PORTERVILLE, Calif., July 24 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced record financial results for the second quarter and first

half of 2006. Net income for the second quarter was $5.1 million, a

36% increase relative to the second quarter of the prior year.

Diluted earnings per share were $0.50 for the quarter, an increase

of 39% in comparison to diluted earnings per share of $0.36 in the

second quarter of 2005. Net income for the first half was $9.5

million, also a 36% increase compared to the prior year. Diluted

earnings per share for the half were $0.93, which is 39% higher

than in the first half of 2005. Sierra Bancorp generated a second

quarter return on average equity of 24.7% in 2006 versus 20.2% in

2005, while return on assets was 1.8% for the second quarter of

2006 as compared to 1.5% in the second quarter of 2005. The

Company's return on average equity was 23.6% in the first half of

2006 compared to 19.3% in the same period last year, and its return

on average assets was 1.8% in the first half of 2006 and 1.4% in

the first half of 2005. "We're delighted with the high level of

performance achieved thus far in 2006," commented James C. Holly,

President and CEO. "A variety of factors have contributed," Holly

explained, "but underpinning our growth and profitability are a

culture of innovation and flexibility and the efforts of a

highly-motivated and well-qualified staff. We will continue to

promote a positive team environment for our employees going

forward, which we expect will have a favorable impact on customer

service and will ultimately benefit our shareholders." Financial

Highlights The Company's improved operating results in 2006 are

primarily due to higher net interest income resulting from growth

in average earning assets and an elevated net interest margin.

Average interest-earning assets were $107 million higher in the

second quarter of 2006 than in the second quarter of 2005, and $82

million higher in the first half of 2006 than in the first half of

2005. The increase is due almost exclusively to organic growth in

commercial and real-estate loan and lease balances. The Company's

net interest margin was 5.73% for the second quarter of 2006 versus

5.49% in the second quarter of 2005, and 5.78% in the first half of

2006 as compared to 5.46% in the first half of 2005. The Company's

balance sheet is asset-sensitive, and the net interest margin tends

to increase as short-term interest rates rise. The net interest

margin was also favorably impacted by a drop in non-performing

assets, which declined to $737,000 at June 30, 2006 from $5.8

million at June 30, 2005. Partially offsetting these positive

factors is the fact that loan growth in 2006 has been funded by

relatively high-cost brokered deposits and borrowed money. Although

strong loan growth and an expanding net interest margin were key

factors in the Company's performance, growth in non-interest income

and a slight drop in non-interest operating expenses also

contributed. Non-interest income grew by 23% for the quarter and

13% for the half, due principally to higher service charges on

deposits. The increase for the half was tempered by a $547,000 drop

in loan sale income caused by the bulk sale of $21 million in

mortgage loans at a gain of over $500,000 in the first quarter of

the prior year, although that quarter also includes a $330,000

write-down of the Company's investment in Diversified Holdings,

Inc., a title insurance holding company. Non-interest expenses were

kept in check mainly because of lower marketing, consulting, legal,

and audit costs, and because the prior year includes a $200,000

charge to write-down a foreclosed property. Salaries and benefits

were about 4% higher for the quarter and the half, due to normal

annual increases and the addition of staff for our two newest

branches. The increase in salaries would have been higher if not

for the deferral of loan origination costs, which increased by

$228,000, or 26%, for the quarter, and by $405,000, or 25%, for the

half. Occupancy expense increased by 7% for the quarter and 5% for

the half, also as the result of the new branches. To provide

consistency with 2006 financial reporting there were several

reclassifications of 2005 income statement amounts, including but

not necessarily limited to the following: Dividends received on

restricted stock totaling $128,000 for the quarter and the half

were moved out of interest income and into other non-interest

income; late charge income of $50,000 for the quarter and $102,000

for the half was reclassified from service charges on deposits to

other non-interest income; the $330,000 write-down of Diversified

Holdings was reclassified from a loss on investment to a reduction

of other non-interest income; and tax credit partnership losses

totaling $293,000 for the quarter and $484,000 for the half were

reclassified from other non- interest expenses to a reduction of

other non-interest income. During the second quarter of 2006 gross

loan and lease balances grew by $40 million, or 5%, which comes on

the heels of a first quarter increase of $54 million, or 7%. The

total increase in loan balances for the half was thus $94 million,

or 13%, most of which was in real-estate loans and commercial

loans. Management anticipates that loan growth will taper off in

the latter half of the year, to approximately $7 million to $10

million per month. Total non-performing assets declined slightly,

from $842,000 at the end of 2005 to $737,000 at June 30, 2006.

