false

0001774170

0001774170

2024-01-30

2024-01-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): January 30, 2024

POWERFLEET,

INC.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-39080 |

|

83-4366463 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 123

Tice Boulevard, Woodcliff Lake, New Jersey |

|

07677 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code (201) 996-9000

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☒ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.01 per share |

|

PWFL |

|

The

Nasdaq Global Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As

previously disclosed in the Current Report on Form 8-K filed on October 10, 2023, PowerFleet, Inc., a Delaware corporation (the “Company”),

entered into an Implementation Agreement (the “Agreement”), by and among the Company, MiX Telematics Limited, a public company

incorporated under the laws of the Republic of South Africa (“MiX Telematics”), and Main Street 2000 Proprietary Limited,

a private company incorporated in the Republic of South Africa and a wholly owned subsidiary of the Company (“Powerfleet Sub”),

pursuant to which, subject to the terms and conditions thereof, Powerfleet Sub will acquire all of the issued ordinary shares of Mix

Telematics, no par value (“MiX Ordinary Shares”), including the MiX Ordinary Shares represented by Mix Telematics’

American Depositary Shares (“MiX ADSs”), through the implementation of a scheme of arrangement (the “Scheme”)

in accordance with Sections 114 and 115 of the South African Companies Act, No. 71 of 2008, as amended (the “Companies Act”),

in exchange for shares of common stock, par value $0.01 per share, of the Company. As a result of the transactions, including the Scheme,

contemplated by the Agreement (the “Transactions”), MiX Telematics will become an indirect, wholly owned subsidiary of the

Company.

On

January 30, 2024, the Company and MiX Telematics issued a press release announcing the shareholders meetings to vote on the Transactions

and a submission to the Johannesburg Stock Exchange (the “JSE”) providing an update regarding the issue of documentation

in respect of the Transactions. The full text of the press release and the submission to the JSE, copies of which are attached hereto

as Exhibit 99.1 and Exhibit 99.2, respectively, are incorporated herein by reference.

Additional

Information and Where to Find It

In

connection with the proposed Transactions, the Company filed, and the Securities and Exchange Commission (the “SEC”) declared

effective on January 24, 2024, a registration statement on Form S-4 (the “Registration Statement”) that includes a joint

proxy statement of the Company and MiX Telematics and that also constitutes a prospectus of the Company. The Company and MiX Telematics

commenced the mailing of the joint proxy statement/prospectus on January 29, 2024. Each of the Company and MiX Telematics may also file

other relevant documents with the SEC regarding the proposed Transactions. This report is not a substitute for the definitive joint proxy

statement/prospectus or any other document that the Company or MiX Telematics may file with the SEC. If you hold MiX Ordinary Shares

through an intermediary such as a broker/dealer or clearing agency, or if you hold MiX ADSs, you should consult with your intermediary

or The Bank of New York Mellon, the depositary for the MiX ADSs, as applicable, about how to obtain information on the MiX Telematics

shareholder meeting. INVESTORS AND SECURITYHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS

AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH, OR FURNISHED TO, THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE

DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE TRANSACTIONS. Investors and shareholders can obtain free copies of these documents and other documents containing important information

through the website maintained by the SEC at www.sec.gov. The Company and MiX Telematics make available copies of materials they

file with, or furnish to, the SEC free of charge at https://ir.powerfleet.com and https://investor.mixtelematics.com, respectively.

No

Offer or Solicitation

This

report shall not constitute an offer to buy or sell any securities, or the solicitation of an offer to buy or sell any securities, nor

shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants

in the Solicitation

The

Company, MiX Telematics and their respective directors, executive officers and certain employees and other persons may be deemed to be

participants in the solicitation of proxies from the shareholders of the Company and MiX Telematics in connection with the Transactions.

Securityholders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive

officers in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 31, 2023,

its amended Annual Report on Form 10-K/A for the year ended December 31, 2022, which was filed with the SEC on May 1, 2023, and its definitive

proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on June 21, 2023. Securityholders may obtain

information regarding the names, affiliations and interests of MiX Telematics’ directors and executive officers in its Annual Report

on Form 10-K for the year ended March 31, 2023, which was filed with the SEC on June 22, 2023, and its definitive proxy statement for

its 2023 annual general meeting of shareholders, which was filed with the SEC on July 28, 2023. Other information regarding the participants

in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, may be contained

in other relevant materials to be filed with the SEC regarding the Transactions when such materials become available. Investors should

read such materials carefully when they become available before making any voting or investment decisions. You may obtain free copies

of these documents from the Company or MiX Telematics using the sources indicated above.

