0001710155false00017101552023-07-202023-07-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________

FORM 8-K

_______________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 26, 2023 (July 20, 2023)

_______________________________________________________________________

National Vision Holdings, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________

001-38257

(Commission file number)

| | | | | | | | | | | | | | |

| Delaware | | 46-4841717 |

(State or other jurisdiction of

incorporation) | | (IRS Employer

Identification No.) |

| | | | | |

| 2435 Commerce Ave. | | |

| Building 2200 | | 30096 |

| Duluth, | Georgia | | (Zip Code) |

| (Address of principal executive offices) | | |

(770) 822‑3600

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_______________________________________________________________________

Check the appropriate box below if the Form 8−K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | EYE | | Nasdaq |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive Agreement.

On July 20, 2023, National Vision Holdings, Inc. (the “Company”) received a notice of non-renewal from Walmart Inc. (“Walmart”) of the Management & Services Agreement by and between National Vision, Inc. (“NVI”) and Walmart, dated as of May 1, 2012 (as amended, supplemented or otherwise modified from time to time, the “Walmart MSA”). In accordance with the terms of the Walmart MSA and the notice, the agreement will terminate as of February 23, 2024, unless an alternate date is agreed by the parties (the “Termination Date”). In connection with the termination of the Walmart MSA, that certain Amended and Restated Supplier Agreement between NVI and Walmart, dated as of January 17, 2017 (the “Walmart Supplier Agreement”), and certain other related agreements will also terminate as of the Termination Date.

Under the Walmart MSA and the Walmart Supplier Agreement, the Company earns management fees for managing the operations of, and supplying inventory and laboratory processing services to, 229 Vision Centers in Walmart retail locations. The Walmart MSA includes provisions governing the transition period and post-termination obligations of the parties.

In connection with the termination of the Walmart MSA, the agreement between FirstSight Vision Services, Inc. (“FirstSight”), a wholly-owned subsidiary of the Company, and Walmart, which arranges for the provision by FirstSight of optometric services at optometric offices next to certain Walmart stores throughout California, will also terminate as of the Termination Date. Additionally, another wholly-owned subsidiary of the Company, Arlington Contacts Lens Service, Inc. (“AC Lens”), has delivered notices of non-renewal of the agreements it has with Walmart and its affiliate Sam’s Club regarding wholesale contact lenses distribution and related services, such that these agreements will terminate as of June 30, 2024, unless an earlier date is agreed by the parties.

A copy of the Walmart MSA was filed as Exhibit 10.31 to the Company’s Form S-1 Registration Statement filed on October 16, 2017. The Letter Agreement by and between National Vision, Inc. and Wal-Mart Stores, Inc. re: Management & Services Agreement, dated as of January 11, 2017, Amendment 3 and Amendment 4 to the Walmart MSA were filed as Exhibit 10.32 to the Company’s Form S-1 Registration Statement filed on September 29, 2017, Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on January 22, 2020 and Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on July 20, 2020, respectively. The Walmart Supplier Agreement was filed as Exhibit 10.33 to the Company’s Form S-1 Registration Statement filed on September 29, 2017. The above description of the Walmart MSA and Walmart Supplier Agreement is qualified in its entirety by reference to such exhibits.

Item 2.02 Results of Operations and Financial Condition.

The information set forth in Item 7.01 is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On July 26, 2023, the Company issued a press release related to the matter described in Item 1.02 above, along with preliminary results for its second fiscal quarter of 2023, and a reaffirmation of its expected results for full year 2023 and certain other matters. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information in Items 2.02 and 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished to the Securities and Exchange Commission (the “SEC”) pursuant to Items 2.02 and 7.01 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of National Vision’s filings with the SEC under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

This Form 8-K and the attached exhibit contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These statements include, but are not limited to, statements related to our current beliefs and expectations regarding the Company’s strategic direction, market position, prospects and future results. You can identify these forward-looking statements by the use of words such as “preliminary,” “guidance,” "outlook," “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Caution should be taken not to place undue reliance on any forward-looking statement as such statements speak only as of the date when made. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. Forward-looking statements are not guarantees and are subject to various risks and uncertainties, which may cause actual results to differ materially from those implied in forward-looking statements. Such factors include, but are not limited to, those set forth in our Annual Report on Form 10-K under the heading “Risk Factors” and in subsequent filings by National Vision with the SEC. Potential risks and uncertainties include those

