Sierra Bancorp Closes $15 Million Trust Preferred Private Placement

June 16 2006 - 12:58PM

PR Newswire (US)

PORTERVILLE, Calif., June 16 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced the private issuance of $15 million in trust preferred

securities ("TRUPS") through a newly-established subsidiary, Sierra

Capital Trust III, as part of a pooled transaction with several

other financial institutions. The securities mature on September

23, 2036, and are callable at par after five years. They bear

interest at a quarterly adjustable rate of three-month LIBOR plus

1.40%. While these securities currently qualify as capital for

regulatory purposes, no assurance can be given that this capital

treatment will continue to apply in the future. James C. Holly,

President and Chief Executive Officer, noted that the proceeds will

likely be used to retire $15 million in TRUPS that become callable

in December 2006, after which the Company will continue to use its

TRUPS proceeds for general corporate purposes, including support

for the growth and expansion of Bank of the Sierra. The decision to

replace the Company's first issuance of TRUPS was driven by cost

considerations. "Rate spreads on trust preferred securities have

declined dramatically over the past several years, but have

recently started to increase and appear likely to climb further in

coming months. We thus felt it might be advantageous to 'pre-fund'

the anticipated replacement of our higher-cost TRUPS that become

callable later this year," Holly explained. Sierra Bancorp is the

holding company for Bank of the Sierra

(http://www.bankofthesierra.com/), which is in its 29th year of

operations and is the largest independent bank headquartered in the

South San Joaquin Valley. The Company has over $1.1 billion in

total assets and currently maintains twenty branch offices, an

agricultural credit center, and an SBA center. In June 2005, Sierra

Bancorp was added to the Russell 2000 index based on relative

growth in market capitalization. In its July 2005 edition, US

Banker magazine ranked Sierra Bancorp as the nation's 8th best

performing publicly-traded community bank based on three-year

average return on equity. The statements contained in this release

that are not historical facts are forward-looking statements based

on management's current expectations and beliefs concerning future

developments and their potential effects on the Company. Readers

are cautioned not to unduly rely on forward looking statements.

Actual results may differ from those projected. These forward-

looking statements involve risks and uncertainties including but

not limited to the health of the national and California economies,

the Company's ability to attract and retain skilled employees,

customers' service expectations, the Company's ability to

successfully de ploy new technology and gain efficiencies there

from, the success of branch expansion, changes in interest rates,

loan portfolio performance, the Company's ability to secure buyers

for foreclosed properties, and other factors detailed in the

Company's SEC filings. DATASOURCE: Sierra Bancorp CONTACT: Ken

Taylor, EVP/CFO of Sierra Bancorp, +1-559-782-4900 or

+1-888-454-BANK Web site: http://www.bankofthesierra.com/

Copyright

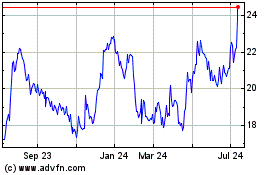

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2024 to Jul 2024

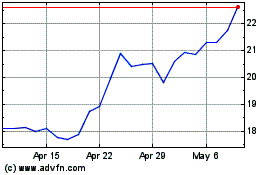

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jul 2023 to Jul 2024