While other real estate owned dropped to zero, non-accruing loans

more than doubled during the period due to the addition of an

unsecured loan of close to $500,000. The collection potential of

the loan is currently in question, thus it has been fully reserved.

Despite this addition, total non-performing assets remain

relatively low at 0.06% of total assets, as compared to 0.58% a

year ago. Net charge-offs also increased to $820,000 for the

quarter and $903,000 for the half, due primarily to the second

quarter charge-off of one $400,000 commercial loan where the

borrower was not able to provide sufficient evidence of ability to

repay principal. Management does not feel that these events are

indicative of declining credit quality in the loan portfolio as a

whole. Aggregate deposit balances increased by $16 million, or 2%,

from the end of 2005 to June 30, 2006. Time certificates of deposit

increased by $6 million during the half, but would have dropped by

$25 million if not for the addition of $31 million in brokered

deposits. Non-interest demand deposits were down by about $10

million, and combined NOW/savings deposits fell by about $8

million. Money market account balances, on the other hand,

increased by $27 million, due mainly to growth in the Company's new

on-balance sheet sweep account. The remainder of the funding for

the Company's first half loan growth came in the form of other

borrowed money: Overnight borrowings from correspondent banks and

the Federal Home Loan Bank (FHLB) increased by $27 million; other

FHLB borrowings increased by a net $41 million; and junior

subordinated debentures increased by $15 million. The increase in

junior subordinated debentures is related to the recent issuance of

trust-preferred securities (TRUPS) by Sierra Capital Trust III, a

wholly-owned trust subsidiary of the Company. These recently-issued

TRUPS will likely be used to retire higher- cost TRUPS that were

issued in late 2001 and become callable in December 2006. "Our

financial performance this year has been considerably better than

originally anticipated, largely because of the relatively rapid

growth in earning assets in the first half of the year," stated Ken

Taylor, Executive Vice President and Chief Financial Officer.

"While not discouraging loan growth for the remainder of the year,

we have been shifting more energy toward core deposits in an effort

to promote more balanced growth," Taylor noted. He explained that a

new on-balance sheet sweep product, an enhanced deposit product

line-up, the anticipated addition of remote deposit capture

capabilities in the latter half of the year, a deposit incentive

program for branch loan officers, and increased promotional efforts

should all contribute to future deposit growth. About Sierra

Bancorp Sierra Bancorp is the holding company for Bank of the

Sierra (http://www.bankofthesierra.com/), which is in its 29th year

of operations and is the largest independent bank headquartered in

the South San Joaquin Valley. The Company has $1.15 billion in

total assets and currently maintains twenty branch offices, an

agricultural credit center, and an SBA center. In June 2005, Sierra

Bancorp was added to the Russell 2000 index based on relative

growth in market capitalization. The statements contained in this

release that are not historical facts are forward-looking

statements based on management's current expectations and beliefs

concerning future developments and their potential effects on the

Company. Readers are cautioned not to unduly rely on forward

looking statements. Actual results may differ from those projected.

