NI Holdings, Inc. Reports Results for Second Quarter Ended June 30, 2024

August 08 2024 - 4:15PM

NI Holdings, Inc. (NASDAQ: NODK) announced today results for the

quarter ended June 30, 2024.

Summary of Second Quarter 2024 Results –

Continuing Operations(All comparisons vs. continuing

operations for the second quarter of 2023, unless noted

otherwise)

- Direct written premiums of $118.5

million compared to $121.6 million. This 2.6% reduction was driven

by Crop as a result of lower commodity prices impacting multi-peril

crop insurance premiums, partially offset by growth in Non-Standard

Auto (26.4%) due to rate and new business increases, and Home and

Farm (11.5%), driven by higher rate and insured values.

- Net earned premiums of $85.2

million, up 8.0%.

- Combined ratio of 113.7% versus

107.1%, driven by increased weather-related losses in Home and Farm

and unfavorable prior year reserve development in Non-Standard

Auto.

- Net investment loss of $0.6 million

and net investment income of $2.5 million, up 31.2% driven by

higher fixed income reinvestment rates.

- Closed on sale of Westminster

American Insurance Company, resulting in a one-time loss on sale of

$7.8 million, net of taxes.

- Basic loss per share of ($0.36)

compared to ($0.12).

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| Dollars in thousands, except

per share data(unaudited) |

2024 |

2023 |

Change |

|

2024 |

2023 |

Change |

| Direct written premiums |

$118,472 |

$121,576 |

(2.6%) |

|

$201,513 |

$193,948 |

3.9% |

| Net earned premiums |

$85,169 |

$78,835 |

8.0% |

|

$155,053 |

$141,706 |

9.4% |

| Loss and LAE ratio |

81.4% |

76.2% |

5.2 pts |

|

70.6% |

71.4% |

(0.8) pts |

| Expense ratio |

32.3% |

30.9% |

1.4 pts |

|

34.2% |

33.2% |

1.0 pts |

| Combined ratio |

113.7% |

107.1% |

6.6 pts |

|

104.8% |

104.6% |

0.2 pts |

| Net income (loss) attributable

to NI Holdings |

$(16,236) |

$(8,122) |

NM |

|

$(9,817) |

$(12,332) |

(20.4%) |

|

Continuing operations |

(7,478) |

(2,463) |

NM |

|

(543) |

(359) |

51.3% |

|

Discontinued operations |

(996) |

(5,659) |

NM |

|

(1,512) |

(11,973) |

NM |

|

Loss on sale of discontinued operations |

(7,762) |

- |

NM |

|

(7,762) |

- |

NM |

| Return on average equity |

(12.7%) |

(4.5%) |

(8.2) pts |

|

(0.5%) |

(0.3%) |

(0.2) pts |

| Basic earnings (loss) per

share |

$(0.77) |

$(0.38) |

NM |

|

$(0.47) |

$(0.58) |

(19.0%) |

|

Continuing operations |

$(0.36) |

$(0.12) |

NM |

|

$(0.03) |

$(0.02) |

50.0% |

|

NM = not meaningful |

|

|

Management Commentary

“During the second quarter we closed on the

strategic sale of Westminster American Insurance Company,” said

Michael J. Alexander, President and Chief Executive Officer. “The

sale has enabled us to refocus our efforts and resources on our

core business and the actions necessary to deliver appropriate

returns to our shareholders. We continue to benefit from prior rate

actions, which were ahead of much of the industry and contributed

to strong growth in our Non-Standard Auto and Home and Farm

segments and improved profitability in Private Passenger

Auto.

The second quarter is generally a time of

volatile weather in the Upper Midwest, and our Home and Farm

segment was once again impacted by non-catastrophe weather-related

losses during the quarter. Overall, we continue to focus on

pursuing continued aggressive rate and underwriting actions, along

with other strategic measures to improve our overall risk profile

across all lines of business. We remain confident that these

actions will enable all segments to achieve profitable results over

time.”

Securities and Exchange Commission (SEC)

FilingsThe Company’s Quarterly Report on Form 10-Q and

latest financial supplement can be found on the Company’s website

at www.niholdingsinc.com. The Company’s filings with the SEC can

also be found at www.sec.gov.

About the CompanyNI Holdings,

Inc. is an insurance holding company. The company is a North Dakota

business corporation that is the stock holding company of Nodak

Insurance Company and became such in connection with the conversion

of Nodak Mutual Insurance Company from a mutual to stock form of

organization and the creation of a mutual holding company. The

conversion was consummated on March 13, 2017. Immediately following

the conversion, all of the outstanding shares of common stock of

Nodak Insurance Company were issued to Nodak Mutual Group, Inc.,

which then contributed the shares to NI Holdings in exchange for

55% of the outstanding shares of common stock of NI Holdings. Nodak

Insurance Company then became a wholly-owned stock subsidiary of NI

Holdings. NI Holdings’ financial statements are the consolidated

financial results of NI Holdings; Nodak Insurance, including

Nodak’s wholly-owned subsidiaries American West Insurance Company,

Primero Insurance Company and Battle Creek Insurance Company;

Direct Auto Insurance Company; and Westminster Insurance Company

until the date of sale.

Safe Harbor StatementSome of

the statements included in this news release, particularly those

anticipating future financial performance, including investment

performance and yields, business prospects, growth and operating

strategies, the impact of pricing and underwriting changes on

operating results, our ability to deliver appropriate returns to

shareholders, and similar matters, are forward-looking statements

within the meaning of the U.S. Private Securities Litigation Reform

Act of 1995. Actual results could vary materially. Factors that

could cause actual results to vary materially include: our ability

to maintain profitable operations, the adequacy of the loss and

loss adjustment expense reserves, business and economic conditions,

interest rates, competition from various insurance and other

financial businesses, terrorism, the availability and cost of

reinsurance, adverse and catastrophic weather events, including the

impacts of climate change, legal and judicial developments, changes

in regulatory requirements, our ability to integrate and manage

successfully the insurance companies we may acquire from time to

time, the impact of inflation on our operating results, and other

risks we describe in the periodic reports we file with the

Securities and Exchange Commission. You should not place undue

reliance on any such forward-looking statements. We disclaim any

obligation to update such statements or to announce publicly the

results of any revisions that we may make to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements.

For a detailed discussion of the risk factors

that could affect our actual results, please refer to the risk

factors identified in our SEC reports, including, but not limited

to our Annual Report on Form 10-K, as filed with the SEC.

Investor Relations Contact: Seth

DaggettExecutive Vice President, Treasurer and Chief Financial

Officer701-298-4348IR@nodakins.com

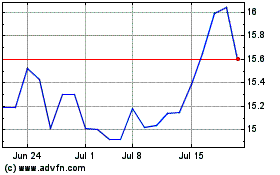

NI (NASDAQ:NODK)

Historical Stock Chart

From Oct 2024 to Nov 2024

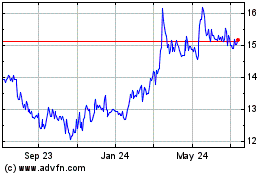

NI (NASDAQ:NODK)

Historical Stock Chart

From Nov 2023 to Nov 2024