0000899923false00008999232023-12-152023-12-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 15, 2023

MYRIAD GENETICS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 0-26642 | | 87-0494517 |

(State or other jurisdiction of

incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

322 North 2200 West

Salt Lake City, Utah 84116

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (801) 584-3600

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | MYGN | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Departure of Chief Financial Officer

On December 15, 2023, R. Bryan Riggsbee, Chief Financial Officer and principal financial officer of Myriad Genetics, Inc. (the “Company”) and the Company mutually reached an agreement that Mr. Riggsbee would step down from such position, effective upon the earlier of (1) the date that a new Chief Financial Officer and principal financial officer commences his or her employment at the Company and (2) January 31, 2024.

In connection with Mr. Riggsbee’s departure, the Company and Mr. Riggsbee entered into a Separation and Consulting Agreement and Release of Claims, dated December 15, 2023 (the “Separation Agreement”). Pursuant to the terms of the Separation Agreement, Mr. Riggsbee will remain an employee of the Company until January 31, 2024, upon which he will transition to providing consulting services to the Company until March 31, 2024 (the “Separation Date” and such period, the “Consulting Period”). During the Consulting Period, Mr. Riggsbee will receive a weekly consulting fee of $2,713.65. In consideration for, among other things, his compliance with certain restrictive covenants, including customary non-compete and non-solicitation covenants, and a typical release of claims, (1) Mr. Riggsbee will be entitled to continued vesting of all outstanding performance and time-based restricted stock units previously granted to Mr. Riggsbee that are scheduled to vest during the Consulting Period (“Equity Awards Vesting During the Consulting Period”); (2) all outstanding time-based restricted stock units previously granted to Mr. Riggsbee, other than Equity Awards Vesting During the Consulting Period, will be deemed to vest in monthly installments over the applicable vesting period starting on the grant date (“RSUs Vesting Monthly”) and all such RSUs Vesting Monthly shall vest on the Separation Date to the extent scheduled to vest as modified on or before the date one year following the Separation Date; and (3) all outstanding restricted stock units with unsatisfied performance conditions (“PSUs”) previously granted to Mr. Riggsbee, other than Equity Awards Vesting During the Consulting Period, will remain outstanding and, if the applicable performance condition is satisfied on or before the date one year following the Separation Date, such PSUs will, to the extent so earned, vest to the extent scheduled to vest within such one-year period upon satisfaction of such performance-based condition. Mr. Riggsbee will also be eligible to receive an annual bonus for fiscal year 2023, as determined by the Compensation and Human Capital Committee (the “CHCC”) of the Board of Directors of the Company (the “Board”).

Mr. Riggsbee’s departure is not the result of any disagreement with the Company on any matter related to the Company's operations, policies or procedures.

The foregoing description of the Separation Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Separation Agreement, a copy of which will be filed with the Company's Annual Report on Form 10-K for the fiscal year ending December 31, 2023.

Appointment of a New Chief Financial Officer

On December 15, 2023, the Board appointed Scott J. Leffler (“Mr. Leffler”) as the Company's Chief Financial Officer and principal financial officer, effective as of his first date of employment, January 29, 2024. Mr. Leffler’s appointment as Chief Financial Officer and principal financial officer was announced by the Company via press release on December 21, 2023.

Mr. Leffler, 48, has served as Chief Financial Officer of Clover Health Investments, Corp. (“Clover Health”) since July 2022. Before joining Clover Health, Mr. Leffler served as Chief Financial Officer and Treasurer of Sotera Health, a provider of sterilization, lab testing and advisory services for the healthcare industry, from April 2017 to July 2022. Prior to joining Sotera Health, Mr. Leffler served as Chief Financial Officer at Exal Corporation (now called Trivium Packaging) and held various financial leadership positions at PolyOne Corporation (now called Avient). Mr. Leffler holds a B.A. in economics from Yale University and an M.B.A. from Emory University and is both a Certified Public Accountant (inactive) and a Certified Treasury Professional (inactive).

There are no arrangements or understandings between Mr. Leffler and any other person pursuant to which he was appointed as an officer of the Company. Mr. Leffler does not have any family relationship with any director or other executive officer of the Company and is not party to any related party transactions required to be reported pursuant to Item 404(a) of Regulation S-K.

