PACIFIC PREMIER BANCORP INC0001028918false00010289182024-01-292024-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | | | | | | | | | | |

| Date of Report (Date of earliest event reported) | January 29, 2024 |

| PACIFIC PREMIER BANCORP, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 0-22193 | 33-0743196 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17901 Von Karman Avenue, Suite 1200, Irvine, CA 92614

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (949) 864-8000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

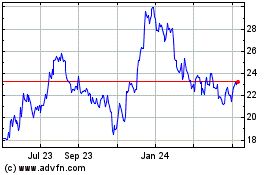

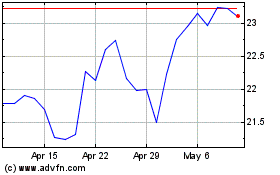

| Common Stock, par value $0.01 per share | | PPBI | | NASDAQ Global Select Market |

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On January 29, 2024, Pacific Premier Bancorp, Inc. (“PPBI”) issued a press release setting forth its (unaudited) financial results for the fourth quarter of 2023. A copy of PPBI's press release is furnished as Exhibit 99.1 and hereby incorporated by reference. A presentation regarding PPBI’s financial results for the three months ended December 31, 2023 is furnished as Exhibit 99.2 and incorporated herein by reference.

The information furnished under Item 2.02 and Item 9.01 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 to this Current Report on Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liabilities under that Section, nor shall it be deemed incorporated by reference in any registration statement or other filings of PPBI under the Securities Act of 1933, as amended, except as shall be set forth by specific reference in such filing.

ITEM 8.01 OTHER EVENTS

Quarterly Dividend

On January 27, 2024, PPBI’s Board of Directors declared a $0.33 per share dividend, payable on February 16, 2024 to shareholders of record on February 9, 2024.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

| | | | | |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | PACIFIC PREMIER BANCORP, INC. |

| | | |

| Dated: | January 29, 2024 | By: | /s/ STEVEN R. GARDNER |

| | | Steven R. Gardner |

| | | Chairman, Chief Executive Officer, and President |

Exhibit 99.1

Pacific Premier Bancorp, Inc. Announces Fourth Quarter 2023 Financial Results and a Quarterly Cash Dividend of $0.33 Per Share

Fourth Quarter 2023 Summary

•Net loss of $135.4 million, or $1.44 per diluted share; adjusted net income of $48.4 million, or $0.51 per diluted share(1)

•Sold $1.26 billion of available-for-sale securities for a net after-tax loss of $182.3 million, repositioning the balance sheet

•Net interest margin expanded 16 basis points to 3.28%

•Cost of deposits of 1.56%, and cost of non-maturity deposits(1) of 1.02%

•Non-maturity deposits increased to 84.7% of total deposits

•Reduced $617.0 million in higher cost brokered certificates of deposit and $200.0 million in FHLB borrowings during the quarter

•Total delinquency of 0.08% of loans held for investment, nonperforming assets to total assets of 0.13%, and net charge-offs to average loans of 0.03%

•Common equity tier 1 capital ratio of 14.32%, and total risk-based capital ratio of 17.29%

•Tangible book value per share(1) increased $0.33 to $20.22 compared to the prior quarter

•Tangible Common Equity (“TCE”) Ratio(1) increased to 10.72%

•Available liquidity of $9.91 billion; cash and cash equivalents was $936.5 million

Irvine, Calif., January 29, 2024 -- Pacific Premier Bancorp, Inc. (NASDAQ: PPBI) (the “Company” or “Pacific Premier”), the holding company of Pacific Premier Bank (the “Bank”), reported net loss of $135.4 million, or $1.44 per diluted share, for the fourth quarter of 2023, compared with net income of $46.0 million, or $0.48 per diluted share, for the third quarter of 2023, and net income of $73.7 million, or $0.77 per diluted share, for the fourth quarter of 2022.

For the fourth quarter of 2023, the Company’s return on average assets (“ROAA”) was (2.76)%, return on average equity (“ROAE”) was (19.01)%, and return on average tangible common equity (“ROATCE”)(1) was (28.01)%, compared to 0.88%, 6.43%, and 10.08%, respectively, for the third quarter of 2023, and 1.36%, 10.71%, and 16.99%, respectively, for the fourth quarter of 2022.

Excluding net loss of $254.1 million from an investment securities repositioning transaction and $2.1 million FDIC special assessment expense(1), the Company’s adjusted net income was $48.4 million, or $0.51 per diluted share, ROAA was 0.99%, ROAE was 7.03%, and ROATCE was 11.19% for the fourth quarter of 2023.

Total assets as of December 31, 2023 were $19.03 billion, compared to $20.28 billion at September 30, 2023, and $21.69 billion at December 31, 2022.

Steven R. Gardner, Chairman, Chief Executive Officer, and President of the Company, commented, “Our team delivered another solid quarter to close out 2023, an extraordinary year for the banking industry. During the fourth quarter, we proactively repositioned our securities portfolio to enhance our future earnings profile and provide additional liquidity as we navigate a challenging operating environment. The repositioning produced immediate results, fueling a 16 basis point net interest margin expansion in the fourth quarter while our capital ratios remain among the strongest in the industry. We generated $0.51 per share in operating earnings when excluding the impact from the securities portfolio repositioning and the FDIC special assessment expense.”

“Our financial performance continues to demonstrate the strength of our franchise and our disciplined commitment to prudent capital, liquidity, and credit risk management. Throughout the year, we leveraged our best- in-class service to deepen our relationships with existing clients and attract new clients to the Bank, generating

meaningful growth in new deposit account openings while maintaining pricing discipline. The new account opening activity, coupled with our ability to opportunistically deploy liquidity generated from the securities portfolio repositioning, allowed us to reduce higher cost wholesale funding in the fourth quarter by $817 million and to tightly manage our overall cost of funds, which increased only two basis points to 1.69%.”

“We enter 2024 on solid footing, with strong capital levels, ready access to significant liquidity, and favorable asset quality measures. Through our relationship-based business model, our bankers consistently communicate with our clients and monitor key trends within their individual businesses and industries. This access provides our organization with valuable information relative to market dynamics, including emerging trends in the commercial real estate markets, which we are closely monitoring. We are committed to responding quickly and proactively to any signs of stress within the loan portfolio. In short, we believe we are well-positioned heading into 2024 to continue to deliver value for our shareholders, clients, employees, and the communities we serve.”

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | | December 31, | | September 30, | | December 31, |

| (Dollars in thousands, except per share data) | | 2023 | | 2023 | | 2022 |

| Financial Highlights | | | | | | |

Net (loss) income | | $ | (135,376) | | | $ | 46,030 | | | $ | 73,673 | |

| Net interest income | | 146,789 | | | 149,548 | | | 181,396 | |

| Diluted earnings per share | | (1.44) | | | 0.48 | | | 0.77 | |

Common equity dividend per share paid | | 0.33 | | | 0.33 | | | 0.33 | |

| | | | | | |

| Return on average assets | | (2.76) | % | | 0.88 | % | | 1.36 | % |

| Return on average equity | | (19.01) | | | 6.43 | | | 10.71 | |

Return on average tangible common equity (1) | | (28.01) | | | 10.08 | | | 16.99 | |

Pre-provision net (loss) revenue on average assets (1) | | (3.88) | | | 1.27 | | | 1.89 | |

| Net interest margin | | 3.28 | | | 3.12 | | | 3.61 | |

| | | | | | |

| Cost of deposits | | 1.56 | | | 1.50 | | | 0.58 | |

Cost of non-maturity deposits (1) | | 1.02 | | | 0.89 | | | 0.31 | |

Efficiency ratio (1) | | 60.1 | | | 59.0 | | | 47.4 | |

| Noninterest expense as a percent of average assets | | 2.09 | | | 1.96 | | | 1.83 | |

| Total assets | | $ | 19,026,645 | | | $ | 20,275,720 | | | $ | 21,688,017 | |

| Total deposits | | 14,995,626 | | | 16,007,447 | | | 17,352,401 | |

| Non-maturity deposits as a percent of total deposits | | 84.7 | % | | 82.8 | % | | 85.6 | % |

| Noninterest-bearing deposits as a percent of total deposits | | 32.9 | | | 36.1 | | | 36.3 | |

| Loans-to-deposit ratio | | 88.6 | | | 82.9 | | | 84.6 | |

| Book value per share | | $ | 30.07 | | | $ | 29.78 | | | $ | 29.45 | |

Tangible book value per share (1) | | 20.22 | | | 19.89 | | | 19.38 | |

| Tangible common equity ratio | | 10.72 | % | | 9.87 | % | | 8.88 | % |

| Common equity tier 1 capital ratio | | 14.32 | | | 14.87 | | | 12.99 | |

| Total capital ratio | | 17.29 | | | 17.74 | | | 15.53 | |

_____________________________________________________________

(1) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

INCOME STATEMENT HIGHLIGHTS

Net Interest Income and Net Interest Margin

Net interest income totaled $146.8 million in the fourth quarter of 2023, a decrease of $2.8 million, or 1.8%, from the third quarter of 2023. The decrease in net interest income was primarily attributable to lower average interest-earning asset balances, partially offset by higher yields on interest-earning assets as well as lower average wholesale/brokered CD balances and lower average borrowings, both a direct result of our balance sheet repositioning.

