAM MCKERNAN JR | |

| 4,240 | | |

| * | | |

| - | | |

| 4,240 | | |

| - | | |

| - | | |

| - | | |

| - | |

| LINCOLN KENDALL | |

| 3,922 | | |

| * | | |

| - | | |

| 3,922 | | |

| - | | |

| - | | |

| - | | |

| - | |

| DONALD R. KENDALL, JR. | |

| 79,195 | | |

| * | | |

| 16,875 | | |

| 96,070 | | |

| 16,875 | | |

| - | | |

| - | | |

| - | |

| LINDSEY HARVEL | |

| 4,240 | | |

| * | | |

| - | | |

| 4,240 | | |

| - | | |

| - | | |

| - | | |

| - | |

| JOHN WHITMIRE | |

| 31,250 | | |

| * | | |

| 7,500 | | |

| 38,750 | | |

| 7,500 | | |

| - | | |

| - | | |

| - | |

| ROBERT BENNETT | |

| 4,157 | | |

| * | | |

| - | | |

| 4,157 | | |

| - | | |

| - | | |

| - | | |

| - | |

| ROBERT NELSON MURRAY | |

| 31,250 | | |

| * | | |

| 7,500 | | |

| 38,750 | | |

| 7,500 | | |

| - | | |

| - | | |

| - | |

| DAVID FARINA | |

| 63,089 | | |

| * | | |

| 9,812 | | |

| 72,901 | | |

| 9,812 | | |

| - | | |

| - | | |

| - | |

| JAMES R. JARD | |

| 27,473 | | |

| * | | |

| 7,500 | | |

| 14,973 | | |

| 7,500 | | |

| - | | |

| - | | |

| - | |

| LNR ENTERPRISES MANAGEMENT LLC | |

| 31,250 | | |

| * | | |

| 7,500 | | |

| 38,750 | | |

| 7,500 | | |

| - | | |

| - | | |

| - | |

| SAN LUIS DEVELOPMENT LP | |

| 68,681 | | |

| * | | |

| 18,750 | | |

| 87,431 | | |

| 18,750 | | |

| - | | |

| - | | |

| - | |

| GARY WAYNE MOORE JR | |

| 10,537 | | |

| * | | |

| - | | |

| 10,537 | | |

| - | | |

| - | | |

| - | | |

| - | |

| JODY D CROOK | |

| 6,868 | | |

| * | | |

| 1,875 | | |

| 8,743 | | |

| 1,875 | | |

| - | | |

| - | | |

| - | |

| AARON M GUREWITZ TRUSTEE | |

| 27,122 | | |

| * | | |

| 4,218 | | |

| 31,340 | | |

| 4,218 | | |

| - | | |

| - | | |

| - | |

| PETER BAIRD | |

| 834,625 | | |

| 6.6 | % | |

| - | | |

| 834,625 | | |

| - | | |

| - | | |

| - | | |

| - | |

| J5D ENTERPRISE, LP | |

| 41,209 | | |

| * | | |

| 11,250 | | |

| 52,459 | | |

| 11,250 | | |

| - | | |

| - | | |

| - | |

| LAURA BEAVERS | |

| 4,240 | | |

| * | | |

| - | | |

| 4,240 | | |

| - | | |

| - | | |

| - | | |

| - | |

| WILLIAM H PROPPER, III | |

| 2,747 | | |

| * | | |

| 750 | | |

| 3,497 | | |

| 750 | | |

| - | | |

| - | | |

| - | |

| DONALD RYAN HULSTRAND | |

| 10,971 | | |

| * | | |

| 1,706 | | |

| 12,677 | | |

| 1,706 | | |

| - | | |

| - | | |

| - | |

| BRAD WALLACE | |

| 20,954 | | |

| * | | |

| - | | |

| 20,954 | | |

| - | | |

| - | | |

| - | | |

| - | |

| 2009 SANDERS CHILDRENS TRUST | |

| 2,500 | | |

| * | | |

| - | | |

| 2,500 | | |

| - | | |

| - | | |

| - | | |

| - | |

| ANDREW J. MARTIN | |

| 36,067 | | |

| * | | |

| - | | |

| 36,067 | | |

| - | | |

| - | | |

| - | | |

| - | |

| JOHN DOUGLAS SCHICK | |

| 13,736 | | |

| * | | |

| 3,750 | | |

| 17,486 | | |

| 3,750 | | |

| - | | |

| - | | |

| - | |

| SHADAYSHA, LLC | |

| 82,418 | | |

| * | | |

| 22,500 | | |

| 104,918 | | |

| 22,500 | | |

| - | | |

| - | | |

| - | |

| KANE VENTURES, LTD. | |

| 6,868 | | |

| * | | |

| 1,875 | | |

| 8,743 | | |

| 1,875 | | |

