false

0001114925

0001114925

2024-02-08

2024-02-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 8, 2024

LANTRONIX,

INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

1-16027 |

|

33-0362767 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

48

Discovery, Suite

250

Irvine, California 92618 |

| (Address of Principal Executive Offices, including zip code) |

| |

|

|

|

|

| Registrant’s telephone number, including area code: (949) 453-3990 |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

_______________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each Class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

LTRX |

The Nasdaq Stock Market LLC |

| |

|

|

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of Securities Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On February 8, 2024, Lantronix, Inc., a Delaware

corporation (the “Company”), issued a press release setting forth the Company’s financial results for its second fiscal

quarter ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

In addition, on February 8, 2024, the Company

posted on its website at www.lantronix.com a transcript of management’s prepared remarks

for the Company’s second quarter fiscal 2024 investor conference call and audio webcast, scheduled for 2:00 p.m. Pacific Time (5:00

p.m. Eastern Time) on February 8, 2024.

The information furnished under this Item 2.02, including Exhibits

99.1 and 99.2, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in

any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly

set forth by specific reference in such filing.

| Item 7.01 |

Regulation FD Disclosure. |

The information disclosed in Item 2.02 of this Current Report on Form

8-K is incorporated by reference into this Item 7.01.

The information furnished pursuant to this Item 7.01 shall not be deemed

“filed” for purposes of Section 18 of the Exchange Act or incorporated by reference in any filing under the Securities Act

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

LANTRONIX, INC. |

| |

|

|

|

| |

|

By: |

/s/ Jeremy Whitaker |

| |

|

|

Jeremy Whitaker

Chief Financial Officer |

Date: February 8, 2024

Exhibit 99.1

Lantronix Reports Record Revenue for Second

Quarter of Fiscal 2024

| · | Second Quarter Net Revenue of $37 Million, up 12 Percent Sequentially

and up 18 Percent Year-Over-Year |

| · | Second Quarter GAAP EPS of ($0.07) vs. ($0.07) in the Prior Year |

| | · | Second

Quarter Non-GAAP EPS of $0.08 vs. $0.04 in the Prior Year |

IRVINE, Calif., Feb. 8, 2024 – Lantronix Inc. (NASDAQ:

LTRX), a global provider of compute and connectivity IoT solutions that target high-growth applications in Smart Cities, Automotive, and

Enterprise, today reported results for its second quarter of fiscal 2024.

Net revenue totaled $37.0 million, up 12 percent sequentially and up

18 percent year-over-year.

GAAP EPS of ($0.07), compared to ($0.07) in the prior year and ($0.05)

in the prior quarter.

Non-GAAP EPS of $0.08, compared to $0.04 in the prior year and $0.07

in the prior quarter.

Business Outlook

For the third fiscal quarter of 2024, the company expects revenue in

a range of $38 million to $42 million and non-GAAP EPS of $0.09 to $0.13 per share.

For fiscal year 2024, the company expects revenue in a range of $155

million to $165 million and non-GAAP EPS in a range of $0.35 to $0.45 per share.

Conference Call and Webcast

Management will host an investor conference call and audio webcast

on Thursday, Feb. 8, 2024, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) to discuss its results for the second quarter of fiscal

2024 that ended Dec. 31, 2023. To access the live conference call, investors should dial 1-844-802-2442 (US) or 1-412-317-5135 (international)

and indicate that they are participating in the Lantronix Q2 FY 2024 call. The webcast will be available simultaneously via the investor

relations section of the company’s website.

Investors can access a replay of the conference call starting at approximately

7:00 p.m. Pacific Time on Feb. 8, 2024, at the Lantronix website. A telephonic replay will also be available through Feb. 15, 2024, by

dialing 1-877-344-7529 (US) or 1-412-317-0088 (international) or Canada toll-free at 1-855-669-9658 and entering passcode 8152889.