The net interest margin for the fourth quarter of 2023 increased 16 basis points to 3.28% from 3.12% in the third quarter of 2023. The increase was primarily due to higher loan yields as well as higher investment securities yields resulting from the sale of lower-yielding available-for-sale ("AFS") securities of $1.26 billion at fair value at a weighted average yield of 1.34% and redeploying part of the sale proceeds into higher-yielding AFS securities at a weighted average yield of 5.28% during the fourth quarter of 2023.

Net interest income for the fourth quarter of 2023 decreased $34.6 million, or 19.1%, compared to the fourth quarter of 2022. The decrease was primarily attributable to a higher cost of funds as a result of the higher interest rate environment. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

| CONSOLIDATED AVERAGE BALANCES AND YIELD DATA |

| (Unaudited) |

| | Three Months Ended |

| | | December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| (Dollars in thousands) | | Average Balance | | Interest | | Average

Yield/

Cost | | Average Balance | | Interest | | Average

Yield/

Cost | | Average Balance | | Interest | | Average Yield/ Cost |

| Assets | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 1,281,793 | | | $ | 15,744 | | | 4.87 | % | | $ | 1,695,508 | | | $ | 21,196 | | | 4.96 | % | | $ | 1,015,197 | | | $ | 8,636 | | | 3.37 | % |

| Investment securities | | 3,203,608 | | | 24,675 | | | 3.08 | | | 3,828,766 | | | 25,834 | | | 2.70 | | | 4,130,042 | | | 24,688 | | | 2.39 | |

Loans receivable, net (1) (2) | | 13,257,767 | | | 176,773 | | | 5.29 | | | 13,475,194 | | | 177,032 | | | 5.21 | | | 14,799,417 | | | 184,457 | | | 4.94 | |

| Total interest-earning assets | | $ | 17,743,168 | | | $ | 217,192 | | | 4.86 | | | $ | 18,999,468 | | | $ | 224,062 | | | 4.68 | | | $ | 19,944,656 | | | $ | 217,781 | | | 4.33 | |

| | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits | | $ | 10,395,116 | | | $ | 60,915 | | | 2.32 | % | | $ | 10,542,884 | | | $ | 62,718 | | | 2.36 | % | | $ | 11,021,383 | | | $ | 25,865 | | | 0.93 | % |

| Borrowings | | 942,689 | | | 9,488 | | | 4.01 | | | 1,131,656 | | | 11,796 | | | 4.15 | | | 1,157,258 | | | 10,520 | | | 3.62 | |

| Total interest-bearing liabilities | | $ | 11,337,805 | | | $ | 70,403 | | | 2.46 | | | $ | 11,674,540 | | | $ | 74,514 | | | 2.53 | | | $ | 12,178,641 | | | $ | 36,385 | | | 1.19 | |

| Noninterest-bearing deposits | | $ | 5,141,585 | | | | | | | $ | 6,001,033 | | | | | | | $ | 6,587,400 | | | | | |

| Net interest income | | | | $ | 146,789 | | | | | | | $ | 149,548 | | | | | | | $ | 181,396 | | | |

Net interest margin (3) | | | | | | 3.28 | % | | | | | | 3.12 | % | | | | | | 3.61 | % |

Cost of deposits (4) | | | | | | 1.56 | | | | | | | 1.50 | | | | | | | 0.58 | |

Cost of funds (5) | | | | | | 1.69 | | | | | | | 1.67 | | | | | | | 0.77 | |

Cost of non-maturity deposits (6) | | 1.02 | | | | | | | 0.89 | | | | | | | 0.31 | |

| Ratio of interest-earning assets to interest-bearing liabilities | | 156.50 | | | | | | | 162.74 | | | | | | | 163.77 | |

______________________________

(1) Average balance includes loans held for sale and nonperforming loans and is net of deferred loan origination fees/costs, discounts/premiums, and the basis adjustment of certain loans included in fair value hedging relationships.

(2) Interest income includes net discount accretion of $2.6 million, $2.2 million, and $3.5 million, for the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, respectively.

(3) Represents annualized net interest income divided by average interest-earning assets.

(4) Represents annualized interest expense on deposits divided by the sum of average interest-bearing deposits and noninterest-bearing deposits.

(5) Represents annualized total interest expense divided by the sum of average total interest-bearing liabilities and noninterest-bearing deposits.

(6) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

Provision for Credit Losses

For the fourth quarter of 2023, the Company recorded a $1.7 million provision expense, compared to a $3.9 million provision expense for the third quarter of 2023, and a $2.8 million provision expense for the fourth quarter of 2022. The provision for credit losses was impacted by changes to the overall size, composition, and asset quality trends of the loan portfolio, as well as changes in the economic forecasts.

The provision expense for loan losses for the fourth quarter of 2023 was largely attributable to increases associated with economic forecasts, partially offset by the changes in loan composition. The provision recapture for unfunded commitments was attributable to lower unfunded commitments as well as changes in economic forecasts during the quarter.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | December 31, | | September 30, | | December 31, | | | | |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | | | | | | | |

| Provision for Credit Losses | | | | | | | | | | | | | | |

| Provision for loan losses | | $ | 8,275 | | | $ | 2,517 | | | $ | 3,899 | | | | | | | | | |

| Provision for unfunded commitments | | (6,577) | | | 1,386 | | | (1,013) | | | | | | | | | |

| Provision for held-to-maturity securities | | (2) | | | 15 | | | (48) | | | | | | | | | |

| Total provision for credit losses | | $ | 1,696 | | | $ | 3,918 | | | $ | 2,838 | | | | | | | | | |

Noninterest Income

Noninterest loss for the fourth quarter of 2023 was $234.2 million, compared to noninterest income of $18.6 million for the third quarter of 2023. The decrease was related to the investment securities portfolio repositioning during the fourth quarter of 2023 whereby the Bank sold $1.26 billion of its AFS securities portfolio for a loss of $254.1 million. Excluding the loss from sales of AFS securities, noninterest income was $19.9 million, an increase of $1.3 million from the third quarter of 2023.

Noninterest income for the fourth quarter of 2023 decreased $254.7 million, compared to the fourth quarter of 2022. The decrease was primarily due to the $254.1 million net loss from sales of investment securities during the fourth quarter of 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | December 31, | | September 30, | | December 31, | | | | |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | | | | | | | |

| Noninterest income | | | | | | | | | | | | | | |

| Loan servicing income | | $ | 359 | | | $ | 533 | | | $ | 346 | | | | | | | | | |

| Service charges on deposit accounts | | 2,648 | | | 2,673 | | | 2,689 | | | | | | | | | |

| Other service fee income | | 322 | | | 280 | | | 295 | | | | | | | | | |

| Debit card interchange fee income | | 844 | | | 924 | | | 1,048 | | | | | | | | | |

| Earnings on bank owned life insurance | | 3,678 | | | 3,579 | | | 3,359 | | | | | | | | | |

Net (loss) gain from sales of loans | | (4) | | | 45 | | | 151 | | | | | | | | | |

| Net (loss) gain from sales of investment securities | | (254,065) | | | — | | | — | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Trust custodial account fees | | 9,388 | | | 9,356 | | | 9,722 | | | | | | | | | |

| Escrow and exchange fees | | 1,074 | | | 938 | | | 1,282 | | | | | | | | | |

| Other income | | 1,562 | | | 223 | | | 1,605 | | | | | | | | | |

Total noninterest (loss) income | | $ | (234,194) | | | $ | 18,551 | | | $ | 20,497 | | | | | | | | | |

Noninterest Expense

Noninterest expense totaled $102.8 million for the fourth quarter of 2023, an increase of $585,000 compared to the third quarter of 2023, primarily as a result of the $2.1 million FDIC special assessment. Excluding the special assessment, noninterest expense decreased $1.5 million from the prior quarter primarily due to a $2.2 million decrease in compensation and benefits, partially offset by a $341,000 increase in deposit expense.

Noninterest expense increased by $3.6 million compared to the fourth quarter of 2022 primarily due to a $4.4 million increase in deposit expense, driven by higher deposit earnings credit rates, and a $2.8 million increase in FDIC insurance premiums, partially offset by a $2.4 million decrease in compensation and benefits, a $512,000 decrease in legal and professional services, and a $458,000 decrease in premises and occupancy.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | December 31, | | September 30, | | December 31, | | | | |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | | | | | | | |

| Noninterest expense | | | | | | | | | | | | | | |

| Compensation and benefits | | $ | 51,907 | | | $ | 54,068 | | | $ | 54,347 | | | | | | | | | |

| Premises and occupancy | | 11,183 | | | 11,382 | | | 11,641 | | | | | | | | | |

| Data processing | | 7,409 | | | 7,517 | | | 6,991 | | | | | | | | | |

| Other real estate owned operations, net | | 103 | | | (4) | | | — | | | | | | | | | |

| FDIC insurance premiums | | 4,267 | | | 2,324 | | | 1,463 | | | | | | | | | |

| Legal and professional services | | 4,663 | | | 4,243 | | | 5,175 | | | | | | | | | |

| Marketing expense | | 1,728 | | | 1,635 | | | 1,985 | | | | | | | | | |

| Office expense | | 1,367 | | | 1,079 | | | 1,310 | | | | | | | | | |

| Loan expense | | 437 | | | 476 | | | 743 | | | | | | | | | |

| Deposit expense | | 11,152 | | | 10,811 | | | 6,770 | | | | | | | | | |

| | | | | | | | | | | | | | |

| Amortization of intangible assets | | 3,022 | | | 3,055 | | | 3,440 | | | | | | | | | |

| Other expense | | 5,532 | | | 5,599 | | | 5,317 | | | | | | | | | |

| Total noninterest expense | | $ | 102,770 | | | $ | 102,185 | | | $ | 99,182 | | | | | | | | | |

Income Tax

For the fourth quarter of 2023, our income tax benefit totaled $56.5 million, resulting in an effective tax rate of 29.4%, compared to income tax expense of $16.0 million and an effective tax rate of 25.8% for the third quarter of 2023, and income tax expense of $26.2 million and an effective tax rate of 26.2% for the fourth quarter of 2022. The income tax benefit was primarily attributable to the pretax loss recorded for the fourth quarter, driven by the balance sheet repositioning related to the Bank’s investment securities portfolio.

