UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of May, 2024.

Commission

File Number 001-41976

Solarbank

Corporation

(Translation

of registrant’s name into English)

505

Consumers Rd., Suite 803

Toronto,

Ontario, M2J 4Z2 Canada

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☐ Form 40-F ☒

INCORPORATION

BY REFERENCE

Each

of the Exhibits 99.1-99.6 to this report on Form 6-K furnished to the SEC is expressly incorporated by reference into the Registration

Statement on Form F-10 of SOLARBANK CORPORATION (File No. 333-279027), as amended and supplemented.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date

May 14, 2024 |

Solarbank

Corporation |

| |

|

| |

By: |

/s/ “Sam

Sun” |

| |

|

Sam

Sun |

| |

|

Chief

Financial Officer & Corporate Secretary |

Exhibit

Index

| Exhibit |

|

Description

of Exhibit |

| |

|

|

| 99.1 |

|

Management’s Discussion and Analysis for the three and nine months ended March 31, 2024 |

| |

|

|

| 99.2 |

|

Condensed Consolidated Interim Unaudited Financial Statements for the three and nine months ended March 31, 2024 |

| |

|

|

| 99.3 |

|

Material Change Report, dated October 26, 2023 (incorporated by reference to Exhibit 99.84 to the Registrant’s Amended Registration Statement on Form 40-F/A, filed with the Commission on March 28, 2024) (File No. 0001-41976). |

| |

|

|

| 99.4 |

|

Material Change Report, dated October 13, 2023 (incorporated by reference to Exhibit 99.79 to the Registrant’s Amended Registration Statement on Form 40-F/A, filed with the Commission on March 28, 2024) (File No. 0001-41976). |

| |

|

|

| 99.5 |

|

Material Change Report, dated September 28, 2023 (incorporated by reference to Exhibit 99.70 to the Registrant’s Amended Registration Statement on Form 40-F/A, filed with the Commission on March 28, 2024) (File No. 0001-41976). |

| |

|

|

| 99.6 |

|

Material Change Report, dated July 6, 2023 (incorporated by reference to Exhibit 99.58 to the Registrant’s Amended Registration Statement on Form 40-F/A, filed with the Commission on March 28, 2024) (File No. 0001-41976). |

| |

|

|

| 99.7 |

|

Form 52-109F2 - Certification of Interim Filings of Chief Executive Officer dated May 13, 2024 |

| |

|

|

| 99.8 |

|

Form 52-109F2 - Certification of Interim Filings of Chief Financial Officer dated May 13, 2024 |

| |

|

|

| 99.9 |

|

News Release announcing results for the three and nine months ended March 31, 2024 dated May 14, 2024 |

Exhibit

99.1

Management’s

Discussion and Analysis

For

the Three and Nine Months End March 31, 2024

| |

Contact

Information : |

| |

|

| |

SolarBank

Corporation

(Formerly

Abundant Solar Energy Inc.) |

| |

505

Consumers Road, Suite 803 |

| |

Toronto,

ON M2J 4V8 |

| |

Contact

Person: Mr. Sam Sun, CFO |

| |

Email:

info@solarbankcorp.com |

The

following Management Discussion and Analysis (“MD&A”) of the financial condition and results of operations of SolarBank

Corporation. (“SUNN” or the “Company”) was prepared by management as of May 13, 2024 and was reviewed and approved

by the Board of Directors. The following discussion of performance, financial condition and future prospects should be read in conjunction

with the interim consolidated financial statements of the Company and notes thereto for the three and nine months ended March 31st,

2024. The information provided herein supplements but does not form part of the financial statements. All amounts are stated in Canadian

dollars unless otherwise indicated.

Overview

Business

Profile

SolarBank

Corporation is incorporated in Ontario, Canada with its registered and head office at 505 Consumers Road, Suite 803, Toronto, Ontario,

M2J 4V8. The Company was originally founded in Canada in 2013 as Abundant Solar Energy Inc, and in 2017 established a 100% owned U.S.

subsidiary, Abundant Solar Power Inc., to meet the demand for renewable energy in both countries. The company commenced trading its common

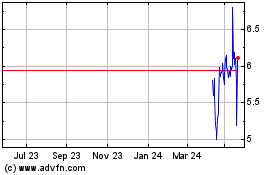

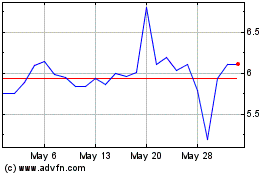

shares on the Canadian Securities Exchange (the “CSE”) under the symbol “SUNN” on March 2, 2023. On February

14, 2024, the Company migrated its listing to Cboe Canada Exchange Inc. under the existing trading symbol “SUNN”. On April

8, 2024, the Company’s common shares commenced trading on the Nasdaq Global Market (“Nasdaq”) under the symbol “SUUN”.

The

Company is a growing renewable energy sector Company that specializes in delivering solar and other renewable energy power plants in

Canada and the United States of America. Throughout its years in business, the Company has worked to provide safe, reliable and low-cost

solar power plants that would generate solar renewable electricity to: (a) address the growing requirements to reduce carbon emissions

in the form of Solar Renewable Energy Credits (“SREC”); and (b) provide a cost competitive alternative to conventional electricity

generation to further decarbonize the electricity grid.

As

an established independent renewable and clean energy project developer and asset operator, the Company is engaged in the site origination,

development, engineering, procurement and construction (“EPC”), operation and maintenance (“O&M”), and asset

management of a solar power plants, whether electricity grid interconnected or behind-the-meter (“BTM”) solar photovoltaic

power plants on roofs of commercial and/or industrial buildings, or ground-mount solar farms, community-scale or utility-scale in size.

The solar power plants could be net metered or virtual net metered to supply renewable energy to a specific commercial and industrial

customer, or supply the green energy to community solar subscribers, or sell the renewable power or SREC to utilities in order to meet

their Renewable Procurement Standard (“RPS”) compliance requirement or large corporations in meeting their carbon emission

reduction limits or Net-Zero targets, such as NZ2050 or NZ2035.

The

Company is shifting its business model from a “develop to sell” strategy to the ownership of renewable projects as an Independent

Power Producer. The Company will accelerate its portfolio growth via organic growth and M&A.

Development

of the Business

USA

The

Company is focused on its key markets in New York, Maryland and California. In New York, the Company has 3 projects that reached Notice

to Proceed (“NTP”) stage and construction started in November 2023. The Company reached Permission to Operate (“PTO”)

for 1 project in New York in January 2024. The Company also expects to reach PTO for a 3.7 MW project by the end of FY2024; this project

is to be owned by the Company subject to receipt of financing. Around 20 projects are under utility interconnection studies. In addition,

the Company is working on sites origination of potential community solar and utility scale solar projects.

Community

solar needs state-level polices in order to thrive. The Company is monitoring certain potential markets such as Illinois, Pennsylvania,

Michigan, Ohio and Virginia where legislation for community solar programs has been passed or is being proposed.

Canada

The

Company entered into an EPC agreement for the construction of three separate Battery Energy Storage System (“BESS”) projects

in October 2023 in Ontario.

The

Company commenced construction on a 1.4MW DC rooftop solar project in Alberta. In addition, 2 projects in Alberta and 3 projects in Nova

Scotia are under utility interconnection studies and development work is ongoing.

The

Company, in addition to its on-going business in Canada to provide operation and maintenance services of solar projects, is developing

solutions to assist the real estate sector to achieve net zero greenhouse gas emissions.

Acquisitions

The

Company acquired control of two corporations, OFIT GM Inc. (“OFIT GM”) and OFIT RT Inc. (“OFIT RT,”), (the “Purchased

Entities”) as a result of Share Purchase Agreements entered into on October 23, 2023 (the “SPAs”). The Purchased Entities

hold solar projects located in Ontario with a combined capacity of 2.5 MW and have been operating since 2017. The transaction closed

on November 1, 2023. The shares of the Purchased Entities were acquired from N. Fine Investments Limited and Linden Power Inc. Pursuant

to the terms of the SPAs, the Company acquired 49.9% ownership of OFIT RT Inc. and 49.9% ownership of OFIT GM Inc.