About Lantronix

Lantronix Inc. is a global provider of compute and connectivity IoT

solutions that target high-growth industries, including Smart Cities, Automotive and Enterprise. Lantronix’s products and services

empower companies to achieve success in the growing IoT markets by delivering customizable solutions that address each layer of the IoT

stack. Lantronix’s leading-edge solutions include intelligent substation infrastructure, infotainment systems and video surveillance,

supplemented with advanced Out-of-Band Management (OOB) for Cloud and Edge Computing.

For more information, visit the Lantronix website.

Discussion of Non-GAAP Financial Measures

Lantronix believes that the presentation of non-GAAP financial information,

when presented in conjunction with the corresponding GAAP measures, provides important supplemental information to management and investors

regarding financial and business trends relating to the company’s financial condition and results of operations. Management uses

the aforementioned non-GAAP measures to monitor and evaluate ongoing operating results and trends to gain an understanding of our comparative

operating performance. The non-GAAP financial measures disclosed by the company should not be considered a substitute for, or superior

to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations

of the non-GAAP financial measures to the financial measures calculated in accordance with GAAP should be carefully evaluated. The non-GAAP

financial measures used by the company may be calculated differently from, and therefore may not be comparable to, similarly titled measures

used by other companies. The company has provided reconciliations of the non-GAAP financial measures to the most directly comparable GAAP

financial measures.

Non-GAAP net income consists of net loss excluding (i) share-based

compensation and the employer portion of withholding taxes on stock grants, (ii) depreciation and amortization, (iii) interest income

(expense), (iv) other income (expense), (v) income tax provision (benefit), (vi) restructuring, severance and related charges, (vii) acquisition

related costs, (viii) impairment of long-lived assets, (ix) amortization of purchased intangibles, (x) amortization of manufacturing profit

in acquired inventory, (xi) fair value remeasurement of earnout consideration, and (xii) loss on extinguishment of debt.

Non-GAAP EPS is calculated by dividing non-GAAP net loss by non-GAAP

weighted-average shares outstanding (diluted). For purposes of calculating non-GAAP EPS, the calculation of GAAP weighted-average shares

outstanding (diluted) is adjusted to exclude share-based compensation, which for GAAP purposes is treated as proceeds assumed to be used

to repurchase shares under the GAAP treasury stock method.

Guidance on earnings per share growth is provided only on a non-GAAP

basis due to the inherent difficulty of forecasting the timing or amount of certain items that have been excluded from the forward-looking

non-GAAP measures, and a reconciliation to the comparable GAAP guidance has not been provided because certain factors that are materially

significant to Lantronix’s ability to estimate the excluded items are not accessible or estimable on a forward-looking basis without

unreasonable effort.

Forward-Looking Statements

This news release contains forward-looking statements,

including statements concerning our revenue and earnings expectations for the third fiscal quarter of 2024 and fiscal year 2024. These

forward-looking statements are intended to qualify for the safe harbor from liability established by the Private Securities Litigation

Reform Act of 1995. We have based our forward-looking statements on our current expectations and projections about trends affecting our

business and industry and other future events. Although we do not make forward-looking statements unless we believe we have a reasonable

basis for doing so, we cannot guarantee their accuracy. Forward-looking statements are subject to substantial risks and uncertainties

that could cause our results or experiences, or future business, financial condition, results of operations or performance, to differ

materially from our historical results or those expressed or implied in any forward-looking statement contained in this news release.

