O�Reilly Automotive, Inc. (�O�Reilly� or �the Company�) (Nasdaq:

ORLY) today announced revenues and earnings for the second quarter

ended June 30, 2008. Net income for the second quarter ended June

30, 2008, totaled $55.8 million, up 7.5% from $51.9 million for the

same period in 2007. Diluted earnings per common share for the

second quarter of 2008 increased 6.7% to $0.48 on 116.5 million

shares compared to $0.45 for the second quarter of 2007 on 116.1

million shares. Sales for the three months ended June 30, 2008,

totaled $704 million, up 9.5% from $643 million for the same period

a year ago. Gross profit for the second quarter of 2008 increased

to $317 million (or 45.0% of sales) from $287 million (or 44.7% of

sales) for the second quarter of 2007, representing an increase of

10.4%. Selling, General and Administrative expenses increased to

$229 million (or 32.5% of sales) for the second quarter of 2008

from $206 million (or 32.0% of sales) for the second quarter of

2007, representing an increase of 11.2%. Net income for the first

six months of 2008 totaled $102.1 million, up 1.8% from $100.3

million for the same period a year ago. Diluted earnings per common

share for the first six months of 2008 increased 1.1% to $0.88 on

116.4 million shares compared to $0.87 a year ago on 115.9 million

shares. Sales for the first six months of 2008 totaled $1.35

billion, up 7.5% from $1.26 billion for the same period a year ago.

Gross profit for the first six months of 2008 increased to $606

million (or 44.8% of sales) from $556 million (or 44.3% of sales)

for the same period a year ago, representing an increase of 8.8%.

Selling, General and Administrative expenses increased to $443

million (or 32.8% of sales) for the first six months of 2008 from

$398 million (or 31.7% of sales) for the same period a year ago,

representing an increase of 11.4%. Comparable store sales for

stores open at least one year increased 3.4% and 1.5% for the

second quarter and first six months of 2008, respectively.

Comparable store sales for the second quarter and first six months

of 2007 were 2.0% and 4.3%, respectively. �We are very proud of the

continued high levels of customer service provided by Team O�Reilly

that enabled us to achieve solid 3.4% comparable store sales growth

this quarter,� Greg Henslee, CEO and Co-President stated. �We�re

also very excited about the potential of our acquisition of CSK

Auto Corporation and the opportunity to optimize our very

complementary business models including the implementation of our

dual-market strategy in CSK�s markets. On July 11th, O�Reilly and

CSK became one team of 40,000 members, operating over 3,200 stores

in 38 states and we�re looking very forward to beginning the

integration process and working together to become an even more

dominant force in the auto parts business in the western half of

the U.S.� �In addition to opening 51 stores during the second

quarter, we continued to prepare for the opening of our newest

distribution center in Lubbock this fall,� stated Ted Wise, COO and

Co-President. �Our team continues to focus on the fundamentals of

providing industry leading customer service to our Professional

Installer and do-it-yourself customers in all our markets. We�re

very proud of the quality of our sales growth during the quarter,

which was highlighted by a 10.4% increase in gross margin.� The

Company estimates diluted earnings per share for the year ending

December 31, 2008, to range from $1.50 to $1.54. Excluding the

expected impact of one-time charges relating to the CSK acquisition

of $0.07 per diluted share, adjusted earnings per share are

expected to range from $1.57 to $1.61. Anticipated one-time charges

relating to the CSK acquisition include a prepayment penalty of

$6.4 million associated with repayment of existing O�Reilly debt in

conjunction with the acquisition, financing costs of $4.2 million

related to an interim financing facility and estimated severance

costs of $3 million. The impact of the acquisition of CSK,

excluding the one-time items presented above, is expected to dilute

2008 earnings by approximately $0.15 per diluted share, and this

impact is reflected in both the diluted EPS and adjusted diluted

EPS ranges provided above. The Company continues to expect the

acquisition to be slightly accretive to earnings per share in 2009

and to realize ongoing synergies of $100 million annually beginning

in 2010. Comparable store sales for the second-half of 2008 are

estimated to range from 2% to 4% for existing O�Reilly stores and

(3%) to (1%) for CSK stores for a combined Company range of 0% to

2%. Full year comparable store sales are estimated to range from 2%

to 3% for existing O�Reilly stores and (3%) to (1%) for CSK stores

for a combined Company full year range of 0% to 2%. CSK�s

historical comparable store sales from May 5, 2008 to July 11,

2008, reflecting the period from the end of CSK�s most recently

reported fiscal quarter to the date of acquisition, were (1.6%).

This release contains certain financial information not derived in

accordance with United States generally accepted accounting

principles (�GAAP�). The Company does not, and does not suggest

investors should, consider such non-GAAP financial measures in

isolation from, or as a substitute for, GAAP financial information.

