$104.3 Million in 2013 Revenue; 17 Percent

Increase

PCTEL, Inc. (NASDAQ:PCTI), a leader in simplifying wireless and

site solutions for private and public networks, announced its 2013

fourth quarter and annual results.

Fourth Quarter and Annual

Highlights

- $26.0 million in revenue for the

quarter, unchanged from the same period last year. $104.3

million in revenue for the year, an increase of 17 percent over

2012.

- Gross profit margin of 42 percent in

the quarter, compared to 38 percent in the same period last

year. Gross profit margin of 40 percent for the year, unchanged

from 2012.

- GAAP operating margin from

continuing operations of two percent for the quarter, compared

to operating margin of negative (46) percent for the same period

last year. Operating margin for the year of just above breakeven as

compared to negative (12) percent in 2012. The fourth quarter of

2012 contained a $12.6 million impairment of goodwill related to

its TelWorx acquisition. Without the impairment, 2012 operating

margin in the quarter and the year were three percent and two

percent, respectively.

- GAAP net income from continuing

operations of $453,000 for the quarter, or $0.02 per diluted

share, compared to a net loss of $(7.3) million from continuing

operations, or $(0.41) per diluted share for the same period last

year. $3.3 million net income from continuing operations for the

year, or $0.18 per diluted share, as compared to net loss from

continuing operations of $(6.7) million or $(0.38) per diluted

share in 2012. The goodwill and intangible asset impairment in the

fourth quarter 2012 accounted for a net loss of approximately

$(0.44) per diluted share in the quarter and year.

- Non-GAAP operating profit and net

income are measures the company uses to reflect the results of its

core earnings. The Company’s reporting of Non-GAAP net income

excludes expenses for restructuring, gain or loss on sale of

assets, stock based compensation, amortization and impairment of

intangible assets and goodwill related to the Company’s

acquisitions, and non-cash related income tax expense.

- Non-GAAP operating margin from

continuing operations of 10 percent in the quarter, compared to

seven percent in the same period last year. Non-GAAP operating

margin for the year was nine percent as compared to eight percent

in 2012.

- Non-GAAP net income from continuing

operations of $2.1 million or $0.12 per diluted share in the

quarter, as compared to $1.5 million or $0.08 per diluted share

in the same period last year. Non-GAAP net income from continuing

operations of $7.7 million or $0.42 per diluted share for the year,

as compared to $6.0 million or $0.34 per diluted share in

2012.

- $57.9 million of cash, short-term

investments at December 31, 2013, an increase of approximately

$3.0 million from the preceding quarter. This change reflects

approximately $4.2 million of cash flow from operations less

approximately $1.0 million in capital expenditures.

"Growth in our in-building engineering services and strong

scanning receiver sales made strong contributions to our quarter

and the year,” said Marty Singer, PCTEL’s Chairman and CEO. “We

were pleased with the steady performance of our Connected Solutions

business and with the reaction to our new antenna and scanning

receiver products at the Mobile World Congress (MWC) and Healthcare

Information and Management Systems Society (HIMSS) industry

events,” added Singer.

CONFERENCE CALL / WEBCAST

PCTEL’s management team will discuss the Company’s results today

at 8:30 AM ET. The call can be accessed by dialing (877) 734-5369

(U.S. / Canada) or (706) 679-6397 (International), conference ID:

83290470. The call will also be webcast at

http://investor.pctel.com/events.cfm.

REPLAY: A replay will be available for two weeks after the call

on either the website listed above or by calling (855) 859-2056

(U.S./Canada), or International (404) 537-3406, conference ID:

83290470.

About PCTEL

PCTEL, Inc. (NASDAQ: PCTI), develops antenna, scanning receiver,

and engineered site solutions and services for public and private

networks. PCTEL RF Solutions enables superior utilization of

wireless spectrum for cellular and WiFi networks. The RF Solutions

services team specializes in the design, testing, and optimization

of in-building, small cell, and traditional wireless networks.

PCTEL RF Solutions develops and supports specialized network test

equipment for LTE FDD, TD-LTE, WCDMA, GSM, CDMA, EV-DO, TD-SCDMA,

and WiFi networks. The company's SeeGull® scanning receivers and

SeeHawk® visualization tool measure and analyze wireless signals

for efficient cellular network planning, deployment, and

optimization. Its IBflex™ simplifies in-building wireless network

testing and SeeWave™ identifies and locates interference sources

that impair network throughput.