| - | | |

| - | | |

| - | |

| SCOTT ZINDLER | |

| 13,736 | | |

| * | | |

| 3,750 | | |

| 17,486 | | |

| 3,750 | | |

| - | | |

| - | | |

| - | |

| JOHN S. BEESON | |

| 20,604 | | |

| * | | |

| 5,625 | | |

| 26,229 | | |

| 5,625 | | |

| - | | |

| - | | |

| - | |

| FLIGHT PARTNERS MANAGEMENT, LLC | |

| 109,375 | | |

| * | | |

| 26,250 | | |

| 135,625 | | |

| 26,250 | | |

| - | | |

| - | | |

| - | |

| CAMERON WIEDING | |

| 6,868 | | |

| * | | |

| 1,875 | | |

| 8,743 | | |

| 1,875 | | |

| - | | |

| - | | |

| - | |

| JAMES G TURNER | |

| 6,868 | | |

| * | | |

| 1,875 | | |

| 8,743 | | |

| 1,875 | | |

| - | | |

| - | | |

| - | |

| ROCKER U INTERESTS, LLC | |

| 17,857 | | |

| * | | |

| 4,875 | | |

| 22,732 | | |

| 4,875 | | |

| - | | |

| - | | |

| - | |

| JAMES ZAVORAL | |

| 34,744 | | |

| * | | |

| 5,403 | | |

| 40,147 | | |

| 5,403 | | |

| - | | |

| - | | |

| - | |

| STEVE DYER | |

| 34,744 | | |

| * | | |

| 5,403 | | |

| 40,147 | | |

| 5,403 | | |

| - | | |

| - | | |

| - | |

| CHARLES THOMAS MARTIN PENDERGRAFT | |

| 6,868 | | |

| * | | |

| 1,875 | | |

| 8,743 | | |

| 1,875 | | |

| - | | |

| - | | |

| - | |

| CHICAGO EARLY GROWTH VENTURES, LLC | |

| 10,165 | | |

| * | | |

| 2,775 | | |

| 12,940 | | |

| 2,775 | | |

| - | | |

| - | | |

| - | |

| MATTHEW DAY | |

| 18,286 | | |

| * | | |

| 2,844 | | |

| 21,130 | | |

| 2,844 | | |

| - | | |

| - | | |

| - | |

| KEVIN HARRIS | |

| 51,203 | | |

| * | | |

| 7,963 | | |

| 59,166 | | |

| 7,963 | | |

| - | | |

| - | | |

| - | |

| CREEKSIDE 1 HOLDINGS, LLC | |

| 99,063 | | |

| * | | |

| - | | |

| 99,063 | | |

| - | | |

| - | | |

| - | | |

| - | |

| COUNTLESS HOLDINGS, LLC | |

| 27,473 | | |

| * | | |

| 7,500 | | |

| 34,973 | | |

| 7,500 | | |

| - | | |

| - | | |

| - | |

| MAROON ALLIANCE, LLC | |

| 27,473 | | |

| * | | |

| 7,500 | | |

| 34,973 | | |

| 7,500 | | |

| - | | |

| - | | |

| - | |

| ROCINANTE VENTURES | |

| 13,736 | | |

| * | | |

| 3,750 | | |

| 17,486 | | |

| 3,750 | | |

| - | | |

| - | | |

| - | |

| SCOTT G BURDINE TTEE | |

| 71,500 | | |

| * | | |

| 15,000 | | |

| 86,500 | | |

| 15,000 | | |

| - | | |

| - | | |

| - | |

| GEORGE J KLAMER | |

| 68,681 | | |

| * | | |

| 18,750 | | |

| 87,431 | | |

| 18,750 | | |

| - | | |

| - | | |

| - | |

| JAN HOLZINGER BRES | |

| 13,736 | | |

| * | | |

| 3,750 | | |

| 17,486 | | |

| 3,750 | | |

| - | | |

| - | | |

| - | |

| FRED S. ZEIDMAN | |

| 3,922 | | |

| * | | |

| - | | |

| 3,922 | | |

| - | | |

| - | | |

| - | | |

| - | |

| GHCJ RANCHES, LLC | |

| 41,209 | | |

| * | | |

| 11,250 | | |

| 52,459 | | |

| 11,250 | | |

| - | | |

| - | | |

| - | |

| STEVE W HEROD | |

| 31,250 | | |

| * | | |

| 7,500 | | |

| 38,750 | | |

| 7,500 | | |

| - | | |

| - | | |

| - | |

| JERRELL GLEN CLAY, SR. | |

| 14,375 | | |

| * | | |

| 2,250 | | |

| 16,625 | | |

| 2,250 | | |

| - | | |

| - | | |

| - | |

| GARY PETERSEN | |

| 63,519 | | |

| * | | |

| - | | |

| 63,519 | | |

| - | | |

