UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

|

Date

of Report

(Date of earliest

event reported)

:

|

November

7, 2008

|

Republic

First Bancorp, Inc.

(Exact

name of registrant as specified in its charter)

|

Pennsylvania

(State

or other jurisdiction

of

incorporation)

|

000-17007

(Commission

File Number)

|

23-2486815

(I.R.S.

Employer

Identification

No.)

|

50

South 16th Street, Suite 2400, Philadelphia, PA 19102

(Address

of principal executive offices) (Zip code)

(215)-735-4422

(Registrant’s

telephone number, including area code)

Check the

appropriate box below if the Form 8-K is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following

provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities

Act

|

|

[

X

]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange

Act

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange

Act

|

Item

1.01 Entry into a Material Definitive Agreement.

On

November 7, 2008, Republic First Bancorp, Inc., a Pennsylvania corporation

(“Republic First”), the holding company of Republic First Bank, and Pennsylvania

Commerce Bancorp, Inc., a Pennsylvania corporation (“Pennsylvania Commerce”),

the holding company of Commerce Bank/Harrisburg, entered into an Agreement and

Plan of Merger (“merger agreement”). The merger agreement provides

that, upon the terms and subject to the conditions set forth in the merger

agreement, Republic First will merge with and into Pennsylvania Commerce, with

Pennsylvania Commerce continuing as the surviving corporation (the

“merger”). Following the merger, Republic First Bank and Commerce

Bank/Harrisburg will continue to operate as separate banking subsidiaries of the

surviving corporation. Each of the directors of Republic First has

entered into a voting agreement with Pennsylvania Commerce and each of the

directors of Pennsylvania Commerce has entered into a voting agreement with

Republic First, in each case to vote all of his shares of Republic First common

stock or Pennsylvania Commerce common stock, as applicable, for approval of the

merger agreement and merger.

At the

effective time and as a result of the merger, each issued and outstanding share

of the common stock, $0.01 par value per share, of Republic First will be

converted into the right to receive a fraction of a share of common stock, $1.00

par value per share, of Pennsylvania Commerce, based on the exchange ratio

calculated in accordance with the merger agreement. The exchange

ratio will equal $10 divided by an average closing price of Pennsylvania

Commerce’s common stock during a 20 trading day period prior to closing, subject

to a minimum exchange ratio of 0.34 and a maximum exchange ratio of

0.38. The exchange ratio will be subject to adjustment in the event

of stock splits, stock dividends, or similar events, and may be increased at

Pennsylvania Commerce’s option, in order to prevent a termination of the merger

agreement based on a significant decline in the market price of Pennsylvania

Commerce’s common stock. The merger is intended to constitute a

reorganization under the U.S. Internal Revenue Code and, as such, the receipt of

the merger consideration by Republic First’s shareholders will generally be

tax-free for U.S. federal income tax purposes. Upon consummation of

the merger, all outstanding options to acquire Republic First common stock and

all securities convertible into Republic First common stock, will be assumed by

Pennsylvania Commerce and be exercisable for or convertible into a number of

shares of Pennsylvania Commerce stock based on the exchange ratio.

The

initial board of directors of the surviving corporation will be comprised of

eight of Pennsylvania Commerce’s current directors and four of Republic First’s

current directors. It is a condition to the closing of the merger

that Harry D. Madonna, Chairman, President and Chief Executive Officer of

Republic First and Republic First Bank, enter into an employment agreement with

Pennsylvania Commerce which contemplates that Mr. Madonna will serve as Vice

Chairman of Pennsylvania Commerce’s Board of Directors and continue as President

and Chief Executive Officer of Republic First Bank.

Pennsylvania

Commerce and Republic First have made representations, warranties and covenants

in the merger agreement, including, among others, covenants to conduct their

respective businesses in the ordinary course consistent with past practice

between the execution of the merger agreement and consummation of the merger;

not to engage in certain kinds of transactions during this period; and to use

their reasonable best efforts to consummate the merger, including using their

reasonable best efforts to take all steps necessary to obtain required

regulatory approvals and third-party consents. They have also made

covenants to cause meetings of their shareholders to be held to consider

approval of the merger agreement and merger and for their boards of directors,

subject to certain exceptions, to recommend adoption and approval of the merger

agreement and merger to their respective shareholders. In addition,

Republic First has agreed that neither it nor its representatives will solicit

proposals relating to alternative mergers, acquisitions or similar transactions

or, subject to certain exceptions, enter into discussions or negotiations

concerning, or furnish non-public information in connection with, any such

alternative transactions.

