NOTES TO FINANCIAL STATEMENTS – DECEMBER 31, 2018 and 2017

NOTE 1 – PLAN DESCRIPTION

The following description of the Republic Bancorp Inc. 401(k) Retirement Plan (the “Plan”) is provided for general information. Participants should refer to the plan agreement for a complete description of the Plan’s provisions. The sponsor of the Plan is Republic Bancorp, Inc. (the “Company” or “Employer”).

General

: The Plan is a Safe-Harbor Qualified Automatic Enrollment Contribution Account (“QACA”) plan covering all eligible employees of the Company. The Plan allows for both traditional and Roth contributions. Employer matching contributions begin immediately upon eligibility to participate in the plan. All employees of the Company (and any participating affiliate), other than leased employees, non-resident aliens, employees covered by a collective bargaining agreement (unless the terms of the bargaining agreement otherwise provides), employees in co-op placements, other individuals who for any period are classified by the Company as independent contractors (regardless of any subsequent reclassification by the Company, a government agency or a court), and, employees employed in a temporary job classification, are eligible to participate in the Plan as soon as administratively feasible following their date of hire.

The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”).

Contributions

: Employees, as designated by the Plan, are eligible to participate in the Plan immediately upon employment. Unless otherwise elected, employees are automatically enrolled in the Plan following 30 days of employment with a pre-tax contribution rate of 6% of pay. Contributions are invested into the Plan’s default fund unless participant-directed investments are made. The deferral percentage automatically escalates 1% each year up to 10%, unless otherwise elected. Participants in the Plan may contribute up to the annual maximum legal limit, as defined by the IRS, including catch-up contributions on or after attaining age 50. If a participant elects to contribute to the Plan, the Employer shall make a safe-harbor enhanced matching contribution, as defined below. In addition, the Employer may award a discretionary bonus match to eligible participants for meeting certain corporate financial performance goals. For the years ended December 31, 2018 and 2017, discretionary bonus match of $392,000 and $335,000 was awarded.

Safe-Harbor Enhanced Matching Contribution — Each payroll period, the Employer shall make an enhanced matching contribution on behalf of each Employee participating in the Plan in an amount equal to: one hundred percent (100%) of the first one percent (1%) of the participant's compensation contributed as elective deferrals, plus seventy-five percent (75%) of the elective deferrals of such participant to the extent that such elective deferrals exceed one percent (1%), but do not exceed five percent (5%) of the participant's compensation.

Participant Accounts

: Each participant’s account is credited with the participant’s contribution, any applicable Employer matching or bonus contribution, and an allocation of plan earnings. Each participant’s account is also charged with withdrawals and an allocation of administrative expenses.

Forfeitures of terminated participants’ non-vested accounts are used to offset Plan expenses (including the Employer contributions). Income is allocated on a basis proportional to account balances. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Retirement, Death and Disability

: Participants are entitled to 100% of their account balance upon retirement (on or after attaining age 65), death, or permanent and total disability.

Vesting

: Participants are immediately vested in their contributions plus actual earnings thereon. Participants are 100% vested in the Company contributions plus earnings thereon, after two years of employment.

NOTE 1 – PLAN DESCRIPTION

(Continued)

Payment of Benefits upon Termination

: On termination of service, and depending on the account balance, a participant may receive a lump-sum amount equal to the value of their vested interest in the account. If a participant’s account balance exceeds $5,000, no portion of the account balance will be distributed without the participant’s consent. In addition, unless the participant makes a timely election to roll over their vested account to an eligible IRA or another eligible retirement plan, or elect to have their vested account distributed, balances equal to or less than $5,000 are automatically rolled over into a John Hancock IRA product outside of the Plan as soon as administratively possible.

Investment Options

: All investment accounts are participant directed to either a) investments offered through the Plan or b) other permissible investments by way of participant self-directed brokerage accounts (“Self-Directed”). Employer matching and bonus contributions are allocated ratably based on each participant’s contribution to their investment options.

Investments offered through the Plan include a guaranteed interest account, certain mutual funds, and shares of the Company’s common stock. Participants may adjust their allocation on these investments up to 20 times per calendar year and may direct employee contributions in 1% increments to a maximum of 75%.

Self-Directed investment options include any specific assets or investments permitted to be acquired by the trustee under the Plan. Self-Directed accounts are charged a transaction fee for any direct investments a participant makes, other than the investment options provided by the Plan.

Republic Bancorp, Inc. Common Stock

: The Class A Common shares are entitled to cash dividends equal to 110% of the cash dividend paid per share on Class B Common Stock. Class A Common shares have one vote per share and Class B Common shares have ten votes per share. Class B Common Stock may be converted, at the option of the holder, to Class A Common Stock on a share for share basis. The Class A Common Stock is not convertible into any other class of the Company’s capital stock. Class A and Class B shares participate equally in undistributed earnings.