For the full year 2023, our income tax expense totaled $3.2 million, resulting in an effective tax rate of 9.4%, compared to income tax expense of $100.6 million and an effective tax rate of 26.18% for the full year 2022. The decrease in effective tax rate was primarily attributable to the decrease in pretax income.

BALANCE SHEET HIGHLIGHTS

Loans

Loans held for investment totaled $13.29 billion at December 31, 2023, an increase of $18.9 million, or 0.1%, from September 30, 2023, and a decrease of $1.39 billion, or (9.5)%, from December 31, 2022. The increase from September 30, 2023 was driven primarily by increased net draws on existing lines of credits, partially offset by higher loan prepayments and maturities.

During the fourth quarter of 2023, new loan commitments totaled $128.1 million, and new loan fundings totaled $103.7 million, compared with $67.8 million in loan commitments and $25.6 million in new loan fundings for the third quarter of 2023, and $239.8 million in loan commitments and $149.1 million in new loan fundings for the fourth quarter of 2022.

At December 31, 2023, the total loan-to-deposit ratio was 88.6%, compared with 82.9% and 84.6% at September 30, 2023 and December 31, 2022, respectively.

The following table presents the primary loan roll-forward activities for total gross loans, including both loans held for investment and loans held for sale, during the quarters indicated:

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, | | September 30, | | December 31, |

| (Dollars in thousands) | 2023 | | 2023 | | 2022 |

| Beginning loan balance | $ | 13,319,591 | | | $ | 13,665,596 | | | $ | 14,979,098 | |

| New commitments | 128,102 | | | 67,811 | | | 239,829 | |

| Unfunded new commitments | (24,429) | | | (42,185) | | | (90,758) | |

| Net new fundings | 103,673 | | | 25,626 | | | 149,071 | |

| | | | | |

| Amortization/maturities/payoffs | (422,607) | | | (370,044) | | | (481,120) | |

| Net draws on existing lines of credit | 354,711 | | | 7,180 | | | 107,560 | |

| Loan sales | (32,464) | | | (1,206) | | | (9,471) | |

| Charge-offs | (4,138) | | | (7,561) | | | (4,271) | |

Transferred to other real estate owned | (195) | | | — | | | — | |

Net decrease | (1,020) | | | (346,005) | | | (238,231) | |

| Ending gross loan balance before basis adjustment | 13,318,571 | | | 13,319,591 | | | 14,740,867 | |

Basis adjustment associated with fair value hedge (1) | (29,551) | | | (48,830) | | | (61,926) | |

| Ending gross loan balance | $ | 13,289,020 | | | $ | 13,270,761 | | | $ | 14,678,941 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

______________________________

(1) Represents the basis adjustment associated with the application of hedge accounting on certain loans.

The following table presents the composition of the loans held for investment as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | |

| | | December 31, | | September 30, | | December 31, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 |

| Investor loans secured by real estate | | | | | | |

| Commercial real estate (“CRE”) non-owner-occupied | | $ | 2,421,772 | | | $ | 2,514,056 | | | $ | 2,660,321 | |

| Multifamily | | 5,645,310 | | | 5,719,210 | | | 6,112,026 | |

| Construction and land | | 472,544 | | | 444,576 | | | 399,034 | |

SBA secured by real estate (1) | | 36,400 | | | 37,754 | | | 42,135 | |

| Total investor loans secured by real estate | | 8,576,026 | | | 8,715,596 | | | 9,213,516 | |

Business loans secured by real estate (2) | | | | | | |

| CRE owner-occupied | | 2,191,334 | | | 2,228,802 | | | 2,432,163 | |

| Franchise real estate secured | | 304,514 | | | 313,451 | | | 378,057 | |

SBA secured by real estate (3) | | 50,741 | | | 53,668 | | | 61,368 | |

| Total business loans secured by real estate | | 2,546,589 | | | 2,595,921 | | | 2,871,588 | |

Commercial loans (4) | | | | | | |

| Commercial and industrial | | 1,790,608 | | | 1,588,771 | | | 2,160,948 | |

| Franchise non-real estate secured | | 319,721 | | | 335,053 | | | 404,791 | |

| SBA non-real estate secured | | 10,926 | | | 10,667 | | | 11,100 | |

| Total commercial loans | | 2,121,255 | | | 1,934,491 | | | 2,576,839 | |

| Retail loans | | | | | | |

Single family residential (5) | | 72,752 | | | 70,984 | | | 72,997 | |

| Consumer | | 1,949 | | | 1,958 | | | 3,284 | |

| Total retail loans | | 74,701 | | | 72,942 | | | 76,281 | |

Loans held for investment before basis adjustment (6) | | 13,318,571 | | | 13,318,950 | | | 14,738,224 | |

Basis adjustment associated with fair value hedge (7) | | (29,551) | | | (48,830) | | | (61,926) | |

| Loans held for investment | | 13,289,020 | | | 13,270,120 | | | 14,676,298 | |

| Allowance for credit losses for loans held for investment | | (192,471) | | | (188,098) | | | (195,651) | |

| Loans held for investment, net | | $ | 13,096,549 | | | $ | 13,082,022 | | | $ | 14,480,647 | |

| | | | | | |

| Total unfunded loan commitments | | $ | 1,703,470 | | | $ | 2,110,565 | | | $ | 2,489,203 | |

| Loans held for sale, at lower of cost or fair value | | $ | — | | | $ | 641 | | | $ | 2,643 | |

___________________________________________

(1) SBA loans that are collateralized by hotel/motel real property.

(2) Loans to businesses that are collateralized by real estate where the operating cash flow of the business is the primary source of repayment.

(3) SBA loans that are collateralized by real property other than hotel/motel real property.

(4) Loans to businesses where the operating cash flow of the business is the primary source of repayment.

(5) Single family residential includes home equity lines of credit, as well as second trust deeds.

(6) Includes net deferred origination (fees) costs of $(74,000), $451,000, and $(1.9) million, and unaccreted fair value net purchase discounts of $43.3 million, $46.2 million, and $54.8 million as of December 31, 2023, September 30, 2023, and December 31, 2022, respectively.

(7) Represents the basis adjustment associated with the application of hedge accounting on certain loans.

The total end of period weighted average interest rate on loans, excluding fees and discounts, at December 31, 2023 was 4.87%, compared with 4.76% at September 30, 2023 and 4.61% at December 31, 2022. The quarter-over-quarter and year-over-year increases reflect higher rates on new loan originations and the repricing of loans as a result of the increases in benchmark interest rates.

The following table presents the composition of loan commitments originated during the quarters indicated:

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | | December 31, | | September 30, | | December 31, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 |

| Investor loans secured by real estate | | | | | | |

| CRE non-owner-occupied | | $ | 1,450 | | | $ | 2,900 | | | $ | 34,258 | |

| Multifamily | | 94,462 | | | 3,687 | | | 28,285 | |

| Construction and land | | — | | | 17,400 | | | 31,175 | |

| | | | | | |

| Total investor loans secured by real estate | | 95,912 | | | 23,987 | | | 93,718 | |

Business loans secured by real estate (1) | | | | | | |

| CRE owner-occupied | | 3,870 | | | — | | | 24,266 | |

| Franchise real estate secured | | — | | | — | | | 840 | |

SBA secured by real estate (2) | | — | | | — | | | 4,198 | |

| Total business loans secured by real estate | | 3,870 | | | — | | | 29,304 | |

Commercial loans (3) | | | | | | |

| Commercial and industrial | | 24,766 | | | 40,399 | | | 96,566 | |

| Franchise non-real estate secured | | — | | | — | | | 14,130 | |

| SBA non-real estate secured | | — | | | 406 | | | 1,058 | |

| Total commercial loans | | 24,766 | | | 40,805 | | | 111,754 | |

| Retail loans | | | | | | |

Single family residential (4) | | 3,554 | | | 3,019 | | | 5,053 | |

| | | | | | |

| Total retail loans | | 3,554 | | | 3,019 | | | 5,053 | |

| Total loan commitments | | $ | 128,102 | | | $ | 67,811 | | | $ | 239,829 | |

______________________________

(1) Loans to businesses that are collateralized by real estate where the operating cash flow of the business is the primary source of repayment.

