240.14a-103 Notice of Exempt Solicitation

U.S. Securities and Exchange Commission, Washington DC 20549

NAME OF REGISTRANT: Monro, Inc.

NAME OF PERSON RELYING ON EXEMPTION: Ides Capital Management LP

ADDRESS OF PERSON RELYING ON EXEMPTION: 3 Columbus Circle, Suite 1636, New York,

NY 10019

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the

Securities Exchange Act of 1934.*

*Submission is not required of this filer under the terms of the Rule, but is made

voluntarily in the interest of public disclosure and consideration of these important issues.

This is not a solicitation of authority to vote your proxy. Please

DO NOT send us your proxy card; the Proponent is not able to vote your proxies, nor does this communication contemplate such an event.

The proponent urges shareholders to vote YES on item number 5 following the instruction provided on the Management’s proxy mailing.

Investors with questions may contact us at dmckeever@idescapital.com

or contact our information agent, Okapi Partners, via phone at (844) 343-2623 or via E-mail at info@okapipartners.com.

July 19, 2021

Dear Monro, Inc. Shareholders,

At the Monro, Inc. (MNRO) Annual Meeting of Shareholders on August 17, 2021 please

vote FOR: Item #5 – Shareholder Proposal – Proposal for Board to Adopt Recapitalization Plan.

The Resolution:

RESOLVED: Shareholders request that our Board take all practicable

steps in its control to initiate and adopt a recapitalization plan for all outstanding classes of stock to have one vote per share in

each voting situation and eliminate any veto power held by one class of stock over the voting power of another class of stock.

Summary and Rationale For Your Support

Overview of Monro’s Undemocratic and Unequal Voting Rights

Our Company has two classes of stock:

|

|

·

|

Common Stock, representing approximately 98% of the economic ownership of the Company as of the date when this proposal was filed,

and

|

|

|

·

|

Class C Convertible Preferred Stock (the “Class C Preferred”), representing approximately 2% of the economic ownership

of the Company as of the date when this proposal was filed.

|

As Monro’s own Proxy Statement discloses, the holders of the Class

C Preferred “have an effective veto over all matters put to a vote of

our common shareholders, and could use that veto power to block any matter

that our common shareholders may approve at the Annual Meeting.”

This is not a solicitation of authority to vote your proxy. Please

DO NOT send us your proxy card; the Proponent is not able to vote your proxies, nor does this communication contemplate such an event.

The proponent urges shareholders to vote YES on item number 5 following the instruction provided on the Management’s proxy mailing.

Investors with questions may contact us at dmckeever@idescapital.com

or contact our information agent, Okapi Partners, via phone at (844) 343-2623 or via E-mail at info@okapipartners.com.

Monro’s Class C Preferred – A Corporate Golden Share

Monro’s Class C Preferred structure could be described as a corporate golden

share – in other words, it appears that only one share of the Class C Preferred need exist for its owners to retain and exercise

an exclusive veto power. And this structural possibility could soon be borne out in reality, as the owners of the Class C Preferred regularly

convert their Class C Preferred into Common Stock, which, in turn, they often sell into the market. In fact, today, the owners of the

Class C Preferred are reduced to a single individual – Monro, Inc. Director Peter J. Solomon - and entities related to him. But

whether owned by a single individual or smaller group, the existence of these preferred rights in-and-of-itself is problematic.

In granting certain shares a veto right over common shareholders, Monro does not afford its common shareholders any guaranteed voice in

our Company’s governance.

It is, however, worth noting that under the current status quo, it is conceivable

that a single individual could retain one share of Monro’s Class C Preferred – a share worth, at today’s

market valuation, approximately $1,500 – and could veto the affirmative will of a majority of Monro’s common shareholders

whose current economic interests in Monro total approximately $2,100,000,000, or $2.1 billion.

Companies with Dual-Class Structures Underperform Over the Long-Term and Monro

is No Exception

Study after study establishes the long-term underperformance of companies with dual-class

share structures and most especially those that are “perpetual” and lack “sunset provisions”, as is the case at

Monro. As one example, in a speech titled “Perpetual Dual-Class Stock: The Case Against Corporate Royalty” and within its

corresponding Data Appendix, former SEC Commissioner Robert J. Jackson Jr. highlighted that “the valuations of firms with perpetual

dual-class stock at least three years after IPO are 37% lower (= 0.66 / 1.783) than the valuations of firms with sunset provisions in

these years.”1

And Monro, to the detriment of its long-suffering shareholders, is the rule rather

than the exception. Monro’s stock price has underperformed when compared with the Russell 2000 Index over the past 1, 3, 5

and 10 years.2

|

Time Period (Years)

|

Monro, Inc.

