As filed with the Securities and Exchange Commission on May 23, 2024

Registration No. 333-[●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Nexalin Technology, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

3845 |

|

27-5566468 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification No.) |

1776 Yorktown, Suite 550

Houston, TX 77056

(832) 260-0222

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark White

Chief Executive Officer

Nexalin Technology, Inc.

1776 Yorktown, Suite 550

Houston, TX 77056

(832) 260-0222

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Martin S. Siegel, Esq.

Warshaw Burstein, LLP

575 Lexington Avenue

New York, NY 10022

Telephone: (212) 984-7741 |

|

Andrew M. Tucker, Esq.

Nelson Mullins Riley & Scarborough LLP

101 Constitution Avenue NW, Suite 900

Washington, D.C. 20001

Telephone: (202) 689-2987 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☒

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 23, 2024

Preliminary PROSPECTUS

NEXALIN TECHNOLOGY, INC.

Up to $7,000,000 of

Common Stock

We are offering on a reasonable best effort basis up to $7,000,000 of our common stock, $0.001 par value per share. We are offering each share of common stock at an assumed public offering price of $[●] per share.

The securities will be offered at a fixed price and are expected to be issued in a single closing. The offering will terminate on [●], 2024, unless completed sooner or unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We expect this offering to be completed not later than two business days following the commencement of sales in this offering (after the effective date of the registration statement of which this prospectus forms a part) and we will deliver all securities to be issued in connection with this offering delivery versus payment or receipt versus payment, as the case may be, upon receipt of investor funds received by us. Accordingly, neither we nor the Placement Agent (as defined below) have made any arrangements to place investor funds in an escrow account or trust account since the Placement Agent will not receive investor funds in connection with the sale of the securities offered hereunder.

We have engaged Maxim Group LLC (the “Placement Agent” or “Maxim”), to act as our exclusive placement agent in connection with this offering. The Placement Agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The Placement Agent is not purchasing or selling any of the securities we are offering and the Placement Agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount. We have agreed to pay to the Placement Agent the Placement Agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus. Because we will deliver the securities to be issued in this offering upon our receipt of investor funds, there is no arrangement for funds to be received in escrow, trust or similar arrangement. There is no minimum offering requirement as a condition of closing of this offering. We may sell fewer than all of the shares of common stock offered hereby, which may significantly reduce the amount of proceeds received by us. Because there is no escrow account and no minimum number of securities or amount of proceeds, investors could be in a position where they have invested in us, but we have not raised sufficient proceeds in this offering to adequately fund the intended uses of the proceeds as described in this prospectus. See “Risk Factors” for more information regarding risks related to this offering. We will bear all costs associated with the offering. See “Plan of Distribution” for more information regarding these arrangements.

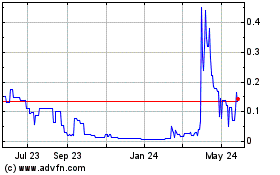

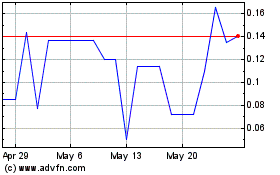

Our common stock is currently listed on the Nasdaq Capital Market under the symbol “NXL.” The last reported sale price of our common stock on the Nasdaq Capital Market on May 22, 2024, was $1.14 per share.

We are an “emerging growth company” under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See the section titled “Prospectus Summary -- Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Investing in our securities involves a high degree of risk. Before buying any shares, you should carefully read the discussion of the material risks of investing in our securities under the heading “Risk Factors” beginning on page 17 of this prospectus.

Neither the Securities and Exchange Commission, any state securities commission, nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The following table sets forth the expected proceeds from this offering, assuming an offering price at the minimum of the proposed price range of the shares of our common stock:

| |

|

Proposed

Maximum

Offering

Price Per

Share |

|

|

Total |

|

| Public offering price |

|

$ |

|

|

|

$ |

|

|

| Placement agent fees(1) |

|

$ |

|

|

|

$ |

|

|

| Proceeds, before expenses, to us |

|

$ |

|

|

|

$ |

|

|

|

(1) |

See “Plan of Distribution” for a description of the compensation payable to the Placement Agent. |

Maxim Group LLC

The date of this prospectus is May 23, 2024

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. Neither we, nor the Placement Agent, have authorized any other person to provide you with information that is different from, or adds to, that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the Placement Agent take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction in which such offer is unlawful.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this public offering and the distribution of this prospectus applicable to that jurisdiction.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (“SEC”). It omits some of the information contained in the registration statement and reference is made to the registration statement for further information with regard to us and the securities being offered hereby. You should review the information and exhibits in the registration statement for further information about us and the securities being offered hereby. Statements in this prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to the filings. You should review the complete document to evaluate these statements.

In this prospectus, unless the context requires otherwise, references to “we,” “us,” “our,” “Nexalin” or the “Company” refer to Nexalin Technology, Inc. and, where appropriate, its subsidiaries. Additionally, references to the “Board” refer to the board of directors of Nexalin Technology, Inc.

We have proprietary rights

to a number of trademarks and tradenames used in this prospectus which are important to our business, including Nexalin®

and the Nexalin logo. Solely for convenience, trademarks, service marks and tradenames referred to in this prospectus may appear without

the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the

fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and tradenames.

This prospectus may also contain trademarks, service marks, tradenames and copyrights of other companies, which are the property of their

respective owners.

We have not, and the Placement Agent and its affiliates have not, authorized anyone to provide you with any information or to make any representation not contained or incorporated by reference in this prospectus or any related free writing prospectus. We do not, and the Placement Agent and its affiliates do not, take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide to you. This prospectus is not an offer to sell or an offer to buy securities in any jurisdiction where offers and sales are not permitted. The information in this prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or any sale of securities. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find More Information” in the prospectus.

PROSPECTUS SUMMARY

This summary

highlights information contained in greater detail elsewhere in this prospectus and does not contain all the information that you

should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire

prospectus including the “Risk Factors,” “Special Note Regarding Forward-Looking Statements and Industry

Data” included in this prospectus, “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” in our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on

March 27, 2024 (the “2023 Form 10-K”), as supplemented by our Quarterly Reports on Form 10-Q, and as may

be further amended, supplemented or superseded from time to time by our subsequent filings under the Exchange Act which are

incorporated herein by reference, and the financial statements and the notes to those financial statements.

