Lifeway Foods, Inc. (Nasdaq: LWAY) (“Lifeway” or “the Company”),

the leading U.S. supplier of kefir and fermented probiotic products

to support the microbiome, today reported financial results for the

fourth quarter and full year ended December 31, 2020.

“I am very pleased to report another exciting

and strong year of growth here at Lifeway, particularly in light of

this difficult year defined by the COVID-19 pandemic,” commented

Julie Smolyansky, CEO and President of Lifeway. “Of note, our net

sales grew 8.9% to $102.0 million compared to 2019, and our net

income increased from $0.5 million in 2019 to $3.2 million in

2020. The food retail environment has been majorly reshaped this

year, and our decision to focus on digital engagement has paid

dividends in continuing to attract more and more consumers to our

multi-serve, immune supporting products. I am very encouraged by

the ongoing market trends towards healthy products like Lifeway’s,

and I believe this momentum will carry on far past just 2021. Our

current retail partnerships are seeing gains, illustrated by our

strong results, as we continue to enhance category growth, and we

plan on both expanding the current and identifying new profitable

relationships in the year ahead. Finally, this year we will

continue to invest in customer acquisition strategies because we

want more and more people to hear the Lifeway story. We are looking

forward to an outstanding 2021.”

Full Year 2020 Results

Net sales were $102.0 million for the year ended

December 31, 2020, an increase of $8.4 million or 8.9% versus prior

year. The net sales increase was primarily driven by higher volumes

of our branded drinkable kefir, partially offset by lower cream

revenues associated with a decline in the market price of butter

fat.

Gross profit as a percentage of net sales

increased to 26.4% for the year ended December 31, 2020 from 23.6%

during the same period in 2019. The increase versus the prior year

was primarily due to the impact of favorable milk pricing, and to a

lesser extent favorable freight costs.

Selling expenses decreased $0.9 million, or 7.8%, to $10.2

million for the year ended December 31, 2020 from $11.1 million in

2019. Selling expenses as a percentage of net sales were 10.0% in

2020 compared to 11.8% in 2019.

General and administrative expenses decreased

$1.2 million, or 9.1%, to $11.7 million for the year ended December

31, 2020 from $12.8 million during the same period in 2019. The

decrease is primarily a result of lower compensation expense due to

organizational changes made in 2019 and lower incentive

compensation, partially offset by increased professional fee

expense.

Income tax expense was $1.6 million for the year

ended December 31, 2020, compared to $0.8 million during the same

period in 2019. Our effective income tax rate (ETR) for the year

ended December 31, 2020 was 33.1% compared to an ETR of 63.3% in

the same period last year.

The Company reported net income of $3.2 million

or $0.21 per basic and diluted common share for the year ended

December 31, 2020 compared to a net income of $0.5 million or $0.03

per basic and diluted common share in 2019.

About Lifeway Foods, Inc.

Lifeway Foods, Inc., which has been recognized

as one of Forbes’ Best Small Companies, is America’s leading

supplier of the probiotic, fermented beverage known as kefir. In

addition to its line of drinkable kefir, the company also produces

frozen kefir, specialty cheeses, and a ProBugs line for kids.

Lifeway’s tart and tangy fermented dairy products are now sold

across the United States, Mexico, Ireland and the United Kingdom,

with limited distribution in additional countries. Learn how

Lifeway is good for more than just you at www.lifewaykefir.com.

Forward-Looking Statements

This release (and oral statements made regarding

the subjects of this release) contains “forward-looking statements”

as defined in the Private Securities Litigation Reform Act of 1995

regarding, among other things, future operating and financial

performance, product development, market position, business

strategy and objectives. These statements use words, and variations

of words, such as “continue,” “build,” “future,” “increase,”

“drive,” “believe,” “look,” “ahead,” “confident,” “deliver,”

