Filed by Simmons First National Corporation

pursuant to Rule 425 under the

Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the

Securities Exchange Act of 1934, as amended

Subject Company: The Landrum Company

Commission File Number: 000-06253

July 31, 2019, Message from The Landrum Company to Its

Associates

July 31, 2019

Landmark Bankers,

I have an important and exciting announcement to share with

all of you.

The Landrum Company has entered into a definitive agreement

and plan of merger with Simmons First National Corporation. Under the agreement, Landrum will merge with and into Simmons, with

Simmons as the surviving corporation, subject to certain terms and conditions, including approval of the transaction by Landrum’s

shareholders. We expect the transaction to close in the fourth quarter of this year, after which time Landmark Bank will join Simmons’

bank subsidiary, Simmons Bank, through a separate merger.

After extensive evaluation of this proposal, Landrum’s

Board recognized its significant positive potential for Landrum’s shareholders and Landmark’s customers. It also brings

new opportunities for Landmark employees.

But before I say anything else, I want to personally thank you

for what you have accomplished—as a team you built an organization that many in the banking industry, including Simmons,

recognized as a very valuable enterprise. In doing so, you admirably honored your commitment to our organization. You can always

be proud of what was built here and will become a meaningful component of the future Simmons culture.

Landmark Bank prides itself on its efforts to continuously seek

self-improvement—finding solutions to serve its customers and communities in more and better ways. As such we have remained

open to exploring opportunities that we seek out as well as some that are brought to our attention.

Even so, this transition is a big change, for each of us individually,

as well as for Landmark Bank. While we can’t see the exact future of the new organization, our bond as Landmark Bankers will

allow us to support each other and work together through the change.

The process to join Landrum and Landmark Bank with Simmons is

not instantaneous. There are still many things to do. While the public announcement of the acquisition occurs today, July 31, 2019,

the transaction is not expected to officially close until later this year. After that, Landmark Bank will operate as a separately

chartered bank under the Simmons holding company until the charter and systems conversion. Currently, the conversion date is expected

to occur in the first half of 2020. Please see the Simmons Bank news release dated July 31, 2019 for more details.

Many decisions will be made throughout the next few months,

decisions on products, technology, and numerous others. Our goal will be to continue to operate at the same level of excellence

we always have, and I am confident we’ll have Simmons’ support during this time.

We know you have many questions, and while we do not have all

the answers now, know that we will communicate definitive decisions as soon as we can in the transparent way that Landmark Bank

has always communicated with you.

Today, we will continue to do our best job, just as we did yesterday

and will do again tomorrow. Landmark customers are counting on us to continue to support their financial needs and maintain our

continuing commitment to their financial well-being. Based on what we have learned about Simmons, our customers can expect this

same dedication to service during the transition and beyond.

Simmons is, in many ways, an ideal match for Landmark Bank.

The Simmons banking model has small-town roots and today, remains community-based and customer-focused. Just 5 years ago, Simmons

was roughly the same size as Landmark is today. A publicly traded company with access to widespread investor capital, Simmons has

grown to about $18 billion in assets with more than 200 branches in 8 states. Their geographic footprint is a well-matched compliment

with Landmark Bank’s because while Simmons already serves communities in Missouri, Oklahoma, and Texas, none of those are

the cities or towns currently served by Landmark.

Finally, the strategy of the Simmons banking organization is

very similar to that of Landmark but with far greater resources. Customers will have the opportunity to benefit from greater lending

capacity, as well as additional products and technology. Landmark bankers will have opportunities to be considered for different

roles and projects in an organization with a remarkably similar culture. And the offer results in an impressive return for Landrum’s

shareholders as well as enhanced liquidity.

We really expect that very little adjustment will be required

of our customers. However, we know there will be a lot of acclimation on the part of our bankers—including meeting new people

and learning new ways of doing things.

Anxiety and uncertainty are natural responses to change. I have

felt those emotions during the evaluation of this proposal. I can tell you that I now also feel extraordinarily optimistic about

the future of this combined financial services organization. Landmark has a strong team of knowledgeable and skilled bankers. The

Simmons Bank team recognizes this and looks forward to bringing the strengths of both companies together.

For now, you can expect many aspects of the Landmark Bank culture,

which are also contained in the Simmons culture, to support us through this transition. These include: strong, caring leadership;

frequent and proactive communication; channels to interact and ask questions, as well as opportunities to learn, grow, and try

new things. I’d like to close by sharing with you a welcome message from the chief executives of Simmons First National Corporation

and Simmons Bank, which is attached to this email.