These forward- looking statements involve risks and uncertainties

including but not limited to the health of the national and

California economies, the Company's ability to attract and retain

skilled employees, customers' service expectations, the Company's

ability to successfully de ploy new technology and gain

efficiencies there from, the success of branch expansion, changes

in interest rates, loan portfolio performance, the Company's

ability to secure buyers for foreclosed properties, and other

factors detailed in the Company's SEC filings. CONSOLIDATED INCOME

STATEMENT (in $000's, unaudited) 3-Month Period Ended: 6-Month

Period Ended: 6/30/ 6/30/ % 6/30/ 6/30/ % 2006 2005 Change 2006

2005 Change Interest Income $19,864 $15,227 30.5% $37,883 $29,886

26.8% Interest Expense 5,744 3,078 86.6% 10,284 5,909 74.0% Net

Interest Income 14,120 12,149 16.2% 27,599 23,977 15.1% Provision

for Loan & Lease Losses 1,049 900 16.6% 2,099 1,900 10.5% Net

Int after Provision 13,071 11,249 16.2% 25,500 22,077 15.5% Service

Charges 1,519 1,307 16.2% 2,994 2,566 16.7% Loan Sale &

Servicing Income 7 9 -22.2% 20 567 -96.5% Other Non-Interest Income

1,320 1,006 31.2% 2,401 1,656 45.0% Gain (Loss) on Investments --

-- 0.0% -- -- 0.0% Total Non-Interest Income 2,846 2,322 22.6%

5,415 4,789 13.1% Salaries & Benefits 3,920 3,753 4.4% 8,111

7,819 3.7% Occupancy Expense 1,602 1,499 6.9% 3,150 2,996 5.1%

Other Non-Interest Expenses 2,688 2,962 -9.3% 5,298 5,943 -10.9%

Total Non-Interest Expense 8,210 8,214 0.0% 16,559 16,758 -1.2%

Income Before Taxes 7,707 5,357 43.9% 14,356 10,108 42.0% Provision

for Income Taxes 2,608 1,606 62.4% 4,807 3,096 55.3% Net Income

$5,099 $3,751 35.9% $9,549 $7,012 36.2% Tax Data Tax-Exempt Muni

Income $515 $363 42.0% $990 $697 42.1% Tax-Exempt BOLI Income $251

$108 132.9% $436 $361 20.7% Interest Income - Fully Tax Equiv

$20,141 $15,414 30.7% $38,416 $30,245 27.0% Net Charge-Offs

(Recoveries) $820 $(232) $903 $(41) PER SHARE DATA 3-Month Period

Ended: 6-Month Period Ended: (unaudited) 6/30/ 6/30/ % 6/30/ 6/30/

% 2006 2005 Change 2006 2005 Change Basic Earnings per Share $0.52

$0.38 36.8% $0.98 $0.72 36.1% Diluted Earnings per Share $0.50

$0.36 38.9% $0.93 $0.67 38.8% Common Dividends $0.13 $0.11 18.2%

$0.26 $0.22 18.2% Wtd. Avg. Shares Outstanding 9,765,599 9,813,400

9,759,300 9,768,676 Wtd. Avg. Diluted Shares 10,269,671 10,408,054

10,270,221 10,396,971 Book Value per Basic Share (EOP) $8.55 $7.80

9.6% $8.55 $7.80 9.6% Tangible Book Value per Share (EOP) $7.99

$7.24 10.4% $7.99 $7.24 10.4% Common Shares Outstanding (EOP)