(2) SBA loans that are collateralized by real property other than hotel/motel real property.

(3) Loans to businesses where the operating cash flow of the business is the primary source of repayment.

(4) Single family residential includes home equity lines of credit, as well as second trust deeds.

The weighted average interest rate on new loan commitments was 6.34% in the fourth quarter of 2023, compared to 8.01% in the third quarter of 2023, and 6.34% in the fourth quarter of 2022.

Asset Quality and Allowance for Credit Losses

At December 31, 2023, our allowance for credit losses (“ACL”) on loans held for investment was $192.5 million, an increase of $4.4 million from September 30, 2023, and a decrease of $3.2 million from December 31, 2022. The change in ACL from September 30, 2023 was largely impacted by changes in economic forecasts and, to a lesser extent, loan composition.

During the fourth quarter of 2023, the Company incurred $3.9 million of net charge-offs, compared with $6.8 million of net charge-offs during the third quarter of 2023, and $3.8 million of net charge-offs during the fourth quarter of 2022, respectively.

The following table provides the allocation of the ACL for loans held for investment, as well as the activity in the ACL attributed to various segments in the loan portfolio as of and for the period indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | Beginning ACL Balance | | | | | | Charge-offs | | Recoveries | | | | | | Provision for Credit Losses | | Ending

ACL Balance |

| Investor loans secured by real estate | | | | | | | | | | | | | | | | | |

| CRE non-owner occupied | $ | 31,583 | | | | | | | $ | (815) | | | $ | 93 | | | | | | | $ | 169 | | | $ | 31,030 | |

| Multifamily | 55,221 | | | | | | | (1,582) | | | — | | | | | | | 2,673 | | | 56,312 | |

| Construction and land | 8,506 | | | | | | | — | | | — | | | | | | | 808 | | | 9,314 | |

SBA secured by real estate (1) | 2,199 | | | | | | | — | | | — | | | | | | | (17) | | | 2,182 | |

Business loans secured by real estate (2) | | | | | | | | | | | | | | | | | |

| CRE owner-occupied | 29,086 | | | | | | | — | | | 4 | | | | | | | (303) | | | 28,787 | |

| Franchise real estate secured | 7,566 | | | | | | | — | | | — | | | | | | | (67) | | | 7,499 | |

SBA secured by real estate (3) | 4,562 | | | | | | | — | | | 40 | | | | | | | (175) | | | 4,427 | |

Commercial loans (4) | | | | | | | | | | | | | | | | | |

| Commercial and industrial | 32,497 | | | | | | | (1,740) | | | 96 | | | | | | | 5,839 | | | 36,692 | |

| Franchise non-real estate secured | 15,779 | | | | | | | — | | | — | | | | | | | (648) | | | 15,131 | |

| SBA non-real estate secured | 472 | | | | | | | — | | | 3 | | | | | | | (17) | | | 458 | |

| | | | | | | | | | | | | | | | | |

| Retail loans | | | | | | | | | | | | | | | | | |

Single family residential (5) | 491 | | | | | | | — | | | — | | | | | | | 14 | | | 505 | |

| Consumer loans | 136 | | | | | | | (1) | | | — | | | | | | | (1) | | | 134 | |

| Totals | $ | 188,098 | | | | | | | $ | (4,138) | | | $ | 236 | | | | | | | $ | 8,275 | | | $ | 192,471 | |

______________________________

(1) SBA loans that are collateralized by hotel/motel real property.

(2) Loans to businesses that are collateralized by real estate where the operating cash flow of the business is the primary source of repayment.

(3) SBA loans that are collateralized by real property other than hotel/motel real property.

(4) Loans to businesses where the operating cash flow of the business is the primary source of repayment.

(5) Single family residential includes home equity lines of credit, as well as second trust deeds.

The ratio of ACL to loans held for investment at December 31, 2023 increased to 1.45%, compared to 1.42% at September 30, 2023 and 1.33% at December 31, 2022. The fair value net discount on loans acquired through bank acquisitions was $43.3 million, or 0.33% of total loans held for investment, as of December 31, 2023, compared to $46.2 million, or 0.35% of total loans held for investment, as of September 30, 2023, and $54.8 million, or 0.37% of total loans held for investment, as of December 31, 2022.

Nonperforming assets declined slightly to $25.1 million, or 0.13% of total assets, at December 31, 2023, compared with $25.9 million, or 0.13% of total assets, at September 30, 2023 and $30.9 million, or 0.14% of total assets, at December 31, 2022. Loan delinquencies were $10.1 million, or 0.08% of loans held for investment, at December 31, 2023, compared to $10.9 million, or 0.08% of loans held for investment, at September 30, 2023, and $43.3 million, or 0.30% of loans held for investment, at December 31, 2022.

Classified loans totaled $142.0 million, or 1.07% of loans held for investment, at December 31, 2023, compared with $149.3 million, or 1.12% of loans held for investment, at September 30, 2023, and $149.3 million, or 1.02% of loans held for investment, at December 31, 2022.

The following table presents the asset quality metrics of the loan portfolio as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | |

| | | December 31, | | September 30, | | December 31, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 |

| Asset Quality | | | | | | |

| Nonperforming loans | | $ | 24,817 | | | $ | 25,458 | | | $ | 30,905 | |

| Other real estate owned | | 248 | | | 450 | | | — | |

| | | | | | |

| Nonperforming assets | | $ | 25,065 | | | $ | 25,908 | | | $ | 30,905 | |

| | | | | | |

Total classified assets (1) | | $ | 142,210 | | | $ | 149,708 | | | $ | 149,304 | |

| Allowance for credit losses | | 192,471 | | | 188,098 | | | 195,651 | |

| Allowance for credit losses as a percent of total nonperforming loans | | 776 | % | | 739 | % | | 633 | % |

| Nonperforming loans as a percent of loans held for investment | | 0.19 | | | 0.19 | | | 0.21 | |

| Nonperforming assets as a percent of total assets | | 0.13 | | | 0.13 | | | 0.14 | |

| Classified loans to total loans held for investment | | 1.07 | | | 1.12 | | | 1.02 | |

| Classified assets to total assets | | 0.75 | | | 0.74 | | | 0.69 | |

| Net loan charge-offs (recoveries) for the quarter ended | | $ | 3,902 | | | $ | 6,752 | | | $ | 3,797 | |

| Net loan charge-offs (recoveries) for the quarter to average total loans | | 0.03 | % | | 0.05 | % | | 0.03 | % |

Allowance for credit losses to loans held for investment (2) | | 1.45 | | | 1.42 | | | 1.33 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Delinquent Loans: | | | | | | |

| 30 - 59 days | | $ | 2,484 | | | $ | 2,967 | | | $ | 20,538 | |

| 60 - 89 days | | 1,294 | | | 475 | | | 185 | |

| 90+ days | | 6,276 | | | 7,484 | | | 22,625 | |

| Total delinquency | | $ | 10,054 | | | $ | 10,926 | | | $ | 43,348 | |

| Delinquency as a percent of loans held for investment | | 0.08 | % | | 0.08 | % | | 0.30 | % |

______________________________

(1) Includes substandard and doubtful loans and other real estate owned.

(2) At December 31, 2023, 24% of loans held for investment include a fair value net discount of $43.3 million, or 0.33% of loans held for investment. At September 30, 2023, 24% of loans held for investment include a fair value net discount of $46.2 million, or 0.35% of loans held for investment. At December 31, 2022, 26% of loans held for investment include a fair value net discount of $54.8 million, or 0.37% of loans held for investment.

Investment Securities

At December 31, 2023, AFS and held-to-maturity ("HTM") investment securities were $1.14 billion and $1.73 billion, respectively, compared to $1.91 billion and $1.74 billion, respectively, at September 30, 2023, and $2.60 billion and $1.39 billion, respectively, at December 31, 2022.

In total, investment securities were $2.87 billion at December 31, 2023, a decrease of $782.9 million from $3.65 billion at September 30, 2023 and a decrease of $1.12 billion from $3.99 billion at December 31, 2022. The decrease in the fourth quarter of 2023 compared to the prior quarter was primarily attributable to sales of $1.26 billion of AFS securities, as well as principal payments, amortization, and redemptions of $64.3 million, partially offset by purchases of $539.1 million, predominantly short-term U.S. Treasury securities.

The decrease in investment securities from December 31, 2022 was primarily attributable to sales of $1.57 billion of AFS securities, as well as principal payments, amortization, and redemptions of $349.5 million, partially offset by purchases of $784.9 million.

Deposits

At December 31, 2023, total deposits were $15.00 billion, a decrease of $1.01 billion, or 6.3%, from September 30, 2023, and a decrease of $2.36 billion, or 13.6%, from December 31, 2022. The decrease from the prior quarter included the reduction of $617.0 million in brokered certificates of deposit. The remainder of the deposit decrease from the prior quarter of $394.8 million was driven by a decrease of $849.5 million in noninterest-bearing deposits, partially offset by increases of $301.2 million in interest-bearing checking and $158.6 million in retail certificates of deposit.

