0001906324false00019063242023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 8, 2023

QUIDELORTHO CORPORATION

(Exact name of Registrant as specified in its Charter)

| | | | | | | | |

Delaware

| 001-41409

| 87-4496285

|

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

9975 Summers Ridge Road, San Diego, California 92121

(Address of principal executive offices, including zip code)

(858) 552-1100

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | QDEL | The Nasdaq Stock Market |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2023, QuidelOrtho Corporation (“QuidelOrtho”) issued a press release announcing the financial results for its second quarter ended July 2, 2023 and will hold an earnings conference call at 2:00 p.m., Pacific Time, on August 8, 2023 to discuss such results. A copy of the press release is furnished with this Current Report on Form 8-K (“Form 8-K”) as Exhibit 99.1.

The information in this Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits. | | | | | | | | | | | | | | |

| | | | |

| | (d) Exhibits. |

| | The following exhibit is furnished with this Form 8-K: |

| | |

| Exhibit Number | Description of Exhibit |

| 99.1 | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL Document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 8, 2023 | | | | | | | | |

|

| | |

| | | |

| QUIDELORTHO CORPORATION |

| | |

| By: | /s/ Joseph M. Busky | |

| Name: | Joseph M. Busky | |

| Its: | Chief Financial Officer | |

QuidelOrtho Reports Second Quarter 2023 Financial Results

Highlights

•Second quarter revenue of $665.1 million increased by 8% as reported with non-respiratory revenue up 3% on a supplemental combined basis (up 4% in constant currency) and respiratory revenue down 74% on a supplemental combined basis

•Non-respiratory revenue driven by 9% constant currency growth in Labs business unit

•Second quarter GAAP loss per share of $(0.80); adjusted EPS of $0.26, an 88% decrease from prior year on a supplemental combined basis, largely reflecting the strength of respiratory revenue in the second quarter of 2022

•Paid down $72 million on Term Loan ($20 million more than contractually required) and completed the final $40 million payment for the 2017 acquisition of the Alere Cardiometabolic assets

•Completed the Savanna® Emergency Use Authorization (“EUA”) and 510(k) FDA submissions as planned

San Diego, CA — August 8, 2023 — QuidelOrtho Corporation (Nasdaq: QDEL) (the “Company” or “QuidelOrtho”), a global provider of innovative in vitro diagnostic technologies designed for point-of-care settings, clinical labs and transfusion medicine, today announced financial results for the second quarter ended July 2, 2023.

The Company reported total revenue for the second quarter of 2023 of $665.1 million, compared to $613.4 million for the second quarter of 2022. GAAP diluted loss per share (LPS) for the second quarter of 2023 decreased to $(0.80), compared to diluted EPS of $0.36 for the second quarter of 2022. GAAP operating loss for the second quarter of 2023 was $(26.9) million, compared to operating income of $79.7 million for the second quarter of 2022, and GAAP operating margin was (4)% and 13% for the second quarters of 2023 and 2022, respectively. The second quarter 2023 results include significant one-time charges related to the integration.

In addition to the Company’s GAAP results, the Company is providing supplemental combined second quarter 2022 revenues and adjusted operating results as if Quidel Corporation (“Quidel”) and Ortho Clinical Diagnostics Holdings plc (“Ortho”) had been combined for the applicable periods. The following discussion of financial results is based on supplemental combined information:

Second quarter 2023 total revenue of $665.1 million decreased by 26% in constant currency, compared to $898.5 million for the second quarter of 2022. Foreign currency translation negatively impacted sales growth by approximately 10 basis points for the second quarter of 2023. Adjusted diluted EPS for the second quarter of 2023 decreased to $0.26, compared to $2.12 for the second quarter of 2022. Adjusted EBITDA for the second quarter of 2023 was $113.3 million, compared to $290.8 million in the second quarter of 2022. Adjusted EBITDA margin for the second quarter of 2023 was 17.0%, compared to 32.4% for the second quarter of 2022.

“We are pleased with our solid financial results in the second quarter largely driven by continued strength in our Labs business across all major geographic regions. Equally important, our execution on our key growth drivers was outstanding in the quarter – our Labs backlog is approaching normalized levels and utilization is increasing, Sofia® non-COVID pull-through continues to increase, and Savanna EUA and 510(k) submissions were completed as planned,” said Douglas Bryant, President and Chief Executive Officer of QuidelOrtho. “Looking to the future, we will continue to identify additional cost synergies and the integration is now in its final phase, which will focus on our future growth model by identifying, prioritizing and executing transformational initiatives that will accelerate our growth, foster productivity and enable us to be a more nimble, responsive organization.”

