0001071236false00010712362024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

August 8, 2024

Date of Report (Date of earliest event reported)

Red River Bancshares, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

Louisiana | 001-38888 | 72-1412058 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| |

1412 Centre Court Drive, Suite 301, Alexandria, Louisiana | 71301 |

(Address of Principal Executive Offices) | (Zip Code) |

(318) 561-4000

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol(s) | Name of each exchange

on which registered |

| Common Stock, no par value | RRBI | The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 1.01 Entry into a Material Definitive Agreement.

On August 8, 2024, Red River Bancshares, Inc. (the “Company”) entered into a stock repurchase agreement (the “Stock Repurchase Agreement”) with the Angela Katherine Simpson Irrevocable Trust UA 25-NOV-03 and the John Charles Simpson Jr. Irrevocable Trust UA 25-NOV-03 (the “Stockholders”) for the purchase by the Company of 60,000 shares of the Company’s common stock, no par value per share (the “Common Stock”) from the Stockholders in a privately-negotiated transaction for a total purchase price of approximately $3.0 million. The purchase price for the Common Stock reflects a discount to the 10-, 20-, and 30-day volume weighted average price on July 31, 2024. The Stock Repurchase Agreement contains customary representations and warranties, covenants, and closing conditions, and the transaction is expected to close on or before August 12, 2024. The Stockholders, whose beneficiaries are the children of former Company director John C. Simpson, have informed the Company that they are entering into the Stock Repurchase Agreement in order to diversify their investment portfolios for estate planning purposes.

The Company’s Board of Directors and the Nominating and Corporate Governance Committee of the Board of Directors approved the repurchase. Prior to the transaction, the Angela Katherine Simpson Irrevocable Trust UA 25-NOV-03 and the John Charles Simpson Jr. Irrevocable Trust UA 25-NOV-03 directly and indirectly beneficially owned 314,739 and 321,407 shares of Common Stock, respectively, representing collectively 9.2% of the Company’s issued and outstanding Common Stock. Immediately following the transaction, the Angela Katherine Simpson Irrevocable Trust UA 25-NOV-03 and the John Charles Simpson Jr. Irrevocable Trust UA 25-NOV-03 will directly and indirectly beneficially own 284,739 and 291,407 shares of Common Stock, respectively, representing collectively 8.4% of the Company’s issued and outstanding Common Stock.

In connection with the repurchase, the Company reduced the availability under its previously announced $5.0 million repurchase program (“Repurchase Program”) by $3.0 million. Following the closure of the transaction under the Stock Repurchase Agreement, the Company will have approximately $1.2 million of remaining capacity under the Repurchase Program.

The foregoing description of the Stock Repurchase Agreement does not purport to be complete and is qualified in its entirety by the full text of the Stock Repurchase Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item. 8.01 Other Events.

On August 8, 2024, Red River Bancshares, Inc. (the “Company”) announced the transactions described above and that its board of directors has reduced the dollar amount authorized under the Repurchase Program by $3.0 million (“Repurchase Plan Reduction”). A copy of the press release issued by the Company announcing the Repurchase Plan Reduction is attached to this report as Exhibit 99.1 and is incorporated herein by reference.

Item. 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following are furnished as exhibits to this Current Report on Form 8-K.

| | | | | | | | |

Exhibit Number | | Description of Exhibit |

10.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 8, 2024

| | | | | | | | |

| | |

| RED RIVER BANCSHARES, INC. |

| | |

| By: | /s/ Julia E. Callis |

| | Julia E. Callis |

| | Senior Vice President, General Counsel, and

Corporate Secretary |

STOCK REPURCHASE AGREEMENT

THIS STOCK REPURCHASE AGREEMENT (this “Agreement”) is entered into as of August 8, 2024 by and between Red River Bancshares, Inc., a Louisiana corporation (the “Company”), Angela Katherine Simpson Irrevocable Trust UA 25-NOV-03 (the “Angela Trust”) and John Charles Simpson Jr. Irrevocable Trust UA 25-NOV-03 (the “John Trust” and, together with the Angela Trust, the “Selling Stockholders”). Each of the Company and the Selling Stockholders are sometimes individually referred to as a “party” and collectively as the “parties.”