relating to our ability to recruit and retain vision care professionals, management and retail associates, our ability to compete for managed vision care contracts, our ability to obtain favorable terms, such as discounts and rebates, from optical vendors and generate cash to fund our business and service our debt obligations, and our ability to replace lost Walmart locations with new America’s Best or Eyeglass World stores and support the carrying value of the intangible assets at these brands or replace the lost revenues and cash flows. Additional information about these and other factors that could cause National Vision’s results to differ materially from those described in the forward-looking statements can be found in filings by National Vision with the SEC, including our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Form 8-K, attached exhibit and in our filings with the SEC.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| Press Release dated July 26, 2023. |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | |

| | | | National Vision Holdings, Inc. |

| | |

| Date: July 26, 2023 | | By: | | /s/ Jared Brandman |

| | Name: | | Jared Brandman |

| | Title: | | Senior Vice President, General Counsel and Secretary |

National Vision Announces Walmart Partnership Ending in 2024

Positions Company to Enhance Focus on Delivering Further Profitable Growth

Across Its Remaining Business

Announces Preliminary Second Quarter 2023 Financial Results

and Reaffirms Fiscal 2023 Outlook

DULUTH, Ga. – July 26, 2023 – National Vision Holdings, Inc. (NASDAQ: EYE) (“National Vision” or the “Company”), the nation’s second largest optical retailer providing quality, affordable eye care and eyewear, today announced its partnership with Walmart Inc. (“Walmart”) will be ending in 2024. This includes supplying and operating Vision Centers in select Walmart stores, providing contact lens distribution and related services to Walmart and its affiliate, and arranging for the provision of optometric services at certain Walmart locations in California.

“We value and appreciate the contributions that our partnership with Walmart has had in helping us grow National Vision over the past three decades. With the progression of growth opportunities in our freestanding brands – America’s Best and Eyeglass World, we have become the second largest optical chain in the U.S. and a major force in providing low-cost eye exams, eyeglasses and contact lenses to budget-conscious American families,” said Reade Fahs, chief executive officer of National Vision. “While this decision was not expected, we look forward to beginning a new chapter as a more streamlined company ever more focused on delivering value to our stakeholders through our mission of making eyewear and eye care more affordable and accessible. We are grateful for and thank all our associates and associated optometrists who have been part of our Walmart journey.”

Fahs continued, “As we look ahead, we remain focused on executing our strategic initiatives and making changes to our cost structure to best align with our go-forward operating model. In addition, we remain focused on returning to a mid-single digit adjusted operating margin.”

On July 20, 2023, Walmart notified National Vision that it is not renewing its agreement for the Company to operate Vision Centers inside select Walmart locations as of February 23, 2024. Walmart also notified FirstSight Vision Services, Inc. (“FirstSight”), a wholly owned subsidiary of National Vision licensed as a single-service health plan in California, that as of February 23, 2024, it is ending the relationship whereby FirstSight arranges for the provision of optometric services at offices next to certain Walmart stores in California. In connection with these non-renewals, Arlington Contacts Lens Service, Inc. (“AC Lens”), National Vision’s wholly owned subsidiary, notified Walmart and its affiliate that it is not renewing its agreements for wholesale and e-commerce contact lenses distribution and related services. National Vision expects the AC Lens agreements will terminate on June 30, 2024.

National Vision’s Legacy segment, which consists of the operations and supply of inventory and laboratory processing services to Vision Centers in select Walmart retail locations, combined with the

Company’s wholesale distribution and e-commerce portion of AC Lens tied to Walmart and its affiliate, which is included in its Corporate/Other segment, contributed $348.9 million in net revenue and $15.0 million in Total Consolidated Earnings Before Income Taxes (EBIT) in fiscal 2022. Set forth in the table below is the estimated financial impact from the termination of these businesses based on fiscal 2022 total consolidated results and the Legacy and Corporate/Other segments.

| | | | | | | | | | | | | | | | | | | | | | | |

Fiscal Year 2022 - Estimated Financial Impact |

| In thousands | Reported Total Consolidated Results | | Legacy Segment Impact | | Corporate/Other Segment Impact* | | Total Impact from Termination of Walmart Businesses** |

| Total net revenue | $ | 2,005,404 | | | $ | (151,877) | | | $ | (196,995) | | | $ | (348,872) | |

| Total costs applicable to revenue | $ | 925,587 | | | $ | (70,040) | | | $ | (173,526) | | | $ | (243,566) | |