Other factors which could have a material adverse effect on our operations and future prospects or which could cause actual results to

differ materially from our expectations include, but are not limited to: the effects of negative or worsening regional and worldwide economic

conditions or market instability on our business, including effects on purchasing decisions by our customers; our ability to mitigate

any disruption in our and our suppliers’ and vendors’ supply chains due to the COVID-19 pandemic or other outbreaks, wars

and recent conflicts in Europe, Asia and the Middle East, hostilities in the Red Sea, or other causes; our ability to successfully convert

our backlog and current demand; the impact of the COVID-19 pandemic or another pandemic or similar outbreak, including the emergence

of new more contagious and/or vaccine-resistant strains, on our business, employees, supply and distribution chains and the global economy;

our ability to successfully implement our acquisitions strategy or integrate acquired companies; uncertainty as to the future profitability

of acquired businesses, and delays in the realization of, or the failure to realize, any accretion from acquisition transactions; acquiring,

managing and integrating new operations, businesses or assets, and the associated diversion of management attention or other related costs

or difficulties; our ability to continue to generate revenue from products sold into mature markets; our ability to develop, market, and

sell new products; our ability to succeed with our new software offerings; fluctuations in our revenue due to the project-based timing

of orders from certain customers; unpredictable timing of our revenues due to the lengthy sales cycle for our products and services and

potential delays in customer completion of projects; our ability to accurately forecast future demand for our products; delays in qualifying

revisions of existing products; constraints or delays in the supply of, or quality control issues with, certain materials or components;

difficulties associated with the delivery, quality or cost of our products from our contract manufacturers or suppliers; risks related

to the outsourcing of manufacturing and international operations; difficulties associated with our distributors or resellers; intense

competition in our industry and resultant downward price pressure; rises in inventory levels and inventory obsolescence; undetected software

or hardware errors or defects in our products; cybersecurity risks; our ability to obtain appropriate industry certifications or approvals

from governmental regulatory bodies; changes in applicable U.S. and foreign government laws, regulations, and tariffs; our ability to

protect patents and other proprietary rights and avoid infringement of others’ proprietary technology rights; issues relating to

the stability of our financial and banking institutions and relationships; the level of our indebtedness, our ability to service our indebtedness

and the restrictions in our debt agreements; the impact of rising interest rates; our ability to attract and retain qualified management;

and any additional factors included in our Report on Form 10-K for the fiscal year ended June 30, 2023, filed with the Securities and

Exchange Commission (the “SEC”) on Sept. 12, 2023, including in the section entitled “Risk Factors” in Item 1A

of Part I of that report; in our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2023, filed with the SEC on

November 8, 2023, including in the section entitled “Risk Factors” in Item 1A of Part II of such report; and in our other

public filings with the SEC. In addition, actual results may differ as a result of additional risks and uncertainties of which we are

currently unaware or which we do not currently view as material to our business. For these reasons, investors are cautioned not to place

undue reliance on any forward-looking statements. The forward-looking statements we make speak only as of the date on which they are made.

We expressly disclaim any intent or obligation to update any forward-looking statements after the date hereof to conform such statements

to actual results or to changes in our opinions or expectations, except as required by applicable law or the rules of the Nasdaq Stock

Market LLC. If we do update or correct any forward-looking statements, investors should not conclude that we will make additional updates

or corrections.

© 2024 Lantronix Inc. All rights reserved.

Lantronix is a registered trademark.

Lantronix Investor Relations Contact:

Jeremy Whitaker

Chief Financial Officer

investors@lantronix.com

# # #

LANTRONIX, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

| | |

December 31, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 22,146 | | |

$ | 13,452 | |

| Accounts receivable, net | |

| 30,381 | | |

| 27,682 | |

| Inventories, net | |

| 42,774 | | |

| 49,736 | |

| Contract manufacturers' receivables | |

| 1,767 | | |

| 3,019 | |

| Prepaid expenses and other current assets | |

| 2,839 | | |

| 2,662 | |

| Total current assets | |

| 99,907 | | |

| 96,551 | |

| Property and equipment, net | |

| 4,815 | | |

| 4,629 | |

| Goodwill | |

| 27,824 | | |

| 27,824 | |

| Intangible assets, net | |

| 7,871 | | |

| 10,565 | |

| Lease right-of-use assets | |

| 10,617 | | |

| 11,583 | |

| Other assets | |

| 589 | | |

| 472 | |

| Total assets | |

$ | 151,623 | | |

$ | 151,624 | |

| | |

| | | |

| | |

| Liabilities and stockholders' equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 9,595 | | |