Cautionary

Note Regarding Forward-Looking Statements

This

report contains forward-looking statements within the meaning of federal securities laws. The Company’s, MiX Telematics’

and the combined business’s actual results may differ from their expectations, estimates and projections and consequently, you

should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,”

“project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,”

“may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,”

“continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements

include, without limitation, the parties’ expectations with respect to their beliefs, plans, goals, objectives, expectations, anticipations,

assumptions, estimates, intentions and future performance, as well as anticipated financial impacts of the Transactions, the satisfaction

of the closing conditions to the Transactions and the timing of the completion of the Transactions. Forward-looking statements involve

significant known and unknown risks, uncertainties and other factors, which may cause their actual results, performance or achievements

to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements.

All statements other than statements of historical fact are statements that could be forward-looking statements. Most of these factors

are outside the parties’ control and are difficult to predict. The risks and uncertainties referred to above include, but are not

limited to, risks related to: (i) the completion of the Transactions in the anticipated timeframe or at all; (ii) the satisfaction of

the closing conditions to the Transactions including, but not limited to the ability to obtain approval of the stockholders of the Company

and shareholders of MiX Telematics and the ability to obtain financing; (iii) the failure to obtain necessary regulatory approvals; (iv)

the ability to realize the anticipated benefits of the Transactions; (v) the ability to successfully integrate the businesses; (vi) disruption

from the Transactions making it more difficult to maintain business and operational relationships; (vii) the negative effects of the

announcement of the Transactions or the consummation of the Transactions on the market price of MiX Telematics’ or the Company’s

securities; (viii) significant transaction costs and unknown liabilities; (ix) litigation or regulatory actions related to the Transactions;

and (x) such other factors as are set forth in the periodic reports filed by MiX Telematics and the Company with the SEC, including but

not limited to those described under the heading “Risk Factors” in their annual reports on Form 10-K, quarterly reports on

Form 10-Q and any other filings made with the SEC from time to time, which are available via the SEC’s website at https://www.sec.gov.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results

may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of

these forward-looking statements.

The

forward-looking statements included in this report are made only as of the date of this report, and except as otherwise required by applicable

securities law, neither MiX Telematics nor the Company assumes any obligation, nor do they intend to publicly update or revise any forward-looking

statements to reflect subsequent events or circumstances.

| Item

9.01. |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

POWERFLEET,

INC. |

| |

|

| |

By: |

/s/

David Wilson |

| |

Name: |

David

Wilson |

| |

Title: |

Chief

Financial Officer |

| |

|

|

| Date:

January 30, 2024 |

|

|

Exhibit

99.1

Powerfleet

and MiX Telematics Announce Shareholders Meetings to Vote on Proposed Business Combination

Completion

of Regulatory Milestones Results in Scheduled Shareholders Meetings

WOODCLIFF

LAKE, NJ – January 30, 2024 – Powerfleet, Inc. (Nasdaq: PWFL) and MiX Telematics Limited (NYSE: MIXT, JSE: MIX)

today announced that their respective shareholders meetings will be held virtually on Wednesday, February 28, 2024 to vote on the proposed

business combination between the parties. Powerfleet’s shareholder meeting will be held at 10:00 a.m., Eastern Time and MiX’s

shareholder meeting will be held at 2:30 p.m., SAST.

The

Powerfleet and MiX teams have worked diligently to satisfy all necessary regulatory requirements, in both South Africa and the U.S.,

to proceed with the shareholders meetings. The registration statement, which contains the joint proxy statement/prospectus relating to

the transaction and the shareholders meetings, was declared effective by the SEC on January 24, 2024. Powerfleet and MiX commenced mailing

of the joint proxy statement/prospectus on January 29, 2024. The scheme circular (together with the prospectus for the Powerfleet secondary

listing on the JSE) with respect to the MiX shareholders meeting will be distributed by MiX to MiX shareholders today, Tuesday, January

30, 2024. The extensive work completed since signing the deal on October 10, 2023 has further prepared the companies to realize the anticipated

strategic and financial benefits from the combination.

