Current Report Filing (8-k)

February 12 2020 - 4:06PM

Edgar (US Regulatory)

false

0001002047

0001002047

2020-02-12

2020-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2020

NetApp, Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

0-27130

|

|

77-0307520

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

1395 Crossman Avenue

Sunnyvale, CA 94089

|

|

(Address of principal executive offices) (Zip Code)

|

|

|

|

(408) 822-6000

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 Par Value

|

|

NTAP

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 12, 2020, NetApp, Inc. (“NetApp” or the “Company”) issued a press release reporting financial results for the third quarter ended January 24, 2020. The press release is furnished herewith as Exhibit 99.1, and is incorporated herein by reference.

The information contained herein and in the accompanying exhibits shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing. The information in this report, including the exhibits hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b), (e)

Retirement of Named Executive Officer

On February 12, 2020, NetApp announced that Ronald J. Pasek informed the Company of his intent to retire from his position as Executive Vice President and Chief Financial Officer of the Company by the end of the Company’s fiscal year 2020 (“Fiscal 2020”). Mr. Pasek has agreed to work with the Company and its Board of Directors (the “Board”) to ensure an orderly transition.

On February 8, 2020, the Compensation Committee (the “Committee”) of the Board approved the terms of a separation and release agreement with Mr. Pasek (the “Pasek Agreement”). The Pasek Agreement, upon becoming effective, provides for (i) release of all claims by Mr. Pasek in favor of the Company; (ii) a payment to Mr. Pasek of $626,000; and (iii) accelerated vesting of Mr. Pasek’s service-vested restricted stock units (“RSUs”) such that Mr. Pasek shall be entitled to the pro rata portion of the RSUs that would have otherwise vested in June 2020 (based on days of service during the vesting period). If Mr. Pasek remains an employee of the Company through the end of Fiscal 2020, he shall be entitled to: (i) payment of the amount earned under his Fiscal 2020 incentive compensation award in accordance with the terms and conditions approved by the Committee under the Company’s Executive Compensation Plan; and (ii) vesting of that portion of his outstanding performance-based restricted stock units (“PBRSUs”) with a performance period ending on April 24, 2020, with payout based on the actual performance of the Company relative to the metrics set forth in the grant agreement.

On February 8, 2020, the Committee also approved the terms of a separation and release agreement with Henri Richard, (the “Richard Agreement”). As previously announced, Mr. Richard intends to retire from his position of Executive Vice President, World Wide Field and Customer Operations at the end of the Fiscal 2020. The Richard Agreement, upon becoming effective, provides for (i) release of all claims by Mr. Richard in favor of the Company; (ii) a payment to Mr. Richard of $300,000 and (iii) accelerated vesting of Mr. Richard’s RSUs such that Mr. Richard shall be entitled to the pro rata portion of the RSUs that would have otherwise vested in June 2020 (based on days of service during the vesting period). If Mr. Richard remains an employee of the Company through the end of Fiscal 2020, he shall be entitled to: (i) payment of the amount earned under his Fiscal 2020 incentive compensation award in accordance with the terms and conditions approved by the Committee under the Company’s Executive Compensation Plan and (ii) vesting of that portion of his outstanding PBRSUs with a performance period ending on April 24, 2020, based on the actual performance of the Company relative to the metrics set forth in the grant agreement. If Mr. Richard remains an employee of the Company through May 13, 2020, he is eligible for pro rata vesting of his outstanding PBRSUs in accordance with the terms of the applicable grant agreements.

The foregoing summaries of the Pasek Agreement and the Richard Agreement do not purport to be complete and are qualified in their entirety by the full text of the applicable agreement, a copy of which will be filed with the Company’s Annual Report on Form 10-K for the year ending April 24, 2020.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NETAPP, INC.

|

|

|

(Registrant)

|

|

February 12, 2020

|

By:

|

/s/ Matthew K. Fawcett

|

|

|

|

Matthew K. Fawcett

|

|

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

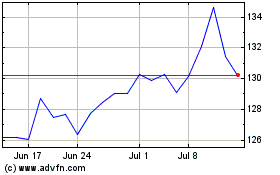

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

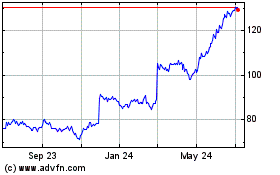

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Apr 2023 to Apr 2024