Lakeland Industries Announces Stock Repurchase Plan

November 01 2010 - 9:39AM

Marketwired

Lakeland Industries, Inc. (NASDAQ: LAKE), a market leader in

protective apparel, today announced that the Company's Board of

Directors has authorized the repurchase of up to $2,000,000 worth

of Lakeland's outstanding common stock.

Christopher J. Ryan, Lakeland Industries President and Chief

Executive Officer, commented, "The Board's approval of this

repurchase program is a reflection of the confidence that the Board

and management have in Lakeland's operating fundamentals and growth

prospects and, accordingly, our shared belief that our current

valuation does not reflect Lakeland's underlying long-term value.

Accordingly, we believe that the acquisition of Lakeland stock is

an attractive and appropriate investment in the current market and

an appropriate use of our cash. This repurchase program reflects

the ongoing commitment of the Lakeland Board to taking tangible

steps intended to enhance shareholder value."

"For the most recently reported quarter ended July 31, 2010,

Lakeland demonstrated its ability to deliver strong financial

performance driven by growth in its international operations and

streamlining of its global operating structure," continued Mr.

Ryan. "Net sales increased 6.5% to $24.6 million in the quarter

from the same period of the prior fiscal year. As a result of

higher sales and improved margins, second fiscal quarter diluted

earnings per share increased to $0.10 from $0.00 in the year

earlier period. In the fiscal year to date, Lakeland significantly

reduced its bank debt while increasing its cash position. As we

continue to execute on our business initiatives through the balance

of the fiscal year, we believe we are well positioned for further

growth."

Under this new program, share repurchases may be made from time

to time depending on market conditions, share price and

availability and other factors at Lakeland's discretion. Lakeland's

repurchase of shares will take place in open market transactions or

in privately negotiated transactions in accordance with applicable

securities and other laws, including the Securities Exchange Act of

1934.

Depending on market conditions and other factors, the repurchase

program may be commenced or suspended at any time without prior

notice. The repurchased shares will be held as treasury stock and

will be principally used for ongoing stock issuances under employee

stock plans and other general corporate purposes.

About Lakeland Industries, Inc.:

Lakeland Industries manufactures and sells a comprehensive line

of safety garments and accessories for the industrial protective

clothing market. The Company's products are sold by an in-house

sales force and independent sales representatives to a network of

over 1,000 safety and mill supply distributors. These distributors

in turn supply end user industrial customers such as

chemical/petrochemical, automobile, steel, glass, construction,

smelting, janitorial, pharmaceutical and high technology

electronics manufacturers, as well as hospitals and laboratories.

In addition, Lakeland supplies fire and police departments, airport

crash rescue units, and numerous federal, state and municipal

agencies for a variety of uses including Homeland Security

Protection for chemical and biological warfare. For more

information concerning Lakeland, please visit us at:

www.lakeland.com.

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the "Securities Act"), and Section 21E of the Securities

Exchange Act of 1934, as amended (the "Exchange Act"), including

statements, without limitation, statements relating to our belief

about Lakeland's future, our belief about Lakeland's long-term

value and our belief that the repurchase of our stock is an

attractive investment. We intend that such forward-looking

statements be subject to the safe-harbor provided by the Private

Securities Litigation Reform Act of 1995. The forward-looking

information is based upon current information and expectations.

These estimates and statements speak only as of the date on which

they are made, are not guarantees of future performance and involve

certain risks, uncertainties and assumptions that are difficult to

predict. Therefore, actual outcomes and results could materially

differ from what is expressed, implied, or forecasted in such

forward-looking statements. Factors that could cause actual events

or results to differ materially include, among others, the

following: general economic factors and capital market conditions,

general industry trends, the potential effects on us of competition

in the protective apparel market, growth rates in the protective

apparel markets, rapid technological change that can adversely

affect the demand for our products, shifts in customer demand,

market acceptance of new or enhanced products developed, marketed

or sold by us, delays in scheduled product availability dates,

actions or announcements by our competitors, reduction in sales to

or loss of any significant customers, our ability to successfully

integrate acquisitions, our dependence on certain licenses from

third parties, our ability to attract and retain qualified

personnel and our failure to reduce costs. These and other risks

are detailed from time to time in our periodic reports filed with

the Securities and Exchange Commission, copies of which may be

obtained from the SEC at www.sec.gov. Lakeland is under no

obligation to (and expressly disclaims any such obligation to)

update or alter its forward-looking statements whether as a result

of new information, future events or otherwise.

Lakeland Industries Contacts: Christopher J. Ryan CEO

631-981-9700 Email Contact Gary Pokrassa CFO 631-981-9700 Email

Contact Investor Relation Contact: Jordan Darrow Darrow Associates

631-367-1866 Email Contact

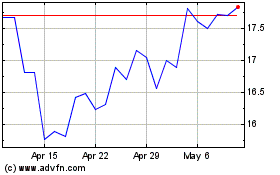

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jun 2024 to Jul 2024

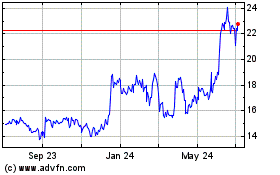

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jul 2023 to Jul 2024