Fiscal Year 2023 Financial Guidance

The Company will provide 2023 financial guidance during its financial results conference call today.

Conference Call Information

QuidelOrtho will hold a conference call today at 2:00 p.m. PT / 5:00 p.m. ET to discuss its financial results for the second quarter ended July 2, 2023. Interested parties can access the call on the “Events & Presentations” section of the “Investor Relations” page of the Company’s website at https://ir.quidelortho.com/. Presentation materials will also be posted to the “Events & Presentations” section of the “Investor Relations” page of the Company’s website at the time of the call. Those unable to access the webcast may join the call via phone by dialing 833-470-1428 (domestic) or 929-526-1599 (international) and entering Conference ID number 695066.

A replay of the conference call will be available shortly after the event on the “Investor Relations” page of the Company’s website, under the “Events & Presentations” section.

About QuidelOrtho Corporation

QuidelOrtho Corporation (Nasdaq: QDEL) is a world leader in in vitro diagnostics, developing and manufacturing intelligent solutions that transform data into understanding and action for more people in more places every day.

Offering industry-leading expertise in immunoassay and molecular testing, clinical chemistry and transfusion medicine, bringing fast, accurate and reliable diagnostics when and where they are needed – from home to hospital, lab to clinic. So that patients, clinicians and health officials can spot trends sooner, respond quicker and chart the course ahead with accuracy and confidence.

Building upon its 80-year legacy of groundbreaking innovation, QuidelOrtho continues to partner with customers across the healthcare continuum and around the globe to forge a new diagnostic frontier. One where insights and solutions know no bounds, expertise seamlessly connects and a more informed path is illuminated for each of us.

QuidelOrtho is transforming the power of diagnostics into a healthier future for all.

For more information, please visit www.quidelortho.com.

Source: QuidelOrtho Corporation

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include any statements contained herein that are not strictly historical, including, but not limited to, the synergies and other benefits and results of the business combination of Quidel and Ortho (the “Combinations”) and integration of the businesses of Quidel and Ortho, and QuidelOrtho’s commercial, integration, transformation and other strategic goals, future financial and operating results, and future plans, objectives, strategies, expectations and intentions. These statements in this press release may be identified by words such as “may,” “will,” “would,” “should,” “might,” “expect,” “anticipate,” “believe,” “estimate,” “plan,” “intend,” “goal,” “project,” “strategy,” “future,” “continue” or similar words, expressions or the negative of such terms or other comparable terminology. Such statements are based on the beliefs and expectations of QuidelOrtho’s management as of today and are subject to significant known and unknown risks and uncertainties. Actual results or outcomes may differ significantly from those set forth or implied in the forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth or implied in the forward-looking statements: the challenges and costs of integrating, restructuring and achieving anticipated synergies as a result of the Combinations; the ability to retain key employees; and other economic, business, competitive and/or regulatory factors affecting the business of QuidelOrtho generally. Additional risks and factors are identified under “Risk Factors” in QuidelOrtho’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “Commission”) on February 23, 2023 and subsequent reports filed with the Commission. You should not rely on forward-looking statements as predictions of future events because these statements are based on assumptions that may not come true and are speculative by their nature. QuidelOrtho undertakes no obligation to update any of the forward-looking information or time-sensitive information included in this press release, whether as a result of new information, future events, changed expectations or otherwise, except as required by law. All forward-looking statements are based on information currently available to QuidelOrtho and speak only as of the date hereof.

