Lakeland Industries, Inc. (NASDAQ: LAKE) today announced

financial results for its second quarter fiscal year 2011 ended

July 31, 2010.

Financial Results Highlights and

Recent Company Developments

- Revenue of $24.6 million in

Q2FY11 up 6.5% over Q2 last year

- International expansion efforts

drive non-US revenue growth and improved market share

- Revenues from outside the US

were 43.5% of total in Q2FY11 as compared with 37.5% for

Q2FY10

- International Growth

- China external sales continued

very strong growth at nearly double Q2 sales from last year

- India sales double from Q2 last

year

- Brazil sales relatively flat

absent large orders in Q2 this year; bids outstanding on several

large orders through balance of FY11

- Stage set for further market

expansion with strategically positioned global manufacturing

facilities and enhanced product lines

- Sales of disposable products in

North America were flat in Q2FY11 compared with prior year periods

due to Gulf oil spill demand offsetting continued depressed

economy, particularly in the industrial and automotive supply

chain

- Gulf oil spill demand resulting

in stock-outs and increased backlog at end of quarter although

backlog is declining during Q3

- Despite weakness in US sales

during Q2FY11, the US Glove Division increased sales by more than

100% from Q2FY10, driven by Indian glove product gaining traction

and the Gulf oil spill

- Gross margin improved due to

contributions from international operations and disposables

relating to industry-wide shortages and price increases

- Operating expenses increased

largely due to:

- Higher sales volumes

overall

- Freight out increases, due in

part to higher volume and use of air freight due to stock-outs

- Unusual items in Q2 operating

results:

- $457,000 cumulative charge to

equity compensation resulting from the Board of Directors changing

the performance level on the 2009 Equity Plan from zero to baseline

[$0.054 per share]

- $175,000 charge for legal and

professional fees in Brazil resulting from the terminations of two

managers [$0.027 per share]

- $220,000 charge for severance

pay resulting from a Reduction in Force [$0.026 per share]

- Without unusual expenses in

Q2FY11 EPS would have been $0.21 as compared to reported basic EPS

of $0.11 and $0.00 in the same period in prior year

- Effective inventory control and

cash management initiatives resulted in $6.6 million reduction of

bank debt at 7/31/10 from 1/31/10

- Cash position increased by 30%

to $6.6 million at end of Q2FY11 from beginning of fiscal year

- No settlement reached in Brazil

as arbitration approaches relating to Brazil employment

terminations

Fiscal 2011 Second Quarter

Financial Results

Net Sales. Net sales increased $1.5 million, or 6.5%, to $24.6

million for the three months ended July 31, 2010, from $23.0

million for the three months ended July 31, 2009. The net increase

was due to an increase of $2.1 million in foreign sales, offset by

a $0.6 million decrease in domestic sales.

External sales from China increased by $2.2 million, or 98%,

driven by Australian sales and domestic sales in China. Canadian

sales increased by $0.2 million, or 12.4%, UK sales increased by

$0.2 million or 16.7%, Chile sales decreased by $0.6 million, or

68%, in part resulting from an earthquake that led to business

disruptions, and India sales increased by $0.2 million, or 100%.

Sales in Brazil were down 7.6% mainly from lack of large bid sales

in Q2 this year as compared with the prior period.

US domestic sales of disposables were flat despite positive

order flow due to manufacturing capacity constraints and stock-out

conditions. Softness in various industrial sectors and economic

uncertainty in the US led to chemical suit sales decreasing by $0.5

million, wovens decreasing by $0.4 million and flat reflective

sales. Glove sales in the US increased by $0.7 million due to

traction for this relatively new product line and demand relating

to the Gulf oil spill.

Gross Profit. Gross profit increased $2.0 million, or 32.6%, to

$8.3 million for the three months ended July 31, 2010, from $6.2

million for the three months ended July 31, 2009. Gross profit as a

percentage of net sales increased to 33.7% for the three months

ended July 31, 2010, from 27.1% for the three months ended July 31,

2009. Major factors driving the changes in gross margins were:

- Disposables gross margin

increased by $1.5 million this year compared with last year. This

increase was mainly due to higher margins in Q2 resulting from the

prevailing industry wide shortages and price increases

- Brazil’s gross margin was 46.8%

this year compared with 40.6% last year. This increase was largely

due to the sales mix, and favorable exchange rates

- Continued gross losses of $0.1

million from India in Q2 FY11

- Chemical division gross margin

increased 1.1 percentage points resulting from sales mix

- Canada gross margin increased

6.9 percentage points due to higher volume and favorable exchange

rates

Operating Expenses. Operating expenses increased $1.4 million,

or 23%, to $7.4 million for the three months ended July 31, 2010,

from $6.0 million for the three months ended July 31, 2009. As a

percentage of sales, operating expenses increased to 30.3% for the

three months ended July 31, 2010 from 26.1% for the three months

ended July 31, 2009. The $1.4 million increase in operating

expenses in the three months ended July 31, 2010 as compared to the

three months ended July 31, 2009 was comprised of:

- $0. 5 million increase in equity

compensation resulting from the 2009 restricted stock plan treated

at the baseline performance level and the resulting cumulative

charge

- $0.2 million increase in

professional fees resulting from the terminations in Brazil

- $0.2 million increase in freight

out shipping costs, in part due to higher volume and in part due to

use of air freight in some cases resulting from stock-out

conditions

- $0.2 million increase in

administrative payroll mainly resulting from severance pay from

terminations in Canada and the US

- $0.2 million in increased

operating costs in China were the result of the large increase in

direct international sales made by China, that are now allocated to

SG&A costs although previously allocated to cost of goods

sold

- $0.1 million in increased sales

commissions resulting from higher volume

- $0.1 million increase in sales

salaries resulting from increased sales personnel in Argentina,

China and the wovens Division

- $(0.1) million in miscellaneous

decreases

Operating profit. Operating profit increased 293.6% to $0.8

million for the three months ended July 31, 2010 from $0.2 million

for the three months ended July 31, 2009. Operating margins were

3.4% for the three months ended July 31, 2010 compared to 0.9% for

the three months ended July 31, 2009.

Interest Expenses. Interest expenses decreased by $0.1 million

for the three months ended July 31, 2010 as compared to the three

months ended July 31, 2009 due to lower borrowing levels

outstanding and lower interest rates.

Income Tax Expense. Income tax expenses consist of federal,

state, and foreign income taxes. Income tax expenses increased $0.2

million to $0.2 million for the three months ended July 31, 2010,

from $0.0 million for the three months ended July 31, 2009. The

Company’s effective tax rates were not meaningful for Q2FY10 and

25.8% for the three months ended July 31, 2010, due to the near

breakeven profit in the previous year. The effective tax rate for

Q2FY11 reflects goodwill write-offs in Brazil and tax benefits from

India resulting from “check the box” in the US.

Net Income. Net income increased $0.6 to $0.6 million for the

three months ended July 31, 2010 from $0.0 million for the three

months ended July 31, 2009. The increase in net income primarily

resulted from higher sales and improved margins resulting from a

favorable pricing environment in Q2FY11, partially offset by

charges to net income of $0.3 million for the cumulative change in

Restricted Stock performance level ($0.05 per share), $0.2 million

for legal fees in Brazil resulting from management terminations

($0.03 per share), and $0.2 million for severance costs in Canada

($0.03 per share). Excluding these charges, the Company would have

reported net income of $1.3 million in the second quarter of fiscal

2011 ($0.21 per share).

Fiscal 2011 First Half

Financial Results

Net Sales. Net sales increased $2.9 million, or 6.1%, to $49.9

million for the six months ended July 31, 2010, from $47.0 million

for the six months ended July 31, 2009. The net increase was due to

an increase of $5.2 million in foreign sales, partially offset by a

$2.3 million decrease in domestic sales. External sales from China

increased by $3.3 million, or 83%, driven by sales of products to

Australia and domestically in China. Canadian sales increased by

$0.7 million or 24%, UK sales increased by $0.6 million or 33%,

Chile sales decreased by $0.5 million or 46% in part due to the

earthquake. US domestic sales of disposables decreased by $1.0

million, chemical suit sales decreased by $0.8 million, wovens

decreased by $0.3 million, reflective sales decreased by $0.3

million and glove sales increased by $0.9 million. Sales in Brazil

were flat in the first half of fiscal 2011 as compared with the

same period in fiscal 2010.

Gross Profit. Gross profit increased $2.4 million, or 19.8%, to

$14.7 million for the six months ended July 31, 2010, from $12.2

million for the six months ended July 31, 2009. Gross profit as a

percentage of net sales increased to 29.4% for the six months ended

July 31, 2010, from 26.0% for the six months ended July 31, 2009.