Company Overview

Overview

We design and develop innovative neurostimulation products to uniquely and effectively help combat the ongoing global mental health epidemic. We developed an easy-to-administer medical device — referred to as “Generation 1” or “Gen-1” — that utilizes bioelectronic medical technology to treat anxiety and insomnia, without the need for drugs or psychotherapy. Our original Gen-1 devices are cranial electrotherapy stimulation (CES) devices that emit waveform at 4 milliamps during treatment and are presently classified by the U.S. Food and Drug Administration (the “FDA”) as a Class II device.

Medical professionals in the United States have utilized the Gen-1 device to administer to patients in clinical settings. While the Gen-1 device had been cleared by the FDA to treat depression, anxiety, and insomnia, three prevalent and serious diseases, because of the FDA’s December 2019 reclassification of CES devices, the Gen-1 device was reclassified as a Class II device for the treatment of anxiety and insomnia. We are required to file a new application under Section 510(k) of the Federal Food, Drug and Cosmetic Act (“510(k) Application”) to be approved by the FDA for the sales and marketing of our devices for the treatment of anxiety and insomnia. In the FDA’s December 2019 reclassification ruling, the treatment of depression with our device will require a Class III certification and require a new PMA (premarket approval) application to demonstrate safety and effectiveness.

While we continue providing services to medical professionals to support patients’ use of the Gen-1 devices which were in operation prior to December 2019, we are not making new sales or new marketing efforts of Gen-1 devices in the United States. We continue to derive revenue from devices which we sold or leased prior to the FDA’s December 2019 reclassification announcements. This revenue consists of monthly licensing fees and payments for the sale of electrodes and patient cables. We have suspended marketing efforts for new sales of devices related to the Gen-1 device for treatment of anxiety and insomnia in the United States until the Nexalin regulatory team decides on a new 510(k) application at 4 milliamps based on FDA comments expected to be received in late 2024. Our regulatory team continues to inform the FDA of the suspension of the marketing and sale of the Gen-1 products to new providers. We are currently analyzing whether to proceed with an amended application with the FDA for Gen-1 devices for the treatment of insomnia and anxiety.

The waveform that comprises the basis of Gen-2 and new Gen-3 headset devices is in pre-submission for review by the FDA for safety evaluation and eventual marketing in the United States. Determinations of the safety and efficacy of our devices in the United States are solely within the authority of the FDA. We plan to conduct decentralized clinical trials for the Gen-3 device in the U.S. and we continue to consult with the FDA as part of the pre-submission meetings.

Our Technology

We have designed and

developed a new advanced waveform technology to be emitted at 15 milliamps through new and improved medical devices referred to as

“Generation 2” or “Gen-2” and “Generation 3” or “Gen-3.” Gen-2 is a clinical use

device with a modern enclosure to emit the new 15 milliamp advanced waveform. Gen-3 is a new patient headset that will be prescribed

by licensed medical professionals in a virtual clinic setting similar to existing tele-health platforms. The Nexalin research team

believes that the new 15 milliamp Gen-2 and Gen-3 devices can penetrate deeper into the brain and stimulate associated structures of

mental illness, which we believe will generate enhanced patient response without any risk or unpleasant side effects. The Nexalin

regulatory team has made a strategic decision to develop strategies for pilot trials and/or pivotal trials in various mental health

disease states. In addition, a new PMA application in the United States is in strategic development for the treatment of depression

utilizing both Gen-2 and Gen-3. We plan to schedule additional pilot trials and/or pivotal trials for the new Gen-3 device for

anxiety and insomnia in the United States and China beginning in the late third quarter or early fourth quarter of 2024. Preliminary

data provided by The University of California, San Diego and recent published data from Asia supports the safety of utilizing our 15

milliamp waveform technology. However, the determination of safety and efficacy of medical devices in the United States is subject

to clearance by the FDA.

Currently, the waveform that comprises the basis of Gen-2 and new Gen-3 headset devices has been tested in research settings to develop safety data that has been submitted for review by the FDA for safety evaluation and eventual marketing in the United States and around the world. Determinations of the safety and efficacy of our devices in the United States are solely within the authority of the FDA.

A new pre-submission document in preparation of a new 510(k) and/or de novo application for our Gen-3 Halo headset at 15 milliamps was filed with the FDA in January of 2023. Formal comments to our pre-submission document filing were received in March of 2023. A formal meeting to address FDA comments took place on May 9, 2023.

A second FDA pre-submission document was submitted on February 13, 2024. FDA comments to this second pre-submission document were received on April 26, 2024. A formal teleconference was held with the FDA on April 30, 2024. The Nexalin regulatory team and the FDA came to a consensus on the Anxiety and Insomnia Clinical research protocols.

In part due to increasing incidence attributed to the devastating impacts of the COVID-19 pandemic, mental health and cognitive disorders are widespread across the globe and cause substantial health, social and economic losses, and hardships accordingly. Our focus is on the continued development of our innovative bioelectronic medical technologies and rapid regulatory approval. We intend to help reverse these losses, and hardships of these losses, by safely and effectively treating various mental health disorders associated with post Covid and long Covid mental disease states.

All our products are

non-invasive, undetectable to the human body and are designed to provide relief to those afflicted with mental health issues without

adverse side effects. We have a proprietary design that stabilizes currents, electromagnetic fields, and various frequencies —

referred to collectively as a waveform - particularly our proprietary, 15 milliamp patented waveform. Additionally, our devices

generate a proprietary high frequency carrier wave for deeper penetration into the brain. It is applied to the brain with an array

of electrodes on the forehead and behind each ear at the mastoid. The features of this proprietary waveform and the array of

electrodes allow the application of the waveform to the entire brain rather than a small, targeted area of the brain. To ensure

deeper penetration into the brain, we have created a waveform that is undetectable to the brain which allows the increase of the

power from < 4 mAmps to 15 mAmps, more than a 400% increase without incurring any patient discomfort, risk, or adverse side

effects. By increasing the power, our waveform can penetrate deeper into the brain and stimulate deep mid-brain structures

associated with mental illness. Our research data and clinical teams believe that a more powerful waveform will create a stronger

response in the brain. A stronger response creates a higher level of efficacy. This entire proprietary technique allows Nexalin to

provide a non-invasive and comfortable treatment, which we believe is more powerful than any FDA-cleared stimulation device in the

market. Current pilot study protocols and randomized clinical trials have been designed and submitted to the FDA to provide feedback

on final reports and data sets for the purpose of safety and efficacy evaluations in the future. Determinations of the safety and

efficacy of our devices are solely within the authority of the FDA.