| SG&A | $ | 915,355 | | | $ | (58,217) | | | $ | (28,270) | | | $ | (86,487) | |

| Net income | $ | 42,122 | | | | | | |

|

| EBITDA | $ | 161,231 | | | $ | (23,620) | | | $ | 4,801 | | | $ | (18,819) | |

| Depreciation and amortization | $ | 99,956 | | | | | | | $ | 3,770 | |

| Earnings before income taxes | $ | 60,813 | | | | | | | $ | (15,049) | |

* Reflects the estimated total impact of the termination of the Company’s wholesale distribution and e-commerce portion of AC Lens tied to Walmart and its affiliate and does not include FirstSight impacts. **Reflects the estimated total impact of the termination of the Legacy segment and the Company’s wholesale distribution and e-commerce portion of AC Lens tied to Walmart and its affiliate. The estimated total impact does not include FirstSight impacts. |

The Company expects EBITDA contribution from Walmart and its affiliate businesses in fiscal 2023 to be lower than in fiscal 2022.

In connection with the termination of these agreements, the Company expects to record noncash goodwill and intangible asset impairment charges of approximately $60 million and $10 million, respectively, in the third quarter of fiscal 2023.

Second Quarter 2023 Preliminary Financial Results and Fiscal 2023 Outlook

National Vision also announced its preliminary unaudited financial results for the quarter ended July 1, 2023. The Company noted that these preliminary results have been prepared in good faith on a consistent basis with prior periods; however National Vision has not yet completed its financial closing procedures for the quarter ended July 1, 2023, and its actual results are subject to change and could be materially different from this preliminary financial information. Such preliminary information should not be regarded as a representation by National Vision or its management as actual results for the quarter ended July 1, 2023.

| | | | | | | | | | | | | | |

$ in thousands, except per share amounts | Three months ended July 1, 2023 | | Three months ended July 2, 2022 | Change |

Net revenue | $ | 525,340 | | | $ | 509,555 | | 3.1 | % |

Comparable store sales growth | (0.1) | % | | (11.0) | % | |

Adjusted Comparable Store Sales Growth | 1.0 | % | | (12.4) | % | |

Stores opened | 24 | | | 22 | | |

Stores closed | 1 | | | — | | |

Ending store count | 1,381 | | | 1,314 | | 5.1 | % |

Net income | $ | 5,614 | | | $ | 9,734 | | (42.3) | % |

Diluted EPS | $ | 0.07 | | | $ | 0.12 | | (40.8) | % |

Adjusted Operating Income | $ | 16,448 | | | $ | 27,780 | | (40.8) | % |

Adjusted Diluted EPS | $ | 0.17 | | | $ | 0.21 | | (19.1) | % |

National Vision noted that its fiscal 2023 second quarter performance was largely in line with its expectations and driven primarily by continued strength from its managed care business and ongoing execution of its strategic initiatives. The year-over-year change in Adjusted Operating Income was primarily driven by the Company’s ongoing investments in strategic initiatives and the normalization of incentive compensation, as the Company expected, partially offset by the timing of certain selling, general and administrative expense as well as lower depreciation expense in the quarter.

The Company also today reaffirmed its fiscal 2023 outlook as previously communicated on May 11, 2023, and, given its year-to-date performance, the Company expects Adjusted Operating Income and Adjusted Diluted Earnings Per Share (EPS) to be at or above the midpoint of its previously provided guidance ranges.

The information provided above includes preliminary estimates of Adjusted Operating Income and Adjusted Diluted EPS, which are non-GAAP financial measures management uses in measuring performance.

Additionally, the fiscal 2023 outlook is forward-looking, subject to significant business, economic, regulatory and competitive uncertainties and contingencies, including constraints on exam capacity, many of which are beyond the control of the Company and its management, and based upon assumptions with respect to future decisions, which are subject to change. The ultimate impact of these factors on the Company’s financial outlook remains uncertain and assumes no material deterioration to the Company’s current business operations as a result of such factors or as a result of the end of the Walmart partnership. Actual results may vary and those variations may be material. As such, the Company’s results may not fall within the ranges contained in its fiscal 2023 outlook. The Company uses these forward-looking measures internally to assess and benchmark its results and strategic plans. See “Forward-Looking Statements” below.

The Company expects to provide more detail on its second quarter 2023 financial results and fiscal-year 2023 outlook on its upcoming conference call on August 10, 2023, at 8:30 a.m. Eastern Time. To pre-register for the conference call and obtain a dial-in number and passcode please refer to the “Investors” section of the Company’s website at www.nationalvision.com/investors. A live audio webcast of the

conference call will be available in the “Investors” section of the Company’s website at www.nationalvision.com/investors, where presentation materials will be posted prior to the conference call. A replay of the audio webcast will also be archived on the “Investors” section of the Company’s website.