“I

am delighted by the completion of the regulatory steps required for us to arrive at the shareholders meetings next month. These meetings

represent a significant step towards the closing of our transformative combination with MiX,” said Steve Towe, Powerfleet’s

Chief Executive Officer, who will continue serving as CEO of the combined Powerfleet company. “As we shared at our joint investor

day in November, the business combination is expected to unlock significant incremental value creation opportunities while establishing

Powerfleet as a world-leading AIoT SaaS company, giving us the speed and capability to achieve accelerated growth in high-quality recurring

revenues and expanded profitability more quickly. We have been extremely encouraged with the engagement of new prospective investors

following the deal announcement and Investor Day event.”

Stefan

Joselowitz, Chief Executive Officer at MiX Telematics, intends to retire at the conclusion of this transaction, but plans to continue

to be a shareholder of the new combined entity. Joselowitz added, “My confidence and excitement for the transaction has grown even

greater throughout the regulatory process period. As a shareholder, I strongly believe that the combined leadership group with Steve’s

stewardship, Powerfleet’s Unity strategy, and our combined scale will undoubtedly accelerate the achievement of our shared strategic

goals.”

The

transaction is expected to close at the beginning of April 2024, subject to the satisfaction of customary conditions, including obtaining

the required shareholder approvals. Upon closing, the combined business will be branded as Powerfleet, with its primary listing on Nasdaq.

ABOUT

POWERFLEET

Powerfleet

(Nasdaq: PWFL; TASE: PWFL) is a global leader of internet of things (IoT) software-as-a-service (SaaS) solutions that optimize the performance

of mobile assets and resources to unify business operations. Our data science insights and advanced modular software solutions help drive

digital transformation through our customers’ and partners’ ecosystems to help save lives, time, and money. We help connect

companies, enabling customers and their customers to realize more effective strategies and results. Powerfleet’s tenured and talented

team is at the heart of our approach to partnership and tangible success. The company is headquartered in Woodcliff Lake, New Jersey,

with our Pointer Innovation Center (PIC) in Israel and field offices around the globe. For more information, please visit www.powerfleet.com.

ABOUT

MIX TELEMATICS

MiX

Telematics is a leading global provider of fleet and mobile asset management solutions delivered as SaaS to over 1 million global subscribers

spanning more than 120 countries. The company’s products and services provide enterprise fleets, small fleets, and consumers with

efficiency, safety, compliance, and security solutions. MiX Telematics was founded in 1996 and has offices in South Africa, the United

Kingdom, the United States, Uganda, Brazil, Mexico and Australasia as well as a network of more than 130 fleet partners worldwide. MiX

Telematics shares are publicly traded on the Johannesburg Stock Exchange (“JSE”) (JSE: MIX) and the New York Stock Exchange

(NYSE: MIXT). For more information, visit www.mixtelematics.com.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

press release contains forward-looking statements within the meaning of federal securities laws. Powerfleet’s, MiX’s and

the combined business’s actual results may differ from their expectations, estimates and projections and consequently, you should

not rely on these forward-looking statements as predictions of future events. Forward-looking statements may be identified by words such

as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “continue,” and similar expressions.

These

forward-looking statements include, without limitation, the parties’ expectations with respect to their beliefs, plans, goals,

objectives, expectations, anticipations, assumptions, estimates, intentions and future performance, as well as anticipated financial

impacts of the proposed transaction, the satisfaction of the closing conditions to the proposed transaction and the timing of the completion

of the proposed transaction. Forward-looking statements involve significant known and unknown risks, uncertainties and other factors,

which may cause their actual results, performance or achievements to be materially different from the future results, performance or

achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements

that could be forward-looking statements. Most of these factors are outside the parties’ control and are difficult to predict.