$ | 12,401 | |

| Accrued payroll and related expenses | |

| 3,303 | | |

| 2,431 | |

| Current portion of long-term debt, net | |

| 3,002 | | |

| 2,743 | |

| Other current liabilities | |

| 32,089 | | |

| 28,813 | |

| Total current liabilities | |

| 47,989 | | |

| 46,388 | |

| Long-term debt, net | |

| 14,720 | | |

| 16,221 | |

| Other non-current liabilities | |

| 12,138 | | |

| 11,459 | |

| Total liabilities | |

| 74,847 | | |

| 74,068 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Common stock | |

| 4 | | |

| 4 | |

| Additional paid-in capital | |

| 299,385 | | |

| 295,686 | |

| Accumulated deficit | |

| (222,984 | ) | |

| (218,505 | ) |

| Accumulated other comprehensive income | |

| 371 | | |

| 371 | |

| Total stockholders' equity | |

| 76,776 | | |

| 77,556 | |

| Total liabilities and stockholders' equity | |

$ | 151,623 | | |

$ | 151,624 | |

LANTRONIX, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

December 31, | | |

September 30, | | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net revenue | |

$ | 37,038 | | |

$ | 33,031 | | |

$ | 31,506 | | |

$ | 70,069 | | |

$ | 63,301 | |

| Cost of revenue | |

| 22,007 | | |

| 18,934 | | |

| 17,712 | | |

| 40,941 | | |

| 35,471 | |

| Gross profit | |

| 15,031 | | |

| 14,097 | | |

| 13,794 | | |

| 29,128 | | |

| 27,830 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 10,224 | | |

| 9,170 | | |

| 9,813 | | |

| 19,394 | | |

| 18,970 | |

| Research and development | |

| 4,725 | | |

| 5,106 | | |

| 5,084 | | |

| 9,831 | | |

| 9,610 | |

| Restructuring, severance and related charges | |

| 530 | | |

| 20 | | |

| 82 | | |

| 550 | | |

| 174 | |

| Acquisition-related costs | |

| – | | |

| – | | |

| 102 | | |

| – | | |

| 315 | |

| Fair value remeasurement of earnout consideration | |

| – | | |

| (9 | ) | |

| (673 | ) | |

| (9 | ) | |

| (673 | ) |

| Amortization of intangible assets | |

| 1,310 | | |

| 1,384 | | |

| 1,497 | | |

| 2,694 | | |

| 2,916 | |

| Total operating expenses | |

| 16,789 | | |

| 15,671 | | |

| 15,905 | | |

| 32,460 | | |

| 31,312 | |

| Loss from operations | |

| (1,758 | ) | |

| (1,574 | ) | |

| (2,111 | ) | |

| (3,332 | ) | |

| (3,482 | ) |

| Interest expense, net | |

| (232 | ) | |

| (338 | ) | |

| (354 | ) | |

| (570 | ) | |

| (616 | ) |

| Other income (loss), net | |

| (23 | ) | |

| 19 | | |

| (26 | ) | |

| (4 | ) | |

| 8 | |

| Loss before income taxes | |

| (2,013 | ) | |

| (1,893 | ) | |

| (2,491 | ) | |

| (3,906 | ) | |

| (4,090 | ) |

| Provision (benefit) for income taxes | |

| 580 | | |

| (7 | ) | |

| 118 | | |

| 573 | | |

| 172 | |

| Net loss | |

$ | (2,593 | ) | |

$ | (1,886 | ) | |

$ | (2,609 | ) | |

$ | (4,479 | ) | |

$ | (4,262 | ) |

| Net loss per share - basic and diluted | |

$ | (0.07 | ) | |

$ | (0.05 | ) | |

$ | (0.07 | ) | |

$ | (0.12 | ) | |

$ | (0.12 | ) |

| Weighted-average common shares - basic and diluted | |

| 37,354 | | |

| 36,982 | | |

| 36,352 | | |

| 37,170 | | |

| 35,883 | |

LANTRONIX, INC.

UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTMENTS

(In thousands, except per share data)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

December 31, | | |

September 30, | | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP net loss | |

$ | (2,593 | ) | |

$ | (1,886 | ) | |

$ | (2,609 | ) | |

$ | (4,479 | ) | |

$ | (4,262 | ) |

| Non-GAAP adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 64 | | |

| 41 | | |

| 61 | | |

| 105 | | |

| 112 | |

| Employer portion of withholding taxes on stock grants | |

| 1 | | |

| 4 | | |

| – | | |

| 5 | | |

| 12 | |

| Amortization of manufacturing profit in acquired inventory | |

| 189 | | |

| 317 | | |

| 80 | | |

| 506 | | |

| 104 | |

| Depreciation and amortization | |

| 109 | | |

| 86 | | |

| 118 | | |

| 195 | | |

| 248 | |

| Total adjustments to cost of revenue | |

| 363 | | |

| 448 | | |

| 259 | | |

| 811 | | |

| 476 | |

| Selling, general and administrative: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 1,628 | | |

| 1,273 | | |

| 1,434 | | |

| 2,901 | | |

| 2,839 | |

| Employer portion of withholding taxes on stock grants | |

| 10 | | |

| 37 | | |

| 10 | | |

| 47 | | |

| 142 | |

| Depreciation and amortization | |

| 338 | | |

| 334 | | |

| 260 | | |

| 672 | | |

| 415 | |

| Total adjustments to selling, general and administrative | |

| 1,976 | | |

| 1,644 | | |

| 1,704 | | |

| 3,620 | | |

| 3,396 | |

| Research and development: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 484 | | |

| 428 | | |

| 370 | | |

| 912 | | |

| 702 | |

| Employer portion of withholding taxes on stock grants | |

| 5 | | |

| 13 | | |

| 2 | | |

| 18 | | |

| 24 | |

| Depreciation and amortization | |

| 52 | | |

| 108 | | |

| 63 | | |

| 160 | | |

| 127 | |

| Total adjustments to research and development | |

| 541 | | |

| 549 | | |

| 435 | | |

| 1,090 | | |

| 853 | |

| Restructuring, severance and related charges | |

| 530 | | |

| 20 | | |

| 82 | | |

| 550 | | |

| 174 | |

| Acquisition related costs | |

| – | | |

| – | | |

| 102 | | |

| – | | |

| 315 | |

| Fair value remeasurement of earnout consideration | |

| – | | |

| (9 | ) | |

| (673 | ) | |

| (9 | ) | |

| (673 | ) |

| Amortization of purchased intangible assets | |

| 1,310 | | |

| 1,384 | | |

| 1,497 | | |

| 2,694 | | |

| 2,916 | |

| Litigation settlement cost | |

| – | | |

| – | | |

| 80 | | |

| – | | |

| 80 | |

| Total non-GAAP adjustments to operating expenses | |

| 4,357 | | |

| 3,588 | | |

| 3,227 | | |

| 7,945 | | |

| 7,061 | |

| Interest expense, net | |

| 232 | | |

| 338 | | |

| 354 | | |

| 570 | | |

| 616 | |

| Other (income) expense, net | |

| 23 | | |

| (19 | ) | |

| 26 | | |

| 4 | | |

| (8 | ) |

| Provision (benefit) for income taxes | |

| 580 | | |

| (7 | ) | |

| 118 | | |

| 573 | | |

| 172 | |

| Total non-GAAP adjustments | |

| 5,555 | | |

| 4,348 | | |

| 3,984 | | |

| 9,903 | | |

| 8,317 | |

| Non-GAAP net income | |

$ | 2,962 | | |

$ | 2,462 | | |

$ | 1,375 | | |

$ | 5,424 | | |

$ | 4,055 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP net income per share - diluted | |