Forfeitures

: As of December 31, 2018 and 2017, approximately $107,000 and $89,000 of forfeited employer matching contributions were available to offset future plan expenses including Employer contributions.

Notes Receivable from Participants

: Participants may borrow up to 50% of the value of their vested account balance (including any funds from rollovers into the Plan) if they experience one of the six Internal Revenue Service approved financial hardships. Participants may borrow a minimum of $350 up to a maximum of $50,000. Only one loan may be outstanding at one time. The highest outstanding balance for prior loans plus any new loans may not exceed $50,000 in a 12-month period. Loan repayment periods typically range from one to five years. The loan is secured by the balance in the participant's account and bears interest at the same rate throughout the life of the loan. The interest rate is fixed and is equal to the

The Wall Street Journal

Prime Rate on the day the loan is initiated. Principal and interest are paid through bi-weekly payroll deductions. A $100 loan-setup fee and an annual loan-maintenance fee of $24 are deducted from the participant’s account for each new loan.

Loan repayments may be suspended for up to one year in case of an approved leave of absence. Loans to participants on a leave of absence due to a qualified military leave will be automatically suspended for the period of the qualified military leave.

Participants who terminate employment at the time a loan is outstanding may be permitted to continue making loan payments, subject to the terms of the loan agreement and promissory note, or may choose to pay off the loan in full. Loan payments may be made electronically or by check.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

: The financial statements of the Plan are prepared under the accrual basis of accounting.

Estimates

: The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect assets, liabilities, and changes therein, and disclosures of contingent assets and liabilities.

Actual results could differ from those estimates.

Investment Valuation and Income Recognition

: The Plan’s investments, other than its fully benefit-responsive investment contract, are reported at fair value. Purchases and sales of securities are recorded on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex‑dividend date. Net appreciation (depreciation) includes the Plan’s gains and losses on investments bought and sold, as well as, held during the year.

Payment of Benefits

: Benefits are recorded when paid.

Risks and Uncertainties:

The Plan provides for various investment options such as a guaranteed interest account, certain mutual funds, shares of the Company’s stock, and other securities. The investments are exposed to various risks, such as interest rate, market, liquidity and credit risk. Due to the level of risk associated with certain investments and the level of uncertainty related to changes in the value of investments, it is at least reasonably possible that changes in the value of investments will occur in the near term and that such changes could materially affect the amounts reported in the Statements of Net Assets Available for Benefits and participants’ individual account balances.

Concentrations

: Republic Bancorp, Inc. common stock represented 11% and 11% of the Plan’s net assets available for benefits at December 31, 2018 and 2017. A change in the value of the Company’s common stock can cause the value of the Plan’s net assets available for benefits to change significantly due to this concentration.

Fully Benefit-Responsive Investment Contracts

: The Plan holds a direct interest in a fully benefit-responsive contract and reports this investment at contract value. Contract value represents contributions made to a contract, plus earnings, less participant withdrawals and administrative expenses. Participants in fully benefit-responsive contracts may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value.

Notes Receivable:

Loans are valued at unpaid principal plus accrued but unpaid interest. Delinquent participant loans are recorded as distributions based on the terms of the Plan. No allowance for loan losses was recorded at December 31, 2018 and 2017, as no loans were in default.

Administrative Expenses

– Plan participants pay administrative expenses incurred in connection with the operation of the Plan. Administrative expenses generally include management, consulting, and loan processing fees.

NOTE 3 – FAIR VALUE

Fair value is the price that would be received by the Plan for an asset or paid by the Plan to transfer a liability (an exit price) in an orderly transaction between market participants on the measurement date in the Plan’s principal or most advantageous market for the asset or liability. The effect of a change in valuation technique or its application on a fair value estimate is accounted for prospectively as a change in accounting estimate. When evaluating indications of fair value resulting from the use of multiple valuation techniques, the Plan is to select the point within the resulting range of reasonable estimates of fair value that is most representative of fair value under current market conditions. Fair value measurements are determined by maximizing the use of observable inputs and minimizing the use of unobservable inputs.

The hierarchy places the highest priority on unadjusted quoted market prices in active markets for identical assets or liabilities (level 1 measurements) and gives the lowest priority to unobservable inputs (level 3 measurements). The three levels of inputs within the fair value hierarchy are defined as follows:

Level 1: Quoted prices (unadjusted) for identical assets or liabilities in active markets that the Plan has the ability to access as of the measurement date.