Sincerely,

Kevin

Kevin D. Gibbens

President and CEO

Landmark Bank / The Landrum Company

Forward Looking

Statements

Statements in this communication

may not be based on historical facts and are “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements may be identified by reference to a future period(s) or by the

use of forward-looking terminology, such as “anticipate,” “estimate,” “expect,” “foresee,”

“may,” “might,” “will,” “would,” “could” or “intend,” future

or conditional verb tenses, and variations or negatives of such terms. These forward-looking statements include, without limitation,

statements relating to the expected impact of the proposed transaction between Simmons First National Corporation (“Company”)

and The Landrum Company (“Landrum”) (the “Proposed Transaction”) on the combined entities operations, financial

condition, and financial results, and the expectations regarding the ability of the Company and Landrum to successfully integrate

the combined businesses and the amount of cost savings and other benefits that are expected to be realized as a result of the Proposed

Transaction. Readers are cautioned not to place undue reliance on the forward-looking statements contained in this communication

in that actual results could differ materially from those indicated in such forward-looking statements, due to a variety of factors.

These factors, include, but are not limited to, the ability to obtain regulatory approvals and meet other closing conditions to

the Proposed Transaction, including approval by Landrum’s shareholders on the expected terms and schedule, delay in closing

the Proposed Transaction, difficulties and delays in integrating the Landrum business or fully realizing cost savings and other

benefits of the Proposed Transaction, business disruption following the Proposed Transaction, changes in interest rates and capital

markets, inflation, customer acceptance of the Company’s products and services, and other risk factors. Other relevant risk

factors may be detailed from time to time in the Company’s press releases and filings with the Securities and Exchange Commission

(the “SEC”). All forward-looking statements, expressed or implied, included in this communication are expressly qualified

in their entirety by the cautionary statements contained or referred to herein. Any forward-looking statement speaks only as of

the date of this communication, and the Company and Landrum undertake no obligation, and specifically decline any obligation, to

revise or update these forward-looking statements, whether as a result of new information, future developments or otherwise.

Additional Information

and Where to Find It

This communication does not constitute

an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to

the Proposed Transaction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the

Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

In connection with the Proposed Transaction,

the Company will file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include

a proxy statement of Landrum and a prospectus of the Company (the “Proxy Statement/Prospectus”), and the Company may

file with the SEC other relevant documents concerning the Proposed Transaction. The definitive Proxy Statement/Prospectus will

be mailed to shareholders of Landrum.

Shareholders are urged to read the Registration Statement

and the Proxy Statement/Prospectus regarding the Proposed Transaction carefully and in their entirety when it becomes available

and any other relevant documents filed with the SEC by the Company, as well as any amendments or supplements to those documents,

because they will contain important information about the Proposed Transaction.

Free copies of the Proxy Statement/Prospectus,

as well as other filings containing information about the Company, may be obtained at the SEC’s Internet site (http://www.sec.gov),

when they are filed by the Company. You will also be able to obtain these documents, when they are filed, free of charge, from

the Company at www.simmonsbank.com under the heading “Investor Relations.” Copies of the Proxy Statement/Prospectus

can also be obtained, when it becomes available, free of charge, by directing a request to Simmons First National Corporation,

501 Main Street, Pine Bluff, Arkansas 71601, Attention: Stephen C. Massanelli, Investor Relations Officer, Email: steve.massanelli@simmonsbank.com

or ir@simmonsbank.com, Telephone: (870) 541-1000 or to The Landrum Company, 801 East Broadway, Columbia, Missouri, 65201, Attention:

Kevin Gibbens, CEO, Telephone: (800) 618-5503.

Participants in the Solicitation

The Company, Landrum and certain of its

directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders

of Landrum in connection with the Proposed Transaction. Information about the Company’s directors and executive officers

is available in its proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on March 12, 2019.

Information regarding all of the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation

and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement/Prospectus

regarding the Proposed Transaction and other relevant materials to be filed with the SEC when they become available. Free copies

of these documents may be obtained as described in the preceding paragraph.

Frequently Asked Questions

If you cannot find your question below, please email Questions@landmarkbank.com.

What is happening?