Recitals

WHEREAS, the Angela Trust owns an aggregate of 314,739 shares of the Company’s common stock, no par value per share (the “Common Stock”);

WHEREAS, the John Trust owns an aggregate of 321,407 shares of the Company’s Common Stock;

WHEREAS, the Angela Trust desires to sell to the Company, and the Company desires to repurchase from the Angela Trust, 30,000 shares of Common Stock;

WHEREAS, the John Trust desires to sell to the Company, and the Company desires to repurchase from the John Trust, 30,000 shares of Common Stock;

NOW, THEREFORE, in consideration of the mutual covenants herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, these Recitals are incorporate into the Agreement and the undersigned hereby agree as follows:

Agreement

1. Repurchase.

(a) Purchase and Sale. At the Closing (as defined below), the Company hereby agrees to repurchase from the Selling Stockholders, and the Selling Stockholders hereby agree to sell and deliver, or cause to be delivered, to the Company in the amounts and from the parties described in the Recitals, 60,000 shares of Common Stock (the “Shares”) at a purchase price of $50.00 per Share, for an aggregate purchase price of THREE MILLION DOLLARS ($3,000,000.00) (the “Purchase Price” and such repurchase, the “Repurchase”), upon the terms and subject to the conditions set forth in this Agreement.

(b) Closing. Subject to the terms and conditions of this Agreement and the delivery of the deliverables contemplated by Section 1(c) of this Agreement, the closing of the sale of the Shares (the “Closing”) will take place as promptly as practicable following the signing of this Agreement, via the electronic exchange of deliverables, but in no event later than August 12, 2024 unless otherwise agreed upon in writing by the parties.

(c) Closing Deliveries and Actions. At or prior to the Closing, the Selling Stockholders shall deliver, or cause to be delivered, to the Company, or as instructed by the Company: (i) duly executed stock powers or instruction letters relating to the Shares; and (ii)

written wire transfer instructions relating to the Company’s payment of the Purchase Price to the Selling Stockholders. At the Closing, the Company shall deliver, or cause to be delivered to the Selling Stockholders, the Purchase Price by wire transfer in immediately available funds in accordance with the Selling Stockholders’ written wire transfer instructions.

(d) Other Payments. The Selling Stockholders agree to pay all stamp, stock transfer and similar duties, if any, in connection with the Repurchase.

2. Representations of the Company. The Company represents and warrants to the Selling Stockholders that, as of the date hereof and at the Closing:

(a) The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Louisiana.

(b) The Company has the full power and authority to execute, deliver and carry out the terms and provisions of this Agreement and to consummate the transactions contemplated hereby, and has taken all necessary action to authorize the execution, delivery and performance of this Agreement.

(c) This Agreement has been duly and validly authorized, executed and delivered by the Company and constitutes a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except to the extent that (i) such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws now or hereafter in effect affecting creditors’ rights generally, and (ii) the remedy of specific performance and injunctive and other forms of equitable relief may be subject to certain equitable defenses and to the discretion of the court before which any proceedings thereof may be brought.

(d) The execution and delivery of this Agreement and the consummation of the transactions contemplated hereby will not conflict with, result in the breach of any of the terms or conditions of, constitute a default under or violate, accelerate or permit the acceleration of any other similar right of any other party under the Restated Articles of Incorporation or Amended and Restated Bylaws of the Company, any law, rule or regulation or any agreement, lease, mortgage, note, bond, indenture, license or other document or undertaking to which the Company is a party or by which the Company or its properties may be bound, nor will such execution, delivery and consummation violate any order, writ, injunction or decree of any federal, state, local or foreign court, administrative agency or governmental or regulatory authority or body (each, an “Authority”) to which the Company or any of its properties is subject, the effect of any of which, either individually or in the aggregate, would have, or reasonably be expected to have, a material adverse effect on the consolidated financial position, stockholders’ equity or results of operations of the Company and its subsidiaries, taken as a whole, or materially impact the Company’s ability to consummate the transactions contemplated by this Agreement (a “Material Adverse Effect”); and no consent, approval, authorization, order, registration or qualification of or with any such Authority is required for the consummation by the Company of the transactions contemplated by this Agreement, except such consents, approvals, authorizations and orders as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(e) The Company acknowledges that it has not relied upon any express or implied representations or warranties of any nature made by or on behalf of the Selling Stockholders, whether or not any such representations, warranties or statements were made in writing or orally, except as expressly set forth for the benefit of the Company in this Agreement.

3. Representations of the Selling Stockholder. The Selling Stockholders jointly and severally represent and warrant to the Company that, as of the date hereof and at the Closing:

(a) The Angela Trust is a trust organized under the laws of the State of Louisiana. The John Trust is a trust organized under the laws of the State of Louisiana. Simeon A. Thibeaux is the duly appointed trustee of each of the Selling Stockholders (the “Trustee”).