Level 2: Significant other observable inputs other than level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3: Significant unobservable inputs that reflect the Plan’s own assumptions about the assumptions that market participants would use in pricing an asset or liability.

In some cases, a valuation technique used to measure fair value may include inputs from multiple levels of the fair value hierarchy. The lowest level of significant input determines the placement of the entire fair value measurement in the hierarchy.

The Plan recognizes transfers into and out of fair value hierarchy levels, if applicable, at the beginning of the period.

The following descriptions of the valuation methods and assumptions used by the Plan to estimate the fair values of investments apply to investments held directly by the Plan.

Mutual funds

: The fair values of mutual fund investments are determined by obtaining quoted prices on nationally recognized securities exchanges (level 1 inputs).

Common stock

: The fair values of Republic Bancorp, Inc. common stock and other common stocks are determined by obtaining quoted prices from nationally recognized exchanges (level 1 inputs).

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of

different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

NOTE 3 – FAIR VALUE

(Continued)

Investments measured at fair value on a recurring basis at December 31, 2018 and 2017 are summarized below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements at

|

|

|

|

|

|

|

|

December 31, 2018 Using:

|

|

|

|

|

|

|

|

Quoted Prices in

|

|

|

Significant

|

|

|

|

|

|

|

|

|

|

|

Active Markets

|

|

|

Other

|

|

|

Significant

|

|

|

|

|

|

|

|

for Identical

|

|

|

Observable

|

|

|

Unobservable

|

|

|

Total

|

|

|

|

|

Assets

|

|

|

Inputs

|

|

|

Inputs

|

|

|

Fair

|

|

|

|

|

(Level 1)

|

|

|

(Level 2)

|

|

|

(Level 3)

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant-Directed Investments, Other Than Self-Directed Brokerage Accounts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Republic Bancorp, Inc. Common Stock (Class A)

|

|

$

|

6,671,921

|

|

$

|

—

|

|

$

|

—

|

|

$

|

6,671,921

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

|

59,534,567

|

|

|

—

|

|

|

—

|

|

|

59,534,567

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant Self-Directed Brokerage Accounts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Republic Bancorp, Inc. Common Stock (Class A and B)

|

|

|

2,227,854

|

|

|

—

|

|

|

—

|

|

|

2,227,854

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Stocks

|

|

|

2,754,138

|

|

|

—

|

|

|

—

|

|

|

2,754,138

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

|

1,833,042

|

|

|

—

|

|

|

—

|

|

|

1,833,042

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

73,021,522

|

|

$

|

—

|

|

$

|

—

|

|

$

|

73,021,522

|

There were no transfers between Level 1 and Level 2 investments in 2018.

NOTE 3 – FAIR VALUE

(Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements at

|

|

|

|

|

|

|

|

December 31, 2017 Using:

|

|

|

|

|

|

|

|

Quoted Prices in

|

|

|

Significant

|

|

|

|

|

|

|

|

|

|

|

Active Markets

|

|

|

Other

|

|

|

Significant

|

|

|

|

|

|

|

|

for Identical

|

|

|

Observable

|

|

|

Unobservable

|

|

|

Total

|

|

|

|

|

Assets

|

|

|

Inputs

|

|

|

Inputs

|

|

|

Fair

|

|

|

|

|

(Level 1)

|

|

|

(Level 2)

|

|

|

(Level 3)

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant-Directed Investments, Other Than Self-Directed Brokerage Accounts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Republic Bancorp, Inc. Common Stock Class (Class A)

|

|

$

|

6,697,945

|

|

$

|

—

|

|

$

|

—

|

|

$

|

6,697,945

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

|

61,741,652

|

|

|

—

|

|

|

—

|

|

|

61,741,652

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant Self-Directed Brokerage Accounts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Republic Bancorp, Inc. Common Stock (Class A and B)

|

|

|

2,279,353

|

|

|

—

|

|

|

—

|

|

|

2,279,353

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Stocks

|

|

|

2,970,576

|

|

|

—

|

|

|

—

|

|

|

2,970,576

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

|

1,807,231

|

|

|

—

|

|

|

—

|

|

|

1,807,231

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

75,496,757

|

|

$

|

—

|

|

$

|

—

|

|

$

|

75,496,757

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

There were no transfers between Level 1 and Level 2 investments in 2017.

NOTE 4 – INVESTMENTS

John Hancock Trust Company LLC (“JHTC”) is the Plan Custodian and Trustee. The Custodian of the Plan held investment assets and executed transactions therein.

