Rick’s Cabaret International, Inc. (NASDAQ:RICK) today

reported financial results for its fiscal year ending September 30,

2010. The company had consolidated total revenues of $83 million,

an increase of 9.4 percent over the $75.8 million reported in the

previous year. The company reported a loss from continuing

operations of $7.6 million for the year, primarily because of

non-cash balance sheet impairment charges of $20.5 million,

compared with 2009 income from continuing operations $5.5

million.

“Our income statement was dramatically affected by the

impairment charges incurred chiefly because of losses at the Las

Vegas club we acquired in 2008 and we believe that the growth in

our adjusted EBITDA to $17.6 million is a more realistic way to

look at the year,” said Eric Langan, President and CEO of

Rick’s Cabaret International, Inc.

Mr. Langan said the company generated cash flow from operations

of $17.3 million compared with $8.9 million in 2009, despite the

Las Vegas losses, benefitting from continuing strong performances

of Rick’s Cabaret in New York City and Tootsie’s Cabaret in

Miami.

“We think 2011 is looking very good,” Mr. Langan said. “We plan

to add four more locations in 2011, staying on our goal of making

at least one acquisition per quarter. In addition we will benefit

from the Super Bowl in February in Dallas, where we will

have a terrific cluster of seven clubs ready to welcome fans.”

Other highlights from results for the year ending September 30,

2010 include:

- The company’s adjusted EBITDA for 2010

$17.6 million, compared with $16.0 million in 2009. Diluted

adjusted EBITDA per common share was $1.84 compared with $1.70,

based on shares outstanding of 9.7 million and 9.4 million

respectively. The adjusted EBITDA calculation (earnings before

interest expense, income taxes, depreciation, amortization and

impairment charges) is a non-GAAP performance measure that excludes

the largest recurring non-cash charges (depreciation, amortization

and impairment) and provides a core operational performance

measurement that compares results without the need to adjust for

Federal, state and local taxes that have considerable variation

between domestic jurisdictions. Interest cost is also excluded from

the calculation of adjusted EBITDA. The results are, therefore,

without consideration of financing alternatives of capital

employed. Adjusted EBITDA is one guideline to assess unleveraged

performance return on the company’s investments and is also the

target benchmark for acquisitions of nightclubs.

- The 9.4 per cent increase in total

revenues was driven by revenues generated at new clubs and an

overall 7.0 percent increase from clubs open more than one year,

especially the New York location, offset by a decrease in revenues

from the Las Vegas club.

- The Las Vegas club is still not

profitable even with the taxi marketing costs under more control

than in the prior year, due principally to decreased revenues since

the Las Vegas market collapsed after September 2008. The company

noted that the club it acquired had revenues of approximately $16.6

million in the year ended July 31, 2008, compared to $8.8 million

and $9.7 million for the years ended September 30, 2010 and 2009.

The club had adjusted EBITDA of approximately ($37,000) and ($1.4)

million for the years ended September 30, 2010 and 2009,

respectively, compared to pro forma EBITDA income of $2.6 million

for the year ended July 31, 2008.

About Rick’s Cabaret: Rick’s Cabaret International, Inc.

(NASDAQ: RICK) is home to upscale adult nightclubs serving

primarily businessmen and professionals that offer live

entertainment, dining and bar operations. Nightclubs in New York

City, Miami, Philadelphia, New Orleans, Charlotte, Dallas, Houston,

Minneapolis and other cities operate under the names "Rick's

Cabaret," "XTC," “Club Onyx” and “Tootsie’s Cabaret”. Sexual

contact is not permitted at these locations. Rick’s Cabaret also

operates a media division, ED Publications, and owns the adult

Internet membership Website couplestouch.com as well as a network

of online adult auction sites under the flagship URL

naughtybids.com. Rick’s Cabaret common stock is traded on NASDAQ

under the symbol RICK. For further information contact ir@ricks.com

or visit www.ricksinvestor.com.

Forward-looking Statements: This document contains

forward-looking statements that involve a number of risks and

uncertainties that could cause the company’s actual results to

differ materially from those indicated in this document, including

the risks and uncertainties associated with operating and managing

an adult business, the business climates in cities where it

operates, the success or lack thereof in launching and building the

company’s businesses, risks and uncertainties related to the

operational and financial results of our Web sites, conditions

relevant to real estate transactions, and numerous other factors

such as laws governing the operation of adult entertainment

businesses, competition and dependence on key personnel. Rick's has

no obligation to update or revise the forward-looking statements to

reflect the occurrence of future events or circumstances. For

further information visit www.ricksinvestor.com.