Supplemental Combined Financial Measures

This press release contains unaudited supplemental combined financial information (“Supplemental Combined Information”) that gives effect to the Combinations as if Quidel and Ortho had been combined for the applicable periods. Certain Supplemental Combined Information presented is based on the historical financial statements of Quidel and Ortho with reclassification adjustments only and do not include all of the pro forma adjustments required under Regulation S-X Article 11 or Accounting Standards Codification 805, Business Combinations (“ASC 805”). The Supplemental Combined Information is provided for illustrative purposes only, may be updated in the future, and is not necessarily, and should not be assumed to be, indicative of the Company’s expected results of operations or financial position that would have been achieved had the Combinations been completed as of the dates indicated or that may be achieved in any future period. The Supplemental Combined Information should be considered supplemental to, and not as a substitute for, pro forma financial information prepared in accordance with Regulation S-X Article 11 or ASC 805 and should be read in conjunction with the information contained in the sections entitled “The Combinations,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Ortho” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Quidel” in QuidelOrtho’s joint proxy statement/prospectus (the “Joint Proxy Statement/Prospectus”) filed with the Commission on April 11, 2022 and the historical consolidated financial statements and related notes appearing elsewhere in, or incorporated into, the Joint Proxy Statement/Prospectus, and the Company’s subsequent reports filed with the Commission. The Company’s actual results of operations and financial position will differ, potentially significantly, from the Supplemental Combined Information reflected in this press release as a result of the methodology used to prepare the Supplemental Combined Information as well as a variety of factors, including but not limited to the effect of certain expected financial benefits of the Combinations (such as revenue and cost synergies), the anticipated costs to achieve these benefits (including the cost of integration activities), tax impacts, and changes in operating results following the date of this press release.

Non-GAAP Financial Measures

This press release contains financial measures, including but not limited to “constant currency” revenue changes, “adjusted net income,” “adjusted diluted EPS,” “adjusted EBITDA,” “adjusted EBITDA margin,” “supplemental combined adjusted net income,” “supplemental combined adjusted diluted EPS,” “supplemental combined adjusted EBITDA” and “supplemental combined adjusted EBITDA margin,” which are considered non-GAAP financial measures under applicable rules and regulations of the Commission. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). “Adjusted net income,” “adjusted EBITDA” and “adjusted diluted EPS” eliminate impacts of certain non-cash, unusual or other items that the Company does not consider indicative of its ongoing operating performance, and the Company generally uses these non-GAAP financial measures to facilitate management’s financial and operational decision-making, including evaluation of the Company’s historical operating results and comparison to competitors’ operating results. The Company believes that “supplemental combined adjusted net income,” “supplemental combined adjusted diluted EPS,” “supplemental combined adjusted EBITDA” and “supplemental combined adjusted EBITDA margin” provide helpful Supplemental Combined Information to assist management and investors in evaluating the Company’s adjusted operating results as if Quidel and Ortho had been combined for the applicable periods. The Company’s definitions of these non-GAAP measures may differ from similarly titled measures used by others. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of factors and trends affecting the Company’s business. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, management strongly encourages investors to review the Company’s consolidated financial statements and reports filed with the Commission in their entirety. Reconciliations of the non-GAAP financial measures, including the non-GAAP Supplemental Combined Information, to the most directly comparable GAAP financial measures are included in the tables accompanying this press release.

Investor Contact:

Bryan Brokmeier, CFA

IR@QuidelOrtho.com

Media Contact:

media@QuidelOrtho.com

QuidelOrtho

Consolidated Statements of Operations

(Unaudited)

(In millions except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | July 2, 2023 (a) | | July 3, 2022 (b) | | July 2, 2023 (a) | | July 3, 2022 (b) |

| Total revenues | $ | 665.1 | | | $ | 613.4 | | | $ | 1,511.2 | | | $ | 1,615.7 | |

| Cost of sales, excluding amortization of intangibles | 368.7 | | | 275.9 | | | 766.2 | | | 536.2 | |

| Selling, marketing and administrative | 179.1 | | | 118.4 | | | 381.5 | | | 203.2 | |

| Research and development | 62.8 | | | 34.2 | | | 125.1 | | | 60.6 | |

| Amortization of intangible assets | 51.4 | | | 21.0 | | | 102.2 | | | 28.1 | |

| Acquisition and integration costs | 24.2 | | | 80.2 | | | 53.9 | | | 83.2 | |

| Other operating expenses | 5.8 | | | 4.0 | | | 9.6 | | | 4.0 | |

| Operating (loss) income | (26.9) | | | 79.7 | | | 72.7 | | | 700.4 | |

| Interest expense, net | 36.5 | | | 10.3 | | | 73.2 | | | 11.3 | |

| Loss on extinguishment of debt | — | | | 24.0 | | | — | | | 24.0 | |

| Other expense, net | 1.0 | | | 2.5 | | | 3.9 | | | 1.6 | |

| (Loss) income before income taxes | (64.4) | | | 42.9 | | | (4.4) | | | 663.5 | |