In connection with his appointment, the Company entered into an employment agreement with Mr. Leffler, dated December 15, 2023 (the “Employment Agreement”), setting forth Mr. Leffler’s compensation, certain other terms, and the commencement of his employment on January 29, 2024 (the “Commencement Date”). Pursuant to the Employment Agreement, Mr. Leffler will be paid an annual base salary of $550,000. Mr. Leffler will be eligible to receive an annual target cash bonus equal to 75% of his annual base salary upon achievement of goals to be established by the CHCC or the Chief Executive Officer each fiscal year and will be eligible to participate in the Company’s annual long-term incentive compensation program. In addition, Mr. Leffler will be entitled to a sign-on bonus in the amount of $400,000, which will be paid on the next regularly scheduled payroll date following the Commencement Date, portions of which are subject to clawback in the event of a termination for certain reasons before the first and second anniversaries of the commencement of Mr. Leffler’s employment. Mr. Leffler will also be eligible to participate in the standard health, welfare and retirement benefit plans that are applicable to similarly situated executives of the Company. The Employment Agreement also provides for an initial one-time grant of restricted stock units (the "Initial RSU Grant") to Mr. Leffler in connection with the commencement of his employment. The Initial RSU Grant will be granted on the Commencement Date, as to a number of RSUs equal to (1) $1.25 million divided by the closing price of a share of Company common stock on the Nasdaq Stock Market on the last trading day before the Commencement Date and (2) $1.25 million divided by the closing price of a share of Company common stock on the Nasdaq Stock Market on the last trading day before the date on which the Company makes public disclosure of Mr. Leffler being hired. The Employment Agreement also provides that Mr. Leffler will be eligible in 2024 for a grant of an additional equity award of restricted stock units ("RSUs") valued at approximately $2 million (based on the closing price of a share of Company common stock on the Nasdaq Stock Market on the last trading day before the grant date) in accordance with the Company’s annual equity grant cycle, with such award consisting of (i) 50% RSUs subject to standard time-based vesting and (ii) 50% RSUs subject to vesting upon meeting certain performance metrics and standard time-based vesting, as determined by the CHCC in its sole discretion.

The Company and Mr. Leffler also entered into the Company's standard Employee Invention Assignment, Confidentiality, and Restrictive Covenants Agreement and will enter into a Severance and Change of Control Agreement and the Company's standard Indemnification Agreement for executive officers upon the commencement of Mr. Leffler’s employment with the Company.

The foregoing description of the Employment Agreement does not purport to be complete and is qualified in its entirety by the full text of such agreement, a copy of which will be filed with the Company's Annual Report on Form 10-K for the fiscal year ending December 31, 2023.

ITEM 7.01 Regulation FD Disclosure.

A copy of the press release announcing Mr. Riggsbee’s departure and Mr. Leffler’s appointment as Chief Financial Officer and principal financial officer on December 21, 2023 is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

ITEM 9.01 Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| MYRIAD GENETICS, INC. |

| | |

| Date: December 21, 2023 | By: | /s/ R. Bryan Riggsbee |

| | R. Bryan Riggsbee |

| | Chief Financial Officer |

| | |

Myriad Genetics Chief Financial Officer Bryan Riggsbee Retires; Scott Leffler Appointed as Successor; Reiterates Previously Issued Financial Guidance SALT LAKE CITY, Dec. 21, 2023 – Myriad Genetics, Inc., (NASDAQ: MYGN), a leader in genetic testing and precision medicine, today announced the appointment of Scott Leffler as Chief Financial Officer (CFO), effective January 29, 2024. Leffler will succeed Myriad CFO Bryan Riggsbee who is retiring. Riggsbee will continue as a strategic advisor through March 31, 2024, to ensure a smooth transition. Riggsbee joined Myriad in 2014 as CFO. During his nine-year tenure, he has made significant contributions to Myriad’s growth strategy and business transformation. In 2020, he served for six months as Myriad’s interim CEO, navigating the business and supporting teammates through the height of the pandemic. “I want to extend my gratitude to Bryan for his leadership and the key role he has played in shaping our business over the past nine years,” said Paul J. Diaz, president and CEO, Myriad Genetics. “His vision and financial acumen were critical components to the successful execution of our transformation plan and bringing focus to our three core business units. We thank him for setting the stage for business success and wish him all the best in his next chapter.” Leffler brings to Myriad nearly 20 years of finance experience, across a broad range of healthcare and payer market segments at both public and private equity-backed companies. Leffler has held numerous financial leadership positions and brings expertise in finance transformation, acquisitions and integrations, as well as risk management. In his role as CFO, he is responsible for leading the company’s financial team and strategy to support the advancement of Myriad’s long-term growth and profitability. “We are pleased to welcome Scott to Myriad. He is a thoughtful and focused leader who has a proven track record of financial leadership, strategy and execution resulting in notable business growth,” said Diaz. “With his strategic vision, analytical curiosity and industry expertise, Scott will play an important role in building on our Media Contact: Glenn Farrell (385) 318-3718 PR@myriad.com Investor Contact: Matt Scalo (801) 584-3532 IR@myriad.com

