Current Report Filing (8-k)

October 19 2021 - 4:27PM

Edgar (US Regulatory)

0000921738

false

0000921738

2021-10-19

2021-10-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the

Securities Exchange

Act of 1934

Date of Report (Date of earliest event reported): October 19, 2021

PENN NATIONAL GAMING, INC.

(Exact name of registrant as specified in its charter)

|

Pennsylvania

|

|

0-24206

|

|

23-2234473

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

825 Berkshire Blvd., Suite 200

Wyomissing, PA 19610

(Address of principal

executive offices and zip code)

Registrant’s telephone number, including area code: (610) 373-2400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

PENN

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 3.02.

|

Unregistered Sale of Equity Securities

|

On October 19, 2021, in connection with the

closing of Penn National Gaming, Inc.’s (the “Company”) previously

announced acquisition of Score Media and Gaming Inc., a British Columbia corporation (“theScore”),

and pursuant to the Arrangement Agreement, dated as of August 4, 2021, by and among the Company, 1317774 B.C. Ltd., a British

Columbia corporation and an indirect wholly owned subsidiary of the Company (“Purchaser”),

and theScore (as amended, the “Arrangement Agreement”), the Company

issued a total of 12,319,340 shares of common stock, par value $0.01 per share, of the Company (“Company

Common Stock”), 311,119 options to purchase Company Common Stock (“Company

Option”) and 472,588 restricted stock units covering Company Common Stock (“Company

RSU”) and Purchaser issued a total of 768,441 shares of Purchaser that are exchangeable into Company Common Stock

(“Exchangeable Shares”), in each case to holders of Class A Subordinate

Voting Shares, Special Voting Shares, options or restricted share units of theScore, as applicable. The transactions contemplated by

the Arrangement Agreement were implemented by way of a court-approved plan of arrangement (the “Plan

of Arrangement”) under Division 5 of Part 9 of the Business Corporations Act (British Columbia), as

amended (the “Arrangement”).

Each Exchangeable Share will be exchangeable into

one share of Company Common Stock (the “Exchangeable Share Exchange Ratio”) at the option of the holder, subject to

certain adjustments. In addition, Purchaser may require all outstanding Exchangeable Shares to be exchanged into shares of Company Common

Stock at any time following the fifth anniversary of the closing, or earlier under certain circumstances. Holders of Exchangeable Shares

will be entitled to receive dividends economically equivalent to the dividends declared by the Company with respect to the Company Common

Stock, unless there is an adverse tax consequence to Purchaser and Purchaser elects to equitably adjust the Exchangeable Share Exchange

Ratio in lieu of paying such equivalent dividend. The Company Options and Company RSUs will continue to be governed by substantially the

same terms and conditions applicable to the corresponding option or restricted share unit award granted by theScore prior to the consummation

of the Arrangement (including, but not limited to, the term to expiration, conditions to and manner of exercising, if applicable, and

the vesting schedule).

The shares of Company Common Stock, Company Options,

Company RSUs and Exchangeable Shares (collectively “Issued Securities”) were issued in reliance upon Section 3(a)(10)

of the Securities Act of 1933, as amended (the “Securities Act”). The Supreme Court of British Columbia (the “Court”)

was advised that the Company and Purchaser intended to reply upon Section 3(a)(10) of the Securities Act in connection with the issuance

of the Issued Securities based upon the Court’s approval of the Arrangement. Following a hearing that was open to any person entitled

to receive Issued Securities pursuant to the Arrangement Agreement and the Plan of Arrangement, the Court on October 14, 2021 approved

the Arrangement and determined that the Arrangement was procedurally and substantively fair and reasonable to those parties affected by

the Arrangement, including all persons who were entitled to receive Issued Securities pursuant to the Arrangement.

On October 19, 2021, the Company issued a

joint press release, a copy of which is attached as Exhibit 99.1 and incorporated by reference in this Current Report on Form 8-K,

announcing the completion of the transactions contemplated by the Arrangement Agreement and the Plan of Arrangement.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

Penn NATIONAL gaming, inc.

|

|

|

|

|

|

Date: October 19, 2021

|

By:

|

/s/ Harper Ko

|

|

|

|

Name:

|

Harper Ko

|

|

|

|

Title:

|

Executive Vice President, Chief Legal Officer and Secretary

|

|

|

|

|

|

|

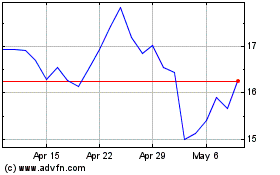

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024