We recognize that an additional barrier to treatment in today’s mental health treatment landscape — beyond the concerns about safety, efficacy and side-effects that have been associated with conventional mental health treatments such as ECT (shock therapy), drugs and psychotherapy is stigma. Industry reports and feedback indicate that many patients that struggle with mood disorders have the stigma of embarrassment associated with psychiatrists and psychotherapy (e.g., counselling with a therapist). Additional stigmas and other issues are associated with the side effects of medication prescribed by psychiatrists. When we researched the current pharmaceuticals model, public information highlighted the many side effects associated with such medications. Frequently, patients would stop taking the medication because of the uncomfortable side effects. Additional public information mentions dependency and withdrawal issues associated with medication for psychiatric disorders.

To address the embarrassment stigma, we are developing a new virtual clinic that will allow the physician to diagnose a mental health issue in the privacy of a tele-psychiatry virtual platform. After diagnosis, the physician will prescribe the Nexalin Gen-3 headset to the patient for treatment. Next, the Gen-3 device will be shipped to the patient’s home. After the patient receives the device, they will pair the headset device with an app in the patient’s smart phone. The app will communicate with the Nexalin cloud servers to authorize the device for treatment according to the protocol designed by the physician. The physician will monitor treatment compliance and other health related issues in a private physician dashboard that connects through the Nexalin app and cloud servers. We believe that to preserve product safety and integrity for home use, the headset device will require physician oversight that will include a prescription for use with a monthly authorization provided by the physician after a monthly virtual visit. All appointments will be in a virtual setting to provide privacy and convenience for the physician and patient. The Nexalin virtual clinic will be provided in a proprietary virtual platform currently in the design stage.

Our China Gen-2 15 milliamp device was approved in China by the NMPA for the treatment of insomnia and depression in China. This device and all other clinical devices will include a single use electrode for long term revenue streams. The USA Gen-2 device bears a fresh and modern appearance that meets the technology standards of the digital tech world of 2024. Early adopters of the Gen-1 device will be able to access additional firmware upgrades which are planned to enhance the previously purchased devices to the new symmetric15-milliamp waveform. Our Gen-2 device will be equipped with RFID technology that exchanges electrode usage data with a reader in the main device. The purpose of RFID is to track and maintain control of the proprietary single use electrode. Our electrode chip will be programmed to exchange data with the device and allow activation for a single treatment with a new electrode only. This ensures a recurring revenue stream on the device and protects against any generic knockoffs designed to avoid treatment costs. This upgrade in technology also ensures the proprietary nature of the electrodes that support treatment outcomes are sustained.

Overall, we believe that our advanced waveform, technological upgrades and the development of a modern headset monitored with our IT management platform will position us with the opportunity to disrupt the traditional mental health treatment model. Our mission is to remove the stigma of expensive psychotherapy or pharmaceuticals with the attendant side effects and dependency issues and replace such stigma with clinically proven and cost-effective technology that is easily accessible in the privacy of the patient’s home and monitored by licensed healthcare providers.

Formalized Joint Venture; China Related Activities

On May 31, 2023, the Company formalized an agreement related to the formation of a joint venture established to engage in the clinical development, marketing, sale and distribution of Nexalin’s second generation transcranial Alternating Current Stimulation (“tACS”) devices (“Gen-2 devices”) in China and other countries in the region. The Joint Venture is registered in Hong Kong.

As of the date of this prospectus”, (i) our operations are carried on outside of China; and (ii) the Joint Venture does not maintain any variable interest entity structure or operate any data center in China.

Under the Joint Venture Agreement, Wider Come Limited (“Wider”), a related party, is obligated to fund all operations for the initial 12-month period of the Joint Venture, after which Nexalin and Wider plan to jointly fund the Joint Venture’s operating expenses in accordance with their pro rata ownership.

The Joint Venture is controlled by a Board of Directors in which Wider is to have sole representation but neither the Company nor Wider has exclusive decision-making ability over day-to-day or significant operational decisions. Wider and Nexalin own 52% and 48% of the Joint Venture, respectively. In accordance with ASC 323 Investments - Equity Method and Joint Ventures (“ASC 323”) and ASC 810 - Consolidations (“ASC 810”), the Company recognized $5,783 of equity method investment income from the Joint Venture on a one-quarter reporting lag for the three months ended March 31, 2024, on the condensed consolidated statements of operations and comprehensive loss.

The investment in the Joint Venture is accounted for using the equity method of accounting. As of March 31, 2024 and December 31, 2023 the Company had an Equity Method Investment of $101,783 and $96,000, respectively, recorded on the condensed consolidated balance sheets. The Company invested $96,000 in the joint venture in September 2023 which is recorded on the consolidated balance sheet at December 31, 2023 as an Equity Method Investment. Wider invested $104,000. In accordance with ASC 323, the Company uses the equity method of accounting for its investment in the Joint Venture, an unconsolidated entity over which it does not have a controlling interest. The equity method of accounting requires the investment to be initially recorded at cost and subsequently adjusted for the Company’s share of equity in the unconsolidated entity’s earnings or losses. The Company evaluates the carrying amount of this investment in the Joint Venture for impairment in accordance with ASC 323. If the Company determines that a loss in the value of the investment is other than temporary, the Company writes down the investment to its estimated fair value. Any such losses are recorded to equity in income of unconsolidated entities in the Company’s consolidated statements of operations and comprehensive loss. The Company has made an election to classify distributions received from the Joint Venture using the nature of the distribution approach. Distributions received are classified as cash inflows from operating activities based on the nature of the activities of the unconsolidated entity.

Under the preceding terms of the collaborative arrangement between the Company and Wider, Wider served as an authorized distributor of the Company’s Gen-2 devices in Asia. As part of the consideration for Wider’s performance of its obligations to the Company prior to the formalization of the Joint Venture, the Company and certain designated Wider shareholders entered into stock issuance agreements for the issuance of 450,000 shares of the Company’s common stock, and simultaneously with the execution of this service agreement, Wider invested $200,000 to the Company. During the year ended December 31, 2020, the Company issued 150,000 shares to affiliates of Wider in satisfaction of the obligation. Under the terms of the collaborative agreement, designated shareholders of Wider are entitled to an additional 300,000 shares upon Wider’s achievement of certain milestones. The fair value of the 150,000 shares issued during the year ended December 31, 2020 (less the invested $200,000 in cash) resulted in a charge to stock-based compensation of $550,000 and was recorded in selling, general and administrative expenses on the consolidated statement of operations and comprehensive loss. During the twelve months ended December 31, 2023, the Company issued an additional 150,000 shares to affiliates of Wider in satisfaction of obligations pursuant to the collaborative agreement and also recognized its obligation to issue an additional 150,000 shares. The grant date fair value of the 300,000 shares issued and to be issued resulted in a charge to research and development of $1,500,000 and was recorded in selling, general and administrative expenses on the consolidated statement of operations and comprehensive loss.