Performance

|

Russell 2000

Performance

|

Monro, Inc.

Underperformance

|

|

1

|

3.7%

|

48.2%

|

(44.5%)

|

|

3

|

(5.7%)

|

30.5%

|

(36.2%)

|

|

5

|

(2.1%)

|

81.7%

|

(83.8%)

|

|

10

|

68.7%

|

164.3%

|

(95.6%)

|

Governance experts are largely in agreement that these types of preferential share

classes, if they are to exist at all, should, at a minimum, have limits. As one example, the Council of Institutional Investors (CII)

recommends a seven-year phase-out for share offerings where there is more than one class of shares.3 Since Monro’s IPO

was nearly 30 years ago, we are well-past these organizations’ suggested timelines, yet the Board has failed to act.

_____________________________

1 https://www.sec.gov/files/case-against-corporate-royalty-data-appendix.pdf

2 Price performance data from Bloomberg and calculated on a trailing basis

as of 7/15/2021

3 https://www.cii.org/dualclass_stock

This is not a solicitation of authority to vote your proxy. Please

DO NOT send us your proxy card; the Proponent is not able to vote your proxies, nor does this communication contemplate such an event.

The proponent urges shareholders to vote YES on item number 5 following the instruction provided on the Management’s proxy mailing.

Investors with questions may contact us at dmckeever@idescapital.com

or contact our information agent, Okapi Partners, via phone at (844) 343-2623 or via E-mail at info@okapipartners.com.

Monro’s Own Board Will Not Defend the Class C Preferred Yet Seemingly

Remains Beholden to its Owner

It is telling that within the Proxy Statement, Monro’s Board of Directors does

not oppose and instead makes “No Recommendation” to shareholders with respect to voting on Ides’ Proposal (Item #5)

that the Board adopt and initiate a recapitalization plan. One can read between the lines and speculate that Monro’s own Board of

Directors is aware that the Class C Preferred structure is retrograde and likely harmful to shareholders.

In spite of the Board’s unwillingness to defend the Class C Preferred, Monro’s

Proxy Statement goes on to disclose that the Board expects “that the holders of the Class C Preferred Stock will approve, by unanimous

written consent, Proposal Nos.1–4 being put to a vote of our common shareholders at the Annual Meeting.” There is a glaring

omission of expected support for Proposal 5 by the holders of the Class C Preferred. Implicit in this conspicuous omission is the likelihood

that the owner of the Class C Preferred – Monro, Inc. Director Peter J. Solomon –may exercise his veto power over the potential

affirmative vote of common shareholders on Proposal 5.

There is perhaps no clearer sign of the immense threat to Monro’s shareholders

encompassed by the rights associated with the Class C Preferred than the paradox at hand and on clear display within the Company’s

own Proxy Statement - a Board that, at least on balance, declined to defend the indefensible Class C Preferred and stands by in silence

while a single Director may contemplate overriding the potential will of a majority of common shareholders.

The rights and most especially the singular veto power associated with Monro’s

Class C Preferred are the embodiment of a conflict that Directors’ fiduciary duties are actually designed to thwart – the

agency problem. We remind Monro’s entire Board that a corporate fiduciary’s obligations to his principals are never subordinated

by an ownership interest in the Company, even one that is Preferred.

Monro’s Common Shareholders Deserve a Guaranteed Voice in Our Company’s

Governance

An unassailable majority vote by Monro’s common shareholders is the safeguard

of our ability to provide effective and democratic feedback to Management and the Board. Monro’s dual-class share structure is one

where common shareholders have no guaranteed voting power, and without any guaranteed voting power we cannot hold Management and the Board

accountable. This is a perfect storm and one that enables Monro’s fiduciaries to potentially entrench themselves.

Monro’s current governance structures and shareholder rights are especially

weak, as judged by experts. For example, on a scale of 1 to 10 where 10 represents the worst possible score, Institutional Shareholder

Services (ISS) assigns Monro’s Shareholder Rights a Pillar Score of 9. This score is appropriate, as there are many areas of Monro’s

corporate governance that not only lag current best practices but are unchangeable by Monro’s common shareholders without a 60%

approval by the Class C Preferred. Examples include the classified board structure, the inability for common shareholders to call special

meetings, the inability for common shareholders to amend the charter by a simple majority and the inability of common shareholders to

adopt proxy access, amongst others.

