UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14a

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

Novanta Inc.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than Registrant)

Payment of Filing Fee (check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Novanta Inc.

125 Middlesex Turnpike

Bedford, Massachusetts 01730

(781) 266-5700

April 26, 2021

Dear Shareholder:

The information contained in this letter supplements the definitive proxy statement of Novanta Inc. (the “Company”), which was filed with the Securities and Exchange Commission on April 6, 2021 (the “Proxy Statement”), relating to the Company’s 2021 annual and special meeting of shareholders (the “2021 Annual Meeting”). As a reminder, in light of the ongoing COVID-19 pandemic, all shareholders and any other persons entitled to attend the 2021 Annual Meeting are asked to attend online at www.virtualshareholdermeeting.com/NOVT2021 or to dial into the toll-free conference call line at 1-833-722-0216 (Canada and U.S.) or 1-929-517-0280 (international) at 3:00 p.m. Eastern Time on Thursday, May 13, 2021.

This supplement (“Supplement”) is being made available to the Company’s shareholders on or about April 26, 2021.

The Board of Directors continues to recommend that you vote your shares as follows:

|

|

•

|

“FOR” the election of each of the nominees for director named in the Company’s Proxy Statement;

|

|

|

•

|

“FOR” the approval, on an advisory basis, of the Company’s executive compensation;

|

|

|

•

|

“FOR” the approval of the amended and restated Novanta Inc. 2010 Incentive Award Plan (the “Incentive Award Plan”);

|

|

|

•

|

“FOR” the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm to serve until the 2022 annual meeting of shareholders;

|

|

|

•

|

“FOR” the confirmation of the Company’s Amended and Restated By-Law Number 1; and

|

|

|

•

|

“FOR” the amendment to the Company’s articles to authorize up to 7,000,000 blank check preferred shares.

|

Amendment and Restatement of Item 6 – Amendment to the Company’s Articles to Authorize Blank Check Preferred Shares

At the 2021 Annual Meeting, shareholders are being asked to approve an amendment to the Company’s articles to allow for the issuance of blank check preferred shares. On April 23, 2021, the Board of Directors of the Company approved amended Articles of Amendment (the “Amended Articles of Amendment”) that supersede and replace the proposed Articles of Amendment contained in the Proxy Statement in its entirety, and directed that the Amended Articles of Amendment be submitted to the shareholders of the Company for approval. In accordance with the Amended Articles of Amendment, we are now seeking shareholder approval for up to 7,000,000 (rather than unlimited) preferred shares, representing approximately 19.8% of all outstanding common shares as of the Record Date. The proposed amendment would permit the Board of Directors to designate and issue one or more future series of preferred shares, up to an aggregate of 7,000,000 total preferred shares, and to authorize the Board of Directors to fix the rights, preferences and designations, as it deems necessary or advisable, relating to the preferred shares, provided that no shares of any series may be entitled to more than one vote per share. As previously disclosed, the Board of Directors believes that the approval of an amendment to the Company’s articles to authorize such blank check preferred shares will provide flexibility to take advantage

of financing and acquisition opportunities as they arise. However, the preferred shares will not be issued or used for any defensive or anti-takeover purpose or for the purpose of implementing any shareholder rights plan. The amendment, in and of itself, will not affect any shareholder’s percentage ownership interests in the Company.

Attached at Appendix A to this Supplement is Item 6, as amended and restated to reflect the Amended Articles of Amendment. Attached at Appendix B to this Supplement is the Amended Articles of Amendment and Special Resolution, marked to show changes from the original proposed Articles of Amendment and Special Resolution, respectively, as contained in the Proxy Statement filed on April 6, 2021. Attached at Schedule D are the Amended Articles of Amendment approved by the Board of Directors on April 23, 2021. Attached at Schedule E is the revised special resolution that the shareholders of the Company will be asked to approve at the 2021 Annual Meeting. Schedules D and E in this Supplement replace and supersede the respective schedules in the Proxy Statement filed on April 6, 2021. Any submitted proxy or vote FOR Proposal 6 will be considered to be a vote in favor of the revised special resolution contained in this Supplement. Except as specifically supplemented or superseded by the information contained in this supplement or the Company’s definitive additional materials filed on April 20, 2021, all information set forth in the Proxy Statement remains unchanged. Please see Proxy Voting below for more information.