| - | | |

| - | | |

| - | |

| ASTRA EXPLORATION COMPANY, INC. | |

| 13,736 | | |

| * | | |

| 3,750 | | |

| 17,486 | | |

| 3,750 | | |

| - | | |

| - | | |

| - | |

| BRYCE J LARSON | |

| 20,836 | | |

| * | | |

| - | | |

| 20,836 | | |

| - | | |

| - | | |

| - | | |

| - | |

| STEVE GUIDRY (56) | |

| 17,020 | | |

| * | | |

| - | | |

| 17,020 | | |

| - | | |

| - | | |

| - | | |

| - | |

| JEFF GUIDA (57) | |

| 785,828 | | |

| 6.2 | % | |

| - | | |

| 785,828 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Roth Capital Partners, LLC (58) | |

| 326,250 | | |

| 2.7 | % | |

| - | | |

| 326,250 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Craig-Hallum Capital Group, LLC (59) | |

| 326,250 | | |

| 2.7 | % | |

| - | | |

| 326,250 | | |

| - | | |

| - | | |

| - | | |

| - | |

*Less than 1%.

(1) The percentage of beneficial ownership is calculated based on

11,956,823 outstanding shares of Common Stock at Closing. Unless otherwise indicated, we believe that all persons named in the table

have sole voting and investment power with respect to all shares beneficially owned by them.

(2) Mr.

Strahan was the Chief Executive Officer of ICI and now serves as our Chief Executive Officer and a member of our board of directors.

The address for this registered holder is c/o MultiSensor AI Holdings, Inc., 2105 West Cardinal Drive, Beaumont, Texas 77705.

Includes 100,000 shares of Common Stock held by the Jill A. Blashek Revocable Trust U/A May 8, 2004, as amended and restated, of

which Jill A. Blashek, the wife of Gary Strahan, is trustee.

(3) Mr.

Winch was the President of ICI and now serves as our President and a member of our board of directors. Securities to be sold in this

offering include (i) 5,595 shares of Common Stock held by Mr. Winch, (ii) 547,210 shares of Common Stock held by Villard Capital,

LLC, an estate-planning vehicle for Mr. Winch controlled by Mr. Winch, and (ii) 603,276 shares of Common Stock underlying

Participating Company RSU Awards granted to Mr. Winch in connection with Closing. The address for each registered holder named in

this footnote is c/o MultiSensor AI Holdings, Inc., 2105 West Cardinal Drive, Beaumont, Texas 77705.

(4) Mr. Gow was a director of SportsMap and now serves as a member

of our board of directors. Securities to be sold in this offering include (i) 20,000 Conversion Shares issuable upon conversion of Financing

Notes held by Mr. Gow, (ii) 66,000 Interest Shares issuable to Mr. Gow in lieu of cash interest on Financing Notes held by Mr. Gow and

(iii) 10,000 Financing Warrant Shares issuable to Mr. Gow upon the exercise of Financing Warrants held by Mr. Gow. The business address

for Mr. Gow is 5353 West Alabama, Suite 415 Houston, Texas 77056.

(5) Mr. Ryan was a director of SportsMap and now serves as a

member of our board of directors. The address for this registered holder is 6151 Doliver, Houston, Texas 77057.

(6) Mr. Swain was an officer of SportsMap prior to the Business

Combination. The address for this registered holder is 4002 Walnut Pond, Houston, Texas 77059.