The

Company also acquired 100% interest in the US1 Project and VC1 Project on December 5, 2023, both located in New York (the “Projects)”.

The Company previously held a 67% interest in the Projects and has now acquired the remaining 33% from the minority interest shareholder.

The Projects have a combined installed capacity of 687.6 kW DC.

The

Company acquired a development stage solar project located in the Town of Camillus, New York on a closed landfill. The Company intends

to develop a 3.15 MW DC ground-mount solar power project on the site that will operate as a community solar project.

Recent

Developments

Since

the commencement of the quarter ended March 31, 2024, the Company achieved the following business objectives:

| ● | January

2024: The 3.7 MW Geddes project completed mechanical construction. This is the largest project

to date to be owned by the Company (subject to financing). The next step is completion of

final electrical work and acceptance testing. The Project is expected to become operational

during the second quarter of 2024. |

| ● | January

2024: The Company executed a lease agreement on a site in Greenville, New York. The Company

intends to develop two 7 MW DC ground-mount solar power projects on the site. The Company

also executed a lease agreement on a 3 MW DC ground mount site in Nasau, New York. |

| ● | January

2024: The Manlius, New York community solar project has reached permission to operate stage

(PTO) on January 24, 2024. National Grid has confirmed that the Manlius Project has been

formally accepted, successfully commissioned and it is authorized to produce power. |

| ● | February

2024: The Company executed lease agreements on two closed landfill sites located in Skaneateles,

New York and Lewiston, New York. The Company intends to develop three ground-mount solar

power projects on the sites with a capacity of 19.3 MW DC. |

| ● | February

2024: The Company received approval to list its common shares (the “Shares”)

on the Cboe Canada stock exchange with trading commencing on February 14, 2024. The Shares

were concurrently delisted from the Canadian Securities Exchange. |

| ● | February

2024: Renewable energy professional Chelsea L. Nickles is appointed to the Company’s

Board of Directors as an independent director. |

| ● | March

2024: The Company entered into a definitive agreement with Solar Flow-Through Funds Ltd.

(“SFF”) to acquire all of the issued and outstanding common shares of SFF through

a plan of arrangement for an aggregate consideration of up to $41.8M in an all stock deal.

This transaction values SFF at up to $45M but the consideration payable excludes the common

shares of SFF currently held by the Company. |

| ● | March

2024: The Company acquired a development stage solar project located in the Town of Camillus,

New York on a closed landfill. The Company intends to develop a 3.15 MW DC ground-mount solar

power project on the site that will operate as a community solar project. The acquisition

deal closed in April 2024. |

| ● | April

2024: The Company commenced trading on the Nasdaq Global Market at opening of Monday, April

8, 2024 under the symbol “SUUN”. |

| ● | April

2024: The Company reached mechanical completion on the SB-1, SB-2 and SB-3 Community Solar

Projects acquired by Honeywell International Inc. (“Honeywell”). The projects

are being constructed under an engineering, procurement, and construction (“EPC”)

Contract with SolarBank. SolarBank also expects that it will retain an operations and maintenance

contract for the projects following the completion of construction |

| ● | April

2024: The Company commenced construction on a 1.4 MW DC rooftop solar project in Alberta

as a pilot project. This project received interconnection approval in December 2023, full

permitting in March 2024, and is currently undergoing the process of engineering and final

design. Construction is expected to be completed in November 2024. |

| ● | April

2024: The Company partnered with TriMac Engineering of Sydney, Nova Scotia to develop a 10

MW DC community solar garden in the rural community of Enon, Nova Scotia, and three 7 MW

DC projects in Sydney, Halifax and Annapolis, Nova Scotia respectively (the “NS Projects”).

The NS Projects are being developed under a Community Solar Program that was announced by

the Government of Nova Scotia on March 1, 2024 and owned by AI Renewable Fund. |

| ● | May

2024: The Company announced that it has executed a lease agreement on a 29.6 acre site in

Black Creek, New York. SolarBank intends to develop a 3.2 MW DC ground-mount solar power

project on the site. |

Selected

Quarterly Information

The

following table shows selected financial information for the Company for the three and nine months period ended March 31, 2024 and 2023

and should be read in conjunction with the Company’s consolidated financial statements as at March 31, 2024 and June 30, 2023,

and related notes thereto for such periods.

The

condensed interim consolidated financial statements of the Company have been prepared in accordance with the International Financial

Reporting Standards (“IFRS”) and are expressed in Canadian dollars.

| For the three months ended March 31 | |

2024 $ | | |

2023 $ | |

| Revenue | |

| 24,074,947 | | |

| 706,856 | |

| Revenue – EPC | |

| 23,435,444 | | |

| 684,296 | |

| Revenue – development | |

| 27,207 | | |

| - | |

| Revenue – IPP production | |

| 121,761 | | |

| - | |

| Revenue – O&M | |

| 20,220 | | |

| 22,560 | |

| Revenue – other services | |

| 470,315 | | |

| - | |

| Cost of goods sold | |

| (18,686,509 | ) | |

| (51,601 | ) |

| Net income (loss) | |

| 3,499,241 | | |

| 3,074,090 | |

| Earning (loss) per share | |

| 0.13 | | |

| 0.11 | |

| For the nine months ended March 31 | |

2024 $ | | |

2023 $ | |

| Revenue | |

| 50,400,013 | | |

| 9,152,242 | |

| Revenue – EPC | |

| 47,477,484 | | |

| 9,082,473 | |

| Revenue – development | |

| 2,106,625 | | |

| - | |

| Revenue – IPP production | |

| 259,279 | | |

| - | |

| Revenue – O&M | |

| 86,310 | | |

| 69,769 | |

| Revenue – other services | |

| 470,315 | | |

| - | |

| Cost of goods sold | |

| (40,130,961 | ) | |

| (6,895,613 | ) |

| Net income | |

| 5,522,702 | | |

| 3,426,589 | |

| Earning per share | |

| 0.20 | | |

| 0.13 | |

| | |

March 31, 2024 $ | | |

June 30, 2023 $ | |

| Total assets | |

| 39,456,583 | | |

| 24,969,537 | |

| Total current liabilities | |

| 8,184,142 | | |

| 7,083,876 | |

| Total non-current liabilities | |

| 3,929,978 | | |

| 1,254,465 | |

The

following discussion addresses the operating results and financial condition of the Company for the three and nine months ended March

31st, 2024 compared with the three and nine months ended March 31st, 2023.

Result

of Operations

Three

and nine months ended March 31, 2024 compared to the three and nine months ended March 31, 2023

Trend

In

fiscal 2024, the Company continued to focus on scaling its business model by growing its pipeline and advancing its EPC projects in the

US and continued development activities for projects in both US and Canada. It is expected that the Company’s revenue will keep

growing in the fiscal 2024 as three projects (total of 21MW) in the US sold to Honeywell International started construction this quarter.

Total EPC contract value is US$41 million. The Company acts as EPC contractor. In addition, the Geddes Project (currently owned by the

Company) are expected to finish the construction and reach PTO in 2024.

The

net income for the three months ended March 31, 2024 increased by $425,151 compared to the net income for the three month ended March

31, 2023 with $3,499,241 net income recognized during the third quarter of 2024 as compared to a net income of $3,074,090 for the third

quarter of 2023.

The

net income for the nine months ended March 31, 2024 increased by $2,096,113 compared to the net income for the nine month ended March

31, 2023 with $5,522,702 net income recognized during the period as compared to a net income of $3,426,589 for the same period in fiscal

2023.