Proxy Solicitor

We have engaged Innisfree M&A Incorporated (“Innisfree”) to assist us with the solicitation of proxies in connection with the 2021 Annual Meeting. We expect to pay Innisfree a fee of $20,000, plus reimbursement for out-of-pocket expenses for its services.

Proxy Voting

As a reminder, if for any reason you desire to revoke a submitted proxy or change your vote, your proxy may be revoked at any time prior to the 2021 Annual Meeting: (a) by delivering another properly executed proxy form bearing a later date and depositing it in the same manner as your original proxy and by no later than 3:00 p.m. Eastern Time on Tuesday, May 11, 2021; (b) by delivering an instrument in writing revoking the proxy, executed by the shareholder or by the shareholder’s attorney authorized in writing at the registered office of the Company, at any time up to and including the last business day preceding the date of the meeting, or at any reconvened meeting following its postponement, continuation or adjournment; (c) by voting during the 2021 Annual Meeting, if you are a shareholder of record; or (d) in any other manner permitted by law.

Your vote is important. Thank you for voting.

Sincerely,

/s/ Matthijs Glastra

Matthijs Glastra

Chief Executive Officer

Appendix A

Item 6 – Amendment to the Company’s Articles to Authorize Blank Check Preferred Shares

At the 2021 Annual Meeting, the Company’s shareholders will be asked to approve a special resolution included in Schedule E that approves an amendment to the Company’s articles to authorize up to an aggregate of seven (7.0) million blank check preferred shares (the “Amended Articles of Amendment”), representing approximately 19.8% of all outstanding common shares as of the Record Date. As of the Record Date, the Board of Directors is not authorized to issue preferred shares. The Amended Articles of Amendment is included as Schedule D.

Basis for Amended Articles of Amendment

The Board of Directors believes that approval of the Amended Articles of Amendment will provide the flexibility to take advantage of financing and acquisition opportunities as they arise and will improve the Company’s ability to attract investment capital as various series of preferred shares, including mandatory convertible preferred, may be customized to meet the needs of any particular transaction or market conditions. The Company expects to utilize such preferred shares, if any, for general corporate purposes, including, without limitation, capital raising, merger and acquisition opportunities, the issuance of stock dividends or stock splits, and other general corporate purposes. The Amended Articles of Amendment, in and of itself, will not affect any shareholder’s percentage ownership interests in the Company. The Board of Directors will not issue or use the preferred shares for any defensive or anti-takeover purpose or for the purpose of implementing any shareholder rights plan.

Effect of the Amended Articles of Amendment on Common Shareholders

The effect of the adoption of the Amended Articles of Amendment would be to grant the Board of Directors the authority to issue up to an aggregate of seven (7.0) million preferred shares, including mandatory convertible preferred, in one or more series, with such rights, preferences and designations, as it deems necessary or advisable without any additional action by the Company’s shareholders, unless otherwise required by law or by the rules and policies of Nasdaq or any other quotation system or exchange upon which the common shares of the Company are listed and trade. With regard to such Amended Articles of Amendment, the authority of the Board of Directors to determine the terms of any such preferred shares would include, but not be limited to: (i) the designation of each series and the number of shares that will constitute each such series, but not to exceed seven (7.0) million shares in the aggregate for all such series; (ii) the dividend rate for each series; (iii) the price at which, and the terms and conditions on which, the shares of each series may be redeemed, if such shares are redeemable; (iv) the terms and conditions, if any, upon which shares of each series may be converted into shares of other classes or series of shares of the Company, or other securities; (v) the voting rights for each series, provided that no shares of any series may be entitled to more than one vote per share; (vi) any sinking fund provisions; (vii) liquidation rights; (viii) any preemption rights; and (ix) any other relative, participating, optional or other special rights, preferences, powers, qualifications, limitations or restrictions.

