Current Report Filing (8-k)

September 10 2019 - 4:53PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Form

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): September 5, 2019

Professional

Diversity Network, Inc.

(Exact

Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-35824

|

|

80-0900177

|

(State

of other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification Number)

|

|

801

W. Adams Street, Sixth Floor, Chicago, Illinois

|

|

60607

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (312) 614-0950

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

3.02 Unregistered Sales of Equity Securities

On

September 5, 2019, Professional Diversity Network, Inc. (the “Company”) entered into an agreement with Ms. Yao Wei

Ling, an individual and a resident of the People’s Republic of China (“Yao”), in connection with the purchase

by Yao of 442,830 shares of common stock of the Company (collectively the “Yao Shares”) at a price of $1.58 per share

for gross proceeds of $699,672.55. The closing of the transaction took place on September 10, 2019.

On

September 5, 2019, the Company entered into an agreement with Mr. Gao Yin Chun, an individual and a resident of the People’s

Republic of China (“Gao”), in connection with the purchase by Gao of 189,873 shares of common stock of the Company

(collectively the “Gao Shares”) at a price of $1.58 per share for gross proceeds of $300,000.00. The closing of the

transaction took place on September 10, 2019.

On

September 9, 2019, the Company entered into an agreement with EGBT Foundation Ltd., a Singapore public company limited by guarantee

(“EGBT”), in connection with the purchase by EGBT of 1,265,823 shares of common stock of the Company (collectively

the “EGBT Shares”, and together with Yao Shares and Gao Shares, the “Shares”) at a price of $1.58 per

share for gross proceeds of $2,000,000.00. The closing of the first tranche of approximately $1,000,000 of investment is expected

to take place on or about September 13, 2019 and the closing the remaining $1,000,000 of investment is expected to take place

by September 30, 2019.

The

issuances of the Shares are exempt from registration due to the exemption found in Regulation S promulgated by the Securities

and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”). The sales were offshore

transactions since the offerees/purchasers were outside the United States at the time of the purchase. Further, there were no

directed selling efforts of any kind made in the United States either by the Company or any affiliate or other person acting on

the Company’s behalf in connection with the offerings. All offering materials and documents used in connection with the

offers and sales of the securities included statements to the effect that the securities have not been registered under the Securities

Act and may not be offered or sold in the United States or to U.S. persons unless the securities are registered under the Securities

Act or an exemption therefrom is available, and that hedging transactions involving the Shares may not be conducted unless in

compliance with the Securities Act. Each of Yao, Gao and EGBT certified that she, he or it is not a U.S. person (as that term

is defined in Regulation S) and is not acquiring the Shares for the account or benefit of any U.S. person and agreed to resell

the applicable Shares only in accordance with the provisions of Regulation S, pursuant to registration under the Securities Act

or pursuant to an available exemption from registration. The Shares sold are restricted securities and the certificates representing

the Shares will be affixed with a standard restrictive legend, which states that the Shares cannot be sold without registration

under the Securities Act or an exemption therefrom.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

September 10, 2019

|

PROFESSIONAL

DIVERSITY NETWORK, INC.

|

|

|

|

|

|

|

By:

|

/s/

Xin (Adam) He

|

|

|

|

Xin

(Adam) He

|

|

|

|

Chief

Financial Officer

|

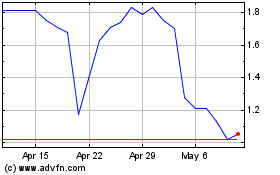

Professional Diversity N... (NASDAQ:IPDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Professional Diversity N... (NASDAQ:IPDN)

Historical Stock Chart

From Apr 2023 to Apr 2024