Key

business highlights and projects updates in FY2024

| Name |

|

Location |

|

Size

(MWdc/MWh) |

|

Timeline |

|

Milestone |

|

Current

Status |

| US1 |

|

New

York, USA |

|

0.4

|

|

December

2022 |

|

Reach

PTO

(permission to operate) |

|

EPC

project. It reached substantial completion in December 2022. The Company acquired 100% of the project in December 2023 |

| VC1 |

|

New

York, USA |

|

0.3

|

|

December

2022 |

|

Reach

PTO

(permission to operate) |

|

EPC

project. It reached PTO in December 2022. The Company acquired 100% of the project in December 2023 |

| Manlius |

|

New

York, USA |

|

5.7

|

|

January

2024 |

|

Reach

PTO

(permission to operate) |

|

EPC

project. It reached PTO in January 2024 |

| Geddes |

|

New

York, USA |

|

3.7

|

|

Q1

FY2025 |

|

Reach

PTO

(permission to operate) |

|

Construction

started in September 2023. This is the largest project to date to be owned by the Company (subject to financing). |

| Settling

Basins - 1 |

|

New

York, USA |

|

7.0

|

|

Q4FY2025 |

|

Reach

PTO

(permission to operate) |

|

EPC

project. Construction started in November 2023 |

| Settling

Basins - 2 |

|

New

York, USA |

|

7.0

|

|

Q4FY2025 |

|

Reach

PTO

(permission to operate) |

|

EPC

project. Construction started in November 2023 |

| Settling

Basins - 3 |

|

New

York, USA |

|

7.0

|

|

Q4FY2025 |

|

Reach

PTO

(permission to operate) |

|

EPC

project. Construction started in November 2023 |

| BESS |

|

Ontario,

Cananda |

|

Discharge:

4.74

Storage:

18.96 |

|

Q1FY2026 |

|

Reach

PTO

(permission to operate) |

|

EPC

project. EPC agreement entered Oct. 3, 2023 for the construction of 3 separate BESS projects |

| ● | Projects

under development |

| Name |

|

Location |

|

Size

(MWDC) |

|

Timeline |

|

Milestone |

|

Expected

Cost |

|

Cost

Incurred |

|

Sources

of Funding |

|

Current

Status |

261

Township |

|

Alberta,

Canada |

|

4.2

|

|

June

2024 |

|

Completion

of engineering work and placement of orders for main project components |

|

800,000

|

|

31,428

|

|

Equity

financing, working capital |

|

Phase

1 is expected to have a construction start date of June 2024.

Interconnection

for Phase 2 will be filed with the utility pending the final results of Phase 1. The Alberta Utilities Commission (“AUC”)

has announced a pause on approvals of new renewable electricity generation projects over one megawatt until Feb. 29, 2024. This pause

has impacted the Company’s receipt of interconnection approval for the project from the AUC. |

| Richmond

2 |

|

New

York, USA |

|

7.0

|

|

December

2025 |

|

NTP |

|

400,000

|

|

10,642 |

|

Equity

financing, working capital |

|

The

four projects are under utility interconnection study. The design work will be after the completion of the interconnection study. |

| Hardie |

|

New

York, USA |

|

7.0

|

|

December

2024 |

|

NTP |

|

300,000

|

|

22,250

|

|

Equity

financing, working capital |

|

| Gainsville |

|

New

York, USA |

|

7.0 |

|

December

2024 |

|

NTP |

|

400,000 |

|

10,750 |

|

Equity

financing, working capital |

|

| 6882

Rice Road |

|

New

York, USA |

|

5.2 |

|

December

2024 |

|

NTP |

|

800,000 |

|

34,150 |

|

Equity

financing, working capital |

|

| SUNNY |

|

New

York, USA |

|

28.0

|

|

December

2025 |

|

Completion

of interconnection studies, engineering and permitting, along with interconnection deposit, and procurement bid application fee |

|

900,000

|

|

127,174 |

|

Equity

financing, working capital |

|

The

Company submitted an interconnection request to New York Independent System Operator. The company signed a lease agreement with the

landowner in 2022. It has also qualified to submit a Proposal under NYSERDA’s RESRFP22-1 for Renewable Energy Credits (RECs).

|

| Camillus |

|

New

York USA |

|

3.15 |

|

September

2024 |

|

NTP |

|

100,000 |

|

- |

|

Equity

financing, working capital |

|

The

project received interconnection approval and is in the final stage of permitting process. |

Revenue

The

Company’s revenue is mainly from EPC services, Development fees and O&M services.

| | |

Three Months Ended March 31 | | |

Nine Months Ended March 31 | |

| | |

2024 | | |

2023 | | |

Change | | |

2024 | | |

2023 | | |

Change | |

| EPC services | |

| 23,435,444 | | |

| 684,296 | | |

| 22,751,148 | | |

| 47,477,484 | | |

| 9,082,473 | | |

| 38,395,011 | |

| Development fees | |

| 27,207 | | |

| - | | |

| 27,207 | | |

| 2,106,625 | | |

| - | | |

| 2,106,625 | |

| IPP Production | |

| 121,761 | | |

| - | | |

| 121,761 | | |

| 259,279 | | |

| - | | |

| 259,279 | |

| O&M services | |

| 20,220 | | |

| 22,560 | | |

| (2,340 | ) | |

| 86,310 | | |

| 69,769 | | |

| 16,541 | |

| Other services | |

| 470,315 | | |

| - | | |

| 470,315 | | |

| 470,315 | | |

| - | | |

| 470,315 | |

| Total Revenue | |

| 24,074,947 | | |

| 706,856 | | |

| 23,368,091 | | |

| 50,400,013 | | |

| 9,152,242 | | |

| 41,247,771 | |

The

following table shows the significant changes in revenue from 2023

| | |

Three months | | |

Nine months | | |

Explanation |

| EPC services | |

| 22,751,148 | | |

| 38,395,011 | | |

Increase due to $.6.M earned from Manlius and $32.2M earned from Settling Basins projects in FY24, $22.6M from Settling Basins earned in Q3.

In FY23, $6.0M earned from Richmond and Portland projects, $1.4M earned from US1&VC1, and $0.7M from SCA project. $516k earned from BESS in FY23 Q3. |

| Development fees | |

| 27,207 | | |

| 2,106,625 | | |

In FY24, $2M earned from Settling Basins projects in Q1. No project has been sold at NTP in FY2023. |

| IPP Production | |

| 121,761 | | |

| 259,279 | | |

IPP production from US1 & VC1 acquired June 2023 and OFIT GM & OFIT RT acquired November 2023 |

| O&M services | |

| (2,340 | ) | |

| 16,541 | | |

No significant changes |

| Other services | |

| 470,315 | | |

| 470,315 | | |

Canadian Renewable Conservation Expenditure (“CRCE”) Solar Project started Q3 FY2024. |

| Total | |

| 23,368,091 | | |

| 41,247,771 | | |

|

Expenses

Expenses

consist of expenditures related to cost of services provided and costs to develop new projects, as well as corporate business development

and administrative expenses.

| Expenses | |

Three Months Ended March 31 | | |

Nine Months Ended March 31 | |

| | |

2024 | | |

2023 | | |

Change | | |

2024 | | |

2023 | | |

Change | |

| Cost of goods sold | |

| (18,686,509 | ) | |

| (51,601 | ) | |

| (18,634,908 | ) | |

| (40,130,961 | ) | |

| (6,895,613 | ) | |

| (33,235,348 | ) |

| Operating expense: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Advertising and promotion | |