If the Amended Articles of Amendment are approved, the availability of undesignated preferred shares may have certain negative effects on the rights of holders of the Company’s common shares. The actual effect of the issuance of any series of preferred shares upon the rights of holders of common shares cannot be stated until the Board of Directors determines the specific rights of the holders of such preferred shares. The Amended Articles of Amendment will permit the Board of Directors, without future shareholder approval, to issue preferred shares with dividend, liquidation, conversion, voting or other rights, which are superior to or which could

adversely affect the voting power or other rights of the holders of our common shares. Specifically, the Board will be in a position to issue securities which could provide, to the holders thereof, preferences or priorities over the holders of common shares with respect to, among other things, liquidation and dividends. This could result in holders of common shares receiving less in the event of a liquidation, dissolution or other winding up of the Company, reduce the amount of funds, if any, available for dividends on common shares, and dilute the voting power of the holders of our common shares.

Anti-takeover Effects

Release No. 34-15230 of the staff of the SEC requires disclosure and discussion of the effects of any proposal that may be used as an anti-takeover device. The preferred shares could be used, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company. For example, the Board of Directors could designate and issue a series of preferred shares, including mandatory convertible preferred, in an amount that sufficiently increases the number of outstanding shares to overcome a vote by the holders of the common shares or with rights and preferences that include special voting rights to veto a change in control. The effect of such provisions could delay or frustrate a merger, tender offer or proxy contest, the removal of incumbent directors, or the assumption of control by shareholders.

However, the Board of Directors will not issue or use the preferred shares for any defensive or anti-takeover purpose or for the purpose of implementing any shareholder rights plan. The Company does not currently have any plans to issue any preferred shares.

Required Vote

A special resolution approved by the affirmative vote of two-thirds of the votes cast in respect of this matter at the 2021 Annual Meeting is required to give effect to the Amended Articles of Amendment. Abstentions and broker non-votes will not be counted in determining the number of votes cast, and thus will not affect the voting results of this proposal.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE SPECIAL RESOLUTION APPROVING THE AMENDED ARTICLES OF AMENDMENT.

Appendix B

(Marked to show changes from the original Articles of Amendment and Special Resolution included in the Definitive Proxy Statement filed on April 6, 2021.)

Articles of Amendment

Novanta Inc.

(herein referred to as the "Corporation")

Section 2 of the Articles of the Corporation are amended by deleting the same and substituting:

The Corporation is authorized to issue (i) an unlimited number of common shares without par value and (ii) up to an unlimited numberaggregate of 7,000,000 preferred shares without par value issuable in series having the rights, privileges, restrictions and conditions set out in Schedule – Share Capital.

SCHEDULE – SHARE CAPITAL

The common shares shall carry and be subject to the following rights, privileges, restrictions and conditions, namely:

|

|

(a)

|

The holders of common shares are entitled to receive notice of any meeting of the shareholders of the Corporation and to attend and vote at such meetings except those meetings where only holders of a specified class or particular series of shares are entitled to vote and each holder thereof shall be entitled to One (1) vote per share in person or by proxy.

|

|

|

(b)

|

Subject to the rights, privileges, restrictions and conditions attaching to any other shares of the Corporation, the holders of the common shares are entitled to receive any dividend declared and paid by the Corporation.

|

|

|

(c)

|

Subject to the rights, privileges, restrictions and conditions attaching to any other shares of the Corporation in the event of the liquidation, dissolution or winding-up of the Corporation, the holders of the common shares are entitled to receive the remaining property of the Corporation after payment of all of the Corporation's liabilities.

|

The preferred shares, as a class, shall carry and be subject to the following rights, privileges, restrictions and conditions, namely:

|

|

(a)

|

The board of directors of the Corporation may issue the preferred shares at any time and from time to time in one or more series. provided that the aggregate number of preferred shares of all series of preferred shares shall not exceed 7,000,000. Before the first shares of a particular series are issued, the board of directors of the Corporation shall fix the number of shares in such series and shall determine, subject to the limitations set out in the articles, the designation, rights, privileges, restrictions and conditions to be attached to the shares of such series including, without limitation, the rate or rates, amount or method or methods of calculation of dividends thereon, the time and place of payment of dividends, whether cumulative or non-cumulative or partially cumulative and whether such rate, amount or method of calculation shall be subject to change or adjustment in the future, the currency or currencies of payment of dividends, the consideration and the terms and conditions of any purchase for cancellation, retraction or redemption rights (if any), the conversion or exchange rights attached thereto (if any), the voting rights attached thereto (if any),) provided that no shares of any series of preferred shares shall be entitled to more than one vote per share, and the terms and conditions of any share purchase plan or sinking fund with respect thereto. Before the issue of the first shares of a series, the board of directors of the Corporation shall send to the Director (as defined in the New Brunswick Business Corporations Act (as the same may from time to time be

|

|

|

|

amended, reenacted or replaced) articles of amendment containing a description of such series including the designation, rights, privileges, restrictions and conditions determined by the board of directors of the Corporation.