| (Benefit from) provision for income taxes | (11.2) | | | 23.6 | | | — | | | 164.3 | |

| Net (loss) income | $ | (53.2) | | | $ | 19.3 | | | $ | (4.4) | | | $ | 499.2 | |

| Basic (loss) earnings per share | $ | (0.80) | | | $ | 0.37 | | | $ | (0.07) | | | $ | 10.62 | |

| Diluted (loss) earnings per share | $ | (0.80) | | | $ | 0.36 | | | $ | (0.07) | | | $ | 10.47 | |

| Weighted-average shares outstanding - basic | 66.8 | | | 52.2 | | | 66.7 | | | 47.0 | |

| Weighted-average shares outstanding - diluted | 66.8 | | | 52.9 | | | 66.7 | | | 47.7 | |

(a) Includes Ortho results of operations for the three and six months ended July 2, 2023.

(b) Includes Ortho results of operations from May 27, 2022 through July 3, 2022.

QuidelOrtho

Condensed Consolidated Balance Sheets

(Unaudited)

(In millions)

| | | | | | | | | | | |

| July 2, 2023 | | January 1, 2023 |

| Cash and cash equivalents | $ | 178.6 | | | $ | 292.9 | |

| Marketable securities | 45.1 | | | 52.1 | |

| Accounts receivable, net | 246.7 | | | 453.9 | |

| Inventories | 542.2 | | | 524.1 | |

| Prepaid expenses and other current assets | 295.5 | | | 252.1 | |

| Property, plant and equipment, net | 1,376.2 | | | 1,339.0 | |

| Marketable securities | 24.7 | | | 21.0 | |

| Right-of-use assets | 177.4 | | | 181.0 | |

| Goodwill | 2,470.9 | | | 2,476.8 | |

| Intangible assets, net | 3,035.7 | | | 3,123.8 | |

| Deferred tax asset | 16.1 | | | 16.4 | |

| Other assets | 141.2 | | | 122.7 | |

| Total assets | $ | 8,550.3 | | | $ | 8,855.8 | |

| | | |

| Accounts payable | $ | 225.9 | | | $ | 283.3 | |

| Accrued payroll and related expenses | 81.5 | | | 139.2 | |

| Income tax payable | 2.1 | | | 51.6 | |

| Current portion of borrowings | 207.4 | | | 207.5 | |

| Other current liabilities | 273.1 | | | 325.4 | |

| Operating lease liabilities | 181.2 | | | 186.4 | |

| Long-term borrowings | 2,308.5 | | | 2,430.8 | |

| Deferred tax liability | 199.6 | | | 213.2 | |

| Other liabilities | 68.5 | | | 83.8 | |

| Total liabilities | 3,547.8 | | | 3,921.2 | |

| Total stockholders’ equity | 5,002.5 | | | 4,934.6 | |

| Total liabilities and stockholders’ equity | $ | 8,550.3 | | | $ | 8,855.8 | |

QuidelOrtho

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In millions)

| | | | | | | | | | | |

| Six Months Ended |

| July 2, 2023 (a) | | July 3, 2022 (b) |

| Cash provided by operating activities | $ | 158.3 | | | $ | 725.6 | |

| Cash used for investing activities | (111.2) | | | (1,555.1) | |

| Cash (used for) provided by financing activities | (159.3) | | | 409.7 | |

| Effect of exchange rates on cash | (2.1) | | | (2.4) | |

| Net decrease in cash, cash equivalents and restricted cash | (114.3) | | | (422.2) | |

| Cash, cash equivalents and restricted cash at beginning of period | 293.9 | | | 802.8 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 179.6 | | | $ | 380.6 | |

| | | |

| Reconciliation to amounts within the consolidated balance sheets: | | | |

| Cash and cash equivalents | $ | 178.6 | | | $ | 379.0 | |

| Restricted cash in Other assets | 1.0 | | | 1.6 | |

| Cash, cash equivalents and restricted cash | $ | 179.6 | | | $ | 380.6 | |

(a) Includes Ortho activities for the six months ended July 2, 2023.

(b) Includes Ortho activities from May 27, 2022 through July 3, 2022.