| (1,879,006 | ) | |

| (47,719 | ) | |

| (1,831,287 | ) | |

| (3,357,708 | ) | |

| (86,332 | ) | |

| (3,271,376 | ) |

| Consulting fees | |

| (320,117 | ) | |

| (448,673 | ) | |

| 128,556 | | |

| (1,076,791 | ) | |

| (781,435 | ) | |

| (295,356 | ) |

| Depreciation | |

| (47,370 | ) | |

| (12,846 | ) | |

| (34,525 | ) | |

| (118,668 | ) | |

| (36,185 | ) | |

| (82,483 | ) |

| Insurance | |

| (89,752 | ) | |

| (29,391 | ) | |

| (60,361 | ) | |

| (217,010 | ) | |

| (87,179 | ) | |

| (129,831 | ) |

| Listing fees | |

| (183,711 | ) | |

| (68,517 | ) | |

| (115,194 | ) | |

| (183,711 | ) | |

| (99,491 | ) | |

| (84,220 | ) |

| Office, rent and utilities | |

| (127,156 | ) | |

| (75,704 | ) | |

| (51,452 | ) | |

| (337,544 | ) | |

| (222,983 | ) | |

| (114,561 | ) |

| Professional fees | |

| (244,341 | ) | |

| (482,659 | ) | |

| 238,318 | | |

| (871,698 | ) | |

| (637,401 | ) | |

| (234,297 | ) |

| Repairs and maintenance | |

| (65,014 | ) | |

| (15,449 | ) | |

| (49,565 | ) | |

| (111,861 | ) | |

| (17,299 | ) | |

| (94,562 | ) |

| Salary and Wages | |

| (389,902 | ) | |

| (160,888 | ) | |

| (229,014 | ) | |

| (867,318 | ) | |

| (576,853 | ) | |

| (290,465 | ) |

| Stock based compensation | |

| (108,408 | ) | |

| (2,621,451 | ) | |

| 2,513,043 | | |

| (758,507 | ) | |

| (2,621,451 | ) | |

| 1,862,944 | |

| Travel and events | |

| (53,019 | ) | |

| (21,022 | ) | |

| (31,997 | ) | |

| (224,253 | ) | |

| (113,924 | ) | |

| (90,329 | ) |

| Total operating expenses | |

| (3,507,796 | ) | |

| (3,984,319 | ) | |

| (476,523 | ) | |

| (8,125,069 | ) | |

| (5,300,533 | ) | |

| (2,824,536 | ) |

| Total Expenses | |

| (22,194,305 | ) | |

| (4,035,920 | ) | |

| (18,158,385 | ) | |

| (48,256,030 | ) | |

| (12,196,146 | ) | |

| (36,059,884 | ) |

The

following table shows the significant changes in expenses from 2023:

| | |

Three months | | |

Nine months | | |

Management Commentary |

| Cost of goods sold | |

| (18,634,908 | ) | |

| (33,235,348 | ) | |

Consistent with increase in revenue. |

| Operating expense: | |

| | | |

| | | |

|

| Advertising and promotion | |

| (1,831,287 | ) | |

| (3,271,376 | ) | |

Additional costs incurred in FY24 relating to marketing expenditure to build the awareness of the Company |

| Consulting fees | |

| 128,556 | | |

| (295,356 | ) | |

$207k bonus paid in FY23 Q3 for completion of Richmond and Portland projects. In first 2 quarters of FY24, there were increased consulting fees relating to exploring investor markets and preparation for Cboe and Nasdaq listings. |

| Depreciation | |

| (34,525 | ) | |

| (82,483 | ) | |

Increase related to depreciation of IPP facilities acquired in June and October 2023. |

| Insurance | |

| (60,361 | ) | |

| (129,831 | ) | |

Insurance was higher due to increased activity and higher director and officer insurance premiums following completion of the IPO. Increase also affected by higher revenue and new companies acquired. |

| Listing fees | |

| (115,194 | ) | |

| (84,220 | ) | |

$184k listing fees for Cboe and Nasdaq in FY24. |

| Office, rent and utilities | |

| (51,452 | ) | |

| (114,561 | ) | |

Increase in rent costs due to new IPP facilities acquired. |

| Professional fees | |

| 238,318 | | |

| (234,297 | ) | |

Increase due to audit fees, due diligence work on acquisitions, tax preparations, and fees for new hires. Decrease in Q3 due to $211k legal fees accrued due to accumulation of unbilled legal fees in FY23 Q3. |

| Repairs and maintenance | |

| (49,565 | ) | |

| (94,562 | ) | |

Increase in maintenance costs due to new car and IPP facilities acquired. |

| Salary and Wages | |

| (229,014 | ) | |

| (290,465 | ) | |

Increase in salary due to 4 new employees hired in FY24 and $120k bonus paid in FY24 Q3. |

| Stock based compensation | |

| 2,513,043 | | |

| 1,862,944 | | |

Employee stock compensation started March 2023 and 50% vested November 2023. $1.8M advisory warrants also vested March 2023. |

| Travel and events | |

| (31,997 | ) | |

| (90,329 | ) | |

More travel and seminars activities in FY2024 to grow the company’s pipeline |

| Total operating expenses | |

| (476,523 | ) | |

| (2,824,536 | ) | |

|

| Total Expenses | |

| (18,158,385 | ) | |

| (36,059,884 | ) | |

|

Other

Income (Expense)

For

the three months ended March 31, 2024, the Company had other income of $3,534,692 compared to other income of $6,363,363 for the three

months ended March 31, 2023. Other income for the three months ended March 31, 2024 consists mainly of bad debt recovery of $3,376,686,

foreign exchange gain of $65,715 and other income of $92,271. Other income for the three months ended March 31, 2023 consists mainly

of Pre-Construction Development Costs recovered from IESO of $6,338,640, CESIR refund of $18,327, and other income of $6,396.

For

the nine months ended March 31, 2024, the Company had other income of $5,270,382 compared to other income of $6,473,127 for the nine

months ended March 31, 2023. Other income for the nine months ended March 31, 2024 consists mainly of bad debt recovery of $4,839,438,

gain from acquisition of non-controlling interest of $195,893, foreign exchange gain of $160,748 and other gain of $74,758. Other income

for the nine months ended March 31, 2023 consists mainly of Pre-Construction Development Costs recovered from IESO of $6,338,640, foreign

exchange gain of $114,900, CESIR refund of $18,327, government subsidies of $2,808, offsetting by interest expense of $1,548.

Impairment

Loss

The

impairment loss of $1,124,791 determined on March 31, 2024 relates to 702,820 SFF shares acquired prior to March 27, 2024. After the

Company entered a definitive agreement with SFF on March 20, 2024 to acquire all issued and outstanding common shares of SFF, the Company

determined that the shares previously acquired were overvalued based on the terms of the acquisition agreement. An impairment loss was

recorded to reflect the contingent portion of the acquisition agreement. See point (4) under Legal Matters and Contingent Assets section

for more detail on the agreement.

Net

Income

The

net income for the three months ended March 31, 2024 was $3,499,241 for income per share of $0.13 based on 27,136,075 outstanding shares

versus $3,074,090 for an income per share of $0.11 based on 26,800,000 outstanding shares for the comparative period.

The

net income for the nine months ended March 31, 2024 was $5,522,702 for earning per share of $0.20 based on 26,993,260 outstanding shares

versus $3,426,589 for a income per share of $0.13 based on 26,800,000 outstanding shares for the comparative period.

Legal

Matters and Contingent Assets

The

Company is subject to the following legal matters and contingencies:

| (1) | In

June 2022, a group of residents filed an Article 78 lawsuit against the town of Manlius,

New York, over a solar panel project on town property that is being developed by SolarBank.

The lawsuit was filed challenging the approval of the Manlius landfill. SolarBank is not

named in the lawsuit; however, in cooperation with the town, SolarBank is vigorously defending

this suit. On October 5, 2022 by decision of the State of New York Supreme Court, the lawsuit

was dismissed. However, on October 19, 2022 an appeal was filed by the petitioners in the

Appellate Division of the State of New York Supreme Court. On March 15, 2024 the Appellate

Division of the State of New York Supreme Court dismissed the appeal. The petitioners having

remaining appeal rights the timelines of which have not yet expired. The likelihood of success

in these lawsuits cannot be reasonably predicted. |

| (2) | On

December 2, 2020, a Statement of Claim was filed by the Company’s subsidiary, 2467264

Ontario Inc, and seven independent solar project developers (collectively the “Plaintiffs”)

against the Ontario Ministry of Energy, Northern Development and Mines (“MOE”),

the IESO, and John Doe (collectively the “Defendants”). Plaintiffs seek damages

from the Defendants in the amount of $240 million in lost profits, $17.8 million in development

costs, and $50 million in punitive damages for misfeasance of public office, breach of contract,

inducing the breach of contract, breach of the duty of good faith and fair dealing, and conspiracy

resulting in the wrongful termination of 111 FIT Contracts. 2467264 Ontario Inc. will receive

its proportionate entitlement of any net legal award based on its economic entitlement of

8.3% to the legal claim. This lawsuit was previously subject to a leave requirement under

s. 17 of the Crown Liability and Proceedings Act, 2019. However, a recent decision of the

Ontario Superior Court of Justice has deemed s. 17 of no force and effect (see Poorkid Investments

v. HMTQ 2022 ONSC 883). Accordingly, the lawsuit will continue to move forward through the

normal course. We expect statements of defence to be served following the determination of

some preliminary motions. No amounts are recognized in these consolidated special purpose

financial statements with respect to this claim. |

| (3) | On

January 29, 2021, a second Statement of Claim was filed by the Company’s subsidiary,

2467264 Ontario Inc, and fourteen independent solar project developer (collectively the “Plaintiffs”)

against the MOE, the IESO, and Greg Rickford, as Minister of the MOE (collectively the “Defendants”).

