Filed by Simmons First National Corporation

pursuant to Rule 425 under the

Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the

Securities Exchange Act of 1934, as amended

Subject Company: The Landrum Company

Commission File Number: 000-06253

July 31, 2019, Message from Simmons First National Corporation

to Associates of The Landrum Company

Hello from Simmons,

Today marks an exciting milestone for both of our organizations,

and on behalf of Simmons’ associates, we are thrilled about the opportunity to join with you! We have enjoyed getting to

know the Landmark Bank leadership group and are extremely impressed by all that you and your team have been able to accomplish.

As The Landrum Company and Simmons First National Corporation, as well as Landmark Bank and Simmons Bank, prepare to come together,

we look forward to learning much from each other and creating an even stronger organization. Our combined organizations will provide

greater opportunities for our associates, our customers and our communities. Your customers will have access to more products,

more services, more lending power and more than 200 branch locations throughout Arkansas, Colorado, Illinois, Kansas, Missouri,

Oklahoma, Tennessee and Texas.

As part of Simmons’ commitment to our associates, we look

forward to answering your questions and helping ensure a smooth transition. We value your input, your passion and your collaboration

as we continue our journey to build a better bank.

If you are interested in learning more about Simmons and our

company culture, please visit our welcome page. We’ll be providing regular updates, and we encourage you to reference it

often during the transition period. We recognize the key to any successful merger is to keep everyone informed and engaged, and

we want an open line of communication going both ways.

Until our banks are merged, your customers will continue to

do their banking with Landmark as they normally do. There will be several customer communication pieces to keep them informed along

the way. All of this will be shared with you as details are finalized.

You have our commitment to making this transition as smooth

as possible for everyone involved. We look forward to our success together.

Sincerely,

|

|

|

|

George A. Makris, Jr.

|

|

Marty D. Casteel

|

|

Chairman & Chief Executive Officer

|

|

President & Chief Executive Officer

|

|

Simmons First National Corporation

|

|

Simmons Bank

|

Forward Looking

Statements

Statements in this communication

may not be based on historical facts and are “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements may be identified by reference to a future period(s) or by the

use of forward-looking terminology, such as “anticipate,” “estimate,” “expect,” “foresee,”

“may,” “might,” “will,” “would,” “could” or “intend,” future

or conditional verb tenses, and variations or negatives of such terms. These forward-looking statements include, without limitation,

statements relating to the impact Simmons First National Corporation (“Company”) expects the proposed transaction with

The Landrum Company (“Landrum”) (the “Proposed Transaction”) to have on the combined entities operations,

financial condition, and financial results, and the Company’s expectations about its ability to successfully integrate the

combined businesses and the amount of cost savings and other benefits the Company expects to realize as a result of the Proposed

Transaction. Readers are cautioned not to place undue reliance on the forward-looking statements contained in this communication

in that actual results could differ materially from those indicated in such forward-looking statements, due to a variety of factors.

These factors, include, but are not limited to, the ability to obtain regulatory approvals and meet other closing conditions to

the Proposed Transaction, including approval by Landrum’s shareholders on the expected terms and schedule, delay in closing

the Proposed Transaction, difficulties and delays in integrating the Landrum business or fully realizing cost savings and other

benefits of the Proposed Transaction, business disruption following the Proposed Transaction, changes in interest rates and capital

markets, inflation, customer acceptance of the Company’s products and services, and other risk factors. Other relevant risk

factors may be detailed from time to time in the Company’s press releases and filings with the Securities and Exchange Commission

(the “SEC”). All forward-looking statements, expressed or implied, included in this communication are expressly qualified

in their entirety by the cautionary statements contained or referred to herein. Any forward-looking statement speaks only as of

the date of this communication, and the Company and Landrum undertake no obligation, and specifically decline any obligation, to

revise or update these forward-looking statements, whether as a result of new information, future developments or otherwise.

Additional Information

and Where to Find It

This communication does not constitute

an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to

the Proposed Transaction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the

Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

In connection with the Proposed Transaction,

the Company will file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include

a proxy statement of Landrum and a prospectus of the Company (the “Proxy Statement/Prospectus”), and the Company may

file with the SEC other relevant documents concerning the Proposed Transaction. The definitive Proxy Statement/Prospectus will

be mailed to shareholders of Landrum.

Shareholders are urged to read the Registration Statement

and the Proxy Statement/Prospectus regarding the Proposed Transaction carefully and in their entirety when it becomes available

and any other relevant documents filed with the SEC by the Company, as well as any amendments or supplements to those documents,

because they will contain important information about the Proposed Transaction.

Free copies of the Proxy Statement/Prospectus,

as well as other filings containing information about the Company, may be obtained at the SEC’s Internet site (http://www.sec.gov),

when they are filed by the Company. You will also be able to obtain these documents, when they are filed, free of charge, from

the Company at www.simmonsbank.com under the heading “Investor Relations.” Copies of the Proxy Statement/Prospectus

can also be obtained, when it becomes available, free of charge, by directing a request to Simmons First National Corporation,

501 Main Street, Pine Bluff, Arkansas 71601, Attention: Stephen C. Massanelli, Investor Relations Officer, Email: steve.massanelli@simmonsbank.com

or ir@simmonsbank.com, Telephone: (870) 541-1000 or to The Landrum Company, 801 East Broadway, Columbia, Missouri, 65201, Attention:

Kevin Gibbens, CEO, Telephone: (800) 618-5503.