QuidelOrtho

Reconciliation of Non-GAAP Financial Information - Adjusted Net Income

(In millions, except per share data; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 2, 2023 (a) | | Diluted EPS | | July 3, 2022 (b) | | Diluted EPS | | July 2, 2023 (a) | | Diluted EPS | | July 3, 2022 (b) | | Diluted EPS |

| Net (loss) income | $ | (53.2) | | | $ | (0.80) | | | $ | 19.3 | | | $ | 0.36 | | | $ | (4.4) | | | $ | (0.07) | | | $ | 499.2 | | | $ | 10.47 | |

| Adjustments: | | | | | | | | | | | | | | | |

| Amortization of intangibles | 51.4 | | | | | 21.0 | | | | | 102.2 | | | | | 28.1 | | | |

| Acquisition and integration costs | 24.2 | | | | | 80.2 | | | | | 53.9 | | | | | 83.2 | | | |

Incremental depreciation on PP&E fair value

adjustment | 8.5 | | | | | — | | | | | 17.1 | | | | | — | | | |

Amortization of deferred cloud computing

implementation costs | 1.5 | | | | | 1.3 | | | | | 3.1 | | | | | 2.3 | | | |

| EU medical device regulation transition costs | 0.7 | | | | | 0.4 | | | | | 1.5 | | | | | 0.4 | | | |

| Impairment of long-lived assets | 0.5 | | | | | — | | | | | 1.0 | | | | | — | | | |

| Loss on investments | 0.2 | | | | | 0.8 | | | | | 0.2 | | | | | 0.8 | | | |

Noncash interest expense for deferred

consideration | 0.1 | | | | | 0.8 | | | | | 0.7 | | | | | 1.7 | | | |

| Loss on extinguishment of debt | — | | | | | 24.0 | | | | | — | | | | | 24.0 | | | |

| Unwind inventory fair value adjustment | — | | | | | 11.2 | | | | | — | | | | | 11.2 | | | |

| Employee compensation charges and other costs | — | | | | | 0.5 | | | | | 1.5 | | | | | 0.5 | | | |

| Change in fair value of acquisition contingencies | — | | | | | 0.1 | | | | | — | | | | | 0.1 | | | |

| Derivative mark-to-market gain | — | | | | | (1.0) | | | | | — | | | | | (1.0) | | | |

| Income tax impact of adjustments | (15.2) | | | | | (34.9) | | | | | (37.3) | | | | | (37.5) | | | |

| Discrete tax items | (1.3) | | | | | — | | | | | (1.1) | | | | | — | | | |

| Adjusted net income | $ | 17.4 | | | $ | 0.26 | | | $ | 123.7 | | | $ | 2.34 | | | $ | 138.4 | | | $ | 2.06 | | | $ | 613.0 | | | $ | 12.85 | |

| Ortho pre-combination adjusted net income | — | | | | | 20.2 | | | | | — | | | | | 77.2 | | | |

| Supplemental combined adjusted net income | $ | 17.4 | | | $ | 0.26 | | | $ | 143.9 | | | $ | 2.12 | | | $ | 138.4 | | | $ | 2.06 | | | $ | 690.2 | | | $ | 10.15 | |

| Weighted-average shares outstanding - diluted | | | 67.2 | | | | | 52.9 | | | | | 67.2 | | | | | 47.7 | |

Weighted-average shares outstanding - diluted -

supplemental combined | | | 67.2 | | | | | 68.0 | | | | | 67.2 | | | | | 68.0 | |

(a) Adjusted net income includes Ortho activities for the three and six months ended July 2, 2023.

(b) Adjusted net income includes Ortho activities from May 27, 2022 through July 3, 2022.

QuidelOrtho

Reconciliation of Non-GAAP Financial Information - Adjusted EBITDA

(In millions, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 2, 2023 (a) | | July 3, 2022 (b) | | July 2, 2023 (a) | | July 3, 2022 (b) |

| Net (loss) income | $ | (53.2) | | | $ | 19.3 | | | $ | (4.4) | | | $ | 499.2 | |

| Depreciation and amortization | 114.5 | | | 47.5 | | | 228.7 | | | 62.8 | |

| Interest expense, net | 36.5 | | | 10.3 | | | 73.2 | | | 11.3 | |

| (Benefit from) provision for income taxes | (11.2) | | | 23.6 | | | — | | | 164.3 | |