The risks and uncertainties referred to above include, but are not limited to, risks related to: (i) the completion of the proposed transaction

in the anticipated timeframe or at all; (ii) the satisfaction of the closing conditions to the proposed transaction including, but not

limited to the ability to obtain approval of the stockholders of Powerfleet and shareholders of MiX and the ability to obtain financing;

(iii) the failure to obtain necessary regulatory approvals; (iv) the ability to realize the anticipated benefits of the proposed transaction;

(v) the ability to successfully integrate the businesses; (vi) disruption from the proposed transaction making it more difficult to maintain

business and operational relationships; (vii) the negative effects of the announcement of the proposed transaction or the consummation

of the proposed transaction on the market price of MiX’s or Powerfleet’s securities; (viii) significant transaction costs

and unknown liabilities; (ix) litigation or regulatory actions related to the proposed transaction; and (x) such other factors as are

set forth in the periodic reports filed by MiX and Powerfleet with the Securities and Exchange Commission (“SEC”), including

but not limited to those described under the heading “Risk Factors” in their annual reports on Form 10-K, quarterly reports

on Form 10-Q and any other filings made with the SEC from time to time, which are available via the SEC’s website at http://www.sec.gov.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove to be incorrect, actual results

may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of

these forward-looking statements.

The

forward-looking statements included in this press release are made only as of the date of this press release, and except as otherwise

required by applicable securities law, neither MiX nor Powerfleet assumes any obligation, nor do they intend to publicly update or revise

any forward-looking statements to reflect subsequent events or circumstances.

ADDITIONAL

INFORMATION AND WHERE TO FIND IT

In

connection with the proposed transaction, Powerfleet has filed, and the SEC declared effective on January 24, 2024, a registration statement

on Form S-4 that includes a joint proxy statement of Powerfleet and MiX Telematics and that also constitutes a prospectus of Powerfleet.

Powerfleet and MiX Telematics commenced the mailing of the joint proxy statement/prospectus on January 29, 2024. Each of Powerfleet and

MiX Telematics may also file other relevant documents with the SEC regarding the proposed transaction. This press release is not a substitute

for the definitive joint proxy statement/prospectus or any other document that Powerfleet or MiX Telematics may file with the SEC. Additionally,

MiX is distributing a scheme circular in respect of the scheme and a prospectus for the Powerfleet secondary listing on the JSE to MiX

shareholders in accordance with the Companies Act of South Africa (including the Companies Act Regulations, 2011 thereunder) and the

JSE Listings Requirements. The scheme circular includes a notice of general meeting convening a shareholder meeting at which MiX shareholders

will be asked to vote on the proposed transaction, which, together with the Powerfleet prospectus, will contain all relevant information

for MiX shareholders voting on the proposed transaction. If you hold MiX ordinary shares through an intermediary such as a broker/dealer

or clearing agency, or if you hold MiX American Depositary Shares (ADS), you should consult with your intermediary or The Bank of New

York Mellon, the depositary for the MiX ADSs, as applicable, about how to obtain information on the MiX shareholder meeting. INVESTORS

AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS

THAT MAY BE FILED WITH, OR FURNISHED TO, THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR

ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors

and shareholders can obtain free copies of these documents and other documents containing important information through the website maintained

by the SEC at www.sec.gov. Powerfleet or MiX Telematics make available copies of materials they file with, or furnish to, the SEC free

of charge at https://ir.powerfleet.com and http://investor.mixtelematics.com, respectively.

NO

OFFER OR SOLICITATION

This

communication shall not constitute an offer to buy or sell any securities, or the solicitation of an offer to buy or sell any securities,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

PARTICIPANTS

IN THE SOLICITATION

Powerfleet,

MiX and their respective directors, executive officers and certain employees and other persons may be deemed to be participants in the

solicitation of proxies from the shareholders of Powerfleet and MiX in connection with the proposed transaction. Securityholders may

obtain information regarding the names, affiliations and interests of Powerfleet’s directors and executive officers in its Annual

Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 31, 2023, its amended Annual Report

on Form 10-K/A for the year ended December 31, 2022, which was filed with the SEC on May 1, 2023, and its definitive proxy statement

for its 2023 annual meeting of stockholders, which was filed with the SEC on June 21, 2023. Securityholders may obtain information regarding

the names, affiliations and interests of MiX’s directors and executive officers in its Annual Report on Form 10-K for the year

ended March 31, 2023, which was filed with the SEC on June 22, 2023, and its definitive proxy statement for its 2023 annual general meeting

of shareholders, which was filed with the SEC on July 28, 2023. Other information regarding the participants in the proxy solicitations

and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus

and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors

should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

You may obtain free copies of these documents from Powerfleet or MiX using the sources indicated above.