(b) Each of the Selling Stockholders has the full power and authority to execute, deliver and carry out the terms and provisions of this Agreement and consummate the transactions contemplated hereby, and has taken all necessary action to authorize the execution, delivery and performance of this Agreement. The Trustee has taken all necessary action to authorize the execution, delivery and performance of this Agreement by each Selling Stockholder and the transactions contemplated under this Agreement are within the scope and power of the Trustee.

(c) This Agreement has been duly and validly authorized, executed and delivered by each of the Selling Stockholders, and constitutes a legal, valid and binding agreement of the Selling Stockholders, enforceable against the Selling Stockholders in accordance with its terms, except to the extent that (i) such enforceability may be limited by bankruptcy, insolvency, moratorium or other similar laws now or hereafter in effect affecting creditors’ rights generally, and (ii) the remedy of specific performance and injunctive and other forms of equitable relief may be subject to certain equitable defenses and to the discretion of the court before which any proceedings therefor may be brought.

(d) The sale of the Shares to be sold by the Selling Stockholders hereunder and the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby will not conflict with, result in the breach of any of the terms or conditions of, constitute a default under or violate, accelerate or permit the acceleration of any other similar right of any other party under any law, rule or regulation, or any agreement, lease, mortgage, note, bond, indenture, license or other document or undertaking, to which such Selling Stockholder is a party or by which such Selling Stockholder or its properties may be bound, nor will such execution, delivery and consummation violate any order, writ, injunction or decree of any Authority to which such Selling Stockholder or any of its properties is subject, the effect of any of which, either individually or in the aggregate, would affect the validity of the Shares to be sold by such Selling Stockholder or reasonably be expected to materially impact such Selling Stockholder’s ability to perform its obligations under this Agreement; and no consent, approval, authorization, order, registration or qualification of or with any such Authority is required for the performance by such Selling Stockholder of its obligations under this Agreement and the consummation by such Selling Stockholder of the transactions contemplated by this Agreement in connection with the Shares to be sold by such Selling Stockholder hereunder, except such consents, approvals, authorizations and orders as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect on the Selling Stockholder’s ability to consummate the transactions contemplated by this Agreement. For the avoidance of doubt, the

Selling Stockholders are not making any representations or warranties regarding compliance by the Company of the sale of Shares contemplated by this Agreement with any laws, rules, or regulations of the United States or the laws of any State, and the departments and agencies thereof, (i) governing the sale of securities, (ii) or the operation of banks and bank holding companies.

(e) Each Selling Stockholder has valid and unencumbered title, free and clear of any and all liens, claims, charges, pledges, encumbrances and security interests, to the Shares to be sold by such Selling Stockholder hereunder. At Closing, each Selling Stockholder will have valid and unencumbered title free and clear of any and all liens, claims, charges, pledges, encumbrances and security interests, to the Shares to be sold by such Selling Stockholder hereunder. At the Closing, valid title to the Shares shall vest with the Company, free and clear of any and all liens, claims, charges, pledges, encumbrances and security interests other than those existing under applicable securities laws and those created by the Company or any of its affiliates.

(f) There is no action, suit, proceeding, claim, arbitration, litigation or investigation, pending or, to the knowledge of each Selling Stockholder, threatened in writing against such Selling Stockholder which, if adversely determined, would prevent the consummation of the transaction contemplated by this Agreement. There is no action, suit, proceeding, claim, arbitration, litigation or investigation by any Selling Stockholder pending or threatened against any other person relating to the Shares owned by such Selling Stockholder.

(g) Neither the Company nor any of its representatives has been requested to or has provided any Selling Stockholder with any information or advice with respect to the Shares nor is such information or advice necessary or desired.

(h) Each Selling Stockholder acknowledges and understands that the Company may possess material nonpublic information that is not known to the Selling Stockholders that may impact the value of the Shares, and that the Company is not disclosing any information to the Selling Stockholders. Each Selling Stockholder understands, based on its experience, the disadvantage to which such Selling Stockholder is subject due to the disparity of information between the Company and the Selling Stockholders but nevertheless desires to enter into this transaction as a means to sell the Shares in a single large transaction rather than engage in sales in the open market over an extended period of time. Each Selling Stockholder agrees that the Company and its directors, officers, employees and agents shall have no liability to the Selling Stockholders, their affiliates, principals, stockholders, partners, employees, agents, grantors or beneficiaries, whatsoever due to or in connection with the Company’s use or non-disclosure of any such information or otherwise as a result of the transaction contemplated by this Agreement, and each Selling Stockholder hereby irrevocably waives any claim that it might have based on the failure of the Company to disclose such information.

