Current Report Filing (8-k)

October 06 2021 - 8:46AM

Edgar (US Regulatory)

false0001472091NASDAQ00014720912021-09-302021-09-30

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2021

PDS BIOTECHNOLOGY CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-37568

|

26-4231384

|

|

|

|

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

25B Vreeland Road,

Suite 300, Florham Park,

NJ 07932

(Address of Principal Executive Offices, and Zip Code)

(800) 208-3343

Registrant’s Telephone Number, Including Area Code

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

|

Common Stock, par value $0.00033 per share

|

PDSB

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On September 30, 2021, PDS Biotechnology Corporation (the “Company”) delivered a

notice of termination without cause to Seth Van Voorhees and removed him from his position as the Company’s Chief Financial Officer, principal financial officer and principal accounting officer. The Company and Mr. Van Voorhees are continuing to

discuss the terms of Mr. Van Voorhees separation from the Company. Frank Bedu-Addo, the Company’s Chief Executive Officer, will serve as the Company’s interim principal financial officer, and Janetta Trochimiuk, the Company’s controller, will

serve as the interim principal accounting officer, in each case, until the Effective Date (as defined below).

On October 4, 2021, the Company entered into an Executive Employment Agreement with Matthew Hill (the “Employment Agreement”), pursuant to which Mr. Hill will be appointed as the Company’s Chief Financial Officer, effective as of October 18, 2021 (the “Effective Date”). On the Effective Date, Mr. Hill will serve as the Company’s principal financial officer and principal accounting officer.

Mr. Hill, age 53, previously served as the Chief Financial Officer of Strata Skin Sciences (Nasdaq: SSKN), where he led the

financial vision and strategy for the medical device company from May 2018 through October 2021. Immediately prior to joining Strata Skin Sciences, Mr. Hill served as the Chief Financial Officer of SS White Burs, Inc., a privately held medical

device manufacturer, from May 2010 until May 2018. Mr. Hill also served as the Chief Financial Officer of Velcera (Nasdaq: VLCR) prior to its acquisition by the Perrigo Company, and EP Medsystems (Nasdaq: EMPD) prior to its acquisition by St. Jude

Medical, where he also served as the VP of Operations. Mr. Hill holds a Bachelor of Science in accounting from Lehigh University.

There are no family relationships between Mr. Hill and any of

the Company’s directors or other executive officers. There are no arrangements or understandings between Mr. Hill and any other persons or entities pursuant to which he has been appointed as Chief Financial Officer and Mr. Hill has no direct or indirect interest in any transaction or proposed

transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Under the terms of the Employment Agreement, Mr. Hill will receive an annual salary of $350,000, which is subject to adjustment at the discretion of

the Board of Directors of the Company (the “Board”). Mr. Hill is also eligible for an annual performance bonus of 35% of his base salary, as determined by the Board or the Compensation

Committee of the Board, provided that Mr. Hill remains employed with the Company on the last day of the relevant performance period. The Employment Agreement further provides that if

Mr. Hill’s employment is terminated by the Company without cause or if he resigns for good reason, then, Mr. Hill will be entitled to receive (i) a severance payment equal to twelve months’ of his then-current base salary and (ii) reimbursement for

health care continuation (COBRA) premiums for up to 12 months following the date of his termination. The Employment Agreement contains customary non-competition and non-solicitation covenants, as well as an invention assignment agreement.

The foregoing summary of the Employment Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text

of the Employment Agreement, which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

On the first trading day after the Effective Date, Mr. Hill will receive an option to purchase 202,800 shares of the Company’s

common stock, par value $0.00033 per share, pursuant to the inducement grant exception under Nasdaq Rule 5635(c)(4) under the PDS Biotechnology Corporation 2019 Inducement Plan, as amended (the “Options”)

as an inducement material to Mr. Hill’s acceptance of employment with the Company. The Options will have an exercise price equal to the fair market value on the date of grant and will vest over four years, with 25% vesting on October 18, 2022 and the

remaining 75% vesting in 36 equal monthly installments thereafter, subject to Mr. Hill’s continued service to the Company through each vesting date.

On October 4, 2021, the Company issued a press release announcing the completion of enrollment

for the first stage of the checkpoint inhibitor naïve arm of its VERSATILE-002 Phase 2 study for the treatment of recurrent and/or metastatic human papillomavirus (HPV16)-associated head and neck cancer. A copy of the press release is filed as

Exhibit 99.1 hereto and incorporated by reference herein.

On October 6, 2021, the Company issued a press release announcing the appointment of Mr. Hill as Chief Financial Officer. A copy of the press release is

filed herewith as Exhibit 99.2. and incorporated by reference herein.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

|

|

Executive Employment Agreement by and between PDS Biotechnology Corporation and Matthew Hill, dated as of October

4, 2021.

|

|

|

|

Press Release dated October 4, 2021.

|

|

|

|

Press release dated October 6, 2021.

|

|

104

|

|

Cover Page Interactive Data File - the cover page interactive date file does not appear in the Interactive Date File because its XBRL tags are embedded within the Inline XBRL

document.

|

|

*

|

|

Certain portions of the Exhibit have been redacted pursuant to Item 601(b)(10)(iv) of Regulation S-K.

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

PDS BIOTECHNOLOGY CORPORATION

|

|

Date: October 6, 2021

|

By:

|

/s/ Frank Bedu-Addo, Ph.D.

|

|

|

Name:

|

Frank Bedu-Addo, Ph.D.

|

|

|

Title:

|

President and Chief Executive Officer

|

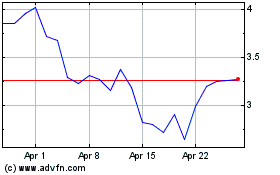

PDS Biotechnology (NASDAQ:PDSB)

Historical Stock Chart

From Aug 2024 to Sep 2024

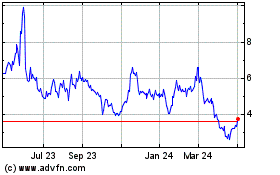

PDS Biotechnology (NASDAQ:PDSB)

Historical Stock Chart

From Sep 2023 to Sep 2024