“outlook,” “expect,” and “predict.” Other examples of forward

looking statements may include, but are not limited to, (i)

statements of Company plans and objectives, including the

introduction of new products, or estimates or predictions of

actions by customers or suppliers, (ii) statements of future

economic performance, and (III) statements of assumptions

underlying other statements and statements about Lifeway or its

business. You are cautioned not to rely on these forward-looking

statements. These statements are based on current expectations of

future events and thus are inherently subject to uncertainty. If

underlying assumptions prove inaccurate or known or unknown risks

or uncertainties materialize, actual results could vary materially

from Lifeway’s expectations and projections. These risks,

uncertainties, and other factors include: price competition; the

decisions of customers or consumers; the actions of competitors;

changes in the pricing of commodities; the effects of government

regulation; possible delays in the introduction of new products;

and customer acceptance of products and services. A further list

and description of these risks, uncertainties, and other factors

can be found in Lifeway’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2020, and the Company’s subsequent filings

with the SEC. Copies of these filings are available online at

https://www.sec.gov, http://lifewaykefir.com/investor-relations/,

or on request from Lifeway. Information in this release is as of

the dates and time periods indicated herein, and Lifeway does not

undertake to update any of the information contained in these

materials, except as required by law. Accordingly, YOU SHOULD NOT

RELY ON THE ACCURACY OF ANY OF THE STATEMENTS OR OTHER INFORMATION

CONTAINED IN ANY ARCHIVED PRESS RELEASE.

Contact:

Lifeway Foods, Inc.Phone: 847-967-1010Email:

info@lifeway.net

LIFEWAY FOODS, INC. AND

SUBSIDIARIESConsolidated Balance

SheetsDecember 31, 2020 and

2019(In thousands)

| |

|

December 31, |

|

| |

|

2020 |

|

|

2019 |

|

Current assets |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

7,926 |

|

|

|

$ |

3,836 |

|

|

Accounts receivable, net of allowance for doubtful accounts and

discounts & allowances of $1,350 and $1,100 at December 31,

2020 and 2019, respectively |

|

|

8,002 |

|

|

|

|

6,692 |

|

|

Inventories, net |

|

|

6,930 |

|

|

|

|

6,392 |

|

|

Prepaid expenses and other current assets |

|

|

1,163 |

|

|

|

|

1,598 |

|

|

Refundable income taxes |

|

|

31 |

|

|

|

|

681 |

|

|

Total current assets |

|

|

24,052 |

|

|

|

|

19,199 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

21,048 |

|

|

|

|

22,274 |

|

|

Operating lease right-of use asset |

|

|

345 |

|

|

|

|

738 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangible assets |

|

|

|

|

|

|

|

|

|

|

Goodwill and indefinite-lived intangibles |

|

|

12,824 |

|

|

|

|

12,824 |

|

|

Other intangible assets, net |

|

|

– |

|

|

|

|

152 |

|

|

Total intangible assets |

|

|

12,824 |

|

|

|

|

12,976 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets |

|

|

1,800 |

|

|

|

|

1,800 |

|

|

Total assets |

|

$ |

60,069 |

|

|

|

$ |

56,987 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

5,592 |

|

|

|

$ |

5,282 |

|

|

Accrued expenses |

|

|

2,196 |

|

|

|

|

4,087 |

|

|

Accrued income taxes |

|

|

653 |

|

|

|

|

154 |

|

|

Total current liabilities |

|

|

8,441 |

|

|

|

|

9,523 |

|

|

Line of credit |

|

|

2,768 |

|

|

|

|

2,745 |

|

|

Operating lease liabilities |

|

|

165 |

|

|

|

|

488 |

|

|

Deferred income taxes, net |

|

|

1,764 |

|

|

|

|

922 |

|

|

Other long-term liabilities |

|

|

77 |

|

|

|

|

58 |

|

|

Total liabilities |

|

|

13,215 |

|

|

|

|

13,736 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

Preferred stock, no par value; 2,500 shares authorized; no shares

issued or outstanding at 2020 and 2019 |

|

|

– |

|

|

|

|

– |

|

|

Common stock, no par value; 40,000 shares authorized; 17,274 shares

issued; 15,604 and 15,710 shares outstanding at 2020 and 2019 |

|

|

6,509 |

|

|

|

|

6,509 |

|

|

Paid-in capital |

|

|

2,600 |

|

|

|

|

2,380 |

|

|

Treasury stock, at cost |

|

|

(12,450 |

) |

|

|

|

(12,601 |

) |

|

Retained earnings |

|

|

50,195 |

|

|

|

|

46,963 |

|

|

Total stockholders’ equity |

|

|

46,854 |

|

|

|

|

43,251 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

|

$ |

60,069 |

|

|

|

$ |

56,987 |

|

LIFEWAY FOODS, INC. AND

SUBSIDIARIESConsolidated Statements of

OperationsFor the three months and twelve months

ended December 31, 2020 and 2019 (In thousands,

except per share data)