(i) Each Selling Stockholder (either alone or together with its advisors) has such knowledge and experience in financial or business matters that it is capable of evaluating the merits and risks of the transaction contemplated by this Agreement. Each Selling Stockholder is entering into this Agreement with a full understanding of all of the terms, conditions and risks and willingly assumes those terms, conditions and risks. Each Selling Stockholder has received (through electronic access on EDGAR) and carefully reviewed the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, all subsequent public filings of the Company with the Securities and Exchange Commission (the “SEC”), other publicly available

information regarding the Company, and such other information that it and its advisers deem necessary to make its decision to enter into this Agreement and consummate the transactions contemplated hereby. Each Selling Stockholder has evaluated the merits and risks of the transactions under this Agreement based exclusively on its own independent review and consultations with such investment, legal, tax, accounting and other advisers as it deemed necessary, and has made its own decision concerning such transaction without reliance upon any express or implied representations or warranties of any nature made by or on behalf of the Company, whether or not any such representations, warranties or statements were made in writing or orally, except as expressly set forth for the benefit of the Selling Stockholders in this Agreement.

(j) The Company is relying on each Selling Stockholder’s representations, warranties, acknowledgments and agreements in this Agreement as a condition to proceeding with the transaction contemplated hereby, and without such representations, warranties and agreements, the Company would not enter into this Agreement or engage in such transaction.

4. Indemnification. Each party (the “Indemnifying Party”) shall indemnify, defend and hold harmless the other party and its affiliates and their respective representatives (the “Indemnified Party”) from and against any and all costs, expenses (including reasonable attorney’s fees), judgements, fines and losses incurred or sustained by, or imposed upon the Indemnified Party based upon, arising out of, with respect to or by reason of: (a) any inaccuracy in or breach of any of the representations or warranties of the Indemnifying Party contained in this Agreement or in any certificate or instrument delivered by or on behalf of the Indemnifying Party pursuant to this Agreement; and (b) any breach or non-fulfillment of any covenant, agreement or obligation to be performed by the Indemnifying Party pursuant to this Agreement.

5. Publicity. Each of the Selling Stockholders and the Company agrees that it shall not, and that it shall cause its affiliates and representatives not to, (a) publish, release or file any initial press release or other public statement or announcement relating to the transactions contemplated by this Agreement (an “Initial Press Release”) before providing a copy of such release, statement or announcement to the other, and (b) after the date hereof, publish, release or file any future press release or other public statement or announcement relating to the transactions contemplated by this Agreement that is materially inconsistent with any such Initial Press Release; provided however, that each party acknowledges and agrees that any party shall be permitted to make any required filings with the SEC without providing a copy of such filing to any other party.

6. Notices. All notices, demands or other communications to be given or delivered under or by reason of the provisions of this Agreement will be in writing and will be deemed to have been given when delivered personally, mailed by certified or registered mail (return receipt requested and postage prepaid), sent via a nationally recognized overnight courier, or sent via email to the recipient. Such notices, demands and other communications shall be sent as follows:

To the Angela Trust:

Simeon A. Thibeaux, Trustee

c/o S3 Dynamics, L.P.

1412 Centre Court Drive, Suite 300

Alexandria, Louisiana 71301

Email: simmythibeaux@aol. com

To the John Trust:

Simeon A. Thibeaux, Trustee

c/o S3 Dynamics, L.P.

1412 Centre Court Drive, Suite 300

Email: simmythibeaux@aol. com

With a copy to (which shall not constitute notice):

Sher Garner Cahill Richter Klein & Hilbert, LLC

909 Poydras Street, Suite 2800

New Orleans, Louisiana 70112

Attn: Steven I. Klein

Email: sklein@shergarner.com

To the Company:

Red River Bancshares, Inc.

1412 Centre Court Drive, Suite 301

Alexandria, Louisiana

Attention: Julia Callis

Email: Julia.callis@redriverbank.net

With a copy (which shall not constitute notice):

Jones Walker, LLP

201 St. Charles Avenue

Suite 5100

New Orleans, Louisiana 70170

Attn: Clinton H. Smith

Email: csmith@joneswalker.com

or such other address or to the attention of such other person as the recipient party shall have specified by prior written notice to the sending party.

