0001456772

false

0001456772

2023-09-01

2023-09-01

0001456772

us-gaap:CommonStockMember

2023-09-01

2023-09-01

0001456772

opi:SeniorUnsecuredNotes6.375PercentDueIn2050Member

2023-09-01

2023-09-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 1, 2023

OFFICE PROPERTIES INCOME TRUST

(Exact Name of Registrant as Specified in

Its Charter)

Maryland

(State or Other Jurisdiction of Incorporation)

| 001-34364 |

|

26-4273474 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

Two Newton Place, 255 Washington Street, Suite

300, Newton, Massachusetts 02458-1634

(Address of Principal Executive Offices) (Zip Code)

617-219-1440

(Registrant's Telephone Number, Including

Area Code)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title Of Each Class |

|

Trading Symbol(s) |

|

Name

Of Each Exchange On Which Registered |

| Common Shares of Beneficial Interest |

|

OPI |

|

The Nasdaq Stock Market LLC |

| 6.375% Senior Notes due 2050 |

|

OPINL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

In this Current Report on Form 8-K, the terms “we”,

“us” and “our” refer to Office Properties Income Trust, and the term “DHC” refers to Diversified Healthcare

Trust.

Item 1.01. Entry Into a Material Definitive Agreement.

The disclosure set forth below under Item 1.02

of this Current Report on Form 8-K is incorporated by reference herein.

Item 1.02. Termination of a Material Definitive Agreement.

As previously disclosed, on April 11, 2023,

we and DHC entered into an Agreement and Plan of Merger, or the Merger Agreement, pursuant to which we and DHC agreed that DHC would merge

with and into us, with us as the surviving entity in the merger, subject to the terms and conditions of the Merger Agreement. On September 1,

2023, we and DHC mutually agreed to terminate the Merger Agreement and entered into a termination agreement, or the Termination Agreement.

The mutual termination of the Merger Agreement was separately recommended by our and DHC’s respective Special Committee and approved

by our and DHC’s respective Board of Trustees.

Pursuant to the Termination Agreement, the termination

of the Merger Agreement is effective as of September 1, 2023. Neither we nor DHC will be required to pay any termination fee as a

result of the mutual decision to terminate the Merger Agreement. We and DHC will bear our and their respective costs and expenses related

to the Merger Agreement and the transactions contemplated thereby in accordance with the terms of the Merger Agreement.

The foregoing description of the Merger Agreement

and the Termination Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the

Merger Agreement, which was previously filed as Exhibit 2.1 to our Current Report on Form 8-K on April 12, 2023, and the

full text of the Termination Agreement, which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

Contemporaneously with the execution of the Merger

Agreement, on April 11, 2023, we and our manager, The RMR Group LLC, or RMR, entered into a Third Amended and Restated Property Management

Agreement, or the Amended Property Management Agreement. The effectiveness of the Amended Property Management Agreement was conditioned

upon the consummation of the merger. Since the merger will not be consummated, the Amended Property Management Agreement will not become

effective and the Second Amended and Restated Property Management Agreement between us and RMR will remain in effect.

Item 8.01. Other Information.

On September 1, 2023, we and DHC issued a

joint press release announcing the mutual termination of the Merger Agreement and the cancellation of our and DHC’s respective special

meetings of shareholders to be held in connection with the Merger Agreement. A copy of the press release is attached hereto as Exhibit 99.1

and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

OFFICE PROPERTIES INCOME TRUST |

| |

|

|

| |

By: |

/s/ Matthew C. Brown |

| |

Name: |

Matthew C. Brown |

| |

Title: |

Chief Financial Officer and Treasurer |

| |

|

|

| Dated: September 1, 2023 |

|

|

Exhibit 10.1

TERMINATION AGREEMENT

This TERMINATION AGREEMENT, dated as of September 1,

2023 (this “Agreement”), is entered into by and between Office Properties Income Trust, a Maryland real estate investment

trust (“Parent”), and Diversified Healthcare Trust, a Maryland real estate investment trust (the “Company”).

Each of the foregoing are collectively referred to herein as the “Parties” and each individually as a “Party.”