Powerfleet

Investor Contact

Matt

Glover

Gateway

Group, Inc.

PWFL@gateway-grp.com

+1

(949) 574-3860

Powerfleet

Media Contact

Andrea

Hayton

ahayton@powerfleet.com

+1

(610) 401-1999

MiX

Telematics Investor Contact

Cody

Cree

Gateway

Group, Inc.

+1

(949) 574-3860

MIXT@gateway-grp.com

MiX

Telematics Media Contact

Jonathan

Bates

jonathan.bates@mixtelematics.com

+44

7921 242892

Exhibit

99.2

|

|

MIX

TELEMATICS LIMITED

(Incorporated

in the South Africa)

(Registration

number 1995/013858/06)

JSE

share code: MIX

ISIN:

ZAE000125316

NYSE

share code: MIXT

(“MiX

Telematics” or “the Company”) |

POWERFLEET,

INC.

(Incorporated

in the State of Delaware, USA)

Nasdaq

share code: PWFL

ISIN:

US73931J1097

(“PowerFleet”) |

TRANSACTION

UPDATE AND ISSUE OF DOCUMENTATION IN RESPECT OF PROPOSED TRANSACTION BETWEEN MiX TELEMATICS AND POWERFLEET

Unless

otherwise indicated, capitalised words and terms contained in this announcement shall bear the same meanings ascribed thereto in the

joint firm intention announcement published by MiX and PowerFleet on SENS on 10 October 2023.

POSTING

OF SCHEME CIRCULAR AND NOTICE OF SCHEME MEETING, POWERFLEET PROSPECTUS AND REGISTRATION STATEMENT

Shareholders

are referred to the joint firm intention announcement released on SENS by MiX Telematics and PowerFleet on 10 October 2023 and the update

regarding the issue of documentation announcement released on SENS on 22 November 2023 relating to the Proposed Transaction.

MiX

Telematics will distribute the Scheme Circular in respect of the Scheme and the PowerFleet Prospectus in respect of the PowerFleet Listing

to MiX Telematics’ shareholders today, Tuesday, 30 January 2024.

The

Scheme Circular incorporates a notice of scheme meeting convened for the purposes of approving the resolutions required to implement

the Scheme. MiX Telematics and PowerFleet have satisfied all relevant regulatory requirements (in both South Africa and the U.S.) in

order to proceed with shareholder meetings in respect of the Proposed Transaction. A scheme meeting of shareholders will be held at 2:30

p.m. South African Standard Time (“SAST”) on Wednesday, 28 February 2024 and will be held entirely by way of electronic

communication, for the purpose of considering and, if deemed fit, passing with or without modification the resolutions required to be

approved by shareholders in order to authorise and implement the Scheme.

The

PowerFleet Prospectus is prepared and issued in accordance with the Companies Act, 71 of 2008, the Companies Regulations, 2011 and the

JSE Listings Requirements for the purpose of providing statutorily required information about PowerFleet to MiX Telematics shareholders

following the implementation of the Scheme, the termination of listing of all the MiX Telematics shares from the Main Board of the JSE

pursuant to the Scheme and the simultaneous secondary inward listing of PowerFleet on the Main Board of the JSE as further detailed the

PowerFleet Prospectus. An abridged version of the PowerFleet Prospectus has been released on SENS on Tuesday, 30 January 2024.

In

connection with the Proposed Transaction, PowerFleet has filed, and the U.S. Securities and Exchange Commission (the “SEC”)

declared effective on 24 January 2024, a Registration Statement on Form S-4, which includes a joint proxy statement of the Company and

PowerFleet and a U.S. prospectus of PowerFleet. The Company and PowerFleet commenced the mailing of the joint proxy statement/U.S. prospectus

on 29 January 2024. Each of the Company and PowerFleet may also file other relevant documents with the SEC regarding the Proposed Transaction.

Any holder of MiX Telematics ordinary shares through an intermediary such as a broker/dealer or clearing agency or MiX Telematics ADSs

should consult with their intermediary or The Bank of New York Mellon, the depositary for the MiX Telematics ADSs, as applicable, about

how to obtain information on the Company’s shareholder meeting.