In September of 2021, the NMPA approved the Gen-2 device for marketing and sale in China for the treatment of insomnia and depression. These treatment indications and clearances from the NMPA have allowed Wider to market and sell the Gen-2 device in China for the treatment of insomnia and depression.

Regulatory Background and Matters Related to our Business

United States

Medical devices commercially distributed in the United States require either FDA clearance of a 510(k) premarket notification submission, granting of a de novo request or Premarket Approval (PMA), unless an exemption exists. Under the FFDCA, as administered by the FDA, medical devices are classified into one of three classes — Class I, Class II or Class III — depending on the degree of risk associated with each medical device and the extent of manufacturer and regulatory control needed to ensure its safety and effectiveness. Regulatory control increases from Class I to Class III. Prior to December 20, 2019, in the United States, all cranial electrical stimulation (CES) technology was classified as a Class III medical device (high-risk).

Class II devices are moderate risk devices and are subject to the FDA’s general controls, and special controls as deemed necessary by the FDA to ensure the safety and effectiveness of the device. Such special controls can include performance standards, post-market surveillance, patient registries and FDA guidance documents. Most manufacturers of Class II devices are required to submit to the FDA a premarket notification under Section 510(k) of the FFDCA requesting permission to commercially distribute the device.

Class III devices are deemed the highest risk devices by the FDA and generally include life-sustaining, life-supporting or some implantable devices or devices that have a new intended use or use advanced technology that is not substantially equivalent to that of a legally marketed device. Class III devices require a PMA. For a device that is Class III by default (because it is a novel device that was not previously classified and has no predicate), the manufacturer may request that the FDA reclassify the device into Class II or Class I via a de novo request.

To obtain 510(k) clearance, a premarket notification submission must be submitted to the FDA demonstrating that the proposed device is substantially equivalent to a predicate device. A predicate device is a legally marketed device that is not subject to premarket approval, i.e., a device that was legally marketed prior to May 28, 1976 (pre-amendments device) and for which a PMA is not required, a device that has been reclassified from Class III to Class II or I (e.g., via the de novo classification process), or a device that was previously cleared through the 510(k) process. The FDA’s 510(k) review process usually takes from three to six months but can take longer.

After a device receives 510(k) marketing clearance, any modification that could significantly affect its safety or effectiveness or that would constitute a major change or modification in its intended use, will require a new 510(k) marketing clearance or, depending on the modification, a de novo request or PMA approval. The FDA requires each manufacturer to determine whether the proposed change requires submission of a 510(k), de novo, or a PMA in the first instance. If the FDA disagrees with a manufacturer’s determination, the FDA can require the manufacturer to cease marketing and/or request the recall of the modified device until FDA has cleared or approved a 510(k), de novo or PMA for the modification.

The PMA process is more demanding than the 510(k) premarket notification process. In a PMA, the manufacturer must demonstrate that the device is safe and effective, and the PMA must be supported by extensive data, including data from preclinical studies and human clinical trials. The PMA must also contain, among other things, a full description of the device and its components, a full description of the methods, facilities and controls used for manufacturing and proposed labelling. Following receipt of a PMA submission, the FDA determines whether the application is sufficiently complete to permit a substantive review. If the FDA accepts the application for review, it has 180 days under the FDCA to complete its review of a PMA, although in practice, the FDA’s review often takes significantly longer, and can take several years.

On December 20, 2019, the FDA issued new rulings related to CES devices for the treatment of anxiety, depression, and insomnia. As a result of these rulings, depression treatment with CES devices remained a Class III medical device and will require a full PMA that provides definitive clinical trial evidence of effectiveness and safety. A PMA is the most extensive application and process at the FDA. All CES manufacturers had one year to prepare and file intentions for the depression treatment with a PMA. CES devices that treat anxiety and insomnia were reclassified as Class II devices and required a new application in the form of a special control trial, a summary version of a PMA, requiring safety data and mild efficacy response. All CES manufacturers had one year to complete special control trials for anxiety and insomnia. We are presently analyzing our previous 510(k) Application for such treatment of anxiety and insomnia in accordance with the FDA reclassification ruling in December 2019. Our intent is to move forward with our new 15 milliamp waveform given its success in the China studies. We have also completed 2 prototypes of a Nexalin headset which can be used at home or in a clinical setting. The new headset will utilize the new 15 milliamp waveform. Final prototypes and design files for manufacturing have been completed.

We have made a strategic decision to file a new PMA for the treatment of depression with the Gen-2 and Gen-3 devices that administer the new advanced Nexalin waveform at 15 milliamps. The Gen-1 device was previously cleared by the FDA at 4 milliamps and the re-classification does not prevent us from servicing previously sold or leased devices. Providers may continue to use these devices for treatment purposes. Servicing consists of warranty coverage, electrode sales, and patient cable replacement. This servicing is included in the monthly lease payment. We continue to derive revenue from devices which we sold or leased prior to the FDA’s December 2019 reclassification announcements. This revenue consists of monthly license fees and payment for the sale of electrodes to clinical providers of our technology. As we are in the process of evaluating our new Gen-2 15 milliamp waveform for our technology, a strategic decision was made to not pursue a PMA for the treatment of depression on our existing Gen-1 device. Strategy development has begun for a full PMA for the treatment of depression for our next generation Gen-2 and Gen-3 devices.

China

The NMPA is the governmental authority principally responsible for the supervision and administration of medical devices in the Peoples Republic of China (the “PRC”). Medical devices in the PRC (including manufacturing, marketing, and sale) are subject to a mandatory filing/registration regime regulated by the NMPA. The exact filing pathways are mainly determined by the classification of such devices — like the United States, a three-class classification system, from Class I (lowest risk) to Class III (highest risk). Local testing and clinical trials are generally required for Class II and Class III devices. Some imported devices may need to be registered with a higher-level government authority than domestic devices.

As determined by the NMPA the three classes for devices are:

|

● |

Class I — Medical devices for which routine administration can ensure safety for users and the effectiveness of the device. |

|

● |

Class II — Medical devices that can only be safe and effective with further control in addition to routine administration. |

|

● |

Class III — Medical devices that are implanted into the patient’s body, pose a threat to the patient’s health, or provide sustenance or life support. |

All medical devices must be registered with the NMPA. An overseas device company must submit product samples to test with the NMPA. In addition, all included product information, packaging, and labels, and related material need to be translated into simplified Chinese. For a Class I device, simple product filing to NMPA is required. However, for Class II and Class III medical devices, the manufacturing company must meet all the requirements in the latest regulation, guidelines, and standards.