Capitalized terms used but not defined in this Agreement shall have the respective meanings given to them in the Merger Agreement (as

defined below).

RECITALS

A. WHEREAS,

the Parties entered into that certain Agreement and Plan of Merger, dated as of April 11, 2023 (the “Merger Agreement”),

providing for the merger of the Company with and into Parent, with Parent being the surviving entity in the merger (the “Merger”).

B. WHEREAS,

Section 9.1(a) of the Merger Agreement provides that the Merger Agreement may be terminated by the mutual written consent of

each of Parent and the Company.

C. WHEREAS,

Parent and the Company have been advised that all of the conditions to the Closing set forth in Article VIII of the Merger Agreement

will not be satisfied and, accordingly, have determined that they desire to terminate the Merger Agreement on the terms and conditions

set forth herein.

NOW, THEREFORE, in consideration of the foregoing

and the mutual representations, warranties, covenants and agreements contained herein, and other good and valuable consideration, the

receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, hereby agree as follows:

AGREEMENT

1. Termination

of Merger Agreement. The Parties hereby mutually agree in accordance with Section 9.1(a) of the Merger Agreement that, immediately

upon execution of this Agreement, the Merger Agreement is terminated and shall be of no further force or effect, in each case other than

the provisions of the Merger Agreement that survive the termination thereof pursuant to Section 9.2(a) of the Merger Agreement,

which shall survive in accordance with such section (other than Section 9.3 of the Merger Agreement, which, notwithstanding anything

to the contrary set forth in Section 9.2(a) of the Merger Agreement, is hereby terminated and shall be of no further force and

effect and no Termination Fee is or will be payable by either Party thereunder), in each case subject to the releases contained herein.

2. Mutual

Releases; Covenants Not to Sue.

(a) Parent,

for and on behalf of itself and the Parent Related Parties (as defined below), does hereby unequivocally release and discharge, and hold

harmless, the Company and any of its former and current Affiliates and its and their respective trustees, directors, officers, employees,

agents, members, managers, general and limited partners, assignees, equity holders, controlling persons, successors, successors-in-interest,

financial and other advisors, attorneys, representatives, accountants and insurers (collectively, the “Company Related Parties”),

from any and all past, present, direct, indirect, individual, class, representative and derivative liabilities, actions, potential actions,

causes of action, rights, losses, obligations, duties, costs, expenses, interest, penalties, sanctions, decrees, matters, cases, claims,

suits, debts, dues, sums of money, attorneys’ fees, accounts, reckonings, bonds, bills, specialties, covenants, contracts, controversies,

agreements, promises, variances, trespasses, injuries, harms, damages, judgments, remedies, extents, executions, demands, liens and damages

of every kind and nature, in law, equity or otherwise, asserted or that could have been asserted, under federal, state, local, foreign,

regulatory, statutory, or common law or rule (including, without limitation, any claims under federal securities laws or state disclosure

law or any claims that could be asserted derivatively on behalf of the Parent), known or unknown, suspected or unsuspected, foreseen or

unforeseen, anticipated or unanticipated, disclosed or undisclosed, accrued or unaccrued, apparent or not apparent, foreseen or unforeseen,

matured or not matured, liquidated or not liquidated, fixed or contingent, whether or not concealed or hidden, from the beginning of time

until the date of execution of this Agreement, that in any way arises from or out of, are based upon, or are in connection with or relate

in any way to or involve, directly or indirectly, any of the actions, transactions, occurrences, statements, representations, misrepresentations,

omissions, allegations, facts, practices, events, claims or any other matters, things or causes whatsoever, or any series thereof, that

were, could have been, or in the future can or might be alleged, asserted, set forth, claimed, embraced, involved, or referred to in,

or related to, directly or indirectly: (i) the Merger Agreement and the other agreements and documents contemplated hereby or thereby

(collectively, the “Transaction Documents”); (ii) any breach, non-performance, action or failure to act under

the Transaction Documents; (iii) the proposed Merger, including, without limitation, the events leading to the abandonment of the

