Semiconductor Equipment Industry Turns Into a Hotbed of Merger Activity

January 02 2012 - 8:16AM

Marketwired

The Semiconductor Equipment and Materials industry was a hotbed of

mergers and acquisitions last year. With competition picking up,

and margins getting squeezed, several industry heavyweights looked

towards mergers to create cost synergies. The Bedford Report

examines the outlook for companies in the Semiconductor Equipment

and Materials industry and provides equity research on Applied

Materials, Inc. (NASDAQ: AMAT) and Lam Research Corporation

(NASDAQ: LRCX). Access to the full company reports can be found at:

www.bedfordreport.com/AMAT

www.bedfordreport.com/LRCX

Last month the semiconductor equipment maker Lam Research Corp.

agreed to buy rival Novellus Systems Inc. for $3.3 billion in

stock. Lam said that the acquisition will help it cultivate more

advanced chip making technology and increase its revenue faster

than either company could on its own. The company also expects it

to speed up its earnings growth.

When the deal is completed -- which is expected in the second

quarter of 2012 -- Lam shareholders will own 59 percent of the new

business, with Novellus investors holding the rest, according to

last month's statement. The acquisition will result in annual cost

savings of about $100 million by the fourth quarter of 2013, Lam

explained.

The Bedford Report releases stock research on the Semiconductor

Equipment and Materials industry so investors can stay ahead of the

crowd and make the best investment decisions to maximize their

returns. Take a few minutes to register with us free at

www.bedfordreport.com and get exclusive access to our numerous

stock reports and industry newsletters.

According to reports from Bloomberg, Lam's purchase is the

largest in the industry since Applied Materials announced plans

last May to buy Varian Semiconductor Equipment Associates Inc. for

$4.9 billion in cash. Applied paid a 55 percent markup over

Varian's closing price in that deal -- close to double the premium

in the Novellus acquisition.

Applied Materials, Inc. is the global leader in providing

innovative equipment, services and software to enable the

manufacture of advanced semiconductor, flat panel display and solar

photovoltaic products. In December the company announced that its

Board of Directors approved a quarterly cash dividend of $0.08 per

share payable on the company's common stock. The dividend is

payable on March 15, 2012 to stockholders of record as of February

23, 2012.

The Bedford Report provides Equity Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create stock reports and newsletters for our members.

The Bedford Report has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

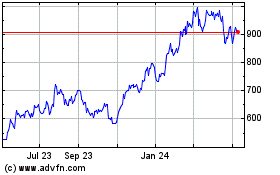

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From May 2024 to Jun 2024

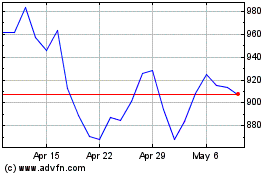

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2023 to Jun 2024