(7) Mr. Gow was an officer of SportsMap prior to the Business

Combination. Mr. Gow’s father is David Gow. The address for this registered holder is 5135 Greentree Road, Houston, Texas

77056.

(8) Mr. Graff was a director of SportsMap prior to the Business

Combination. The address for this registered holder is 110 South 14th Street, Suite 301, Lincoln, Nebraska 68508.

(9) Mr. Luck was a director of SportsMap prior to the Business

Combination. Securities to be sold in this offering include (i) 10,000 Conversion Shares issuable upon conversion of Financing Notes

held by Mr. Luck, (ii) 33,000 Interest Shares issuable to Mr. Luck in lieu of cash interest on Financing Notes held by Mr. Luck and

(iii) 5,000 Financing Warrant Shares issuable to Mr. Luck upon the exercise of Financing Warrants held by Mr. Luck. The address for

this registered holder is 265 Dillon Ridge Road, Suite C, Dillon, Colorado 80435.

(10) Mr. Webster was a director of SportsMap prior to the

Business Combination. Securities to be sold in this offering include (i) 50,000 Conversion Shares issuable upon conversion of

Financing Notes held by Mr. Webster, (ii) 165,000 Interest Shares issuable to Mr. Webster in lieu of cash interest on Financing

Notes held by Mr. Webster and (iii) 25,000 Financing Warrant Shares issuable to Mr. Webster upon the exercise of Financing Warrants

held by Mr. Webster. The address for this registered holder is 3200 Southwest Freeway, Suite 1490, Houston, Texas 77027.

(11) Securities to be sold in this offering include 29,373 shares

of Common Stock issuable to Mr. Bondele upon the exercise of New ICI Options to be held by Mr. Bondele.

(12) Securities to be sold in this offering include 6,167 shares

of Common Stock issuable to Mr. Bush upon the exercise of New ICI Options to be held by Mr. Bush.

(13) Securities to be sold in this offering include (i) 30,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 99,000 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 15,000 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(14) Securities to be sold in this offering include (i) 7,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 24,750 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 3,750 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(15) Securities to be sold in this offering include (i) 15,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 49,500 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 7,500 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(16) Securities to be sold in this offering include (i) 7,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 24,750 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 3,750 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(17) Securities to be sold in this offering include (i) 5,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 16,500 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 2,500 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder. Don Weir

is the managing partner of this registered holder, and has controlling interest in other registered holders as disclosed herein.

(18) Securities to be sold in this offering include (i) 20,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 66,000 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 10,000 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(19) Securities to be sold in this offering include (i) 40,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 132,000 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 20,000 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(20) Securities to be sold in this offering include (i) 5,000 Conversion

Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 16,500 Interest Shares issuable to this registered

holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 2,500 Financing Warrant Shares issuable to

this registered holder upon the exercise of Financing Warrants held by this registered holder.

(21) Securities to be sold in this offering include (i) 50,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 165,000 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 25,000 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(22) Securities to be sold in this offering include (i) 20,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 66,000 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 10,000 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(23) Securities to be sold in this offering include (i) 5,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 16,500 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 2,500 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(24) Securities to be sold in this offering include (i) 25,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 82,500 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 12,500 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(25) Securities to be sold in this offering include (i) 20,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 66,000 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 10,000 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(26) Securities to be sold in this offering include (i) 15,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 49,500 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 7,500 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(27) Securities to be sold in this offering include (i) 15,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 49,500 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 7,500 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(28) Securities to be sold in this offering include (i) 25,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 82,500 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 12,500 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(29) Securities to be sold in this offering include (i) 15,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 49,500 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 7,500 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(30) Securities to be sold in this offering include (i) 25,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 82,500 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 12,500 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(31) Securities to be sold in this offering include (i) 50,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 165,000 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 25,000 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(32) Securities to be sold in this offering include (i) 20,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 66,000 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 10,000 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(33) Securities to be sold in this offering include (i) 20,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 66,000 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 10,000 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(34) Securities to be sold in this offering include (i) 20,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 66,000 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 10,000 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder. Don A.

Sanders, another registered holder, is the trustee of this registered holder.

(35) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(36) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(37) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder. Ashley Batistick

is the trustee if this registered holder.

(38) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(39) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder. Don Weir is the

trustee of this registered holder, and has controlling interest in other registered holders as disclosed herein.