7. Miscellaneous.

(a) Survival of Representations and Warranties. All representations and warranties contained herein or made in writing by any party in connection herewith shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby until the expiration of the applicable statute of limitations.

(b) Severability. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal, or unenforceable in any respect under any applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability will not affect any other provision or any other jurisdiction, but this Agreement will be reformed, construed, and enforced in such jurisdiction as if such invalid, illegal or unenforceable provision had never been contained herein.

(c) Complete Agreement. This Agreement supersedes all prior agreements and understandings (whether written or oral) between the Company and the Selling Stockholders with respect to the subject matter hereof.

(d) Counterparts. This Agreement may be executed by any one or more of the parties hereto in any number of counterparts, each of which shall be deemed to be an original, but all such counterparts shall together constitute one and the same instrument. This Agreement, and any and all agreements and instruments executed and delivered in accordance herewith, to the extent signed and delivered by means of facsimile or other electronic format or signature (including email, “pdf,” “tif,” “jpg,” DocuSign and Adobe Sign), shall be treated in all manner and respects and for all purposes as an original signature and an original agreement or instrument and shall be considered to have the same legal effect, validity and enforceability as if it were the original signed version thereof delivered in person.

(e) Successors and Assigns. Neither this Agreement nor any of the rights, interests or obligations hereunder shall be assigned, in whole or in part, by either party without the prior written consent of the other party. Except as otherwise provided herein, this Agreement shall bind and inure to the benefit of and be enforceable by the Selling Stockholders and the Company and their respective successors and assigns.

(f) No Third Party Beneficiaries or Other Rights. Other than releases provided to third parties, this Agreement is for the sole benefit of the parties and their successors and permitted assigns and nothing herein express or implied shall give or shall be construed to confer any legal or equitable rights or remedies to any person other than the parties to this Agreement and such successors and permitted assigns.

(g) Governing Law. THIS AGREEMENT AND ANY MATTERS RELATED TO THIS TRANSACTION SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF LOUISIANA WITHOUT REGARD TO PRINCIPLES OF CONFLICT OF LAWS THAT WOULD RESULT IN THE APPLICATION OF ANY LAW OTHER THAN THE LAWS OF THE STATE OF LOUISIANA. The Company and each Selling Stockholder each agrees that any suit or proceeding arising in respect of this Agreement will be tried exclusively in the U.S. District Court for the Eastern District of Louisiana or, if that court does not have subject matter jurisdiction, in any state court located in The City and Parish of Orleans, and the Company and the Selling Stockholders each agree to submit to the jurisdiction of, and to venue in, such courts.

(h) Waiver of Jury Trial. The Company and each Selling Stockholder each hereby irrevocably waives, to the fullest extent permitted by applicable law, any and all right to trial by jury in any legal proceeding arising out of or relating to this Agreement or the transactions contemplated hereby.

(i) Mutuality of Drafting. The parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as jointly drafted by the parties, and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provision of the Agreement.

(j) Remedies. The parties hereto agree and acknowledge that money damages may not be an adequate remedy for any breach of the provisions of this Agreement and that any party may in its sole discretion apply to any court of law or equity of competent jurisdiction (without posting any bond or deposit) for specific performance or other injunctive relief in order to enforce, or prevent any violations of, the provisions of this Agreement.

(k) Amendment and Waiver. The provisions of this Agreement may be amended or waived only with the prior written consent of the Company and each Selling Stockholder.

(l) Expenses. Except as provided in Section 4, each of the Company and the Selling Stockholders shall bear its own expenses in connection with the drafting, negotiation, execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

(m) Termination. This Agreement may be terminated by either party if: (i) the Closing has not occurred by the fifth business day following the date of this Agreement (except a party may not terminate this Agreement if the failure of the Closing is due to such party), (ii) there is a law, rule or order that makes the transactions contemplated by this Agreement illegal or otherwise prohibited, or (iii) the other party has breached its representations and warranties. The provisions of this Section 7 shall survive any termination.

[Signatures appear on following pages.]

IN WITNESS WHEREOF, the parties hereto have executed this Stock Repurchase Agreement as of the date first written above.

COMPANY:

RED RIVER BANCSHARES, INC.