The NMPA approved the new Gen-2 15 milliamp device for the treatment of insomnia and depression. These treatment indications and clearances from the NMPA have allowed us to market and sell the Gen-2 device in China. Wider will be responsible for obtaining future NMPA registrations and approvals related to the marketing and sales of our devices in China.

Recent statements and regulatory actions by the Chinese government have targeted those companies whose operations involve cross-border data security or anti-monopoly concerns. Regarding data security, China has promulgated several important laws recently. Among them, on June 10, 2021, China promulgated the PRC Data Security Law (“DSL”), which became effective on September 1, 2021. The legislative intent for this law mainly includes regulating data processing activities, ensuring data security, promoting data development and utilization, protecting the data related legitimate rights and interests of individuals and organizations, and safeguarding national sovereignty, security and development interests. Article 36 provides that any Chinese entity that provides the data to foreign judicial or law enforcement agencies (regardless of whether directly or through a foreign entity) without approval from the Chinese authority would likely be deemed to be in violation of DSL. In addition, pursuant to Article 2 of Measures for Cybersecurity Reviews, the procurement of any network product or service by an operator of critical information infrastructure that affects or may affect national security shall be subjected to a cybersecurity review under the Measures. Pursuant to Article 35 of Cybersecurity Law of the People’s Republic of China, where “critical information infrastructure operators” purchase network products and services, which may influence national security, the operators are required to be subjected to a cybersecurity review. We do not operate any critical information infrastructure. As a result, we do not believe that these new legal requirements in China are applicable to us, including sales made to date by Wider as a distributor. However, the exact scope of the term “critical information infrastructure operator” remains unclear, so there can be no assurance that the Joint Venture will not be subjected to critical information infrastructure operator review in the future. Furthermore, in the event that the Joint Venture becomes an operator of critical information infrastructure in the future it may be subjected to the above-described regulation.

With regard to anti-monopoly concerns, Article 3 of Anti-Monopoly Law of the People’s Republic of China prohibits “monopolistic practices,” which include: a) the conclusion of monopoly agreements between operators; b) the abuse of dominant market position by operators; c) concentration of undertakings which has or may have the effect of eliminating or restricting market competition. Also, according to Article 19, the operator(s) will be assumed to have a dominant market position if it has following situation: a) an operator has 50% or higher market share in a relevant market; b) two operators have 66% or higher market share in a relevant market; c) three operators have 75% or higher market share in a relevant market. We believe that we have not conducted any monopolistic practices in China, and that recent statements and regulatory actions by the Chinese government do not impact our ability to conduct business, accept foreign investments, or list on a U.S. or other foreign stock exchange. However, there can be no assurance that regulators in China will not promulgate new laws and regulations or adopt new series of interpretations or regulatory actions which may require the Joint Venture to meet new requirements on the issues mentioned above.

Currently, these statements and regulatory actions of China authorities have had no impact on our daily business operation, including the sales and marketing efforts made to date of our Gen-2 devices in China through Wider. We do not believe that these statements and regulatory actions will have any impact on the Joint Venture. Further, we are a United States’ company with no physical presence in China, and we do not believe that the formation of the Joint Venture in Hong Kong and any resultant exposure to China regulatory actions will adversely impact our ability to accept foreign investments or list our securities on a United States or other foreign exchange. However, since these statements and regulatory actions from China authorities are relatively recent, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list our securities on a United States or other foreign exchange. In the event any existing or new laws or regulations or detailed implementations and interpretations are modified or promulgated, we and the Joint Venture will take any and all actions to remain in compliance with any such laws or regulations or detailed implementations and interpretations thereof. See “Risk Factors — Risks Related to Doing Business in China.”

As a result of the formation of the Joint Venture, we are conducting our clinical research and implementing a business distribution plan for our devices in China and elsewhere through the Joint Venture, which we believe confers clinical, commercial, and regulatory advantages, but may subject us to significant regulatory, liquidity, and enforcement risks. Although we do not intend to have any physical presence in China, Hong Kong, Macau and Taiwan, the Joint Venture entity has physical presence in Hong Kong. Wider, as a China formed entity with its physical presence in China may be subject to regulatory actions and prohibitions from China regulatory entities and required to obtain certain approvals.

The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions under the civil law system may be cited for reference but have limited precedential value. Uncertainties in the interpretation and enforcement of Chinese laws and regulations could limit the legal protections available to us.”

Market and Industry Background

General

Historically, pharmaceutical solutions have been the first line of treatment for those who suffer from anxiety, insomnia, depression, and other mental health disorders. Beginning in 1950, for patients that were not responding to medication, ECT, also called “shock therapy,” became available. Over time, researchers began to look at alternative ways to inject electricity into the human brain. One such method was via implantable neurostimulators that required invasive surgery procedures associated with high cost and high risk. Implantable devices became the potential solution for those who would not take or could no longer take pharmaceuticals. The interest in electricity continued with the creation of small handheld devices powered by a direct current (DC) battery that the consumer could buy without any medical supervision. Clinical versions of DC stimulators, known as transcranial direct current stimulation (tDCS), were developed by researchers; many of these devices are still in research settings without industry support.

In 1992, a new neurostimulation technique emerged called trans-cranial magnetic stimulation (TMS). This technique evolved into repetitive trans-cranial magnetic stimulation (rTMS), which utilized repetitive magnetic pulse energy to stimulate the brain of patients struggling with depression. The American pharmaceutical industry embraced and funded this technology. The FDA cleared rTMS only for patients who had failed to respond to anti-depressants. Side effects, high cost and moderate efficacy continue to burden this technology sector.

Both insurance companies and healthcare providers are looking for alternative ways to decrease costs while still providing safe and effective treatments.

We believe that our new marketing and growth strategy in combination with our advanced 15 milliamp waveform, technological upgrades and the development of a modern headset monitored with our IT management platform, will position us for the opportunity to disrupt the traditional mental health treatment model. Our mission is to remove the stigma of expensive psychotherapy or pharmaceuticals with the attendant side effects and dependency issues and replace it with clinically proven and cost-effective technology that is easily accessible in the privacy of the patient’s home and monitored by licensed healthcare providers.

Anxiety Market

Anxiety disorders are considered the most prevalent of psychiatric disorders. Anxiety disorders include generalized anxiety disorder, social anxiety disorder, panic disorder, obsessive-compulsive disorder, post-traumatic stress disorder (PTSD) and phobias.