At December 31, 2023, non-maturity deposits(1) totaled $12.70 billion, or 84.7% of total deposits, a decrease of $553.5 million, or 4.2%, from September 30, 2023, and a decrease of $2.15 billion, or 14.5%, from December 31, 2022. The decrease compared to the prior quarter was partially attributable to seasonal outflows for client tax payments. Additionally, the linked-quarter and year-ago quarter decreases were impacted by clients redeploying funds into higher yielding alternatives, prepaying or paying down loans, and shifting depositor behavior following the industry-wide turmoil experienced in the first half of 2023.

At December 31, 2023, maturity deposits totaled $2.29 billion, a decrease of $458.4 million, or 16.6%, from September 30, 2023, and a decrease of $208.4 million, or 8.3%, from December 31, 2022. The decrease in the fourth quarter of 2023 compared to the prior quarter was primarily due to the reduction of $617.0 million in brokered certificates of deposit, partially offset by an increase of $158.6 million in retail certificates of deposit.

The weighted average cost of total deposits for the fourth quarter of 2023 was 1.56%, compared with 1.50% for the third quarter of 2023 and 0.58% for the fourth quarter of 2022. The increases in the weighted average cost of deposits for the fourth quarter of 2023 compared to the third quarter of 2023 and fourth quarter of 2022 were principally driven by higher pricing across most deposit categories. The weighted average cost of non-maturity deposits(1) for the fourth quarter of 2023 was 1.02%, compared to 0.89% for the third quarter of 2023, and 0.31% for the fourth quarter of 2022.

At December 31, 2023, the end-of-period weighted average rate of total deposits was 1.55%, compared to 1.52% at September 30, 2023 and 0.79% at December 31, 2022. At December 31, 2023, the end-of-period weighted average rate of non-maturity deposits was 1.04%, compared to 0.96% at September 30, 2023 and 0.43% at December 31, 2022.

At December 31, 2023, the Company’s FDIC-insured deposits as a percentage of total deposits was 60%. Insured and collateralized deposits comprised 66% of total deposits at December 31, 2023, which includes federally-insured deposits, $732.6 million of collateralized municipal and tribal deposits, and $70.0 million of privately insured deposits.

_____________________________________________________________

(1) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

The following table presents the composition of deposits as of the dates indicated.

| | | | | | | | | | | | | | | | | | | | |

| | | December 31, | | September 30, | | December 31, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 |

| Deposit Accounts | | | | | | |

| Noninterest-bearing checking | | $ | 4,932,817 | | | $ | 5,782,305 | | | $ | 6,306,825 | |

| Interest-bearing: | | | | | | |

| Checking | | 2,899,621 | | | 2,598,449 | | | 3,119,850 | |

| Money market/savings | | 4,868,442 | | | 4,873,582 | | | 5,422,607 | |

Total non-maturity deposits (1) | | 12,700,880 | | | 13,254,336 | | | 14,849,282 | |

| Retail certificates of deposit | | 1,684,560 | | | 1,525,919 | | | 1,086,423 | |

| Wholesale/brokered certificates of deposit | | 610,186 | | | 1,227,192 | | | 1,416,696 | |

| Total non-core deposits | | 2,294,746 | | | 2,753,111 | | | 2,503,119 | |

| Total deposits | | $ | 14,995,626 | | | $ | 16,007,447 | | | $ | 17,352,401 | |

| | | | | | |

| Cost of deposits | | 1.56 | % | | 1.50 | % | | 0.58 | % |

Cost of non-maturity deposits (1) | | 1.02 | | | 0.89 | | | 0.31 | |

| Noninterest-bearing deposits as a percent of total deposits | | 32.9 | | | 36.1 | | | 36.3 | |

Non-maturity deposits (1) as a percent of total deposits | | 84.7 | | | 82.8 | | | 85.6 | |

______________________________

(1) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

Borrowings

At December 31, 2023, total borrowings amounted to $931.8 million, a decrease of $199.8 million from September 30, 2023 and a decrease of $399.4 million from December 31, 2022. Total borrowings at December 31, 2023 included $600.0 million of FHLB term advances and $331.8 million of subordinated debt. The decrease in borrowings at December 31, 2023 as compared to September 30, 2023 was primarily due to an early redemption of a $200.0 million in FHLB term advance during the fourth quarter of 2023. The decrease in borrowings at December 31, 2023 as compared to December 31, 2022 was primarily due to a decrease of $400.0 million in FHLB term advances.

As of December 31, 2023, our unused borrowing capacity was $8.68 billion, which consists of available lines of credit with FHLB and other correspondent banks as well as access through the Federal Reserve Bank's discount window and the Bank Term Funding Program, neither of which were utilized during the fourth quarter of 2023.

Capital Ratios

At December 31, 2023, our common stockholder's equity was $2.88 billion, or 15.15% of total assets, compared with $2.86 billion, or 14.08% of total assets, at September 30, 2023, and $2.80 billion, or 12.90% of total assets, at December 31, 2022, with a book value per share of $30.07, compared with $29.78 at September 30, 2023 and $29.45 at December 31, 2022. At December 31, 2023, the ratio of tangible common equity to total assets(1) was 10.72%, compared with 9.87% at September 30, 2023 and 8.88% at December 31, 2022, and tangible book value per share(1) was $20.22, compared with $19.89 at September 30, 2023 and $19.38 at December 31, 2022. The increase in tangible book value per share at December 31, 2023 from September 30, 2023 was primarily driven by other comprehensive income from the realized loss, net of tax, resulting from the sale of AFS securities in the fourth quarter of 2023, partially offset by the net loss and the dividends paid during the quarter. The increase in tangible book value per share at December 31, 2023 from December 31, 2022 was primarily driven by other comprehensive income and, to the lesser extent, net income, partially offset by the dividends paid in 2023.

The Company implemented the CECL model on January 1, 2020 and elected to phase in the full effect of CECL on regulatory capital over the five-year transition period. In the first quarter of 2022, the Company began phasing into regulatory capital the cumulative adjustments at the end of the second year of the transition period at 25% per year. At December 31, 2023, the Company and Bank were in compliance with the capital conservation buffer requirement and exceeded the minimum Common Equity Tier 1, Tier 1, and total capital ratios, inclusive of the fully phased-in capital conservation buffer of 7.0%, 8.5% and 10.5%, respectively, and the Bank qualified as “well-capitalized” for purposes of the federal bank regulatory prompt corrective action regulations.

The following table presents capital ratios and share data as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | |

| | | December 31, | | September 30, | | December 31, |

| Capital Ratios | | 2023 | | 2023 | | 2022 |

| Pacific Premier Bancorp, Inc. Consolidated | | |

| Tier 1 leverage ratio | | 11.03 | % | | 11.13 | % | | 10.29 | % |

| Common equity tier 1 risk-based capital ratio | | 14.32 | | | 14.87 | | | 12.99 | |

| Tier 1 risk-based capital ratio | | 14.32 | | | 14.87 | | | 12.99 | |

| Total risk-based capital ratio | | 17.29 | | | 17.74 | | | 15.53 | |

Tangible common equity ratio (1) | | 10.72 | | | 9.87 | | | 8.88 | |

| | | | | | |

| Pacific Premier Bank | | | | | | |

| Tier 1 leverage ratio | | 12.43 | % | | 12.42 | % | | 11.80 | % |

| Common equity tier 1 risk-based capital ratio | | 16.13 | | | 16.59 | | | 14.89 | |

| Tier 1 risk-based capital ratio | | 16.13 | | | 16.59 | | | 14.89 | |

| Total risk-based capital ratio | | 17.23 | | | 17.66 | | | 15.74 | |

| | | | | | |

| Share Data | | | | | | |

| Book value per share | | $ | 30.07 | | | $ | 29.78 | | | $ | 29.45 | |

Tangible book value per share (1) | | 20.22 | | | 19.89 | | | 19.38 | |

| Common equity dividends declared per share | | 0.33 | | | 0.33 | | | 0.33 | |

Closing stock price (2) | | 29.11 | | | 21.76 | | | 31.56 | |

| Shares issued and outstanding | | 95,860,092 | | | 95,900,847 | | | 95,021,760 | |

Market Capitalization (2)(3) | | $ | 2,790,487 | | | $ | 2,086,802 | | | $ | 2,998,887 | |

______________________________

(1) A reconciliation of the non-GAAP measures of tangible common equity and tangible book value per share to the GAAP measures of common stockholders' equity and book value per share is set forth at the end of this press release.

(2) As of the last trading day prior to period end.

(3) Dollars in thousands.

Dividend and Stock Repurchase Program

On January 27, 2024, the Company's Board of Directors declared a $0.33 per share dividend, payable on February 16, 2024 to stockholders of record on February 9, 2024. In January 2021, the Company’s Board of Directors approved a stock repurchase program, which authorized the repurchase up to 4,725,000 shares of its common stock. During the fourth quarter of 2023, the Company did not repurchase any shares of common stock.

Conference Call and Webcast

The Company will host a conference call at 9:00 a.m. PT / 12:00 p.m. ET on January 29, 2024 to discuss its financial results. Analysts and investors may participate in the question-and-answer session. A live webcast will be available on the Webcasts page of the Company's investor relations website. An archived version of the webcast will be available in the same location shortly after the live call has ended. The conference call can be accessed by telephone at (866) 290-5977. Participants should ask to be joined into the Pacific Premier Bancorp, Inc. call. Additionally, a telephone replay will be made available through February 5, 2024 at (877) 344-7529, access code 7917033.