$ | 0.08 | | |

$ | 0.07 | | |

$ | 0.04 | | |

$ | 0.14 | | |

$ | 0.11 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Denominator for GAAP net income per share - diluted | |

| 37,354 | | |

| 36,982 | | |

| 36,352 | | |

| 37,170 | | |

| 35,883 | |

| Non-GAAP adjustment | |

| 1,228 | | |

| 693 | | |

| 819 | | |

| 938 | | |

| 1,126 | |

| Denominator for non-GAAP net income per share - diluted | |

| 38,582 | | |

| 37,675 | | |

| 37,171 | | |

| 38,108 | | |

| 37,009 | |

LANTRONIX, INC.

UNAUDITED NET REVENUES BY PRODUCT LINE AND REGION

(In thousands)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

December 31, 2023 | | |

September 30, 2023 | | |

December 31, 2022 | | |

December 31, 2023 | | |

December 31, 2022 | |

| Embedded IoT Solutions | |

$ | 11,764 | | |

$ | 11,373 | | |

$ | 13,668 | | |

$ | 23,137 | | |

$ | 28,763 | |

| IoT System Solutions | |

| 23,022 | | |

| 19,036 | | |

| 14,913 | | |

| 42,058 | | |

| 29,534 | |

| Software & Services | |

| 2,252 | | |

| 2,622 | | |

| 2,925 | | |

| 4,874 | | |

| 5,004 | |

| | |

$ | 37,038 | | |

$ | 33,031 | | |

$ | 31,506 | | |

$ | 70,069 | | |

$ | 63,301 | |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

December 31, 2023 | | |

September 30, 2023 | | |

December 31, 2022 | | |

December 31, 2023 | | |

December 31, 2022 | |

| Americas | |

$ | 20,601 | | |

$ | 22,933 | | |

$ | 19,688 | | |

$ | 43,534 | | |

$ | 40,618 | |

| EMEA | |

| 12,886 | | |

| 6,591 | | |

| 4,905 | | |

| 19,477 | | |

| 10,106 | |

| Asia Pacific Japan | |

| 3,551 | | |

| 3,507 | | |

| 6,913 | | |

| 7,058 | | |

| 12,577 | |

| | |

$ | 37,038 | | |

$ | 33,031 | | |

$ | 31,506 | | |

$ | 70,069 | | |

$ | 63,301 | |

Exhibit 99.2

Lantronix, Inc.

– Second Quarter Fiscal 2024 Earnings Call

Prepared Remarks

Rob: Introduction & Safe Harbor

Good afternoon everyone and thank you for joining the second quarter

fiscal 2024 conference call. Joining us on the call today are Saleel Awsare, Chief Executive Officer, and Jeremy Whitaker, Chief Financial

Officer.

A “live” and archived webcast of today’s call will

be available on the company’s website. In addition, you can find the call-in details for the phone replay in today’s earnings

release.

During this call, management may make forward-looking statements which

involve risks and uncertainties that could cause our results to differ materially from management's current expectations. We encourage

you to review the cautionary statements and risk factors contained in the earnings release, which was furnished to the SEC today and is

available on our website, and in the Company’s SEC filings such as its 10-K and 10-Qs. Lantronix undertakes no obligation to revise

or update publicly any forward-looking statements to reflect future events or circumstances.

Please refer to the news release and the financial information in the

investor relations section of our website for additional details that will supplement management’s commentary.

Furthermore, during the call the company will discuss some non-GAAP

financial measures. Today's earnings release, which is posted in the investor relations section of our website, describes the differences

between our non-GAAP and GAAP reporting, and presents reconciliations for the non-GAAP financial measures that we use.

With that, I’ll now turn the call over to Saleel Awsare, Lantronix

President and CEO.

Saleel: Business Overview

Thanks, Rob, and thank you, everyone, for joining us on the call today.