The Plaintiffs seek damages from the Defendants in the amount of $260 million in lost profits,

$26.9 million in development costs, and $50 million in punitive damages for breach of contract

and breach of duty of good faith and fair dealing resulting in the wrongful termination of

133 FIT contracts. 2467264 Ontario Inc. will receive its proportionate entitlement of any

net legal award based on its economic entitlement of 0.7% to the legal claim. This second

Statement of Claim is separate and in addition to the first Statement of Claim filed. This

lawsuit was previously subject to a leave requirement under s. 17 of the Crown Liability

and Proceedings Act, 2019. However, a recent decision of the Ontario Superior Court of Justice

has deemed s. 17 of no force and effect (see Poorkid Investments v. HMTQ 2022 ONSC 883).

Accordingly, the lawsuit will continue to move forward through the normal course. We expect

statements of defence to be served following the determination of some preliminary motions,

including a motion to consolidate the two actions into a single action. No amounts are recognized

in these combined special purpose financial statements with respect to this claim. |

| (4) | On

March 20, 2024, the Company entered into a definitive agreement with Solar Flow-Through Funds

Ltd. (“SFF”) to acquire all of the issued and outstanding common shares of SFF

through a plan of arrangement for an aggregate consideration of up to $41.8 million in an

all stock deal (the “SFF Transaction”). The SFF Transaction values SFF at up

to $45 million but the consideration payable excludes the common shares of SFF currently

held by SolarBank. |

Under

the terms of the SFF Transaction, the Company has agreed to issue up to 5,859,567 common shares of SolarBank (“SolarBank Shares”)

for an aggregate purchase price of up to $41.8 million, representing $4.50 per SFF common share acquired. The number of SolarBank Shares

was determined using a 90 trading day volume weighted average trading price as of the date of the Agreement which is equal to $7.14 (the

“Agreement Date VWAP”). The SFF Transaction represents a 7% premium to a valuation report prepared by Evans & Evans,

Inc. on SFF and its assets.

The

consideration for the SFF Transaction consists of an upfront payment of approximately 3,575,638 SolarBank Shares (Cdn$25.53 million)

and a contingent payment representing up to an additional 2,283,929 SolarBank Shares ($16.31 million) that will be issued in the form

of contingent value rights (“CVRs”). The SolarBank Shares underlying the CVRs will be issued once the final contract pricing

terms have been determined between SFF, the Ontario Independent Electricity System Operator (“IESO”) and the major suppliers

for the SFF BESS portfolio and the binding terms of the debt financing for the BESS portfolio have been agreed (the “CVR Conditions”).

On satisfaction of the CVR Conditions, Evans & Evans, Inc. shall revalue the BESS portfolio and SolarBank shall then issue SolarBank

Shares having an aggregate value that is equal to the lesser of (i) Cdn$16.31 million and (ii) the final valuation of the BESS portfolio

determined by Evans & Evans, Inc. plus the sale proceeds of any portion of the BESS portfolio that may be sold, in either case divided

by the Agreement Date VWAP. The maximum number of additional shares issued for the CVRs will be 2,283,929 SolarBank Shares.

Summary

of Quarterly Results

| Description | |

Q3 March 31, 2024 ($) | | |

Q2 December 31, 2023 ($) | | |

Q1 September 30, 2023 ($) | | |

Q4 June 30, 2023 ($) | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| 24,074,947 | | |

| 18,643,804 | | |

| 7,681,261 | | |

| 9,245,267 | |

| Income (Loss) for the period | |

| 3,499,241 | | |

| (15,508 | ) | |

| 2,038,968 | | |

| (1,076,836 | ) |

Earning (Loss) per share

(basic and diluted) | |

| 0.13 (basic) 0.09 (diluted) | | |

| (0.00) (basic) | | |

| 0.08 (basic) 0.05 (diluted) | | |

| (0.06) (basic) | |

| Description | |

| Q3 March 31, 2023 ($) | | |

| Q2 December 31, 2022 ($) | | |

| Q1 September 30, 2022 ($) | | |

| Q4 June 30, 2022 ($) | |

| | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| 706,856 | | |

| 2,964,934 | | |

| 5,480,452 | | |

| 388,369 | |

| Income (Loss) for the period | |

| 3,064,872 | | |

| 89,468 | | |

| 225,957 | | |

| (880,801 | ) |

Income (Loss) per share

(basic and diluted) | |

| 0.11 (basic) 0.09 (diluted) | | |

| 0.01 | | |

| 0.01 | | |

| (0.06 | ) |

Historical

quarterly results of operations and income per share data do not necessarily reflect any recurring expenditure patterns or predictable

trends except for the fact that seasonally the Company’s third quarter typically has the smallest amount of revenue due to winter

conditions that are less favorable for construction. The Company’s revenues fluctuate from quarter to quarter based on the timing

of recognition of revenue which is dependent on the stage of the various solar power projects under development. However, generally the

Company has seen increased revenues over the last four quarters as its greater access to capital following its March 2023 initial public

offering has provided it with more resources to develop, construct, operate and/or own solar power projects. Refer to “Results

of Operations” for additional discussion.

Liquidity

and Capital Resources

The

following table summarizes the Company’s liquidity position:

| As at | |

March 31, 2024

$ | | |

June 30, 2023

$ | |

| Cash | |

| 6,091,112 | | |

| 749,427 | |

| Working capital | |

| 9,396,704 | | |

| 14,962,023 | |

| Total assets | |

| 39,456,583 | | |

| 24,969,537 | |

| Total liabilities | |

| 12,114,120 | | |

| 8,338,341 | |

| Shareholders’ equity | |

| 27,342,462 | | |

| 16,631,196 | |

The

Company is working on securing financing to support continuation of its operations and progression on a growing number of projects but

it does not presently have sufficient working capital to continue operating for the next twelve months. To date, the Company’s

operations have been financed from cash flows from operations, debt financing and equity financing. The Company will continue to identify

financing opportunities, including equity issuances, in order to provide additional financial flexibility and execute on the Company’s

growth plans. While the Company has been successful raising the necessary funds in the past, there can be no assurance it can do so in

the future.

To

assist with potential liquidity needs, the Company has filed a final short form base shelf prospectus (the “Shelf Prospectus”)

with the securities regulatory authorities in each of the provinces of Canada. The Shelf Prospectus will enable the Company to make offerings

of up to $200 million of common shares, warrants, subscription receipts, units and share purchase contracts or a combination thereof

of the Company from time to time, separately or together, in amounts, at prices and on terms to be determined based on market conditions

at the time of the offering and as set out in an accompanying prospectus supplement, during the 25-month period that the Shelf Prospectus

remains valid.

The

nature, size and timing of any such financings (if any) will depend, in part, on the Company’s assessment of its requirements for

funding and general market conditions. Unless otherwise specified in the prospectus supplement relating to a particular offering of securities,

the net proceeds from any sale of any securities will be used for to advance the Company’s business objectives and for general

corporate purposes, including funding ongoing operations or working capital requirements, repaying indebtedness outstanding from time

to time, discretionary capital programs and potential future acquisitions. The specific terms of any future offering will be established

in a prospectus supplement to the Shelf Prospectus, which supplement will be filed with the applicable Canadian securities regulatory

authorities.

In

addition. The Company has entered into an equity distribution agreement (the “Distribution Agreement”) with Research

Capital Corporation (the “Agent”) to establish an at-the-market equity program (the “ATM Program”). The

Company may issue up to $15,000,000 of common shares of the Company (the “ATM Offered Shares”) from treasury under the

ATM Program. The ATM Offered Shares will be issued by the Company to the public from time to time, through the Agent, at the Company’s

discretion. The ATM Offered Shares sold under the ATM Program, if any, will be sold at the prevailing market price at the time of

sale. Since the ATM Offered Shares will be distributed at trading prices prevailing at the time of the sale, prices may vary between

purchasers and during the period of distribution. The Company intends to use the net proceeds from any sales of ATM Offered Shares under

the ATM Program, if any, to advance the Company’s business objectives and for general corporate purposes, including, without limitation,

funding ongoing operations or working capital requirements, repaying indebtedness outstanding from time to time, discretionary capital

programs and potential future acquisitions.