About Pacific Premier Bancorp, Inc.

Pacific Premier Bancorp, Inc. (Nasdaq: PPBI) is the parent company of Pacific Premier Bank, a California-based commercial bank focused on serving small, middle-market, and corporate businesses throughout the western United States in major metropolitan markets in California, Washington, Arizona, and Nevada. Founded in 1983, Pacific Premier Bank has grown to become one of the largest banks headquartered in the western region of the United States, with approximately $19 billion in total assets. Pacific Premier Bank provides banking products and services, including deposit accounts, digital banking, and treasury management services, to businesses, professionals, entrepreneurs, real estate investors, and nonprofit organizations. Pacific Premier Bank also offers a wide array of loan products, such as commercial business loans, lines of credit, SBA loans, commercial real estate loans, agribusiness loans, franchise lending, home equity lines of credit, and construction loans. Pacific Premier Bank offers commercial escrow services and facilitates 1031 Exchange transactions through its Commerce Escrow division. Pacific Premier Bank offers clients IRA custodial services through its Pacific Premier Trust division, which has approximately $17 billion of assets under custody and close to 35,000 client accounts comprised of self-directed investors, financial institutions, capital syndicators, and financial advisors. Additionally, Pacific Premier Bank provides nationwide customized banking solutions to Homeowners' Associations and Property Management companies. Pacific Premier Bank is an Equal Housing Lender and Member FDIC. For additional information about Pacific Premier Bancorp, Inc. and Pacific Premier Bank, visit our website: www.ppbi.com.

FORWARD-LOOKING STATEMENTS

The statements contained herein that are not historical facts are forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company including, without limitation, plans, strategies and goals, and statements about the Company’s expectations regarding revenue and asset growth, financial performance and profitability, loan and deposit growth, yields and returns, loan diversification and credit management, stockholder value creation, tax rates, liquidity, and the impact of acquisitions we have made or may make.

Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of the Company. There can be no assurance that future developments affecting the Company will be the same as those anticipated by management. The Company cautions readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the strength of the United States economy in general and the strength of the local economies in which we conduct operations; adverse developments in the banking industry highlighted by high-profile bank failures and the potential impact of such developments on customer confidence, liquidity, and regulatory responses to these developments; the effects of, and changes in, trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; interest rate, liquidity, economic, market, credit, operational, and inflation risks associated with our business, including the speed and predictability of changes in these risks; our ability to attract and retain deposits and access to other sources of liquidity, particularly in a rising or high interest rate environment, and the quality and composition of our deposits; business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic markets, including the tight labor market, ineffective management of the U.S. Federal budget or debt, or turbulence or uncertainty in domestic or foreign financial markets; the effect of acquisitions we have made or may make, including, without

limitation, the failure to achieve the expected revenue growth and/or expense savings from such acquisitions, and/or the failure to effectively integrate an acquisition target into our operations; the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; possible impairment charges to goodwill, including any impairment that may result from increased volatility in our stock price; the impact of changes in financial services policies, laws, and regulations, including those concerning taxes, banking, securities, and insurance, and the application thereof by regulatory bodies; compliance risks, including the costs of monitoring, testing, and maintaining compliance with complex laws and regulations; the effectiveness of our risk management framework and quantitative models; the transition away from USD LIBOR and related uncertainty as well as the risk and costs related to our adoption of Secured Overnight Financing Rate (“SOFR”); the effect of changes in accounting policies and practices or accounting standards, as may be adopted from time-to-time by bank regulatory agencies, the U.S. Securities and Exchange Commission (“SEC”), the Public Company Accounting Oversight Board, the Financial Accounting Standards Board or other accounting standards setters; possible credit-related impairments of securities held by us; changes in the level of our nonperforming assets and charge-offs; the impact of governmental efforts to restructure the U.S. financial regulatory system; the impact of recent or future changes in the FDIC insurance assessment rate or the rules and regulations related to the calculation of the FDIC insurance assessment amount, including any special assessments; changes in consumer spending, borrowing, and savings habits; the effects of our lack of a diversified loan portfolio, including the risks of geographic and industry concentrations; the possibility that we may reduce or discontinue the payments of dividends on our common stock; the possibility that we may discontinue, reduce or otherwise limit the level of repurchases of our common stock we may make from time to time pursuant to our stock repurchase program; changes in the financial performance and/or condition of our borrowers; changes in the competitive environment among financial and bank holding companies and other financial service providers; geopolitical conditions, including acts or threats of terrorism, actions taken by the United States or other governments in response to acts or threats of terrorism, and/or military conflicts, including the war between Russia and Ukraine and the war in the Middle East, which could impact business and economic conditions in the United States and abroad; public health crises and pandemics, including with respect to COVID-19, and their effects on the economic and business environments in which we operate, including on our credit quality and business operations, as well as the impact on general economic and financial market conditions; cybersecurity threats and incidents, and related potential costs and risks, including reputation, financial and litigation risks; climate change, including the enhanced regulatory, compliance, credit, and reputational risks and costs; natural disasters, earthquakes, fires, and severe weather; unanticipated regulatory or legal proceedings; and our ability to manage the risks involved in the foregoing. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in the Company's 2022 Annual Report on Form 10-K and subsequent Reports on Form 10-Q filed with the SEC and available at the SEC’s Internet site (http://www.sec.gov).

The Company undertakes no obligation to revise or publicly release any revision or update to these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made.

Contacts:

Pacific Premier Bancorp, Inc.

Steven R. Gardner

Chairman, Chief Executive Officer, and President

(949) 864-8000

Ronald J. Nicolas, Jr.

Senior Executive Vice President and Chief Financial Officer

(949) 864-8000

Matthew J. Lazzaro

Senior Vice President, Director of Investor Relations

(949) 243-1082

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION |

| (Unaudited) |

| | | December 31, | | September 30, | | June 30, | | March 31, | | December 31, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2023 | | 2023 | | 2022 |

| ASSETS | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Cash and cash equivalents | | $ | 936,473 | | | $ | 1,400,276 | | | $ | 1,463,677 | | | $ | 1,424,896 | | | $ | 1,101,249 | |

| Interest-bearing time deposits with financial institutions | | 995 | | | 1,242 | | | 1,487 | | | 1,734 | | | 1,734 | |

| Investments held-to-maturity, at amortized cost, net of allowance for credit losses | | 1,729,541 | | | 1,737,866 | | | 1,737,604 | | | 1,749,030 | | | 1,388,103 | |

| Investment securities available for sale, at fair value | | 1,140,071 | | | 1,914,599 | | | 2,011,791 | | | 2,112,852 | | | 2,601,013 | |

| FHLB, FRB, and other stock | | 99,225 | | | 105,505 | | | 105,369 | | | 105,479 | | | 119,918 | |

Loans held for sale, at lower of amortized cost or fair value | | — | | | 641 | | | 2,184 | | | 1,247 | | | 2,643 | |

| Loans held for investment | | 13,289,020 | | | 13,270,120 | | | 13,610,282 | | | 14,171,784 | | | 14,676,298 | |

| Allowance for credit losses | | (192,471) | | | (188,098) | | | (192,333) | | | (195,388) | | | (195,651) | |

| Loans held for investment, net | | 13,096,549 | | | 13,082,022 | | | 13,417,949 | | | 13,976,396 | | | 14,480,647 | |

| Accrued interest receivable | | 68,516 | | | 68,131 | | | 70,093 | | | 69,660 | | | 73,784 | |

| Other real estate owned | | 248 | | | 450 | | | 270 | | | 5,499 | | | — | |

Premises and equipment, net | | 56,676 | | | 59,396 | | | 61,527 | | | 63,450 | | | 64,543 | |

| Deferred income taxes, net | | 113,580 | | | 192,208 | | | 184,857 | | | 177,778 | | | 183,602 | |

| Bank owned life insurance | | 471,178 | | | 468,191 | | | 465,288 | | | 462,732 | | | 460,010 | |

| Intangible assets | | 43,285 | | | 46,307 | | | 49,362 | | | 52,417 | | | 55,588 | |

| Goodwill | | 901,312 | | | 901,312 | | | 901,312 | | | 901,312 | | | 901,312 | |

| Other assets | | 368,996 | | | 297,574 | | | 275,113 | | | 257,082 | | | 253,871 | |

| Total assets | | $ | 19,026,645 | | | $ | 20,275,720 | | | $ | 20,747,883 | | | $ | 21,361,564 | | | $ | 21,688,017 | |

| LIABILITIES | | | | | | | | | | |

| Deposit accounts: | | | | | | | | | | |

| Noninterest-bearing checking | | $ | 4,932,817 | | | $ | 5,782,305 | | | $ | 5,895,975 | | | $ | 6,209,104 | | | $ | 6,306,825 | |

| Interest-bearing: | | | | | | | | | | |

| Checking | | 2,899,621 | | | 2,598,449 | | | 2,759,855 | | | 2,871,812 | | | 3,119,850 | |

| Money market/savings | | 4,868,442 | | | 4,873,582 | | | 4,801,288 | | | 5,128,857 | | | 5,422,607 | |