Participants in the Solicitation

The Company, Landrum

and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies

from the shareholders of Landrum in connection with the Proposed Transaction. Information about the Company’s directors and

executive officers is available in its proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC

on March 12, 2019. Information regarding all of the persons who may, under the rules of the SEC, be deemed participants in the

proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained

in the Proxy Statement/Prospectus regarding the Proposed Transaction and other relevant materials to be filed with the SEC when

they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

July 31, 2019, Message from Simmons First National Corporation

to Its Associates

As we continue in our growth, today marks another milestone

for the Simmons family. I am excited to announce a signed agreement to acquire The Landrum Company, including its wholly-owned

subsidiary, Landmark Bank.

Landmark was established in 1865. In the early 1900s, an enterprising

businessman, Marquis Lafayette Landrum, purchased the small bank in Mountain View, Missouri. Since then, the Landrum family has

been building their banking organization for four generations. Today, Landmark Bank is an over $3 billion banking franchise. With

nearly 40 branches in Missouri, Oklahoma and Texas, this merger will strengthen our market share and bring forth additional opportunities

in these areas of our footprint and beyond.

If you receive questions from the media, please direct them

to Caroline Makris (caroline.makris@simmonsbank.com or 501-377-7615) or Elizabeth Machen (elizabeth.machen@simmonsbank.com or 501-377-7652).

Thank you for your continued hard work and dedication. I am

excited about the opportunities this merger presents and look forward to our continued success.

Sincerely,

George A. Makris, Jr.

Chairman & Chief Executive Officer

Simmons First National Corporation

Forward Looking

Statements

Statements in this communication

may not be based on historical facts and are “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements may be identified by reference to a future period(s) or by the

use of forward-looking terminology, such as “anticipate,” “estimate,” “expect,” “foresee,”

“may,” “might,” “will,” “would,” “could” or “intend,” future

or conditional verb tenses, and variations or negatives of such terms. These forward-looking statements include, without limitation,

statements relating to the impact Simmons First National Corporation (“Company”) expects the proposed transaction with

The Landrum Company (“Landrum”) (the “Proposed Transaction”) to have on the combined entities operations,

financial condition, and financial results, and the Company’s expectations about its ability to successfully integrate the

combined businesses and the amount of cost savings and other benefits the Company expects to realize as a result of the Proposed

Transaction. Readers are cautioned not to place undue reliance on the forward-looking statements contained in this communication

in that actual results could differ materially from those indicated in such forward-looking statements, due to a variety of factors.

These factors, include, but are not limited to, the ability to obtain regulatory approvals and meet other closing conditions to

the Proposed Transaction, including approval by Landrum’s shareholders on the expected terms and schedule, delay in closing

the Proposed Transaction, difficulties and delays in integrating the Landrum business or fully realizing cost savings and other

benefits of the Proposed Transaction, business disruption following the Proposed Transaction, changes in interest rates and capital

markets, inflation, customer acceptance of the Company’s products and services, and other risk factors. Other relevant risk

factors may be detailed from time to time in the Company’s press releases and filings with the Securities and Exchange Commission

(the “SEC”). All forward-looking statements, expressed or implied, included in this communication are expressly qualified

in their entirety by the cautionary statements contained or referred to herein. Any forward-looking statement speaks only as of

the date of this communication, and the Company and Landrum undertake no obligation, and specifically decline any obligation, to

revise or update these forward-looking statements, whether as a result of new information, future developments or otherwise.

Additional Information

and Where to Find It

This communication does not constitute

an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to

the Proposed Transaction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the

Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

In connection with the Proposed Transaction,

the Company will file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include

a proxy statement of Landrum and a prospectus of the Company (the “Proxy Statement/Prospectus”), and the Company may

file with the SEC other relevant documents concerning the Proposed Transaction. The definitive Proxy Statement/Prospectus will

be mailed to shareholders of Landrum.

Shareholders are urged to read the Registration Statement

and the Proxy Statement/Prospectus regarding the Proposed Transaction carefully and in their entirety when it becomes available

and any other relevant documents filed with the SEC by the Company, as well as any amendments or supplements to those documents,

because they will contain important information about the Proposed Transaction.

Free copies of the Proxy Statement/Prospectus,

as well as other filings containing information about the Company, may be obtained at the SEC’s Internet site (http://www.sec.gov),

when they are filed by the Company. You will also be able to obtain these documents, when they are filed, free of charge, from

the Company at www.simmonsbank.com under the heading “Investor Relations.” Copies of the Proxy Statement/Prospectus

can also be obtained, when it becomes available, free of charge, by directing a request to Simmons First National Corporation,

501 Main Street, Pine Bluff, Arkansas 71601, Attention: Stephen C. Massanelli, Investor Relations Officer, Email: steve.massanelli@simmonsbank.com

or ir@simmonsbank.com, Telephone: (870) 541-1000 or to The Landrum Company, 801 East Broadway, Columbia, Missouri, 65201, Attention:

Kevin Gibbens, CEO, Telephone: (800) 618-5503.

Participants in the Solicitation

The Company, Landrum and certain of its directors, executive

officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Landrum in connection

with the Proposed Transaction. Information about the Company’s directors and executive officers is available in its proxy

statement for its 2019 annual meeting of stockholders, which was filed with the SEC on March 12, 2019. Information regarding all

of the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their

direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement/Prospectus regarding

the Proposed Transaction and other relevant materials to be filed with the SEC when they become available. Free copies of these

documents may be obtained as described in the preceding paragraph.

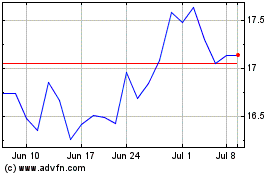

Simmons First National (NASDAQ:SFNC)

Historical Stock Chart

From Aug 2024 to Sep 2024

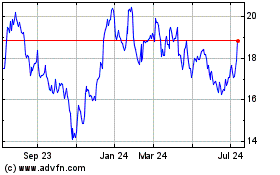

Simmons First National (NASDAQ:SFNC)

Historical Stock Chart

From Sep 2023 to Sep 2024