Current Report Filing (8-k)

July 24 2019 - 3:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of

1934

Date of Report (Date of earliest event reported): July 19,

2019

__________________________________________

Lakeland Industries, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

0-15535

|

|

13-3115216

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

EmployerIdentification No.)

|

3555 Veterans Memorial Highway, Suite C, Ronkonkoma, New York

11779-7410

(Address of

principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code:

(631)

981-9700

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the

Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name of

each exchange on which registered

|

|

Common

Stock, $0.01 Par Value

|

|

LAKE

|

|

NASDAQ

Market

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item

5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

On

July 19, 2019, Lakeland Industries, Inc. (the

“Company”) entered into an Employment Agreement (the

“Employment Agreement”) with Allen Dillard pursuant to

which Mr. Dillard will be employed as Chief Financial Officer of

the Company, effective August 12, 2019.

Prior

to joining the Company, Mr. Dillard, age 59, was employed by

Digium, Inc., a provider of Voip communications solutions, as the

Chief Financial Officer from 2015 to 2019. From 2004 to 2015, Mr.

Dillard served as Chief Executive Officer of Mobular Technologies,

a provider of web-based compliance communications to the financial

services industry.

The Employment Agreement is for a term of eighteen

(18) months commencing on August 12, 2019 through and including

February 11, 2021 (the “Term”), subject to early

termination as provided therein. The Employment Agreement provides

for a base salary of $240,000 per year. The Employment Agreement

also provides for a grant of a stock option upon commencement of

employment and eligibility for a bonus of up to 20% of base salary

for the fiscal year ending January 31, 2020 and thereafter an

annual bonus

if determined in the Company’s sole

discretion by the Compensation Committee of the Company’s

Board of Directors (the “Compensation Committee”) in

such amount, and based upon such parameters (if any), as determined

by the Compensation Committee.

The

Employment Agreement contains certain provisions providing for

severance payments to Mr. Dillard in the event that he is

terminated by the Company without cause or by Mr. Dillard for Good

Reason (generally, for failure by the Company to pay Mr.

Dillard’s salary, material diminution in Mr. Dillard’s

authority or material breach by the Company of the Employment

Agreement). The payment is to Mr. Dillard is greater in the event

that such termination without cause or for Good Reason is within 18

months after a change of control. Also under the Employment

Agreement,

Mr. Dillard is

subject to non-competition and non-solicitation restrictions during

the Term and for a period of one year thereafter.

The

foregoing description of the Employment Agreement does not purport

to be complete and is qualified in its entirety by reference to the

text of the Employment Agreement with Mr. Dillard, a copy of which

are attached hereto as Exhibit 10.1 and incorporated herein by

reference.

Item

9.01. Financial Statements and Exhibits.

10.1

Employment Agreement, dated July

19, 2019, between Lakeland Industries, Inc. and Allen

Dillard.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

LAKELAND

INDUSTRIES, INC.

|

|

|

|

|

|

|

|

Date:

July 24, 2019

|

By:

|

/s/

Christopher J. Ryan

|

|

|

|

|

Christopher J.

Ryan

|

|

|

|

|

Chief Executive

Officer & President

|

|

EXHIBIT INDEX

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

|

|

Employment

Agreement, dated July 19, 2019, between Lakeland Industries, Inc.

and Allen Dillard.

|

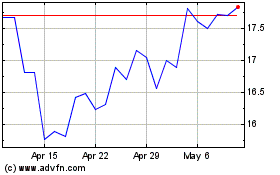

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From May 2024 to Jun 2024

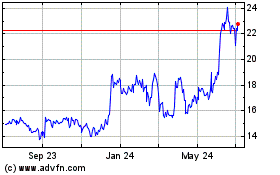

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jun 2023 to Jun 2024