PCTEL Connected Solutions™ simplifies network and site

deployment for wireless data and communications applications for

private network, public safety, and government customers. PCTEL

Connected Solutions develops and delivers high-value YAGI, Land

Mobile Radio, WiFi, GPS, In-Tunnel, Subway, and broadband antennas

(parabolic and flat panel) through its MAXRAD®, Bluewave™, and

Wi-Sys™ product lines. PCTEL also designs specialized towers,

enclosures, and specialized kits to deliver custom engineered site

solutions. The company's vertical markets include SCADA, Health

Care, Smart Grid, Positive Train Control, Precision Agriculture,

Indoor Wireless, Telemetry, Off-loading, and Wireless Backhaul.

PCTEL's products are sold worldwide through direct and indirect

channels. For more information, please visit the company's web

sites www.pctel.com, www.antenna.com, or

www.rfsolutions.pctel.com.

PCTEL Safe Harbor Statement

This press release contains “forward-looking statements” as

defined in the Private Securities Litigation Reform Act of 1995.

Specifically, the statements regarding the growth of PCTEL’s

in-building engineering services and scanning receiver sales, the

performance of the Connected Solutions business and the anticipated

success of our new antenna and scanning receiver products, are

forward-looking statements within the meaning of the safe harbor.

These statements are based on management’s current expectations and

actual results may differ materially from those projected as a

result of certain risks and uncertainties, including the ability to

successfully grow the wireless products business and the ability to

implement new technologies and obtain protection for the related

intellectual property. These and other risks and uncertainties are

detailed in PCTEL's Securities and Exchange Commission filings.

These forward-looking statements are made only as of the date

hereof, and PCTEL disclaims any obligation to update or revise the

information contained in any forward-looking statement, whether as

a result of new information, future events or otherwise.

PCTEL, INC. CONSOLIDATED BALANCE SHEETS

(in thousands, except share data) December

31, December 31, 2013 2012

ASSETS

Cash and cash equivalents $ 21,790 $ 17,543 Short-term

investment securities 36,105 33,596

Accounts receivable, net of allowance for

doubtful accounts of $130 and $222 at December 31, 2013 and

December 31, 2012, respectively

18,603 18,586 Inventories, net 14,535 17,573 Deferred tax assets,

net 1,629 1,484 Prepaid expenses and other assets 3,166

2,160 Total current assets 95,828 90,942 Property and

equipment, net 14,971 14,775 Goodwill 161 161 Intangible assets,

net 4,604 7,004 Deferred tax assets, net 11,827 14,034 Other

noncurrent assets 41 1,636 Assets of discontinued operations

0 18

TOTAL ASSETS $ 127,432 $

128,570 LIABILITIES AND STOCKHOLDERS’ EQUITY

Accounts payable $ 4,440 $ 10,557 Accrued liabilities

7,803 5,899 Total current liabilities 12,243 16,456

Contingent consideration 0 1,130 Other long-term liabilities 3,137

2,736 Liabilities of discontinued operations 0 103

3,137 3,969 Total liabilities 15,380

20,425 Stockholders’ equity:

Common stock, $0.001 par value,

100,000,000 shares authorized, 18,566,119 and 18,514,809 shares

issued and outstanding at December 31, 2013 and December 31, 2012,

respectively

19 19 Additional paid-in capital 143,572 140,388 Accumulated

deficit (31,748) (32,410) Accumulated other comprehensive income

209 148 Total equity 112,052 108,145

TOTAL LIABILITIES AND EQUITY $ 127,432

$ 128,570 PCTEL,

INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited) (in thousands, except per share data)

Three Months Ended Year Ended December

31, December 31, 2013 2012 2013

2012 REVENUES $ 25,963 $ 25,842 $ 104,253 $

88,849

COST OF REVENUES 15,120 15,911

62,493 53,029

GROSS PROFIT 10,843 9,931

41,760 35,820

OPERATING EXPENSES: Research and

development 3,102 2,412 11,064 9,290 Sales and marketing 3,134

3,450 12,121 11,343 General and administrative 3,589 2,946 15,623

10,982 Amortization of intangible assets 596 357 2,400 2,359

Impairment of intangible assets 0 12,550 0 12,550 Restructuring

charges 2 1 256 157 Total operating

expenses 10,423 21,716 41,464 46,681

OPERATING INCOME (LOSS) 420 (11,785) 296 (10,861) Other

income, net 600 16 5,378 100

INCOME

(LOSS) BEFORE INCOME TAXES 1,020 (11,769) 5,674 (10,761)