The

Company’s cash is held in highly liquid accounts. No amounts have been or are invested in asset-backed commercial paper.

The

chart below highlights the Company’s cash flows:

| For nine months ended | |

March 31, 2024

$ | | |

March 31, 2023

$ | |

| Net cash provided by (used in) | |

| | | |

| | |

| Operating activities | |

| 10,919,336 | | |

| 4,653,394 | |

| Investing activities | |

| (5,078,827 | ) | |

| (4,680,000 | ) |

| Financing activities | |

| (310,121 | ) | |

| 4,546,451 | |

| Increase (decrease) in cash, cash equivalents, and restricted cash | |

| 5,341,685 | | |

| 4,698,622 | |

Cash

flow from operating activities

The

Company has positive cash flow of $10,919,336 from operating activities during the nine months ended March 31, 2024, while the Company

generated $4,653,394 cash during the same period ended March 31, 2023. The Company generated cash of $4,294,116 from the operational

activities and generate $6,625,220 for the change of working capital during the nine months ended March 31, 2024, while the Company generated

cash of $6,084,225 from the operational activities and used $1,430,831 for the change of working capital for the same period ended March

31, 2023.

Cash

flow from financing activities

The

Company used cash of $310,121 from financing activities during the nine months ended March 31, 2024, while the Company generated $4,546,451

cash during the same period ended March 31, 2023. The cash usage in financing activities for the nine months ended March 31, 2024 was

driven by repayment of long-term debt of $271,001 and payment of lease obligation of $102,029. This was offset by cash generation from

issuance of common shares for net proceeds of $21,659 and proceeds from broker warrants exercised of $41,250. The cash generated in financing

activities for the nine months ended March 31, 2023 was the result of net proceeds of $1,250,000 received from debenture financing completed

in October 2022 and net proceed from the issuance of common shares of $5,611,802, offset by the issuance of notes receivable of $1,284,393,

repayment of short-term loans of $593,167, long-term loans of $417,996.

Cash

flow from investing activities

The

Company used cash of $5,078,827 in investing activities during the nine months ended March 31, 2024, while the Company used $4,680,000

cash in investing activities during the same period ended March 31, 2023. The cash used for the nine months ended March 31, 2024 includes

acquisition of property, plant and equipment of $42,908, acquisition of development asset of $6,316,741, purchase of partnership units

of $2,465,000, and purchase of non-controlling interest of $95,333, offset by net cash of $11,155 received from acquisition and redemption

of GIC of $3,830,000. The cash used in investing activities for the nine months ended March 31, 2023 was the result of purchase of ST

GIC of $4,680,000.

Capital

Transactions

During

the nine months ended March 31, 2024, the Company issued the following shares:

| i. | On

September 20, 2023, 55,000 broker warrants were exercised to purchase common shares at $0.75

per share. |

| | | |

| ii. | On

September 21, 2023, the Company sold 1,000 Common Shares through at-the-market offerings

at an average price of $10 per share for gross proceeds of $10,000. |

| | | |

| iii. | On

September 22, 2023, the Company sold 1,200 Common Shares through at-the-market offerings

at an average price of $10 per share for gross proceeds of $12,004. |

| | | |

| iv. | The

Company has entered into the SPAs dated October 23, 2023 to acquire control of OFIT GM and

OFIT RT for consideration of 278,875 common shares of the Company that were issued November

1, 2023. |

Capital

Structure

The

Corporation is authorized to issue an unlimited number of common shares. The table below sets out the Company’s outstanding common

share and convertible securities as of March 31, 2024 and as of the date of this MD&A:

| Security Description | |

March 31, 2024 | | |

Date of report | |

| | |

| | |

| |

| Common shares | |

| 27,136,075 | | |

| 27,191,075 | |

| Warrants | |

| 7,928,000 | | |

| 7,873,000 | |

| Stock options | |

| 2,766,500 | | |

| 2,766,500 | |

| Restricted share units | |

| 265,000 | | |

| 265,000 | |

The

following table reflects the details of warrants issued and outstanding as of the date of this MD&A:

| Date granted | |

Expiry | | |

Exercise price (CAD) | | |

Outstanding warrants | |

| 03-Oct-2022 | |

| 10-Jun-2027 | | |

$ | 0.10 | | |

| 2,500,000 | |

| 01-Mar-2023 | |

| 01-Mar-2026 | | |

$ | 0.75 | | |

| 373,000 | |

| 01-Mar-2023 | |

| 01-Mar-2028 | | |

$ | 0.50 | | |

| 5,000,000 | |

| | |

| | | |

| | | |

| 7,873,000 | |

| Weighted average exercise price | | |

| | | |

$ | 0.38 | |

The

following table reflects the details of options issued and outstanding as of the date of this MD&A:

| Date granted | |

Expiry | | |

Exercise price (CAD) | | |

Outstanding options | |

| 10-Feb-2023 | |

| 04-Nov-2027 | | |

$ | 0.75 | | |

| 2,759,000 | |

| 04-Dec-2023 | |

| 04-Dec-2028 | | |

$ | 6.60 | | |

| 7,500 | |

| | |

| | | |

| | | |

| 2,766,500 | |

| Weighted average exercise price | |

| | | |

$ | 0.77 | |

The

following table reflects the details of RSUs issued and outstanding as of the date of this MD&A:

| Date granted | |

Vesting Date | |

Outstanding RSUs | |

| 4-Nov-2022 | |

02-Aug-20 | |

| 250,000 | |

| 13-Mar-2023 | |

12-Mar-2024 | |

| 7,500 | |

| 13-Mar-2023 | |

12-Mar-2025 | |

| 7,500 | |

| | |

| |

| 265,000 | |

Capital

Management

The

Company’s objectives in managing liquidity and capital are to safeguard the Company’s ability to continue as a going concern

and to provide financial capacity to meet its strategic objectives. The capital structure of the Company consists of the following:

| | |

March 31, 2024 | | |

June 30, 2023 | |

| Long-term debt -non-current portion | |

$ | 2,819,904 | | |

| 759,259 | |

| Shareholder Equity | |

$ | 27,342,463 | | |

| 16,631,196 | |

The

Company manages the capital structure and makes adjustments to it in light of changes in economic conditions and the risk characteristics

of the underlying assets. To maintain or adjust the capital structure, the strategies employed by the Company may include the issuance

or repayment of debt, dividend payments, issuance of equity, or sale of assets. The Company has determined it will have sufficient funds

to meet its current operating and development obligations for at least 12 months from the reporting date.

No

changes to capital management from the prior year.

Off-Balance

Sheet Arrangements

The

Company is not a party to any off-balance sheet arrangements or transactions.

Transactions

Between Related Parties

Key

management compensation

Key

management personnel include those persons having authority and responsibility for planning, directing and controlling the activities

of the Company as a whole. The Company has determined that key management personnel consists of members of the Company’s Board

of Directors and corporate officers, including the Company’s Chief Executive Officer, Chief Financial Officer, Chief Operating

Officer and Chief Administrative Officer.

The

remuneration of directors and other members of key management personnel, for the three and nine months ended March 31, 2024 and 2023

were as follows:

| | |

Three Month Ended March 31, | |

| | |

2024 | | |

2023 | |

| Short-term employee benefits | |

$ | 409,599 | | |

$ | 280,016 | |

| Share-based compensation | |

| 59,473 | | |

| 83,531 | |

| Advisory warrants | |

| - | | |

| 445,361 | |

| | |

Nine Month Ended March 31, | |

| | |

2024 | | |

2023 | |

| Short-term employee benefits | |

$ | 1,020,227 | | |

$ | 1,020,355 | |

| Share-based compensation | |

| 345,957 | | |

| 83,531 | |

| Advisory warrants | |

| - | | |

| 445,361 | |

Short-term

employee benefits include consulting fees and salaries made to key management.