PowerFleet

will convene a meeting of PowerFleet shareholders at 10:00 a.m. Eastern Time (5:00 p.m. SAST) on Wednesday, 28 February 2024 in order

to obtain the approval of its shareholders to implement the Proposed Transaction, including shareholder approval to increase the number

of authorised PowerFleet shares to enable PowerFleet to settle the Scheme Consideration.

The

Scheme Circular, the PowerFleet Prospectus and the Registration Statement are available on the MiX Telematics’ website (https://investor.mixtelematics.com/overview/default.aspx)

and may be requested from MiX Telematics by emailing company.secretary@mixtelematics.com or the sponsor, Java Capital, at sponsor@javacapital.co.za.

OPINIONS

AND RECOMMENDATIONS OF THE INDEPENDENT BOARD

The

Independent Board of MiX Telematics, comprising Fikile Futwa, Richard Bruyns and Charmel Flemming appointed BDO to provide the Independent

Board with its opinion as to whether the terms of the Scheme are fair and reasonable to MiX Telematics shareholders, in accordance with

the requirements of Chapter 5 of the Companies Regulations, 2011.

BDO

has delivered to the Independent Board its opinion that, as at the date of issue of its opinion, the Scheme is fair and reasonable to

MiX Telematics shareholders. The Independent Board, having considered the terms of the Scheme and, inter alia, the opinion of

BDO, is of the view that the Scheme is fair and reasonable to MiX Telematics shareholders.

SALIENT

DATES AND TIMES

The

salient dates and times relating to the Scheme and its implementation are set out below:

| |

|

2024 |

Notice

record date to determine which MiX Telematics shareholders and ADS holders are entitled to receive the Scheme Circular and the PowerFleet

Prospectus

|

|

Friday,

19 January |

| Scheme

Circular together with the accompanying notice convening the scheme meeting, form of proxy and form of surrender and transfer distributed

to MiX Telematics shareholders on |

|

Tuesday,

30 January |

| |

|

|

| Announcement

relating to the abridged PowerFleet Prospectus published on SENS on |

|

Tuesday,

30 January |

| |

|

|

| Announcement

relating to the issue of the Scheme Circular (together with the notice of the scheme meeting) and the PowerFleet Prospectus published

in the press on |

|

Wednesday,

31 January |

| |

|

|

| Announcement

relating to the abridged PowerFleet Prospectus published in the press on |

|

Wednesday,

31 January |

| |

|

|

| Last

date to trade in MiX Telematics shares on the JSE in order to be recorded on the register to vote at the scheme meeting on (“voting

LDT”) |

|

Tuesday,

20 February |

| |

|

|

| Record

date to be eligible to vote at the scheme meeting, being the voting record date, by the close of trade on (“voting record

date”) |

|

Friday,

23 February |

| |

|

|

| Last

date and time to lodge forms of proxy in respect of the scheme meeting with the transfer secretaries by 2:30 p.m SAST on (alternatively,

the form of proxy may be provided to the chairperson of the scheme meeting at any time prior to the commencement of the scheme meeting

or prior to voting on any resolution to be proposed at the scheme meeting) |

|

Monday,

26 February |

| |

|

|

| Last

date and time for MiX Telematics shareholders to give notice of their objections to the scheme resolutions in terms of section 164

of the Companies Act by no later than 2:30 p.m SAST on |

|

Wednesday,

28 February |

| |

|

|

| Scheme

meeting held at 2:30 p.m SAST on |

|

Wednesday,

28 February |

| |

|

|

| Results

of the scheme meeting published on SENS on |

|

Wednesday,

28 February |

| |

|

|

| Results

of the scheme meeting published in the press on |

|

Thursday,

29 February |

Assuming

that the scheme is approved and no court approval or review of the scheme in terms of section 115(3) of the Companies Act is required

and that the scheme meeting is the second to last of the condition precedent to be fulfilled, the salient dates are as follows:

| Last

day for MiX Telematics shareholders who voted against the Scheme to require MiX Telematics to seek court approval for the Scheme

in terms of section 115(3)(a) of the Companies Act, if at least 15% of the total votes of MiX Telematics shareholders at the scheme

meeting were exercised against the Scheme |

|

Wednesday,

6 March |

| |

|

|

| Last

day for MiX Telematics shareholders who voted against the Scheme to apply for a court to review the Scheme in terms of section 115(3)(b)

of the Companies Act if less than 15% of the total votes of MiX Telematics shareholders at the scheme meeting were exercised against

the Scheme |

|

Wednesday,

13 March |

| |

|

|

| Last

date for MiX Telematics to send notice of adoption of the Scheme Resolutions in terms of section 164(4) of the Companies Act to MiX