9,756,287 9,817,505 9,756,287 9,817,505 KEY FINANCIAL RATIOS

3-Month Period Ended: 6-Month Period Ended: (unaudited) 6/30/ 6/30/

6/30/ 6/30/ 2006 2005 2006 2005 Return on Average Equity 24.74%

20.17% 23.62% 19.27% Return on Average Assets 1.82% 1.50% 1.76%

1.41% Net Interest Margin (Tax-Equiv.) 5.73% 5.49% 5.78% 5.46%

Efficiency Ratio (Tax-Equiv.) 47.24% 56.14% 48.99% 56.77% Net C/O's

to Avg Loans (not annualized) 0.10% -0.03% 0.12% -0.01% AVERAGE

BALANCES (in $000's, unaudited) 3-Month Period Ended: 6-Month

Period Ended: 6/30/ 6/30/ % 6/30/ 6/30/ % 2006 2005 Change 2006

2005 Change Average Assets $1,121,145 $1,003,570 11.7% $1,091,353

$1,001,244 9.0% Average Interest- Earning Assets $1,008,499

$901,637 11.9% $981,010 $898,869 9.1% Average Gross Loans &

Leases $812,196 $691,656 17.4% $784,308 $692,216 13.3% Average

Deposits $824,058 $776,130 6.2% $818,839 $765,645 6.9% Average

Equity $82,668 $74,576 10.9% $81,514 $73,383 11.1% STATEMENT OF

CONDITION End of Period: (in $000's, unaudited) 6/30/2006

12/31/2005 6/30/2005 Annual Chg ASSETS Cash and Due from Banks

$49,444 $50,147 $37,335 32.4% Securities and Fed Funds Sold 191,867

193,676 210,643 -8.9% Agricultural 11,142 9,898 13,200 -15.6%

Commercial & Industrial 129,991 110,683 108,914 19.4% Real

Estate 606,656 537,182 498,247 21.8% SBA Loans 27,254 24,190 21,991

23.9% Consumer Loans 52,150 51,006 50,314 3.6% Consumer Credit Card

Balances 8,051 8,401 8,321 -3.2% Gross Loans & Leases 835,244

741,360 700,987 19.2% Deferred Loan Fees (3,077) (2,250) (1,306)

135.6% Loans & Leases Net of Deferred Fees 832,167 739,110

699,681 18.9% Allowance for Loan & Lease Losses (10,526)

(9,330) (10,783) -2.4% Net Loans & Leases 821,641 729,780

688,898 19.3% Bank Premises & Equipment 18,440 18,055 17,138

7.6% Other Assets 67,112 61,028 56,672 18.4% Total Assets

$1,148,504 $1,052,686 $1,010,686 13.6% LIABILITIES & CAPITAL

Demand Deposits $272,455 $282,451 $256,478 6.2% NOW / Savings

Deposits 133,267 140,989 142,136 -6.2% Money Market Deposits

133,922 107,045 118,336 13.2% Time Certificates of Deposit 291,685

285,186 266,740 9.4% Total Deposits 831,329 815,671 783,690 6.1%

Subordinated Debentures 46,392 30,928 30,928 50.0% Other

Interest-Bearing Liabilities 173,815 113,861 109,083 59.3% Total

Deposits & Int.-Bearing Liab. 1,051,536 960,460 923,701 13.8%

Other Liabilities 13,507 13,463 10,406 29.8% Total Capital 83,461

78,763 76,579 9.0% Total Liabilities & Capital $1,148,504

$1,052,686 $1,010,686 13.6% CREDIT QUALITY DATA End of Period: (in

$000's, unaudited) 6/30/2006 12/31/2005 6/30/2005 Annual Chg

Non-Accruing Loans $737 $309 $3,938 -81.3% Over 90 Days PD and

Still Accruing -- -- 1 -100.0% Other Real Estate Owned -- 533 1,899

-100.0% Total Non- Performing Assets $737 $842 $5,838 -87.4%

Non-Perf Loans to Total Loans 0.09% 0.04% 0.56% Non-Perf Assets to

Total Assets 0.06% 0.08% 0.58% Allowance for Ln Losses to Loans

1.26% 1.26% 1.54% OTHER PERIOD-END STATISTICS End of Period:

(unaudited) 6/30/2006 12/31/2005 6/30/2005 Shareholders Equity /

Total Assets 7.3% 7.5% 7.6% Loans / Deposits 100.5% 90.9% 89.4%

Non-Int. Bearing Dep. / Total Dep. 32.8% 34.6% 32.7% DATASOURCE:

Sierra Bancorp CONTACT: Ken Taylor, EVP/CFO, or Hope Attenhofer,

SVP/Marketing Director, both of Sierra Bancorp, +1-559-782-4900, or

888-454-BANK Web site: http://www.bankofthesierra.com/ Web site:

http://www.sierrabancorp.com/

Copyright

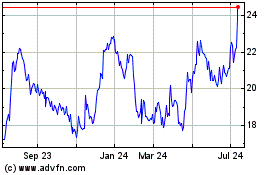

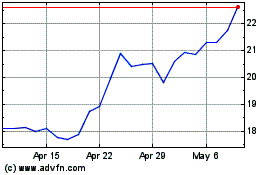

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jul 2023 to Jul 2024