| Retail certificates of deposit | | 1,684,560 | | | 1,525,919 | | | 1,366,071 | | | 1,257,146 | | | 1,086,423 | |

| Wholesale/brokered certificates of deposit | | 610,186 | | | 1,227,192 | | | 1,716,686 | | | 1,740,891 | | | 1,416,696 | |

| Total interest-bearing | | 10,062,809 | | | 10,225,142 | | | 10,643,900 | | | 10,998,706 | | | 11,045,576 | |

| Total deposits | | 14,995,626 | | | 16,007,447 | | | 16,539,875 | | | 17,207,810 | | | 17,352,401 | |

| FHLB advances and other borrowings | | 600,000 | | | 800,000 | | | 800,000 | | | 800,000 | | | 1,000,000 | |

| Subordinated debentures | | 331,842 | | | 331,682 | | | 331,523 | | | 331,364 | | | 331,204 | |

| | | | | | | | | | |

| Accrued expenses and other liabilities | | 216,596 | | | 281,057 | | | 227,351 | | | 191,229 | | | 206,023 | |

| Total liabilities | | 16,144,064 | | | 17,420,186 | | | 17,898,749 | | | 18,530,403 | | | 18,889,628 | |

| STOCKHOLDERS’ EQUITY | | | | | | | | | | |

| | | | | | | | | | |

| Common stock | | 938 | | | 937 | | | 937 | | | 937 | | | 933 | |

| Additional paid-in capital | | 2,377,131 | | | 2,371,941 | | | 2,366,639 | | | 2,361,830 | | | 2,362,663 | |

| Retained earnings | | 604,137 | | | 771,285 | | | 757,025 | | | 731,123 | | | 700,040 | |

| Accumulated other comprehensive loss | | (99,625) | | | (288,629) | | | (275,467) | | | (262,729) | | | (265,247) | |

| Total stockholders' equity | | 2,882,581 | | | 2,855,534 | | | 2,849,134 | | | 2,831,161 | | | 2,798,389 | |

| Total liabilities and stockholders' equity | | $ | 19,026,645 | | | $ | 20,275,720 | | | $ | 20,747,883 | | | $ | 21,361,564 | | | $ | 21,688,017 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited) |

| | | | |

| | | Three Months Ended | | Year Ended |

| | | December 31, | | September 30, | | December 31, | | December 31, | | December 31, |

| (Dollars in thousands, except per share data) | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| INTEREST INCOME | | | | | | | | | | |

| Loans | | $ | 176,773 | | | $ | 177,032 | | | $ | 184,457 | | | $ | 717,615 | | | $ | 673,720 | |

| Investment securities and other interest-earning assets | | 40,419 | | | 47,030 | | | 33,324 | | | 170,370 | | | 94,858 | |

| Total interest income | | 217,192 | | | 224,062 | | | 217,781 | | | 887,985 | | | 768,578 | |

| INTEREST EXPENSE | | | | | | | | | | |

| Deposits | | 60,915 | | | 62,718 | | | 25,865 | | | 217,447 | | | 40,093 | |

| FHLB advances and other borrowings | | 4,927 | | | 7,235 | | | 5,960 | | | 27,255 | | | 13,131 | |

| Subordinated debentures | | 4,561 | | | 4,561 | | | 4,560 | | | 18,244 | | | 18,242 | |

| Total interest expense | | 70,403 | | | 74,514 | | | 36,385 | | | 262,946 | | | 71,466 | |

| Net interest income before provision for credit losses | | 146,789 | | | 149,548 | | | 181,396 | | | 625,039 | | | 697,112 | |

| Provision for credit losses | | 1,696 | | | 3,918 | | | 2,838 | | | 10,129 | | | 4,832 | |

| Net interest income after provision for credit losses | | 145,093 | | | 145,630 | | | 178,558 | | | 614,910 | | | 692,280 | |

| NONINTEREST INCOME | | | | | | | | | | |

| Loan servicing income | | 359 | | | 533 | | | 346 | | | 1,958 | | | 1,664 | |

| Service charges on deposit accounts | | 2,648 | | | 2,673 | | | 2,689 | | | 10,620 | | | 10,698 | |

| Other service fee income | | 322 | | | 280 | | | 295 | | | 1,213 | | | 1,351 | |

| Debit card interchange fee income | | 844 | | | 924 | | | 1,048 | | | 3,485 | | | 3,628 | |

| Earnings on bank owned life insurance | | 3,678 | | | 3,579 | | | 3,359 | | | 14,118 | | | 13,159 | |

Net (loss) gain from sales of loans | | (4) | | | 45 | | | 151 | | | 415 | | | 3,238 | |

| Net (loss) gain from sales of investment securities | | (254,065) | | | — | | | — | | | (253,927) | | | 1,710 | |

| Trust custodial account fees | | 9,388 | | | 9,356 | | | 9,722 | | | 39,129 | | | 41,606 | |

| Escrow and exchange fees | | 1,074 | | | 938 | | | 1,282 | | | 3,994 | | | 6,325 | |

| Other income | | 1,562 | | | 223 | | | 1,605 | | | 5,077 | | | 5,369 | |

Total noninterest (loss) income | | (234,194) | | | 18,551 | | | 20,497 | | | (173,918) | | | 88,748 | |

| NONINTEREST EXPENSE | | | | | | | | | | |

| Compensation and benefits | | 51,907 | | | 54,068 | | | 54,347 | | | 213,692 | | | 225,245 | |

| Premises and occupancy | | 11,183 | | | 11,382 | | | 11,641 | | | 45,922 | | | 47,433 | |

| Data processing | | 7,409 | | | 7,517 | | | 6,991 | | | 29,679 | | | 26,649 | |

| Other real estate owned operations, net | | 103 | | | (4) | | | — | | | 215 | | | — | |

| FDIC insurance premiums | | 4,267 | | | 2,324 | | | 1,463 | | | 11,373 | | | 5,772 | |

| Legal and professional services | | 4,663 | | | 4,243 | | | 5,175 | | | 19,123 | | | 17,947 | |

| Marketing expense | | 1,728 | | | 1,635 | | | 1,985 | | | 7,080 | | | 7,632 | |

| Office expense | | 1,367 | | | 1,079 | | | 1,310 | | | 4,958 | | | 5,103 | |

| Loan expense | | 437 | | | 476 | | | 743 | | | 2,126 | | | 3,810 | |

| Deposit expense | | 11,152 | | | 10,811 | | | 6,770 | | | 39,593 | | | 19,448 | |

| | | | | | | | | | |

| Amortization of intangible assets | | 3,022 | | | 3,055 | | | 3,440 | | | 12,303 | | | 13,983 | |

| Other expense | | 5,532 | | | 5,599 | | | 5,317 | | | 20,887 | | | 23,648 | |

| Total noninterest expense | | 102,770 | | | 102,185 | | | 99,182 | | | 406,951 | | | 396,670 | |

Net (loss) income before income taxes | | (191,871) | | | 61,996 | | | 99,873 | | | 34,041 | | | 384,358 | |

Income tax (benefit) expense | | (56,495) | | | 15,966 | | | 26,200 | | | 3,189 | | | 100,615 | |

Net (loss) income | | $ | (135,376) | | | $ | 46,030 | | | $ | 73,673 | | | $ | 30,852 | | | $ | 283,743 | |

(LOSS) EARNINGS PER SHARE | | | | | | | | | | |

| Basic | | $ | (1.44) | | | $ | 0.48 | | | $ | 0.78 | | | $ | 0.31 | | | $ | 2.99 | |

| Diluted | | (1.44) | | | 0.48 | | | 0.77 | | | 0.31 | | | 2.98 | |

| WEIGHTED AVERAGE SHARES OUTSTANDING | | | | | | | | | | |

| Basic | | 94,233,813 | | 94,189,844 | | 93,810,468 | | 94,113,132 | | | 93,718,293 | |

| Diluted | | 94,233,813 | | 94,283,008 | | 94,176,633 | | 94,236,875 | | | 94,091,461 | |

SELECTED FINANCIAL DATA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

| CONSOLIDATED AVERAGE BALANCES AND YIELD DATA |

| (Unaudited) |

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | | December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| (Dollars in thousands) | | Average Balance | | Interest | | Average

Yield/

Cost | | Average Balance | | Interest | | Average

Yield/

Cost | | Average Balance | | Interest | | Average Yield/ Cost |

| Assets | | | | | | | | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 1,281,793 | | | $ | 15,744 | | | 4.87 | % | | $ | 1,695,508 | | | $ | 21,196 | | | 4.96 | % | | $ | 1,015,197 | | | $ | 8,636 | | | 3.37 | % |

| Investment securities | | 3,203,608 | | | 24,675 | | | 3.08 | | | 3,828,766 | | | 25,834 | | | 2.70 | | | 4,130,042 | | | 24,688 | | | 2.39 | |

