Lifeway Foods, Inc. (Nasdaq: LWAY), the leading U.S. supplier of

kefir and fermented probiotic products to support the microbiome,

today reported financial results for fourth quarter and year ended

December 31, 2018.

Julie Smolyansky, Lifeway’s CEO commented, “Our

team continues to work diligently on our strategic long-term plan,

Lifeway 2.0, to reinvigorate growth. We are pleased with the

initial steps we have taken in a very short period of time that are

aligned with our key strategies to expand core kefir product

distribution, build upon our introduction of convenient, on-the-go

health and wellness product innovation, and enhance consumer

experiences to increase Lifeway brand trial, awareness and

consumption. We are also taking decisive actions across our

organization to align our corporate infrastructure with the return

to growth that we aim to achieve over the next several years. While

certain of these efforts resulted in higher expenses late in 2018,

we expect Lifeway to realize greater efficiencies over time. We

believe we are well positioned for growth with our core product

offerings and innovation pipeline, including Plantiful, our new

plant-based probiotic beverage that has created industry

excitement. Our strong manufacturing, sales and marketing

foundation is now set to execute our strategic growth plan and

enhance value for all of our stakeholders.”

Full Year 2018

ResultsNet SalesNet sales were $103.4

million for the year ended December 31, 2018, a decrease of $15.5

million or 13.1% versus the prior year. The decline was primarily

due to volume/mix of 16.6%, partially offset by lower spend in

trade promotion and allowances of 1.7%, and partially offset by

pricing gains of 1.8%. The decline in volume/mix was primarily

driven by volume softness in Lifeway’s branded drinkable and

ProBugs kefir, partially offset by the incremental volume of new

item introductions. The volume decline reflects lower consumption

of the Company’s products that is consistent with the overall

volume decline in dairy and cultured dairy product categories.

Pricing primarily includes the favorable impact of a second quarter

2018 price increase to recover higher input costs. This increase

was partially offset by the lapping of a price reduction driven by

the shift in delivery method for select customers in the first

quarter 2017. The favorable promotional activity reflects lower

trade spending, partially offset by the increased redemptions on

the Company’s 2018 coupon program.

Gross ProfitGross profit as a

percentage of net sales was 25.0% for the year ended December 31,

2018. Gross profit percentage was 25.8% in the prior year. The

decline versus the prior year was primarily due to the unfavorable

impact of operating leverage that arises from lower net sales

relative to fixed costs, increased trade promotion investment, and

higher freight and fixed costs, partially offset by an increase in

pricing and a reduction in variable costs. Additionally,

depreciation expense increased reflecting the continued investment

in manufacturing improvements. The Company incurred $0.1 million of

direct labor severance expense in 2018 to reduce expense and create

efficiencies in the Company’s manufacturing process.

Selling ExpensesSelling

expenses decreased $3.1 million or 18.8% to $13.5 million for the

year ended December 31, 2018. The decrease versus the prior year,

primarily reflects a change in media spending to reduce programs

with lower efficiency. The primary driver was a reduction in

television advertising spend in 2018 compared to the prior year,

and to a lesser extent lower broker commissions and marketing

spending. The reduction was partially offset by severance expense.

The Company incurred $0.3 million of selling severance expense in

2018 to align the organizational structure and reduce expenses.

General and administrative

expensesGeneral and administrative expenses were slightly

lower for the year ended December 31, 2018 finishing at $13.6

million, 2.4% below the prior year. This reflects decreased

incentive compensation and bad debt expense, partially offset by

severance expense. The Company incurred $0.4 million of general and

administrative severance expense in 2018 to align its

organizational structure and reduce expenses. As noted in the

sections above, the Company incurred a total of $0.8 million of

severance expense during fiscal year 2018, primarily in the fourth

quarter.

As noted in the sections above, the Company

incurred a total of $0.8 million of severance expense during fiscal

year 2018, primarily in the fourth quarter.