| Acquisition and integration costs | 24.2 | | | 80.2 | | | 53.9 | | | 83.2 | |

Amortization of deferred cloud computing

implementation costs | 1.5 | | | 1.3 | | | 3.1 | | | 2.3 | |

| EU medical device regulation transition costs | 0.7 | | | 0.4 | | | 1.5 | | | 0.4 | |

| Impairment of long-lived assets | 0.5 | | | — | | | 1.0 | | | — | |

| Loss on investments | 0.2 | | | 0.8 | | | 0.2 | | | 0.8 | |

| Tax indemnification income | (0.4) | | | — | | | (0.1) | | | — | |

| Loss on extinguishment of debt | — | | | 24.0 | | | — | | | 24.0 | |

| Unwind inventory fair value adjustment | — | | | 11.2 | | | — | | | 11.2 | |

| Employee compensation charges and other costs | — | | | 0.5 | | | 1.5 | | | 0.5 | |

| | | | | | | |

| Change in fair value of acquisition contingencies | — | | | 0.1 | | | — | | | 0.1 | |

| Derivative mark-to-market gain | — | | | (1.0) | | | — | | | (1.0) | |

| Adjusted EBITDA | $ | 113.3 | | | $ | 218.2 | | | $ | 358.6 | | | $ | 859.1 | |

| Ortho pre-combination Adjusted EBITDA | — | | | 72.6 | | | — | | | 212.5 | |

| Supplemental combined Adjusted EBITDA | $ | 113.3 | | | $ | 290.8 | | | $ | 358.6 | | | $ | 1,071.6 | |

(a) Adjusted EBITDA includes Ortho activities for the three and six months ended July 2, 2023.

(b) Adjusted EBITDA includes Ortho activities from May 27, 2022 through July 3, 2022.

QuidelOrtho

Supplemental Combined Revenues by Business Unit and Region

(In millions, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | |

| July 2, 2023 | | July 3, 2022 | | % Change | | Currency Impact | | Constant Currency (a) |

| Respiratory revenues | $ | 89.0 | | | $ | 339.1 | | | (73.8) | % | | — | % | | (73.8) | % |

| Non-Respiratory revenues | 576.1 | | | 559.4 | | | 3.0 | % | | (1.1) | % | | 4.1 | % |

| Total supplemental combined revenues | $ | 665.1 | | | $ | 898.5 | | | (26.0) | % | | (0.1) | % | | (25.9) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | | | | | |

| July 2, 2023 | | July 3, 2022 | | % Change | | Currency Impact | | Constant Currency (a) | | Respiratory Revenue Impact | | Constant Currency (a) Non-Respiratory Revenue |

| Labs | $ | 361.4 | | | $ | 342.0 | | | 5.7 | % | | (1.3) | % | | 7.0 | % | | (2.1) | % | | 9.1 | % |

| Transfusion Medicine | 163.3 | | | 168.8 | | | (3.3) | % | | (0.8) | % | | (2.5) | % | | — | % | | (2.5) | % |

| Point of Care | 134.2 | | | 367.0 | | | (63.4) | % | | 0.1 | % | | (63.5) | % | | (59.0) | % | | (4.5) | % |

| Molecular Diagnostics | 6.2 | | | 20.7 | | | (70.0) | % | | — | % | | (70.0) | % | | (62.6) | % | | (7.4) | % |

| Total supplemental combined revenues | $ | 665.1 | | | $ | 898.5 | | | (26.0) | % | | (0.1) | % | | (25.9) | % | | (30.0) | % | | 4.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | | | | | |

| July 2, 2023 | | July 3, 2022 | | % Change | | Currency Impact | | Constant Currency (a) | | Respiratory Revenue Impact | | Constant Currency (a) Non-Respiratory Revenue |

| North America | $ | 378.8 | | | $ | 595.7 | | | (36.4) | % | | (0.3) | % | | (36.1) | % | | (34.4) | % | | (1.7) | % |

| EMEA | 80.6 | | | 82.9 | | | (2.8) | % | | (0.3) | % | | (2.5) | % | | (6.0) | % | | 3.5 | % |

| China | 81.3 | | | 96.1 | | | (15.4) | % | | (2.0) | % | | (13.4) | % | | (38.9) | % | | 25.5 | % |

| Other | 124.4 | | | 123.8 | | | 0.5 | % | | (0.6) | % | | 1.1 | % | | (7.7) | % | | 8.8 | % |

| Total supplemental combined revenues | $ | 665.1 | | | $ | 898.5 | | | (26.0) | % | | (0.1) | % | | (25.9) | % | | (30.0) | % | | 4.1 | % |

Tables above include Ortho revenues as if the acquisition had occurred on January 2, 2022.