The Landrum Company has entered into a definitive agreement

and plan of merger with Simmons First National Corporation. Under the agreement, Landrum will merge with and into Simmons, with

Simmons as the surviving corporation, subject to certain terms and conditions, including approval of the transaction by Landrum’s

shareholders. Simmons First National Corporation is the parent company of Simmons Bank, and as you know, the Landrum Company is

the parent company of Landmark Bank. Following completion of the holding company merger, Landmark Bank is expected to continue

operations as a separate bank subsidiary of Simmons First National Corporation for an interim period until it is merged with and

into Simmons Bank.

Landmark Bank has had great success, especially in the last

10 years; for example, we’ve been recognized by nationwide organizations, such as American Banker and Forbes, and these awards

have been noticed by industry experts, larger banks, and potential investors. It became apparent that Landmark could be even more

successful as part of a larger bank with greater resources. Simmons is a great fit for our customers and our banker culture.

Why Simmons?

Simmons Bank is a highly successful financial institution with

assets of nearly $18 billion. Just five years ago they were roughly our size but have accomplished rapid growth over the past several

years.

They have over 200 locations across 8 states (Arkansas, Tennessee,

Missouri, Illinois, Kansas, Oklahoma Colorado and Texas). They are in large and small markets, just as we are.

We view this as a good opportunity for the bank. To combine

and invest with a larger partner allows us to take better care of our customers, bankers, and shareholders. This combination will

allow us to gain scale to afford new technology and to offer improved products and larger loan limits.

Simmons has an amazing focus on their customers with relationship

building, capabilities to serve as a one-stop shop for financial resources and an impressive digital roadmap to mention a few.

They also passionately care about their employees. All these factors were very important when Landmark Bank considered joining

their team.

Simmons has provided a website with more information about themselves.

We encourage you to review this website in-depth and to check back frequently as new materials will be added over time with information

on Simmons’ customers, benefits and culture.

Is Simmons Bank a state or nationally chartered bank?

Simmons Bank is an Arkansas state-chartered bank and member

bank of the Federal Reserve.

What is the timeline?

Following the announcement of the definitive agreement on July

31, 2019, the focus will be on preparing for shareholder meetings, and the satisfaction of the closing conditions, as well as evaluating

how best to integrate the two banking organizations. The acquisition is expected to close in the fourth quarter of 2019. At that

time, Landmark Bank will officially become a subsidiary of Simmons First National Corporation. The major conversion of all systems

(including Bankway) and merger of Landmark Bank with and into Simmons Bank is targeted for the first half of 2020.

Did we do something wrong?

Absolutely not. In fact, it’s just the opposite. We built

a great franchise and should all be proud that our efforts are being recognized by a much larger, high-performing regional community

bank like Simmons. Each of our bankers had a significant impact on making Landmark Bank so desirable.

Will my job change?

Initially all our jobs will stay the same. We will serve our

customers and continue to run the bank with our same level of excellence.

Eventually, yes, all of our jobs will change. The changes could

include new products, systems, and goals to serve our customers. The change for some individuals will be significant, as Simmons

asks us to transition to different responsibilities. These answers are not determined yet, and we will work through them together.

Will I have a job?

All our Landmark bankers are valued employees, and we want you

to stay with us to work through this transition and identify potential roles within the Simmons Bank organization. Simmons Bank

leaders are impressed by our bankers’ talents and are excited about this great new pool of bankers to add to their employee

base. Be patient and give yourself the best possible opportunity to evaluate your options as decisions are made and they become

known to you.

What will happen to my medical benefits?

It is currently expected that medical benefits will remain the

same under Landmark Bank plans until 12-31-2019, and starting January 1, 2020, bankers will migrate to the Simmons Bank medical

plan. Details for their plans will be made available on the website , but keep in mind that they could change for 2020 as, similar

to Landmark Bank, benefits are renewed with providers annually.

What will happen to my retirement plans?

You can rest assured that your retirements funds are safe and

that you will receive the vested balance in your retirement plans after all of The Landrum Company retirement plans are terminated

in connection with the closing of the transaction. Your plan balance will be made available to you, and you will have options to

transfer it to another tax-qualified plan. Each of TLC’s plans has unique aspects to it so beginning in August, the Financial

Well-Being program and the Private Client Group will team up to host informational sessions for you to learn more about how to

plan for this event and the options available to you.

If I have specific benefit questions, whom do I call?

You can contact AskHR@simmonsbank.com for any questions about

Simmons benefits. For questions about Landmark benefits, a senior manager in the Human Resources department is available to help

you.

Will I interview to retain my position?