I'm happy to be speaking to you for the first time since I joined at the end of November. I am pleased to report record results for the

second quarter of FY 2024, with total revenues of $37M in FYQ2, an increase of 18% compared to the same period of 2023 and an increase

of 12% over the last quarter and we expect record revenue for Fiscal 2024. I'm optimistic about the future of Lantronix, given our wide

array of leadership in technology, strong product pipeline and growing customer engagements.

I thought it would be helpful to provide some of my background and

why I joined Lantronix as well also discuss some of the initiatives that I’m driving in the short-term.

For more than 25 years I’ve navigated the high-tech landscape

driving success across hardware, software and services. Most recently, I was the SVP & GM of the Enterprise & Mobile business

at Synaptics, the company’s largest division. Prior to that I ran the IoT division. While at Synaptics, I made significant changes,

streamlining operations, prioritizing customer centricity and implementing robust go-to-market methodologies that led to significant gross

margin and profitability improvements.

Across multiple companies, including Conexant, Winbond and Synaptics,

I have established a track record of business performance improvement across a range of metrics.

When the Lantronix opportunity was presented, it was quickly apparent

to me that there is much potential to be unlocked. The macro trends of IoT are accelerating and Lantronix, with its unique portfolio of

Secure Compute & Connect solutions is perfectly positioned to capitalize on this momentum. From wireless routers, programmable telematics,

Out-of-Band Management, Edge Compute modules and a rapidly growing secure custom solutions business, we have the breadth and depth to

be the differentiated and trusted Western supplier of IoT solutions providing unparalleled global reach and coverage

As the new President and CEO, I see myself as a steward of shareholder

capital and I take that responsibility seriously. You’ll find me to be direct, results oriented and focused on building a profitable,

growing business. In my first sixty days, I’ve met with many customers, partners, and employees, immersing myself in our strengths

and opportunities. However, my focus remains on enhancing performance. We’ve launched multiple initiatives, including a Strategic

Portfolio Review, delving deeply into various areas like Engineering, Operations and Marketing.

In Q2, we made our first volume shipments to our smart grid customer

and we have the backlog in place to drive a strong ramp for the remainder of the year. In fiscal 2025, we expect to transition to a run

rate business, receiving purchase orders against our existing design win and in line with lead times. Having just met with the customer

in Europe, I am happy to say the relationship has deepened and I expect this to be a long-term engagement.

Other noteworthy business highlights include the commencement of volume

shipments of our Fox 3 Gateway device to a major telecom player. This device enables tracking, data collection, communications, and diagnostics

in power-critical applications. Initial deployments will be in generators supplying cell towers. This adoption is driven by mandates in

power backup systems and state energy reporting standards. And finally, our Out of Band products continue to perform well with our large

enterprise customers resuming purchases.

Before I hand the call over to Jeremy to review the Q2 financials in

more detail, I’d like to conclude by saying I’m really excited about the opportunity ahead for Lantronix. Since I’ve

been on board, I’ve been impressed with our team, the broad portfolio of technology and IP, and our great customers. We have a lot

of work ahead of us as we continue down the path of transformation, but I’m confident we have the building blocks in place to drive

Lantronix to become an even stronger company, built on differentiated and sustainable franchises that generate profitable growth.

I’ll now turn the call over to Jeremy Whitaker, Lantronix Chief

Financial Officer.

Jeremy: Financial Results

Thank you, Saleel,

Now, I will provide the financial results and some business highlights

for our second quarter of fiscal year 2024 before commenting on our financial targets for the remainder of the fiscal year.

For FQ2 2024, we reported revenue of 37.0 million, an all-time record

for Lantronix, driven by initial production shipments to a smart grid solutions provider. Revenue was up 12 percent and 18 percent from

the sequential and year ago periods, respectively.

IOT system solutions increased by 21 percent and 54 percent from the

sequential and year ago periods, respectively. The increase was primarily driven by initial production shipments for our lead smart grid

customer, as noted previously. In addition, the year-over-year increase was impacted by strong sales from Out of Band deployments. For

the remainder of the fiscal year, we expect continuing growth from our IoT system solutions, driven by the production ramp of our smart

grid customer, continued strength in Out of Band, and telematics asset tracking solutions to a tier one telecom carrier.