Major factors driving the changes in gross margins were:

- Disposables gross margin

increased by 4.7 percentage points this year compared with last

year. This increase was mainly due to higher margins in Q2

resulting from the industry wide shortages prevailing, partially

offset by higher priced raw materials and a very competitive

pricing environment coupled with lower volume in Q1

- Brazil’s gross margin was 48.1%

this year compared with 43.3% last year. This increase was largely

due to the volume provided by a larger bid contract this year

- Gross losses of $0.2 million

from India in FY11

- Chemical division gross margin

declined 2.3 percentage points resulting from lower volume and

sales mix

- Canada gross margin increased

6.8 percentage points due to higher volume and favorable exchange

rates

Operating Expenses. Operating expenses increased $2.2 million,

or 19.3%, to $13.5 million for the six months ended July 31, 2010,

from $11.4 million for the six months ended July 31, 2009. As a

percentage of sales, operating expenses increased to 27.1% for the

six months ended July 31, 2010 from 24.1% for the six months ended

July 31, 2009. The $2.2 million increase in operating expenses in

the six months ended July 31, 2010 as compared to the six months

ended July 31, 2009 were comprised of:

- $0.5 million increase in equity

compensation resulting from the 2009 restricted stock plan treated

at the baseline performance level and the resulting cumulative

charge

- $0.4 million in increased

operating costs in China were the result of the large increase in

direct international sales made by China which are now allocated to

SG&A costs, previously allocated to cost of goods sold

- $0.4 million increase in

administrative payroll mainly resulting from $0.3 million severance

pay from terminations in Canada and the US

- $0.3 million increase in foreign

exchange costs resulting from unhedged losses against the Euro in

China. The company has since commenced a hedging program for the

Euro

- $0.3 million increase in freight

out shipping costs, in part due to higher volume and in part due to

use of air freight in some cases resulting from stock-out

conditions

- $0.2 million increase in

professional fees relating to the terminations in Brazil

- $0.2 million increase in

salaries for additional sales personnel in Argentina, China and the

wovens division

- $0.1 million in increased sales

commissions resulting from higher volume

- $(0.2) million miscellaneous

decreases

Operating profit. Operating profit increased 27% to $1.1 million

for the six months ended July 31, 2010 from $0.9 million for the

six months ended July 31, 2009. Operating margins were 2.3% for the

six months ended July 31, 2010 compared to 1.9% for the six months

ended July 31, 2009.

Interest Expenses. Interest expenses decreased by $0.2 million

for the six months ended July 31, 2010 as compared to the six

months ended July 31, 2009 due to lower borrowing levels

outstanding and lower interest rates.

Income Tax Expense. Income tax expenses consist of federal,

state, and foreign income taxes. Income tax expenses decreased $0.2

million, or 58%, to $0.2 million for the six months ended July 31,

2010 from $0.4 million for the six months ended July 31, 2009. The

Company’s effective tax rates were not meaningful for this year and

80% for the six months ended July 31, 2009. The effective tax rate

for Q1FY10 was affected by a $350,000 allowance against deferred

taxes resulting from the India restructuring, losses in India and

UK with no tax benefit, tax benefits in Brazil resulting from

government incentives and goodwill write-offs, and credits to prior

year’s taxes in the US not previously recorded. The effective tax

rate for the first six months of fiscal year 2011 reflects goodwill

write-offs in Brazil and tax benefits from India resulting from

“check the box” in the US, and the $1.6 million charge for VAT tax

expense in Brazil.

Net Income (loss). Net income decreased $0.9 to a loss of $0.8

million for the six months ended July 31, 2010 from a profit of

$0.1 million for the six months ended July 31, 2009. The decrease

in net income primarily resulted from the $1.6 million charge for

VAT tax expense in Brazil in the first quarter of the present

fiscal year. Excluding the Brazilian VAT tax expense, the Company

would have reported net income of $0.8 million in the six months

ended July 31, 2010, a 771% increase as compared to the same period

in fiscal 2009. The improved profitability before VAT tax expense

reflects an increase in sales. higher margins particularly in

Q2FY11, and a $350,000 allowance against deferred taxes in the

prior year resulting from the India restructuring, partially offset

by a reduction in gross margins in disposables.