Transactions

with related parties, are described above, were for services rendered to the Company in the normal course of operations, and were measured

based on the consideration established and agreed to by the related parties. Related party transactions are made without stated terms

of repayment or interest. The balances with related parties are unsecured and due on demand.

The

Company acquired control of OFIT GM and OFIT RT on November 1, 2023. Dr. Richard Lu, the President & Chief Executive Officer and

a director of the Company is indirectly a shareholder of the Purchased Entities and indirectly received one-third of the Consideration

Shares. As a result, the Transaction is considered a related party transaction.

Critical

Accounting Estimates and Policies

The

preparation of the consolidated financial statements in accordance with IFRS as issued by IASB requires management to make estimates

and assumptions that affect the amounts reported on the consolidated financial statements. These critical accounting estimates represent

management’s estimates that are uncertain and any changes in these estimates could materially impact the Company’s consolidated

financial statements. Management continuously reviews its estimates and assumptions using the most current information available. The

Company’s critical accounting policies and estimates are described in Note 3 of the audited consolidated financial statements for

the year ended June 30, 2023.

Financial

Instruments and Other Instruments (Management of Financial Risks)

Fair

value

The

Company’s financial assets and liabilities carried at fair value are measured and recognized according to a fair value hierarchy

that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted

quoted prices in active markets for identical assets and liabilities and the lowest priority to unobservable inputs. The three levels

of fair value hierarchy are as follows:

| ● | Level

1: Quoted prices in active markets for identical assets or liabilities. |

| ● | Level

2: Inputs other than quoted prices that are observable for the asset or liability. |

| ● | Level

3: Inputs for the asset or liability that are not based on observable market data. |

Cash

is carried at fair value using a Level 1 fair value measurement. Investment in partnership units is carried at fair value using a Level

3 fair value measurement. Significant unoberservable inputs are used in discount cash flows method to determine the fair value of the

investment in SFF shares, There were no transfers into or out of Level 3 during the period ended March 31, 2024.

The

carrying amounts of trade and other receivables, trade and other payables approximate their fair values due to the short-term maturities

of these items. The carrying amounts of loan payable, lease liabilities, tax equity liabilities and long-term debt approximate their

fair value as they are discounted at the current market rate of interest.

Credit

risk

Credit

risk is the risk of financial loss associated with the counterparty’s inability to fulfill its payment obligations. The Company

has no significant credit risk with its counterparties. The carrying amount of financial assets net of impairment, if any, represents

the Company’s maximum exposure to credit risk.

The

Company has assessed the creditworthiness of its trade and other receivables and amount determined the credit risk to be low. Utility

deposits are made to local government utility with high creditworthiness. Cash has low credit risk as it is held by internationally recognized

financial institutions.

Concentration

risk and economic dependence

The

outstanding accounts receivable balance is relatively concentrated with a few large customers representing majority of the value. See

table below showing a few customers who account for over 10% of total revenue as well as customers who account for over 10% percentage

of outstanding Accounts Receivable.

Nine months ended

March 31, 2024 | |

Revenue | | |

% of Total Revenue | |

| Customer B | |

$ | 5,343,090 | | |

| 11 | % |

| Customer E | |

$ | 34,518,159 | | |

| 68 | % |

| Customer F | |

$ | 6,550,519 | | |

| 13 | % |

Nine months ended

March 31, 2023 | |

Revenue | | |

% of Total Revenue | |

| Customer A | |

$ | 5,919,270 | | |

| 65 | % |

Three months ended

March 31, 2024 | |

Revenue | | |

% of Total Revenue | |

| Customer E | |

$ | 22,858,350 | | |

| 95 | % |

Three months ended

March 31, 2023 | |

Revenue | | |

% of Total Revenue | |

| Customer A | |

$ | 105,180 | | |

| 15 | % |

| Customer B | |

$ | 264,572 | | |

| 37 | % |

| Customer C | |

$ | 151,696 | | |

| 21 | % |

| Customer D | |

$ | 100,000 | | |

| 14 | % |

| | |

| | | |

| | |

| March 31, 2024 | |

| Account Receivable | | |

| % of Account Receivable | |

| Customer E | |

$ | 2,494,047 | | |

| 72 | % |

| June 30, 2023 | |

Account Receivable | | |

% of Account Receivable | |

| Customer F | |

$ | 1,179,132 | | |

| 31 | % |

| Customer G | |

$ | 1,537,357 | | |

| 40 | % |

Liquidity

risk

Liquidity

risk is the risk that the Company will not be able to meet its financial obligations as they become due. The Company’s approach

to managing liquidity risk is to ensure that it will have sufficient liquidity to meet liabilities when due by maintaining adequate reserves,

banking facilities, and borrowing facilities. All of the Company’s financial liabilities are subject to normal trade terms.

Interest

rate risk

Interest

rate risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes in market

interest rates. The Company does not carry debt at a variable rate and is exposed to interest rate risk on its cash which is not considered

significant.

Subsequent

Events

Not

significant subsequent events to note.

Risk

Factors

Readers

are cautioned that the risk factors discussed above in this MD&A are not exhaustive. Readers should also carefully consider the matters

discussed under the heading, “Forward Looking Information”, in this MD&A and under the heading, “Risk Factors”,

in the Company’s Annual Information Form for the year ended June 30, 2023 and filed on SEDAR+ at www.sedarplus.com.

Forward-Looking

Statements

This

MD&A contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation

(collectively, “forward-looking statements”) that relate to the Company’s current expectations and views of future

events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or

future events or performance (often, but not always, through the use of words or phrases such as “will likely result”,

“are expected to”, “expects”, “will continue”, “is anticipated”, “anticipates”,

“believes”, “estimated”, “intends”, “plans”, “forecast”, ”projection”,

“strategy”, “objective” and “outlook”) are not historical facts and may be forward-looking statements

and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from

those expressed in such forward-looking statements. In particular and without limitation, this MD&A contains forward-looking

statements pertaining to the Company’s expectations regarding its industry trends and overall market growth; the Company’s

expectations about its liquidity and sufficient of working capital for the next twelve months of operations; the Company’s growth

strategies the expected energy production from the solar power projects mentioned in this MD&A; the reduction of carbon emissions;

the receipt of incentives for the projects; the expected value of EPC Contracts; and the size of the Company’s development pipeline.

No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in

this MD&A should not be unduly relied upon. These statements speak only as of the date of this MD&A.

Forward-looking

statements are based on certain assumptions and analyses made by the Company in light of the experience and perception of historical

trends, current conditions and expected future developments and other factors it believes are appropriate, and are subject to risks and

uncertainties. In making the forward looking statements included in this MD&A, the Company has made various material assumptions,

including but not limited to: obtaining the necessary regulatory approvals; that regulatory requirements will be maintained; general

business and economic conditions; the Company’s ability to successfully execute its plans and intentions; the availability of financing

on reasonable terms; the Company’s ability to attract and retain skilled staff; market competition; the products and services offered

by the Company’s competitors; that the Company’s current good relationships with its service providers and other third parties

will be maintained; and government subsidies and funding for renewable energy will continue as currently contemplated. Although the Company

believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect, and the Company cannot assure

that actual results will be consistent with these forward-looking statements. Given these risks, uncertainties and assumptions, investors

should not place undue reliance on these forward-looking statements.