NOTE 5 – PARTY‑IN‑INTEREST TRANSACTIONS

Parties‑in‑interest are defined under the Department of Labor’s Rules and Regulations as any fiduciary of the Plan, any party rendering service to the Plan, the Employer, and certain others.

JHTC is the Custodian and Trustee as defined by the Plan and, therefore, transactions of the plan which are managed by affiliates of the Trustee qualify as party-in-interest transactions. Professional fees of approximately $348,000 and $285,000 were paid by the Plan to the Custodian for the years ended December 31, 2018 and 2017. Investment management fees and operating expenses charged to the Plan for investments are deducted from the assets held by the participant. Consequently, investment management fees and operating expenses paid to parties-in-interest are reflected as a reduction of investment return for such investments. The Plan also holds a guaranteed interest contract administered by New York Life Insurance Company (New York Life; Issuer).

IRON Financial LLC (“IRON”) performs investment consulting services for the Plan and qualifies as a party-in-interest. IRON’s fees for such services were $70,000 and $60,000 for the years ended December 31, 2018 and 2017. Such fees were not paid directly to IRON by the Plan but were remitted to IRON by JHTC from the previously mentioned amounts paid to JHTC during the years ended December 31, 2018 and 2017.

TD Ameritrade (“Ameritrade”) provides participant self-directed brokerage accounts associated with the Plan and is considered a party-in-interest. Ameritrade fees for advisory and management services were $80 and $140 for the years ended December 31, 2018 and 2017.

The Plan had outstanding notes receivable from participants totaling $205,000 and $137,000, respectively at December 31, 2018 and 2017.

The Plan held 229,850 and 2,648 shares of Republic Bancorp, Inc. Class A and Class B Common Stock, at December 31, 2018 and recorded dividend income and net realized gains of approximately $221,000 and $248,000 from its investments in the Employer’s common stock during the 2018 plan year. The Plan held 233,582 and 2,648 shares of Republic Bancorp, Inc. Class A and Class B Common Stock, at December 31, 2017 and recorded dividend income and net realized gains of approximately $207,000 and $70,000 from its investments in the Employer’s common stock during the 2017 plan year.

NOTE 6 – PLAN TERMINATION

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA and its related regulations. In the event of plan termination, participants will become 100% vested in their accounts.

NOTE 7 – INCOME TAX STATUS

The Internal Revenue Service has determined and informed the Company by a letter dated September 27, 2016, that the Plan and related trust are designed in accordance with applicable sections of the Internal Revenue Code (“IRC”). Although the Plan has been amended since receiving the determination letter, the plan administrator believes that the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2018 and 2017, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by various taxing authorities; however, there are currently no audits for any tax periods in progress. The plan administrator believes it is no longer subject to income tax examinations for years prior to and including 2014.

NOTE 8 – INVESTMENT CONTRACT WITH INSURANCE COMPANY

The Plan holds a fully benefit‑responsive investment contract with New York Life. New York Life maintains the contributions in its general account. New York Life’s general account is credited with contributions and earnings, including interest and dividends, on the underlying investments and is charged for participant withdrawals and administrative expenses. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investments at contract value. There are no reserves against contract value for credit risk of the Issuer or otherwise.

The terms of the contract prohibit transfer or assignment of rights under the contract and provide for all distributions at contract value, frequent re-setting of contractual interest rates based upon market conditions, no significant liquidity restrictions, and no defined maturities. Generally, there are no events that could limit the ability of the plan to transact at contract value and there are no events that allow the Issuer to terminate the contract and which require the Plan to settle at an amount different than contract value.

The Plan or New York Life can terminate the contract by providing written notice to the other party 30 days prior to the termination date. If the contract was terminated by the Plan or New York Life, interest would not be less than the minimum interest rate established in the investment contract. There may be a market value adjustment upon the Plan’s election to terminate the contract with a lump-sum distribution, which may result in a distribution that is less than or in excess of contract value.

The investment contract is considered a “traditional” contract, meaning that the Plan owns the contract itself and not the underlying assets of the investment contract.

The crediting interest rate of the contract is based on an agreed‑upon formula with the Issuer, as defined in the contract agreement, but cannot be less than 1%. Such interest rates are reviewed on a semi-annual basis for resetting. The key factors that influence future interest-crediting rates could include the following: the level of market interest rates; the amount and timing of participant contributions, transfers and withdrawals into/out of the contracts; and the duration of the underlying investments backing the contract.

REPUBLIC BANCORP INC. 401(k) RETIREMENT PLAN

SCHEDULE H, LINE 4i – SCHEDULE OF ASSETS (HELD AT END OF YEAR)

DECEMBER 31, 2018

Name of Plan Sponsor: Republic Bancorp, Inc.