About National Vision Holdings, Inc.

National Vision Holdings, Inc. (NASDAQ: EYE) is the second largest optical retail company (by sales) in the United States with over 1,300 stores in 44 states and Puerto Rico. With a mission of helping people by making quality eye care and eyewear more affordable and accessible, the company operates five retail brands: America’s Best Contacts & Eyeglasses, Eyeglass World, Vision Centers inside select Walmart stores, and Vista Opticals inside select Fred Meyer stores and on select military bases, and several e-commerce websites, offering a variety of products and services for customers’ eye care needs.

For more information, please visit www.nationalvision.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, statements related These statements include, but are not limited to, statements contained under “Second Quarter 2023 Preliminary Financial Results and Fiscal 2023 Outlook” as well as other statements related to our current beliefs and expectations regarding the Company’s strategic direction, market position, prospects and future results. You can identify these forward-looking statements by the use of words such as “preliminary,” “guidance,” “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Caution should be taken not to place undue reliance on any forward-looking statement as such statements speak only as of the date when made. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. Forward-looking statements are not guarantees and are subject to various risks and uncertainties, which may cause actual results to differ materially from those implied in forward-looking statements. Such factors include, but are not limited to, those set forth in our Annual Report on Form 10-K under the heading “Risk Factors” and in subsequent filings by National Vision with the SEC. Potential risks and uncertainties include those relating to our ability to recruit and retain vision care professionals, management and retail associates, our ability to compete for managed vision care contracts, our ability to obtain favorable terms, such as discounts and rebates, from optical vendors and generate cash to fund our business and service our debt obligations, and our ability to replace lost Walmart locations with new America’s Best or Eyeglass World stores and support the carrying value of the intangible assets at these brands or replace the lost revenues and cash flows. Additional information about these and other factors that could cause National Vision’s results to differ materially from those described in the forward-looking statements can be found in filings by National Vision with the SEC, including our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this press release and in our filings with the SEC.

Non-GAAP Financial Measures

To supplement the Company’s financial information presented in accordance with GAAP and aid understanding of the Company’s business performance, the Company uses certain non-GAAP financial measures, namely “Adjusted Operating Income,” “Adjusted Diluted EPS,” “EBITDA” and “Adjusted Comparable Stores Sales Growth.” We believe Adjusted Operating Income and Adjusted Diluted EPS and EBITDA assist investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Management believes these non-GAAP financial measures are useful to investors in highlighting trends in our operating performance, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate and capital investments. Management uses these non-GAAP financial measures to supplement GAAP measures of performance in the evaluation of the effectiveness of our business strategies, to make budgeting decisions, to establish discretionary annual incentive compensation and to compare our performance against that of other peer companies using similar measures. Management supplements GAAP results with non-GAAP financial measures to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone.

To supplement the Company’s comparable store sales growth presented in accordance with GAAP, the Company provides “Adjusted Comparable Store Sales Growth,” which is a non-GAAP financial measure we believe is useful because it provides timely and accurate information relating to the two core metrics of retail sales: number of transactions and value of transactions. Management uses Adjusted Comparable Store Sales Growth as the basis for key operating decisions, such as allocation of advertising to particular markets and implementation of special marketing programs. Accordingly, we believe that Adjusted Comparable Store Sales Growth provides timely and accurate information relating to the operational health and overall performance of each brand. We also believe that, for the same reasons, investors find our calculation of Adjusted Comparable Store Sales Growth to be meaningful.

Adjusted Operating Income: We define Adjusted Operating Income as net income, plus interest expense (income), net and income tax provision (benefit), further adjusted to exclude stock-based compensation expense, loss on extinguishment of debt, asset impairment, litigation settlement, secondary offering expenses, management realignment expenses, long-term incentive plan expenses, amortization of acquisition intangibles, and certain other expenses.

Adjusted Diluted EPS: We define Adjusted Diluted EPS as diluted earnings per share, adjusted for the per share impact of stock-based compensation expense, loss on extinguishment of debt, asset impairment, litigation settlement, secondary offering expenses, management realignment expenses, long-term incentive plan expenses, amortization of acquisition intangibles, amortization of debt discounts and deferred financing costs of the term loan borrowings, amortization of the conversion feature and deferred financing costs related to the 2025 Notes when not required under U.S. GAAP to be added back for diluted earnings per share, losses (gains) on change in fair value of derivatives, certain other expenses, and tax expense (benefit) from stock-based compensation, less the tax effect of these adjustments.