Insomnia Market

Insomnia is a common sleep disorder considered to be responsible for at least $63 billion in direct and indirect healthcare costs each year, according to the Harvard American Insomnia Study. A frightening number of insomnia cases are undiagnosed and untreated, even as the condition becomes a mounting financial burden on America’s employers and the healthcare system. Data surrounding sleep disorders demonstrate that insomnia is a growing problem that shows no signs of slowing down. Current market conditions present an opportunity to introduce technology that provides a safe, effective and drug-free alternative for those suffering from insomnia. We believe we have the ability to decrease the number of potentially addictive insomnia prescriptions needed by patients and offer physicians a non-pharmaceutical option to provide their patients. Additionally, we are developing a solution for home-based treatment for chronic insomnia and to improve sleep hygiene for its users.

Depression Market

Depression continues to be the leading cause of medical disability around the world. Poor efficacy, risk and adverse side effects of current anti-depressants are driving the preference for non-pharmacological therapies, which will limit growth for the pharmaceutical sector of the depression treatment market. This limitation will enhance the research and development of novel therapies that treat depression safely and effectively without adverse side effects. Historically, according to the CDC, only one-third of people with severe depression have taken anti-depressants.

Any decline in the depression medication market should indirectly accelerate the growth of the neurostimulator market. Management believes that, based on the market data and current trends, the depression market — like the anxiety and insomnia market — creates enormous potential for our products.

Prior to December 2019, our Gen-1 device was considered a Class III device. Treatment of depression in the United States is limited to Class III devices only. Prior to 2019, our existing Gen-1 4 milliamp medical device had been used to successfully treat depression in the U.S. The Gen-2 15 milliamp version of our device when introduced into the United States will be subject to approximately eighteen months of clinical study before our PMA application for depression will be accepted. Assuming we will be able to obtain successful classification from the FDA, we expect to market our device in the United States as a treatment for depression.

Substance Use Disorders (Opioid Addiction) Market

According to the National Institute on Drug Abuse (NIDA,) substance use, and substance use disorders cost the United States more than $740 billion a year in healthcare, crime and lost productivity costs; but dollars barely capture the devastating human cost of addiction to individuals, families and communities. According to the National Survey on Drug Use and Health, 19.7 million adults in the United States suffered from a substance use disorder in 2017.

The current success rate of the best drug and alcohol rehabilitation facilities is minimal. We believe that this represents a significant market opportunity for our company. The disease of addiction is brain-based in its nature. Currently brain-based treatments for the disease are only available to patients who can afford long-term expensive boutique treatment centers. We intend to demonstrate that a brain-based approach to addiction treatment will enhance a patient’s success at long-term recovery. Our hypothesis is that the current pilot study design at The University California, San Diego (see below) will provide a source of validation for this treatment modality in addiction treatment.

Chronic Pain Market

Originally, our waveform was designed as an electro-analgesic for pain. This refers to the ability to electrically interrupt the pain signaling process in the brain. By interrupting the pain signaling process in the brain, our products can reduce symptoms and discomfort associated with chronic pain. By reducing the symptoms and discomfort associated with chronic pain, physicians can reduce medications and avoid dependency issues related to opiate-based medications.

According to Research and Markets, the global chronic pain treatment market is predicted to progress at a CAGR of 5.8% from 2020 to 2030 and generate revenue of $151.7 billion in 2030.

Currently, we own an electrostimulation patent for a device that will apply electrodes to the brain, spine, and the place of injury. The placement of these electrodes in conjunction with our various waveforms creates an opportunity for us to treat chronic pain without medication. The Nexalin executive team is preparing strategies to develop a prototype of our existing patented design and introduce it into clinical trials for the treatment of chronic pain. In previous pilot studies, our existing Gen-1 product reduced pain in patients suffering from injuries originating in industrial accidents. However, we plan to use the new advanced waveform emitted at 15 milliamps into the new prototype pain device for new clinical trials for the treatment of chronic pain.

Alzheimer’s Disease and Dementia Market

Alzheimer’s disease is a degenerative brain disease and the most common form of dementia. Dementia is not a specific disease, but rather an overall term that describes a group of symptoms. According to the WHO, there are around 50 million people living with Alzheimer’s disease and other dementias worldwide.

According to Reports and Data, the global Alzheimer’s therapeutics market is projected to reach $13.7 billion by 2030 from $2.2 billion in 2020 with a substantial compound annual growth rate (CAGR) of 20% through the forecast period.

We believe our products could be leveraged to extend the quality of life for millions of people who are diagnosed with Alzheimer’s disease.

Marketing and Sales Efforts

We believe that our marketing and sales plan provides a long-term scalable business model. Our team will prepare the foundation and marketing assets necessary to launch the new virtual clinic model that will complement the traditional clinic model. Our sales model is to place more than 1,000 Gen-2 and Gen-3 devices on the global stage. The momentum and branding strategies of Nexalin providers will be leveraged to enhance the launch of a global sales plan. The Gen-2 device at 15 milliamps supported by the Gen-3 outpatient headset and our virtual digital management platform is intended to disrupt the current mental healthcare model. The Gen-2 and Gen-3 device at 15 milliamps will offer patients a cost effective and efficient treatment model for day-to-day mental health challenges. We believe those devices, with their advanced waveform, can treat existing mental health disorders associated with anxiety and insomnia. Additionally, new strategies are in research and development for FDA treatment indications of depression, substance use disorder, TBI (traumatic brain injury), PTSD, opioid addiction, alcoholism and chronic pain. Additional research and treatment efficacy are being investigated for the Alzheimer’s community for patient care and management.

Our plan is designed to triangulate and stimulate the physician, consumer, and manufacturer relationship. Trends in healthcare indicate consumers are involved in treatment decisions that concern their mental health. Because of the advancement in healthcare technologies, home-based care with medical supervision provides patients with a cost-effective and efficient treatment option. Home-based care also avoids the stigma associated with treatment for mental health disorders. In our current sales plan, we intend to launch with a physician provider in each state. These physicians will lead the Nexalin campaign in each state as that state’s primary provider. These preferred state providers will begin with the virtual clinic. Our digital marketing team will drive consumers with quality-of-life struggles related to mental health issues into the virtual clinic and then to the provider in the consumer’s state of residence. These initial state physicians providing mental health services in the virtual clinic, will also have the ability to offer treatment in their clinic. The in-clinic model will use the Gen-2 clinical device while the virtual clinic will use the Gen-3 headset. This initial launch plan with state providers will develop and support multiple marketing verticals to drive the Nexalin brand and treatment as an alternative to medications and psychotherapy. We will leverage this physician / patient community to establish a national network of physicians that offer mental health evaluations and the Nexalin treatment in either a clinical setting or in the privacy of the patient’s home with medical supervision through the future Nexalin app.

Most, if not all, patients treated in the Nexalin virtual clinic would be part of a digital community that supports brand awareness and the sharing of anonymous treatment outcomes in a social media setting. The Patient Activation Program will include a robust data gathering system on providers and patients (opt-in) that enhances our marketing strategies.