Employer Identification Number: 61-0862051

Three Digit Plan Number: 001

|

|

|

|

|

|

|

|

(a)

|

(b)

|

(c)

|

(d)

|

|

(e)

|

|

|

|

|

|

|

|

|

Party

|

Identity of Issue,

|

|

|

|

|

|

in

|

Borrower, Lessor

|

|

|

|

Fair

|

|

Interest

|

or Similar Party

|

Description of Assets

|

Cost**

|

|

Value

|

|

|

|

|

|

|

|

|

|

Plan Investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Republic Bancorp, Inc.

|

Class A Common Stock

|

|

$

|

6,671,921

|

|

*

|

New York Life Insurance Co.

|

Guaranteed Interest Account

|

|

|

8,930,479

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds:

|

|

|

|

|

|

Wells Fargo

|

Government Money Market

|

|

|

519,996

|

|

|

TIAA-CREF

|

International Equity Index Fund (Institutional Class)

|

|

|

5,725,676

|

|

|

Federated

|

Federated Institutional High Yield Bond (Institutional Class)

|

|

|

616,930

|

|

|

Vanguard

|

GNMA Fund (Admiral Shares)

|

|

|

3,117,292

|

|

|

Vanguard

|

Total International Bond Index Fund (Admiral Shares)

|

|

|

245,701

|

|

|

Vanguard

|

Short Term Investment Grade (Admiral Shares)

|

|

|

1,309,197

|

|

|

Vanguard

|

Emerging Markets Stock Index Fund (Admiral Shares)

|

|

|

1,110,464

|

|

|

Vanguard

|

Growth Index Fund (Institutional Class)

|

|

|

11,106,800

|

|

|

Vanguard

|

Mid-Cap Index Fund (Institutional Class)

|

|

|

6,588,248

|

|

|

Vanguard

|

REIT Index Fund (Admiral Shares)

|

|

|

764,729

|

|

|

Vanguard

|

Small-Cap Index Fund (Institutional Class)

|

|

|

5,876,092

|

|

|

Vanguard

|

Value Index Fund (Institutional Class)

|

|

|

7,431,728

|

|

|

Vanguard

|

Vanguard Total Stock Mkt Inst (Institutional Class)

|

|

|

5,908,987

|

|

|

Vanguard

|

Vanguard Total Bond Index Inst (Institutional Class)

|

|

|

5,918,491

|

|

|

Vanguard

|

Vanguard Ultra-S-T Bond (Admiral Shares)

|

|

|

1,981,843

|

|

|

BlackRock

|

BlackRock Strategic Income Opps (Institutional Class)

|

|

|

1,312,393

|

|

|

|

Total Mutual Funds

|

|

|

59,534,567

|

|

|

|

|

|

|

|

|

|

Total Plan Investments

|

|

|

|

75,136,967.00

|

|

|

|

|

|

|

|

|

|

Participant Self-Directed Brokerage Accounts:

|

|

|

|

|

|

*

|

Republic Bancorp, Inc.

|

Class A and B Common Stock

|

|

|

2,227,854

|

|

*

|

Ameritrade

|

Self-Directed Brokerage

|

|

|

4,587,180

|

|

|

|

|

|

|

|

|

|

Total Participant Self-Directed Brokerage Accounts

|

|

|

|

6,815,034

|

|

|

|

|

|

|

|

|

|

Participant Loans:

|

|

|

|

|

|

*

|

Participant Loans

|

Weighted average rate of 4.54% due through 2028

|

|

|

205,316

|

|

|

|

|

|

|

|

|

|

Total Participant Loans

|

|

|

|

205,316

|

|

|

|

|

|

|

|

|

|

Total Assets Held for Investment

|

|

|

$

|

82,157,317

|

*Denotes party-in-interest.

**Investments are participant directed, therefore, historical cost is not required.

See accompanying report of independent registered public accounting firm.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

REPUBLIC BANCORP, INC. 401(K) RETIREMENT PLAN

|

|

|

(Name of Plan)

|

|

|

|

|

|

|

|

|

June 28, 2019

|

/s/ Kevin Sipes

|

|

By:

|

Kevin Sipes

|

|

|

Executive Vice President & Chief Financial Officer

|

|

|

Republic Bancorp, Inc.

|

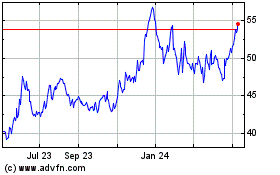

Republic Bancorp (NASDAQ:RBCAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Republic Bancorp (NASDAQ:RBCAA)

Historical Stock Chart

From Apr 2023 to Apr 2024