|

|

|

Three Months Ended December

31, |

|

|

Twelve months Ended December

31, |

|

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

25,585 |

|

|

|

$ |

23,165 |

|

|

|

$ |

102,026 |

|

|

|

$ |

93,662 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

|

18,393 |

|

|

|

|

17,144 |

|

|

|

|

72,006 |

|

|

|

|

68,367 |

|

|

Depreciation expense |

|

|

761 |

|

|

|

|

911 |

|

|

|

|

3,087 |

|

|

|

|

3,146 |

|

|

Total cost of goods sold |

|

|

19,154 |

|

|

|

|

18,055 |

|

|

|

|

75,093 |

|

|

|

|

71,513 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

6,431 |

|

|

|

|

5,110 |

|

|

|

|

26,933 |

|

|

|

|

22,149 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

2,786 |

|

|

|

|

2,553 |

|

|

|

|

10,197 |

|

|

|

|

11,062 |

|

|

General and administrative |

|

|

2,980 |

|

|

|

|

3,728 |

|

|

|

|

11,661 |

|

|

|

|

12,828 |

|

|

Amortization expense |

|

|

35 |

|

|

|

|

40 |

|

|

|

|

152 |

|

|

|

|

192 |

|

|

Total operating expenses |

|

|

5,801 |

|

|

|

|

6,321 |

|

|

|

|

22,010 |

|

|

|

|

24,082 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) income from operations |

|

|

630 |

|

|

|

|

(1,211 |

) |

|

|

|

4,923 |

|

|

|

|

(1,933 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(22 |

) |

|

|

|

(47 |

) |

|

|

|

(118 |

) |

|

|

|

(249 |

) |

|

Fair value gain on investments |

|

|

– |

|

|

|

|

1,731 |

|

|

|

|

– |

|

|

|

|

1,731 |

|

|

Realized gain on investments, net |

|

|

– |

|

|

|

|

1,413 |

|

|

|

|

4 |

|

|

|

|

1,413 |

|

|

Loss (gain) on sale of property and equipment |

|

|

– |

|

|

|

|

6 |

|

|

|

|

(28 |

) |

|

|

|

189 |

|

|

Other income |

|

|

45 |

|

|

|

|

2 |

|

|

|

|

47 |

|

|

|

|

84 |

|

|

Total other (expense) income |

|

|

23 |

|

|

|

|

3,105 |

|

|

|

|

(95 |

) |

|

|

|

3,168 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before provision for income taxes |

|

|

653 |

|

|

|

|

1,894 |

|

|

|

|

4,828 |

|

|

|

|

1,235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

373 |

|

|

|

|

840 |

|

|

|

|

1,596 |

|

|

|

|

782 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

280 |

|

|

|

$ |

1,054 |

|

|

|

$ |

3,232 |

|

|

|

$ |

453 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.02 |

|

|

|

$ |

0.07 |

|

|

|

$ |

0.21 |

|

|

|

$ |

0.03 |

|

|

Diluted |

|

$ |

0.02 |

|

|

|

$ |

0.07 |

|

|

|

$ |

0.21 |

|

|

|

$ |

0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

15,604 |

|

|

|

|

15,709 |

|

|

|

|

15,597 |

|

|

|

|

15,748 |

|

|

Diluted |

|

|

15,797 |

|

|

|

|

15,821 |

|

|

|

|

15,766 |

|

|

|

|

15,804 |

|

LIFEWAY FOODS, INC. AND

SUBSIDIARIESConsolidated Statements of Cash

FlowsFor the Years Ended December 31, 2020 and

2019(In thousands)