EBITDA: We define EBITDA as net income, plus interest expense (income), net, income tax provision (benefit), and depreciation and amortization.

Adjusted Comparable Store Sales Growth: We measure Adjusted Comparable Store Sales Growth as the increase or decrease in sales recorded by the comparable store base in any reporting period, compared to sales recorded by the comparable store base in the prior reporting period, which we calculate as follows: (i) sales are recorded on a cash basis (i.e. when the order is placed and paid for or submitted to a managed care payor, compared to when the order is delivered), utilizing cash basis point of sale information from stores; (ii) stores are added to the calculation during the 13th full fiscal month following the store’s opening; (iii) closed stores are removed from the calculation for time periods that are not comparable; (iv) sales from partial months of operation are excluded when stores do not open or close on the first day of the month; and (v) when applicable, we adjust for the effect of the 53rd week. Quarterly, year-to-date and annual adjusted comparable store sales are aggregated using only sales from all whole months of operation included in both the current reporting period and the prior reporting period. When a partial month is excluded from the calculation, the corresponding month in the subsequent period is also excluded from the calculation. There may be variations in the way in which some of our competitors and other retailers calculate comparable store sales. As a result, our adjusted comparable store sales may not be comparable to similar data made available by other retailers.

Adjusted Operating Income, Adjusted Diluted EPS, EBITDA and Adjusted Comparable Store Sales Growth are not recognized terms under U.S. GAAP and should not be considered as an alternative to net income or the ratio of net income to net revenue as a measure of financial performance, cash flows provided by operating activities as a measure of liquidity, comparable store sales growth as a measure of operating performance, or any other performance measure derived in accordance with U.S. GAAP. Additionally, these measures are not intended to be a measure of free cash flow available for management’s discretionary use as they do not consider certain cash requirements such as interest payments, tax payments and debt service requirements. The presentations of these measures have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of our results as reported under U.S. GAAP. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company.

Please see “Reconciliation of Non-GAAP to GAAP Financial Measures” below for reconciliations of non-GAAP financial measures used in this release to their most directly comparable GAAP financial measures.

National Vision Holdings, Inc. and Subsidiaries

Reconciliation of Non-GAAP to GAAP Financial Measures

In Thousands, Except Earnings Per Share

(Unaudited)

| | | | | | | | |

| Preliminary Reconciliation of Adjusted Operating Income to Net Income |

| Three Months Ended | Three Months Ended |

| In thousands | July 1, 2023 | July 2, 2022 |

| Net income | $ | 5,614 | | $ | 9,734 | |

| Interest expense (income), net | 1,836 | | 3,963 | |

| Income tax provision | 275 | | 4,674 | |

Stock-based compensation expense (a) | 5,473 | | 3,638 | |

Asset impairment (b) | 893 | | 3,509 | |

Amortization of acquisition intangibles (c) | 1,872 | | 1,872 | |

Other (f) | 485 | | 390 | |

| Adjusted Operating Income | $ | 16,448 | | $ | 27,780 | |

| | | | | | | | |

| Preliminary Reconciliation of Adjusted Diluted EPS to Diluted EPS |

| Three Months Ended | Three Months Ended |

| Shares in thousands, except per share amounts | July 1, 2023 | July 2, 2022 |

| Diluted EPS | $ | 0.07 | | $ | 0.12 | |

Stock-based compensation expense (a) | 0.07 | | 0.05 | |

Asset impairment (b) | 0.01 | | 0.04 | |

Amortization of acquisition intangibles (c) | 0.02 | | 0.02 | |

Amortization of debt discount and deferred financing costs (d) | 0.01 | | 0.01 | |

Losses (gains) on change in fair value of derivatives (e) | 0.00 | | (0.01) | |

Other (i) | 0.01 | | 0.00 | |

Tax expense (benefit) from stock-based compensation (g) | 0.00 | | 0.00 | |

Tax effect of total adjustments (h) | (0.03) | | (0.03) | |

| Adjusted Diluted EPS | $ | 0.17 | | $ | 0.21 | |

| | |

| Weighted average diluted shares outstanding | 78,343 | 80,403 |

Note: Some of the totals in the table above do not foot due to rounding differences. |

(a)Non-cash charges related to stock-based compensation programs, which vary from period to period depending on the timing of awards and performance vesting conditions.

(b)Reflects write-off of primarily property, equipment and lease-related assets on closed or underperforming stores.