Expense (benefit) for income taxes 567 (4,519)

2,332 (4,089)

NET INCOME (LOSS) FROM CONTINUING

OPERATIONS 453 (7,250) 3,342

(6,672)

NET INCOME (LOSS) FROM DISCONTINUED OPERATIONS, NET OF

TAX BENEFIT 17 (1,073) (91) (2,587)

NET INCOME (LOSS) $ 470 ($8,323) $ 3,251

($9,259)

Earnings (Loss) per Share from

Continuing Operations:

Basic $ 0.03 ($0.41) $ 0.19 ($0.38) Diluted $ 0.02 ($0.41) $ 0.18

($0.38)

Earnings (Loss) per Share from

Discontinued Operations:

Basic $ 0.00 ($0.07) ($0.01) ($0.15)

Diluted

$ 0.00 ($0.07) $ 0.00 ($0.15)

Earnings (Loss) per

Share: Basic $ 0.03 ($0.48) $ 0.18 ($0.53) Diluted $ 0.02

($0.48) $ 0.18 ($0.53)

Weighed Average Shares: Basic

17,916 17,501 17,797 17,402 Diluted 18,508 17,501 18,184 17,402

Cash dividend per share $ 0.035 $ 0.030 $ 0.140 $ 0.120

PCTEL,

INC. P&L INFORMATION BY SEGMENT - Continuing

Operations (in thousands) Three Months

Ended December 31, 2013 Year Ended December 31, 2013 Connected

Connected Solutions RF Solutions Consolidating Total Solutions RF

Solutions Consolidating Total

REVENUES $ 17,349 $

8,693 ($79) $ 25,963 $ 74,223 $ 30,310 ($280) $ 104,253

GROSS

PROFIT 5,368 5,471 4 10,843 22,720 19,018 22 41,760

OPERATING

INCOME (LOSS) $ 1,140 $ 2,109 ($2,829) $ 420 $ 6,012 $ 7,248

($12,964) $ 296 Three Months Ended December 31, 2012

Year Ended December 31, 2012 Connected Connected Solutions RF

Solutions Consolidating Total Solutions RF Solutions Consolidating

Total

REVENUES $ 19,861 $ 6,045 ($64) $ 25,842 $

67,511 $ 21,469 ($131) $ 88,849

GROSS PROFIT 5,850 4,077 4 9,931 21,037

14,744 39 35,820

OPERATING INCOME (LOSS) ($10,602) $ 1,223

($2,406) ($11,785) ($6,062) $ 4,246 ($9,045)

($10,861)

Reconciliation

GAAP To non-GAAP Results Of Continuing Operations

(unaudited)

(in thousands except per share information)

Reconciliation of

GAAP operating income to non-GAAP operating income (a) from

Continuing Operations

Three Months Ended December 31, Year Ended

December 31,

2013

2012

2013

2012

Operating Income (Loss) $ 420 ($11,785) $ 296 ($10,861)

(a) Add: Amortization of intangible assets 596 357 2,400

2,359 Impairment of goodwill and intangible assets 0 12,550 0

12,550 TelWorx restructuring: -Restructuring charges 2 1 256 157

-Cost of Goods Sold 0 0 284 0 TelWorx investigation: -General &

Administrative 747 0 2,626 0 Stock Compensation: -Cost of Goods

Sold 95 77 390 378 -Engineering 185 147 689 585 -Sales &

Marketing 140 146 575 543 -General & Administrative 402

286 1,786 1,479 2,167 13,564 9,006 18,051

Non-GAAP Operating Income $ 2,587 $

1,779 $ 9,302 $ 7,190 % of revenue 10.0% 6.9% 8.9% 8.1%

Reconciliation of

GAAP net income to non-GAAP net income (b) from Continuing

Operations

Three Months Ended December 31, Year Ended

December 31,

2013

2012

2013

2012

Net Income (Loss) from Continuing Operations $ 453 ($7,250)

$ 3,342 ($6,672) Adjustments: (a) Non-GAAP adjustment to

operating income 2,167 13,564 9,006 18,051 (b) Other income related

to the TelWorx legal settlement (586) 0 (5,353) 0 (b) Income Taxes

99 (4,842) 653 (5,401) 1,680 8,722

4,306 12,650 Non-GAAP Net Income from

Continuing Operations $ 2,133 $ 1,472 $ 7,648 $ 5,978

Non-GAAP Earning per Share: Basic $ 0.12 $ 0.08 $ 0.43 $

0.34 Diluted $ 0.12 $ 0.08 $ 0.42 $ 0.34

Weighed Average

Shares: Basic 17,916 17,501 17,797 17,402 Diluted 18,508 17,501

18,184 17,402

This schedule reconciles the Company's

GAAP operating income and GAAP net income to its non-GAAP operating

income and non-GAAP net income. The Company believes that

presentation of this schedule provides meaningful supplemental

information to both management and investors that is indicative of

the Company's core operating results and facilitates comparison of

operating results across reporting periods. The Company uses these

non-GAAP measures when evaluating its financial results as well as

for internal planning and forecasting purposes. These non-GAAP

measures should not be viewed as a substitute for the Company's

GAAP results.