Insurance Reimbursement for Our Products

In January 2020, the Centers for Medicare & Medicaid Services (CMS) in conjunction with the Durable Medical Equipment for Medicare Administrative Contractors issued a code for Cranial Electrotherapy Stimulators (CES). CMS issues codes that are used by medical practitioners to obtain Medicare, Medicaid and private insurance reimbursement. The issuance of this code is the first time that a reimbursement code from CMS has been designated specifically for CES. The code does not guarantee reimbursement and is considered at this time, experimental. The Nexalin executive team plans to continue preparing clinical data and durability data to pursue long term clinical reimbursement.

Reimbursement strategies for this type of technology are complex and vary from one diagnosis to another. Nexalin plans to utilize an RFID system that will track treatments completed. This will simplify comparing our devices to pharmaceutical interventions. Beginning in 2024, a complete reimbursement assessment is being conducted and evaluated to develop a strategy to acquire reimbursement. We will employ a two-prong approach for eventual reimbursement. The first prong will evaluate the clinic-based product offered by physicians. The second prong will focus on tracking usage and response from the outpatient headset model that is tracked through the virtual platform. Frequently therapies that are used in the home are not classified as durable medical equipment and will fall into a reimbursement gap without coverage. We intend to work to successfully achieve a Level 2 code under the healthcare common procedure coding system. We will work to seek reimbursement for conditions in sequence with the home based and the clinic-based unit that will maximize value of treatment from a financial standpoint as well as monitoring the response by the patient community.

Research

Research is the fundamental core of any pharmaceutical or medical device company. Although small trials, with limited patients, can show promise for a treatment, they are generally not acceptable to the FDA for product approval. To commercialize a product for widespread use, multiple large-scale trials are required to demonstrate both efficacy and safety. In the past two decades, the cost of conducting such trials has more than doubled, with many small start-up companies unable to raise the necessary capital to complete these vital projects. The increase in cost reflects several variables which are required for successful clinical trial completion.

The various costs can include patient recruitment and retention expenses, physician, and nurse expenses, as well as the expenses of other healthcare providers. Various regulations, each more complex than the next, also have added significant cost to the process. Data collection, as well as data analysis, is also a significant portion of the study cost. Additionally, almost all studies are conducted through either a large university, with its underlying overhead for administrative costs and institutional review board approval, or through a contract research organization, which also adds significant overhead costs in addition to the hard cost of the study itself. Latest estimates for the cost per patient for an average trial is approximately $41,000.

In 2019, we began a research partnership with The University California, San Diego. Prior to the pandemic, two pilot clinical studies were undertaken with UCSD, however, these trials were paused due to the shutdown of college campuses in California. Beginning in the summer of 2022 and continuing to present, new discussions began to explore strategies for PTSD and Opiate dependency and mild traumatic brain injury (mTBI) with our new Gen-3 headset.

At UCSD the first clinical is studying the benefits of our Gen-2 device as a treatment for veterans suffering with opiate addiction. This pilot study was designed by UCSD and funded by the department of Veterans Affairs. For this opiate addiction study, the primary endpoint will be alleviating withdrawal symptoms. Secondary endpoints will include decreasing dosages of medication used in opiate addiction cessation, as well as Magnetoencephalography (MEG) gamma band improvement.

The other study at UCSD is focused on veterans suffering from mild traumatic brain injury (mTBI) and is funded by the United States Department of Defense. One of the primary symptoms associated with mTBI is PTSD (post-traumatic stress disorder). The primary endpoint associated with this study will be the assessment and reduction of post-concussion symptoms associated with PTSD. A secondary endpoint for the study will be improvement and MEG slow-wave abnormalities. Additional studies are planned for patients and veterans with suicidal thoughts related to mTBI.

In addition to UCSD, we are developing additional strategies to initiate further trials to address new FDA guidelines. These new strategies and pivotal trials will support new 510(k)s and/or de novo applications for anxiety and insomnia at 15 milliamps. These trials are in addition to the special control trials required by the FDA. Final trial designs are due to be executed after recommendations are reviewed from the April 30, 2024 meeting FDA pre-sub meetings. Other areas of research that will be designed and funded relate to the treatment of substance use disorders, TBI, PTSD, Alzheimer’s disease, and dementia.

Additional research in China is being performed with the goal of publishing the findings in a peer reviewed journal. All research will be controlled by our team, with all trial designs requiring written final approval by our Chief Medical Officer. Clinical updates will be required every 30 days. Frequent in-person WeChat meetings will also be performed to ensure the integrity of the research efforts.

In addition to clinical trials in China and current studies in the United States required by the FDA, an additional study is planned with the 15 milliamp Gen-2 and Gen-3 devices to evaluate a large cohort of patients with depression. This trial will include a double-blind study design with active and sham groups. Patient selection screening will evaluate 200-250 subjects to acquire the number of patients needed for a successful trial. Each patient, upon enrollment, will be evaluated extensively prior to initiation of therapy. Patients will be treated a minimum of 20 separate times, with pre- and post-test screening. Moreover, upon completion of therapy, post-test examination will be performed not only immediately thereafter but also over the course of one to three months to establish not only efficacy but durability of the treatment. The results of this study will provide the basis of the PMA with the FDA for the treatment of Depression.

At the start of 2021, an Alzheimer’s specific clinical trial was underway in China: “Transcranial alternating current stimulation for patients with mild Alzheimer’s disease.” Extensive cognitive pre- and post-evaluations are being performed at the beginning and conclusion of the study, with less rigorous evaluations before and after each therapy session. Because of issues related to Covid-19 in China, this trial was paused. Additionally, results of this trial will dictate additional testing strategies to determine specific treatment protocols for complex Alzheimer’s and dementia patients.

A final area of study includes the evaluation of chemical changes within the brain following transcranial stimulation. Chemicals, which are naturally formed in the brain, control many of our moods and thoughts, modulating feelings of pain, depression and generalized mood. These substances also drive cravings in substance use disorders. One of the specific areas of research is to validate changes of serotonin levels in the brain. Serotonin is a “feel good” chemical which has also been associated with learning. Other chemicals, such as dopamine, act in a reward center mechanism. Additionally, certain other neurons require specific chemicals to either fire or be inhibited from firing. These areas can be explored with specific radioactive markers in the brain for evaluation with PET MRI scans.