Telematics shareholders who provided written notice of objection of and subsequently voted against the Scheme Resolutions, on |

|

Wednesday,

13 March |

| |

|

|

| TRP

compliance certificate issued in terms of section 121(b) of the Companies Act, expected on or about |

|

Friday,

15 March |

Assuming the scheme is unconditional, the

salient dates are as follows:

| Finalisation

date expected to be on |

|

Friday,

15 March |

| |

|

|

| Finalisation

announcement expected to be published on SENS by 11:00 a.m. SAST on |

|

Friday,

15 March |

| |

|

|

| Finalisation

announcement expected to be published in the press on |

|

Monday,

18 March |

| |

|

|

| Expected

last day to trade in MiX Telematics shares on the JSE in order to be recorded on the register on the scheme record date to receive

the Scheme Consideration on (“scheme LDT”) |

|

Monday,

25 March |

| |

|

|

| Expected

date of the suspension of listing of MiX Telematics shares on the JSE at the commencement of trade on |

|

Tuesday,

26 March |

| |

|

|

| Expected

date of admission of listing as a secondary inward listing of PowerFleet shares on the Main Board of the JSE with ISIN US73931J1097,

alpha code: PWR and short name “Power” with effect from the commencement of business at 9:00 a.m. SAST on |

|

Tuesday,

26 March |

| |

|

|

| Announcement

released on SENS in respect of any cash payment applicable to any fractional entitlement to a scheme consideration share by 11:00

a.m. SAST |

|

Wednesday,

27 March |

| |

|

|

| Expected

scheme record date |

|

Thursday,

28 March |

| |

|

|

| Expected

Scheme Implementation Date on |

|

Tuesday,

2 April |

| |

|

|

| Scheme

participants who are dematerialised shareholders expected to have their accounts held at their broker or CSDP credited with the Scheme

Consideration on the scheme record date, on |

|

Tuesday,

2 April |

| |

|

|

| Scheme

participants who are certificated shareholders and who deliver a form of surrender and transfer and documents of title so as to be

received by the transfer secretaries on or before 12:00 p.m. SAST on the scheme record date, expected to have their accounts held

at their broker or CSDP credited with the Scheme Consideration, on |

|

Tuesday,

2 April |

| |

|

|

| Scheme

participants who are issuer nominee shareholders expected to have their Scheme Consideration credited to the account of Computershare

Nominees, on |

|

Tuesday,

2 April |

| |

|

|

| Expected

date of the termination of listing of MiX Telematics shares on the JSE at the commencement of trade on |

|

Wednesday,

3 April |

Notes:

| 1. |

The

dates and times set out in the Scheme Circular and the PowerFleet Prospectus are subject to change, with the approval of the JSE

and the TRP, if required. Any change in the dates and times will be published on SENS and in the press. |

| 2. |

The

dates and times are expected dates and times and have been determined based on certain assumptions regarding the date by which conditions

precedent will be fulfilled or waived including the date by when certain regulatory approvals will be obtained. |

| 3. |

All

times given in the Scheme Circular are in SAST, unless otherwise stated. |

| 4. |

Shareholders

should note that, since trades in MiX Telematics shares are settled by way of the electronic settlement system used by Strate, settlement

will take place 3 (three) business days after the date of a trade. Therefore, persons who acquire MiX Telematics shares after the

voting LDT, namely, Tuesday, 20 February 2024, will not be entitled to attend, participate in or vote at the scheme meeting, but

may nevertheless if the Scheme becomes operative, participate in the Scheme, provided that they acquire MiX Telematics shares on

or prior to the scheme LDT, namely, Monday, 25 March 2024. |

| 5. |

No

dematerialisation or rematerialisation of MiX Telematics shares may take place: |

| |

a. |

on

or after the business day following the voting LDT up to and including the voting record date for shareholders; and |

| |

b. |

on

or after the business day following the scheme LDT. |

| 6. |

No

removals between the ADS register administered by BNYM and the share register administered by Computershare Investor Services Proprietary