LIFEWAY FOODS, INC. AND

SUBSIDIARIESConsolidated Balance

SheetsDecember 31, 2018 and

2017(In thousands)

| |

|

December 31, |

|

| |

|

2018 |

|

|

2017 |

|

| Current

assets |

|

|

|

|

|

|

|

|

| Cash

and cash equivalents |

|

$ |

2,998 |

|

|

$ |

4,978 |

|

|

Accounts receivable, net of allowance for doubtful accounts and

discounts and allowances of $1,220 and $2,010 at December 31, 2018

and 2017, respectively |

|

|

6,276 |

|

|

|

8,676 |

|

|

Inventories, net |

|

|

5,817 |

|

|

|

7,697 |

|

|

Prepaid expenses and other current assets |

|

|

1,077 |

|

|

|

983 |

|

|

Refundable income taxes |

|

|

2,748 |

|

|

|

2,347 |

|

|

Total current assets |

|

|

18,916 |

|

|

|

24,681 |

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

24,573 |

|

|

|

24,645 |

|

|

|

|

|

|

|

|

|

|

|

|

Intangible assets |

|

|

|

|

|

|

|

|

|

Goodwill and indefinite-lived intangibles |

|

|

12,824 |

|

|

|

14,068 |

|

| Other

intangible assets, net |

|

|

344 |

|

|

|

975 |

|

|

Total intangible assets |

|

|

13,168 |

|

|

|

15,043 |

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets |

|

|

150 |

|

|

|

150 |

|

|

Total assets |

|

$ |

56,807 |

|

|

$ |

64,519 |

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Current maturities of notes payable |

|

$ |

– |

|

|

$ |

3,166 |

|

|

Accounts payable |

|

|

4,570 |

|

|

|

6,848 |

|

|

Accrued expenses |

|

|

2,777 |

|

|

|

2,984 |

|

|

Accrued income taxes |

|

|

106 |

|

|

|

203 |

|

|

Total current liabilities |

|

|

7,453 |

|

|

|

13,201 |

|

|

Line of Credit |

|

|

5,995 |

|

|

|

– |

|

|

Notes payable |

|

|

– |

|

|

|

3,113 |

|

|

Deferred income taxes, net |

|

|

390 |

|

|

|

840 |

|

|

Other long-term liabilities |

|

|

564 |

|

|

|

775 |

|

|

Total liabilities |

|

|

14,402 |

|

|

|

17,929 |

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

Preferred stock, no par value; 2,500 shares authorized; no shares

issued or outstanding at 2018 and 2017 |

|

|

– |

|

|

|

– |

|

| Common stock, no par

value; 40,000 shares authorized; 17,274 shares issued; 15,814 and

16,008 shares outstanding at 2018 and 2017 |

|

|

6,509 |

|

|

|

6,509 |

|

|

Paid-in capital |

|

|

2,303 |

|

|

|

2,244 |

|

|

Treasury stock, at cost |

|

|

(12,970 |

) |

|

|

(11,812 |

) |

|

Retained earnings |

|

|

46,563 |

|

|

|

49,649 |

|

|

Total stockholders’ equity |

|

|

42,405 |

|

|

|

46,590 |

|

|

|

|

|

|

|

|

|

|

|

| Total

liabilities and stockholders’ equity |

|

$ |

56,807 |

|

|

$ |

64,519 |

|

| |

|

|

|

|

|

|

|

|

LIFEWAY FOODS, INC. AND

SUBSIDIARIESConsolidated Statements of

OperationsFor the three months and twelve months

ended December 31, 2018 and 2017 (In

thousands, except per share data)