By: /s/ Isabel V. Carriere

Name: Isabel V. Carriere, CPA, CGMA

Title: Executive Vice President, Chief Financial

Officer, and Assistant Corporate Secretary

SELLING STOCKHOLDER:

ANGELA TRUST

By:/s/ Simeon A. Thibeaux

Name: Simeon A. Thibeaux

Title: Trustee

SELLING STOCKHOLDER:

JOHN TRUST

By: /s/ Simeon A. Thibeaux

Name: Simeon A. Thibeaux

Title: Trustee

Red River Bancshares, Inc. Announces

Private Stock Repurchase and Amendment

of Repurchase Program

ALEXANDRIA, La., August 8, 2024 (GLOBE NEWSWIRE) – Red River Bancshares, Inc. (Nasdaq: RRBI) (the “Company”) announced today that, on August 8, 2024, the Company entered into a stock repurchase agreement with two shareholders for the repurchase by the Company of 60,000 shares of its common stock in a privately-negotiated transaction for a purchase price of $3.0 million. The purchase price reflects a discount to the 10-, 20-, and 30-day volume weighted average price on July 31, 2024. In connection with the repurchase, the Company reduced the availability under its previously announced 2024 $5.0 million repurchase program (“Repurchase Program”) by $3.0 million. Blake Chatelain, the Company’s President and Chief Executive Officer, said, “We are pleased to complete this repurchase, which shows our continued commitment to increasing shareholder value.” Following closure of this transaction, the Company will have approximately $1.2 million of remaining capacity under the Repurchase Program.

About Red River Bancshares, Inc.

The Company is the bank holding company for Red River Bank, a Louisiana state-chartered bank established in 1999 that provides a fully integrated suite of banking products and services tailored to the needs of our commercial and retail customers. Red River Bank operates from a network of 28 banking centers throughout Louisiana and one combined loan and deposit production office in New Orleans, Louisiana. Banking centers are located in the following Louisiana markets: Central, which includes the Alexandria metropolitan statistical area (“MSA”); Northwest, which includes the Shreveport-Bossier City MSA; Capital, which includes the Baton Rouge MSA; Southwest, which includes the Lake Charles MSA; the Northshore, which includes Covington; Acadiana, which includes the Lafayette MSA; and New Orleans.

Forward-Looking Statements

This press release may contain forward-looking statements that are based on various facts and derived using numerous assumptions that are subject to known and unknown risks, uncertainties, and other factors that may cause the Company’s actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Forward-looking statements include information about the expected benefits of the repurchase, information concerning the timing, manner, amount, and overall impact of future purchases under the repurchase program, as well as any other statement other than statements of historical fact. Words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” and “outlook,” or the negative version of those words, or such other comparable words or phrases are intended to identify forward-looking statements, but are not the exclusive means of identifying such

statements. These forward-looking statements are not historical facts, and are based on current expectations, estimates, and projections about the Company’s industry, management’s beliefs, and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond the Company’s control. Accordingly, you are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, assumptions, and uncertainties that are difficult to predict. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Unless required by law, the Company also disclaims any obligation to update any forward-looking statements. Interested parties should not place undue reliance on any forward-looking statement and should carefully consider the risks and other factors that the Company faces. For a discussion of these risks and other factors, please see the sections titled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and any subsequent quarterly reports on Form 10-Q, and in other documents that we file with the Securities and Exchange Commission from time to time.

Contact:

Julia Callis

Senior Vice President, General Counsel, and Corporate Secretary

318-561-4042

julia.callis@redriverbank.net

###

v3.24.2.u1

Document and Entity Information Document

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity Registrant Name |

Red River Bancshares, Inc.

|

| Entity Central Index Key |

0001071236

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

LA

|

| Entity File Number |

001-38888

|

| Entity Tax Identification Number |

72-1412058

|

| Entity Address, Address Line One |

1412 Centre Court Drive

|

| Entity Address, Address Line Two |

Suite 301

|

| Entity Address, City or Town |

Alexandria

|

| Entity Address, State or Province |

LA

|

| Entity Address, Postal Zip Code |

71301

|

| City Area Code |

318

|

| Local Phone Number |

561-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

RRBI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

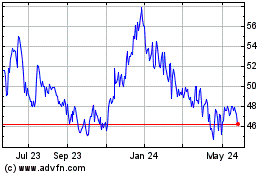

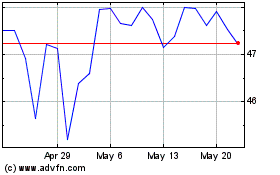

Red River Bancshares (NASDAQ:RRBI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Red River Bancshares (NASDAQ:RRBI)

Historical Stock Chart

From Nov 2023 to Nov 2024