The Company believes that the presentation of estimates excluding

the one-time acquisition-related charges provides meaningful

supplemental information to both management and investors that is

indicative of the Company's core operations. The Company excludes

these items in judging its performance and believes this non-GAAP

information is useful to investors as well. The Company will host a

conference call July 23, 2008, at 10:00 a.m. central time to

discuss its results as well as future expectations. Investors may

listen to the conference call live on the Company�s web site,

www.oreillyauto.com, by clicking on �Investor Relations� then �News

Room.� A replay of the call will also be available on the Company�s

website following the conference call. We invite interested

analysts to join our call. The dial-in number for the call is (706)

643-0114, the conference call ID number is 55451326. O�Reilly

Automotive, Inc. is one of the largest specialty retailers of

automotive aftermarket parts, tools, supplies, equipment and

accessories in the United States, serving both the do-it-yourself

and professional installer markets. Founded in 1957 by the O�Reilly

family, the Company operated 1,918 stores in the states of Alabama,

Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kansas,

Kentucky, Louisiana, Minnesota, Mississippi, Missouri, Montana,

Nebraska, North Carolina, North Dakota, Ohio, Oklahoma, South

Carolina, South Dakota, Tennessee, Texas, Virginia, Wisconsin and

Wyoming as of June 30, 2008. The Company claims the protection of

the safe-harbor for forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These

statements can be identified by forward-looking words such as

�expect,� �believe,� �anticipate,� �should,� �plan,� �intend,�

�estimate,� �project,� �will� or similar words. In addition,

statements contained within this press release that are not

historical facts are forward-looking statements, such as statements

discussing among other things, expected growth, store development

and expansion strategy, business strategies, future revenues and

future performance. These forward-looking statements are based on

estimates, projections, beliefs and assumptions and are not

guarantees of future events and results. Such statements are

subject to risks, uncertainties and assumptions, including, but not

limited to, competition, product demand, the market for auto parts,

the economy in general, inflation, consumer debt levels,

governmental approvals, our ability to hire and retain qualified

employees, risks associated with the integration of acquired

businesses, weather, terrorist activities, war and the threat of

war. Actual results may materially differ from anticipated results

described or implied in these forward-looking statements. Please

refer to the Risk Factors sections of the Company�s Form 10-K for

the year ended December 31, 2007, for more details. O�REILLY

AUTOMOTIVE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS (In thousands, except share data) � � June 30, 2008 June 30,

2007 December 31, 2007 (Unaudited) (Unaudited) (Note) Assets

Current assets: Cash and cash equivalents $ 117,214 $ 92,484 $

47,555 Accounts receivable, net 97,186 92,202 84,242 Amounts

receivable from vendors 42,571 48,839 48,263 Inventory 904,152

853,127 881,761 Other current assets � 20,182 � 19,971 � 40,483 �

Total current assets 1,181,305 1,106,623 1,102,304 � Property and

equipment, at cost 1,601,180 1,349,332 1,479,779 Accumulated

depreciation and amortization � 429,403 � 361,391 � 389,619 � Net

property and equipment 1,171,777 987,941 1,090,160 � Notes

receivable, less current portion 24,100 28,047 25,437 Goodwill

51,145 49,499 50,447 Other assets � 34,440 � 12,594 � 11,389 �

Total assets $ 2,462,767 $ 2,184,704 $ 2,279,737 � � Liabilities

and shareholders' equity Current liabilities: Accounts payable $

446,013 $ 393,916 $ 380,683 Accrued payroll 25,075 23,060 23,739

Accrued benefits and withholdings 44,837 46,661 43,463 Deferred

income taxes 10,765 4,780 6,235 Other current liabilities 55,909

47,475 49,536 Current portion of long-term debt � 311 � 25,315 �

25,320 � Total current liabilities 582,910 541,207 528,976 �

Long-term debt, less current portion 75,000 75,311 75,149 Deferred

income taxes 27,592 25,666 27,241 Other liabilities 60,026 49,957

55,894 � Shareholders' equity: Common stock, $0.01 par value:

Authorized shares � 245,000,000 Issued and outstanding shares �

115,761,048 as of June 30, 2008, 114,836,096 as of June 30, 2007

and 115,260,564 as of December 31, 2007 1,158 1,148 1,153

Additional paid-in capital 457,041 428,704 441,731 Retained

earnings 1,258,512 1,062,711 1,156,393 Accumulated other

comprehensive income/(loss) � 528 � - � (6,800 ) Total

shareholders� equity � 1,717,239 � 1,492,563 � 1,592,477 � Total

liabilities and shareholders� equity $ 2,462,767 $ 2,184,704 $

2,279,737 � � Note: The balance sheet at December 31, 2007 has been

derived from the audited consolidated financial statements at that

date, but does not include all of the information and footnotes

required by accounting principles generally accepted in the United

States for complete financial statements. O'REILLY AUTOMOTIVE, INC.

AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited) (In thousands, except per share data) � � Three Months

Ended Six Months Ended June 30, June 30, 2008 � 2007 2008 � 2007 �

Sales $ 704,430 $ 643,108 $ 1,350,650 $ 1,256,253 Cost of goods

sold, including warehouse and distribution expenses � 387,333 �

355,923 � 745,059 � 699,787 � Gross profit 317,097 287,185 605,591

556,466 Selling, general and administrative expenses � 228,709 �

205,627 � 443,047 � 397,716 � Operating income 88,388 81,558

162,544 158,750 Other income, net � 675 � 781 � 225 � 771 � Income

before income taxes 89,063 82,339 162,769 159,521 Provision for

income taxes � 33,275 � 30,440 � 60,650 � 59,215 � Net income $

55,788 $ 51,899 $ 102,119 $ 100,306 � Net income per common share $

0.48 $ 0.45 $ 0.88 $ 0.88 Net income per common share - assuming

dilution $ 0.48 $ 0.45 $ 0.88 $ 0.87 � Weighted-average common

shares outstanding � 115,696 � 114,533 � 115,541 � 114,288 Adjusted

weighted-average common shares outstanding � assuming dilution �

116,509 � 116,111 � 116,400 � 115,878 O'REILLY AUTOMOTIVE, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) (In thousands) � � Six Months Ended June 30, 2008 �

2007 � Net cash provided by operating activities $ 215,468 $

191,930 � Investing activities: Purchases of property and equipment

(125,352 ) (140,622 ) Proceeds from sale of property and equipment

1,565 1,453 Payments received on notes receivable 2,444 2,560 Other

� (4,570 ) � (2,095 ) � Net cash used in investing activities

(125,913 ) (138,704 ) � Financing activities: Proceeds from

issuance of long-term debt - 16,450 Tax benefit of stock options

exercised 572 5,379 Principal payments of long-term debt (25,159 )

(26,303 ) Net proceeds from issuance of common stock � 4,691 � �

13,829 � � Net cash (used in)/provided by financing activities

(19,896 ) 9,355 � Net increase in cash and cash equivalents 69,659

62,581 Cash and cash equivalents at beginning of period � 47,555 �

� 29,903 � � Cash and cash equivalents at end of period $ 117,214 �

$ 92,484 � O'REILLY AUTOMOTIVE, INC. AND SUBSIDIARIES SELECTED

FINANCIAL INFORMATION (Unaudited) � June 30, 2008 � 2007 �

Inventory turnover (1) 1 .6 1 .6 Inventory turnover, net of

payables (2) 3 .1 2 .9 � AP to inventory (3) 49 .3% 46 .2%

Debt-to-capital (4) 4 .2% 6 .3% Return on equity (5) 12 .0% 13 .5%

Return on assets (6) 8 .3% 9 .2% � Three Months Ended June 30, 2008

� 2007 Other Information (in thousands): Capital Expenditures $

66,166 $ 76,533 Depreciation and Amortization $ 22,039 $ 18,593

Interest Expense $ 836 $ 739 Lease and Rental Expense $ 14,545 $

13,725 � Sales per weighted-average square foot (7) $ 53.77 $ 54.91

� Square footage (in thousands) 13,092 11,675 � Sales per

weighted-average store (in thousands) (8) $ 367 $ 370 � Store

count: New stores, net (9) 51 44 Total stores 1,918 1,731 � Total

employment 25,136 23,910 � (1) Calculated as cost of sales for the

last 12 months divided by average inventory. Average inventory is

calculated as the average of inventory for the trailing four

quarters used in determining the numerator. � (2) Calculated as

cost of sales for the last 12 months divided by average net

inventory. Average net inventory is calculated as the average of

inventory less accounts payable for the trailing four quarters used

in determining the numerator. � (3) Accounts payable divided by

inventory. � (4) The sum of long-term debt and current portion of

long-term debt, divided by the sum of long-term debt, current

portion of long-term debt and total shareholders' equity. � (5)

Last 12 months net income divided by average shareholders' equity.

Average shareholders' equity is calculated as the average of

shareholders' equity for the trailing four quarters used in

determining the numerator. � (6) Last 12 months net income divided

by average total assets. Average total assets is calculated as the

average total assets for the trailing four quarters used in

determining the numerator. � (7) Total sales less jobber sales,

divided by weighted-average square feet. Weighted-average sales per

square foot is weighted to consider the approximate dates of store

openings or expansions. � (8) Total sales less jobber sales,

divided by weighted-average stores. Weighted-average sales per

store is weighted to consider the approximate dates of store

openings or expansions. � (9) New stores, net reflects the closing

of one store during the second quarter of 2008; two stores were

closed in the second quarter of 2007.

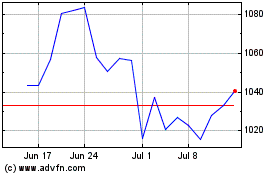

O Reilly Automotive (NASDAQ:ORLY)

Historical Stock Chart

From Oct 2024 to Nov 2024

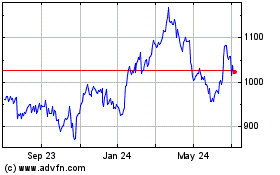

O Reilly Automotive (NASDAQ:ORLY)

Historical Stock Chart

From Nov 2023 to Nov 2024