(a) These adjustments reflect stock based

compensation expense, amortization of intangible assets,

restructuring charges, and general and administrative expenses

associated with the TelWorx investigation.

(b) These adjustments include the items

described in footnote (a) as well as other income for the TelWorx

legal settlement and insurance claims related to the TelWorx

investigation, and non-cash income tax expense.

Reconciliation

GAAP To non-GAAP SEGMENT INFORMATION (unaudited) (a) - Continuing

Operations

(in thousands except per share information)

Three Months Ended December 31, 2013 Year Ended December 31, 2013

Connected Connected Solutions RF Solutions Consolidating Total

Solutions RF Solutions Consolidating Total

Operating Income (Loss) $ 1,140 $ 2,109 ($2,829) $ 420 $

6,012 $ 7,248 ($12,964) $ 296 Add: Amortization of

intangible assets 392 204 0 596 1,573 827 0 2,400 TelWorx

restructuring: -Restructuring charges 2 0 0 2 256 0 0 256 -Cost of

Goods Sold 0 0 0 0 284 0 0 284 TelWorx investigation: -General

& Administrative 0 0 747 747 0 0 2,626 2,626 Stock

Compensation: -Cost of Goods Sold 44 51 0 95 153 237 0 390

-Engineering 78 107 0 185 285 404 0 689 -Sales & Marketing 122

18 0 140 450 125 0 575 -General & Administrative 91

33 278 402 341 109 1,336 1,786

729 413 1,025 2,167 3,342 1,702 3,962 9,006

Non-GAAP Operating Income

(Loss) $ 1,869 $ 2,522 ($1,804) $ 2,587 $ 9,354 $ 8,950

($9,002) $ 9,302 Three Months Ended December 31, 2012

Year Ended December 31, 2012 Connected Connected Solutions RF

Solutions Consolidating Total Solutions RF Solutions Consolidating

Total

Operating Income (Loss) ($10,602) $

1,223 ($2,406) ($11,785) ($6,062) $ 4,246 ($9,045) ($10,861)

Add: Amortization of intangible assets 139 218 0 357 1,478 881 0

2,359 Impairment of intangible assets 12,550 12,550 12,550 12,550

Restructuring charges 1 0 0 1 157 0 0 157 Stock Compensation: -Cost

of Goods Sold 9 68 0 77 132 246 0 378 -Engineering 57 90 0 147 223

362 0 585 -Sales & Marketing 97 49 0 146 356 187 0 543 -General

& Administrative 37 30 219 286 175

120 1,184 1,479 12,890 455 219 13,564 15,071 1,796

1,184 18,051

Non-GAAP Operating Income (Loss) $ 2,288 $ 1,678

($2,187) $ 1,779 $ 9,009 $ 6,042 ($7,861) $ 7,190

This schedule reconciles the Company's

GAAP operating income by segment to its non-GAAP operating income

and non-GAAP net income. The Company believes that presentation of

this schedule provides meaningful supplemental information to both

management and investors that is indicative of the Company's core

operating results and facilitates comparison of operating results

across reporting periods. The Company uses these non-GAAP measures

when evaluating its financial results as well as for internal

planning and forecasting purposes. These non-GAAP measures should

not be viewed as a substitute for the Company's GAAP results.

(a) These adjustments reflect stock based

compensation expense, amortization of intangible assets,

restructuring charges, and general and administrative expenses

associated with the TelWorx investigation.

For further information contact:PCTEL, Inc.John

SchoenCFO(630) 372-6800orPCTEL, Inc.Jack SellerPublic

Relations(630)372-6800Jack.seller@pctel.com

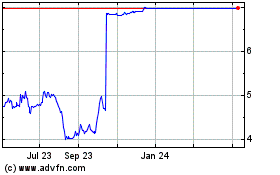

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Jan 2025 to Feb 2025

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Feb 2024 to Feb 2025