Sequentially, embedded IOT solutions were up 3 percent with meaningful

contribution from our lead EV customer design-in. As expected, we experienced a year-on-year decline in embedded IOT solutions as the

year ago period included a large enterprise video customer design win that ended in FQ4 2023.

In FQ2 2024, Software and Services revenues were down sequentially,

primarily a function of the completion of two large design services projects that have transitioned into production.

GAAP gross margin was 40.6 percent for FQ2 2024 compared to 42.7 percent

in the prior quarter and 43.8 percent in the year ago quarter.

Non-GAAP gross margin was 41.6 percent for FQ2 2024 compared to 44.0

percent in the prior quarter and 44.6 percent in the year ago quarter.

The decline in gross margin was primarily a function of a change in

product mix from the prior quarter and increased logistics costs. For FQ3 2024, we expect gross margins in a similar range.

GAAP SG&A expenses for FQ2 2024 were 10.2 million compared with

9.8 million in the year-ago quarter and 9.2 million in the prior quarter. The sequential increase in GAAP SG&A was primarily

due to costs related to variable and share-based compensation partially offset by cost cutting activities.

GAAP R&D expenses for FQ2 2024 were 4.7 million, compared with

5.1 million in the year-ago quarter and prior quarter. The decline was primarily related to cost-cutting efforts.

Company-wide, we reduced headcount by approximately 7 percent during

FQ2 2024. Over the last several quarters we have reduced headcount by approximately 10 percent as part of our ongoing efforts to capture

cost synergies from our previous acquisitions, run the business more efficiently and improve operating margins.

GAAP net loss was 2.6 million, or 7 cents per share during FQ2 2024

compared to GAAP net loss of 2.6 million, or 7 cents per share, in the year ago quarter.

Non-GAAP net income was 2.9 million, or 8 cents per share during FQ2

2024 compared to non-GAAP net income of 1.4 million, or 4 cents per share, in the year ago quarter.

Now turning to the balance sheet.

We ended FQ2 2024 with cash and cash equivalents of 22.1 million, an

increase of 2.7 million from the prior quarter.

Working capital

was 51.9 million, an increase of 1.8 million from the prior quarter.

Net inventories were 42.8 million as of FQ2 2024, a decrease of 3.0

million from the prior quarter.

Now turning to our outlook. For the third quarter of fiscal 2024 we

expect: Revenue in a range of 38 to 42 million; and Non-GAAP EPS in a range of 0.09 to 0.13 cents per share.

For fiscal 2024 we are updating our annual guidance to: Revenue in

a range of 155 to 165 million and Non-GAAP EPS in a range of 0.35 to 0.45 cents per share.

The change in our annual guidance is primarily due to lower expected

sales for our embedded IOT solutions as a result of two factors: a general slowdown in our broad-based channel business as customers work

through their inventories, and an embedded compute design win in video applications that was slated for revenue in the second half of

fiscal 2024 that pushed into fiscal 2025.

We remain optimistic on the business and are on track to deliver a

record year on both the top & bottom lines with 18 to 26 percent organic revenue growth and over 50 percent growth in non-GAAP EPS.

With that we complete our prepared remarks for today so I will now

turn it over to the operator to conduct our Q&A session.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

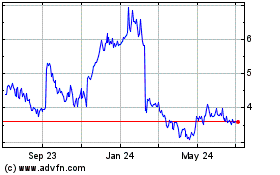

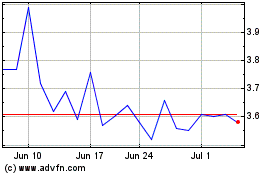

Lantronix (NASDAQ:LTRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lantronix (NASDAQ:LTRX)

Historical Stock Chart

From Apr 2023 to Apr 2024