|

|

|

2020 |

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

3,232 |

|

|

|

$ |

453 |

|

|

Adjustments to reconcile net income to operating cash

flow: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

3,239 |

|

|

|

|

3,338 |

|

|

Non-cash interest expense |

|

|

23 |

|

|

|

|

23 |

|

|

Non-cash rent expense |

|

|

(37 |

) |

|

|

|

(17 |

) |

|

Bad debt expense |

|

|

(6 |

) |

|

|

|

7 |

|

|

Deferred Revenue |

|

|

(91 |

) |

|

|

|

(97 |

) |

|

Reserve for inventory obsolescence |

|

|

– |

|

|

|

|

(52 |

) |

|

Stock-based compensation |

|

|

393 |

|

|

|

|

838 |

|

|

Deferred income taxes |

|

|

841 |

|

|

|

|

533 |

|

|

Fair value gain on investment |

|

|

– |

|

|

|

|

(1,731 |

) |

|

Net gain on sale of investment |

|

|

– |

|

|

|

|

(1,413 |

) |

|

(Loss) gain on sale of property and equipment |

|

|

28 |

|

|

|

|

(189 |

) |

|

(Increase) decrease in operating assets: |

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(1,304 |

) |

|

|

|

(423 |

) |

|

Inventories |

|

|

(538 |

) |

|

|

|

(523 |

) |

|

Refundable income taxes |

|

|

649 |

|

|

|

|

2,067 |

|

|

Prepaid expenses and other current assets |

|

|

423 |

|

|

|

|

(526 |

) |

|

Increase (decrease) in operating liabilities: |

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

311 |

|

|

|

|

710 |

|

|

Accrued expenses |

|

|

(1,278 |

) |

|

|

|

783 |

|

|

Operating lease asset amortization/liability |

|

|

– |

|

|

|

|

(17 |

) |

|

Accrued income taxes |

|

|

500 |

|

|

|

|

47 |

|

|

Net cash provided by operating activities |

|

|

6,385 |

|

|

|

|

3,811 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

Purchases of investments |

|

|

– |

|

|

|

|

(15 |

) |

|

Proceeds from sale of investments |

|

|

– |

|

|

|

|

1,509 |

|

|

Purchases of property and equipment |

|

|

(1,895 |

) |

|

|

|

(1,178 |

) |

|

Proceeds from sale of property and equipment |

|

|

5 |

|

|

|

|

522 |

|

|

Net cash (used in) provided by investing

activities |

|

|

(1,890 |

) |

|

|

|

838 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

Purchase of treasury stock |

|

|

(405 |

) |

|

|

|

(538 |

) |

|

Repayment of line of credit |

|

|

– |

|

|

|

|

(3,273 |

) |

|

Net cash used in financing activities |

|

|

(405 |

) |

|

|

|

(3,811 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net increase in cash and cash equivalents |

|

|

4,090 |

|

|

|

|

838 |

|

|

Cash and cash equivalents at the beginning of the period |

|

|

3,836 |

|

|

|

|

2,998 |

|

|

Cash and cash equivalents at the end of the

period |

|

$ |

7,926 |

|

|

|

$ |

3,836 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

|

|

|

|

|

|

Cash paid for income taxes, net of (refunds) |

|

$ |

(426 |

) |

|

|

$ |

(1,865 |

) |

|

Cash paid for interest |

|

|

99 |

|

|

|

|

259 |

|

|

Non-cash investing activities |

|

|

|

|

|

|

|

|

|

|

Right-of-use assets recognized at ASU 2016-02 transition |

|

|

– |

|

|

|

|

944 |

|

|

Operating lease liability recognized at ASU 2016-02 transition |

|

|

– |

|

|

|

|

997 |

|

|

Increase (decrease) in right-of-use assets and operating lease

obligations recognized after ASU 2016-02 transition |

|

|

(44 |

) |

|

|

|

305 |

|

|

Non-cash financing activities |

|

|

|

|

|

|

|

|

|

|

Issuance of common stock under equity incentive plans |

|

|

522 |

|

|

|

|

– |

|

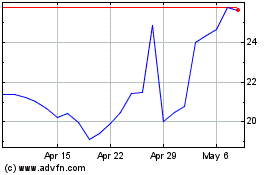

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From May 2024 to Jun 2024

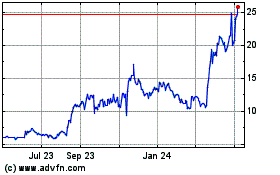

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Jun 2023 to Jun 2024