| |

|

Three Months Ended December

31, |

|

Twelve months Ended December

31, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

|

|

| Net

sales |

|

$ |

23,032 |

|

|

$ |

26,257 |

|

|

$ |

103,350 |

|

|

$ |

118,893 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

|

17,234 |

|

|

|

20,495 |

|

|

|

74,646 |

|

|

|

85,757 |

|

| Depreciation

expense |

|

|

703 |

|

|

|

639 |

|

|

|

2,846 |

|

|

|

2,440 |

|

| Total cost of goods

sold |

|

|

17,937 |

|

|

|

21,134 |

|

|

|

77,492 |

|

|

|

88,197 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

5,095 |

|

|

|

5,123 |

|

|

|

25,858 |

|

|

|

30,696 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling expenses |

|

|

2,940 |

|

|

|

4,947 |

|

|

|

13,477 |

|

|

|

16,595 |

|

| General and

administrative |

|

|

3,765 |

|

|

|

3,212 |

|

|

|

13,616 |

|

|

|

13,955 |

|

| Goodwill

impairment |

|

|

1,244 |

|

|

|

|

|

|

1,244 |

|

|

|

|

| Amortization

expense |

|

|

141 |

|

|

|

168 |

|

|

|

631 |

|

|

|

672 |

|

| Total operating

expenses |

|

|

8,090 |

|

|

|

8,327 |

|

|

|

28,968 |

|

|

|

31,222 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

(2,995 |

) |

|

|

(3,204 |

) |

|

|

(3,110 |

) |

|

|

(526 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(51 |

) |

|

|

(62 |

) |

|

|

(271 |

) |

|

|

(242 |

) |

| Gain (loss) on sale of

property and equipment |

|

|

12 |

|

|

|

1 |

|

|

|

54 |

|

|

|

(38 |

) |

| Other income |

|

|

5 |

|

|

|

2 |

|

|

|

16 |

|

|

|

2 |

|

| Total other

expense |

|

|

(34 |

) |

|

|

(59 |

) |

|

|

(201 |

) |

|

|

(278 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before

provision for income taxes |

|

|

(3,029 |

) |

|

|

(3,263 |

) |

|

|

(3,311 |

) |

|

|

(804 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Benefit for income

taxes |

|

|

(217 |

) |

|

|

(1,514 |

) |

|

|

(225 |

) |

|

|

(458 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

$ |

(2,812 |

) |

|

$ |

(1,749 |

) |

|

$ |

(3,086 |

) |

|

$ |

(346 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.18 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.02 |

) |

| Diluted |

|

$ |

(0.17 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.02 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average common shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

15,831 |

|

|

|

16,018 |

|

|

|

15,872 |

|

|

|

16,105 |

|

| Diluted |

|

|

16,221 |

|

|

|

16,018 |

|

|

|

16,319 |

|

|

|

16,105 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIFEWAY FOODS, INC. AND

SUBSIDIARIESConsolidated Statements of Cash

FlowsFor the Years Ended December 31, 2018 and

2017(In thousands)

|

|

|

|

|

|

|

|

2018 |

|

|

2017 |

|

|

|

|

|

|

|

|

|

| Cash flows

from operating activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(3,086 |

) |

|

$ |

(346 |

) |

|

Adjustments to reconcile net loss to operating cash

flow: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

3,477 |

|

|

|

3,112 |

|

|

Non-cash interest expense |

|

|

14 |

|

|

|

– |

|

|

Bad debt expense |

|

|

21 |

|

|

|

480 |

|

|

Deferred Revenue |

|

|

(97 |

) |

|

|

– |

|

|

Reserve for inventory obsolescence |

|

|

558 |

|

|

|

374 |

|

|

Stock-based compensation |

|

|

802 |

|

|

|

596 |

|

|

Deferred income taxes |

|

|

(451 |

) |

|

|

(352 |

) |

|

(Gain) loss on sale of property and equipment |

|

|

(54 |

) |

|

|

38 |

|

|

Goodwill impairment |

|

|

1,244 |

|

|

|

– |

|

|

(Increase) decrease in operating assets: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

2,379 |

|

|

|

780 |

|

|

Inventories |

|

|

1,322 |

|

|

|

(29 |

) |

|

Refundable income taxes |

|

|

(401 |

) |

|

|

(2,038 |

) |

|

Prepaid expenses and other current assets |

|

|

(78 |

) |

|

|

(197 |

) |

|

Increase (decrease) in operating liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

(2,278 |

) |

|

|

1,130 |

|

|

Accrued expenses |

|

|

(858 |

) |

|

|

711 |

|

|

Accrued income taxes |

|

|

(97 |

) |

|

|

(451 |

) |

|

Net cash provided by operating activities |

|

|

2,417 |

|

|

|

3,808 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of investments |

|

|

(500 |

) |

|

|

(25 |

) |

|

Proceeds from sale of investments |

|

|

500 |

|

|

|

– |

|

|

Purchases of property and equipment |

|

|

(2,824 |

) |

|

|

(5,341 |

) |

|

Proceeds from sale of property and equipment |

|

|

104 |

|

|

|

50 |

|

|

Net cash used in investing activities |

|

|

(2,720 |

) |

|

|

(5,316 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Borrowings under revolving credit facility |