(c)Amortization of the increase in carrying values of finite-lived intangible assets resulting from the application of purchase accounting to the acquisition of the Company by affiliates of KKR & Co. Inc.

(d)Amortization of deferred financing costs and other non-cash charges related to our long-term debt. We adjust for amortization of deferred financing costs related to the 2025 Notes only when adjustment for these costs is not required in the calculation of diluted earnings per share under U.S. GAAP.

(e)Reflects losses (gains) recognized in interest expense (income), net on change in fair value of de-designated hedges.

(f)Other adjustments include amounts that management believes are not representative of our operating performance (amounts in brackets represent reductions in Adjusted Operating Income and Adjusted Diluted EPS), which are primarily related to excess payroll taxes on vesting of restricted stock units and exercises of stock options, executive severance and relocation and other expenses and adjustments.

(g)Tax expense (benefit) associated with accounting guidance requiring excess tax expense (benefit) related to vesting of restricted stock units and exercises of stock options to be recorded in earnings as discrete items in the reporting period in which they occur.

(h)Represents the income tax effect of the total adjustments at our combined statutory federal and state income tax rates.

(i)Reflects other expenses in (f) above, including debt issuance costs of $0.2 million for the three months ended July 1, 2023.

| | | | | | | | | | | |

Preliminary Reconciliation of Adjusted Comparable Store Sales Growth to

Total Comparable Store Sales Growth |

| Three Months Ended

July 1, 2023 | | Three Months Ended

July 2, 2022 |

| | | |

Total comparable store sales growth (a) | (0.1) | % | | (11.0) | % |

Adjustments for effects of: (b) | | | |

| Unearned & deferred revenue | 1.2 | % | | (1.2) | % |

| Retail sales to Legacy partner’s customers | (0.1) | % | | (0.2) | % |

| Adjusted Comparable Store Sales Growth | 1.0 | % | | (12.4) | % |

(a)Total comparable store sales is calculated based on consolidated net revenue excluding the impact of (i) Corporate/Other segment net revenue, (ii) sales from stores opened less than 13 months, (iii) stores closed in the periods presented, (iv) sales from partial months of operation when stores do not open or close on the first day of the month and (v) if applicable, the impact of a 53rd week in a fiscal year.

(b)There are two differences between total comparable store sales growth based on consolidated net revenue and Adjusted Comparable Store Sales Growth: (i) Adjusted Comparable Store Sales Growth includes the effect of deferred and unearned revenue as if such revenues were earned at the point of sale, resulting in the changes from total comparable store sales growth based on consolidated net revenue as shown in the table above; and (ii) Adjusted Comparable Store Sales Growth includes retail sales to the Legacy partner’s customers (rather than the revenues recognized consistent with the management & services agreement with the Legacy partner), resulting in the changes from total comparable store sales growth based on consolidated net revenue as shown in the table above.

| | | | | | | | |

Reconciliation of EBITDA to Net Income |

| In thousands | | Fiscal Year 2022 |

| Net income | | $ | 42,122 |

| Interest expense | | 462 |

| Income tax provision | | 18,691 |

| Depreciation and amortization | | 99,956 |

| EBITDA | | $ | 161,231 |

| | | | | |

| Investor Contact: | Media Contact: |

| Angie McCabe | Racheal Peters |

| investorrelations@nationalvision.com | media@nationalvision.com |

| (770) 212-7605 | (470) 448-2303 |

v3.23.2

Cover Page

|

Jul. 20, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 20, 2023

|

| Entity Registrant Name |

National Vision Holdings, Inc.

|

| Entity Central Index Key |

0001710155

|

| Amendment Flag |

false

|

| Entity File Number |

001-38257

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

46-4841717

|

| Entity Address, Address Line One |

2435 Commerce Ave.

|

| Entity Address, Address Line Two |

Building 2200

|

| Entity Address, City or Town |

Duluth,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30096

|

| City Area Code |

770

|

| Local Phone Number |

822‑3600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

EYE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

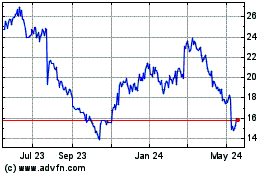

National Vision (NASDAQ:EYE)

Historical Stock Chart

From Mar 2024 to Apr 2024

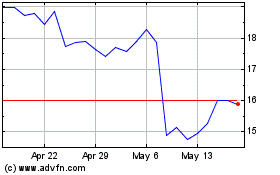

National Vision (NASDAQ:EYE)

Historical Stock Chart

From Apr 2023 to Apr 2024