Clinical trials for the Gen-2 device were conducted in China during 2023. These clinical trials were funded by Wider, and its related companies, and was conducted at the Xuanwu Hospital, Capital Medical University in Beijing, China. The results were also published in General Psychiatry, an open-source, peer-reviewed scientific journal. The published results of the study concluded that repeated treatment with the Company’s neurostimulation device suggests an acute effect in reducing depressive symptoms in patients with treatment-resistant depression (“TRD”). In addition, no adverse events were observed during treatment. As part of the clinical study, 7 migraine patients were treated at the Xuanwu Hospital. Treatment was administered for 4 consecutive weeks via the forehead and both mastoid (twice per day, five days a week). Efficacy and adverse reactions were assessed at a two-week screening/baseline period followed by a four-week treatment phase. The study concluded that twice daily 15mA tACS, a unique form of non-invasive brain stimulation, offers an acute effective intervention for patients with TRD. The study showed that all patients with TRD had a significant reduction in depression symptoms after the four-week treatment, and all of them achieved a clinical response (defined as HAMD-17/ MADRS scores that decreased by 50% or more from the baseline). Additional Insomnia clinical trial results are expected in Q2 2024 with additional submissions for publication.

Virtual Clinic Digital Management Platform

We expect to capitalize on the post pandemic digital health model. Our team began researching IT digital development firms at the beginning of the pandemic. We have now completed our research and bidding process and have begun contract negotiations with a leading IT design team to begin work on an advanced, proprietary IT management platform that will eventually manage all aspects of the Nexalin virtual clinic model. The vision is to implement a virtual clinic model that will enable providers and clinics to integrate remote outpatients into an overall treatment process. Our IT platform goes well beyond telehealth and is designed to support all aspects of the treatment model in conjunction with various data sets to support marketing, data collection and patient monitoring. Our digital management platform will manage the entire clinical and outpatient headset business model. The proprietary IT platform will manage all aspects of a new virtual health center related to treatment for mental health. As the development of the new generations of our devices and the outpatient headset are developed, the digital platform will eventually manage and triangulate the relationship between the medical professional, the patient, and the manufacturer. The digital platform will handle logistics, data collection and user experience data for clinical evaluation. Additionally, there will be an app that the patients will install on their phones that will communicate with the outpatient headset. The app will upload user information that is HIPAA compliant to the IT management platform. Modules will be designed and implemented in the platform to collect biometric data. Biometric data will be utilized to evaluate patient response. A symptom exam for additional clinical validation will also be offered in the app. All data and user information will be stored in a secure, HIPAA compliant cloud computing center and access to the information will be managed through a secure and compliant dashboard management system. The medical professional will have access to all data to monitor outpatient experience, client response and general health and wellness information.

We will leverage our IT investment to create a lead management system for mental health physicians connecting prospective patients with providers. The medical professional will be able to engage in a telehealth virtual appointment with prospective patients to complete an evaluation and assess whether the patient is a candidate for the outpatient headset program. After the professional approves the device for the patient, we will automatically prepare shipment of the device directly to the outpatient consumer from the manufacturer. We will have an internal department to monitor shipment, and to answer questions through a help desk on how to set up and use the device. The medical professional can be reimbursed for the virtual appointment via the outpatient’s insurance for telehealth care which is becoming part of the new normal in the post-pandemic, digital-health world.

Additional design and implementation of modules related to social media marketing, bio-metric data collection and user experience will eventually complete the design of the IT management platform.

Manufacturing

In December 2021, we entered into a quality assurance agreement with Apical Instruments, an FDA-registered manufacturer, to ensure quality assurance of our products. We currently have enough design and manufacturing support to meet all projected company design and sales goals. Our regulatory team works closely with the Apical quality team to ensure all current compliance and testing standards are adhered to. All distribution channels will rely on a collaboration between the Apical and Nexalin teams.

Intellectual Property

Our commercial success depends in part on our ability to: obtain and maintain proprietary or intellectual property protection for our products, our core technologies and other know-how; operate without infringing on the proprietary rights of others; and prevent others from infringing on our proprietary or intellectual property rights. Our policy is to seek to protect our proprietary and intellectual property position by, among other methods, filing United States and foreign patent applications related to our proprietary technology, inventions and improvements that are important to the development and implementation of our business. We also rely on the skills, knowledge, and experience of our scientific and technical personnel, as well as that of our advisors, consultants and other contractors. To help protect our proprietary know-how that is not patentable, we rely on trade secret protection and confidentiality agreements to protect our interests. As part of our hiring practices and as described in our Code of Ethics which is binding on all employees, our employees, consultants, and advisors are prohibited from disclosing confidential information and are required to assign to us the ideas, developments, discoveries and inventions important to our business.

We file patent applications directed to our key products to establish intellectual property positions. These patent applications are intended to protect these products as well as their uses in the treatment of diseases. We are the owner and inventor of three existing patents and four pending patents related to the electro-stimulation techniques related to our products and services. Our current patents cover a therapeutic electro-stimulation apparatus (the medical device) and the software used to create and administer the stimulation to the patient and our core technology utilized in the Gen-2 and Gen-3 system. We expect to file additional provisional and non-provisional patent applications and copyright protection pertaining to future Generation technology, proprietary software, and trademarks. The patent claims associated with the non-provisional patent applications will be defined and prepared in the filings. The intention is to continue building an intellectual property portfolio asset. Future research and development projects related to advancements in neurostimulation and neuromodulation technology will be identified and investigated for future patent filings.

Our trademark portfolio currently consists of registered trademark rights for the mark, NEXALIN TECHNOLOGY, in the United States. In connection with the ongoing development and advancement of our products and services in the United States and various international jurisdictions, we routinely seek to create protection for our marks and enhance their value by pursuing trademarks and service marks where available and when appropriate. In addition to patents and trademark protection, we rely upon unpatented trade secrets and know-how and continuing technological innovation to develop and maintain our competitive position.

Competition

We plan to be the leader in brain-based health. We compete with traditional pharmaceutical therapies. All of these have side effects, such as drug dependency as well as adverse health risks.

We also compete with several neurostimulators at the high and low end of the market as well as implanted devices. All have either a high-risk profile or uncomfortable side effects with moderate efficacy. Our products were designed as a cost-effective option to all current reimbursed treatments available to the patient.

We believe that some existing neurostimulation products are either high risk, high cost and difficult to administer. In addition, they are invasive, frequently requiring surgery and multiple visits to a physician. Since many of the conditions require ongoing treatments, the difficulty and cost of administering them make them of limited utility for broad application.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Start-ups Act of 2012, as amended, or the JOBS Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from some of the reporting requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include:

| |

● |

being permitted to present only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations disclosures; |

| |

● |

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; |

| |

● |

not being required to comply with any requirements that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| |

● |

reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| |

● |

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |