Deutsche Boerse, NYSE Battle To Keep Merger On Track

December 07 2011 - 12:21PM

Dow Jones News

The planned merger of Deutsche Boerse AG (DB1.XE) and NYSE

Euronext (NYX) is facing severe challenges despite the efforts of

the two exchange operators to appease European regulators by

reducing their hold on more of their prized derivatives assets.

The companies have insisted they would drop the deal if forced

to offload their Liffe and Eurex derivatives arms completely, but

have floated smaller-scale asset disposals in a bid to secure

approval from officials at the European Commission.

A person familiar with the situation said Wednesday that the

merger partners are considering further moves after Commission

officials gave a cool reception to an initial offer that included

allowing rivals to access the Eurex clearinghouse for transactions

and selling their overlapping European options operations.

The planned merger would create the world's largest venue for

trading listed stocks and derivatives, but the dominant scale of

its European futures and options arms has concerned regulators at a

time when the region is pushing ahead with further liberalization

of the financial sector.

A final decision is expected from the Commission in mid-January,

and the prospect of forced asset sales has attracted some interest

from rivals opposed to the combination.

The head of Nasdaq OMX Group Inc. (NDAQ) said Wednesday that he

remained interested in acquiring NYSE's Liffe arm, but isn't

interested in the European equity derivatives that the merger

partners have already offered to sell.

Nasdaq and IntercontinentalExchange Inc. (ICE) unsuccessfully

sought to break up the NYSE-Deutsche Boerse deal earlier this year

by buying the Big Board operator. Their proposal would have seen

Nasdaq acquire the securities business while ICE took on the

derivatives operation.

London Stock Exchange Group PLC (LSE.LN), which is expanding its

own small derivatives arm, declined to comment on any potential

interest in acquiring assets from NYSE and its German partner.

"We've never been against the [DB-NYSE] deal. But we will

support anything which promotes competition and choice for

customers in the European market," said a spokeswoman from the

London Stock Exchange.

NYSE shares were recently down 4.6% at $27.07, with Deutsche

Boerse--whose shareholders would control 60% of the enlarged

entity--down 3.2% at 43.11 euros.

-By Joern Rehren, Dow Jones Newswires; 49-69-29725-511;

joern.rehren@dowjones.com

-By Jacob Bunge, Dow Jones Newswires; 312-750-4117;

jacob.bunge@dowjones.com

--Vladimir Guevarra contributed to this article.

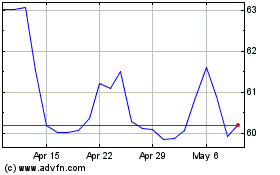

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From May 2024 to Jun 2024

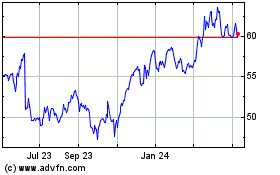

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Jun 2023 to Jun 2024