|

|

|

(b)

|

No rights, privileges, restrictions or conditions attached to a series of preferred shares shall confer upon a series a priority in respect of dividends or return of capital over any other series of preferred shares then outstanding. Subject to the rights which may from time to time be attached to any series of preferred shares, the preferred shares shall be entitled to priority over the common shares and over any other shares of the Corporation ranking junior to the preferred shares with respect to priority in the payment of dividends and the distribution of assets in the event of the liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, or any other distribution of the assets of the Corporation among its shareholders for the purpose of winding-up its affairs. If any cumulative dividends or amounts payable on a return of capital in respect of a series of preferred shares are not paid in full, the preferred shares of all series shall participate rateably in respect of such dividends, including accumulations, if any, in accordance with the sums that would be payable on such shares if all such dividends were declared and paid in full, and in respect of any repayment of capital in accordance with the sums that would be payable on such repayment of capital if all sums so payable were paid in full; provided however, that in the event of there being insufficient assets to satisfy in full all such claims to dividends and return of capital, the claims of the holders of the preferred shares with respect to repayment of capital shall first be paid and satisfied and any assets remaining thereafter shall be applied towards the payment and satisfaction of claims in respect of dividends. The preferred shares of any series may also be given such other preferences, not inconsistent with subparagraphs (a) to (d) hereof, over the common shares and over any other shares ranking junior to the preferred shares as may be determined in the case of such series of preferred shares.

|

|

|

(c)

|

Except as hereinafter referred to or as otherwise required by law or in accordance with any voting rights which may from time to time be attached to any series of preferred shares, the holders of the preferred shares as a class shall not be entitled as such to receive notice of, to attend or to vote at any meeting of the shareholders of the Corporation.

|

|

|

(d)

|

The rights, privileges, restrictions and conditions attaching to the preferred shares as a class may be added to, changed or removed but only with the approval of the holders of the preferred shares given as hereinafter specified.

|

|

|

(e)

|

The approval of the holders of preferred shares to add to, change or remove any right, privilege, restriction or condition attaching to the preferred shares as a class or to any other matter requiring the consent of the holders of the preferred shares as a class may be given in such manner as may then be required by law, subject to a minimum requirement that such approval shall be given by resolution passed by the affirmative vote of at least two-thirds of the votes cast at a meeting of the holders of preferred shares duly called for that purpose. The formalities to be observed in respect of the giving of notice of any such meeting or any adjourned meeting and the conduct thereof shall be those from time to time required by the New Brunswick Business Corporations Act (as the same from time to time amended, reenacted or replaced) and prescribed in the by-laws of the Corporation with respect to meetings of shareholders. On every poll taken at a meeting of holders of preferred shares as a class, each holder entitled to vote thereat shall have one vote in respect of each One Dollar ($1.00) of the issue price of each preferred share held by the holder. One or more shareholders entitled to vote at the meeting holding or representing, in total, at least one-third of the issued preference shares shall constitute a quorum for any meeting of the holders of the preferred shares to consider any variation in the rights privileges, restrictions or conditions attaching to the preferred shares in accordance with this paragraph 2(e).

|

|

|

|

CERTIFIED duly adopted by the Board of Directors

of the Corporation on March 19April 23, 2021.

|

|

|

|

/s/ Robert J. Buckley

Robert J. Buckley

Chief Financial Officer

|

SPECIAL RESOLUTION

Be it Resolved as a Special Resolution that:

1.The articles of the Corporation are amended to createauthorize up to an unlimited numberaggregate of 7,000,000 preferred shares issuable in series having the rights, privileges, restrictions and conditions as set out in Schedule D.

2.The Corporation is hereby authorized and directed to make application pursuant to the Business Corporations Act (New Brunswick) (the "NBBCA") for a Certificate of Amendment to give effect to this special resolution.