Whether

actual results, performance or achievements will conform to the Company’s expectations and predictions is subject to a number of

known and unknown risks, uncertainties, assumptions and other factors, including those listed under “Forward-Looking Statements”

and “Risk Factors” in the Company’s Annual Information Form, and other public filings of the Company, which include:

the Company may be adversely affected by volatile solar power market and industry conditions; the execution of the Company’s growth

strategy depends upon the continued availability of third-party financing arrangements; the Company’s future success depends partly

on its ability to expand the pipeline of its energy business in several key markets; governments may revise, reduce or eliminate incentives

and policy support schemes for solar and battery storage power; general global economic conditions may have an adverse impact on our

operating performance and results of operations; the Company’s project development and construction activities may not be successful;

developing and operating solar projects exposes the Company to various risks; the Company faces a number of risks involving Power Purchase

Agreements (“PPAs”) and project-level financing arrangements; any changes to the laws, regulations and policies that the

Company is subject to may present technical, regulatory and economic barriers to the purchase and use of solar power; the markets in

which the Company competes are highly competitive and evolving quickly; an anti-circumvention investigation could adversely affect the

Company by potentially raising the prices of key supplies for the construction of solar power projects; foreign exchange rate fluctuations;

a change in the Company’s effective tax rate can have a significant adverse impact on its business; seasonal variations in demand

linked to construction cycles and weather conditions may influence the Company’s results of operations; the Company may be unable

to generate sufficient cash flows or have access to external financing; the Company may incur substantial additional indebtedness in

the future; the Company is subject to risks from supply chain issues; risks related to inflation; unexpected warranty expenses that may

not be adequately covered by the Company’s insurance policies; if the Company is unable to attract and retain key personnel, it

may not be able to compete effectively in the renewable energy market; there are a limited number of purchasers of utility-scale quantities

of electricity; compliance with environmental laws and regulations can be expensive; corporate responsibility may adversely impose additional

costs; the future impact of COVID-19 on the Company is unknown at this time; the Company has limited insurance coverage; the Company

will be reliant on information technology systems and may be subject to damaging cyberattacks; the Company may become subject to litigation;

there is no guarantee on how the Company will use its available funds; the Company will continue to sell securities for cash to fund

operations, capital expansion, mergers and acquisitions that will dilute the current shareholders; and future dilution as a result of

financings.

The

Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for the

Company to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors,

may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements

contained in this MD&A are expressly qualified in their entirety by this cautionary statement.

Approval

The

Board of Directors of the Company has approved the disclosure contained in this MD&A.

Exhibit

99.2

SOLARBANK

CORPORATION

(Formerly

Abundant Solar Energy Inc.)

Condensed

Interim Consolidated Financial Statements

(Expressed

in Canadian Dollars)

(Unaudited)

For

the three and nine months ended March 31, 2024 and 2023

SOLARBANK

CORPORATION

Condensed

Interim Consolidated Statements of Financial Position

(Expressed

in Canadian dollars)

(Unaudited)

| | |

Notes | | |

March

31, 2024 | | |

June

30, 2023 | |

| Assets | |

| | |

| | |

| |

| Current

assets: | |

| | |

| | |

| |

| Cash | |

| | | |

$ | 6,091,112 | | |

$ | 749,427 | |

| Short-term

investments | |

| 3 | | |

| 2,720,000 | | |

| 6,550,000 | |

| Trade

and other receivables | |

| 4 | | |

| 3,451,994 | | |

| 3,837,207 | |

| Unbilled

revenue | |

| | | |

| 539,008 | | |

| 7,405,866 | |

| Prepaid

expenses and deposits | |

| 5 | | |

| 2,003,586 | | |

| 3,054,678 | |

| Inventory | |

| 7 | | |

| 2,775,146 | | |

| 448,721 | |

| | |

| | | |

| 17,580,846 | | |

| 22,045,899 | |

| Non-current

assets | |

| | | |

| | | |

| | |

| Property,

plant and equipment | |

| 6 | | |

| 2,293,167 | | |

| 950,133 | |

| Right-of-use

assets | |

| 11 | | |

| 860,152 | | |

| 144,487 | |

| Development

asset | |

| 8 | | |

| 7,881,168 | | |

| 1,106,503 | |

| Goodwill | |

| 17 | | |

| 5,689,227 | | |

| - | |

| Investment | |

| 18 | | |

| 5,152,023 | | |

| 722,515 | |

| | |

| | | |

| 21,875,737 | | |

| 2,923,638 | |

| Total

assets | |

| | | |

$ | 39,456,583 | | |

$ | 24,969,537 | |

| | |

| | | |

| | | |

| | |

| Liabilities

and Shareholder’s equity | |

| | | |

| | | |

| | |

| Current

liabilities: | |

| | | |

| | | |

| | |

| Trade

and other payables | |

| 9 | | |

$ | 5,954,513 | | |

$ | 4,713,497 | |

| Unearned

revenue | |

| 10 | | |

| 1,672,548 | | |

| 1,150,612 | |

| Current

portion of long-term debt | |

| 12 | | |

| 303,882 | | |

| 151,111 | |

| Loan

payables | |

| | | |

| 42,816 | | |

| - | |

| Tax

payable | |

| | | |

| 10,983 | | |

| 929,944 | |

| Current

portion of lease liability | |

| 11 | | |

| 119,797 | | |

| 44,961 | |

| Current

portion of tax equity | |

| 13 | | |

| 79,603 | | |

| 93,751 | |

| Non-current

liabilities: | |

| | | |

| 8,184,142 | | |

| 7,083,876 | |

| Long-term

debt | |

| 12 | | |

| 2,819,904 | | |

| 759,259 | |

| Lease

liability | |

| 11 | | |

| 793,342 | | |

| 128,350 | |

| Tax

equity | |

| 13 | | |

| 316,732 | | |

| 366,856 | |

| | |

| | | |

| 3,929,978 | | |

| 1,254,465 | |

| Total

liabilities | |

| | | |

$ | 12,114,120 | | |

$ | 8,338,341 | |

| Shareholders’

equity: | |

| | | |

| | | |

| | |

| Share

capital | |

| 15 | | |

| 8,984,448 | | |

| 6,855,075 | |

| Contributed

surplus | |

| | | |

| 3,760,431 | | |

| 3,001,924 | |

| Accumulated

other comprehensive income | |

| | | |

| (42,009 | ) | |

| (116,759 | ) |

| Retained

earnings | |

| | | |

| 12,247,821 | | |

| 6,652,551 | |

| Equity

attributable to shareholders of the company | |

| | | |

| 24,950,690 | | |

| 16,392,791 | |

| Non-controlling

interest | |

| 17 | | |

| 2,391,772 | | |

| 238,405 | |

| Total

equity | |

| | | |

| 27,342,462 | | |

| 16,631,196 | |

| Total

liabilities and shareholders’ equity | |

| | | |

$ | 39,456,583 | | |

$ | 24,969,537 | |

Approved

and authorized for issuance on behalf of the Board of Directors on May 13, 2024 by:

| “Richard

Lu” |

|

“Sam

Sun” |

| Richard

Lu, CEO, and Director |

|

Sam

Sun, CFO |

See

accompanying notes to these condensed interim consolidated financial statements.

SOLARBANK

CORPORATION

Condensed

Interim Consolidated Statements of Income and Comprehensive Income

(Expressed

in Canadian dollars)

(Unaudited)

| | |

| | |

Three

Months Ended March 31 | | |

Nine

Months Ended March 31 | |

| | |

Notes | | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue

from EPC services | |

| | | |

$ | 23,435,444 | | |

$ | 684,296 | | |

$ | 47,477,484 | | |

$ | 9,082,473 | |

| Revenue

from development fees | |

| | | |

| 27,207 | | |

| - | | |

| 2,106,625 | | |

| - | |

| Revenue

from IPP production | |

| | | |

| 121,761 | | |

| - | | |

| 259,279 | | |

| - | |

| Revenue

from O&M services | |

| | | |

| 20,220 | | |

| 22,560 | | |

| 86,310 | | |

| 69,769 | |

| Revenue

from other services | |

| | | |

| 470,315 | | |

| - | | |

| 470,315 | | |

| - | |

| | |

| | | |

| 24,074,947 | | |

| 706,856 | | |

| 50,400,013 | | |

| 9,152,242 | |

| Cost

of goods sold | |

| | | |

| (18,686,509 | ) | |

| (51,601 | ) | |

| (40,130,961 | ) | |

| (6,895,613 | ) |

| Gross

profit | |

| | | |

| 5,388,438 | | |

| 655,255 | | |

| 10,269,052 | | |

| 2,256,629 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating

expense: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Advertising

and promotion | |

| | | |

| (1,879,006 | ) | |

| (47,719 | ) | |

| (3,357,708 | ) | |

| (86,332 | ) |

| Consulting

fees | |

| | | |

| (320,117 | ) | |

| (448,673 | ) | |