Management’s Comments

Commenting on the financial results, Lakeland Industries

President and Chief Executive Officer Christopher J. Ryan said,

“Lakeland continues to deliver strong financial performance driven

by the growth of its international operations and streamlining of

its global operating structure. We have been successful in managing

our costs while navigating through a volatile pricing and supply

chain environment. Based on continued demand and our backlog at the

end of the quarter of approximately $7 million, we believe the

Company is positioned for strong results through the balance of the

fiscal year.

“During the second fiscal quarter, we benefited from

requirements related to the Gulf of Mexico oil spill. Although the

oil well has been contained, a significant clean up effort is

underway. We experienced demand for our protective and safety

apparel that outstripped our supply of products. Our warehouse

inventory was used up, our manufacturing capacity was nearly at

full scale production for the specific products required for the

clean up, and raw materials and our other sourcing of goods were on

backorders. Stock-out condition and capacity issues resulted in a

backlog of orders at the end of the quarter. Presently, the Company

is working down the backlog, and we expect to fulfill the

backorders by the end of the fiscal year. Following the new

agreement with DuPont announced last quarter, we have essentially

depleted our inventory of products made from material we receive

from them, and will resell finished goods they send to us, although

they also are experiencing manufacturing constraints.

“The oil spill-related demand benefited our US operations, which

overall has experienced longer term challenges. The impact from the

recession served to magnify the reduced requirements for industrial

products in the US, although downward pressures had abated as the

economy had somewhat retraced from its low point last year. The

long term trend in the US was the basis for our international

diversification strategy. Our timing was prescient as we are now

more than offsetting the decline in the US with foreign revenues.

Furthermore, revenues in our overseas operations generally are

higher margin as compared to our domestic sales.

“On a larger base of sales in the second quarter of fiscal 2011

as compared with the fiscal 2010 period, nearly 44% of our

consolidated revenues were from our foreign operations versus 37%

in the prior period. China and India represent relatively new

markets for us in terms of sales operations, and we are gaining

traction in both, as evidenced by our nearly doubling of revenues

in each market. Brazil contributes significantly to our presence in

industrial growth markets and can deliver significant upswings as

there is an abundance of large bid contracts for public and private

sectors for which we have bids outstanding.

“Progress has also been made in our mission to improve our cost

structure and balance sheet. Inventories have been brought down 13%

fiscal year-to-date and are now at a reasonable steady state. We do

not expect significant further reductions. Our debt has been

reduced 69% in the time frame to $3 million, while our cash

position is up 30% to $6.6 million at the end of the second

quarter.

“In an attempt to rationalize our resources and retain and

motivate our workforce in a challenging operating environment, we

took the necessary actions that resulted in unusual expenses in the

second quarter. While our second quarter diluted earnings per share

surged to $0.10 from break-even last year, an equity compensation

adjustment expense and a reduction in force and related costs

reduced earnings per share by nearly $0.11 in the second quarter.

Excluding these charges, the Company would have reported net income

of $1.2 million in the second quarter of fiscal 2011 ($0.21 per

share). In light of the improvement made at our international

operations which presently represent minimal global market share as

well as the steps taken to maximize profits, we are confident that

there is substantial room for growth.”

Financial Results Conference

Call

Lakeland will host a conference call at 10:00 AM (EDT) on

September 14, 2010, to discuss the Company’s second quarter fiscal

year 2011 financial results. The conference call will be hosted by

Christopher J. Ryan, Lakeland’s President and CEO. Investors can

listen to the call by dialing 877-723-9523 (domestic) or

719-325-4771 (international), code 1429827.

A conference call replay will be available by dialing

888-203-1112 (domestic) or 719-457-0820 (international), code

1429827.

About Lakeland Industries, Inc.:

Lakeland Industries, Inc. (NASDAQ: LAKE) manufactures and sells

a comprehensive line of safety garments and accessories for the

industrial protective clothing market. The Company’s products are

sold by a direct sales force and through independent sales

representatives to a network of over 1,000 safety and mill supply

distributors. These distributors in turn supply end user industrial

customers such as chemical/petrochemical, automobile, steel, glass,

construction, smelting, janitorial, pharmaceutical, and high

technology electronics manufacturers, as well as hospitals and

laboratories. In addition, Lakeland supplies federal, state, and

local government agencies, fire and police departments, airport

crash rescue units, the Department of Defense, the Centers for

Disease Control and Prevention, and may other federal and state

agencies. For more information concerning Lakeland, please visit

the Company online at www.lakeland.com.