Merger and the termination of, and the decision to terminate, the Merger Agreement or any other Transaction Documents; (iv) any deliberations

or negotiations in connection with the proposed Merger; (v) the consideration proposed to be received by the Company’s shareholders

in connection with the proposed Merger; (vi) any pending or completed financings undertaken by Parent in connection with the proposed

Merger and fees and expenses incurred by Parent relating thereto; and (vii) any SEC filings, public filings, periodic reports, press

releases, registration statements, proxy statements or other statements issued, made available or filed relating, directly or indirectly,

to the proposed Merger, including, without limitation, claims under any and all federal securities laws (including, without limitation,

those within the exclusive jurisdiction of the federal courts) (collectively, the “Parent Released Claims”); provided,

however, that (A) no Party shall be released from any breach, non-performance, action or failure to act under this Agreement

or otherwise occurring from or after the date hereof (including, without limitation, with respect to the Confidentiality Agreement); (B) the

release in this Section 2(a) shall not apply to claims that any Parent Related Party may have against any Company Related

Party resulting from such Company Related Party’s fraud or criminal misconduct; and (C) the release in this Section 2(a) shall

not apply to any provision of the Merger Agreement that survives termination pursuant to Section 9.2(a) of the Merger Agreement,

as amended by Section 1 of this Agreement.

(b) The

Company, for and on behalf of itself and the Company Related Parties, does hereby unequivocally release and discharge, and hold harmless,

Parent and any of its former and current Affiliates and its and their respective trustees, directors, officers, employees, agents, members,

managers, general and limited partners, assignees, equity holders, controlling persons, successors, successors-in-interest, financial

and other advisors, attorneys, representatives, accountants and insurers (collectively, the “Parent Related Parties”

and, together with the Company Related Parties, the “Related Parties”), from any and all past, present, direct, indirect,

individual, class, representative, and derivative liabilities, actions, potential actions, causes of action, rights, losses, obligations,

duties, costs, expenses, interest, penalties, sanctions, decrees, matters, cases, claims, suits, debts, dues, sums of money, attorneys’

fees, accounts, reckonings, bonds, bills, specialties, covenants, contracts, controversies, agreements, promises, variances, trespasses,

injuries, harms, damages, judgments, remedies, extents, executions, demands, liens and damages of every kind and nature, in law, equity

or otherwise, asserted or that could have been asserted, under federal, state, local, foreign, regulatory, statutory, or common law or

rule (including, without limitation, any claims under federal securities laws or state disclosure law or any claims that could be

asserted derivatively on behalf of the Company), known or unknown, suspected or unsuspected, foreseen or unforeseen, anticipated or unanticipated,

disclosed or undisclosed, accrued or unaccrued, apparent or not apparent, foreseen or unforeseen, matured or not matured, liquidated

or not liquidated, fixed or contingent, whether or not concealed or hidden, from the beginning of time until the date of execution of

this Agreement, that in any way arises from or out of, are based upon, or are in connection with or relate in any way to or involve,

directly or indirectly, any of the actions, transactions, occurrences, statements, representations, misrepresentations, omissions, allegations,

facts, practices, events, claims or any other matters, things or causes whatsoever, or any series thereof, that were, could have been,

or in the future can or might be alleged, asserted, set forth, claimed, embraced, involved, or referred to in, or related to, directly

or indirectly: (i) the Transaction Documents; (ii) any breach, non-performance, action or failure to act under the Transaction

Documents; (iii) the proposed Merger, including, without limitation, the events leading to the abandonment of the Merger and the

termination of, and the decision to terminate, the Merger Agreement or any other Transaction Documents; (iv) any deliberations or

negotiations in connection with the proposed Merger; (v) the consideration proposed to be received by the Company’s shareholders

in connection with the proposed Merger; and (vi) any SEC filings, public filings, periodic reports, press releases, registration

statements, proxy statements or other statements issued, made available or filed relating, directly or indirectly, to the proposed Merger,

including, without limitation, claims under any and all federal securities laws (including, without limitation, those within the exclusive

jurisdiction of the federal courts) (collectively, the “Company Released Claims” and, together with the Parent Released

Claims, the “Released Claims”); provided, however, that (A) no Party shall be released from any

breach, non-performance, action or failure to act under this Agreement or otherwise occurring from or after the date hereof (including,

without limitation, with respect to the Confidentiality Agreement); and (B) the release in this Section 2(b) shall

not apply to claims that any Company Related Party may have against any Parent Related Party resulting from such Parent Related Party’s

fraud or criminal misconduct; and (C) the release in this Section 2(b) shall not apply to any provision of the

Merger Agreement that survives termination pursuant to Section 9.2(a) of the Merger Agreement, as amended by Section 1

of this Agreement.

(c) It

is understood and agreed that, except as provided in the provisos to Section 2(a) and Section 2(b), the

preceding paragraphs are a full and final release covering all known as well as unknown or unanticipated debts, claims or damages of

each of the Parties and their respective Related Parties relating to or arising out of the Transaction Documents. Therefore, each of

the Parties expressly waives any rights it may have under any statute or common law principle under which a general release does not

extend to claims which such Party does not know or suspect to exist in its favor at the time of executing the release, which if known

by such Party must have affected such Party’s settlement with the other, including, without limitation, Section 1542 of the

California Civil Code, which provides:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR

DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM OR HER MUST HAVE MATERIALLY

AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR.

In connection with such waiver and relinquishment, the Parties acknowledge

that they or their attorneys or agents may hereafter discover claims or facts in addition to or different from those which they now know

or believe to exist with respect to the Released Claims, but that it is their intention hereby fully, finally and forever to settle and

release all of the Released Claims. In furtherance of this intention, the releases herein given shall be and remain in effect as full

and complete mutual releases with regard to the Released Claims notwithstanding the discovery or existence of any such additional or different

claim or fact.

(d) Except

as provided in the provisos to Section 2(a) and Section 2(b), and except as required by applicable Law or

the rules or regulations of any Governmental Authority, any self-regulatory authority or by the order of any court of competent jurisdiction,

each Party, on behalf of itself and its respective Related Parties, hereby covenants to the other Party and their respective Related Parties

not to, with respect to any Released Claim, directly or indirectly encourage or solicit or voluntarily assist or participate in any way

in the investigation, filing, reporting or prosecution by such Party or its Related Parties or any third party of a suit, arbitration,

mediation, or claim (including, without limitation, a third-party or derivative claim) against any other Party and/or its Related Parties

relating to any Released Claim. The covenants contained in this Section 2 shall survive this Agreement indefinitely regardless

of any applicable statute of limitations.

3. Representations

of the Parties. Each Party, on behalf of itself and its Related Parties, represents and warrants to the other Parties as follows:

(a) This

Agreement constitutes a valid and binding obligation of such Party, enforceable against such Party in accordance with its terms, subject

to laws of general application relating to bankruptcy, insolvency and the relief of debtors and rules of law governing specific performance,

injunctive relief or other equitable remedies.

(b) The

execution and delivery of this Agreement by such Party do not, and the performance by such Party of the transactions contemplated by this

Agreement does not: (i) conflict with, or result in a violation or breach of, any provision of its charter or bylaws (or equivalent

organizational documents); or (ii) conflict with or violate any Law or Order applicable to such Party or any of its Subsidiaries

or any of its or their assets.

(c) The

execution and delivery of this Agreement by such Party was approved in accordance with Section 10.14 of the Merger Agreement.

4. Notices.

All notices, requests, claims, consents, demands and other communications under this Agreement shall be in writing and shall be deemed

given on the day of actual delivery, if delivered personally, or on the date of receipt, if sent by overnight courier (providing proof

of delivery) to the Parties or if sent by e-mail of a .pdf attachment (providing confirmation of transmission) at the following street

addresses or email addresses, as applicable (or at such other United States street address or email address for a Party as shall be specified

by like notice):

If to the Company, addressed as follows:

Diversified Healthcare Trust

Two Newton Place

255 Washington Street

Suite 300

Newton, Massachusetts 02458

| Attention: | Jennifer Francis, President and

CEO |

| Email: | jfrancis@rmrgroup.com |

with copies (which shall not constitute notice)

to:

Sullivan &

Cromwell LLP

125 Broad Street

New York, NY 10004

| Attention: | Melissa Sawyer and Lauren S. Boehmke |

| Email: | sawyerm@sullcrom.com; boehmkel@sullcrom.com |

If to Parent, addressed as follows:

Office Properties Income Trust

Two Newton Place

255 Washington Street

Suite 300

Newton, Massachusetts 02458

| Attention: | Matthew Brown, Chief Financial

Officer and Treasurer |

| Email: | mbrown@rmrgroup.com |

with a copy (which shall not constitute notice)

to:

Wachtell,

Lipton, Rosen & Katz

51 West 52nd Street

New York, NY 10019

| Attention: | Robin Panovka and Mark A. Stagliano |

| Email: | RPanovka@wlrk.com; MAStagliano@wlrk.com |

5. Entire

Agreement. This Agreement constitutes the entire agreement and supersede all prior agreements and understandings, both written and

oral, between the Parties with respect to the subject matter of this Agreement.

6. Amendments

and Waiver. Subject to compliance with applicable Law, this Agreement may be amended, modified or supplemented in any respect only

by mutual written agreement of the Parties. Any agreement on the part of a Party to any extension or waiver hereunder shall be valid only

if set forth in an instrument in writing signed by the Party to be bound thereby. Notwithstanding the foregoing, no failure or delay by

a Party in exercising any right hereunder shall operate as a waiver thereof nor shall any single or partial exercise thereof preclude

any other or further exercise of any other right hereunder.

7. Severability.

If any term or other provision of this Agreement is invalid, illegal or incapable of being enforced under any present or future Law or

public policy in any jurisdiction, as to that jurisdiction, (a) such term or other provision shall be fully separable, (b) this

Agreement shall be construed and enforced as if such invalid, illegal or unenforceable provision had never comprised a part hereof, (c) all

other conditions and provisions of this Agreement shall remain in full force and effect and shall not be affected by the illegal, invalid

or unenforceable term or other provision or by its severance herefrom, and (d) such terms or other provisions shall not affect the

validity or enforceability of any of the terms or provisions of this Agreement in any other jurisdiction. Upon such determination that

any term or other provision is invalid, illegal or incapable of being enforced in any jurisdiction, the Parties hereto shall negotiate

in good faith to modify this Agreement so as to effect the original intent of the Parties as closely as possible in a mutually acceptable

manner in order that the terms of this Agreement, including, without limitation, the releases of the Released Claims, be consummated as

originally contemplated to the fullest extent possible.

8. Applicable

Law. This Agreement, and all Actions (whether at Law, in contract or in tort) that may be based upon, arise out of or related to this

Agreement or the negotiation, execution or performance of this Agreement, shall be governed by, and construed in accordance with, the

Laws of the State of Maryland without giving effect to any choice or conflict of Law principles (whether of the State of Maryland or any

other jurisdiction) that would cause the application of the Laws of any jurisdiction other than the State of Maryland.

9. Jurisdiction

of Disputes. All Actions arising out of or relating to this Agreement shall be heard and determined exclusively in any Maryland state

or federal court. Each of the Parties hereby irrevocably and unconditionally (i) submits to the exclusive jurisdiction of any Maryland

state or federal court, for the purpose of any Action arising out of or relating to this Agreement brought by any Party, (ii) agrees

not to commence any such action or proceeding except in such courts, (iii) agrees that any claim in respect of any such action or

proceeding may be heard and determined in any Maryland state or federal court, (iv) waives, to the fullest extent it may legally

and effectively do so, any objection which it may now or hereafter have to the laying of venue of any such action or proceeding, and (v) waives,

to the fullest extent permitted by Law, the defense of an inconvenient forum to the maintenance of such action or proceeding. Each of

the Parties agrees that a final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions

by suit on the judgment or in any other manner provided by Law. Each of the Parties irrevocably consents to service of process in the

manner provided for notices in Section 4. Nothing in this Agreement will affect the right of any Party to serve process

in any other manner permitted by Law.

10. WAIVER

OF JURY TRIAL. EACH PARTY HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE

TO A TRIAL BY JURY IN RESPECT OF ANY SUIT, ACTION OR OTHER PROCEEDING (WHETHER BASED ON CONTRACT, TORT OR OTHERWISE) DIRECTLY OR INDIRECTLY

ARISING OUT OF OR RELATING TO THIS AGREEMENT AND ANY OF THE OTHER AGREEMENTS DELIVERED IN CONNECTION HEREWITH, THE MERGER OR THE OTHER

TRANSACTIONS. EACH PARTY (A) CERTIFIES THAT NO REPRESENTATIVE OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH

PARTY WOULD NOT, IN THE EVENT OF ANY ACTION, SUIT OR PROCEEDING, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT

IT AND THE OTHER PARTY HERETO HAVE BEEN INDUCED TO ENTER INTO THIS AGREEMENT, BY, AMONG OTHER THINGS, THE MUTUAL WAIVER AND CERTIFICATIONS

IN THIS SECTION 10.

11. No

Assignment; Binding Effect. Neither this Agreement nor any of the rights, interests or obligations under this Agreement shall be assigned

or delegated, in whole or in part, by operation of Law or otherwise by either Party without the prior written consent of the other Party

and any attempt to make any such assignment without such consent shall be null and void. Subject to the preceding sentence, this Agreement

will be binding upon, inure to the benefit of, and be enforceable by, the Parties and their respective successors and assigns.

12. Third-Party

Beneficiaries. This Agreement is not intended to, and shall not, confer any rights or remedies upon any Person other than the Parties

and their respective successors and permitted assigns, except that each Party acknowledges and agrees that the Company Related Parties

and the Parent Related Parties are express third-party beneficiaries of the releases of such Related Parties and covenants not to sue

such Related Parties contained in Section 2 of this Agreement and are entitled to enforce rights under such section to the

same extent that such Related Parties could enforce such rights if they were a party to this Agreement.

13. Headings.

Headings for this Agreement are for reference purposes only and do not affect in any way the meaning or interpretation of this Agreement.

14. Injunctive

Relief. The Parties agree that irreparable damage would occur if any of the provisions of this Agreement were not performed in accordance

with their specific terms or were otherwise breached, and that monetary damages, even if available, would not be an adequate remedy therefor.

It is accordingly agreed that each Party shall be entitled to an injunction or injunctions, specific performance or other equitable relief

to prevent breaches of this Agreement and to enforce specifically the terms and provisions of this Agreement. Each of the Parties hereby

waives (a) any defense in an Action for specific performance that a remedy at Law would be adequate, and (b) any requirement

under any Law to post a security as prerequisite to obtaining equitable relief. Each Party agrees that the right of specific performance

and other equitable relief is an integral part of this Agreement, and without that right, neither the Company, on the one hand, nor Parent,

on the other hand, would have entered into this Agreement.

15. Counterparts;

Effectiveness. This Agreement may be executed in counterparts, each of which shall be deemed an original and all of which together

shall be deemed one and the same agreement, and shall become effective when one or more counterparts have been signed by each of the Parties

and delivered (by electronic delivery or otherwise) to the other Party. Signatures to this Agreement executed or transmitted by electronic

means will have the same effect as physical delivery of a paper document bearing an original signature.

16. Further

Assurances. Each Party shall, and shall cause its Subsidiaries and Affiliates to, cooperate with each other in the taking of all,

actions necessary, proper or advisable under this Agreement and applicable Laws to effectuate the termination of the Merger Agreement

including, without limitation, as contemplated by the last sentence of Section 9.2 of the Merger Agreement.

17. Non-Liability

of Trustees of the Company and Parent. The Company Charter and the Parent Charter, each as filed with the Maryland SDAT, provide that

no trustee, officer, shareholder, employee or agent of the Company or Parent, respectively, shall be held to any personal liability, jointly

or severally, for any obligation of, or claim against, the Company or Parent, respectively. All Persons dealing with the Company or Parent

in any way shall look only to the assets of the Company or Parent, respectively, for the payment of any sum or the performance of any

obligation.

[Signature page follows]

IN WITNESS WHEREOF, the Parties hereto have caused

this Agreement to be duly executed and delivered as of the date first above written.

| |

DIVERSIFIED HEALTHCARE TRUST |

| |

|

|

| |

By: |

/s/ Jennifer F. Francis |

| |

|

Name: Jennifer F. Francis |

| |

|

Title: President and Chief Executive Officer |

| |

|

|

| |

OFFICE PROPERTIES INCOME TRUST |

| |

|

|

| |

By: |

/s/ Matthew C. Brown |

| |

|

Name: Matthew C. Brown |

| |

|

Title: Chief Financial Officer and Treasurer |

[Signature Page to Termination

Agreement]

Exhibit 99.1

FOR IMMEDIATE RELEASE

Diversified Healthcare

Trust and Office Properties Income Trust

Mutually

Agree to Terminate Merger Agreement

Newton, MA

(September 1, 2023): Diversified Healthcare Trust (Nasdaq: DHC) and Office Properties Income Trust (Nasdaq: OPI) today announced

that they have mutually agreed to terminate their previously announced merger agreement dated April 11, 2023, pursuant to which OPI had

agreed to acquire all outstanding common shares of DHC. Accordingly, the companies have cancelled their respective Special Meetings of

Shareholders scheduled for September 6, 2023.

The mutual termination

was approved by the respective Special Committees and Boards of Trustees of OPI and DHC. The parties have agreed that each company will

bear its costs and expenses in connection with the terminated transaction pursuant to the terms of the merger agreement, and that neither

party will pay any termination fee as a result of the mutual decision to terminate the merger agreement.

About Diversified Healthcare Trust

DHC is a real estate

investment trust focused on owning high-quality healthcare properties located throughout the United States. DHC seeks diversification

across the health services spectrum by care delivery and practice type, by scientific research disciplines and by property type and location.

As of June 30, 2023, DHC’s approximately $7.1 billion portfolio included 376 properties in 36 states and Washington, D.C., occupied

by approximately 500 tenants, and totaling approximately 9 million square feet of life science and medical office properties and more

than 27,000 senior living units. DHC is managed by The RMR Group (Nasdaq: RMR), a leading U.S. alternative asset management company with

approximately $36 billion in assets under management as of June 30, 2023 and more than 35 years of institutional experience in buying,

selling, financing and operating commercial real estate. To learn more about DHC, visit www.dhcreit.com.

About Office Properties Income Trust

OPI is a national

REIT focused on owning and leasing high quality office and mixed-use properties in select growth-oriented U.S. markets. As of June 30,

2023, approximately 63% of OPI's revenues were from investment grade rated tenants. OPI owned and leased 155 properties as of June 30,

2023, with approximately 20.8 million square feet located in 30 states and Washington, D.C. In 2023, OPI was named as an Energy Star®

Partner of the Year for the sixth consecutive year. OPI is managed by The RMR Group (Nasdaq: RMR), a leading U.S. alternative asset management

company with approximately $36 billion in assets under management as of June 30, 2023, and more than 35 years of institutional experience

in buying, selling, financing and operating commercial real estate. OPI is headquartered in Newton, MA. For more information, visit opireit.com.

DHC Investor Contact:

Melissa McCarthy, Manager, Investor

Relations

(617) 796-8234

OPI Investor Contact:

Kevin Barry, Director, Investor Relations

(617) 219-1410

Media Contact:

Andrew Siegel / Michael Reilly

Joele Frank

212-355-4449

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=opi_SeniorUnsecuredNotes6.375PercentDueIn2050Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

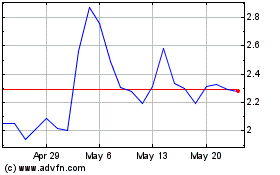

Office Properties Income (NASDAQ:OPI)

Historical Stock Chart

From Apr 2024 to May 2024

Office Properties Income (NASDAQ:OPI)

Historical Stock Chart

From May 2023 to May 2024