Your opportunity to get to know the Simmons Bank leaders will

begin in the next few weeks. The process will vary among departments and positions. We do know that Simmons Bank has a history

of proactively matching new team members from acquired banks with opportunities throughout Simmons Bank. Stay tuned to learn more

about this.

Will my incentive plan change?

Not initially and likely not for the remainder of 2019. As in

the past, all sales and incentive plans will be evaluated for their alignment with the strategic goals for the new year. You can

expect to receive communication about any changes to your 2020 plan, just as you have in the past.

What will happen to my vacation/sick leave?

Your paid time off balances will remain the same for 2019. Beginning

on January 1, 2020, we are planning for you to transition to the Simmons time-off program. You’ll learn more about it on

the website as those details become available. Simmons will grandfather years of service for time off purposes.

Will branches close? How many?

There are no initial plans to close any branches as part of

this acquisition. However, Landmark has had an ongoing practice of evaluating the branch network and from time-to-time we have

made the difficult decision to close a branch. We know that Simmons Bank handles these evaluations and decisions in a similar fashion.

What will happen to my customers?

Your customers can expect to do business with you in your location

just as they do today. Over time products and services will change—just as they have with Landmark over the years. In general,

customers can expect many more things to be the same than different.

Will my Line of Business and/or department change?

For the near-term, the lines of business and department will

not change. Over the longer term, it’s too soon to know. Each bank has a slightly different organization structure and structures

evolve over time. This will be true for Simmons Bank just as it has been true for Landmark Bank.

Will products change?

For the next few months, no product changes will occur. But

over time, all banks change products. We’ll learn about Simmons Bank’s plans to transition our customers at Conversion

(in 2020) as those plans are finalized.

What new products will we be able to offer to our customers?

Simmons Bank has an impressive technology roadmap, and we expect

that there will be new products available to Landmark customers over time. While some may be available sooner, for the most part,

these will likely come after the systems conversion (projected to occur in the first half of 2020).

Will pricing change?

Not now. But all banks have somewhat unique pricing structures,

and over time all banks change pricing. We’ll learn about Simmons Bank’s plans to transition our customers at Conversion

as those plans are finalized.

What can/should I do?

Today, tomorrow, and every day after you should do your job

to the very best of your ability. Today and every day, we are here to assist our customers with their financial needs.

That

has not changed

. We owe it to our customers and each other to be responsive, positive, focused, and thorough in every interaction.

The best new opportunities always come to those who remain positive,

optimistic, and open to new experiences.

What will the new organization look like?

In many ways, it will look a lot like Landmark. It is uncanny

how similar certain aspects of the histories, strategies, and cultures of Simmons and Landmark appear to be. Of course, there will

be differences too. You’ll have many opportunities to get know Simmons Bank’s structure, philosophies and approach

to banking over the next several weeks.

When will the signs change?

There is not a specific date yet, but we expect this to occur

in the first half of 2020 in connection with the merger of Landmark Bank with and into Simmons Bank.

When will the bank name change?

Following the merger of Landmark Bank with and into Simmons

Bank (which is expected to occur in the first half of 2020), banking business will be conducted in Simmons Bank’s name.

When will we fully stop using the Landmark Bank name?

Following the merger of Landmark Bank with and into Simmons

Bank (which is expected to occur in the first half of 2020), banking business will be conducted in Simmons Bank’s name.

When will customers know?

Many customers and community members will learn about this news

from the press release dated July 31, 2019 and stories in local news outlets and online. Others will likely miss the news. For

most customers, the announcement won’t be a very big deal because very little will change until the official transition,

beginning later this year. After that time, customers will begin to see branding and other changes.

Does Simmons Bank use Bankway?

No. Simmons Bank has a different core system. We expect to convert

to the Simmons Bank core platform in early 2020.

Will customers get new debit cards, checks, etc.? If so,

when?

All of these details will be determined over the next few months.

For now, customers will continue to use Landmark Bank cards and checks. It is too soon to know if or when new cards and checks

will be issued, but once we know, you’ll be kept up-to-date. Most likely it will be in conjunction with the merger of Landmark

Bank with and into Simmons Bank in the first half of 2020.

What will be the share exchange ratio between Simmons and

The Landrum Company stock?

Based on the current shares outstanding, each share of Landrum

common stock will convert into the right to receive approximately 25.5 shares of Simmons common stock, subject to certain conditions

and potential adjustments.

What if I’m approached by a reporter?

Please direct all external media to our Marketing department

as is our standard procedure.