|

|

6,050 |

|

|

|

– |

|

|

Payment of deferred financing costs |

|

|

(69 |

) |

|

|

– |

|

|

Purchase of treasury stock |

|

|

(1,379 |

) |

|

|

(1,486 |

) |

|

Repayment of notes payable |

|

|

(6,279 |

) |

|

|

(840 |

) |

|

Net cash used in financing activities |

|

|

(1,677 |

) |

|

|

(2,326 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents |

|

|

(1,980 |

) |

|

|

(3,834 |

) |

|

|

|

|

|

|

|

|

|

|

| Cash

and cash equivalents at the beginning of the period |

|

|

4,978 |

|

|

|

8,812 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the end of the

period |

|

$ |

2,998 |

|

|

$ |

4,978 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid for income taxes, net of refunds |

|

$ |

723 |

|

|

$ |

2,382 |

|

|

Cash paid for interest |

|

|

261 |

|

|

|

241 |

|

|

|

|

|

|

|

|

|

|

|

About Lifeway Foods, Inc.

Lifeway Foods, Inc., which has been recognized as one of Forbes’

Best Small Companies, is America’s leading supplier of the

probiotic, fermented beverage known as kefir. In addition to its

line of drinkable kefir, the company also produces the non-dairy

Plantiful probiotic beverages, cupped kefir and skyr, frozen kefir,

specialty cheeses, probiotic supplements and a ProBugs line for

kids. Lifeway’s tart and tangy fermented dairy and non-dairy

products are now sold across North America, Ireland and the United

Kingdom. Learn how Lifeway is good for more than just you at

www.lifewaykefir.com.

Forward-Looking Statements

All statements in this release (and oral statements made

regarding the subjects of this release) contains “forward-looking

statements” as defined in the Private Securities Litigation Reform

Act of 1995 regarding, among other things, future operating and

financial performance, product development, market position,

business strategy and objectives. These statements use words, and

variations of words, such as "expand," "build," "enhance," "take,"

"action," "align," "return," "aim, "achieve," "expect," "realize,"

"believe," "position," "grow," and "execute." Other examples of

forward looking statements may include, but are not limited to, (i)

statements of Company plans and objectives, including the

introduction of new products, or estimates or predictions of

actions by customers or suppliers, (ii) statements of future

economic performance, and (III) statements of assumptions

underlying other statements and statements about Lifeway or its

business. You are cautioned not to rely on these forward-looking

statements. These statements are based on current expectations of

future events and thus are inherently subject to uncertainty. If

underlying assumptions prove inaccurate or known or unknown risks

or uncertainties materialize, actual results could vary materially

from Lifeway’s expectations and projections. These risks,

uncertainties, and other factors include: price competition; the

decisions of customers or consumers; the actions of competitors;

changes in the pricing of commodities; the effects of government

regulation; possible delays in the introduction of new products;

and customer acceptance of products and services. A further list

and description of these risks, uncertainties, and other factors

can be found in Lifeway’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2018, and the Company’s subsequent filings

with the SEC. Copies of these filings are available online at

https://www.sec.gov, http://lifewaykefir.com/investor-relations/,

or on request from Lifeway. Information in this release is as of

the dates and time periods indicated herein, and Lifeway does not

undertake to update any of the information contained in these

materials, except as required by law. Accordingly, YOU SHOULD NOT

RELY ON THE ACCURACY OF ANY OF THE STATEMENTS OR OTHER INFORMATION

CONTAINED IN ANY ARCHIVED PRESS RELEASE.

Contact:

Lifeway Foods, Inc.Phone: 847-967-1010Email:

info@lifeway.net

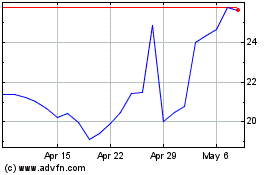

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From May 2024 to Jun 2024

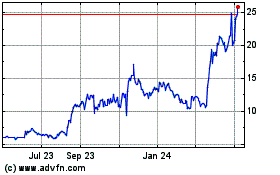

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Jun 2023 to Jun 2024