(40) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder. Ashley Batistick

is the trustee if this registered holder.

(41) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(42) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(43) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(44) Securities to be sold in this offering include (i) 5,000

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 16,500 Interest Shares issuable

to this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 2,500 Financing

Warrant Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(45) Securities

to be sold in this offering include (i) 2,500 Conversion Shares issuable upon conversion of Financing Notes held by this registered

holder, (ii) 8,250 Interest Shares issuable to this registered holder in lieu of cash interest on Financing Notes held by this

registered holder and (iii) 1,250 Financing Warrant Shares issuable to this registered holder upon the exercise of Financing

Warrants held by this registered holder. This registered holder is managed by Nolan Reese Ryan, a sibling of Reid Ryan, a former

director of SportsMap and a continuing director of MultiSensor AI Holdings, Inc..

(46) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(47) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(48) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(49) Securities to be sold in this offering include (i) 2,500

Conversion Shares issuable upon conversion of Financing Notes held by this registered holder, (ii) 8,250 Interest Shares issuable to

this registered holder in lieu of cash interest on Financing Notes held by this registered holder and (iii) 1,250 Financing Warrant

Shares issuable to this registered holder upon the exercise of Financing Warrants held by this registered holder.

(50) Securities

to be sold in this offering include (i) 100,000 Conversion Shares issuable upon conversion of Financing Notes held by this

registered holder, (ii) 330,000 Interest Shares issuable to this registered holder in lieu of cash interest on Financing Notes held

by this registered holder and (iii) 50,000 Financing Warrant Shares issuable to this registered holder upon the exercise of

Financing Warrants held by this registered holder. Jill A. Blashek, the trustee of this holder, is the wife of Gary Strahan, who is

the Chief Executive Officer and a director of MultiSensor AI Holdings, Inc..

(51) CR Financial Holdings, Inc. and Roth Capital Partners, LLC

are entities controlled by Byron Roth, LLC.

(52) This registered holder’s father is David Gow.

(53) Don Weir, another registered holder, is the trustee of this

registered holder, and has controlling interest in other registered holders as disclosed herein.

(54) Brad Sanders, another registered holder, is the trustee of

this registered holder.

(55) Bret Sanders, another registered holder, is the trustee of

this registered holder.

(56) Mr.

Guidry was the General Counsel of ICI and now serves as our. Securities to be sold in this offering represent shares of Common Stock

issuable to Mr. Guidry upon the exercise of New ICI Options to be held by Mr. Guidry. The address for this registered holder is c/o MultiSensor

AI Holdings, Inc., 2105 West Cardinal Drive, Beaumont, Texas 77705.

(57) Mr.

Guida was the Chief Innovation Officer of ICI and now serves as our Chief Innovation Officer. Securities to be sold in this offering

include (i) 658,365 shares of Common Stock underlying Participating Company RSU Awards granted to Mr. Guida in connection with

Closing and (ii) 127,463 shares of Common Stock issuable to Mr. Guida upon the exercise of New ICI Options to be held by Mr. Guida.

The address for this registered holder is c/o MultiSensor AI Holdings, Inc., 2105 West Cardinal Drive, Beaumont, Texas

77705.

(58) Roth Capital Partners, LLC was an underwriter in the IPO and

served as an advisor to SportsMap in connection with the Business Combination. The business address of Roth Capital Partners, LLC is

888 San Clemente Dr, Newport Beach, CA 92660.

(59) Craig-Hallum Capital Group, LLC was an underwriter in the

IPO and served as an advisor to SportsMap in connection with the Business Combination. The business address of Craig-Hallum Capital

Group, LLC is 222 South 9th Street, Suite 350, Minneapolis, MN 55402.

We have determined beneficial ownership in accordance

with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Unless otherwise

indicated below, to our knowledge, the persons and entities named in the tables have sole voting and sole investment power with respect

to all securities that they beneficially own, subject to community property laws where applicable.

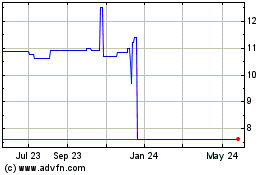

SportsMap Tech Acquisition (NASDAQ:SMAPU)

Historical Stock Chart

From Apr 2024 to May 2024

SportsMap Tech Acquisition (NASDAQ:SMAPU)

Historical Stock Chart

From May 2023 to May 2024