3.Any director or officer of the Corporation is authorized and directed, for and in the name of and on behalf of the Corporation, to execute (whether under the corporate seal of the Corporation or otherwise) and deliver all such further agreements, instruments, amendments, certificates and other documents, including without limitation, Articles of Amendment in the form prescribed by the NBBCA, and to do all such other acts or things as that director or officer may determine to be necessary or advisable to implement the foregoing special resolutions and the matters authorized thereby, the execution of any such document or the doing of any such other act or thing being conclusive evidence of such determination.

4.Notwithstanding the foregoing, the Board of Directors of the Corporation be and is hereby authorized, in its sole discretion, to revoke this resolution without any further approval of the shareholders at any time prior to the issuance of a Certificate of Amendment under the NBBCA giving effect hereto.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE SPECIAL RESOLUTION APPROVING THE AMENDED ARTICLES OF AMENDMENT.

Schedule D

Articles of Amendment

Novanta Inc.

(herein referred to as the "Corporation")

Section 2 of the Articles of the Corporation are amended by deleting the same and substituting:

The Corporation is authorized to issue (i) an unlimited number of common shares without par value and (ii) up to an aggregate of 7,000,000 preferred shares without par value issuable in series having the rights, privileges, restrictions and conditions set out in Schedule – Share Capital.

SCHEDULE – SHARE CAPITAL

The common shares shall carry and be subject to the following rights, privileges, restrictions and conditions, namely:

|

|

(f)

|

The holders of common shares are entitled to receive notice of any meeting of the shareholders of the Corporation and to attend and vote at such meetings except those meetings where only holders of a specified class or particular series of shares are entitled to vote and each holder thereof shall be entitled to One (1) vote per share in person or by proxy.

|

|

|

(g)

|

Subject to the rights, privileges, restrictions and conditions attaching to any other shares of the Corporation, the holders of the common shares are entitled to receive any dividend declared and paid by the Corporation.

|

|

|

(h)

|

Subject to the rights, privileges, restrictions and conditions attaching to any other shares of the Corporation in the event of the liquidation, dissolution or winding-up of the Corporation, the holders of the common shares are entitled to receive the remaining property of the Corporation after payment of all of the Corporation's liabilities.

|

The preferred shares, as a class, shall carry and be subject to the following rights, privileges, restrictions and conditions, namely:

|

|

a.

|

The board of directors of the Corporation may issue the preferred shares at any time and from time to time in one or more series provided that the aggregate number of preferred shares of all series of preferred shares shall not exceed 7,000,000. Before the first shares of a particular series are issued, the board of directors of the Corporation shall fix the number of shares in such series and shall determine, subject to the limitations set out in the articles, the designation, rights, privileges, restrictions and conditions to be attached to the shares of such series including, without limitation, the rate or rates, amount or method or methods of calculation of dividends thereon, the time and place of payment of dividends, whether cumulative or non-cumulative or partially cumulative and whether such rate, amount or method of calculation shall be subject to change or adjustment in the future, the currency or currencies of payment of dividends, the consideration and the terms and conditions of any purchase for cancellation, retraction or redemption rights (if any), the conversion or exchange rights attached thereto (if any), the voting rights attached thereto (if any) provided that no shares of any series of preferred shares shall be entitled to more than one vote per share, and the terms and conditions of any share purchase plan or sinking fund with respect thereto. Before the issue of the first shares of a series, the board of directors of the Corporation shall send to the Director (as defined in the New Brunswick Business Corporations Act (as the same may from time to time be amended, reenacted or replaced) articles of amendment containing a description of such series including

|

|

|

|

the designation, rights, privileges, restrictions and conditions determined by the board of directors of the Corporation.

|

|

|

b.

|

No rights, privileges, restrictions or conditions attached to a series of preferred shares shall confer upon a series a priority in respect of dividends or return of capital over any other series of preferred shares then outstanding. Subject to the rights which may from time to time be attached to any series of preferred shares, the preferred shares shall be entitled to priority over the common shares and over any other shares of the Corporation ranking junior to the preferred shares with respect to priority in the payment of dividends and the distribution of assets in the event of the liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, or any other distribution of the assets of the Corporation among its shareholders for the purpose of winding-up its affairs. If any cumulative dividends or amounts payable on a return of capital in respect of a series of preferred shares are not paid in full, the preferred shares of all series shall participate rateably in respect of such dividends, including accumulations, if any, in accordance with the sums that would be payable on such shares if all such dividends were declared and paid in full, and in respect of any repayment of capital in accordance with the sums that would be payable on such repayment of capital if all sums so payable were paid in full; provided however, that in the event of there being insufficient assets to satisfy in full all such claims to dividends and return of capital, the claims of the holders of the preferred shares with respect to repayment of capital shall first be paid and satisfied and any assets remaining thereafter shall be applied towards the payment and satisfaction of claims in respect of dividends. The preferred shares of any series may also be given such other preferences, not inconsistent with subparagraphs (a) to (d) hereof, over the common shares and over any other shares ranking junior to the preferred shares as may be determined in the case of such series of preferred shares.