Statement of Operations and Balance Sheet Are Available

at www.ricksinvest.com

RICK'S CABARET INTERNATIONAL, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS Year Ended

September 30,

(in thousands,

except per share data)

2010 2009

2008 Revenues: Sales of alcoholic beverages $

33,101 $ 28,679 $ 21,764 Sales of food and merchandise 6,850 6,203

5,145 Service revenues 37,725 36,310 28,362 Internet revenues 562

641 716 Media revenues 1,440 1,404 801 Other 3,309

2,592 2,220 Total revenues 82,987

75,829 59,008 Operating expenses: Cost of goods sold 9,927

8,895 6,796 Salaries and wages 17,767 16,429 13,485 Stock-based

compensation 405 96 157 Other general and administrative: Taxes and

permits 12,367 9,396 7,365 Charge card fees 1,434 1,612 1,060 Rent

4,108 3,716 2,371 Legal and professional 3,071 2,963 1,629

Advertising and marketing 6,740 8,174 2,510 Depreciation and

amortization 3,743 3,423 2,439 Insurance 1,125 1,100 845 Utilities

1,721 1,646 1,218 Impairment of assets 20,511 823 - Other

6,441 5,826 5,147 Total

operating expenses 89,360 64,099

45,022 Income (loss) from operations (6,373 ) 11,730

13,986 Other income (expense): Interest income 18 16 60

Interest expense (4,023 ) (3,358 ) (2,713 ) Interest expense – loan

origination costs (450 ) (65 ) - Gain (loss) on change in fair

value of derivative instruments (31 ) 145 - Gain (loss) on sale of

property and other (3 ) 181 -

Income (loss) from continuing operations before income taxes

(10,862 ) 8,649 11,333 Income taxes (3,221 ) 2,854

3,532 Income (loss) from continuing

operations (7,641 ) 5,795 7,801 Loss from discontinued operations,

net of income taxes (57 ) (293 ) (171 )

Net income (loss) (7,698 ) 5,502 7,630 Less: net income

attributable to noncontrolling interests (260 ) (294

) 31

Net income (loss) attributable to Rick’s

Cabaret International, Inc.

$ (7,958 ) $ 5,208 $ 7,661 Basic earnings

(loss) per share attributable to Rick’s shareholders: Income (loss)

from continuing operations $ (0.81 ) $ 0.59 $ 0.99 Loss from

discontinued operations (0.01 ) (0.03 ) (0.02

) Net income (loss) $ (0.82 ) $ 0.56 $ 0.97

Diluted earnings (loss) per share

attributable to Rick’s shareholders:

Income (loss) from continuing operations $ (0.81 ) $ 0.58 $ 0.93

Loss from discontinued operations (0.01 ) (0.03 )

(0.02 ) Net income (loss) $ (0.82 ) $ 0.55 $ 0.91

Weighted average number of common shares outstanding:

Basic 9,697 9,266 7,931

Diluted 9,697 9,428 8,413

See accompanying notes to consolidated financial statements.

RICK'S CABARET INTERNATIONAL, INC. CONSOLIDATED

BALANCE SHEETS September 30,

(in thousands,

except share data)

2010 2009 Assets Current

assets: Cash and cash equivalents $ 19,168 $ 12,850 Accounts

receivable: Trade, net 888 777 Other, net 204 137 Inventories 1,264

1,232 Deferred tax asset 1,504 120 Prepaid expenses and other

current assets 951 726 Assets of discontinued operations 148

210 Total current assets 24,127 16,052 Property and

equipment, net 59,559 48,300 Other assets: Goodwill and

indefinite lived intangibles, net 62,076 78,331 Definite lived

intangibles, net 1,197 1,161 Other 1,412 1,232 Total

other assets 64,685 80,724 Total assets $

148,371 $ 145,076

Liabilities and Stockholders'

Equity Current liabilities: Accounts payable $ 731 $ 788

Accrued liabilities 4,529 2,414 Texas patron tax liability 3,955

1,163 Current portion of derivative liabilities 1,276 886 Current

portion of long-term debt 7,883 5,856 Liabilities of discontinued

operations 47 52 Total current liabilities 18,421

11,159 Deferred tax liability 15,566 18,581 Other long-term

liabilities 719 642 Long-term debt 34,803 31,956 Derivative

liabilities at fair value, less current portion 1,243

2,456 Total liabilities 70,752 64,794 Commitments and

contingencies Temporary equity - Common stock, subject to

put rights 198 and 317 shares, respectively 4,366 6,871

PERMANENT STOCKHOLDERS' EQUITY: Preferred stock, $.10 par, 1,000

shares authorized; none issued and outstanding - -

Common stock, $.01 par, 20,000 shares

authorized; 9,766 and 8,880 shares issued and

outstanding, respectively

98 89 Additional paid-in capital 62,326 54,530 Retained earnings

7,515 15,473 Total Rick’s permanent stockholders’

equity 69,939 70,092 Noncontrolling interests 3,314

3,319 Total permanent stockholders’ equity 73,253

73,411

Total liabilities and stockholders’

equity

$ 148,371 $ 145,076 See accompanying notes to consolidated

financial statements.

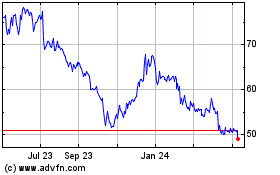

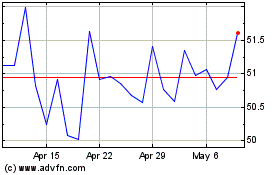

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Jun 2024 to Jul 2024

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Jul 2023 to Jul 2024