Consummation

of the merger is subject to customary conditions, including approval of both

Republic First’s and Pennsylvania Commerce’s shareholders, the registration of

the offering by Pennsylvania Commerce of its common stock to the shareholders of

Republic First and the listing of such stock on the NASDAQ Stock Market, the

absence of any legal prohibition on consummation of the merger, obtaining

required regulatory approvals, the accuracy of the representations and

warranties (subject generally to a material adverse effect standard), the

material performance of all covenants, the absence of material adverse effects,

and the delivery of customary legal opinions as to the federal tax treatment of

the merger.

The

merger agreement contains certain termination rights for both Republic First and

Pennsylvania Commerce, and further provides that, upon termination of the merger

agreement under specified circumstances, Republic First may be required to pay

Pennsylvania Commerce a termination fee of $5 million.

The

foregoing description of the merger agreement does not purport to be complete

and is qualified in its entirety by reference to the merger agreement, which is

filed as Exhibit 2.1 hereto, and is incorporated into this report by

reference.

The

merger agreement, which has been included to provide investors with information

regarding its terms, contains representations and warranties of each of

Pennsylvania Commerce and Republic First. The assertions embodied in

those representations and warranties were made for purposes of the merger

agreement and are subject to qualifications and limitations agreed by the

respective parties in connection with the negotiation of the terms of the merger

agreement. In addition, certain representations and warranties were

made as of a specific date, may be subject to a contractual standard of

materiality different from that which an investor might view as material, or may

have been used for purposes of allocating risk between the respective parties,

rather than establishing matters as facts. Investors should read the

merger agreement together with the other information concerning Pennsylvania

Commerce and Republic First that each company publicly files in reports and

statements with the United States Securities and Exchange Commission (the

“SEC”).

Pennsylvania

Commerce and Republic First will be filing a proxy statement/prospectus and

other relevant documents concerning the merger with the SEC. WE URGE

INVESTORS TO READ THE PROXY STATEMENT/ PROSPECTUS AND ANY OTHER DOCUMENTS TO BE

FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN

THE PROXY STATEMENT/ PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. Investors will be able to obtain these documents free of

charge at the SEC’s web site (www.sec.gov). In addition, documents

filed with the SEC by Republic First will be available free of charge by request

to Republic First Bancorp, Inc., Attention: Linda Lewis, Two Liberty Place, 50

S. 16th Street, Suite 2400, Philadelphia, PA 19103, (215) 735-4422,

ext. 5332, and documents filed with the SEC by Pennsylvania Commerce will be

available free of charge by directing a request to Ms. Sherry Richart at

Pennsylvania Commerce Bancorp, Inc., 3801 Paxton Street, Harrisburg, PA, 17111

(telephone: 800-653-6104).

The

respective directors, executive officers, and certain other members of

management and employees of Republic First and Pennsylvania Commerce may be

participants in the solicitation of proxies in favor of the merger from the

respective shareholders of Republic First and Pennsylvania

Commerce. Information about the directors and executive officers of

Republic First is included in the proxy statement for its 2008 annual meeting of

shareholders, which was filed with the SEC on March 11, 2008, and the current

report on Form 8-K filed with the SEC on July 23, 2008. Information

about the directors and executive officers of Pennsylvania Commerce is set forth

in the proxy statement for Pennsylvania Commerce’s 2008 annual meeting of

shareholders, as filed with the SEC on April 23, 2008. Additional information

regarding the interests of such participants will be included in the proxy

statement/prospectus and the other relevant documents filed with the SEC when

they become available.

|

Item

9.01

|

Financial

Statements and Exhibits.

|

The

following exhibits are filed with this Form 8-K:

|

Exhibit

No.

|

Description

|

|

|

Agreement

and Plan of Merger, dated as of November 7, 2008, between Pennsylvania

Commerce Bancorp, Inc. and Republic First Bancorp,

Inc.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

REPUBLIC

FIRST BANCORP, INC.

|

|

Date: November

12, 2008

|

By:

Edward J.

Ryan

Edward J. Ryan

Acting Chief Financial

Officer

|

EXHIBIT

INDEX

|

Exhibit

No.

|

Description

|

|

|

Agreement

and Plan of Merger, dated as of November 7, 2008, between Pennsylvania

Commerce Bancorp, Inc. and Republic First Bancorp,

Inc.

|

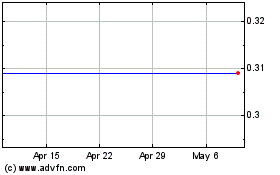

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From May 2024 to Jun 2024

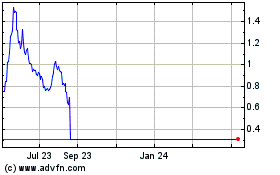

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2023 to Jun 2024