Monro’s recent Annual Meeting voting results, moreover, make clear that common

shareholders are dissatisfied with the current structure as manifested in the low levels of support for certain Directors. As one example,

Director Donald Glickman (who has served as a Monro Director for approximately 37 years) garnered only 69.8% percent of votes cast at

last year’s Annual Meeting. This low level of support puts him within the bottom 2% of all directors in the Russell 3000 with meetings

held during calendar year 2020.4

_____________________________

4 ICS Voting Analytics

This is not a solicitation of authority to vote your proxy. Please

DO NOT send us your proxy card; the Proponent is not able to vote your proxies, nor does this communication contemplate such an event.

The proponent urges shareholders to vote YES on item number 5 following the instruction provided on the Management’s proxy mailing.

Investors with questions may contact us at dmckeever@idescapital.com

or contact our information agent, Okapi Partners, via phone at (844) 343-2623 or via E-mail at info@okapipartners.com.

Monro’s common shareholders should have a guaranteed vote on governance and

policy matters, which we believe will benefit not only shareholders but Monro’s broader and similarly long-suffering stakeholder

base. We encourage common shareholders to send a strong signal to Monro by affirmatively voting that the Board take immediate action to

initiate and adopt a recapitalization plan to ensure that all outstanding classes of stock have one vote per share and no class has a

veto right over the votes of another class.

We urge you to vote “FOR” proxy item #5.

Should you have any proposal-specific questions, please feel free to contact us at

dmckeever@idescapital.com or reach out to our information agent, Okapi Partners, via phone at (844) 343-2623 or via E-mail at info@okapipartners.com.

Thank you for your support.

Sincerely,

|

|

/s/ Dianne K. McKeever

|

|

|

|

Dianne K. McKeever

CIO, Co-Founder and Managing Member

|

|

|

|

Ides Capital Management LP

|

|

Ides Capital Management LP has filed the proposal on behalf of Ides Capital Partners

Master Fund, Ltd., which is a beneficial owner of shares of the Company’s common stock.

This is not a solicitation of authority to vote your proxy.

Please DO NOT send us your proxy card.

This is not a solicitation of authority to vote your proxy. Please DO NOT send us

your proxy card; Ides Capital Management LP is not able to vote your proxies, nor does this communication contemplate such an event. We

urge shareholders to vote for Item No. 5 following the instructions provided on Management's proxy mailing.

This is not a solicitation of authority to vote your proxy. Please

DO NOT send us your proxy card; the Proponent is not able to vote your proxies, nor does this communication contemplate such an event.

The proponent urges shareholders to vote YES on item number 5 following the instruction provided on the Management’s proxy mailing.

Investors with questions may contact us at dmckeever@idescapital.com

or contact our information agent, Okapi Partners, via phone at (844) 343-2623 or via E-mail at info@okapipartners.com.

The views expressed are those of the authors and Ides Capital Management LP as of

the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be a forecast

of future events or a guarantee of future results. These views may not be relied upon as investment advice. The information provided in

this material should not be considered a recommendation to buy or sell any of the securities mentioned. It should not be assumed that

investments in such securities have been or will be profitable. This piece is for informational purposes and should not be construed as

a research report.

This is not a solicitation of authority to vote your proxy. Please

DO NOT send us your proxy card; the Proponent is not able to vote your proxies, nor does this communication contemplate such an event.

The proponent urges shareholders to vote YES on item number 5 following the instruction provided on the Management’s proxy mailing.

Investors with questions may contact us at dmckeever@idescapital.com

or contact our information agent, Okapi Partners, via phone at (844) 343-2623 or via E-mail at info@okapipartners.com.

6

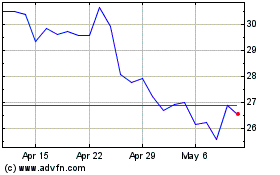

Monro (NASDAQ:MNRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

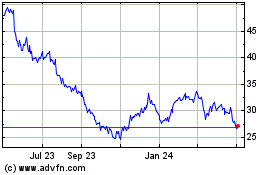

Monro (NASDAQ:MNRO)

Historical Stock Chart

From Nov 2023 to Nov 2024