(a) The term “constant currency” means we have translated local currency revenues for all reporting periods to U.S. dollars using currency exchange rates held constant for each period. This additional non-GAAP financial information is not meant to be considered in isolation from or as substitute for financial information prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended | | | | | | |

| July 2, 2023 | | July 3, 2022 | | % Change | | Currency Impact | | Constant Currency (a) |

| Respiratory revenues | $ | 354.6 | | | $ | 1,286.4 | | | (72.4) | % | | — | % | | (72.4) | % |

| Non-Respiratory revenues | 1,156.6 | | | 1,114.5 | | | 3.8 | % | | (1.6) | % | | 5.4 | % |

Total supplemental combined revenues (b) | $ | 1,511.2 | | | $ | 2,400.9 | | | (37.1) | % | | (0.1) | % | | (37.0) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended | | | | | | | | | | |

| July 2, 2023 | | July 3, 2022 | | % Change | | Currency Impact | | Constant Currency (a) | | Respiratory Revenue Impact | | Constant Currency (a) Non-Respiratory Revenue |

Labs (b) | $ | 732.1 | | | $ | 681.7 | | | 7.4 | % | | (1.7) | % | | 9.1 | % | | (2.8) | % | | 11.9 | % |

| Transfusion Medicine | 319.2 | | | 342.5 | | | (6.8) | % | | (1.5) | % | | (5.3) | % | | — | % | | (5.3) | % |

| Point of Care | 442.3 | | | 1,310.0 | | | (66.2) | % | | — | % | | (66.2) | % | | (67.3) | % | | 1.1 | % |

| Molecular Diagnostics | 17.6 | | | 66.7 | | | (73.6) | % | | 0.1 | % | | (73.7) | % | | (56.3) | % | | (17.4) | % |

Total supplemental combined revenues (b) | $ | 1,511.2 | | | $ | 2,400.9 | | | (37.1) | % | | (0.1) | % | | (37.0) | % | | (42.4) | % | | 5.4 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended | | | | | | | | | | |

| July 2, 2023 | | July 3, 2022 | | % Change | | Currency Impact | | Constant Currency (a) | | Respiratory Revenue Impact | | Constant Currency (a) Non-Respiratory Revenue |

| North America | $ | 961.6 | | | $ | 1,833.5 | | | (47.6) | % | | (0.2) | % | | (47.4) | % | | (48.8) | % | | 1.4 | % |

| EMEA | 161.9 | | | 166.9 | | | (3.0) | % | | (1.9) | % | | (1.1) | % | | (4.6) | % | | 3.5 | % |

| China | 151.9 | | | 159.4 | | | (4.7) | % | | (4.0) | % | | (0.7) | % | | (24.0) | % | | 23.3 | % |

| Other | 235.8 | | | 241.1 | | | (2.2) | % | | (2.0) | % | | (0.2) | % | | (8.9) | % | | 8.7 | % |

Total supplemental combined revenues (b) | $ | 1,511.2 | | | $ | 2,400.9 | | | (37.1) | % | | (0.1) | % | | (37.0) | % | | (42.4) | % | | 5.4 | % |

| | | | | | | | | | | | | |

Tables above include Ortho revenues as if the acquisition had occurred on January 2, 2022.

(a) The term “constant currency” means we have translated local currency revenues for all reporting periods to U.S. dollars using currency exchange rates held constant for each period. This additional non-GAAP financial information is not meant to be considered in isolation from or as substitute for financial information prepared in accordance with GAAP.

(b) The six months ended July 2, 2023 includes an approximate $19 million settlement award from a third party related to one of the Company’s collaboration agreements.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

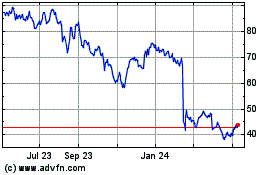

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From Apr 2024 to May 2024

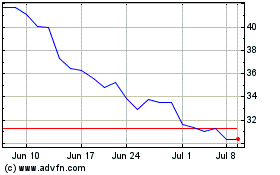

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From May 2023 to May 2024