MarketAxess Receives Approval From Dutch Regulator to Provide Trading Platform and Regulatory Reporting Services in the Euro...

February 27 2019 - 3:00AM

MarketAxess Holdings Inc. (Nasdaq:MKTX), the operator of a leading

global electronic trading platform for fixed-income securities and

provider of market data and post-trade services, announced today

that its group entities have received approval from the Dutch

regulator, the AFM, to operate a Multilateral Trading Facility

(MTF) and act as a Data Reporting Service Provider (DRSP) in the

Netherlands.

The services to EU clients will be provided by

new subsidiaries located in Amsterdam: MarketAxess NL B.V. for the

MTF; and Trax NL B.V. for the post-trade data reporting, acting as

a provider of both Approved Publication Arrangement (APA) and

Approved Reporting Mechanism (ARM) services. Importantly, the MTF

approval includes permissions for MarketAxess to provide its unique

Open Trading™ all-to-all execution service to clients in the EU,

giving those clients ready access to an existing broad pool of

cross-border liquidity.

The AFM’s approval, alongside MarketAxess’s

existing FCA regulatory permissions to provide MTF and DRSP

services to UK customers, ensures that MarketAxess is able to

provide UK and EU clients with uninterrupted service and access to

liquidity post-Brexit. MarketAxess expects the same range of

dealers and liquidity will be available on the EU MTF when compared

to the UK MTF. This level of continuous service will ensure that

MarketAxess clients can confidently comply with their regulatory

obligations, even if divergent transparency and transaction

reporting regimes are introduced following Brexit.

“We’re always looking ahead to anticipate future

client needs. That means not just developing award-winning trade

execution and reporting technologies, but also knowing how to

deliver those technologies to clients in any regulatory

environment,” says Christophe Roupie, Head of Europe and Asia for

MarketAxess and Trax. “Recognising the potential impact of Brexit

on European financial markets, we were one of the first movers in

establishing an office in the Netherlands. Receiving approval from

the AFM further demonstrates our commitment to ensuring that our

clients receive the same level of service and access to liquidity

post-Brexit.”

About MarketAxess

MarketAxess operates a leading electronic

trading platform that enables fixed income market participants to

efficiently trade corporate bonds and other types of fixed-income

instruments using MarketAxess' patented trading technology. Over

1,500 institutional investor and broker-dealer firms are active

users of the MarketAxess trading platform, accessing global

liquidity in U.S. high-grade corporate bonds, emerging markets and

high-yield bonds, European bonds, U.S. agency bonds, municipal

bonds, credit default swaps and other fixed-income securities.

MarketAxess also offers a number of trading-related products and

services, including: market data to assist clients with trading

decisions; connectivity solutions that facilitate straight-through

processing; technology services to optimize trading environments;

and execution services for exchange-traded fund managers and other

clients. Through its Trax® division, MarketAxess also offers a

range of pre- and post-trade services, including trade matching,

regulatory reporting and market and reference data, across a range

of fixed-income products. Trax is the trading name of Xtrakter

Limited and Trax NL B.V., both MarketAxess group companies.

MarketAxess maintains its headquarters in New

York and has offices in London, Amsterdam, Boston, Chicago, Los

Angeles, Miami, Salt Lake City, San Francisco, São Paulo, Hong Kong

and Singapore. For more information, please visit

www.marketaxess.com.

Media Relations

Contacts:MarketAxess Holdings Inc.Toby West+44 (0)20 7709

3270 TWest@marketaxess.com

Cognito:Paul Bowhay+44 (0)20 7426

9417Paul.Bowhay@cognitomedia.com

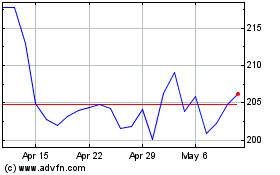

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

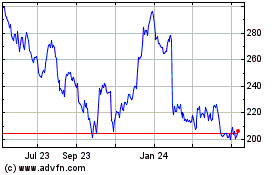

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024