Limited (“Transfer Secretaries”), shall be permitted after the scheme LDT. |

| 7. |

No

removals between the PowerFleet share register maintained in South Africa by the Transfer Secretaries and the PowerFleet share registers

maintained for trading on Nasdaq Stock Exchange and Tel Aviv Stock Exchange shall be permitted from Tuesday, 26 March 2024 until

Wednesday, 3 April 2024. |

| 8. |

Dematerialised

shareholders, other than those with “own-name” registration, must provide their broker or CSDP with their instructions

for voting at the scheme meeting by the cut-off date and time stipulated by their broker or CSDP in terms of their respective custody

agreements. |

| 9. |

Any

form of proxy not delivered to the Transfer Secretaries by the stipulated date and time may be delivered to the chairperson of the

scheme meeting before such MiX Telematics shareholder’s voting rights are exercised at the scheme meeting. |

| 10. |

If

the scheme meeting is adjourned or postponed, the forms of proxy submitted for the initial scheme meeting will remain valid in respect

of any adjournment or postponement of the scheme meeting. |

| 11. |

Shareholders

who wish to exercise their appraisal rights are referred to Annexure 4 to the Scheme Circular. |

| 12. |

The

dates pertaining to the Scheme have been determined on the assumption that all Scheme Conditions will be fulfilled or waived by Friday,

15 March 2024 and that shareholders will not exercise their rights in terms of section 115(3) of the Companies Act. The actual dates

will be confirmed in the finalisation announcement if the Scheme becomes unconditional. |

FOREIGN

SHAREHOLDERS

Participation

in, and implementation of, the Proposed Transaction may be affected by the laws of the relevant jurisdiction applicable to a foreign

shareholder. It is the responsibility of a foreign shareholder (including nominees, agents and trustees for such foreign shareholder)

to ensure that the Scheme Consideration is not issued to such foreign shareholder without the observance of the laws and regulatory requirements

of the relevant jurisdiction, in connection with the Proposed Transaction, including the process of obtaining any governmental, exchange

control or other consents, the making of any filings which may be required, the compliance with other necessary formalities and the payment

of any transfer or other taxes or other requisite payments due in such jurisdiction and, if required, to satisfy PowerFleet that all

relevant formalities have been complied with or that there is an applicable exemption under the laws and regulatory requirements of the

relevant jurisdiction.

RESPONSIBILITY

STATEMENT

The

Independent Board and the MiX Telematics board (to the extent that the information relates to MiX Telematics) collectively and individually

accept responsibility for the information contained in this announcement and certify that, to the best of their knowledge and belief,

the information contained in this announcement relating to MiX Telematics is true and this announcement does not omit anything that is

likely to affect the importance of such information.

The

board of directors of PowerFleet (to the extent that the information relates to PowerFleet) collectively and individually accept responsibility

for the information contained in this announcement and certify that to the best of their knowledge and belief, the information contained

in this announcement relating to PowerFleet is true and this announcement does not omit anything that is likely to affect the importance

of such information.

30

January 2024

Corporate

advisor and sponsor to MiX Telematics

U.S.

legal advisors to MiX Telematics

U.S.

financial advisor to MiX Telematics

U.S.

legal advisors to PowerFleet

SA

legal advisors to PowerFleet

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

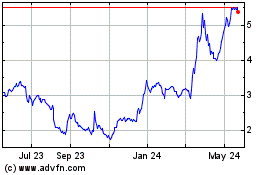

PowerFleet (NASDAQ:PWFL)

Historical Stock Chart

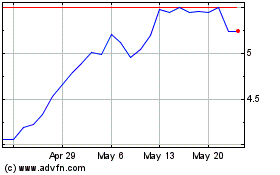

From Mar 2024 to Apr 2024

PowerFleet (NASDAQ:PWFL)

Historical Stock Chart

From Apr 2023 to Apr 2024