“Safe Harbor” Statement under the Private Securities Litigation

Reform Act of 1995: Forward-looking statements involve risks,

uncertainties and assumptions as described from time to time in

Press Releases and 8-K(s), registration statements, annual reports

and other periodic reports and filings filed with the Securities

and Exchange Commission or made by management. All statements,

other than statements of historical facts, which address Lakeland’s

expectations of sources or uses for capital or which express the

Company’s expectation for the future with respect to financial

performance or operating strategies can be identified as

forward-looking statements. As a result, there can be no assurance

that Lakeland’s future results will not be materially different

from those described herein as “believed,” “projected,” “planned,”

“intended,” “anticipated,” “estimated” or “expected,” which words

reflect the current view of the Company with respect to future

events. We caution readers that these forward-looking statements

speak only as of the date hereof. The Company hereby expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any such statements to reflect any change

in the Company’s expectations or any change in events conditions or

circumstances on which such statement is based.

LAKELAND INDUSTRIES, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands except share

data)

July 31,

January 31,

ASSETS

2010

2010

(Unaudited)

Current assets: Cash and cash equivalents $ 6,608 $ 5,093

Accounts receivable, net 16,319 15,809 Inventories, net 33,560

38,576 Deferred income taxes 1,473 1,261 Prepaid income and VAT tax

3,361 1,732 Other current assets

1,507

2,356

Total current assets 62,828 64,827 Property and

equipment, net 13,572 13,742 Intangibles and other assets, net

7,894 5,622 Goodwill

6,090

5,829

Total assets

$

90,384 $ 90,020

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Accounts payable $ 6,665 $ 3,883 Accrued compensation

and benefits 1,546 1,289 Other accrued expenses 644 1,138 Borrowing

under revolving credit facility 2,962 9,517 Other short term

borrowings 589 ----- Current maturity of long term debt

97

94

Total current liabilities 12,503 15,921 Construction loan

payable, net of current maturity 1,600 1,583 VAT taxes payable

long-term 3,309 ----- Other liabilities

98

92

Total liabilities 17,510 17,596 Commitments and

contingencies Stockholders’ equity:

Preferred stock, $0.01 par;

authorized 1,500,000 shares(none issued)

----- -----

Common Stock, $0.01 par;

authorized 10,000,000 sharesissued and outstanding 5,566,537 and

5,564,732 shares atJuly 31, 2010 and at January 31, 2010,

respectively

56

56

Less treasury stock at cost

125,322 shares at July 31, 2010and January 31, 2010

(1,353 )

(1,353

)

Additional paid-in capital 50,098 49,622 Retained earnings 24,448

25,221 Other comprehensive income (loss)

(375

)

(1,122

)

Total stockholders’ equity

72,874

72,424

Total liabilities and stockholders’ equity

$

90,384 $ 90,020

LAKELAND INDUSTRIES, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except share and per share

data) (Unaudited) Three Months

Ended Six Months Ended July 31, July 31,

2010 2009 2010

2009 Net sales $ 24,551 $ 23,049 $ 49,914 $

47,025 Cost of goods sold

16,280

16,812 35,238

34,778 Gross profit 8,271 6,237 14,676 12,247

Operating expenses

7,431

6,023 13,545

11,355 Operating profit 840 214 1,131 892 VAT

tax charge-Brazil from prior periods ----- ----- (1,583 ) -----

Interest and other income, net 22 13 35 54 Interest expense

(92 ) (227

) (179 )

(420 ) Income (loss) before income taxes

770 0 (596 ) 526 Provision (benefit) for income taxes

198 (8 )

178 421 Net

(loss) income

$ 572 $

8 ($774 )

$ 105 Net (loss) income per common

share: Basic

$ 0.11 $

0.00 ($0.14 )

$ 0.02 Diluted

$

0.10 $ 0.00

($0.14 ) $

0.02 Weighted average common shares

outstanding: Basic

5,440,411

5,415,391 5,439,921

5,410,938 Diluted

5,533,196 5,436,309

5,526,626 5,452,560

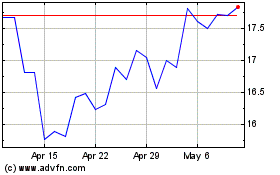

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jun 2024 to Jul 2024

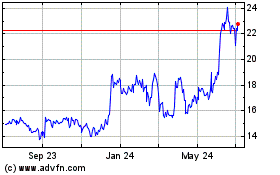

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jul 2023 to Jul 2024