business foundation to accelerate profitability, financial performance and innovation.” Leffler previously served as the CFO of Clover Health. Prior to Clover Health, he was CFO and Treasurer at Sotera Health. He earned his B.A. in economics and history from Yale University and an M.B.A. from Emory University. At its third quarter 2023 earnings call on November 6, Myriad updated its 2023 financial guidance and introduced 2024 revenue guidance. Myriad reiterates the guidance provided at that time. About Myriad Genetics Myriad Genetics is a leading genetic testing and precision medicine company dedicated to advancing health and well-being for all. Myriad develops and offers genetic tests that help assess the risk of developing disease or disease progression and guide treatment decisions across medical specialties where genetic insights can significantly improve patient care and lower healthcare costs. For more information, visit www.myriad.com. Safe Harbor Statement This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements concerning 2023 financial guidance and 2024 revenue guidance. These “forward-looking statements” are management’s present expectations of future events as of the date hereof and are subject to a number of known and unknown risks and uncertainties that could cause actual results, conditions, and events to differ materially and adversely from those anticipated. These risks include, but are not limited to: the risk that sales and profit margins of the company’s existing tests may decline or that the company may not be able to operate its business on a profitable basis; risks related to the company’s ability to achieve certain revenue growth targets and generate sufficient revenue from its existing product portfolio or in launching and commercializing new tests to be profitable; risks related to changes in governmental or private insurers’ coverage and reimbursement levels for the company’s tests or the company’s ability to obtain reimbursement for its new tests at comparable levels to its existing tests; risks related to increased competition and the development of new competing tests; the risk that the company may be unable to develop or achieve commercial success for additional tests in a timely manner, or at all; the risk that the company may not successfully develop new markets or channels for its tests, including the company’s ability to successfully generate substantial revenue outside the United States; the risk that licenses to the technology underlying the company’s tests and any future tests are terminated or cannot be maintained on satisfactory terms; risks related to delays or other problems with constructing and operating the company’s laboratory testing facilities; risks related to public concern over genetic testing in general or the company’s tests in particular; risks related to regulatory

requirements or enforcement in the United States and foreign countries and changes in the structure of the healthcare system or healthcare payment systems; risks related to the company’s ability to obtain new corporate collaborations or licenses and acquire or develop new technologies or businesses on satisfactory terms, if at all; risks related to the company’s ability to successfully integrate and derive benefits from any technologies or businesses that it licenses, acquires or develops; the risk that the company is not able to secure additional financing to fund its business, if needed, in a timely manner or on favorable terms, if it all; risks related to the company’s projections or estimates about the potential market opportunity for the company’s current and future products; the risk that the company or its licensors may be unable to protect or that third parties will infringe the proprietary technologies underlying the company’s tests; the risk of patent-infringement claims or challenges to the validity of the company’s patents; risks related to changes in intellectual property laws covering the company’s tests, or patents or enforcement, in the United States and foreign countries; risks related to security breaches, loss of data and other disruptions, including from cyberattacks; risks of new, changing and competitive technologies in the United States and internationally and that the company may not be able to keep pace with the rapid technology changes in its industry, or properly leverage new technologies to achieve or sustain competitive advantages in its products; the risk that the company may be unable to comply with financial operating covenants under the company’s credit or lending agreements; risks related to the company’s inability to achieve and maintain effective disclosure controls and procedures and internal control over financial reporting; risks related to current and future investigations, claims or lawsuits, including derivative claims, product or professional liability claims, and other factors discussed under the heading “Risk Factors” contained in Item 1A of the company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (SEC) on March 1, 2023 as updated in the company's Quarterly Report on Form 10-Q filed with the SEC on May 4, 2023, the company's Quarterly Report on Form 10-Q filed with the SEC on August 4, 2023, and the company’s Quarterly Report on Form 10-Q filed with the SEC on November 7, 2023, as well as any further updates to those risk factors filed from time to time in the company’s Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. Myriad Genetics is not under any obligation, and it expressly disclaims any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise except as required by law. Investor Contact Matt Scalo (801) 584-3532 IR@myriad.com Media Contact Glenn Farrell (385) 318-3718 PR@myriad.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

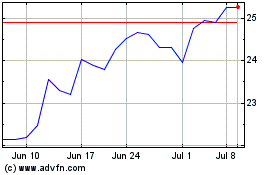

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Apr 2024 to May 2024

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From May 2023 to May 2024