|

Prospectus Supplement No. 2

(to Prospectus dated July 31, 2023)

Prospectus Supplement No. 2

(to Prospectus dated July 31, 2023)

Prospectus Supplement No. 2

(to Prospectus dated July 31, 2023) |

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-271229

Registration No. 333-271795

Registration No. 333-272300

|

NEAR INTELLIGENCE, INC.

8,625,000 Shares of Common Stock Underlying Warrants

49,525,198 Shares of Common Stock

Up to 31,825,271 Shares of Common Stock Underlying

Convertible Debentures

Up to 5,411,734 Shares of Common

Stock Underlying Warrants

5,200,000 Warrants to Purchase

Shares of Common Stock

This prospectus supplement updates

and supplements the prospectus of Near Intelligence, Inc. (“Near,” “we,” “us” or “our”)

dated July 31, 2023, which forms a part of our Registration Statement on Form S-1, as amended (Registration No. 333-271229) (the “Public

Warrants Prospectus”), the prospectus dated July 31, 2023, which forms a part of our Registration Statement on Form S-1, as amended

(Registration No. 333-271795) (the “Omnibus Resale Prospectus”), and the prospectus dated July 31, 2023, which forms a part

of our Registration Statement on Form S-1, as amended (Registration No. 333-272300) (the “Part A-2/Part B Resale Prospectus”

and, collectively with the Public Warrants Prospectus and the Omnibus Resale Prospectus, the “Prospectuses”). This prospectus

supplement is being filed to update and supplement the information in the Prospectuses with the information contained in our Current Report

on Form 8-K, filed with the SEC on August 28, 2023 (the “Form 8-K”). Accordingly, we have attached the Form 8-K to this prospectus

supplement.

The Public Warrants Prospectus,

together with this prospectus supplement, relate to the issuance by us of 8,625,000 shares of our common stock, par value $0.0001 per

share (the “Common Stock”), issuable upon exercise of warrants.

The Omnibus Resale Prospectus,

together with this prospectus supplement, relate to the offer and sale, from

time to time, by the selling securityholders named therein or their permitted transferees of (i) 48,231,701 shares of Common Stock; (ii)

up to 2,897,733 shares of Common Stock issuable upon conversion of Part A-1 Convertible Debentures (as defined in the Omnibus Resale Prospectus);

(iii) up to 149,234 shares of Common Stock issuable upon exercise of Part A-1 Warrants (as defined in the Omnibus Resale Prospectus);

(iv) up to 5,200,000 shares of Common Stock issuable upon exercise of the Private Placement Warrants (as defined in the Omnibus Resale

Prospectus); and (v) 5,200,000 Private Placement Warrants. The Omnibus Resale Prospectus, together with this prospectus supplement,

also relate to the issuance by us of up to an aggregate of 5,200,000 shares of

Common Stock upon exercise of the Private Placement Warrants.

The Part A-2/Part B Resale

Prospectus, together with this prospectus supplement, relate to the offer and sale, from time to time, by the selling securityholders

named therein or their permitted transferees of (i) 1,293,497 shares of Common Stock; (ii) up to 28,927,538 shares of Common Stock issuable

upon conversion of the Part A-2/Part B Convertible Debentures (as defined in the Part A-2/Part B Resale Prospectus; and (iii) up to 62,500

shares of Common Stock issuable upon exercise of the Part A-2 Warrants (as defined in the Part A-2/Part B Resale Prospectus) at an exercise

price of $0.01 per share.

This prospectus supplement should

be read in conjunction with the Prospectuses. This prospectus supplement updates and supplements the information in the Prospectuses.

If there is any inconsistency between the information in the Prospectuses and this prospectus supplement, you should rely on the information

in this prospectus supplement.

Our shares of Common Stock are

listed on The Nasdaq Global Market under the symbol “NIR.” On August 25, 2023, the closing sale price of shares of our Common

Stock was $0.40. The Public Warrants are listed on The Nasdaq Capital Market

under the symbol “NIRWW.” On August 25, 2023, the closing sale price of our Public Warrants was $0.09.

We are an “emerging growth

company” under federal securities laws and are subject to reduced public company reporting requirements.

Investing in our securities

involves risk. See the sections entitled “Risk Factors” beginning on page 11 of the Public Warrants Prospectus, page 13 of

the Omnibus Resale Prospectus, and page 11 of the Part A-2/Part B Resale Prospectus, and under similar headings in any further amendments

or supplements to the Prospectuses, to read about factors you should consider before buying our securities.

Neither the Securities and

Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if any Prospectus

or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is August 28,

2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August

22, 2023

Near Intelligence, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39843 |

|

85-3187857 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

100 W Walnut St., Suite A-4

Pasadena, California 91124 |

|

91124 |

| (Address of principal executive offices) |

|

(Zip Code) |

(628) 889-7680

(Registrant’s telephone number, including area

code)

Not Applicable

(Former name or former address, if changed since last

report)

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each

class |

|

Trading Symbols |

|

Name of each exchange

on

which registered |

| Common Stock, par value $0.0001 per share |

|

NIR |

|

The Nasdaq Global Market |

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

NIRWW |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

Reduction in Executive Officer

Salaries

On August 22, 2023, the Board of Directors (the “Board”)

of Near Intelligence, Inc. (the “Company”) approved a 20% reduction in the annual base salary for members

of the Company’s senior leadership team, including the Company’s named executive officers. As of September 1, 2023, the annual

base salary for (i) Anil Mathews, Chief Executive Officer, will be reduced to $320,000; (ii) Rahul Agarwal, Chief Financial Officer, will

be reduced to $280,000; and (iii) Shobhit Shukla, President, will be reduced to $280,000.

Reduction in Non-Employee Director Cash Compensation

Concurrently with the approval of reduced base salaries

for the Company’s senior leadership team, the Board also approved a 20% reduction in the annual cash compensation for non-employee

directors, effective September 1, 2023. As a result, non-employee directors will be entitled to receive an annual cash retainer of $96,000

for service as a director, payable in 12 monthly installments.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: |

August 28, 2023 |

|

|

| |

|

|

|

| |

|

NEAR INTELLIGENCE, INC. |

| |

|

|

|

| |

|

By: |

/s/ Rahul Agarwal |

| |

|

|

Rahul Agarwal |

| |

|

|

Chief Financial Officer |

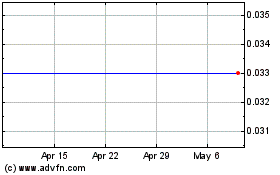

Near Intelligence (NASDAQ:NIR)

Historical Stock Chart

From Apr 2024 to May 2024

Near Intelligence (NASDAQ:NIR)

Historical Stock Chart

From May 2023 to May 2024