UPDATE: Cisco Plans To Acquire NDS Group In $4 Billion Deal

March 15 2012 - 9:46AM

Dow Jones News

Cisco Systems Inc. (CSCO) plans to acquire video software maker

NDS Group Ltd. in a $4 billion deal, a purchase the technology

giant said reflects its increased strategic focus on video.

The takeover of NDS Group, the U.K. provider of equipment to

television service providers like cable and satellite companies, is

a natural extension of Cisco's Scientific Atlanta business and fits

with the company's recent intimations it would become more

acquisitive, analysts say.

The deal, which also includes the assumption of nearly $1

billion of debt, is expected to close in the second half of the

year.

Cisco noted it expects the acquisition will accelerate delivery

of its Videoscape platform. It is expected to expand the tech

giant's capabilities in the service provider market and expanding

its reach into emerging markets, such as China and India. Cisco

also expects the acquisition to add to its adjusted earnings in the

first full year.

The buyout comes as NDS was on course to go public this year.

The company is 51% owned by private-equity firm Permira, with News

Corp. (NWSA)--the owner of Dow Jones--holding the remaining

stake.

Joanna Makris, analyst at Mizuho Securities USA, said the NDS

purchase increases Cisco's exposure to cable-service and other

television providers, rather than the company's traditional focus

on telecommunications providers.

Just as telecommunications providers are increasingly getting

into the television game, Makris noted that "right now there's

convergence going on between the television and PC, and what Cisco

is trying to do is capitalize on that convergence."

Alkesh Shah, analyst at Evercore Partners, noted that as NDS is

primarily a software company, the takeover doesn't raise red flags

about margin degradation for Cisco. It fits with Cisco's search for

high-margin businesses that are international, so the company can

take advantage of its large cash assets sitting offshore.

Cisco Systems last month reported its fiscal second-quarter

earnings rose 43% and gave an upbeat profit forecast as its renewed

focus on networking equipment continued to pay off.

On the conference call for those results, executives noted that

Cisco had a desire to become more acquisitive and seek out bigger

deals.

Cisco shares were down 20 cents at $20 in recent premarket

trading.

-By Joan E. Solsman and Tess Stynes, Dow Jones Newswires;

212-416-2291; joan.solsman@dowjones.com

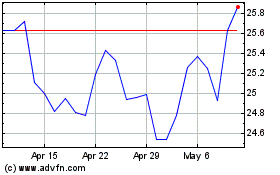

News (NASDAQ:NWS)

Historical Stock Chart

From Jun 2024 to Jul 2024

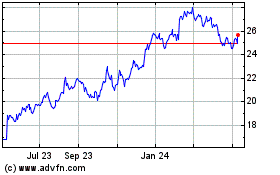

News (NASDAQ:NWS)

Historical Stock Chart

From Jul 2023 to Jul 2024