Forward Looking

Statements

Statements in this communication

may not be based on historical facts and are “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements may be identified by reference to a future period(s) or by the

use of forward-looking terminology, such as “anticipate,” “estimate,” “expect,” “foresee,”

“may,” “might,” “will,” “would,” “could” or “intend,” future

or conditional verb tenses, and variations or negatives of such terms. These forward-looking statements include, without limitation,

statements relating to the expected impact of the proposed transaction between Simmons First National Corporation (“Company”)

and The Landrum Company (“Landrum”) (the “Proposed Transaction”) on the combined entities operations, financial

condition, and financial results, and the expectations regarding the ability of the Company and Landrum to successfully integrate

the combined businesses and the amount of cost savings and other benefits that are expected to be realized as a result of the Proposed

Transaction. Readers are cautioned not to place undue reliance on the forward-looking statements contained in this communication

in that actual results could differ materially from those indicated in such forward-looking statements, due to a variety of factors.

These factors, include, but are not limited to, the ability to obtain regulatory approvals and meet other closing conditions to

the Proposed Transaction, including approval by Landrum’s shareholders on the expected terms and schedule, delay in closing

the Proposed Transaction, difficulties and delays in integrating the Landrum business or fully realizing cost savings and other

benefits of the Proposed Transaction, business disruption following the Proposed Transaction, changes in interest rates and capital

markets, inflation, customer acceptance of the Company’s products and services, and other risk factors. Other relevant risk

factors may be detailed from time to time in the Company’s press releases and filings with the Securities and Exchange Commission

(the “SEC”). All forward-looking statements, expressed or implied, included in this communication are expressly qualified

in their entirety by the cautionary statements contained or referred to herein. Any forward-looking statement speaks only as of

the date of this communication, and the Company and Landrum undertake no obligation, and specifically decline any obligation, to

revise or update these forward-looking statements, whether as a result of new information, future developments or otherwise.

Additional Information

and Where to Find It

This communication does not constitute

an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to

the Proposed Transaction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the

Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

In connection with the Proposed Transaction,

the Company will file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include

a proxy statement of Landrum and a prospectus of the Company (the “Proxy Statement/Prospectus”), and the Company may

file with the SEC other relevant documents concerning the Proposed Transaction. The definitive Proxy Statement/Prospectus will

be mailed to shareholders of Landrum.

Shareholders are urged to read the Registration Statement

and the Proxy Statement/Prospectus regarding the Proposed Transaction carefully and in their entirety when it becomes available

and any other relevant documents filed with the SEC by the Company, as well as any amendments or supplements to those documents,

because they will contain important information about the Proposed Transaction.

Free copies of the Proxy Statement/Prospectus,

as well as other filings containing information about the Company, may be obtained at the SEC’s Internet site (http://www.sec.gov),

when they are filed by the Company. You will also be able to obtain these documents, when they are filed, free of charge, from

the Company at www.simmonsbank.com under the heading “Investor Relations.” Copies of the Proxy Statement/Prospectus

can also be obtained, when it becomes available, free of charge, by directing a request to Simmons First National Corporation,

501 Main Street, Pine Bluff, Arkansas 71601, Attention: Stephen C. Massanelli, Investor Relations Officer, Email: steve.massanelli@simmonsbank.com

or ir@simmonsbank.com, Telephone: (870) 541-1000 or to The Landrum Company, 801 East Broadway, Columbia, Missouri, 65201, Attention:

Kevin Gibbens, CEO, Telephone: (800) 618-5503.

Participants in the Solicitation

The Company, Landrum and certain of its

directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders

of Landrum in connection with the Proposed Transaction. Information about the Company’s directors and executive officers

is available in its proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on March 12, 2019.

Information regarding all of the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation

and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement/Prospectus

regarding the Proposed Transaction and other relevant materials to be filed with the SEC when they become available. Free copies

of these documents may be obtained as described in the preceding paragraph.

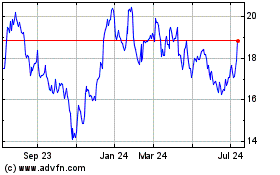

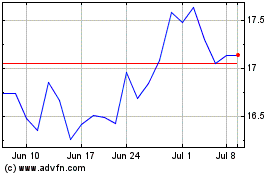

Simmons First National (NASDAQ:SFNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Simmons First National (NASDAQ:SFNC)

Historical Stock Chart

From Apr 2023 to Apr 2024