|

|

|

c.

|

Except as hereinafter referred to or as otherwise required by law or in accordance with any voting rights which may from time to time be attached to any series of preferred shares, the holders of the preferred shares as a class shall not be entitled as such to receive notice of, to attend or to vote at any meeting of the shareholders of the Corporation.

|

|

|

d.

|

The rights, privileges, restrictions and conditions attaching to the preferred shares as a class may be added to, changed or removed but only with the approval of the holders of the preferred shares given as hereinafter specified.

|

|

|

e.

|

The approval of the holders of preferred shares to add to, change or remove any right, privilege, restriction or condition attaching to the preferred shares as a class or to any other matter requiring the consent of the holders of the preferred shares as a class may be given in such manner as may then be required by law, subject to a minimum requirement that such approval shall be given by resolution passed by the affirmative vote of at least two-thirds of the votes cast at a meeting of the holders of preferred shares duly called for that purpose. The formalities to be observed in respect of the giving of notice of any such meeting or any adjourned meeting and the conduct thereof shall be those from time to time required by the New Brunswick Business Corporations Act (as the same from time to time amended, reenacted or replaced) and prescribed in the by-laws of the Corporation with respect to meetings of shareholders. One or more shareholders entitled to vote at the meeting holding or representing, in total, at least one-third of the issued preference shares shall constitute a quorum for any meeting of the holders of the preferred shares to consider any variation in the rights privileges, restrictions or conditions attaching to the preferred shares in accordance with this paragraph 2(e).

|

|

|

|

CERTIFIED duly adopted by the Board of Directors

of the Corporation on April 23, 2021.

|

|

|

|

/s/ Robert J. Buckley

Robert J. Buckley

Chief Financial Officer

|

Schedule E

SPECIAL RESOLUTION

Be it Resolved as a Special Resolution that:

1.The articles of the Corporation are amended to authorize up to an aggregate of 7,000,000 preferred shares issuable in series having the rights, privileges, restrictions and conditions as set out in Schedule D.

2.The Corporation is hereby authorized and directed to make application pursuant to the Business Corporations Act (New Brunswick) (the "NBBCA") for a Certificate of Amendment to give effect to this special resolution.

3.Any director or officer of the Corporation is authorized and directed, for and in the name of and on behalf of the Corporation, to execute (whether under the corporate seal of the Corporation or otherwise) and deliver all such further agreements, instruments, amendments, certificates and other documents, including without limitation, Articles of Amendment in the form prescribed by the NBBCA, and to do all such other acts or things as that director or officer may determine to be necessary or advisable to implement the foregoing special resolutions and the matters authorized thereby, the execution of any such document or the doing of any such other act or thing being conclusive evidence of such determination.

4.Notwithstanding the foregoing, the Board of Directors of the Corporation be and is hereby authorized, in its sole discretion, to revoke this resolution without any further approval of the shareholders at any time prior to the issuance of a Certificate of Amendment under the NBBCA giving effect hereto.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE SPECIAL RESOLUTION APPROVING THE AMENDED ARTICLES OF AMENDMENT.

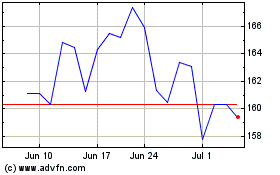

Novanta (NASDAQ:NOVT)

Historical Stock Chart

From May 2024 to Jun 2024

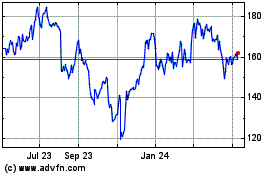

Novanta (NASDAQ:NOVT)

Historical Stock Chart

From Jun 2023 to Jun 2024