Loans receivable, net (1) (2) | | 13,257,767 | | | 176,773 | | | 5.29 | | | 13,475,194 | | | 177,032 | | | 5.21 | | | 14,799,417 | | | 184,457 | | | 4.94 | |

| Total interest-earning assets | | 17,743,168 | | | 217,192 | | | 4.86 | | | 18,999,468 | | | 224,062 | | | 4.68 | | | 19,944,656 | | | 217,781 | | | 4.33 | |

| Noninterest-earning assets | | 1,881,777 | | | | | | | 1,806,319 | | | | | | | 1,784,277 | | | | | |

| Total assets | | $ | 19,624,945 | | | | | | | $ | 20,805,787 | | | | | | | $ | 21,728,933 | | | | | |

| Liabilities and Equity | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | | | | | | | | |

| Interest checking | | $ | 3,037,642 | | | $ | 11,170 | | | 1.46 | % | | $ | 2,649,203 | | | $ | 10,849 | | | 1.62 | % | | $ | 3,320,146 | | | $ | 3,752 | | | 0.45 | % |

| Money market | | 4,525,403 | | | 22,038 | | | 1.93 | | | 4,512,740 | | | 19,182 | | | 1.69 | | | 4,998,726 | | | 7,897 | | | 0.63 | |

| Savings | | 308,968 | | | 190 | | | 0.24 | | | 329,684 | | | 115 | | | 0.14 | | | 443,016 | | | 310 | | | 0.28 | |

| Retail certificates of deposit | | 1,604,507 | | | 16,758 | | | 4.14 | | | 1,439,531 | | | 13,398 | | | 3.69 | | | 975,958 | | | 3,941 | | | 1.60 | |

| Wholesale/brokered certificates of deposit | | 918,596 | | | 10,759 | | | 4.65 | | | 1,611,726 | | | 19,174 | | | 4.72 | | | 1,283,537 | | | 9,965 | | | 3.08 | |

| Total interest-bearing deposits | | 10,395,116 | | | 60,915 | | | 2.32 | | | 10,542,884 | | | 62,718 | | | 2.36 | | | 11,021,383 | | | 25,865 | | | 0.93 | |

| FHLB advances and other borrowings | | 610,913 | | | 4,927 | | | 3.20 | | | 800,049 | | | 7,235 | | | 3.59 | | | 826,125 | | | 5,960 | | | 2.86 | |

| Subordinated debentures | | 331,776 | | | 4,561 | | | 5.50 | | | 331,607 | | | 4,561 | | | 5.50 | | | 331,133 | | | 4,560 | | | 5.51 | |

| Total borrowings | | 942,689 | | | 9,488 | | | 4.01 | | | 1,131,656 | | | 11,796 | | | 4.15 | | | 1,157,258 | | | 10,520 | | | 3.62 | |

| Total interest-bearing liabilities | | 11,337,805 | | | 70,403 | | | 2.46 | | | 11,674,540 | | | 74,514 | | | 2.53 | | | 12,178,641 | | | 36,385 | | | 1.19 | |

| Noninterest-bearing deposits | | 5,141,585 | | | | | | | 6,001,033 | | | | | | | 6,587,400 | | | | | |

| Other liabilities | | 296,604 | | | | | | | 268,249 | | | | | | | 211,731 | | | | | |

| Total liabilities | | 16,775,994 | | | | | | | 17,943,822 | | | | | | | 18,977,772 | | | | | |

| Stockholders' equity | | 2,848,951 | | | | | | | 2,861,965 | | | | | | | 2,751,161 | | | | | |

| Total liabilities and equity | | $ | 19,624,945 | | | | | | | $ | 20,805,787 | | | | | | | $ | 21,728,933 | | | | | |

| Net interest income | | | | $ | 146,789 | | | | | | | $ | 149,548 | | | | | | | $ | 181,396 | | | |

Net interest margin (3) | | | | | | 3.28 | % | | | | | | 3.12 | % | | | | | | 3.61 | % |

Cost of deposits (4) | | | | | | 1.56 | | | | | | | 1.50 | | | | | | | 0.58 | |

Cost of funds (5) | | | | | | 1.69 | | | | | | | 1.67 | | | | | | | 0.77 | |

Cost of non-maturity deposits (6) | | 1.02 | | | | | | | 0.89 | | | | | | | 0.31 | |

| Ratio of interest-earning assets to interest-bearing liabilities | | 156.50 | | | | | | | 162.74 | | | | | | | 163.77 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2023 | | 2022 |

| (Dollars in thousands) | Average

Balance | | Interest | | Average

Yield/Cost | | Average

Balance | | Interest | | Average

Yield/Cost |

| Assets | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | |

| Cash and cash equivalents | $ | 1,437,074 | | | $ | 67,134 | | | 4.67 | % | | $ | 678,270 | | | $ | 12,691 | | | 1.87 | % |

| Investment securities | 3,778,650 | | | 103,236 | | | 2.73 | | | 4,301,005 | | | 82,167 | | | 1.91 | |

Loans receivable, net (1)(2) | 13,759,815 | | | 717,615 | | | 5.22 | | | 14,767,554 | | | 673,720 | | | 4.56 | |

| Total interest-earning assets | 18,975,539 | | | 887,985 | | | 4.68 | | | 19,746,829 | | | 768,578 | | | 3.89 | |

| Noninterest-earning assets | 1,812,254 | | | | | | | 1,766,599 | | | | | |

| Total assets | $ | 20,787,793 | | | | | | | $ | 21,513,428 | | | | | |

| Liabilities and Equity | | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | |

| Interest checking | $ | 3,152,823 | | | $ | 36,520 | | | 1.16 | % | | $ | 3,681,244 | | | $ | 6,351 | | | 0.17 | % |

| Money market | 4,667,007 | | | 69,917 | | | 1.50 | | | 5,155,785 | | | 12,735 | | | 0.25 | |

| Savings | 360,546 | | | 915 | | | 0.25 | | | 433,156 | | | 391 | | | 0.09 | |

| Retail certificates of deposit | 1,385,531 | | | 48,237 | | | 3.48 | | | 944,963 | | | 6,498 | | | 0.69 | |

| Wholesale/brokered certificates of deposit | 1,434,563 | | | 61,858 | | | 4.31 | | | 520,652 | | | 14,118 | | | 2.71 | |

| Total interest-bearing deposits | 11,000,470 | | | 217,447 | | | 1.98 | | | 10,735,800 | | | 40,093 | | | 0.37 | |

| FHLB advances and other borrowings | 798,667 | | | 27,255 | | | 3.41 | | | 574,320 | | | 13,131 | | | 2.29 | |

| Subordinated debentures | 331,534 | | | 18,244 | | | 5.50 | | | 330,885 | | | 18,242 | | | 5.51 | |

| Total borrowings | 1,130,201 | | | 45,499 | | | 4.03 | | | 905,205 | | | 31,373 | | | 3.47 | |

| Total interest-bearing liabilities | 12,130,671 | | | 262,946 | | | 2.17 | | | 11,641,005 | | | 71,466 | | | 0.61 | |

| Noninterest-bearing deposits | 5,564,887 | | | | | | | 6,859,141 | | | | | |

| Other liabilities | 247,946 | | | | | | | 224,739 | | | | | |

| Total liabilities | 17,943,504 | | | | | | | 18,724,885 | | | | | |

| Stockholders’ equity | 2,844,289 | | | | | | | 2,788,543 | | | | | |

| Total liabilities and equity | $ | 20,787,793 | | | | | | | $ | 21,513,428 | | | | | |

| Net interest income | | | $ | 625,039 | | | | | | | $ | 697,112 | | | |

| Net interest rate spread | | | | | 2.51 | % | | | | | | 3.28 | % |

Net interest margin (3) | | | | | 3.29 | | | | | | | 3.53 | |

Cost of deposits (4) | | | | | 1.31 | | | | | | | 0.23 | |

Cost of funds (5) | | | | | 1.49 | | | | | | | 0.39 | |

Cost of non-maturity deposits (6) | | | | | 0.78 | | | | | | | 0.12 | |

| Ratio of interest-earning assets to interest-bearing liabilities | | | | 156.43 | | | | | | | 169.63 | |

______________________________

(1) Average balance includes loans held for sale and nonperforming loans and is net of deferred loan origination fees/costs and discounts/premiums, and the basis adjustments of certain loans included in fair value hedging relationships.

(2) Interest income includes net discount accretion of $2.6 million, $2.2 million, and $3.5 million, for the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, respectively, and $10.2 million and $21.7 million, respectively, for the years ended December 31, 2023 and December 31, 2022, respectively.

(3) Represents net interest income divided by average interest-earning assets.

(4) Represents annualized interest expense on deposits divided by the sum of average interest-bearing deposits and noninterest-bearing deposits.

(5) Represents annualized total interest expense divided by the sum of average total interest-bearing liabilities and noninterest-bearing deposits.

(6) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

| LOAN PORTFOLIO COMPOSITION |

| (Unaudited) |

| | | | | | | | | | |

| | | December 31, | | September 30, | | June 30, | | March 31, | | December 31, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2023 | | 2023 | | 2022 |

| Investor loans secured by real estate | | | | | | | | | | |

| CRE non-owner-occupied | | $ | 2,421,772 | | | $ | 2,514,056 | | | $ | 2,571,246 | | | $ | 2,590,824 | | | $ | 2,660,321 | |

| Multifamily | | 5,645,310 | | | 5,719,210 | | | 5,788,030 | | | 5,955,239 | | | 6,112,026 | |

| Construction and land | | 472,544 | | | 444,576 | | | 428,287 | | | 420,079 | | | 399,034 | |